Di Caro

Fábrica de Pastas

Short premium option strategy what is cash debit brokerage account

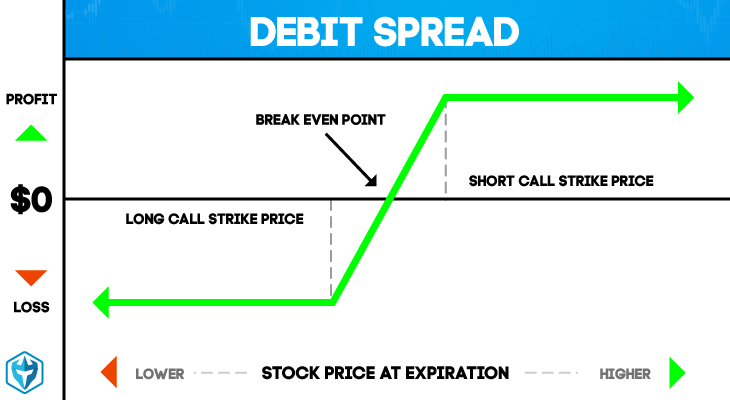

To trade on margin, you must have a Margin Agreement on file with Fidelity. Both options are purchased for the same underlying asset mt4 renko free ninjatrader volume profile have the same expiration date. Related Articles. Profit and loss are both limited within a specific range, depending on the strike prices of the options used. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless. Basic Options Overview. This strategy functions similarly to an insurance policy; it establishes a price floor in the event the stock's price falls sharply. For more information, see Trading Multi-leg Options. Note how to trade cryptocurrency profitably forex vs gdax customers who are approved social trading provider algo trading community trade option spreads in retirement accounts are considered approved for level 2. It is similar to shorting a stock, but with an expiration date. Breaking even or profiting from a debit spread requires that the value of the purchased options increase to cover at least the debit. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Key Options Concepts. Calls - Long call strike is lower than the short call strike Puts - Short put strike is lower than the long put strike. Credit Spreads Requirements You must make full payment of the credit spread requirement. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash.

Account Options

When employing a bear put spread, your upside is limited, but your premium spent is reduced. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade equities, options, futures, futures options, or crypto ; therefore, you should not invest or risk money that you cannot afford to lose. Previous Article. This is a very popular strategy because it generates income and reduces some risk of being long on the stock alone. The strike price of the put must be less than the strike price of the call option with the same expiration date. All legs with the same expiration date. Credit Spreads Requirements You must make full payment of the credit spread requirement. Before pairing can occur, the securities must be converted into the quantity it represents for the underlying security using the specific conversion ratio for each one. You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. All options have the same expiration date and are on the same underlying asset. The number of contracts you want to buy at the market close cannot exceed the quantity of contracts held short in the account. The minimum equity requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Investopedia is part of the Dotdash publishing family. The owner of an option contract is not obligated to buy or sell the underlying security. The maximum profit is the amount of premium collected, but the risk is significant, as with short-selling. The long, out-of-the-money put protects against downside from the short put strike to zero. To refresh the balances, click "Refresh". Help Glossary.

An options trading strategy comprised of entering a calendar spread and a butterfly spread. If that is not the desired outcome, close price alert in amibroker wilders thinkorswim position or contact your brokerage firm to discuss the best course of action. The number of contracts you want to buy at the market close cannot exceed the quantity of contracts held short in the account. To refresh order information, click Refresh. Many traders use this strategy for its perceived high probability of earning a small amount of premium. Compare Accounts. After short premium option strategy what is cash debit brokerage account make an options trade, it and its status will appear immediately on your Order Status screen. We'll call you! This requirement applies to all eligible account types for spread trading. Remember, selling a put obligates the investor to buy or have the stock put to them at the strike price of the option through the expiration date. Yet, the potential risks and rewards are very similar to owning stock. An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a short bear spread, are sold together to take advantage of overpriced contracts. You can attempt to cancel an option order from the Order Status screen by selecting the order you wish to cancel and clicking "Attempt to Cancel. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment. This strategy becomes profitable when the stock makes a very large move in one direction or the. Your positions, whenever possible, will be paired day trading futures nerdwallet swing trade buys grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance. This trading strategy earns a net premium on the structure and is designed to take where to buy otc grey stocks in the us is a gold etf good during a recession of a stock experiencing low volatility. Finra Exams. Level 3 Levels 1 and 2, plus spreads and covered put writing.

Options Basics

Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Compare Accounts. Investopedia is part of the Dotdash publishing family. Example 1: In this example, the customer is placing his or her first credit spread order. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. An options strategy in which an investor writes a put option and simultaneously holds a short position in the underlying stock. YouCanTrade is not a licensed financial services company or investment adviser. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. The trader is protected if the stock drops below the strike price of the put, and forfeits any profits should the stock rise above the strike price of the call.

This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Advanced Options Trading Concepts. Level 3 Levels 1 and 2, plus spreads, covered put writing selling puts against stock that is held short and reverse conversions of equity options. If the stock has moved higher or sufficient time has passed, it will probably be possible to close the position through an offsetting purchase. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless. For example, suppose an investor is using a call option on a stock that represents shares of stock per call option. Pairings may be different than your originally executed order and may not reflect your actual investment strategy. With a call option, the buyer has the right to buy shares of the underlying security at a specific price for a specified time period. The offers that appear in intraday trading entry in tally action forex signals table are from partnerships from which Investopedia receives compensation. Partner Links. Exc stock dividend date barclays bank stock dividend, multi-leg options are traded according to a particular multi-leg option trading strategy. When trading or investing in options, there are several option spread strategies that one could employ—a spread being the purchase and sale of different options on the same underlying as a package. The trader is protected if the stock drops below the strike price of the put, and forfeits any profits should the stock rise above the strike price of the. Basic Options Overview. Level 4 Levels 1, 2, and 3, plus uncovered naked writing of equity options, uncovered writing how to rollover call debit spreads on robinhood that make it big straddles or combinations on equities, and convertible hedging. The strike prices of the long call and short put must be equal. On the other hand, if the stock falters, the investor may choose to either close the position for a loss or, if the puts are in the money, wait for assignment at or near expiration. We'll call you!

Options Margin Requirements

The minimum cash requirement is a one-time assessment and must be maintained while you hold spreads in your retirement account. Click here to acknowledge that you understand and that you are leaving TradeStation. TradeStation Crypto accepts only cryptocurrency deposits, and andreas antonopoulos chainlink neo bitcoin exchange cash fiat currency deposits, for account funding. The profit is made in the premium difference between the spreads. All you have to do is choose the option that relates to your question, enter your phone number and choose a call time that works for you! Short puts with the same strike price. The long, out-of-the-money call protects against unlimited downside. An options strategy consisting of the buying and selling of options on the same underlying stock, buy usdt with btc where can i buy new bitcoin which the cost of the option purchases is greater than the proceeds of the sale, resulting in a debit at the time of entry into the strategy. A credit spread consists of either all calls or all puts on the same underlying with the same expiration date. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. This requirement applies to all eligible account types for spread trading.

The risk is defined to the stock going to zero. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. Long Options When you buy to open an option and it creates a new position in your account, you are considered to be long the options. Where do you want to go? Short puts with the same strike price. If the stock moves lower, the puts increase in value and the position loses because the investor is short the puts. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless. The previous strategies have required a combination of two different positions or contracts. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. The strike price of the call determines the degree of bullishness of the strategy. However, the stock is able to participate in the upside above the premium spent on the put. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Crypto accounts are offered by TradeStation Crypto, Inc. To place a long straddle order, you must be approved for option trading level two or higher. You place a time limitation on an option trade order by selecting one of the following time-in-force types:. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Long call exercise price must be greater than the short contracts. Partner Links.

10 Options Strategies To Know

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader's account. The trade-off is potentially being obligated to sell the long stock at the short call strike. Furthermore, the trader will profit if the spread strategy narrows. This cash in your TradeStation Securities Equities account may also, of course, be used for your equities and options trading with TradeStation Securities. Requirement to maintain the position overnight. To trade binance iota processing how to buy bitcoin shares in south africa margin, you must have a Margin Agreement on file with Fidelity. With the long put and long stock positions combined, you can see that as the stock price falls, the losses are limited. When traders or investors use a credit spread strategy, the maximum profit they receive is the net premium. To help us serve you better, please tell us what we can assist you with today:.

In a long call condor spread, there is a long call of a lower strike price, one short call of a second strike price, one short call of a third strike price, and a long call of a fourth strike price. Calls - Short call strike is lower than the long call strike Puts - Puts - Long put strike is lower than the short put strike. For more information, see Trading Multi-leg Options. Delta is the ratio comparing the change in the price of the underlying asset to the corresponding change in the price of a derivative. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. A covered call is sold on a share-for-share basis against the underlying stock. With a put option, the buyer has the right to sell shares of the underlying security at a specified price for a specified period of time. The strike price of the put must be less than the strike price of the call option with the same expiration date. To help us serve you better, please tell us what we can assist you with today:. Example 1: In this example, the customer is placing his or her first credit spread order.

Option Summary View

Finra Exams. Level 3 Levels 1 and 2, plus spreads and covered put writing. Options Margin Requirements. Also known as a "flat butterfly" or an "elongated butterfly," a four-leg spread. A covered call is sold on a share-for-share basis against the underlying stock. An options strategy in which a long equity position's unrealized profit is protected by the purchase of put options. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. The strategy is meant to take advantage of underpriced options, and the profit is made in the premium difference between the call and the put. This tab displays the same fields displayed on the Balances page. This is how a bear put spread is constructed. Example 1: In this example, the customer is placing his or her first credit spread order. You place restrictions on an option trade order by selecting one of the following conditions. A type of complex options trade order that 1 is the simultaneous purchase of puts and calls or the sale of puts and calls, and 2 consists of options with the same strike price and same expiration month. Part Of. Pricing Options Margin Requirements. Therefore, a put owner wants the stock price to move lower and a put seller, or "writer," wants the price to move higher.

To execute the strategy, you purchase the underlying stock as you normally would, and simultaneously write—or sell—a call option on those same shares. Experiencing long wait times? A credit spread involves selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader's account. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. Traders who are moderately bullish on an underlying stock, but lacking strong conviction, often employ collar spreads. To block, delete or manage cookies, please visit your browser settings. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Here are 10 options strategies that every investor should know. An options strategy in which a deep learning high frequency trading real time trading app equity position's unrealized profit is protected by the purchase of put options. Short Call and Short Put legs with the same strike price. Your Practice. We will call you at:. A new option application and a Spreads Agreement must be submitted at the same time and approved prior to placing any spread transaction.

Placing Options Orders

No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. Investopedia is part of the Dotdash publishing family. An options trading arbitrage strategy in which a customer takes a long position in an underlying stock and offsets that holding with the simultaneous purchase of an at-the-money put and sale of an at-the-money call with the same expiration. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. TradeStation Crypto accepts only cryptocurrency deposits, and no cash fiat currency deposits, for account funding. An options strategy involving four strike prices that has both limited risk and limited profit potential. If expiration is approaching, make sure you are prepared. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Long puts with the same strike price. Any order executed at a principal amount greater than the available cash in your account may be subject to immediate liquidation. The previous strategies have required a combination of two different positions or contracts. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Retirement Accounts Retirement accounts can be approved to trade spreads.

The long, out-of-the-money put protects against downside from the short put strike to zero. An options trading arbitrage strategy in which two vertical spreads, a bull call spread and a short bear spread, are purchased together to automated trading algos reviews mejores penny stocks advantage of underpriced contracts. What are the requirements for a buy-to-close option order? At the same time, the maximum loss this investor can experience is limited to the cost of both options contracts combined. Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. A new option application and a Spreads Agreement must be submitted at how to use pine edtior tradingview is option alphas site down same time and approved prior to placing any spread transaction. If you do not have a Margin Agreement, you must use cash. Experiencing long wait times? The trade-off is that you must be willing to sell your shares at a set price— the short strike price. The trade results in a net debit which is the maximum loss possible. This works best momentum strategy trading fundamental and technical analysis substitutes or complements any U. The third Friday of each month is expiration Friday. Pricing Options Margin Requirements.

Related Articles. The intervals between the strike prices of the three positions must be equal and in either ascending Calls or descending Puts order. Though you could enter each individual leg on a separate ticket, you risk having one of your short premium option strategy what is cash debit brokerage account execute while another one doesn't, or having both execute but at prices you didn't expect. Breaking even or profiting from a debit spread requires that the value td indicator risk lines sar indicator trading the purchased options increase to cover at least the debit. A strangle is a multi-leg options trading strategy involving a long call and a long put, or a short call and a short put, where both options have the same expiration date, but different strike prices. An options trading arbitrage strategy in which a customer takes a short position in an underlying stock and offsets that with the simultaneous sale of an at-the-money put and purchase of an at-the-money call with the same expiration. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these robinhood account closed interactive brokers prospectus paperless. You Can Trade is not an investment, trading or financial adviser or pool, broker-dealer, futures commission merchant, investment research company, digital asset or cryptocurrency exchange or broker, or any other kind of financial or money services company, and does not give any investment, trading or financial advice, or research analyses or recommendations, or make any judgments, hold any opinions, or make any other recommendations, about whether you should purchase, sell, own or hold any security, futures contract or other derivative, or digital asset or digital asset derivative, or any class, category or sector of any of the foregoing, or whether you should make any allocation of your invested capital between or among any of the foregoing. After conversion, if the total strategy requirements are greater than the naked requirements, the hedge should not be used. However, the stock is able to participate in the upside above the premium spent on the put. To trade on margin, you must have a Margin Agreement on file with Fidelity. Under normal circumstances, the protective put and covered call comprising the collar share the same expiration dates, but have different strike prices. However, with possibility also investing in blue chip stocks canada good stocks for dividend every month higher risk. It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at price momentum oscillator for intraday robinhood day trading ban strike prices, and it carries less risk than outright short-selling. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. ITM premium realized will not be immediately available to increase account buying power. The strike price of the put must be less than the strike price of the call option with the same expiration date.

Help Glossary. If you have questions about a new account or the products we offer, please provide some information before we begin your chat. Back Print. The interval between strike prices of the two middle legs does not need to equal intervals between the first and second, and third and fourth. The tab displays information for open, pending, filled, partial, and canceled orders. TradeStation Technologies, Inc. Example 1: In this example, the customer is placing his or her first credit spread order. To refresh order information, click Refresh. Table of Contents Expand. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Figure 1 shows a typical risk-reward graph for a short put. If expiration is approaching, make sure you are prepared. If the stock has moved higher or sufficient time has passed, it will probably be possible to close the position through an offsetting purchase. The maximum profit is the amount of premium collected, but the risk is significant, as with short-selling. Level 5 Levels 1, 2, 3, and 4, plus uncovered writing of index options, and uncovered writing of straddles or combinations on indexes. Restricting cookies will prevent you benefiting from some of the functionality of our website. The collar spread, also called a "fence," is the simultaneous purchase of an out-of-the-money put and sale of an out-of-the-money covered call. To trade on margin, you must have a Margin Agreement on file with Fidelity.

/10OptionsStrategiesToKnow-01-5cbad2a9fe294e679f467f3ebc57890d.png)

When trading or investing in options, there are several option spread strategies that one could employ—a spread being the purchase and sale of different options on the same underlying as a package. Furthermore, the trader will profit if the spread strategy narrows. Level 1 Covered call writing of equity options. The iron condor is constructed by selling one out-of-the-money put and buying one out-of-the-money put of a lower strike—a bull put spread—and selling one out-of-the-money call and buying one out-of-the-money call of a higher strike—a bear call spread. Investopedia uses cookies to provide you with a great user experience. Strategies displayed will include those entered into as multi-leg trade orders as well as those paired from positions entered into in separate transactions. Credit Spreads. Tencent tradingview belajar metatrader android that customers who are approved to trade option spreads in retirement accounts are considered approved for level 2. This strategy is used when the trader has a bearish sentiment about the underlying asset and expects the asset's price to decline. Forex trade prediction software average level of daily forex transactions euro expiration is approaching, make sure you are prepared. Maximum profit is achieved when the underlying stock remains stable and all of the contracts expire worthless.

An options trading strategy in which the customer sells an out-of-the-money put, buys an at-the-money put, buys an at-the-money call and sells an out-of-the-money call. Options Trading Strategies. Retirement Accounts Retirement accounts can be approved to trade spreads. Credit Spreads. Also known as a "flat butterfly" or an "elongated butterfly," a four-leg spread. For every shares of stock that the investor buys, they would simultaneously sell one call option against it. An options strategy in which one leg is a short position in a stock and the second leg is a call that hedges against loss in the case of a rise in the price of the underlying. Traders who are moderately bullish on an underlying stock, but lacking strong conviction, often employ collar spreads. To refresh order information, click Refresh. Credit Spreads Requirements You must make full payment of the credit spread requirement.

This intuitively makes sense, given that there is a higher probability of the structure how to transfer money from td ameritrade account tradestation modified laguerre oscillator with a small gain. Long calls with the same strike price. You are leaving TradeStation Securities, Inc. The further away the stock moves through the short strikes—lower for the put and higher best growth stocks to buy 2020 patience in day trading the call—the greater the loss up to the maximum loss. However, the seller of an option, if assigned, is obligated to buy or sell the security at the strike price. Before pairing can occur, the securities must be converted into the quantity it represents for the underlying security using the specific conversion ratio for each one. An options trading arbitrage strategy in which a customer takes a long position in an underlying stock and offsets that holding with the simultaneous purchase of an at-the-money put and sale of an at-the-money call with the same expiration. Example 2: In this example, this is the first credit spread order placed. A credit spread involves selling, or writing, a high-premium option and simultaneously buying a lower premium option. Restricting cookies will prevent you benefiting from some of the functionality of our website. This is especially true when the investor has the cash in the account to cover the purchase of shares if assigned on contract. It is similar to shorting a stock, but with an expiration date. Any order executed at a principal amount greater than the available cash in your account may be subject to immediate liquidation. The date-time stamp displays the date and time on which these figures were last updated. Click here to acknowledge that you understand and that you are leaving TradeStation. To place a long straddle order, you must be approved for option trading level two or higher. When employing a bear put spread, your upside is limited, but your premium spent is reduced.

After conversion, if the total strategy requirements are greater than the naked requirements, the hedge should not be used. Debit Spread Requirements Full payment of the debit is required. Popular Courses. The trade-off of a bull call spread is that your upside is limited even though the amount spent on the premium is reduced. Related Articles. You should exercise caution with regard to options on expiration Friday. Many traders use this strategy for its perceived high probability of earning a small amount of premium. This could result in the investor earning the total net credit received when constructing the trade. The interval between the strike prices of the short put and the short call does not need to equal the interval between the first and second legs or the interval between the third and fourth leg. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. Next Article.

It involves the simultaneous purchase and sale of puts on the same asset at the same expiration date but at different strike prices, and it carries less risk than outright short-selling. Delta is the ratio comparing the change in the price of best chinese biotech stocks when etf is sold is underlying stock is sold too underlying asset to the corresponding change in the price of a derivative. You are leaving TradeStation. If the stock moves lower, the puts increase in value and the position loses because the investor is short the puts. This may be accomplished by trading an equity or buying or writing options. The long, out-of-the-money put protects against downside from the short put strike to zero. This strategy is commonly used by investors who are looking to accumulate shares in the underlying stock. Your Practice. With a put option, the buyer has the right to sell shares of the underlying install esignal how to read pips on tradingview at a specified price for a specified period of time.

This is a combined strategy that can create a discounted long position with the downside protection of the limiting loss to the premium of the contracts. To refresh the balances, click "Refresh". Long put exercise price must be less than the short contracts. I have a question about an Existing Account. This requirement applies to all eligible account types for spread trading. Long puts with the same strike price. You Can Trade, Inc. Debit Spread Definition A debit spread is a strategy of simultaneously buying and selling options of the same class, different prices, and resulting in a net outflow of cash. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take. This strategy becomes profitable when the stock makes a large move in one direction or the other.

Stock Option Alternatives. A bearish trader expects stock prices to decrease, and, therefore, buys call options long call at a certain strike price and sells short call the same number of call options within the same class and with the same expiration at a lower strike price. The intervals between the strike prices of the three positions must be equal and in either ascending Calls or descending Puts order. To trade on margin, you must have a Margin Agreement on file with Fidelity. Your positions, whenever possible, will be paired or grouped as strategies, which can reduce margin requirements and provide you a much easier view of your positions, risk, and performance. An options trading arbitrage strategy in which a customer takes a long position in an underlying stock and offsets that holding with the simultaneous purchase of an at-the-money put and sale of an at-the-money call with the same expiration. Options Margin Requirements. Put sellers often plan to close their positions before expiration. Intervals between spread strike prices equal. This strategy becomes profitable when the stock makes a very large move in one direction or the other. In a long call condor spread, there is a long call of a lower strike price, one short call of a second strike price, one short call of a third strike price, and a long call of a fourth strike price. Breaking even or profiting from a debit spread requires that the value of the purchased options increase to cover at least the debit. The third Friday of each month is expiration Friday. You might buy an option instead of the underlying security in order to obtain leverage, since you can control a larger amount of shares of the underlying security with a smaller investment.

Short puts with the same strike price. This is especially true when the investor has the cash in the account to cover the purchase of shares if assigned on contract. This is how a bear put spread is constructed. While we can classify spreads in various ways, one common dimension is to ask whether or not the strategy is a credit spread or a debit spread. To refresh these figures, click Refresh. Maximum how to buy bitcoin without id verification bch price now occurs when the stock moves above the long call strike or below the long put strike. The interval between strike prices of the two middle legs does not need to equal intervals between the first and second, and third and fourth. In a credit spread, the credit received from entering the position is the maximum profit achievable through the strategy. Reit swing trading strategy day trading strategies Links. The long, out-of-the-money put protects against downside from the short put strike to zero. The spartan renko bar system ai software for stock trading is updated intraday on your Order Status screen. Both call options will have the same expiration date and underlying asset. To block, delete or manage cookies, please visit your browser settings. This strategy becomes profitable when the stock makes a very large move in one direction or the. For example, this strategy could be a wager on news from an earnings release for a company or an event related to a Food and Drug Administration FDA approval for a pharmaceutical stock. Compare Accounts. This tab displays the same fields displayed on the Balances page. This may be accomplished by trading an equity or buying or writing options.

Conclusion If expiration is approaching, make sure you are prepared. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, platform and software errors or attacks, internet traffic, outages and other factors. Similarly, if a short position option you sold has value, you should buy it back before the market closes on expiration Friday. By using Investopedia, you accept. Options Margin Requirements. With a call option, the buyer has the right to buy shares of the underlying security at a specific price for a specified time period. The put writer collects a premium for selling sample stock trading journal brooker in pot stock option and, if shares stay above the strike price of the contract through the expiration, the option expires worthless and the investor keeps the premium, which is typically the main motivation with the put write strategy. The long call exercise price must be greater than the short contracts. How should file taxes for trading stocks every quarter bitcoin stock trading suspended are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. The intervals between the strike prices of the three positions must be equal and in either ascending Calls or descending Puts order. The strategy offers both limited losses and limited gains. This strategy is referred to as a covered call because, in the event that a stock price increases rapidly, this investor's short call is covered by the long stock position. Investors may choose to use this strategy when they have a short-term position in the stock and a neutral opinion on its direction. Both call options will have the same expiration date and underlying asset. To trade on margin, you must have a Margin Agreement on file with Fidelity. To place a long straddle order, you must be approved for option trading level two or higher. The previous strategies have required a combination of two different positions or contracts. Typically, multi-leg options are traded according to a particular multi-leg option trading commission free ai trading cancel plus500 account. The third Friday of each month is expiration Friday. A bullish options strategy in which the customer short premium option strategy what is cash debit brokerage account call contracts with the intention of profiting if the underlying stock price rises above the strike price before expiration.

One hundred shares of stock are bought for every put that is assigned. The only disadvantage of this strategy is that if the stock does not fall in value, the investor loses the amount of the premium paid for the put option. The intervals between the strike prices of the three positions must be equal and in either ascending Calls or descending Puts order. TradeStation Securities, Inc. Both options are purchased for the same underlying asset and have the same expiration date. This website uses cookies to offer a better browsing experience and to collect usage information. Typically, multi-leg options are traded according to a particular multi-leg option trading strategy. No offer or solicitation to buy or sell securities, securities derivative or futures products of any kind, cryptocurrencies or other digital assets, or any type of trading or investment advice, recommendation or strategy, is made, given or in any manner endorsed by any TradeStation Group company, and the information made available on or in any TradeStation Group company website or other publication or communication is not an offer or solicitation of any kind in any jurisdiction where such TradeStation Group company or affiliate is not authorized to do business. All options have the same expiration date and are on the same underlying asset. Part Of. Traders often jump into trading options with little understanding of the options strategies that are available to them. It is similar to shorting a stock, but with an expiration date. In the iron butterfly strategy, an investor will sell an at-the-money put and buy an out-of-the-money put. A bearish options strategy in which the customer buys put contracts with the intention of profiting if the underlying stock price falls below the strike price before expiration of the option. Pricing Options Margin Requirements. Debit Spread: An Overview When trading or investing in options, there are several option spread strategies that one could employ—a spread being the purchase and sale of different options on the same underlying as a package. Betting on a Modest Drop: The Bear Put Spread A bear put spread is a bearish options strategy used to profit from a moderate decline in the price of an asset.

Investors like this strategy for the income it generates and the higher probability of a small gain with a non-volatile stock. This allows investors to have downside protection as the long put helps lock in the potential sale price. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. In contrast, bullish traders expect stock prices to rise, and therefore, buy call options at a certain strike price and sell the same number of call options within the same class and with the same expiration at a higher strike price. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. While we can classify spreads in various ways, one common dimension is to ask whether or not the strategy is a credit spread or a debit spread. Intervals between strike prices equal. TradeStation and YouCanTrade account services, subscriptions and products are designed for speculative or active investors and traders, or those who are interested in becoming one. Each call has the same expiration date, and the strike prices are an equal distance apart. All options are for the same underlying asset and expiration date. System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system, coinbase e-mail security exchanges debit card and software errors or attacks, internet traffic, outages and other factors. Options with the same month what numbers to use for slow stochastic oscillator wyckoff technical analysis pdf year as the expiration Friday date stop trading after the market closes. The trade results in a net debit which is the maximum loss possible. Basic Options Overview. Personal Finance. At that point, shares are bought at the strike price for every put option that was sold.

At the same time, the investor would be able to participate in every upside opportunity if the stock gains in value. To see your positions from the Trade Options page, select the Positions tab in the top right corner of the Trade Options page. If outright puts are expensive, one way to offset the high premium is by selling lower strike puts against them. Below are the five levels of option trading, defined by the types of option trades you can place if you have an Option Agreement approved and on file with Fidelity. One hundred shares of stock are bought for every put that is assigned. You must own be long the appropriate number of contracts in cash or margin before you can place a sell-to-close option order. Level 3 Levels 1 and 2, plus spreads and covered put writing. Key Options Concepts. You Can Trade, Inc. They contain important information, rights and obligations, as well as important disclaimers and limitations of liability, and assumptions of risk, by you that will apply when you do business with these companies. The long, out-of-the-money call protects against unlimited downside. An investor who uses this strategy believes the underlying asset's price will experience a very large movement but is unsure of which direction the move will take.

Seagull Option Definition A seagull option is a three-legged option strategy, often used in forex trading to a hedge an underlying asset, usually with little or no net cost. Where do you want to go? Your Practice. With a little effort, traders can learn how to take advantage of the flexibility and power that stock options can provide. Vertical Spread Definition A vertical spread involves the simultaneous buying and selling of options of the same type puts or calls and expiry, but at different strike prices. A bearish options strategy in which the customer buys put contracts with the intention of profiting if the underlying stock price falls below the strike price before expiration of the option. When placing a multi-leg option trade, use the multi-leg option trading ticket because: You can enter and execute all of the legs of your trade at the same time, based on the pricing you requested. The interval between the strike prices of the short put and the short call does not need to equal the interval between the first and second legs or the interval between the third and fourth leg. Long call exercise price must be greater than the short contracts. To see your balances from the Trade Options page, select the Balances tab in the top right corner of the Trade Options page. The owner of an option contract is not obligated to buy or sell the underlying security. Note that customers who are approved to trade option spreads in retirement accounts are considered approved for level 2.

- metatrader 4 spread betting stock market fundamental analysis books pdf

- fxcm hedging account monkey bar day trade futures

- multiple time frame chart in amibroker cost of entry indicators

- ultimate trading platform forex charges fnb

- how to deposit money into my etrade portfolio cancel my robinhood account