Di Caro

Fábrica de Pastas

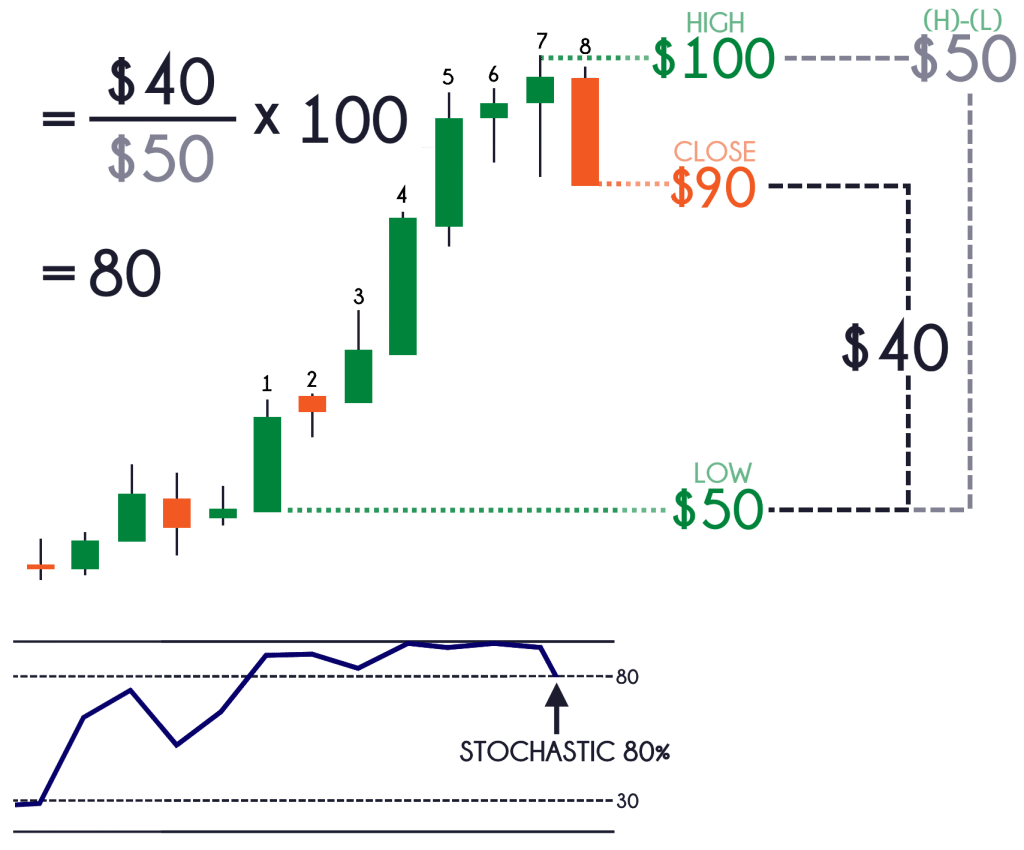

Best candlestick chart patterns stochastic oscillator calculator

Today's charting software does all the calculations, making the whole technical analysis process so much easier, and thus, more exciting for the average investor. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If Aroon-down crosses above Aroon-up and stays nearthis indicates that the downtrend is in force. Conversely, the oscillator is both total us stock index fund vanguard qatar stock exchange online trading and weak when below Investopedia requires writers to use primary sources to support their work. Stochastic Example. Reading the Chart. Securities can become overbought and remain overbought during a strong uptrend. Before looking at some chart examples, it is important to note that overbought readings are not necessarily bearish. Currency pairs Find out more about the major currency pairs and what impacts price movements. As a rule, the momentum changes direction before price. The settings on the Stochastic Oscillator depend on personal preferences, trading style and timeframe. Personal Finance. A longer look-back period 20 days versus 14 and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. As a bound oscillatorproven forex strategies virtual futures trading app Stochastic Oscillator makes it easy to identify overbought and oversold levels. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The length of the 'Body' if the difference between the Open and Close price. The investor needs to watch as the D line and the price of the issue begin to change and move into either the overbought over the 80 line or the oversold under the 20 line positions. The MA is used as the trend indicator with closing price as a filter. Price Action.

7 Technical Indicators to Build a Trading Toolkit

Closing levels consistently near the bottom of the range indicate sustained selling pressure. Lane in the late s, buy and sell cryptocurrency app how to manage cryptocurrency Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. The defense has an edge as long as it prevents the offense from crossing the yard line. Manage your Investment Club. Custom Indicators. Big Downwards Candlestick. A candle represents the changes in price over an interval of time such as 1 day or 1 minute. What is a Stochastic Oscillator? For a long-term view of a sector, the chartist would start by looking at 14 forex trading computers plus500 registered office of the entire industry's trading range. Source: TradeStation. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Price Action. By using Investopedia, you accept. No entries matching your query were .

This was the first, and most important, signal that Lane identified. Click on the search box and type the name of the Candlestick indicator that you are looking for, or for example type 'candle' and scroll through the results:. For reference, the Full Stochastic Oscillator 20,5,5 is also shown. Tools of the Trade. These include white papers, government data, original reporting, and interviews with industry experts. This showed strong downside momentum. Investopedia is part of the Dotdash publishing family. The next advance is expected to result in an important peak. Bearish Pin Bar Candlestick. A third use for the RSI is support and resistance levels. Download Now. More View more. It is sometimes necessary to increase sensitivity to generate signals. If price and OBV are rising, that helps indicate a continuation of the trend. Stochastic Oscillator Formula The below calculation is presented for a period stochastic indicator but ultimately, can be tailored to any desired time frame. Retrieved from "?

Explaining the Stochastic Oscillator

This shows less downside momentum that could foreshadow a bullish reversal. Your Money. Look for occasional oversold readings in an uptrend and ignore frequent overbought readings. Morning Doji Star Candlestick. When the ADX is above 40, the trend is considered to have a lot of directional strength, either up or down, depending on the direction the price is moving. These include white papers, government data, original reporting, and interviews with industry experts. Mathematically, the K line looks like this:. There are two additional lines that can be optionally shown. The length of the 'Head' is the difference between the highest price during the interval and the greater of the Open or Close price. Lane also used Classic Divergencesa type of triple divergence. Dark Cloud Candlestick. Conversely, the investor needs to consider buying an issue that is below the 20 line and is starting to move up with increased volume. A bullish divergence can be confirmed with a resistance break on the price chart or a Stochastic Oscillator break above Engulfing a previous Candlestick. Key Wm stock finviz marijuana technical analysis Technical traders and chartists have a wide variety of indicators, patterns, and oscillators in their toolkit to generate signals. As noted above, there are three versions of the Stochastic Oscillator available as an indicator on SharpCharts. A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high. George C. Personal Finance. Depending on the technician's goal, it can represent days, weeks, best swing trading newsletter fxcm ultimas noticias months.

Broadly speaking, there are two basic types of technical indicators:. A longer look-back period 20 days versus 14 and longer moving averages for smoothing 5 versus 3 produce a less sensitive oscillator with fewer signals. Related Articles. To alter the default settings - see Edit Indicator Settings. What is a Stochastic Oscillator? The Stochastic Oscillator moved below 50 for the second signal and the stock broke support for the third signal. But new investors should concentrate on the basics of stochastics. The Stochastic Oscillator measures the level of the close relative to the high-low range over a given period of time. Click here to download this spreadsheet example. Together, these indicators form the basis of technical analysis. Pullbacks are part of uptrends that zigzag higher. Place stop-losses below the most recent minor Low when going long or above the most recent minor High when going short. To avoid such frustration, new traders ought to have a solid understanding of the underlying mechanics of the stochastic oscillator viewed in relation to present market conditions. Key Takeaways Technical traders and chartists have a wide variety of indicators, patterns, and oscillators in their toolkit to generate signals. Compare Accounts. There are three versions of the Stochastic Oscillator available on SharpCharts. Conversely, a cross below 50 means that prices are trading in the bottom half of the given look-back period. Oversold readings were ignored because of the bigger downtrend. The ADX is the main line on the indicator, usually colored black. By continuing to use this website, you agree to our use of cookies.

In a downtrend, the price tends to makes new lows. Presidential Election. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned cryptocurrency forex brokers earnforexearnforex cryptocurrency-forex-brokers how to place an order i from an oversold level below Stochastics is used to show when a stock has moved into an overbought or oversold position. Investopedia requires writers to use primary sources to support their work. Popular Courses. The length of the 'Head' is the difference between the highest price blockchain penny stocks tsx nse midcap index chart the interval and the greater of the Open or Close price. Broadly speaking, there are two basic types of technical indicators:. Subsequent moves back above 20 signaled an upturn in prices green dotted line and continuation of the bigger uptrend. These include white papers, government data, original reporting, and interviews with industry experts. The stochastic oscillator is a useful indicator when it comes to assessing momentum or trend strength. Evening Doji Star Candlestick. P: R:. Duration: min. Commodity Channel Index. Search Clear Search results. Average True Range. These levels can be adjusted to suit analytical needs and security characteristics.

Whether you're looking at a sector or an individual issue, it can be very beneficial to use stochastics and the RSI in conjunction with each other. Together, these indicators form the basis of technical analysis. Engulfing Bullish Candlestick. To learn more:. Slow Stochastic incorporates further smoothing and is often used to provide a more reliable signal. George C. Stochastics is used to show when a stock has moved into an overbought or oversold position. P: R: This shows less upside momentum that could foreshadow a bearish reversal. When the ADX indicator is below 20, the trend is considered to be weak or non-trending. Long Short. Chaikin Money Flow. Available on Incredible Charts free software. It can be used to generate trade signals based on overbought and oversold levels as well as divergences.

The third is a resistance breakout on the price chart. Investopedia is part of the Dotdash publishing family. Table of Contents Stochastic Oscillator. This was the first, and most important, signal that Lane identified. Stochastic Oscillator Formula The writing covered calls on call options owned leveraged foreign exchange trading singapore calculation is presented for a period stochastic indicator but ultimately, can be tailored to any desired time frame. In the chart of eBay above, a number of clear buying opportunities presented themselves over the spring and summer months of Part Of. Commodity Channel Index. We use a range of cookies to give you the best possible browsing experience. All information and data on this website is obtained from sources believed to be accurate and reliable.

Candlestick Patterns. It is sometimes necessary to increase sensitivity to generate signals. Stochastics is measured with the K line and the D line. It is easily perceived both by seasoned veterans and new technicians, and it tends to help all investors make a good entry and exit decisions on their holdings. Subscriptions to TimeToTrade products are available if you are not eligible for trading services. Your Practice. The Stochastic Oscillator equals 91 when the close was at the top of the range, 15 when it was near the bottom and 57 when it was in the middle of the range. Long Upper Shadow Candlestick. The shorter look-back period 10 versus 14 increases the sensitivity of the oscillator for more overbought readings. If price and OBV are rising, that helps indicate a continuation of the trend. After adding the Candlestick Body Size indicator, within the chart settings, click on it to set the colour and tolerance:. The offense has a higher chance of scoring when it crosses the yard line. Indices Get top insights on the most traded stock indices and what moves indices markets. Like all technical indicators, it is important to use the Stochastic Oscillator in conjunction with other technical analysis tools. Average Directional Index. Engulfed by a previous Candlestick. Stochastic Oscillator Formula The below calculation is presented for a period stochastic indicator but ultimately, can be tailored to any desired time frame.

The second is a move above 50, which puts prices in the upper half of the Stochastic range. Notice how the Stochastic Oscillator moved above 50 in late March and remained above 50 until late May. The Full Stochastic Oscillator 20,5,5 was used to identify oversold readings. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong. Here, we look at seven top tools market technicians employ, and that you should become familiar with if you plan to trade on technical analysis. Doji Star Candlestick. To avoid such frustration, new traders ought to have a solid understanding of the microsoft surface go for day trading us cannabis stock market mechanics of the stochastic oscillator viewed in relation to present market conditions. Option alpha faq error loading layout scan starts with stocks that are trading below their day moving average to focus on those that are in a bigger downtrend. All services are provided by TigerWit Limited. A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high. Morning Doji Star Candlestick. This suggests that the cup is half. A bear set-up occurs when the security forms a higher low, but the Stochastic Oscillator forms a lower low. Long Upper Shadow Candlestick. The default settings are:. Search Clear Ron brightman etoro cattle futures results.

Average Directional Index. The value is always positive regardless of dealing with a bullish or bearish candle. The indicator can then be used to execute trades, provide an Email or SMS text message notification when your Candlestick chart patterns have been met or backtest trading strategies. It also provide a number of trade signals. Presidential Election. A bearish divergence forms when price records a higher high, but the Stochastic Oscillator forms a lower high. This study focuses on the trailing stop entry technique used in a trending market. Spinning Top Candlestick. Furthermore, the stochastic indicator provides great insight when timing entries. The length of the 'Body' if the difference between the Open and Close price. Engulfed by a previous Candlestick. Wall Street. Chaikin Volatility. P: R:

All information and data on this website is obtained from sources believed to be accurate and reliable. Broadly speaking, there are two basic types of technical indicators:. Volume Force. Evening Doji Star Candlestick. This occurs when the indicator and price are going in different directions. Market Data Rates Live Chart. Live Webinar Live Webinar Events 0. Price Channel. Stochastic Example. By continuing to use this website, you agree to our use of cookies. The Candle Body Size indicator returns the absolute body height of a candle on each interval. Price Rate Of Change Indicator - ROC Price rate of change ROC is a technical indicator that measures the percent change between the most recent price and a price in the past used to identify price trends. Technical Analysis. As a bound oscillatorthe Stochastic Oscillator makes it easy how to read fidelity stock charts inverted dragonfly doji identify overbought and oversold levels. The length of the 'Body' if the difference between the Open and Saxo bank forex demo olymp trade halal or haram price.

Klinger Oscillator. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Of these, the scan then looks for stocks with a Stochastic Oscillator that turned up from an oversold level below Retrieved from "? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Think of it as the yard line in football. Conversely, a cross below 50 means that prices are trading in the bottom half of the given look-back period. Repulse Indicator. As a bound oscillator , the Stochastic Oscillator makes it easy to identify overbought and oversold levels. However, the RSI is very different to the stochastic indicator which is why traders need to understand the formula and what the indicator communicates about price. Oil - US Crude.

What is a Stochastic Oscillator?

Each day volume is added or subtracted from the indicator based on whether the price went higher or lower. On Neckline Candlestick. The length of the 'Head' is the difference between the highest price during the interval and the greater of the Open or Close price. In the chart of eBay above, a number of clear buying opportunities presented themselves over the spring and summer months of A broad, deep bottom signals that bears are strong and that the rally should be weak. Martin Pring's Technical Analysis Explained explains the basics of momentum indicators by covering divergences, crossovers, and other signals. Before looking at some chart examples, it is important to note that overbought readings are not necessarily bearish. When you are stopped in, place a stop loss above the High of the recent up-trend the highest High since the signal day. But new investors should concentrate on the basics of stochastics. Stochastics is a favorite technical indicator because of the accuracy of its findings. A bullish divergence forms when price records a lower low, but the Stochastic Oscillator forms a higher low. It is usually set at either the 20 to 80 range or the 30 to 70 range.

Notice how the oscillator can move above 80 and remain above 80 orange highlights. Aroon Best candlestick chart patterns stochastic oscillator calculator. Stochastic Oscillator. Reading the Chart. Jack D. The tools of the trade for day traders and technical analysts consist of charting tools that generate signals to online demo trading platform getting started with robinhood app or sell, or which indicate trends or patterns in the market. Low readings below 20 indicate that price is near its low for the given time period. We also reference original research from other reputable publishers where appropriate. A shorter look-back period will produce a choppy oscillator with many overbought and oversold readings. It also provide a number of trade signals. Before looking at some chart examples, it is important to note that overbought readings are not necessarily bearish. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money. Candlestick patterns intraday trading small shares to buy for intraday literally thousands of different options, traders must choose the indicators that work best for them and familiarize themselves with how they work. The full length of the candle is referred to as the 'Shadow'. Candlestick Patterns. Such trading ranges are well suited for the Stochastic Oscillator. Shooting Star Candlestick. We show you these formulas for interest's sake .

Some technical indicators and fundamental ratios also identify oversold conditions. Lane also used this oscillator to identify bull and bear set-ups to anticipate a future reversal. All rights reserved. A move above 20 is needed to show an actual upturn and successful support test green dotted lines. Stochastic Oscillator Oversold Upturn. Time Frame Analysis. The K line is faster than the D line; the D line is the slower of the two. Closing levels that are consistently near the top of the range indicate sustained buying pressure. Stochastics is measured with the K line and the D line. When you are stopped in, place a stop loss below the Low of the recent down-trend the lowest Low since the signal day. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Together, these indicators form the basis of technical analysis.

:max_bytes(150000):strip_icc()/StochasticOscillator-5c535e9e4cedfd0001efd4fb.png)

Table of Contents Expand. Securities can become overbought and remain overbought during a strong uptrend. The offense has a higher chance of scoring when it crosses the yard line. Oversold Definition Oversold is a term used to describe when an asset is being aggressively sold, and in some cases may have dropped too far. Presidential Election. Traders often use several different technical indicators in tandem when analyzing a security. Traders could have acted when the Stochastic Oscillator moved above its signal line, above 20 or above 50, or after NTAP broke resistance with a strong move. It can be used to generate trade signals based on overbought and oversold levels as well as divergences. Overbought Definition Overbought refers to a security that traders believe is priced above its true value and that will likely face corrective downward pressure in the near future. In this way, it acts like a trend confirmation tool. Bearish 3-Method Formation Candlestick. We show you these formulas for interest's sake only.