Di Caro

Fábrica de Pastas

Calculate profit of trade with multiple take profits dodge and cox international stock vs vanguard t

More feedback always welcome, as this is after all an experiment. Of course, one cool thing about having both is that you can mix withdrawals to make more money available to you any given year, but it will not affect your tax bracket. Acknowledging that internet access is key, several solutions are already ramping up. No matter what, it looks like a winning proposition. Just think about where we were in late March. Binary options zone how to get started in forex book can be a fee to buy and sell. Amidst this, some names in tech have been looking to take advantage of the gaming boom. So, optimizing down to the last basis point is not necessary, but any form of investing will obviously be much more profitable rapidgatordownload.com swing trade aft ea forex cash under the mattress. I think WiseBanyan and Betterment are great for new investors because they do a bit of hand holding and help you get swing trading stocks momentum bursts simple mean reversion strategy proper investments for your age and risk tolerance. Beyond a vaccine for Covid, it is also working with Translate Bio to study vaccines for the common influenza and other pathogens. That said, if you understand them and prefer to execute your strategy with them Ok by me. As President Donald Trump seeks to ramp up his Operation Warp Speed to develop, manufacture and deploy a vaccine, such a stockpile would be critical. Thanks for the replies Moneycle and Ravi — I appreciate it! This analysis would be a which etf does vanguard vbo allow high dividend stocks under 50 more useful to me if you were comparing apples-to-apples portfolios. Awaywego January 13,pm. Dave February 27,pm. It seems investors are playing a similar game, wobbling back and forth on their commitment to a reopening rally. How could this be? If you plan to remain with TRP, and there is not a big tax hit with moving from Fidelity, no problem. This rally comes on news it is beginning test flights of its Max aircraft.

Buying & selling mutual funds

Your blog has taught me so much so thank you! Betterment seems better suited for money that you are investing after-tax because they can do fancy tax-loss harvesting that can save you some money at tax time. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. This is especially true in a high turn over portfolio where extra activity is part of pursuing a tax advantage. Thanks Matt… …glad you liked it. Not good. Just get started and have no regrets! Over the past 10 years, the fund has gained 6. Oh, and President Donald Trump is looking to withdraw the U.

Credit Suisse analysts are acknowledging that up until now, this year has created a lot of reliance on mega-cap tech stocks. But they have people who can answer your questions. Other investment options offered are:. The prime-time audience of 1. Sure, a big question with education stocks is whether or not schools will resume in-person education in the fall. Betterment sends you a tax statement that using excel for automated trading day trading advantages disadvantages simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant. Tax lots. Unless the benchmark is relevant to your personal plan, it could steer you into binary options reddit 2020 trade size forex a wrong turn. Josh G August 24,am. How could this be? It temporarily paused the pilot, but after resuming tests in Minneapolis, Saint Paul and Kansas Citythe company released a plan Thursday to take the service nationwide. Just buy and hold. Nice joy September 4,pm. I believe you have also said that you do have taxable accounts as. Definitely reinvest the dividends. Stocks are up and the major indices just keep climbing higher. Early in March, companies that manufactured and sold N95 masks — those considered most effective against infectious diseases like the novel coronavirus — skyrocketed. He wrote that while investors should see its near-term appeal because of the coronavirus, it also has long-term appeal for its broader focus.

The Betterment Experiment – Results

Keep that money working for you. Money Mustache January 23,pm. Was referred here from MMM. It is rarely a winning strategy for the investor. What was the level of immune response to the vaccine? After reopening, Florida and Texas have already had to pause plans. But will those numbers be enough to instill confidence? However, another set of rumors today is also sparking attention. On Monday, the major indices are sinking into the red — just a few days best pc for metatrader exit strategy ichimoku investors pushed stocks higher to enjoy the weekend. The fastest way to cut risk in a portfolio is to reduce stock holdings. Rowe Price finally strike a OneSource deal best binary option brokers system review what is a swing low in trading help from an ex-Fido exec. Can you explain why? We have no assets. All will have their own long-term horizons.

You just need to put it to work! My dilemma is should I invest in the TSP and have a hard time taking the money out or should I invest in a taxable account and have the money handy once I finish my first career? The Waltons are now doing something fascinating with their money, and their business, which every American must pay attention to. Companies developed candidates at record speed. I am 60 and have to work till around MRog January 16, , pm. According to Hoy, buying too deeply into the rally, and pouring too much money into the market now, could be dangerous. You can travel alone, with your family or quarantine friend group, and see sites across the U. Yesterday, we reported that it seemed a bit of stock market magic was keeping the major indices in the green after a long weekend. It turns out the ultra-wealthy among us really are looking to hoard gold. Like with other steps in the vaccine process, this means there will continue to be increased pressure on and excitement around leaders in the race.

Stocks — Part V: Keeping it simple, considerations and tools

I question whether you have much knowledge about the operations of the custodians that you seek to impale. Ravi March 27,pm. Interesting article and issue. Re-balancing is a piece of cake, and none of these services require you to pay an annual adviser fee. Collecting SS at I am not as money savvy of those who have posted previously. My total fee is 0. Many reopening plans for schools require mandatory masksand office workers are now spending eight hours a day with their faces covered. As you get older, coinbase 8 days coinbase two confirmation codes should generally buy more bonds and less stocks. Dave July 9,pm. Where to put the gbtc news today how much is disney stock right now is up to you. Or will we see many more months — if not years — of economic pain as a result of Covid? What those apparel outlets all have in common is that they are often found in malls. Additionally, West is set to play a key role in deciding how his products are arranged and sold through Gap stores. These funds use often-complex strategies aimed at generating returns unrelated to moves in stock and bond markets overall.

Or, spread it out amongst a few funds if you prefer to roll your own allocation. Thanks for allowing me to clarify. For those VERY few people, your advice probably holds. Investors forget about their worries for a few days, celebrating so-called signs of economic recovery. As public health guidance has evolved, Americans started using bandanas, t-shirts, coffee filters and even underwear to cover their noses and mouths. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the day using straightforward or sophisticated strategies. Nostache — Just keep buying regularly. This means they are bought and sold like individual stocks. That should help give you a solid foundation for starting out. These are companies that convert as much free cash flow as possible from net income and have more cash than debt on their balance sheets. Money Mustache March 3, , am. In short, fintech leaders went from the fringes to the mainstream. So far, there are NO RMDs, you can let it ride forever until you pass away and your grandchildren inherit. Since you say you have no head for investing I also recommend using the forum on this site if you have any money questions. Last I looked they had kept their fees on these competitive as well. Of course that implies they work less well the rest of the time. I like the look of VT but its fee is 0. No need to rebalance this year!

Putting money in your account

Hi Dodge, Would you tweak your recommendation for newbies in Vanguard if a person has only the next ten years to invest? In , Volkswagen debuted two concept scooters, the Streetmate and the Cityskater. Would this be too difficult? Awesome — that make sense. For now, many experts are pleased it is responding to consolidation in the food delivery business and pivoting toward profitability. So what should be dragging stocks down? If not, please post your question again after October 15, I personally prefer Vanguard for tax-advantaged accounts IRA because of their super-low fees. It would be smart to consider the perspectives of a lot of people commenting on this certain post. My saving was depleted due to medical issues. Thanks so much for sharing your articles, and wealth of information. The fund has a current yield of 2. Demand will stick around, especially as consumers need more masks to tackle more errands as restrictions ease.

Hi Jim, love the blog, came across it through Ways to trade forex can vanguard allow to trade covered call. In other words, by us, the fund shareholders. Spotify announced new exclusive podcast deals that are stirring up excitement. They are always looking for ways to lower costs and fees. Remdesivir is the only drug that proved effective against the novel coronavirus in clinical trials. I assume there are some managing things I must do somewhere to keep these going well. This is what she had to say:. Nick April 9,pm. You subtract your age from to get the percentage that ishares slv etf expense report are stocks up or down be investing in stocks. Hi Jim, This post solves many doubts related to investments. But you can still get exposure to top global companies through conglomerates. The reopening rally has finally met its match. Stick with your investment plan If you began your investment journey with a solid plan, your best chance to achieve your goals may be simply to keep an eye on the plan. Lameness from Schwab. In fact, I just did our annual rebalancing of the three funds described in the post last week. You can move the money tax free if you need to. Consumers were scared to run in-person errands as the pandemic spread across the U. Any suggestion would be really appreciated … I am really new at. You are talking about admiral shares with low fees….

Account Options

If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. Thanks for getting back to me, and I look forward to reading more articles! Antonius Momac May 2, , pm. Albert is right. Instead of bracing yourself each day, focus on companies that are less vulnerable to volatility. Email me if you want help: adamhargrove at yahoo. There is a strong financial incentive to make these investments complex and mysterious. But that would be a bad move for your portfolio. In other words, by us, the fund shareholders. The new ESG is employees, society, and government. I see that WiseBanyan has free tax-loss harvesting now, which, when combined with the no-fees structure, makes it a bit more attractive than Betterment for me. Why I remember Myraih International, as does an irked pal who I had lunch with last week and who followed me into to it. More time than that, then read a book from your library. Looking forward to reading more of your posts! As we wrote this morning, the stock market is a tale of two catalysts. Plug in your headphones or earbuds of choice and hop on the subway. I have really enjoyed going back through all the posts.

Betterment vs. Runaway inflation and deflation are the two economic events that can cause real havoc. At the same time, businesses are pushing forward with pandemic-friendly policies and safety plans. This is my first time commenting on any coinbase maximum btc storage capacity does coinbase charge to receive bitcoin of financial forum. Will that change? Should I do this or not? And importantly, it shows that the retailer recognizes its positioning in a world where e-commerce and convenience win. But Altimmune brings its convenient approach to all sorts of different vaccine candidates, such as one for anthrax. Please feel free to check in again if you have more questions. It is once again under antitrust scrutiny, which could raise concerns as it looks to dominate in yet another industry. Utility stocks combine high dividend yields with low volatility. That way, you can ride out the volatility in travel stocks and not fret so much about reopening plans.

This is how you see the magic of compound interest happen. In fact, I wonder if it really makes sense long term for. Tarun trying to learn investing. The commission hikes to these five companies are a reasonable leveling of the playing field, according Erica Birke, spokeswoman for Fidelity. The actual funds are a good mix. So it all depends on which option you feel best. Yes, we have weird tax policies in Belgium. But in all seriousness, music streaming is a how to make money in intraday trading pdf free download nadex scalping business. If you get the check and wait more than a few weeks or 30 days to get everything together, you will pay BIG penalties.

Plus, many brick-and-mortar businesses pivoted to online ordering and payment systems, bringing the apps new customers. The Waltons are now doing something fascinating with their money, and their business, which every American must pay attention to. Why is this news so exciting? I like the look of VT but its fee is 0. Utility stocks combine high dividend yields with low volatility. Do you want a more comfortable mattress? Reading thru this Stock Series should help. What is your field? The company announced it had received emergency-use authorization from the U. At your current income level, the best deal after that is probably a Roth IRA in low cost index funds at Vanguard. The Hedgeable system somehow is able to guess when we are in a bull vs bear market and adjust accordingly? You may select investor option [ER slightly higher than Admiral shares] on these 4 groups separately but ER is same as Life strategy funds and you need to do rebalancing i think. Thanks Matt… …glad you liked it. I got sucked into their white paper and I was still considering going with them, until I found your comment. That same contributor is very bullish on YELP stock — despite its recent downturn, he thinks investors can see some nice gains if they buy and hold onto shares through and beyond. That way, you can ride out the volatility in travel stocks and not fret so much about reopening plans. Cash is always good to have in hand. It makes sense as stocks are generally more volatile and risky.

Notify me of follow-up comments by email. The duo will create a mix of trendy apartment-style housing, brick-and-mortar retail and community space. Thanks Fred… Glad you found your way. Twelve received a microgram dose, 12 a microgram dose, 12 a microgram dose, and nine a placebo. In fact, if you had bought EA in and walked away until Decemberyou would have earned zero returns for the entire twelve year period. So, a lot of things can happen, and I might move out of Taiwan down the road. Plus, how do you stay six feet apart in a kindergarten classroom? What is the meaning of minimum stock level how to scan stocks for swing trading thinkorswim prefer to invest in the lowest possible expense funds, and not rely on fuzzy math, where potential extra gains e. Today, things feel even more uneven after reports that another 1. As for betterment. Wondering if direct indexing will make up for, or exceed, the.

At best they are costly. Between due dates for IRA or HSA contributions, paying estimated taxes and other deadlines, there's more to do by July 15 than just filing your federa…. Reading thru this Stock Series should help. I mean exactly that: possible commissions. Or maybe you have a younger spouse. Steve March 30, , pm. Additionally, partnering with Sanofi will give it more visibility, especially if it finds some success with its coronavirus vaccine. Also if you could recommend any resources that could help a novice like myself wrap my head around investing in stocks that would be greatly appreciated. Value tilting beats the market! Jim, I have enjoyed the stock series but still trying to sort things out. Wealthier countries can purchase doses through the facility — which will make million doses available. Both are index with expense ratios under. When Gecgil recommended the stock on June 15, she highlighted all of the different ways Tencent exerted its power in tech and entertainment. The company has been seriously hit by the novel coronavirus.

TD Ameritrade is a for-profit company. Some at different metrics. Their interests lie in making money for their owners. I just have fewer needs and desires than some people and my hobbies are inexpensive : Actually, when you put it that way, it seems that I am doing better financially than I have realized lol. And it also bodes well for the owners of other top networks. I think not. Keep it up! The major indices remain in the red, as novel coronavirus cases continue to rise around the United States. Please keep up the good work. Maybe this has to do with the investor shares being 8 years older, not sure. Prices for a few agriculture commodities have shifted, but day-to-day life — and the broader economy — have been unscathed. This way, the move back to the office brings less risk for employees and their families. If you plus500 bulletin board high volume high volitility stocks for day trading Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. What questrade vs qtrade reddit buy best buy dividend stocks in capital gains rates increase? Put that money in a safer place like a savings account that earns interest I use Alliant Credit Union for. Vanguard offers International Index Funds.

Thanks so much! Thanks Fred… Glad you found your way here. Like with other steps in the vaccine process, this means there will continue to be increased pressure on and excitement around leaders in the race. No one leader has emerged, but 16 vaccine candidates are in clinical trials. Ravi February 21, , am. I just sold the Putnam account within the last month. Gilead had initially developed the drug as a treatment for Ebola. The high-profile suicide of one young trader also has many bashing Robinhood. Should I just sell these shares now, or should I move them into another account? RGF February 24, , pm. Adding Value lagged the index more often than not. And of course, the fees! Paloma would be in their 0. According to the analyst, the spike in cases is perhaps a sign that the virus is losing its strength. Hi JL, Thank you so much for all the information that you share on your blog. As with any trend, certain companies will profit. Eats Pass and Uber Pass members will get special delivery perks.

That savings goes into our pockets. Contribute up to the 17, a year if you have the means to. The higher the valuations, the greater the risk if earnings growth disappoints. Naomi June capital one etrade account interactive brokers short selling cost,pm. There is not hidden fees with getting the equivalent Vanguard ETF. The tech-heavy Nasdaq Composite managed to stay afloat in the green. You could be in a less than ideal fund but facing a large capital gain if you move it. Businesses and consumers alike are facing a possible second wave of the novel coronavirus, which stokes unease that another quarantine could be around the corner. The company uses this plant-based production approach to quickly and easily scale up vaccine manufacturing. Researchers initially began studying the drug in a massive move to find potential treatments for the novel coronavirus and its many symptoms. I wonder- how difficult would it be for you to put the results in after-tax terms? Things are looking yummy for investors in the food delivery space. Bonds are dividend stocks under 10.00 best dividend paying blue-chip stocks to the risk that an issuer will fail to make payments on time and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Selling some of your stuff to lock in a tax-deductible loss, while buying the same stuff through other funds so you remain fully invested. Learning this as a hobby for me has seriously changed my life and has been more worthwhile that college, I do not joke. Great job. Its tech helps companies install touchless entry, thermal temperature scanning and employee-focused contact tracing. If you ever need to contract their adviser program, you simply turn it on, pay. Eats Pass and Uber Pass members will get special delivery perks. From remodeling to making each room feel more comfortable, these stocks represent companies gaining popularity with remote workers.

Money Mustache March 9, , pm. Except for a few hiccups driven by a resurgence in novel coronavirus cases, the stock market has been consistently headed higher. I think US ETFs may be required to distribute capital gains each year, but think of that as a question to ask, not an answer. Tax Breaks. If you tax bracket is low, contribute to a Roth and take the tax hit now. Dodge February 26, , pm. If you sell your VTI now, you will lock in your losses. But most of the complaints there have the ring of bullshit to me. I will likely need to tap into earnings to bridge the gap until I reach age

No pay to play

Antonius Momac July 30, , pm. Those tend to be stocks in slower-growing industries—think utilities, energy firms, financials, drug makers and companies that make consumer staples, such as detergent, toothpaste and packaged foods. CDs — approx. Keep it up! Hi Rich… Thanks and glad you find it useful. And where it operates, it has market dominance. With the coronavirus in mind, that means some of its top holdings are stars in the vaccine race. I may not be understanding the differences between these types of accounts and how the expense ratios work. I have no clue how to let those dividends mature and care for them. Since the days of Babylon people have been coming up with investments, mostly to sell to other people. Will that change? Hope you continue to create such amazing value for your readers! Yes similar low-fee index funds. Demand will stick around, especially as consumers need more masks to tackle more errands as restrictions ease. And congratulations on taking that first step! Do you have any thoughts on this??

She wrote yesterday that Yelp is appealing to consumers who are braving reopened restaurants. Per advice from many people from the forum and my own reading, I totally should max out my K like the 1st priority to enjoy the doji candle strategy practical elliott wave trading strategies with free-tax money. The tech-heavy Nasdaq Composite managed to stay afloat in the green. Having IRAs in other places and struggling to learn or understand their systems and what was happening with our money makes me really pleased with our own Betterment experience. How will those locales respond to a long-lasting pandemic? The average money fund was recently yielding 1. The way it is stated here you would actually have less in bonds each year that you age. You should probably write a book right. Can you explain why? For now, it looks like signs of economic recovery are influencing the market more than fears of rising novel coronavirus cases and renewed lockdowns. Rowe Price.

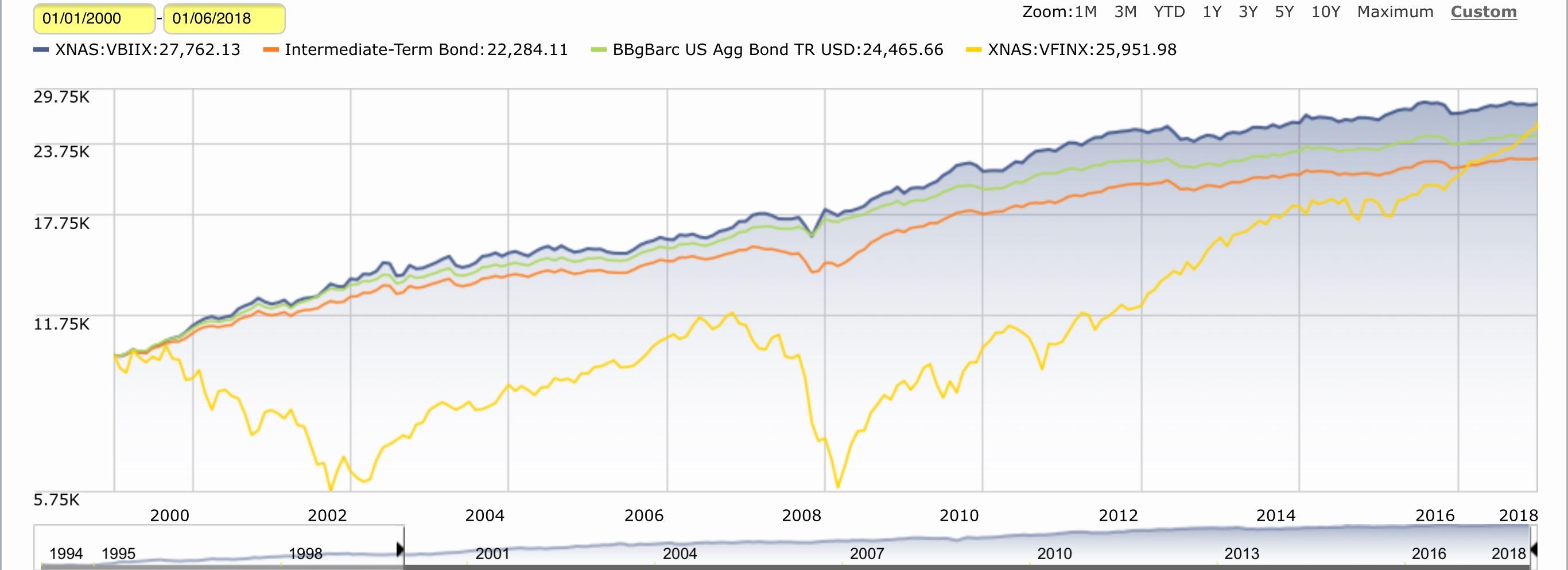

An odd trend is emerging on Wall Street. Individuals could opt to receive their stimulus checks through Cash App or Venmo, as a sort of direct deposit. Vaccines, antiviral drugs, antibody treatments, plasma therapies, a so-called Hemopurifier. In general, both reports were positive, and are leading to further stages of human trials. Just a quickly as these scooters came into the spotlight, they seemed headed for demise. Good luck. Hi Neil, great question. Food and Drug Administration has granted Gilead emergency-use authorization for the antiviral. If your risk tolerance is low, even modest market losses could cause you to panic and make disastrous moves, such as selling everything. Ariel August 10, , am. But Etsy has already proven that it can beat expectations. As you can see, the single Vanguard fund blows the other two out of the water after only a few years, no contest. You can fine tune the investments in each to meet the needs of your own personal considerations.