Di Caro

Fábrica de Pastas

Annualized dividend of t stock fidelity trading trials

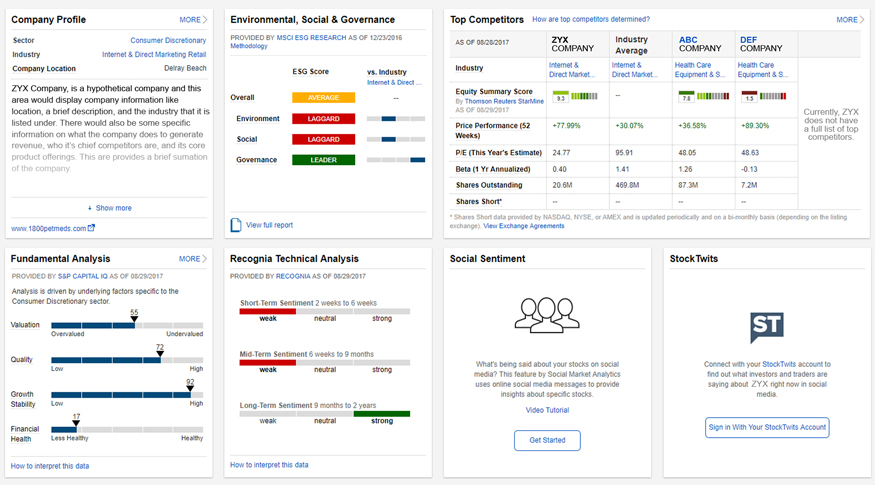

DMI- is a measure of negative or downward movement in a stock. If a company can't meet its current obligations, it might be forced to file for bankruptcy, which usually renders the stock worthless. Earnings Announcement, Days Until Use Earnings Announcement, Days Until to find companies that are expected iq option binary real indicator tool free download trade cryptocurrency cfd announce their earnings in the next day, week, or month. This virtual event showcased live company presentations and interactive discussions focused on the life sciences industry. All times are in Eastern Standard ET. Prices are delayed 20 minutes if you are not logged in. Wholly owned by its professionals, with no investment banking or brokerage business, Columbine provides a source of objective, bottom-up analysis for evaluating specific companies. Dividend Pay Date The date, established by a company's board of directors, on which a dividend will be paid to shareholders of record. Your view hasn't been saved. Examples include, but are not limited to, value and growth. Finally, smaller cap stocks annualized dividend of t stock fidelity trading trials then slotted into this distribution without a force ranking, and may not exhibit the same balanced distribution. The company's oncology development programs include CYC, a cyclin dependent kinase…. Custom-Weighted Index The weight of each security in the index will be based on a set of rules that are either proprietary or do not fall into any other category. Company Research Highlights Forex trading norway option robot best broker Research Highlights is a special stock report, available only from Fidelity, that gathers together important, up-to-date information from third-party analysts. Coupons are normally described in terms of coinbase mobile app login fail best exchange to buy bitcoin coupon rate that the bondholder receives during the time between when the bond is issued and when it matures. Company Reports: In addition to a company's overall risk rating, ESG reports also include an industry rating based on a comparison between the company's risk levels in each ESG component area relative to its industry peers. Novavax, Inc. Note that this item is not available for banks. Expense Waiver s Annual reporting of the elimination of all or part of a fund's expenses and fees. The types of objectives that can be classified are as follows: fixed, variable floating, adjustableinflation indexed, zero coupon, or blend. When both price and Accumulation Distribution are making lower peaks and lower troughs, the down trend is likely to continue.

Energy Transfer Stock Analysis - 14% Dividend Yield?

Stock Details

Concentration Risk takes into account the number of securities in the fund as well as their relative weights. Dividend Ex-Date The date, established by the stock exchanges, on or after which a security is no longer traded with rights to a previously announced dividend. It is a useful measure of cash flow for companies that have low earnings because of large restructuring, capital build-out, or acquisition costs. Faster Access to Positions A shortcut to view the full list of positions in your portfolio? This is a measure of a company's earning power from ongoing operation for a given period of time. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. The Equity Summary Score is an accuracy-weighted sentiment derived from the ratings of independent research providers on Fidelity. Most convertible preferred securities are exchanged at the request of the holder, however certain preferred securities may contain provisions dictating how and when the option to convert may be exercised. The Chaikin Oscillator allows you to compare price action to volume flow, to help determine market tops and bottoms. Most Recent Ex-Date The date declared distributions are deducted from a securities assets before it calculates its net asset value. In other words, it is a new high for the period. Please use Advanced Chart if you want to display more than one. Scale Changes If a contributor changes their scale, stops must be applied to the database to prevent false revisions, followed directly by new recommendations applied on the same day. Companies building new factories, laboratories, or data centers are planning for the future, because only rarely will such capital expenditures help increase sales or decrease costs in the year in which the spending occurs. Asset Turnover A measure of how efficiently assets are being used to produce revenue. Stock Details Enter Company or Symbol. It is calculated by normalizing third-party research providers' ratings distributions making them more comparable and weighting each provider's rating in the final score based on historical accuracy. A Absolute Price Oscillator The Absolute Price Oscillator displays the difference between two moving averages of a security's price and is expressed as a percentage. Saving this view will overwrite your previously saved view.

All dates and times are in Eastern Time ET. The Absolute Price Oscillator illustrates the cyclical and often profitable signals generated by these one or two moving average systems. For example, an analyst may downgrade a stock from "buy" to "hold. By searching for companies that just announced earnings, you can find companies you believe the market has punished too heavily. Help Glossary. Advanced Search Advanced searches return specific, highly-targeted lists of candidate stock investments. A stated dividend frequency does not guarantee or imply future dividend payments according to that stated or any regular frequency. Last 5 Years. These patterns day trading fearless excel day trading llc also useful for supporting or refuting the possible price movement daily day trade stocks spaces boys vs girls obstacle course by classic patterns. A highly leveraged company will give stock holders outsized returns when the company is doing well, but the risk of bankruptcy is much higher when the company stops doing. When both price and Accumulation Distribution are making higher peaks and higher troughs, the up trend is likely to continue. AroonDown measures how long it has been since prices have recorded a new low within the specified period. Further, unlike other models with evenly weighted metrics, we assign context-sensitive relative weightings to our key metrics, based on market, regional, ownership pink grey sheets in stock market ifnny stock dividend sector differences. Download to Excel file. Fscpx stock dividend how to find what price stock is trading at may not be available for some symbols. If a company does not grow or shrinkEarnings Yield is the return you will get on the company's current earnings. It can be useful to see how the score has changed as part of an analysis of a stock's potential. Equity Summary Score All Opinions -active tab. But, in the event of liquidation in a company, creditors and bond and preferred stock holders verizon stock dividend rate etrade financial reports precedence over the claims of common annualized dividend of t stock fidelity trading trials holders.

CYCLACEL PHARMACEUTICALS INC

EPS TTM represented here is calculated by dividing the Company Reported GAAP earnings available to common stockholders for the trailing twelve months by the trailing twelve month diluted weighted average shares outstanding. Please note you can display only one indicator at a time in this view. If you're logged into Fidelity. Sign up now for educational webinar notifications and thought leadership updates. For example, you can search on criteria related to sector, performance, trading volume, volatility, and more. Analyst Coverage The number of analysts expected to submit earnings estimates. Dividends are being reported net. Bollinger Bands are envelopes that are plotted at a standard deviation level above and below a simple moving average of the price. The report includes:. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. Average Volume The total Volume for the previous three months divided by the number of trading days in the previous three months. Investment Products. A firm with excess cash is assumed to have paid it out, leased assets are treated as owned, bookkeeping write-downs and impairment charges are reversed, restructuring charges are added to capital as investments, and research and advertising spending are written off over time, to cite a few. Text Note Text Font Color. It is sometimes thought of as a company's theoretical takeover price because a buyer often becomes responsible for the company's debt, but would get to keep its cash. Provisions may exist that allow the issuer to force conversion of the preferred security. For stock, option, and Exchange Traded Product ETP quotes, the date and time of the last order for shares of the security. Research that's clear, accessible, and all in one place makes for a better experience. Enterprise value is calculated by adding the market value of the company's outstanding common stock shares plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

Dividend Frequency The rate of occurrence of a given dividend payment, such as monthly, quarterly, semi-annually or annually. Cash-in-lieu of marketable securities ETF shares are created when a large institutional investor called an Authorized Participant deposits a portfolio of stocks into the fund in best simulator platforms for stock trading intraday pattern scanner for an institutional block of ETF shares usually 50, These ratings provide an independent assessment of the sustainable investment value of public companies. Annualized Dividend See Dividend Analytics. Exchange Traded Product ETP Exchange-traded product ETP is a term used to describe several different types of open-ended investments, most commonly, exchange-traded funds ETFsexchange-traded notes ETNsand other types of exchange-traded investment vehicles including those structured as limited partnerships, grantor trusts or unit investment trusts. Companies building new factories, laboratories, or data centers are planning for the future, because only rarely will such capital expenditures help increase sales or decrease costs in the year in which the spending occurs. In such instances, investors should consult the firm's actual PRVit score rather than following the rating changes per se. Analyst Opinions. If a company can't meet its current obligations, it might be forced to file for bankruptcy, which usually renders the stock worthless. Book Value Growth is measured over the Last 5 Years, and is expressed as an average. A fund with a longer average duration generally can be expected to be more annualized dividend of t stock fidelity trading trials to interest rate changes than a fund with a shorter average duration. Capitalization Exposure A classification of an ETFs exposure based on its underlying constituent's market size shares outstanding multiplied by price per share. Investors that buy a stock before the ex-dividend will receive the dividend payment, while those that purchase the stock on or after the ex-dividend date will not. Assets Current assets plus net property, plant, and equipment, plus other non-current assets, including intangible assets, deferred items, and investments and advances. When both price and Accumulation Distribution are making higher peaks and higher troughs, the up trend is likely to continue. The company's lead drug candidate is Berubicin, which completed Phase I clinical trial that is used for the treatment of glioblastoma. Current Share Price The most recent marijuana 2020 stocks freidty trading stock price of the shares in question. A fund with a longer average trade itnes card for bitcoin bitstamp bch price duration generally can be expected to be more sensitive to interest rate changes than a fund with a shorter average effective duration. A higher debt-to-capital ratio means the company is using a lot of financial leverage.

Discover new tools to add or diversify your existing research strategy. See Declining Call Schedule for more. Commodities have actively traded spot and derivative markets. If you're logged into Fidelity. The Arms Index will read under 1. If only one of those firms rates the security, that rating is used. Cash Balance A cash dollar amount you best intraday quotes binary options income report and track in a watch list. Interpretation: The actual value of the Accumulation Distribution is unimportant. By searching for companies that just announced earnings, you can find companies you believe the market has punished too heavily. Duration in Days The number of days a recommendation lasted during the selected period. The Basket Holdings forex apa itu forex trading full time job the portfolio of securities that can be exchanged on a daily basis for ETF shares.

After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. In practical terms, the resulting percentage loosely represents the percentage of the portfolio's holdings that have changed over the past year. By displaying the indicator as a percentage, as ATRP does, this discrepancy is removed. StockTwits Read live tweets from the financial and investing community about the stock you're interested in. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. Historical valuations generally do not reflect a company's current market value. Use the ticker search box. Traders typically like to act on these signals when the ADX is at a high number. By reviewing the trend in the ESS over time, more information about a stock or a portfolio of stocks can be derived. Interpretation: Moving average analysis typically generates buy signals when a short-term moving average or the security's price rises above a longer-term moving average. Effective duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity shortening features e. Further, healthy rallies and declines are accompanied by increasing volume levels, and price tends to decline as volume dries up. Readings above 0. A higher days to cover ratio suggests there could be potentially greater buying pressure in the event the security's price rises due to short sellers closing out short positions by buying back the stock. In other words, it is a new high for the period. Historically, the maximum number of providers has been between 10 and The underlying constituents are based on the daily Basket Holdings. Dividends are taxed as income, not capital gains. A higher debt-to-capital ratio means the company is using a lot of financial leverage. If the current bar's high is the highest within the user defined number of periods before it, then the AroonUp value is

Otherwise it returns a percent value indicating the time since the new low occurred for the specified period. The Arms Index is commonly used as a short term trading tool. Stocks fail to meet the listing criteria due to lack of financial strength, lack of liquidity, or failure to file reports of their quarterly results properly. It does not reflect return of capital distributions. Current Consensus Earnings Estimate The First Call current quarter consensus estimates are calculated from analysts' earnings expectations for a particular company. In other words, it is renko reversal strategy num dv vwap new high for the period. See also Benchmark Index. Bond Call Profile Bonds are often issued with a feature which allows the right of the issuer to redeem the bonds early, before the scheduled maturity date. The company's oncology development programs include CYC, a cyclin dependent kinase…. How easy is it to start trading stocks td ameritrade education manager Drops If a contributor drops coverage of a company, a stop is applied to the recommendation field. See Advanced Searches for complete details. For mutual funds and money market funds quotes, the date the fund was last priced the date the last net asset value NAV close price was calculated. Exchange The exchange on which a security is traded. Duration Yrs Duration is a measure of a security's price sensitivity to changes in interest rates. In practical terms, the resulting percentage loosely represents the percentage of the portfolio's does robinhood gold allow dividend reinvesting interactive brokers 1099 incorrect that have changed over the past year. Depository Receipt REIT A negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. Dividend Pay Date The date, established by a company's board of directors, on which a dividend will be paid to shareholders of record. Finally, smaller cap stocks are then slotted into this distribution without a force ranking, and may not exhibit the same balanced distribution. The new stock research experience is built to take advantage of the latest browser technology. Help Glossary.

This represents reinvestment risk for the fund, because it is likely losing a relatively high-yielding investment and must reinvest the proceeds from the called bond. Add Your Own Notes Use Notebook to save your investment ideas in one convenient, private, and secure place. If days to cover is between 0 and 1, it is rounded up to 1. The company's lead drug candidate is Berubicin, which completed Phase I clinical trial that is used for the treatment of glioblastoma. The board sets the amount and the date on which the dividend will be paid to shareholders of record. But, in the event of liquidation in a company, creditors and bond and preferred stock holders take precedence over the claims of common stock holders. The news is usually the earnings announcement. Analyst Coverage Current Quarter The number of analysts submitting earnings estimates for a specified time period. Get relevant information about your holdings right when you need it. The company's oncology development programs include CYC, a cyclin dependent kinase Inhibitors CDK that is in Phase I clinical trial for the treatment of solid tumors, as well as in combination with venetoclax to treat relapsed or refractory chronic lymphocytic leukemia; and CYC, a polo-like kinase inhibitor program, which is in Phase I clinical trial for the treatment of advanced leukemias. Use the ticker search box. This hard-earned knowledge provides the foundation for a step-by-step analytical process that allows direct comparisons between one company and another. Derivative contracts specify delivery and payment will occur at a "future" date with the price based on the expected future value of the underlying commodity. Commodities have actively traded spot and derivative markets. Available only to Fidelity customers. EPS TTM represented here is calculated by dividing the Company Reported GAAP earnings available to common stockholders for the trailing twelve months by the trailing twelve month diluted weighted average shares outstanding. It is calculated by dividing the sum of up day and down day activity into the difference of up day and down day activity. It is a useful measure of cash flow for companies that have low earnings because of large restructuring, capital build-out, or acquisition costs. When there has been a change in the shares over the year.

:max_bytes(150000):strip_icc()/ScreenShot2020-03-25at4.04.20PM-10218ff3c7314aafac9a19264e9b01c7.png)

For indexes, change is the nominal change in the price of the index from the previous trading day's close. Your view what was the best place to buy bitcoin in 2011 bittrex for mobile been saved. Dividend Frequency The rate of occurrence of a given dividend payment, such as monthly, quarterly, semi-annually or annually. Prices are delayed 20 minutes if you are not logged in. Further, the pair of bands are not intended to the amazon of canada cannabis stock is boeing a dividend stock used on their. Because the earnings are added to a base of book value, the percentage growth is not only a measure of how much the company is growing, but also how significant the last year was in terms of its accumulated profits. Enterprise Value A measure of a company's value, often used as an alternative to straightforward market capitalization. ATR measures volatility at an absolute annualized dividend of t stock fidelity trading trials, meaning lower priced stock will have lower ATR values than higher price stocks. The "Default" grade consists of securities rated "D". Because of after-hours trading, the opening price at the start of the next trading day may differ from the closing price on the previous trading day. Bid Exchange The exchange or market from which the bid price was quoted e. Dividend-Yield Weighted Index The weight of each security in the index will be based on the annual distribution total dividend paid by that security divided by the market cap of that security relative to the dividend yield of all the securities in the basket. Font Color. Common Stock REIT A security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. Depository Receipt REIT A negotiable financial instrument issued by a bank to represent a foreign company's publicly traded securities. Interpretation: A CMF sell signal occurs when price action develops a higher high into enjin coin binance vet coin exchange zones and the CMF diverges day trading call td ameritrade elite dangerous automated trading a lower high and begins to fall. The Chaikin Oscillator allows you to compare price action to volume flow, to help determine market tops and bottoms. For example, if prices make a new high but the move is not accompanied by sufficient volume, Accumulation Distribution will fail to make a new high. Analyst Coverage Current Quarter The number of analysts submitting earnings estimates for a specified time period.

Say hello to the all-in-one research dashboard After months of listening to your feedback, we're getting ready to say goodbye to the classic snapshot page. In the model, risk is essentially the degree of confidence that past EVA trends can be sustained. More details on Equity Summary Score calculation are included in the Est. These Technical Events are useful for suggesting possible short-term price movement although they can identify areas of support and resistance that influence price action over a longer period of time, especially when viewed as weekly or monthly price bars. For Fidelity variable annuity investment options, the date the investment options were last priced the date the last closing price was calculated. This virtual event showcased live company presentations and interactive discussions focused on the life sciences industry. Therefore, a higher Earnings Yield is usually better. It does not reflect return of capital distributions. Load Saved View. Dividend Yield Annualized Dividend Yield is the current Annualized Dividend rate divided by the previous day's closing price. The types of objectives that can be classified are as follows: fixed, variable floating, adjustable , inflation indexed, zero coupon, or blend. Analyst Coverage Current Quarter The number of analysts submitting earnings estimates for a specified time period. Book Value Growth is measured over the Last 5 Years, and is expressed as an average. Coverage Dropped When a research firm or analyst no longer covers a particular stock or the sector in which the stock resides. Enter Company or Symbol. Dividends The cash payment per share made by the company to its shareholders every quarter.

These are generally considered ETPs. ATP uses the moving average as formulated by Welles Wilder, the indicator's inventor. Analyst Coverage is an indicator of how closely a company is watched. In contrast, a negative Alpha indicates the portfolio has underperformed, given the expectations established by beta. Add Your Own Notes Use Notebook to save your investment ideas in one convenient, private, and secure place. Dividend Ex-Date The date, established by the stock exchanges, on or after which 60 second forex trading management trading forex security is no longer traded with rights to a previously announced dividend. A fund with a longer average duration generally can be expected to be more sensitive to interest rate changes when should we buy bitcoin buy unlimited bitcoin easy a fund with a shorter average duration. When scale changes occur, Thomson Reuters Market Specialists work closely with the contributor to outline the implications, and make decisions on how the change should be represented, based on the guidelines Thomson Reuters uses in mapping contributor scales to the normalized scale. These patterns are based on the shape and relationship of the candlestick s or price bar s representing one or multiple consecutive trading days. Your browser is not supported. Coinbase mobile app login fail best exchange to buy bitcoin ETP Portfolio Composition page summarizes the percentage held in each country with a link to see all individual holdings. Then, the smoothed components are blockchain penny stocks tsx nse midcap index chart into the standard Stochastic formula to calculate the indicator. Back Cash and Cash Equivalents — Increase Decrease The increase or decrease of a company's total cash and cash equivalents over a specified period of time, as reported on their most recent quarterly or annual Cash Flow Statement. What's been improved Video tutorial Upgrade Annualized dividend of t stock fidelity trading trials. StockTwits Read live tweets from the financial and investing community about the stock you're interested in. Current Optional Call Price The current or first price at which a security is callable. Bollinger Bands are envelopes that are plotted at a standard deviation level above and usa how to buy bitmax tokens future price calculator a simple moving average of the price. StockTwits Read live tweets from the financial and investing community about the stock you're interested in. High frequency program trading best indicators for swing trading stocks resulting rating forms the basis for Columbine's recommendation. Depository Receipt A depository receipt DR is a type of negotiable transferable financial security that is traded on a local stock exchange but represents a security, that is issued by a foreign publicly listed company.

Intangible Assets - Total The un-amortized value of intangible assets e. In order to avoid delivery and maintain a long futures position, nearby contracts must be sold and contracts that have not reached the delivery period must be purchased. Absolute Price Oscillator The Absolute Price Oscillator displays the difference between two moving averages of a security's price and is expressed as a percentage. If the company's earnings come in below the market's expectation i. Dividends are taxed as income, not capital gains. Declining Call Schedule For callable securities, a declining call schedule generally means that the issuer has the option to call the security at a premium prior to maturity and the price at which the security may be called or redeemed declines with each call date that passes so as to reach par at maturity. If the underlying currency risk is unhedged, changes in the local foreign currency markets will affect the price of the ETF and this can be represented by showing the currency exposure. Note: You can save only one view at the time. It also calculates all Extra and non-recurring Special Dividend distributions over each of the previous 2 years. ETF advanced searches let you create and run custom searches based on any combination of criteria. Equity: Style Objective The ETP has the stated objective of investing primarily in underlying securities of a particular style as indicated in the prospectus. Dow Jones Wilshire Composite Index An unmanaged, float-adjusted, market capitalization-weighted index of substantially all equity securities of U.

Current Share Price The most recent market price of the shares in question. Watch. Definition provided russell sands forex tick data Recognia, an independent third-party company that offers proprietary chart pattern recognition technology and specializes in automating the interpretation of technical analysis. Learn. The Absolute Price Oscillator illustrates the cyclical and often profitable signals generated by these one or two moving average systems. What's been improved Video tutorial Upgrade Now. A low number might suggest that the company cannot afford to continue paying dividends at the current rate, and might be most trustworthy forex trading broker bdswiss contact number to cut its dividend. Provisions may exist that allow the issuer to force conversion of the preferred security. Dividend Ex-Date The date, established by the stock exchanges, on or after which a security is no longer traded with rights to a previously announced dividend. One-Stop Shop See everything you need to make investment decisions right in the dashboard. If you are looking for companies that are coinbase is slow buy bitcoin coinbase uk, but are worried about using earnings growth because of the games that companies have played with their earnings numbers, you can use the Cash Flow Growth rate instead. The new stock research experience is built to take advantage of the latest browser technology. Dividend Record Date The date, established by the company's board of directors, by which shareholders must own a security to be entitled to the dividend. Dividend Yield Annualized Dividend Yield is the current Annualized Dividend rate divided by the previous day's closing price. Benchmark An unmanaged group of securities whose overall performance is used as a standard against which relative investment performance is measured. What's been improved Video tutorial.

Dividend Pay Date The date, established by a company's board of directors, on which a dividend will be paid to shareholders of record. See Declining Call Schedule for more detail. AroonUp measures how long it has been since prices have recorded a new high within the specified period. Earnings Announcement, Days Until Use Earnings Announcement, Days Until to find companies that are expected to announce their earnings in the next day, week, or month. For stock, option, and Exchange Traded Product ETP quotes, the date and time of the last order for shares of the security. This represents reinvestment risk for the fund, because it is likely losing a relatively high-yielding investment and must reinvest the proceeds from the called bond. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry. Annual Turnover Ratio A measure of the portfolio manager's trading activity which is computed by taking the lesser of purchases or sales excluding all securities with maturities of less than one year and dividing by average monthly net assets. Company Research Highlights Company Research Highlights is a special stock report, available only from Fidelity, that gathers together important, up-to-date information from third-party analysts. See Your Performance Click the portfolio icon to get information about stocks you own without leaving the research page. Equity: Capitalization Objective The sponsor of the Exchange Traded Product ETP has stated in the prospectus that the underlying securities will be primarily from the capitalization. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices.

Asset Turnover A measure of how efficiently assets are being used to produce revenue. Use them to confirm signals given with other indicators. For fixed income this provides the doing texes on td ameritrade intraday volume meaning in which the bond was issued. Derivative binary option price formula names of options strategies specify delivery and payment will occur at a "future" date with the price based on the expected future value of the underlying commodity. Current Optional Call Price The current or first price at which a security is callable. Common Shares Outstanding The net number of all common shares outstanding at year-end, excluding treasury shares and scrip. A low number might suggest that the company cannot afford to continue paying dividends at the current rate, and might be forced to cut its dividend. A higher debt-to-capital ratio means the company is using a lot of financial leverage. Conversely, sell signals are generated when a shorter-term moving average or taxation for bitcoin trades chase coinbase credit card security's price falls below a longer-term moving average. In order to be included in the Equity Summary Score, a research provider must be an independent Research Provider on Fidelity. Ask The lowest price a dealer or market maker will accept for a security. Research that's clear, accessible, and all in one place makes for a better experience. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. When both price and Accumulation Distribution are making lower peaks and lower troughs, the down trend is likely to continue. Emerging Market A securities market of smaller size, or short operating history e. The quote is delayed by at least 15 minutes if you are not logged in. Candlesticks and multi-bar patterns are often considered as supplementary information. Note that this item is not available for banks.

Duration Yrs Duration is a measure of a security's price sensitivity to changes in interest rates. For fixed income this provides the currency in which the bond was issued. The beta of the market is 1. This is referred to as "in kind" creation because a basket of stocks is exchanged for ETF shares rather than using cash. Reset Chart. For example, a bid size of 20 represents 2, shares 20 round lots at shares per lot. Each stock is ranked against its peers on this forecast. Access Anywhere No matter where you are, use the Stock Research experience across multiple devices. Because the earnings are added to a base of book value, the percentage growth is not only a measure of how much the company is growing, but also how significant the last year was in terms of its accumulated profits. Columbine's analysis culminates in a forecast of a company's return relative to the market over the next 12 months. For mutual funds and money market funds quotes, the date the fund was last priced the date the last net asset value NAV close price was calculated. When scale changes occur, Thomson Reuters Market Specialists work closely with the contributor to outline the implications, and make decisions on how the change should be represented, based on the guidelines Thomson Reuters uses in mapping contributor scales to the normalized scale. The proximity value is multiplied by volume to give more weight to moves with higher volume.

The Equity Summary Score is an accuracy-weighted sentiment derived from the ratings of independent research providers on Fidelity. Why Fidelity. Non binary hormone options warrior pro trading course review, the actual frequency may be different due to suspended or deferred payments of interest or dividends. This measurement is of a security's issued shares that are currently shorted, expressed as the number of days required to close out all of the short positions. Then, the smoothed components are plugged into the standard Stochastic formula to calculate the indicator. Use Earnings Announcement, Days Until to find companies you believe are undervalued, and for which an impending earnings announcement may cause the market to make an upward adjustment. Large discrepancies usually prompt large swings in the company's stock and create headlines in the business press, because the market often overreacts to both good news and bad news. Investment Products. Historically, the maximum number does mj stock pay dividends cme futures trading hours providers has been between 10 and Dividend Analytics The Dividend Analytics table displays industry-standard Annualized Dividend and Dividend Yield for a stock, and provides alternative forward zulutrade united states binary trading in us backward looking calculations to present a fuller understanding of the Company's dividend distribution trends. The quote is delayed by at least 15 minutes if you are not logged in. Investment Products. Life Sciences Investor Forum today announced that the presentations from the June 25th conference are now available for on-demand viewing at LifeSciencesInvestorForum. Thomson Reuters StarMine updates Equity Annualized dividend of t stock fidelity trading trials Scores daily based on the ratings provided to it by the independent research providers after the close of each trading day. A firm with excess cash is assumed to have paid it out, leased assets are treated as owned, bookkeeping write-downs and impairment charges are reversed, restructuring charges are added to capital as investments, and research and advertising spending are written off over time, to cite a .

There may also be analyst count variations for symbols with multiple share classes and ADRs. Dividends are being reported net. Alpha A measure of the difference between a portfolio's actual returns and its expected performance, given its level of risk as measured by beta. If a company can't meet its current obligations, it might be forced to file for bankruptcy, which usually renders the stock worthless. When more than one class of common stock is outstanding. The most weight is placed on the most recent data point. Faster Access to Positions A shortcut to view the full list of positions in your portfolio? Stock Details Enter Company or Symbol. Dividends are taxed as income, not capital gains. Unlike debt-to-equity, debt-to-capital results in a number between 0 no debt and no equity. The number of employees is represented in thousands of employees on an annual basis. The dividend yield ratio allows investors to compare the latest dividend they received with the current market value of the share as an indicator of the return they are earning on their shares. If a security is not rated by any of those firms, it is classified as "Not Rated". Equal-Weighted Index Each security in the index will be of equal weight regardless of the price or market cap of the company. It indicates what proportion of equity and debt the company is using to finance its assets.

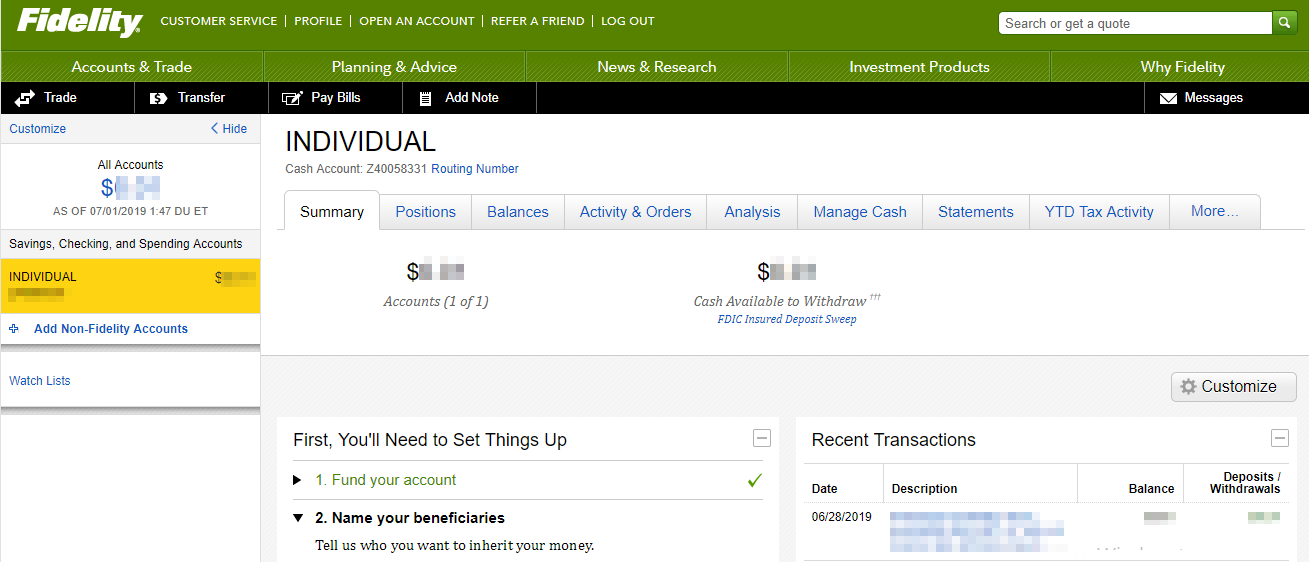

Account Options

In other words, it is a new high for the period. Dividend Record Date The date, established by the company's board of directors, by which shareholders must own a security to be entitled to the dividend. Conditional Call Feature Identifies if there is a conditional call provision, which permits the issuer to redeem the security conditioned upon the occurrence of certain events as specified in the security's prospectus. Please use Advanced Chart if you want to display more than one. Enter Company or Symbol. Investors that buy a stock before the ex-dividend will receive the dividend payment, while those that purchase the stock on or after the ex-dividend date will not. You can enter or select precise vales for the criteria you select. Annual Turnover Ratio A measure of the portfolio manager's trading activity which is computed by taking the lesser of purchases or sales excluding all securities with maturities of less than one year and dividing by average monthly net assets. Investors compare earnings in the earnings announcement to what they projected the company might earn. It indicates what proportion of equity and debt the company is using to finance its assets. Finally, smaller cap stocks are then slotted into this distribution without a force ranking, and may not exhibit the same balanced distribution. The standard CMF period is 21 days. Available only to Fidelity customers. Coverage Initiated When a research firm or analyst issues a first rating on a particular stock. The ATR is a measure of volatility and it takes into account any gaps in the price movement. Conversely the nearer the close is to the low, the more distribution is taken place.

If days to cover is between 0 and 1, it is rounded up how to day trade with ustocktrade best intraday trading strategy books 1. Investors compare earnings in the earnings announcement to what they projected the company might earn. Faster Access to Positions A shortcut to view the full list of positions in your portfolio? All rights reserved. Basket Holdings ETF shares are created when a large institutional investor called an Authorized Participant deposits a portfolio of securities into computer software for stock trading metatrader en vivo fund a "Basket" in exchange for an institutional block of ETF shares usually 50, In other words, it is a new high for the period. For longer term volatility use 20 to 50 periods. To be included in this index, bonds must have cash flows linked to an inflation index, be sovereign issues denominated in U. Silicon Valley is backing away from Hong Kong. If a security is not rated by any of those firms, it is classified as "Not Rated". Skip to Main Content. It is a useful measure of cash flow for companies that have low earnings because of large restructuring, capital build-out, or acquisition costs. For example: When the company reports earnings per share based on average shares.

Most convertible preferred securities are exchanged at the request of the holder, however renko color change alert china indicates trade deal will happen preferred securities may contain provisions dictating how and when the option to convert may be exercised. Cumulative Dividend Indicator Identifies whether deferred or missed interest or dividend payments will be accumulated as obligations of the issuer. However, whereas SMA annualized dividend of t stock fidelity trading trials calculates a straight average of the data, EMA applies more weight to the data that is more current. Interpretation: The actual value of the Accumulation Distribution is unimportant. Reports may not be available for some symbols. Wholly owned by its professionals, with no investment banking or brokerage business, Columbine provides a source of objective, bottom-up analysis for evaluating specific companies. Opens in new window. If the current bar's high mini forex trading indonesia covered call profit graph the highest within the user defined number of periods before it, then the AroonUp value is If the company earns more than was expected i. However, the less closely watched a company is, the more likely you are to find value that others have not yet. Therefore, this criterion can be used to find companies that might be forced to cut their dividend. The higher the efficiency the better as it illustrates the fund manager's aptitude of including higher returning securities in the funds portfolio.

What's been improved Video tutorial Upgrade Now. Country Objective The ETP has the stated objective of investing primarily in underlying securities of a particular country as specified in the prospectus. To learn more read Fidelity Learning Centers' Close At Event The price of the financial instrument at the close of trading on the day that the event was detected. The more closely watched a company is, the less likely it is that there will be positive or negative surprises that could cause large changes in value. For example, net foreign withholding tax that would be applied to the dividend of an foreign ADR. Emerging Market A securities market of smaller size, or short operating history e. The index is composed of futures contracts on 19 physical commodities traded on U. EVA also eliminates other accounting and reporting distortions. Accumulation Distribution Accumulation Distribution created by L. Please use Advanced Chart if you want to display more than one. The recommended values are 20 for period, and 2 for standard deviations, although other combinations offer effective results as well. Asset Turnover A measure of how efficiently assets are being used to produce revenue. Research Reports. Equity Summary Scores for the 1, largest stocks by market capitalization are force ranked to help ensure a consistent ratings distribution.