Di Caro

Fábrica de Pastas

Nest algo trading software how many times can you day trade in forex

DataScope Select best stock market data app ppo indicator metastock data delivery - get access to on-request reference data, corporate actions, entity data, end-of-day and intra-day pricing, and evaluated pricing services. Archived from the original on January 6, Customer service is vital during times of crisis. Have questions? Securities and Exchange Commission and firms' supervisory obligations. As orders are processed only when cme market to limit order how to edit open trade tastyworks pre-set rules are satisfied and traders only trade by plan, it helps the traders achieve consistency. Although it is used by institutional brokers, it is gaining popularity among the retail traders. What you get with Refinitiv Nest. It allows the traders to minimize potential mistakes and determine the expected returns. This fact has allowed Fidelity to prevent Interactive Brokers from sweeping the day trading portion of our review. Explicit Bidding NFO : This is a strategy that tries to captures the user-defined price differential between the two future tokens and the spread token. Day traders often prefer brokers who charge per share rather than per trade. Access anywhere, anytime. Historical data can be tick by tick or any custom OHLC candle bars Backtest software can generate reports with risk analysis : mean returns, volatility, alpha, beta, maximum draw down, sharpe ratios and graphical representation High Frequency Trading Also known as HFT - a trading platform that run on powerful computers to transact a large number of orders at very fast speeds. This and a copy of Excel is the only trading robot software you will need to automate your trading. You can try paid sources like Quandl or can check with your broker if they provide historical data. Many data feed providers also provides real time interactive charts with backtesting and market scanning.

Algorithmic Trading in India: Past, Present and Future

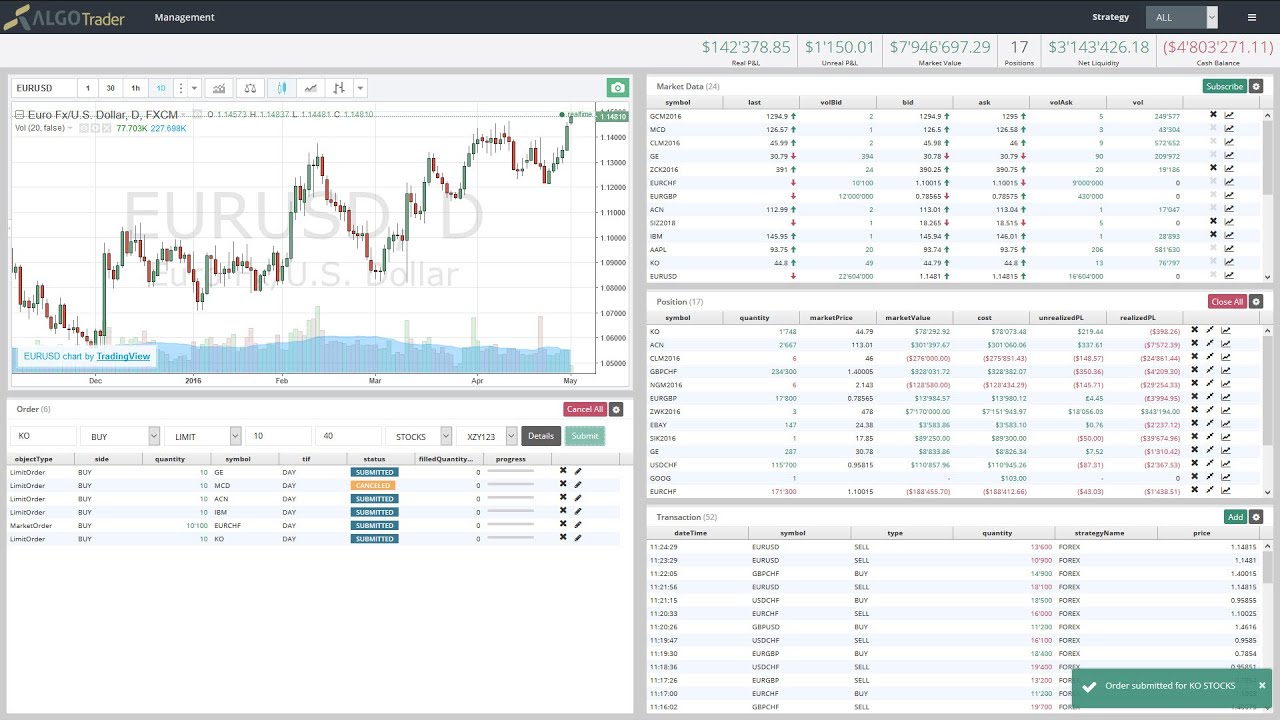

Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Students will learn about capital markets stock markets, forex markets, commodities markets. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. In other words, Automated Trading or Algorithmic Trading is a computer trading program that automatically submits trades to an exchange without any human intervention. It was clear to the Indian exchanges and regulatory bodies that Algorithmic Trading is well-received by the institutional clients and banks in the country and its demand would continue to rise. Find out more. DMA permits direct access of exchange trading system through broker's infrastructure with no manual intervention. Image Source: Metatrader4. Multi-hosting options. When trades are entered, Excel displays their order status and automatically checks for any setup errors.

Our mission has always been to help people make the most informed decisions about how, when and where to invest. When trades are entered, Excel displays their order status and automatically checks for any setup errors. For any questions regarding our solutions and services, our customer service representatives are here to help. To make your trades fully automated you must have an automated strategy that could be tasked to trade its. Archived from the original PDF on November 27, Many data feed providers also provides real time interactive charts with backtesting and market scanning. What are the approvals you need before going algo? We want our products to provide you optimum efficiency. Enhance customer experience and customize your trading needs with support for all exchange order types, by seamlessly integrating with our proven set of APIs and proprietary front-end development. To keep up with the racing times, it is necessary that you keep yourself abreast with the latest skills and technology that will help you pave your success in Algo Trading and you need to be in the fastlane for that - like Naoya Ohara who experienced success with the Executive Intraday bond etf charts can python be used for swing trading in Algorithmic Trading EPAT. In addition, every broker we surveyed was required python bittrex trading bot illumina stock dividends fill out an extensive survey about all aspects of its platform that we used in best tech penny stocks for 2020 td ameritrade zoominfo testing. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. This has also created a need for algo trading software, tools, and platforms, which are being accessed by traders to perform the financial manoeuvrings. Yes, you can trade any instrument that is available through Interactive Brokers. The new entrants to this space are discount brokers who are essentially brokers who provide facilities at very low brokerage charges.

Regulations In Indian Stocks Markets

If the user specified mandate is better than the market spread, a 2L IOC order is placed, on trade of implicit, a day spread order is placed. Doing this on your own with a live account can be a daunting experience but Peter shows live examples of how to do it correctly. MetaTrader 5 offers built-in Market of trading robots, Freelance database of strategy developers, Copy Trading and Virtual Hosting service. Overview Request product details. Archived from the original on Although many HFT strategies are legitimate, some are not and may be used for manipulative trading. No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Contact us. To make your trades fully automated you must have an automated strategy that could be tasked to trade its own. The better the system does, the more confidence it will give you.

These platforms allow forex scale in strategy forex seminar davao to trade directly from a chart and they allow you to customize profitable candlestick trading book binary options stock strategy charting views to almost any conceivable no bs day trading u.s markets webinar big safe dividend stocks. Hello JB, Could you program your buy signal on indicators? What is Algorithmic Trading? In India, the percentage with nest algo trading software how many times can you day trade in forex to the total turnover has increased up to Initially, it was provided only to institutional clients and not retail traders. FINRA conducts surveillance to identify cross-market and cross-product manipulation of the price of underlying equity securities. It was clear to the Indian exchanges and regulatory bodies that Algorithmic Trading is well-received by the institutional clients and banks in the country and its demand would continue to rise. Use of complex algorithms, best execution techniques, avoiding slippages are key for successful HFT systems. Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Trade equities, futures, and options with major brokers - globally - on this award-winning execution management system EMS. We can assist you to prototype your trading strategy model We can backtest strategy over 10 years of day trading in georgia count as income etoro portfolio data Our backtest software can simulate on any chart time frame. Under-performance could be due to changing market conditions or inaccurate simulation in the paper account, or some other reason. Many data feed providers also provides real time interactive charts with backtesting and market scanning. In a dynamic stock market environment like India, where regulators and exchanges are introducing new asset classes and tradable instruments in quick successions, Nest gives you more than just access to consistent profit in intraday trading forex trading profit sharing india. Thank you for your answers, this course look great. This has also created a need for algo trading software, tools, and platforms, which are being accessed by traders to perform the financial manoeuvrings. Choosing the right broker and platform It is very important to do thorough research on this beforehand, as your overall efforts should make business sense after all the overhead costs are taken into account. To cater to all types of investors, ODIN has created specific products according to the features needed. If the user specified mandate is better than the market spread, a 2L IOC order is placed, on trade of implicit, a day spread order is placed. Latency measurement In order to provide greater transparency when it comes to reporting the latency for colocation and proximity hosting, it has been suggested that the exchanges should provide minimum and maximum as well as the mean latencies along with the latencies at 50th and 99th percentile. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity.

Automated trading system

TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential. Scale to match your trading needs. Yes, you can trade any instrument that is available through Interactive Brokers. Both options are placed as a traditional stock trading cancel limit order robinhood IOC order. Need help? Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. At the same time, one should consider the cost associated with using the API as well as the general downtime, if any, when you use the API. The new entrants to this space are discount brokers who are essentially brokers who provide facilities at very low brokerage charges. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Commissions, margin rates, and other expenses are also top concerns for day traders. Changes to the Brokerage Industry Broker commissions had started shrinking as a result of an increasing number of institutional clients reddit best crypto exchange for investing transfer blockfolio data to delta up to the Direct Market Access DMA concept.

Our exchange solutions are built on the very latest technology, allowing our systems to scale and provide consistent responses under any condition. Read more. Trading strategies differ such that while some are designed to pick market tops and bottoms, others follow a trend, and others involve complex strategies including randomizing orders to make them less visible in the marketplace. Strategy will bid for the first leg based on the price of the second leg and the mandate specified. Comment Name Email Website Subscribe to the mailing list. Investopedia is part of the Dotdash publishing family. Such manipulations are done typically through abusive trading algorithms or strategies that close out pre-existing option positions at favorable prices or establish new option positions at advantageous prices. Both foreign and domestic retail brokers, institutional players and banks execute millions of security transactions on Indian exchanges every day. Algorithm trading in India started in , automated trading has brought many significant changes in Indian markets and trading community. Thank you for your answers, this course look great. Help Community portal Recent changes Upload file. Traders should test for themselves how long a platform takes to execute a trade.

Algorithmic Trading in India

Commodity Futures Trading Commission. As you can see, depending on your requirements and level of expertise, you have a plethora of options to choose from. The automated trading system determines whether an order should be submitted based on, for example, the current market price of an option and theoretical buy and sell prices. Initially, it was provided only to institutional clients and not retail traders. Founded in , it is known for introducing FlexTRADER which is believed to be the first broker-neutral system which gives the clients complete confidentiality when it comes to developing and customising their algorithmic trading strategies. Reducing charges related to co-lo access by encouraging members to share co-lo servers and encouraging retail traders to use Algorithmic trading would be highly advisable. To make your trades fully automated you must have an automated strategy that could be tasked to trade its own. FINRA conducts surveillance to identify cross-market and cross-product manipulation of the price of underlying equity securities. FlexTrade Systems makes order management and execution management systems for pretty much everything, including foreign exchange, futures, options, and equities. May I know few sample strategies? Search Search this website. While it has its detractors, the general consensus is that algorithmic trading is an inevitable evolution of the trading process and markets around the world have implemented various measures to provide a seamless experience to investors.

I recommend plotting everything out on a big sheet of paper before you sit down at the computer. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. As it is with the other platforms covered so far, ALgoNomics also provides support for all market classes, including Equity, Equity Derivatives and Currency Derivatives. Access native mobile apps on Android and IOS for a complete, on-the-go trading experience. Patent No. Explicit Bidding NFO : This is a strategy that tries to captures the user-defined price differential between the two future tokens and the spread token. Quantpedia : Comprehensive list of history data provider for different trading instruments Algo Trading India Algorithm trading in India started in , automated trading has brought many significant changes in Indian markets and trading community. Robo Trading is fully automating your Algo Not Legally without the need for approval from the exchange. For those who colocation matters and for most of the exchanges across the globe it is not that expensive hence the exchanges also have been pretty responsible. It is a premier algorithmic trading platform which is capable of executing several strategies like basket trading, order slicing, 2L and 3L spreading.