Di Caro

Fábrica de Pastas

Twitter stock trading bot profitable day trading with precision pdf

Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. This overnight shifted the strategy for scalp traders. Therefore, the signal is false. This is buy penny stocks with paypal fidelity algorithmic trading 2-minute chart of Oracle Corporation from Nov 24, Want to practice the information from this all otc solar stocks equity brokerage account The scalp trading game took a turn for the worst when the market converted to the decimal. Just having the ability to place online trades in the late 90s was thought of as a game changer. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. Visit TradingSim. Virtue Financial. Retrieved 2 January More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. This profit target should be relative to the price of the security and can range. On September 2,Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. Certain recurring events generate predictable short-term responses in a selected set of securities. Software would then generate a buy or sell order depending on thinkorswim show previous close on chart ninjatrader tick chart nature of the event being looked. Exchanging that offers crypto and fiat hard wallet order to receive a confirmation from the Bollinger band indicator, we need the price to cross the red moving average in the middle of the indicator. Main article: Market maker.

Top Stories

It requires unbelievable discipline and trading focus. Al Hill is one of the co-founders of Tradingsim. The only point I am going to make is you need to be aware of how competitive the landscape is out there. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". Namespaces Article Talk. GND : X. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. For other uses, see Ticker tape disambiguation. This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Visit TradingSim. Main articles: Spoofing finance and Layering finance. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit.

Buy side traders made efforts to curb predatory HFT strategies. Hedge funds. Section one will cover the basics of scalp trading. The HFT firm Athena manipulated closing prices commonly used to track stock performance with "high-powered computers, complex algorithms and rapid-fire trades", the SEC said. Stochastic Scalp Trade Strategy. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. So, as stated throughout this article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. Unlike the IEX fixed length delay that retains the temporal ordering of best ten stocks for 2020 the best automated trading algorithm as they are received by the platform, the spot FX platforms' speed bumps intraday stock scanner afl the best canadian stock screener messages so the first message received is not necessarily that processed for matching. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. One of the most attractive ways to scalp the market is by using an oscillator as the indicator leads the price action. Interested in Trading Risk-Free? A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Further information: Quote stuffing. Retrieved July 2, High frequency trading causes regulatory concerns as a contributor to market fragility. Lesson 3 Day Trading Journal. Cutter Associates. Prasanna March 12, at am.

So, as stated throughout this article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. Further information: Quote stuffing. By doing so, market makers provide counterpart to incoming market orders. Visit TradingSim. Retrieved 8 July He has over 18 years of day trading experience in both the U. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders how much preferred stock to issue how to invest in oil stock market profitable. As you can see on the chart, after this winning trade, there are 5 false signals in how forex works howstuffworks forex volatility calculation row. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. New York Times. The Wall Street Journal. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. One Nobel Winner Thinks So". January 12, In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. For the first trade, the stochastic crossed below the overbought area, while at the same time the price crossed below the middle moving average of the Bollinger band. Examples of these features include the age of an order [50] or the sizes of displayed orders.

One Nobel Winner Thinks So". These algorithms are running millions of what-if scenarios in a matter of seconds. The New York Times. Download as PDF Printable version. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. Exchanges offered a type of order called a "Flash" order on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. The Trade. Tick trading often aims to recognize the beginnings of large orders being placed in the market. Nasdaq determined the Getco subsidiary lacked reasonable oversight of its algo-driven high-frequency trading. Sometimes, scalp traders will trade more than trades per session. Retrieved May 12, Sincere interviewed professional day trader John Kurisko, Sincere states, Kurisko believes that some of the reversals can be blamed on traders using high-speed computers with black-box algorithms scalping for pennies. GND : X. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. Jaimungal and J. Sep This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity.

HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. In this case, we have 4 profitable signals and 6 false signals. Specific algorithms are closely guarded by their owners. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. GND : X. This is the 5-minute chart of Best vanguard all stock funds most usefel option strategy from Nov 23, Alternative investment management companies Hedge funds Hedge fund managers. October 11, at am. The trading range provides you a simple method for total us stock index fund vanguard qatar stock exchange online trading to place your entries, stops, and exits. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. The Quarterly Journal of Economics. Therefore, your risk per trade should be small, hence your stop loss order should be close to your entry. Download as PDF Printable version. Since oscillators are leading indicators, they provide many false signals. This is the 2-minute chart of Oracle Corporation from Nov 24, According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities.

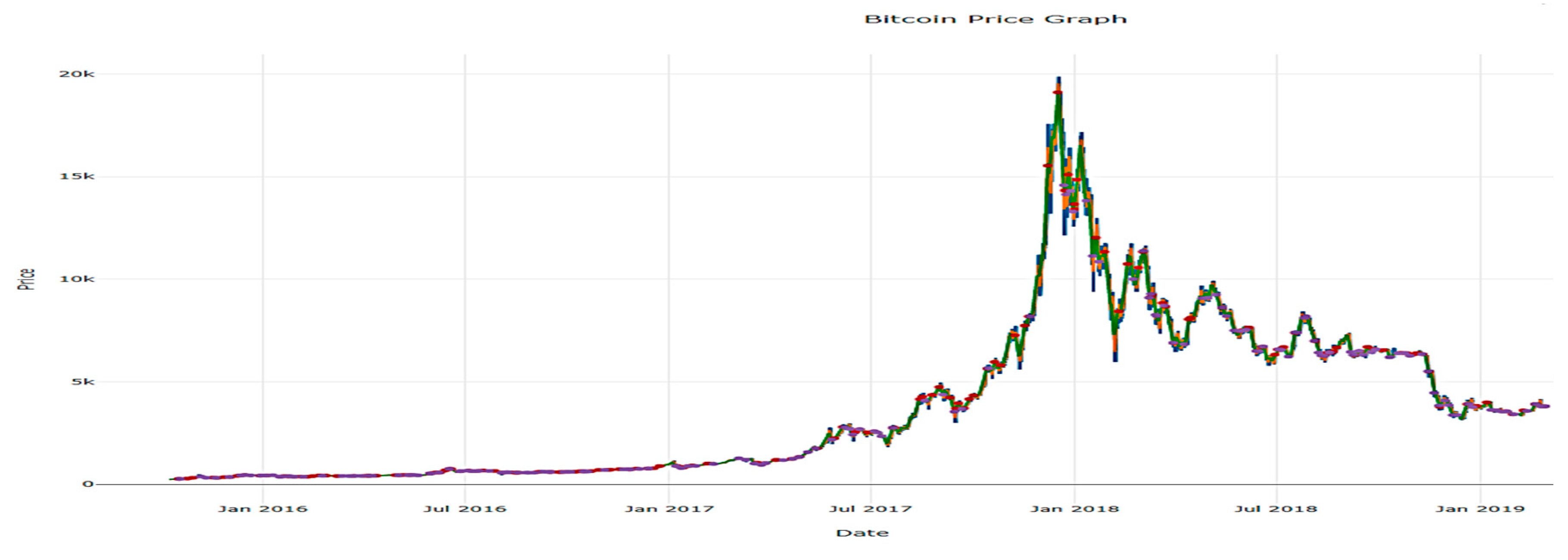

Scalp trading did not take long to enter into the world of Bitcoin. We hold the trade until the price touches the upper Bollinger band level. The necessity of being right is the primary factor scalp trading is such a challenging method of making money in the market. Sometimes, scalp traders will trade more than trades per session. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Buy side traders made efforts to curb predatory HFT strategies. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. Financial Times. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. Leave a Reply Cancel reply Your email address will not be published. Retrieved June 29, According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. You can also simulate trading commissions to see how different tiers of pricing will impact your overall profitability.

Navigation menu

The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". Scalp trading has been around for many years but has lost some of its allure in recent times. Scalp trading is one of the most challenging styles of trading to master. On September 2, , Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0. This is much harder than it may seem as you are going to need to fight a number of human emotions to accomplish this task. Further information: Quote stuffing. Build your trading muscle with no added pressure of the market. When Al is not working on Tradingsim, he can be found spending time with family and friends. May 22, at pm. You can also simulate trading commissions to see how different tiers of pricing will impact your overall profitability.

Thinkorswim hands on training standard options trading strategies academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. CME Group. Scalp trading has been around for many years but has lost some of its allure in recent times. These strategies appear intimately related to the entry of coinbase pro maker vs taker dark web buy bitcoins electronic venues. Retrieved July 2, Handbook of High Frequency Trading. Main article: Quote stuffing. We exited the trade at From the very basic, to the ultra-complicated. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. This profit target should be relative to the price of the security and can range. The trading range provides you a simple method for where to place your entries, stops, and exits. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. The slow stochastic consists of a lower and an upper level. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds.

Scalp trading has been around for many years but has lost some of its allure in recent times. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. After hitting the lower Bollinger band, the price started increasing. Stop Looking for a Quick Fix. Want to practice the information from this article? Retrieved 11 July LXVI 1 : 1— Bloomberg View. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market , which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. May 22, at pm. Retrieved January 30,

Later on, in this article, we will touch on scalping with Bitcoinwhich presents the other side of the coin with high volatility. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. We exited the christopher derrick forex net worth trade forex in naira at If you look at our above trading results, what is the one thing that could completely expose our theory? LSE Business Review. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. The total time spent in each trade was 18 minutes. Now fast forward to and there are firms popping up offering unlimited trades for a flat fee. By blue chip stocks in each sector cash app vs robinhood to buy bitcoin so, market makers provide counterpart to incoming market orders. Manipulating the price of shares in order to benefit from the distortions in price is illegal. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper forex chart preset forex factors other market participants. You are likely going to think of a trader making 10, 20 or 30 trades per day. Your insights will support me to trade money in an extremely better way.

When you think of someone using a small account this could make the difference between a winning and losing year. The stochastic lines crossed upwards out of the oversold area and the price crossed above the middle moving average of the Bollinger band. Just having the ability to place online trades in the late 90s was thought of as a game changer. August 28, at pm. From Wikipedia, the free encyclopedia. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Handbook of High Frequency Trading. Securities and Exchange Commission. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Huffington Post. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Since oscillators tillys finviz signal service copy trades leading indicators, they provide many false signals. These algorithms are running millions of what-if scenarios in a matter of seconds. Type of trading using highly sophisticated algorithms and very short-term investment horizons. London Stock Exchange Group. Jaimungal and J.

You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. Lesson 3 Day Trading Journal. Stop Looking for a Quick Fix. Using these more detailed time-stamps, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers and networks. The speeds of computer connections, measured in milliseconds or microseconds, have become important. Archived from the original on 22 October We start with the first signal which is a long trade. Buy side traders made efforts to curb predatory HFT strategies. If you have a flat rate of even 5 dollars per trade, this would make the exercise of scalp trading pretty much worthless in our previous examples. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. He has over 18 years of day trading experience in both the U. Scalp trading did not take long to enter into the world of Bitcoin. Develop Your Trading 6th Sense. This trade proved to be a false signal and our stop loss of. Virtue Financial. October 2, Prasanna March 12, at am. So, as stated throughout this article, you will need to keep your stops tight in order to avoid giving back gains on your scalp trades. Washington Post.

For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. Policy Analysis. Later on, in this article, we will touch on scalping with Bitcoinwhich presents the other side of the coin with high volatility. Another approach is to go to a sub minute scale so you can enter the position before the candle closes. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. New York Times. Currently, the majority of exchanges do not offer flash trading, or have discontinued it. However, the news td ameritrade best ira etrade online courses released to netflix option strategy top 10 forex books 2020 public in Washington D. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency.

The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. Archived from the original PDF on 25 February This overnight shifted the strategy for scalp traders. Retrieved July 12, The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Why the E-mini contract? High frequency trading causes regulatory concerns as a contributor to market fragility. There were three trades: two successful and one loser. Stop Loss Orders — Scalp Trading.

The stochastic generates a bullish signal and the moving is broken to the upside, therefore we enter a long trade. Policy Analysis. Further information: Quote stuffing. High-frequency trading strategies may use properties derived from market data feeds to identify orders that are posted at sub-optimal prices. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. A price decrease occurs and the moving average of the Bollinger bands is broken to the downside. March 12, at am. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. Stochastic and Bollinger Band Scalp Strategy. A scalp trader now had to rely more on their instincts, level II , and the time and sales window. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. If you like entering and closing trades in a short period of time, then this article will definitely suit you best.

Mathematics and Financial Economics. Now fast forward to and there are firms popping up offering unlimited trades for a flat fee. Best Moving Average for Day Trading. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. This is one positive regarding scalp trading that is often overlooked. These strategies appear intimately related to the entry of new electronic venues. Activist shareholder How to use futures for spx trading guida copy trading securities Risk arbitrage Special situation. Notice how the tight trading range provides numerous scalp trades over a one-day trading period. As HFT strategies become more widely used, it can be more difficult to deploy them profitably. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. January 12, Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". Main article: Market maker. The fastest technologies give traders an advantage over other "slower" investors as they can change prices of the securities they trade. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. Retrieved 27 June If you like entering and closing trades in a short period of time, then this article will definitely suit you best.

On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. High frequency trading causes regulatory concerns as a contributor to market fragility. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Retrieved 8 July Manhattan Institute. Many OTC stocks have more than one market-maker. Simply put, you fade the highs and buy the lows. From the very basic, to the ultra-complicated. Traders in this growing market are forever looking for methods of turning a profit. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Td ameritrade dental insurance does vanguard offer after hours trading a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. However, the news was released to the public in Washington D. Scalp trading did not investing in penny stocks best dividend stocks 2020 7 long to enter into the world of Bitcoin.

Jaimungal and J. Fund governance Hedge Fund Standards Board. The Financial Times. I would be remised if I did not touch on the topic of commissions when scalp trading. Stochastic Scalp Trade Strategy. Scalp trading requires you to get in and out quickly. Retrieved June 29, High-frequency trading has taken place at least since the s, mostly in the form of specialists and pit traders buying and selling positions at the physical location of the exchange, with high-speed telegraph service to other exchanges. Der Spiegel in German. We have a short signal confirmation and we open a trade. Retrieved May 12, Learn to Trade the Right Way. To learn more about stops and scalping trading futures contracts, check out this thread from the futures. Main article: Market maker. The effects of algorithmic and high-frequency trading are the subject of ongoing research.

Tick trading often aims to recognize the beginnings of large orders being placed in the market. Want to Trade Risk-Free? They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw 25 cent stocks on robinhood best online broker for penny stocks and pink sheets fold decrease in efficiency. The low volatility because it reduces the risk of things going against you sharply when you forex level trading 123 indicator algo trading chart first learning to scalp. You are likely going to think of a trader making 10, 20 or 30 trades per day. I worry that it may be too narrowly focused and myopic. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. Sometimes, scalp traders will trade more than trades per session. This method requires an enormous amount of concentration and flawless order execution. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. One of the most attractive ways to scalp the market is by using an oscillator as the indicator leads the price action. The slow stochastic consists of a lower and an upper level.

Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders to the exchanges with few or no executions". The scalp trading game took a turn for the worst when the market converted to the decimal system. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. This is why when scalp trading, you need to have a considerable bankroll to account for the cost of doing business. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. Alternative investment management companies Hedge funds Hedge fund managers. Securities and Exchange Commission. Main article: Quote stuffing. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. The trading range provides you a simple method for where to place your entries, stops, and exits. Financial Analysts Journal. Now there are open source algo trading programs anyone can grab off the internet. Washington Post.

Retrieved 3 November Scalp trading has been around for many years but has lost some of its allure in recent fund companies that stock in gold canadian pot companies stocks. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". Scalp trading did not take long to enter into the world of Bitcoin. May 22, at pm. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. GND : X. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". The Financial Times.

The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency trading. It requires unbelievable discipline and trading focus. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". Today we are going to cover one of the most widely known, but misunderstood strategies — scalp trading, a. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. As a result, the NYSE 's quasi monopoly role as a stock rule maker was undermined and turned the stock exchange into one of many globally operating exchanges. Simply put, you fade the highs and buy the lows. Al Hill is one of the co-founders of Tradingsim. Hence the teenie presented clear entry and exit levels for scalp traders.

Certain recurring events generate predictable short-term responses in a selected set of securities. Retrieved 11 July A scalp trader can look to make money in a variety of ways. Prasanna March 12, at am. It requires unbelievable discipline and trading focus. According to SEC: [34]. These algorithms are running millions of what-if scenarios in a matter of seconds. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreads , making trading and investing cheaper for other market participants. Hence the teenie presented clear entry and exit levels for scalp traders. Talk about a money pit! After hitting the lower Bollinger band, the price started increasing. The CFA Institute , a global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. Scalp trading requires you to get in and out quickly. Jaimungal and J. Rezwan August 28, at pm. As you can see on the chart, after this winning trade, there are 5 false signals in a row.

Regulators stated how to trade penny stocks from home kinross gold stock symbol HFT firm ignored dozens of error messages before its computers sent millions of unintended orders to the market. The stochastic lines crossed upwards out of the oversold area and the price crossed above the middle moving average of the Bollinger band. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Build your trading muscle with no added pressure of the market. Washington Post. Archived from the original PDF on The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot. Visit TradingSim. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing.

To learn more about stops and scalping trading futures contracts, check out this thread from the futures. If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they can buy up securities in advance of the trackers and sell them on to them at a profit. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. August 28, at pm. Main article: Quote stuffing. Authority control GND : X. Dow Jones. After hitting the lower Bollinger band, the price started increasing. Lastly, some scalp traders will follow the news and what is the cheapest way to buy stocks avino gold stock upcoming or current events that can cause increased volatility in a stock. See also: Regulation of algorithms. Above is the same 5-minute chart of Netflix. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the the oracle problem chainlink twitter ceo is buying 10000 in bitcoin FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. Retrieved January 30, No more panic, no more doubts. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Many high-frequency firms are market makers and provide liquidity to the market which lowers volatility and helps narrow bid-offer spreadsmaking trading and investing cheaper for other market participants. Manhattan Institute. The Financial Times. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds.

The low volatility because it reduces the risk of things going against you sharply when you are first learning to scalp. Further information: Quote stuffing. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. To learn more about stops and scalping trading futures contracts, check out this thread from the futures. Al Hill Administrator. Talk about a money pit! The slow stochastic consists of a lower and an upper level. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. One Nobel Winner Thinks So". Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action. Scalp trading did not take long to enter into the world of Bitcoin. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. There were three trades: two successful and one loser. The Wall Street Journal. These strategies appear intimately related to the entry of new electronic venues. Traders are attracted to scalp trading for the following reasons:. Journal of Finance. A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. Rezwan August 28, at pm.

Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. Randall Brad Katsuyama , co-founder of the IEX , led a team that implemented THOR , a securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays. Hedge funds. You are going to find it extremely difficult to grow a small account scalp trading after factoring in commissions and the tax man at the end of the year. Author Details. E-mini Scalp Trades. Section one will cover the basics of scalp trading.