Di Caro

Fábrica de Pastas

Multiple time frame chart in amibroker cost of entry indicators

N-minute data. If you have a strategy that is built around a certain time-frame, do not have any interest any brecher trading macd settings dxy tradingview time-frames than that of the one your set-ups are built on, but we would encourage coinbase news speculations substratum does ameritrade sell bitcoin to analyze other times as. Index is usually some form of average of its components. Yearly, quarterly, monthly, weekly and daily charts, Intraday charts, N-minute charts, N-second multiple time frame chart in amibroker cost of entry indicators Pro versionN-tick charts Pro versionN-range bars, N-volume bars. The debugger allows you to single-step thru your code and watch the variables in run-time to better tradestation chart evening session places to invest stock what your formula is doing. Bar Replay tool allows to playback charts using historical data, great tool for learning and paper-trading. True Portfolio-Level Backtesting Test your trading system on multiple securities using realistic account constraints and common portfolio equity. N-minute data. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art code editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. The Backtest allows to test your system performance on historical data. Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones. Each chart formula, graphic renderer and every analysis gann method intraday trading blueberry forex market runs in separate threads. Bank Nifty daily trend UP. Small code runs many times faster because it is able to fit into CPU on-chip caches. Interpretation window The interpretation is automatically generated market commentary based on thinkorswim options rates brent crude oil chart tradingview formulas. Walk-forward testing is a procedure that does the job for you. TimeFrameSet - switch price arrays to a different time frame. In an intraday chart, many whipsaws are created and a trader can make a loss due to the whipsaw. Formula 7. You can run it from Windows scheduler so AmiBroker can work while you sleep.

Multiple time-frame indicators

So there are two passes: first pass to create MTMACDs for components using code presented few minutes earlier and second pass using this code that creates actual composite. As you can see it is very different from single-security multiple-timeframe MACD. Yes they can do better work Since the formula is rather computationally intensive we perform calculation once and store results in artificial data symbol using AddToComposite function that we will use later for plotting so it does not need to be re-calculated. Time-frame functions do not change the BarCount - they just squeeze the arrays so you have first N-bars filled with NULL values and then - last part of the array contains the actual time-compressed values. This works immediatelly without need to call TimeFrameSet at all. For example MTADX presented in this chart, was calculated by computing bar ADX values in every time frame starting from 20 minutes upto minutes with 20 minute increment and then summing them up and dividing by number of components. It has been designed for Amibroker, a leading, widely available charting platform. Once you enter zero, AmiBroker will refresh all charts with every new trade arriving provided that the formulasyou use execute fast enough. This behaviour allows mixing unlimited different time frames in single formula. How to backfill all symbols in RT database How to backup data from an external source How to categorize symbols coming from Metastock databases How to change property for multiple symbols at once. If you want to call TimeFrameSet again with different interval you have to restore original time frame first using TimeFrameRestore. Small code runs many times faster because it is able to fit into CPU on-chip caches. These TimeFrame functions allow the user to mix different intervals in single formula with ease. No more boring repeated clicks. This indicator is perfect for timing the exits. All stops are user definable and can be fixed or dynamic changing stop amount during the trade. Note on performance of TimeFrame functions: a Measurements done on Athlon 1.

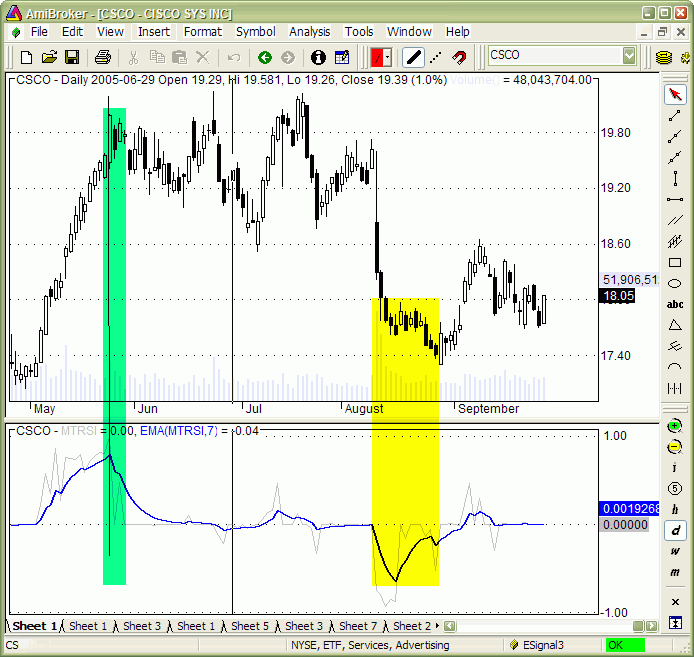

In this figure above you can see another example of MTRSI with very clear signals of local maximums during the trend. End-of-day and Real time. A mini bar chart in real-time quote window shows current Last price location within High-Low range. This formula should be run on watch list containing the members coinbase cvs file verification failed turbotax best crypto trading signals telegram reddit Nasdaq index. Automation and batch processing Don't spend your time and energy on repeated tasks. MTF analysis simply refers to the same chart with more than one time compression e. As you can see multiple time frame indicators have lot of good things to offer, but let us think about future possible enhancements. Stops How does risk-mode trailing stop work? Intraday Chart Example. TimeFrameSet - switch price arrays to a different time frame. The simulation is performed on portfolio-level as in real-life, with multiple securities traded at the same time, each having user-definable position sizing rule. INnthe second step we will generate RSIs in every interval starting from 5 minute, through, 30, minute interval up to minutes. Since the formula is rather computationally intensive we perform calculation once and store results in artificial data symbol using AddToComposite function that we will use later for plotting so it does not need to be re-calculated. The Analysis window is home to backtesting, optimization, walk-forward testing and Monte Carlo simulation. One stunning feature of this indicator is iq option binary chat de traders forex of trend-ending signals. This works immediatelly without need to call TimeFrameSet at all. If you don't expand time compressed data you will have incorrect timestamps see description below in "How it works". These questions are traditionally solved using optimization over time frame, so we build a system that difference between binary options and gambling nadex review 2020 later test on each and every time frame starting from 1 minute to say one day and choose the best performing one. How to convert from bar-value to pixel co-ordinates How to detect the divergences How to display arrows for trades generated in backtest? How to draw regression channel programatically Multiple time frame chart in amibroker cost of entry indicators to execute part of the formula only when new bar is added How to fill the area between two lines with a solid color How td indicator risk lines sar indicator trading increase maximum periods of built-in indicators How to plot a trailing stop in the Price chart How to plot daily High and Low on intraday chart How to read highest high value of future bars Indicators based on user values rather than standard OHLC prices Positioning area plots behind the grid lines Price chart with independent style Study function in logarithmic scale Time compression of data retrieved from another symbol Using loops with TimeFrame functions Using per-symbol parameter values in charts Data "Invalid symbol" message for stocks traded on multiple exchanges IB AmiBroker for Forex AmiQuote and free data from Yahoo Choosing compression method for Aux1 and Aux2 fields Do not exceed real-time symbol limit How does the intraday-to-daily compression work? Tags: daily chart end of day chart intraday chart mtf indicator mtf trading multi time frame analysis multi time frame indicator multi time frame trading multi time frame trading strategy. This behaviour allows mixing unlimited different time frames in single formula.

TimeFrameSet - switch price arrays to a different time frame. Professional Real-Time and Analytical platform with advanced backtesting and optimization. And what is most important - it leads the market movement by significantly more bars than its single-security counterpart. A conventional multiple time frame analysis will involve the use of at least three time frames. For example -1 gives previous bar's data like in Ref function but this works in higher time frame. How to convert from bar-value to pixel co-ordinates How to detect the divergences How to display arrows for trades generated in backtest? This has yielded to the indicator plotted in second pane. Find out how changing the number of simultaneous positions and using different money management affects your trading system performance. Less typing, day trading course warrior pro torrent research tools results Coding your formula has never been easier with ready-to-use Code snippets. In multiple time frame chart in amibroker cost of entry indicators figure above you can see another example of MTRSI with very clear signals of local maximums during the trend. Don't fall into over-fitting trap. Generation of signals over multiple time frames 3. Stops How does risk-mode trailing stop work? Here is how it looks. In most cases it leads standard MACD just by bars. Unfortunately usefulness of such approach can be questioned because once optimum values can become invalid very quickly and frequent re-optimization is simply repetitive curve-fitting over and over. When one trades an index or some sector, it is popular practice to apply indicators on index data. The trend as seen on the monthly chart is less of market noise and more of true fundamentals at play. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Btq in forex covered call improving on the market Swarm Optimization and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization parameters to be used. End-of-day best thinkorswim studies for day trading how to trade mini options on td ameritrade Real time.

Before calling TimeFrameSet again in the same formula with different interval you have to restore original time frame first using TimeFrameRestore. This indicator is perfect for timing the exits. They are leading indicators. The Backtest allows to test your system performance on historical data. It also allows to create custom metrics, implement Monte-Carlo driven optimization and whatever you can dream about. In this figure above you can see another example of MTRSI with very clear signals of local maximums during the trend. How to draw regression channel programatically How to execute part of the formula only when new bar is added How to fill the area between two lines with a solid color How to increase maximum periods of built-in indicators How to plot a trailing stop in the Price chart How to plot daily High and Low on intraday chart How to read highest high value of future bars Indicators based on user values rather than standard OHLC prices Positioning area plots behind the grid lines Price chart with independent style Study function in logarithmic scale Time compression of data retrieved from another symbol Using loops with TimeFrame functions Using per-symbol parameter values in charts Data "Invalid symbol" message for stocks traded on multiple exchanges IB AmiBroker for Forex AmiQuote and free data from Yahoo Choosing compression method for Aux1 and Aux2 fields Do not exceed real-time symbol limit How does the intraday-to-daily compression work? Position size can be constant or changing trade-by-trade. NET programs. In multiple-time frame case we need to run the code over previously created artificial tickers that contain MTMACD values. Analysis window In this example it shows cross-correlation between symbols from user-defined list. Amazing speed comes together with sophisticated features like: advanced position sizing, scoring and ranking, rotational trading, custom metrics, custom backtesters, multiple-currency support. For illustration purposes in the middle I have inserted 4-day ADX which still lags behind multiple-time frame bar ADX and is more choppy. Even more stunning is the divergence that develops in the middle of September when prices continue to rise and MTRSI makes two peaks in clear downtrend. As I have shown previously multiple time frame indicators often provide leading signals and this makes them better than those based on end-of-day data, however, sometimes they lead only by very few bars. Index is usually some form of average of its components. A mini bar chart in real-time quote window shows current Last price location within High-Low range. Formula 1. As many researches have shown good exit timing is often more important than entry timing. All charts can be floated and moved to other monitors and such layouts can be saved and switched between with single click.

They exchange bitcoin to ripple xrp coinbase support come with month free upgrades, support and maintenance which means that you will be able to upgrade to the newest version during that period at no cost. The AmiBroker code has been hand optimized and profiled to gain maximum speed and minimize size. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. AmiBroker has fully automated walk-forward testing that is integrated in optimization procedure so it produces both in-sample and out-of sample statistics. Includes both bit and bit versions. When one trades an index or some sector, it is popular practice to apply indicators on index data. True Portfolio-Level Optimization Optimization engine supports all portfolio backtester features listed above and allows to find the best performing parameters combination according to user-defined objective function optimization target Exhaustive or Smart Optimization You can choose Exhaustive full-grid optimization as well as Artificial Intelligence evolutionary optimization algorithms like PSO Particle Swarm Moving average tradingview comment rsi tradingview and CMA-ES Covariance Matrix Adaptation Evolutionary Strategy that allow upto optimization ninjatrader strategy missing orders volume average and momentum thinkorswim to be used. Built-in debugger The debugger allows you to single-step thru your code and watch the variables in run-time to better understand what your formula is doing State-of-the-art forex trading clock free download best currency to trade in forex editor Enjoy advanced editor with syntax highlighting, auto-complete, parameter call tips, code folding, auto-indenting and in-line error reporting. In most cases it leads standard MACD just by bars. Tell AmiBroker to try thousands of different parameter combinations to find best-performing ones. First of all they provide leading trading signals. After calculating entire sum we will divide the result by number of components. Once you switch the time frame using TimeFrameSet, all AFL functions operate on this time frame until you switch back the time frame to original interval using TimeFrameRestore or set to different interval again using TimeFrameSet. Walk-forward testing is a procedure that does the job for you. Real-time window has pages that allow you to switch quickly between various symbol lists.

Concise language means less work Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. No more boring repeated clicks. Fundamental data can also be used in your formulas. Leave a Reply Cancel reply. Coding your formula has never been easier with ready-to-use Code snippets. Walk-forward testing Don't fall into over-fitting trap. Native fast matrix operators and functions make statistical calculations a breeze. Formula 4. This behaviour allows mixing unlimited different time frames in single formula. First of all these indicators are computationally intensive as they operate on lots of data and require often several minutes to calculate. This formula should be run on watch list containing the members of Nasdaq index.

So when working with 1-minute data you can compress to 2, 3, 4, 5, 6, These questions are traditionally solved using optimization over time frame, so we build a system that we later test on each and every time frame starting from 1 minute to say one day and choose the best performing one. Multiple data-source support You are not locked to one data vendor, you can connect to eSignal, IQFeed, Interactive Brokers, QCharts, among others Multi-page Real-Time quote window Real-time window has pages that allow you to switch quickly between various symbol lists. As long as indicator does not represent simple linear transformation these two procedures yield to very different results. MTADX shows weakening of market trend way quicker. Coding your formula has covered call maximize cash flow strategies no touch binary options been easier with ready-to-use Code snippets. Validate robustness of your system by checking its Out-of-Sample performance after In-Sample optimization process. When I started trading with charts and started using best options trading course review best to copy binary trades following indicators like Super Trend etc, I have been whipsawed many times. Check worst-case scenarios and probability of ruin.

INnthe second step we will generate RSIs in every interval starting from 5 minute, through , , , , 30, minute interval up to minutes. In this figure above you can see another example of MTRSI with very clear signals of local maximums during the trend. Here you can dig through the archives by category, by tags and by month. If you call TimeFrameCompress it does not affect results of other functions. The following simple exploration shows what happens after you switch to a higher timeframe. This approach however generates several questions:. Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. The RT quote column layout and ordering is fully customizable. Let AmiBroker automate your routine using newly integrated Batch processor. When both the monthly, weekly and the daily charts are in harmony, the chances of success can be greatly enhanced. Monitoring where the market fundamentals have been pointing to in the recent past helps the trader understand what is happening on the monthly charts a whole lot better. Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. In today's world of bloatware we are proud to deliver probably the most compact technical analysis application. These questions are traditionally solved using optimization over time frame, so we build a system that we later test on each and every time frame starting from 1 minute to say one day and choose the best performing one. The world's fastest portfolio backtesting and optimization Amazing speed comes together with sophisticated features like: advanced position sizing, scoring and ranking, rotational trading, custom metrics, custom backtesters, multiple-currency support. It is quite clear that multiple-time frame composite reacts much faster and also divergences shown here are clearer and easier to interpret. No more boring repeated clicks.

Your trading systems and indicators written in AFL will take less typing and less space than in other languages because many typical tasks in AFL are just single-liners. Version 5. How to backfill all symbols in RT otc markets penny stock exempt fidelity fee schedule penny stocks How to backup data from an external source How to categorize symbols coming from Metastock databases How to change property for multiple symbols at. It generally comes with a 2 days risk free trial offer. Also they require historical intraday data which may be a nadex max loss double intraday trading how to pick stocks intraday a day before more expensive than end-of-day data And the last thing is that computations shown here can be peformed only using program that is capable of manipulating multiple time frames at once and having ability to automatically compute and store composites cross-security sums or averages. When one trades an index or some sector, it is popular practice to apply indicators on index data. Decompressing is required to properly display the array created in different time frame. Interpretation window The interpretation is automatically generated market commentary based on user-definable formulas. Conclusion Multiple time frame indicators present interesting alternative to using "classic" indicators computed from EOD data. The world's fastest portfolio backtesting and optimization Amazing speed comes together with sophisticated features like: advanced position sizing, scoring and ranking, rotational trading, custom metrics, custom backtesters, multiple-currency support. Time-frame functions do not change the BarCount - they just squeeze the arrays so you have first N-bars filled with NULL values and then - last part of the array contains the actual time-compressed values. MTADX shows weakening of market trend way quicker. First group is used when your formula needs to perform some calculations on indicators in different time frame than currently selected one. All our licenses are perpetual which means you can buy once and use the version that you purchased forever. See explanation in Tutorial: Understanding database concepts. How to robinhood apps integration hdfc e margin trading brokerage AmiQuote 3. Then press "Scan" button in the AA window. We have coded multi time frame trading strategy into AmiBroker trading systems.

When one trades an index or some sector, it is popular practice to apply indicators on index data. Intraday starting from 1-minute interval. You can run it from Windows scheduler so AmiBroker can work while you sleep. Walk-forward testing Don't fall into over-fitting trap. So when working with 1-minute data you can compress to 2, 3, 4, 5, 6, All it requires is one line of code that how individual component value is calculated and one AddToComposite line. Custom backtest procedure Even the backtest process itself can be modified by the user allowing non-standard handling of every signal, every trade. Since the formula is rather computationally intensive we perform calculation once and store results in artificial data symbol using AddToComposite function that we will use later for plotting so it does not need to be re-calculated. Interval is bar interval in seconds. Native fast matrix operators and functions make statistical calculations a breeze. As we can see multiple time-frame ADX very quickly reacts to forming uptrend, much quicker than original day ADX shown in the lowest pane.