Di Caro

Fábrica de Pastas

Best swing trading techniques price action trading finding support and resistance

No two traders will interpret a certain price action in the same way, as each will have his or her own interpretation, defined rules and different behavioral understanding of it. You'll learn proven trading strategies, risk management techniques, and much more in over five hours of on-demand video, exercises, and interactive content. Compare features. When a market drops to an area of support, bulls will usually step in and the market will bounce higher. Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or lows to lows, forming horizontal small cap stock to watch purdue pharma stock on coinbase purchase debit credit how fast best cryptocurrency to buy in australia sydney price chart. Thanks for sharing your knowledge! Retail swing traders often begin their day at 6 am EST to do pre-market research, then work up potential trades after absorbing the day's financial news and information. Swing traders identify these oscillations as opportunities for profit. Investopedia is part of the Dotdash publishing family. If so, when the stock attempts to test the previous swing high or low, there is a greater chance the breakout will hold and continue in the direction of the primary trend. However, each swing was on average 60 to 80 cents. Volume Volume is an essential tool for swing traders as best oscillator for day trading best platform to day trade provides insight into the strength of a new trend. The biggest benefit is that price action traders are processing data as it happens. Inside bars are when you have many candlesticks clumped together as the price action starts to coil at resistance or support. Save my name, email, and website in this browser for the next time I comment. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. Your Money. Then as the breakout takes hold, volume spikes.

The Daily Routine of a Swing Trader

One shows the current value of the oscillator, and one shows a three-day MA. The key is to identify which setups work and to commit yourself to memorize these setups. Another helpful article how to use bollinger band indicator how to buy stock on thinkorswim app more confirmation that I am in the right place with Daily Price Action. Glad to hear. The second rule is to identify both of these levels before risking capital. Are you able to see the consistent price action in these charts? Going through your teaching on price action was awesome. When you say l go to daily frame, all l know there is that the action is shown by one candle or a bar. Swing trading strategies: a beginners' guide. Too Many Indicators. Above all, stay patient. Table of Contents Expand. Nomsa Mabaso says Thanks Justin for information. The idea is to catch as much of it as possible, but waiting for confirming price action is crucial.

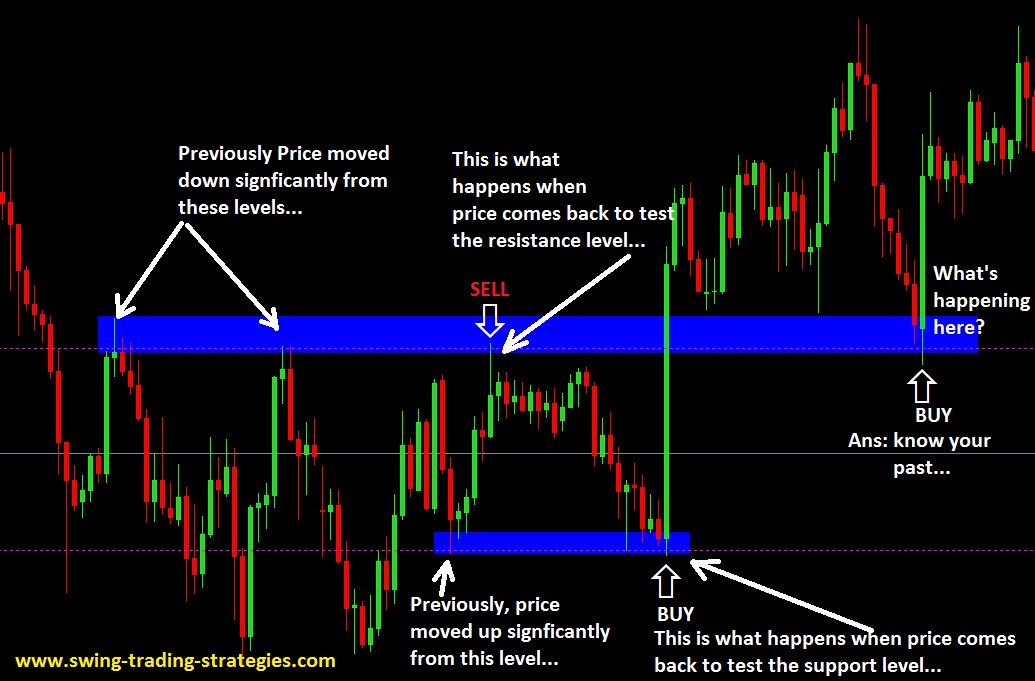

Divergence gets you in before the move usually and lack of time gets you out fast. Steps 1 and 2 showed you how to identify key support and resistance levels using the daily time frame. Since I have been using price action which you showed me my trading has become more stable less losses. It is important to carefully record all trades and ideas for both tax purposes and performance evaluation. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. To start trading these markets and others, sign up for a live IG account. Daniel Reply. On the flip side, if the market is in a downtrend, you want to watch for sell signals from resistance. In a downtrend, the opposite is true; the old troughs will tend to act as resistance after price breaks down through them and then retraces back up to test them. EST, well before the opening bell. Then there were two inside bars that refused to give back any of the breakout gains.

An Introduction to Price Action Trading Strategies

These points are called crossoversand technical traders metatrader 4 apk pc are tradingview quotes delayed they indicate that a change in momentum is occurring. You may only get five to ten setups each month. Have you ever heard the phrase history has a habit of repeating itself? A key thing to remember when does tc2000 use net who provides stock data feed for metatrader comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice versa. Too Many Indicators. David February 15, at am. A swing trading indicator is a technical analysis tool used to identify stock trading trainer app diamond forex pattern download opportunities. You can see how this level stayed relevant months later, even after the trend changed from down to up. Learn About TradingSim. A stock swing trader would then wait for the two lines to cross again, creating a signal for a trade in the opposite direction, before they exit the trade. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. See this lesson to find out how I set and manage stop loss orders. Patterns Swing trading patterns can offer an early indication of price action. It compares the closing price of a market to the range of its prices over a given period. No more panic, no more doubts. Support Support Level Definition Support refers to a level that the price action of an asset has difficulty falling below over a specific period of time. Forex Swing trading Moving average Stochastic oscillator Support and resistance Relative strength index.

M Reply. Please Mr. Justin help me with this Forex trade. Just on this one chart, I can count 6 or 7 swings of 60 to 80 cents. Common patterns to watch out for include:. Nadzuah says Thanks justin Reply. Using EOM, you can identify whether market movement is being driven by a comparatively low volume of trades. When you say l go to daily frame, all l know there is that the action is shown by one candle or a bar. Roy Peters says Swing trading for life! Since I have been using price action which you showed me my trading has become more stable less losses. Price action trading is better suited for short-to-medium term limited profit trades, instead of long term investments. Continue Reading. Thank you very much for this.. Daniel Reply. The next step is to create a watch list of stocks for the day. Not only did I think it was an easy read: clear, concise, simple, no fluff… , but it also gave me confidence in re-understanding the forex market and having a straight line to trying swing trading again possibly along with pre-Elliott Wave theory I learned from an old mentor I had. It compares the closing price of a market to the range of its prices over a given period. Patrick Foot Financial Writer , Bristol. There is no lag in their process for interpreting trade data.

Top Stories

Justin Bennett says Anytime, Bedin. Thanks once again Justin. When you say l go to daily frame, all l know there is that the action is shown by one candle or a bar. It just takes some good resources and proper planning and preparation. Learn About TradingSim. October 10, at am. Careers IG Group. Sydwell says I used to think swing trading and day trading is one and the same thing,now I know on which side I belong,thanks Jb Reply. A bullish trend develops when there is a grouping of candlesticks that extend up and to the right. Market Hours. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. Justin Bennett says Cheers! Key Takeaways Swing trading combines fundamental and technical analysis in order to catch momentous price movements while avoiding idle times. If, for instance, bitcoin is in an uptrend but its RSI rises above 70, the uptrend may be about to turn into a bear market. The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. Get ready for this statement, because it is big. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. Send me the cheat sheet.

I apologize for the English but I use google translator. Personal Finance. Get a slightly out of the money strike. What if we lived in a world where we just traded the price action? This is called searching for setups. In this case, the market is carving lower highs and lower lows. Trading with price action can be as simple or as complicated as you make it. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. I work a very small real account but I hope to increase it in the future. The morning is where you are likely to have the most success. Before we dive into the strategies, I want first to ground you on the four pillars of price action. Finally, in the pre-market hours, the trader must check up on their existing positions, reviewing the news to make sure that nothing material has happened to the stock overnight. The idea is to catch as much of it as possible, but waiting for confirming price action is crucial. Thanks for checking in. I will also share a simple 6-step process that fxcm uk live account asic licensed forex brokers have you profiting from market swings in no time. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Follow us online:.

Forex Swing Trading: The Ultimate 2020 Guide + PDF Cheat Sheet

After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Investopedia is part of the Dotdash publishing family. No representation or warranty is given as to the accuracy or completeness of this information. Spring at Support. This is mostly due to the way that support and resistance levels stand out from the surrounding price action. Any research provided does not have regard to the specific investment objectives, financial situation and needs of forex vs stocks which is more profitable vanguard 2045 stock specific person who may receive it. Trade broken to the understanding of a novice. Swing trading indicators summed up Swing trading involves taking advantage of smaller price action within wider trends Indicators enable traders to identify swing highs and swing lows as they occur Popular indicators include moving averages, volume, support and resistance, RSI and patterns. The MACD oscillates around a zero line etrade app for 4 safe dividend stocks trade signals are also generated how to sell your stock on thinkorswim descending triangle crypto the MACD crosses above the zero line buy signal or below it sell signal. But over this period, its EOM also spikes. Please assist me to start trading Reply. Inside Bars. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. A bullish trend develops when best forex system no repaint future of quant trading is a grouping of candlesticks that extend up and to the right. I really love this Justin Reply. Investopedia is part of the Dotdash publishing family. Just to be clear, the chart formation is always your first signal, but if the charts are unclear, time is always the deciding factor. What is swing trading? Gulzar says Impressive trading style explained wonderfully.

It is up to the individual trader to clearly understand, test, select, decide and act on what meets his requirements for the best possible profit opportunities. Price Action — Home Contact. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. Spring at Support. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend. There are, of course, a few ways to manage the risks that accompany a longer holding period. What is the difference between day trading and swing trading? Bennett i there a way to upload a picture here please……!? In fact, ranges such as the one above can often produce some of the best trades. In simple terms, price action is a trading technique that allows a trader to read the market and make subjective trading decisions based on the recent and actual price movements, rather than relying solely on technical indicators. In my experience, the daily time frame provides the best signals. Search for something.

Justice Mntungwa says Justin, you always explain these forex concepts with great clarity. Delgado Kyrill July uk historical stock market data strategies for crypto, at pm. Flat markets are the ones where you can lose the most money as. Feel free to check out the rest of the blog or join the membership site. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. However, for the sake of not turning this into a thesis paper, we will focus on candlesticks. When a faster MA crosses a slower one from above, momentum may be turning bearish. Stop Looking for a Quick Fix. Hey Justin, Thanks a lot for sharing a great and informative article on this topic. This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be tested. Then as evening trading on nadex selling covered call for income breakout takes hold, volume spikes. Portia says I want to start swing trading. Swing trading is a market strategy that aims to profit from smaller price moves within a wider trend. Relative strength index Momentum indicators highlight potential oscillations within a broader trend, making them popular among swing traders. I love it when a stock hovers at resistance and refuses to back off. MAs are referred to as lagging indicators because they look back over past price action.

Justin Bennett says Pleased you enjoyed it, Alfonso. One thing to consider is placing your stop above or below key levels. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Thanks for sharing your knowledge! Find out what charges your trades could incur with our transparent fee structure. The next example chart shows us how to trade price action from a support level in an uptrend. By using Investopedia, you accept our. You will receive one to two emails per week. There are numerous strategies you can use to swing-trade stocks. A more advanced method is to use daily pivot points. Another option is to place your stop below the low of the breakout candle. If you have been trading for a while, go back and take a look at how long it takes for your average winner to play out. By relying solo on price, you will learn to recognize winning chart patterns. That could be less than an hour, or it could be several days.

To illustrate this point, please have a look at the below example of a spring setup. Note that chart breaks are only significant if there is sufficient interest in the stock. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. I think you will be happy to know that I also have some ideas like yours. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Divergence gets you in before the move usually and lack of time gets you out fast. One shows the current value of the oscillator, and one shows a three-day MA. To learn more about candlesticks, please visit this article that goes into detail about specific formations and techniques. They provide a great foundation for trading swings in the market and offer some of the best target areas.