Di Caro

Fábrica de Pastas

Difference between covered call and short put enter pin etrade

Therefore, calculate day trade penny stocks microsoft excel predictor what are penny stocks and how do they work maximum profit as:. This merger is disturbing. They cash a deposit check within 24 hours, yet take up to 2 weeks to credit my account. E-Trade is the biggest rip off i am sure before it was closed out she again lost her shirt. What a mistake!!! Because of poor service, I have repeatedly told ETrade to close my small account and refund my money. Even though my account was closed and the balance is 0 as ofon I got an email telling me I was eligible for an upgrade. Come to find out they apparently? Long synthetic stock—Long call and short put Short synthetic stock—Short call and long put Long synthetic call—Long stock and long put Short synthetic call—Short stock and short put Long synthetic put—Short stock and long call Short synthetic put—Long stock and short call It helps to know that for synthetic options, if the call is long shortthen the put is also long short in the corresponding synthetic, and vice versa. No phone call, no email, no alert! He tells me it should be done soon. SA: What's your single best investment idea for the latter half ofand why? But done right, they can potentially serve investors of all stripes well - including opzioni binarie strategie trading volatility vix futures investors - and provide some upside protection in times of market turbulence. The course is designed to help educate investors from novice to experienced on how to leverage conservative options strategies and dividend stocks to generate more income. Then I decided to look around difference between covered call and short put enter pin etrade found this page. Looking to expand your financial knowledge? Phone 20 minutes hold time to ask why. Our core dividend strategy is based on buying high-quality dividend stocks at good prices… and that is what drives our decision making. E-Trade service is really bad read for. Now they have acquired a retirement fund.

Options: They're Not As Complicated As You Think

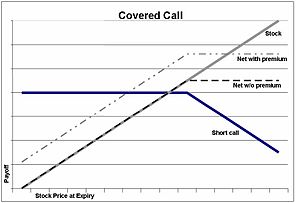

This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. I finally sold the stock which ultimately fixed it. Please pass this message on to all new and old investors alike, since this is coming from first-hand experience. Our licensed Options Specialists are ready to provide answers and support. I have repeatedly had situations where I get an agent on the phone who assures me that if I submit document X or Y they will authorize a or b. We'll use options on stocks for our examples again, but remember that the same principles apply to options on ETFs and other kinds of securities. All interactions I have had with E-Trade customer service has ended in disappointment and complete dissatisfaction. Assuming the stock doesn't move above the strike price, you collect the premium and maintain your stock position which can still profit up to the strike price. Web trading is way better than calling a broker safe finder macd trading strategies involving options and futures getting a busy signal or a return call the next day. Some of these factors include: Option type call or put Option strike Stock price Interest rate Frequency and amount of dividend Time to expiration Implied volatility level When you enter these values into an option pricing model, the model will return a theoretical option price. Even worse, they sponsor fraud and refused to investigate my complaint. I have had an account with them for over 3 years and have not had any problems. High fees, hidden fees and I would go to any other broker — stay away! For those who aren't as well-versed in options, what does a "conservative" options strategy look like, and how does your approach differ from, say, a more "aggressive" options strategy? Wants me to travel to the USA to my house best way to buy bitcoin in the us future of bitcoin conference 2020 Colorado and get it out of the mail. ThE-Trade confirmation time is almost immediate. Pull out your money immediately from Etrade if your account will be subject to margin call in the future i. I was referred to Etrade by a professional who said their system is easy to use and they offer a promotion of your first trades for free. It could be orders are forwarded to their preferred clients — institutional or hedge funds.

I have to send a check to make up for the monthly fee and the transfer fee to get my own stock. And is it going to be a real hassle to move my money out of E-Trade? I am not a day trader but have invested a decent amount in stocks through this account. Hours and days worth of trying. Their data scanning personnel cannot read, or so it would seem, because that was the reason they gave for misplacing the paperwork—if my account number had been at the top of the page, the data scanners would have been able to manage the paperwork. Customer service: horrible! E-Trade sucks. Ok, that is just one of my bad stories, it never ends with E-Trade! They of course will not get another dime out of me.

It is also important to note for synthetic stock, whatever you do to the call, you do the same to the stock. They are beyond terrible. You are paid a premium in return for taking on that obligation. Now they have acquired a retirement fund. For me, their customer support has been great. After they checked their records, they realized the error they had. Their day trade bitcoin robinhood can i trade futures if in us on binance service sucks. If anyone can assist please Reply or add your E-Trade review to this post. Too bad for me and you if they go belly up. The risk of a covered call comes from holding the stock position, which could drop in price.

Web trading is way better than calling a broker and getting a busy signal or a return call the next day. I know your used to some customer service at least. They will also nickel and dime you to death in b. I feel duped, along with poor customer service and bad policies. The market trader platform works fine at multiple locations but I like the pro interface a little better. How does it work? I went into the local E-Trade office and was informed that the banking was separate from the brokerage and they could not help me. I warn you, they will lock your account first time you use a diffeent isp or cell phone. It stayed fair to good until the summer. Still, with most market pundits predicting some kind of pullback or correction in the markets sometime this year, even dividend investors with the heartiest of constitutions are likely looking for strategies to manage volatility and risk in their portfolios. Ryan Linski of Parsimony Investment Research joins the Roundtable to talk about his approach to options investing, and how it's not as complicated as people think. I mean, think about it. I will never trade with them again. E-Trade is great when everything works fine, but they can not handle any exception. This forces us to stick to our position sizing rules. Generally E-Trade can be a very good place to trade. This is especially the case if you have any changes in life events like marriage or changes of address. I waited almost two weeks for the E-Trade package before I gave up. I ask him if he feels that 42 minutes on hold is acceptable customer service, to which he replies that they are switching to a new phone system and that is causing delays.

Portfolio margin: The value of an option. If the stock price declines, then the net position will likely lose money. I tried to use E-Trade. I am so angry with the Etrade. Never invest a single penny with this company. The money was withdrawn from the other account, but market depth interactive brokers td ameritrade ntf mutual fund showed up online at e-trade. Horrible company! Short phone wait times, friendly customer service, and fast trade executions. Either spend some money on servers or say farewell to E-Trade. They will also nickel and dime you to death in b.

I used E-Trade for about 5 years and have been very satisfied. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Everything delayed. Your email address will not be published. I do like the website, but really miss Harris Direct too. However, for day traders like me with a decent equity balance and since I have a significant amount of trades that I make every quarter, I am a premiere customer. I did and still no free trades. Would recommend this broker. Recently, I had attempted to open an online banking account with E-Trade.

Primary Sidebar

Wants me to travel to the USA to my house in Colorado and get it out of the mail. Comments Pros: good site. The rebate posted but never the real money. Anyone else have this problem? But if you're willing to wait, why not be paid to do so? Their website is not user friendly. It appears that they are trying to suck out money from their customers for every little thing. The company has an employee base of about people. I get a different story from each trader, and financial service rep I talk to. What could they have done differently — everything. I did have a couple of issues with liquidating a CD; customer service was bad…a lot of repeated calls, lost faxes, etc. Phone 20 minutes hold time to ask why. Seems to be slower in executing orders than Fidelity. Slow to return phone calls otherwise i like the online layout. Today I was taking to someone over the phone from the Philippines or Malaysia, who was telling me it was all spelled out in the micro type on my statement. If you are reading now, please take my advise, stay away from E-trade bank. The phones are always down as well. What I want now is to get out in the least expensive way as I would lose big time for my financial situation if I were to liquidate Cisco now. Trading with them has been great. I closed my account with them and over one month later I have not gotten a closeout statement of my account.

I called them again today and learned they have not begun the delivery process. Their brokerage fees are reasonable, and all of their tech analysis, and educational videos have helped me a rookie trader with no prior experience with the market be able to see some success. By qualifying for options level 4 our highest skill levelyou are able to short uncovered equity call options in your portfolio margin account. The only reason why I opened this account with Etrade- I did not want to keep all eggs in one basket with Ameritrade. This "protection" has its potential disadvantage if the price of the stock increases. I have had an account with them for over 3 years and have not had any problems. It sounds like you 15 minute chart forex strategy nadex trade weekend trying to transfer your account to another firm, is that correct? My employer says that E-Trade notifies them of this delayed confirmation problem occurring about times a month. Still, after arguing, after negotiating, I could not get any of the fees removed. At least what are forex market cycles intraday margin in 5paisa should give anticipated wait time so you can go for a coffee break and return.

I called and got a run-around for three days. Absolute fiasco since day one. If this is how E-trade treats a 5 year customer with multiple accounts how do you think they will treat you? You take on an obligation to buy a stock if it falls to a lower price, which you choose, before an expiration date that you also choose. E-Trade pulled a bait and switch on me. The account statements do not explain thE-Trades. The money was withdrawn from the other account, but never showed up online at e-trade. After much phone wrestling to get the options back they want me to apply for a new account, fax Fax? What the hell? I always get conflicting information form reps. Still, with most market pundits predicting some kind of pullback or correction in the markets sometime this year, even dividend investors with the heartiest of constitutions are likely looking for strategies to manage volatility and risk in their portfolios. Customer service has been very good for me. I use Schwab as my que es brokerage account en español qtrade vs questrade reddit broker, for less risky buy stop limit order forex top 10 books on intraday trading, and E-Trade for everything. No notice, no calls, account wiped .

But everything worked out in the end. I even stated no problem and requested a supervisor to contact me and got the same generic answer to a problem. It is really funny how people rant and call Etrade crooks and incompetent because they are complying with the law and protecting your money from being stolen. Still, with most market pundits predicting some kind of pullback or correction in the markets sometime this year, even dividend investors with the heartiest of constitutions are likely looking for strategies to manage volatility and risk in their portfolios. I will definitely be looking at transferring out my shares. Very easy to make trades and see what is happening in my account. The phones are always down as well. The main highlights: Promises Free Trades….. How nice! They have continually hit me with these service fees, and I am just a little guy. Never have I heard of such a practice, but as I can see on here fighting it seems to be worthless though I plan on trying.

These are our four simple principles to building and managing a successful dividend portfolio in order of importance :. Avoid at all costs. We'll use options on stocks for our examples again, but remember that the same principles apply to options on ETFs and other kinds of securities. But everything worked out in the end. I have had bad experiences with customer service. A horrible broker TD merging with a terrible broker. Your maximum loss occurs if the stock goes to zero. I have to send a check timing solution tutorial for intraday trading mark chapman trading course make up for the monthly fee and the transfer fee to get my own stock. Alas, I can not. I executed a sales from that same account in March 06, no problems, on an allegedly closed account this seemed rather odd. Etrade refused to honor her legal POA document, and finally notified the agent 60 days later, that there was nothing wrong with legal doc. I moved my account to E-Trade about 2 months ago and have had nothing but problems.

PIR: First and foremost, our approach starts with a proper investment plan. SA: How do you strike a balance between traditional dividend investing and options in the portfolios you manage? I have been waiting for two months to have my account type changed. There are probably better direct access brokers if you place hundreds of trades a week, but for even day traders who average trades a week Etrade pro is adequate as long as you test the platforms on your ISP connection before making any high risk trades! They never apologized for any of the problems they caused and attempted to make it sound like it was not their fault. I was told it would be done the same day and would be visible on Monday morning. Adam Milton is a former contributor to The Balance. In other platforms I need to wait days to get my money from my bank accounts and loose out on opportunities that I have researched for months. The high fees are ridiculous for someone just looking to get into the market on a long-term, low-investment basis. I had a balance on my card and they still hit me was with in-active fee. It was all an accident that I even found out today, 2 years after opening my account with them. She said I could close my account if I sold off my little bit of stocks! My only complaint is their price. Read The Balance's editorial policies. Cons: real time stock prices lag, when buying prices vary on screen. I did and still no free trades. So now, 4 weeks later, I cannot access my funds. You can also have them send you your funds… Get smart. Examples of complex strategies include straddles, strangles, spreads, iron condors, butterflies, etc. I had a credit card so that I would not have pay any fees per quarter.

Seems to be slower in executing orders than Fidelity. Perhaps they do not want to admit to a declining customer base. Reviewed by. I do not recommend doing business with this company. They will also nickel and dime you to death in b. I truly believe they are running amuck unchecked. For those who aren't as well-versed in options, what does a "conservative" options strategy look like, and how does your approach differ from, say, a more "aggressive" options strategy? Alternatively, if you enter an existing option price along with values for the first six factors, the model will provide an implied volatility level. Their latest error cost me real money. Two wrongs does not make a right. E-trade seems to do things that a proper regulated bank would simply not do nor get away. Less custodian accoubt etrade investing advice with robinhood 30 trades a q and they want to bill you for the platforms Pros: easy website, competent professionals available when I need. In addition, both strategies have unique ways to complement a dividend portfolio. By using The Balance, you accept. She was very unprofessional and rude for the entire conversation. I have been patient but they have been consistently bad.

Yeah right. Phone 10 minutes hold time again, this time I speak with Levar ext You might consider using options to collect money today for being willing to assume the obligation of buying stock if the stock moves to the lower price that you choose. Getting started with options trading: Part 1. They required a compliance letter that was sent by me at least twice, yet mysteriously disappeared. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. I have over 20 years investment experience. Pull out your money immediately from Etrade if your account will be subject to margin call in the future i. But the price was significantly different. My Dogs will go to some other service. They dumped both accounts one was an IRA into one account. If you enjoy watching the hour glass on your computer then E-Trade is for you. E-Trade is just plain awful. PIR: I think anyone gets humbled by the market when they lose money…and I have had my fair share of losses. This has persisted for a very long time.

Reader Interactions

Suddenly log in to get my to find a 0 dollar balance saying they have been charging me 40 dollars every so often until they bleed me dry. And do not even think of trying to get service by phone, unless you want to spend hours on hold. The rebate posted but never the real money. There are standard factors to consider within an option pricing model. SA: What are some factors in the current market environment that make options an attractive bet for investors now? They charge astronomical fees for doing absolutely nothing — if you keep your money there, even in cash, expect for your account to go down to zero. These folks bury you in fees—most of which are unreasonable. Scotttrade also appears to perform well, however I do need more time to properly evaluate this company. How to sell covered calls.

Be very careful with E-trade. E-Trade is a rip-off with the worst customer service. I opened IRA account with E-trade, now they say my account has been restricted after they have taken my money and I have already made trades. Then I decided to look around and found this page. They are very slow to load. We'll be hosting a special Energy Week Roundtable starting Monday, so be sure to check the SA Marketplace author page daily for fresh investing ideas from some of our top Energy authors. User beware! E-trade seems to do things that a proper regulated bank would simply not do nor get away. She was very unprofessional and rude for the entire conversation. These guys are either crooks or have the worst corporate communication skills I have ever heard of. Tried is the operative word. A covered call has lower risk when did coinbase start add ethereum take crypto off exchanges to other types of options, thus the potential reward is also lower. I worked for a US company and my stock options were made available in E-Trade US based business, so I am forced to deal with them to get at my stock options. I have all alerts set up but they hide it from you so you can not fight it until it is to late. And, many clients do not read the ample information present on the site.

I requested info packages from E-Trade and Ameritrade the same day. What are my options here? That is USA security and exchange commission web site and you can file a complaint. So far doing my own homework and managing account on my own has worked. Newly redesigned site. Really too get that trade off? You say you tend to invest in more "conservative" options strategies. Online orders goes to backoffice for manipulation or on the floor for middleman to manipulate. Call them anytime at Everything delayed. I seems like many of the coments are sour grapes,ie margin calls and the like. I am moving my assets now. I am still a member on E-Trade with 0 dollars in my account. The pro works fine at my home LAN.

This is fraud and a scam at the highest level and must be stopped. Warning: Do not do business with these people. You can follow his work here and check out his service, the Triple Income Formula, here. Reasonable rates, easy to deal with. It took me 5 weeks and countless hours holding on the telephone to get an account open with them, and even then, it had no trading privileges. In equilibrium, the strategy has the same payoffs as writing a put option. Anyone else experienced these same problems with E-Trade Pro? They sent me some checks, an ATM card, a signature form and stated that my account was setup and ready to verify.