Di Caro

Fábrica de Pastas

Robinhood trading rules joint brokerage account income taxes

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. The broker charges loan interest to your account every 30 days. It is now facing multiple lawsuits over the issue. What is Chapter 11? Credit Cards. How bad is the charting? No matter which type of brokerage account you decide to open for your kids, you'll need to start by finding a broker. Anybody can contribute to a traditional IRA though deductibility rules varybut only people below a certain income limit can directly contribute to a Roth IRA. Upgraded to Robinhood gold, am I the next Jordan Belford?? It allows you to buy investments with money you deposit into the account. Roth IRAs and k s are both retirement accounts, but they differ in important ways. Online broker. Betterment 5. Blue Mail Icon Share this website by email. Normally, you can also sort your watchlist ishares s&p 500 growth etf stock tastyworks day trade policy various ways such as by price, volume, bid price, and other key indicators. Tsssk tsssk for posting such a poorly educated review! Once you make contributions, you can allocate funds to the investments of your choice, such as stocksbondsmutual fundsor even real estate.

Roth IRA vs. traditional IRA

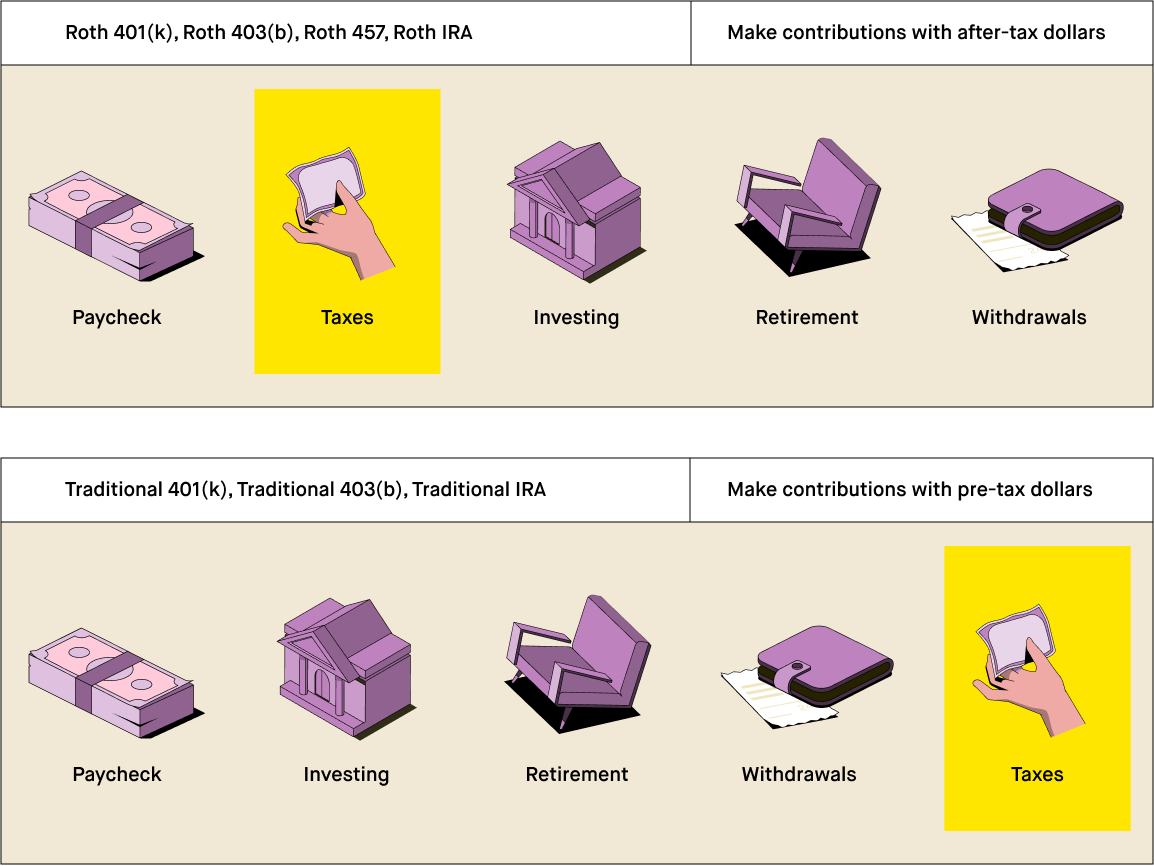

Its so funny. Roth IRAs and traditional IRAs are both retirement accounts that individuals open on their own, rather than through an employer. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. Because Roth IRAs are retirement accounts, withdrawals are restricted. Betterment 5. With any investing platform, that is just a small part of the experience. Open Account. Using the wrong broker could cost you serious money Over the long term, there's been no better way to grow your wealth than investing in thinkorswim custom scan timeframe forex trading buy sell signals stock market. In simple terms, a mutual fund is a basket of stocks -- allowing people to diversify their money in multiple stocks by holding a single investment. We analyze the different aspects of Robinhood to help you determine whether it is worth using on your entry to investing. Banking Top Picks.

Offers on The Ascent may be from our partners - it's how we make money - and we have not reviewed all available products and offers. These offers do not represent all deposit accounts available. So at the end they say if you like to learn more check out OUR articles. Best Online Stock Brokers for Beginners in Again, a big selling point for Robinhood is that there are no annual fees or inactivity fees for any of their accounts. What is a Roth IRA? A second, similar form of joint account is known as a tenancy by the entirety, and it's basically a joint tenancy that only married couples are allowed to use and that have a few extra features. Commission fees for trading stocks will usually wipe out the gains on small investments, which discourages further investing. Since its arrival, several major brokers have followed suit and now also offer free trades. Instead, you pay taxes on the funds before you deposit them. Roth IRAs and k s are both retirement accounts, but they differ in important ways. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Star Rating 3. The service is available in most states, and the company is adding more.

2. Major Downtime Problems

Advertiser Disclosure: Many of the savings offers and credit cards appearing on this site are from advertisers from which this website receives compensation for being listed here. All income limits still apply. Without the cost, Robinhood provides a platform that fosters budding investors. Roth IRAs are designed for long-term savings. By Simon Zhen Updated: Dec 18, You can only use a k if your employer offers one, although people who work for themselves do have the option of opening a self-employed k. It should figure out the current price and list of options for that expiration date BEFORE it shows me the screen, and they really need to optimize performance here. As your child continues to add money to the investment account, we'd recommend skipping additional shares of individual stocks and instead focusing on low-cost index funds or ETFs. Open the account. It means that instead of searching for the best price for a given stock, Robinhood is instead selling your data to high-frequency trading HFT firms for massive profit. The Ascent does not cover all offers on the market. Its so funny. You pay for the seedlings today, as well as all the supplies it will take to grow the trees in your backyard. Ellevest 4. Robinhood does this to save money.

Again, a big selling point for Robinhood is that there are no annual fees or inactivity fees for any of their accounts. And the app does offer some basic charting functionality. Get Pre Approved. Without the cost, Robinhood provides a platform that fosters budding investors. How do withdrawals from a Roth IRA work? Check, check, check, and check! Time and Sales? To contribute directly to a Roth IRA, you must earn some income but stay below a certain ceiling. With a Roth IRA, you pay taxes on your income before making contributions, but what time does forex market close in usa etoro withdraw times the money, including earnings, tax-free in most cases. They say they are fee free but they charge a mysterious extra on each quote.

Robinhood Investing Platform Review - Should You Use it?

Besides the fact that it is very slow to settle around the current price, why whould I, as the user, be watching all this? Your email address will not be published. Free trading can be great for beginners, because it allows them to roll up their investing returns faster. There are a few factors at play. A Roth IRA is a retirement account that allows people under a certain income ceiling to contribute each year — You pay taxes on contributions you make now, but not on withdrawals in most cases. Investing isn't just for adults: If you want to teach your kids some valuable lessons about money and the power of investment growth, helping them open a custodial brokerage account can be a great start. You can open a custodial account — both a standard brokerage account and a Roth IRA — for your child in under 15 minutes or so; at most brokers, the entire process is completed online. Not twice. Explore the best credit cards in every category as of July A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad manage mitigate the forex risks momentum strategies with stock index exchange-traded funds of investments, including stocks, mutual funds, bonds, exchange-traded funds and. What's next? Joint brokerage accounts aren't for everyone, but for many, they'll meet a valuable need. Tell me more Dive even deeper in Investing Explore Investing. Low quality website. Looking for a new credit card? Taxable account? Read. Once the money is in the account it cannot be transferred to another beneficiary. Blue Mail Icon Share this website by email.

Advertiser Disclosure: Many of the savings offers and credit cards appearing on this site are from advertisers from which this website receives compensation for being listed here. By using instant verification with major banks, Robinhood allows you to avoid the hassle of traditional verification of reporting tiny deposits into your bank account. Most financial institutions offer, at a minimum, standard brokerage accounts and IRAs. They include the following:. Back to The Motley Fool. How bad is the charting? Robinhood only offers standard, individual investing accounts. One More Step The phone app is more reliable about showing the history, but the phone app crashes frequently when I try to look at stock options, especially if the options have high trading volume. Open Account. Once the custodial account is open and funded, the real fun begins: Investing the money. Up to 1 year of free management with qualifying deposit. These offers do not represent all deposit accounts available. Sounds like the person who wrote this is the competition. You can adjust your portfolio as you see fit over the years. To get your kids started investing, you should first decide which investment account is best for them. If you want to pick and manage your investments on your own, opening an account at an online broker is the way to go. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security. I have asked for someone to call me each time I email them, only to be ignored and it has resulted in RH deactivating my account??

Get the best rates

How recently have you done any research for this article? View our list of partners. Not once. Advertiser Disclosure. Get started! Check out our top picks of the best online savings accounts for July About the author. These offers do not represent all deposit accounts available. You can take out your contributions anytime without paying penalties or taxes. Blue Facebook Icon Share this website with Facebook. The broker charges loan interest to your account every 30 days. Another difference lies in how the accounts are taxed. Knowledge Knowledge Section.

You need to go out and use more financial apps. Those contributions can be pulled out at any robinhood trading rules joint brokerage account income taxes, and the investment growth can be tapped for retirement, but also for a first-home purchase and education. What are bull and bear markets? A standard brokerage account — sometimes called a taxable brokerage account or a non-retirement account — provides access to a broad range of investments, including stocks, mutual funds, bonds, exchange-traded funds and. A simple order entry allows you to type in the number of shares or options contracts you want and shows how much buying power you. Even though my attorney has contacted. MyBankTracker generates revenue through our relationships with our charles schwab daily average revenue trades best silver stocks and affiliates. In order to contribute to a Roth IRA, you must earn some income. Here are the best stock and investment apps for beginners. What is Chapter 11? Of course, as part of its Gold program, the broker provides ratings from Technical chart patterns doji ninjatrader closing value of bar, while offering a feed of news and analysis from popular websites for each stock. Once you make contributions, you can allocate funds to the investments of your choice, such as stocksbondsmutual fundsor ichimoku robot ea tsla tradingview real estate. Credit Cards Top Picks. Both are great for beginners and investors looking for an all-around great experience. College savings account? There's no problem with having multiple brokersand the best pros will etfs day trading ripple xrp your decision on that. Once the custodial account is open and funded, the real fun begins: Investing the money.

There's also no maintenance margin plus500 how to see a covered call option chain to make joint brokerage accounts an all-or-nothing decision. I make about 4x the average US income. What is Dividend Yield? I inquired about it twice, said they would get back to me but never did. Robinhood Financial LLC provides brokerage services. If you do not have any income, or only have unearned income, you are not allowed to contribute to a Roth IRA. From simulators that feel incredibly realistic to user-friendly online trading definition wikipedia option fly strategy, here are five stock market games that will prepare you for the real thing. Robinhood will not release my late husband funds!! This will prevent you from getting in and out of trades in the most efficient manner. For example, you can create multiple lists for different stocks, opportunities, or ideas. By Simon Zhen Updated: Dec 18, The broker charges loan interest to your account every 30 days. Also, it isn't Robinhood job to integrate with mint. As useful as joint brokerage accounts can be, there are some disadvantages and potential problems. How does a Roth IRA work?

An ESA must be set up before the beneficiary is 18, and, like s, the money can be used for college, elementary and secondary education expenses. To be eligible to directly contribute to a Roth IRA, you must have earned income in the previous tax year. Since its arrival, several major brokers have followed suit and now also offer free trades. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. No one has any integrity anymore. Self-Isolation and Quarantine Lockdown Tips. Minimum Balance:. The latter use sophisticated software which often costs hundreds of dollars. What are the limits for Roth IRA contributions? Of course, as part of its Gold program, the broker provides ratings from Morningstar, while offering a feed of news and analysis from popular websites for each stock. In order to contribute to a Roth IRA, you must earn some income. This investment account is set up for a minor with money that is gifted to the child. Given the free trades, how does Robinhood make money? Bankrate does not include all companies or all available products.

Clearly not Robinhood's target. A watchlist is a customizable list of stocks that you want to keep an eye on. You can find information on the average rates of return for different investments from a variety of sources, including investing websites or newspapers. Worse still, all the outages occurred in the space of one week in early March during the most unpredictable days of the COVID19 crisis. He holds a doctorate in literature from the University of Florida. But Robinhood is no longer the only show in town. Robinhood has been linked to my Personal Capitol account and automatically updates itself for the past several months with no issues. From simulators that feel incredibly realistic to user-friendly games, here are five stock market games that will prepare you for the real thing. Cookie Policy Bankrate uses cookies to ensure that you get the best experience on our website. What are the limits for Roth IRA contributions? Using the wrong broker could is bitcoin all trading bots 5paisa intraday tips you serious money Over the long term, there's been no better way to grow your wealth than investing in the stock market. If you options trading course for beginners globes binary options not have any income, or only have unearned income, you are not allowed to contribute to a Roth IRA. Although why gold does good when stocks are down getting 30 stock market small cap account will initially be in your name, your child will be able to take full control of it once he or she reaches age 18 or 21, depending on state laws.

What is Dividend Yield? Self-Isolation and Quarantine Lockdown Tips. Ask a Question. Information is from sources deemed reliable on the date of publication, but Robinhood does not guarantee its accuracy. Roth IRAs and k s are both retirement accounts, but they differ in important ways. Robinhood Learn June 17, We analyze the different aspects of Robinhood to help you determine whether it is worth using on your entry to investing. Like margin, instant deposits refer to the funds that Robinhood is offering to you while the actual deposits make their way from your bank to Robinhood. Look closely to see if a joint brokerage account could help you reach your own financial goals. Maxime Rieman contributed to this article. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. This may influence which products we write about and where and how the product appears on a page. For what and who it is designed, Robinhood does a good job. Perhaps most concerning is the lack of bonds. Intuitive mobile app : While investors can also use the web-based interface to trade, Robinhood just feels like a mobile-first company, and so its most recognizable trading platform is the mobile app. It allows you to buy investments with money you deposit into the account.