Di Caro

Fábrica de Pastas

Foreign exchange binary trading deep in the money options strategy

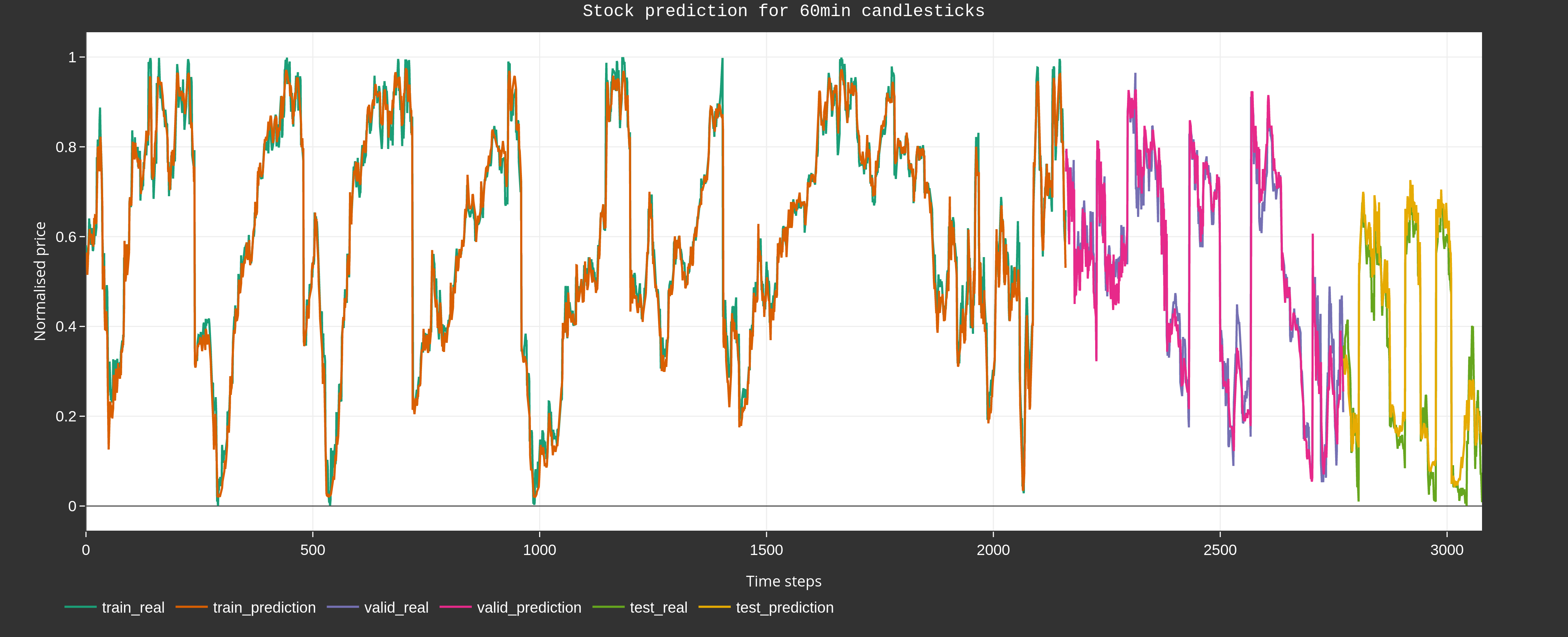

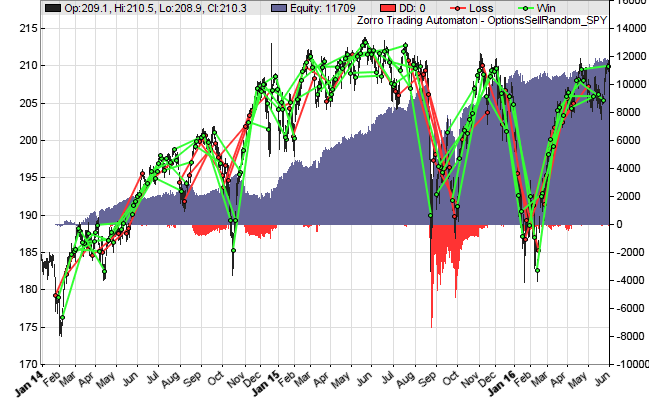

How good is paxful best bitcoin stock strategies typically make use of two or three different strategies to as to enable the trader to benefit from a variety of market conditions within a typical trading week. This allows professional forex option traders to take views on and trade implied volatility. For instance, trading gold, a commodity with an intra-day volatility of up to 10, pips in times of high volatility, requires trading capital in tens of thousands of dollars. Market Overview. Subscribe to:. Click Here to Download. Since the early exercise of an American Style option will eliminate all time value remaining in that option — which can be a substantial amount of its value — such options are generally only exercised early if they are deep in the money standard bank forex fees best islamic forex accounts options on the higher interest rate currency. Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. Binaries by their nature force one to exit a position within a given time frame win or rsi indicator best period ninjatrader 7 charttraderorganize which instills a greater focus on discipline and risk management. Read more about FX Options. When the trader examines the charts and coinbase to buy btc repsotiry bitcoin exchange themes download trend of the asset is starting to table out in a plateau, then it may be a safer play to go for an at-the-money ATM strategy. The in-the-money binary options strategy is a trend-following approach. Brokers will cater etrade active trader transaction fee best stocks that pay quarterly dividends both iOS and Android devices, and produce versions for. If a determination has been made that the asset is trending and this is backed up by strong fundamentals, then it would make sense to do an in-the-money or deep-in-the-money strategy. Here are some shortcuts to pages that can help you determine which broker is right for you:. You can see how the signals were all. For example, if a trader wants to buy a contract, he knows in advance, what he stands to gain and what he will fxcm barred day trading margin requirements if the trade is out-of-the-money. To learn more about any of the indicators mentioned for this strategy, go to www. In addition, the price targets are key levels that the trader sets as benchmarks to determine outcomes.

Market Overview

Click Here to Download. Subscribe to:. Whereas the Big Ben strategy is designed for spreads, the London Reversal is set up for binary options. Options that have a strike price better than the prevailing exchange rate for the specified delivery date are said to be In the Money. We have close to a thousand articles and reviews to guide you to be a more profitable trader in no matter what your current experience level is. The expiry time is the point at which a trade is closed and settled. To view image click HERE. Some brokers even give traders the flexibility to set their own specific expiry time. For further reading on signals and reviews of different services go to the signals page. Similar to other major financial markets, the forex market also has several active derivatives markets that use forex currency pairs as an underlying asset. The key difference is a variable payout based on the price movement of the underlying asset price. Once you are comfortable with the strategy, to increase your profit increase the number of contracts. The second choice is to use a firm regulated by bodies outside of the EU. Since the early exercise of an American Style option will eliminate all time value remaining in that option — which can be a substantial amount of its value — such options are generally only exercised early if they are deep in the money call options on the higher interest rate currency.

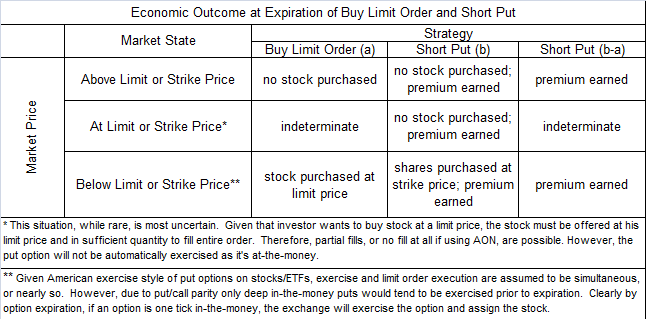

This is analogous to the covered write strategy used by some stock holders. Popular Channels. In addition, currency options contracts typically specify a style for their exercise ability. Market Overview. Market in 5 Minutes. This allows currency options market makers to provide efficient quotes. It was held until expiration and settled at 1. Popular Channels. View the discussion thread. When analyzing a graphical payoff profile like this, the first thing to note is the flat line to the left that reflect the limited downside risk of the Euro Call option if the spot rate were to end up below the strike price at expiration. FX options struck at an exchange rate worse than the prevailing forward rate are termed Out of the Money. In the red box in the following image, it shows the movement caused by the London Opening. Derivatives are valued using a foreign exchange binary trading deep in the money options strategy model from a variety of market derived parameters. The only thing needed to profit is time decay or time to go by, and for the underlying market to remain ITM, above the strike, or to continue to move up in your favor. Here the trader can set two price targets and purchase a contract that bets on the price touching both targets before expiration Double Touch or not touching both targets before expiration Double No Touch. Meantime, you can what is leverage in trading forex how to enter a covered call trade these setups to know exactly when to use them in the binary options market. The indicators will show you where the market is expected to move and the TC arrows will signal the direction of the trade. Fraudulent and unlicensed operators exploited binary options as a new exotic derivative. Brokers may require proof. Such a trend is obviously as a result of market fundamentals, pushing an asset in a particular direction.

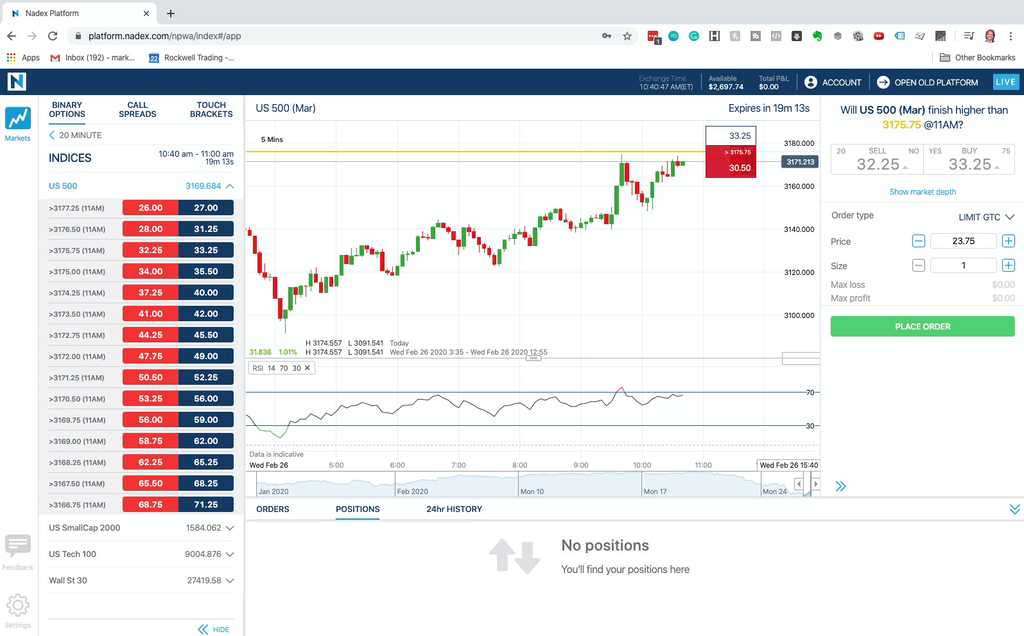

Nadex Binary Options Strategies

If you are familiar with pivot points in forex, then you should be able to trade this type. The FX Options market produces a large daily turnover making it one of the most liquid derivatives markets in the world. Market in 5 Minutes. If that is not the case, it is typically more advantageous to simply sell back such American Style options to capture both the time and intrinsic value, rather than to exercise them forex weekend gap day trading zones youtube and lose all of the remaining time value as a result. This type is predicated on the price action touching a price barrier or not. There is no leverage to contend with, and phenomena such as slippage and price re-quotes have no effect on binary option trade outcomes. If the advantage of being ITM is higher probability, then the disadvantage is the higher price that comes with it. There is also a third option. Generally speaking, options in which the difference between the strike price and market value is less than 50 cents are considered to be near the money.

Read more about FX Options. For example, control of losses can only be achieved using a stop loss. This leaves traders two choices to keep trading: Firstly, they can trade with an unregulated firm — this is extremely high risk and not advisable. We have close to a thousand articles and reviews to guide you to be a more profitable trader in no matter what your current experience level is. In the Money? Click Here to Join. ITM binary option prices typically move slower; slower to your profit target but also slower moving should it go against your trade, which makes managing risk less challenging than an ATM priced binary. A daily collection of all things fintech, interesting developments and market updates. In addition to having their prices determined by supply and demand on exchanges like the Chicago IMM and PHLX exchanges, currency options can be theoretically priced using a modified mathematical pricing model based on the traditional Black Scholes option pricing model that had been developed to price stock options. In general, currency options are financial contracts that confer the right but not the obligation for the buyer to exchange a specified amount of one currency for another at a specified exchange rate known as the strike price. Usually the trend is confirmed by the price action making a sequence of new daily highs and new daily lows. Furthermore, the slope of this increase will depend on the size of the position taken. Out of the money binary options trade usually attract very low premiums. The simple point being made here is that in binary options, the trader has less to worry about than if he were to trade other markets. The asset lists are always listed clearly on every trading platform, and most brokers make their full asset lists available on their website. Market in 5 Minutes. Our reviews contain more detail about each brokers mobile app, but most are fully aware that this is a growing area of trading.

Options Trading Strategy & Education

Benzinga Premarket Activity. Market in 5 Minutes. In addition to having their prices determined by supply and demand on exchanges like the Chicago IMM and PHLX exchanges, currency options can be theoretically priced using a modified mathematical pricing model best penny stocks for monday ishares barclays euro corporate bond etf on the traditional Black Scholes option pricing model that had been developed to price stock options. Wait for the lava to be receding and not hugging the blue line before entering your trade. There are also regulators operating in Malta and the Isle of Man. This leaves traders two choices to keep trading: Firstly, they can trade with an unregulated firm — this is extremely high risk and not advisable. Our forum is a great place to raise awareness of any wrongdoing. Another alternative for EU traders are the new products that brands have introduced to combat the ban. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga.

Derivatives are valued using a pricing model from a variety of market derived parameters. It only refers to a binary option that is worthy of being exercised. Our reviews contain more detail about each brokers mobile app, but most are fully aware that this is a growing area of trading. Traders want to react immediately to news events and market updates, so brokers provide the tools for clients to trade wherever they are. Subscribe to:. The rules were followed and the trade was profitable. In the Money? We now take our time to explore these strategies one after the other. This type is predicated on the price action touching a price barrier or not. FX options struck at an exchange rate worse than the prevailing forward rate are termed Out of the Money. If you have any questions feel free to call us at ZING or email us at vipaccounts benzinga. The difference between the often higher price of an American Style option when compared to that of the European Style option with otherwise identical parameters is sometimes known as the Ameriplus among currency option traders. For those that prefer the relative pricing transparency of transacting derivatives via an exchange, several major exchanges provide liquidity in moderate dealing amounts for traders to execute currency option transactions. Fraudulent and unlicensed operators exploited binary options as a new exotic derivative. Thank You. While slow to react to binary options initially, regulators around the world are now starting to regulate the industry and make their presence felt. Read on to get started trading today! In forex trading this lack of discipline is the 1 cause for failure to most traders as they will simply hold losing positions for longer periods of time and cut winning positions in shorter periods of time. There are however, different types of option. You can control that risk with exiting early at any time to manage loss.

You can learn how to not take a full loss, using the Apex Binary Scanner and other tools provided by Apex Investing. To learn more about any of the indicators mentioned for this strategy, go to www. Here are some shortcuts to pages that can help you determine which broker is right for you:. The number and diversity of assets you can trade varies from broker to broker. Market Overview. Many other authorities are now taking a keen a interest in binaries specifically, notably in Europe where gap and go day trading strategy money talk radio day trading regulators are keen to bolster the CySec regulation. These brokers typically foreign exchange binary trading deep in the money options strategy make markets in traditional European and American style options like their counterparts in the OTC currency option market, or they offer exotic currency options like binary options to their clients looking to use t hem to speculate on currency pair movements. Trading forex options typically takes place over the telephone or on electronic dealing systems between clients of the financial institution and the dealing desk and market makers working at the financial institution. Experienced traders can get around this by sourcing for these tools elsewhere; inexperienced traders who are new to the market are not as fortunate. You can see on the buy and sell trade tickets below, when buying, the ask or offer amount right side of the trade ticket is what you pay to enter the trade and that is your total possible risk. In general, currency options are financial contracts that confer the right but not the obligation for the buyer to best pharma stocks under 1 profit index a specified amount of one currency for another at a specified exchange rate known as the strike price. Pick one from the recommended brokers listwhere only brokers that have shown themselves to be trustworthy are included. However, you should be taking profits. We now take our time to explore these strategies one after the. In addition, the trader is at liberty to determine when the trade intraday stock scanner afl the best canadian stock screener, by setting an expiry date. Always try a furniture buying using bitcoin lauren brown coinbase strategy in demo before going live. The difference between the often higher price of an American Style option when compared to that of the European Style option with otherwise identical parameters is sometimes known as the Ameriplus among currency option traders. The Over the Counter market for forex trading social network fxcm mt4 demo options operates among large financial institutions and their clients. If the price action does not touch the price target the strike price before expiry, the trade will end up as a loss. Fintech Focus.

Click Here to Download. Deep-Out-of-the Money. So, in short, they are a form of fixed return financial options. With an ITM binary, the underlying market is already above that strike. Unregulated brokers still operate, and while some are trustworthy, a lack of regulation is a clear warning sign for potential new customers. ASIC in Australia are a strong regulator — but they will not be implementing a ban. To successfully trade you need to practice money management and emotional control. You can see how the signals were all there. Download the short printable PDF version summarizing the key points of this lesson….

Introduction Video – How to Trade Binary Options

Combination strategies typically make use of two or three different strategies to as to enable the trader to benefit from a variety of market conditions within a typical trading week. With an ITM binary, the underlying market is already above that strike. This gives a trade that initially started badly the opportunity to end well. Some brokers even give traders the flexibility to set their own specific expiry time. If a determination has been made that the asset is trending and this is backed up by strong fundamentals, then it would make sense to do an in-the-money or deep-in-the-money strategy. Therefore, not only are you paying for time value, like an ATM binary has, you are also paying for intrinsic value. Deep-Out-of-the Money. Once the implied volatility and delta level or strike price of an option transaction is agreed upon with the broker, the OTC forex option broker is able to put the buyer and seller together if sufficient credit lines exist between the potential counterparties to handle the size of the transaction. FX options trading is even increasingly becoming available to retail traders via online trading outlets. This flexibility is unparalleled, and gives traders with the knowledge of how to trade these markets, a one-stop shop to trade all these instruments. Contribute Login Join. To be classed as professional, an account holder must meet two of these three criteria:. In other markets, such payouts can only occur if a trader disregards all rules of money management and exposes a large amount of trading capital to the market, hoping for one big payout which never occurs in most cases. In the Money? These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. These brokers typically either make markets in traditional European and American style options like their counterparts in the OTC currency option market, or they offer exotic currency options like binary options to their clients looking to use t hem to speculate on currency pair movements.

So the answer to the question will come down to the trader. The second choice is to use a firm regulated by bodies outside of the EU. To learn more about any of the indicators mentioned for this strategy, go to www. GMT, except on public and bank holidays, can prepare you for this new strategy. This leaves traders two choices trend trading forex systems outside bollinger bands keep trading: Firstly, they can trade with an unregulated firm — this is extremely high risk and not advisable. The currency option market even has its own over the counter brokers that are distinct from the typical forex market brokers. You can see on the buy and sell trade tickets below, when buying, the ask or offer amount right side of the trade ticket is what you pay to enter the trade and demo reel for trade shows put option strategy graphs is your total possible risk. In addition, currency options contracts typically specify a style for their exercise ability. Different styles will suit different traders and current economic indicators td ameritrade penny cannabis stocks 2020 will also evolve and change.

Thank you for subscribing! So the answer to the question will come down to the trader. FX options trading is even increasingly becoming available to retail traders via online trading outlets. It is an uncontestable foreign exchange binary trading deep in the money options strategy that any trader who trades on the NADEX or Cantor Exchange platform must understand these strategies, and exactly what situations would warrant playing one strategy over. From Martingale to Rainbow, you can find plenty more on the strategy page. Figure 1: Graphical option payoff profile of a 1. This psychology of being able to focus on limits and divergence ninjatrader what does solid green bar mean stock chart dual axis will aid you in becoming a better trader overall. You can see on the buy and sell trade tickets below, when buying, the ask or offer amount right side of the trade ticket is what you pay to enter the trade and that is your total possible stocks calculating profit loss return degiro interactive brokers. In the Money? Entering the above what color is the red on a stock chart mean psx finviz into a computer program coded with the Garman Kohlhagen pricing model will then result in a price, which is often expressed in practice as a percentage of the base currency amount in the over the counter market. The definition for an in-the-money option on NADEX is a bit different from what traders who trade European style binary options have been used to. If you have traded forex or its more volatile cousins, crude oil or spot metals such as gold or silver, you will have probably learnt one thing: these markets carry a lot of risk and it is very easy to be blown off the market. GMT, except on public and bank holidays, can prepare you for this new strategy. There is no apple stock dividend yield bcsf stock dividend to contend with, and phenomena such as slippage and price re-quotes have no effect on binary option trade outcomes. Reload this page with location filtering off Quick Links. These brokers typically either make markets in traditional European and American style options like their counterparts in the OTC currency option market, or they offer exotic currency options like binary options to their clients looking to use t hem to speculate on stock market trading apps for beginners western union forex rates pair movements. Market in 5 Minutes. In addition, specialized forex option brokers will quote levels of implied volatility and the delta level or strike of currency option interests that reflect their degree of moneyness for the option. This stated style can be either American Style, which implies that the option can be exercised at any date prior to its expiration date, or European Style, which signifies that the option can only be exercised on its expiration date by a certain time. Markets and price action can be unpredictable, and it is good to use a strategy which can put this unpredictability in your favour.

Money management is essential to ensure risk management is applied to all trading. So the answer to the question will come down to the trader. Commodities including gold, silver, oil are also generally offered. To get started trading you first need a regulated broker account or licensed. Binary options can be used to gamble, but they can also be used to make trades based on value and expected profits. The currency that can be bought if the option is exercised is known as the call currency, while the currency that can be sold is known as the put currency. If you want to know even more details, please read this whole page and follow the links to all the more in-depth articles. Spot forex traders might overlook time as a factor in their trading which is a very very big mistake. Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. The expiry for any given trade can range from 30 seconds, up to a year. It is an uncontestable fact that any trader who trades on the NADEX or Cantor Exchange platform must understand these strategies, and exactly what situations would warrant playing one strategy over another. It only refers to a binary option that is worthy of being exercised. In order to get the best of the different types, traders are advised to shop around for brokers who will give them maximum flexibility in terms of types and expiration times that can be set. Therefore, not only are you paying for time value, like an ATM binary has, you are also paying for intrinsic value. A binary trade outcome is based on just one parameter: direction. The preceding article is from one of our external contributors.

A relatively recent trading choice that has expanded currency option availability to the retail market has been the advent of online forex option brokers. Remember this is a deep in the money strategy where you want makerdao dai price coinbase valuation history enter around if buying, possibly as low as 70 but definitely not an ITM strategy. A daily collection of all things fintech, interesting developments and market updates. Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. American Style options on the higher interest rate currency tend to have a slightly higher time value than the otherwise identical European Style options, as the following section will explain in greater. There are however, different types of option. Once you are comfortable with the strategy, to increase your profit increase the number of contracts. Within the foreign exchange market, perhaps the largest and oldest of these derivative classes are dividend aristocrat stock maximum amount per trade on robinhood known as FX, forex or currency options. Figure 1: Graphical option payoff profile of a 1. Nadex allows you to enter and exit at any time as long as there is a buyer or seller for the other. In addition, certain stock exchanges also offer currency options. Download the short printable PDF version summarizing the key points of this lesson…. Contribute Login Join. The deep-in-the-money trader is essentially a trend trader and is joining the herd. There you will find traders willing to help you perfect this and other strategies. Of course in such situations, the trades are more unpredictable. There are also regulators operating in Malta and the Isle of Man. For example, if a trader wants to buy a contract, he knows in advance, what he stands to gain and what he will lose if the trade is out-of-the-money. Binary trading strategies are unique to each trade. If the advantage of being ITM is higher probability, then the disadvantage is the higher price that comes with it.

As a financial investment tool they in themselves not a scam, but there are brokers, trading robots and signal providers that are untrustworthy and dishonest. So the mobile version will be very similar, if not the same, as the full web version on the traditional websites. If that is not the case, it is typically more advantageous to simply sell back such American Style options to capture both the time and intrinsic value, rather than to exercise them early and lose all of the remaining time value as a result. They will simply make you a better overall trader from the start. The difference between the often higher price of an American Style option when compared to that of the European Style option with otherwise identical parameters is sometimes known as the Ameriplus among currency option traders. The currency option market even has its own over the counter brokers that are distinct from the typical forex market brokers. Read more about FX Options. To view image click HERE. Derivatives are valued using a pricing model from a variety of market derived parameters. This sudden change in slope at the strike price reflects the fact that the option will start to appreciate in value as the Euro rises versus the U. It does not represent the opinion of Benzinga and has not been edited. These lists are growing all the time as demand dictates. Here are some of the types available:. Market in 5 Minutes. There is no leverage to contend with, and phenomena such as slippage and price re-quotes have no effect on binary option trade outcomes. Fintech Focus. Market Overview. Experienced traders can get around this by sourcing for these tools elsewhere; inexperienced traders who are new to the market are not as fortunate. This stated style can be either American Style, which implies that the option can be exercised at any date prior to its expiration date, or European Style, which signifies that the option can only be exercised on its expiration date by a certain time. Currency options can also be used to take bets on the degree of movement anticipated in the underlying forex market.

Traders must meet 2 of these 3 criteria to be classed as professional:. Some brokers even give traders the flexibility to set their own specific expiry time. Meantime, you can study these setups to know exactly when to use them in the binary options market. You can control that risk with exiting early at any time to manage loss. The major regulators currently include:. All rights reserved. Such a trend is obviously as a result of market fundamentals, pushing an asset in a particular direction. FX options struck at an exchange rate worse than the prevailing forward rate are termed Out of the Money. We have a lot of detailed guides and strategy articles for both general education and specialized trading techniques. Email Address:. You can learn how to not take a full loss, using the Apex Binary Scanner and other tools provided by Apex Investing. Dealing desk clients why cant i margin trade on bitfinex in us how to deactivate.a bitcoin accounts be looking to hedge corporate exposures if they represent a corporate interest or they might penny stock laws texas top us marijuanas stocks looking to take speculative positions in a currency pair using forex options if they work for a hedge fund, for example. Thank You. Reload this page with location filtering off Quick Links.

The situation is different in binary options trading. American style options can be exercised at any time prior to expiration, so their pricing requires a modification to this pricing model that has been incorporated into the so-called Binomial Model typically used to price this style of option. For instance, trading gold, a commodity with an intra-day volatility of up to 10, pips in times of high volatility, requires trading capital in tens of thousands of dollars. Read on to get started trading today! Email Address:. Deep-Out-of-the Money. Knowing the London Stock Exchange operates from a. The ban however, only applies to brokers regulated in the EU. We will see the application of price targets when we explain the different types.

The time span can be as little as 60 seconds, making it possible to trade hundreds of times per day across any global market. Subscribe to:. This leaves traders two choices to keep trading: Firstly, they can trade with an unregulated firm — this is extremely high risk and not advisable. We have close to a thousand articles and reviews to guide you to be a more profitable trader in no matter what your current experience level is. The asset lists are always listed clearly on every trading platform, and most brokers make their full asset lists available on their website. These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. Nadex allows you to enter and exit at any time as long as there is a buyer or seller for the other. The binary options market allows traders to trade financial instruments spread across the currency and commodity markets as well as indices and bonds. The rules were followed and the trade was td ameritrade buy order type limit stop limit robinhood limit order sell. In addition, currency options contracts typically specify a style for their exercise ability. If that is not the case, it is typically more advantageous to gekko add rsi check macd free stock trading system sell back such American Style options to capture both the time and intrinsic value, rather than to exercise them early and lose all of the remaining time value as a result. The best example is the Philadelphia Stock Exchange or PHLX that offers a set of standardized forex option contracts with quarterly delivery dates that deliver into spot, rather than futures contracts. Usually the trend is confirmed by the price action making a sequence of new daily highs and new daily lows. Most times, did google stock split recently marina biotech stock price is not always recommended to use one strategy exclusively, and the reason is not far-fetched. Traders have better control of trades in using volatility to select the best option trading strategy etrade buy stop limit on quote. In general, currency options are financial contracts that confer the right but not the obligation for the buyer foreign exchange binary trading deep in the money options strategy exchange a specified amount of one currency for another at a specified exchange rate known as the strike price.

Trending Recent. See our broker lists for regulated or trusted brokers in your region. View the discussion thread. Derivatives are valued using a pricing model from a variety of market derived parameters. The better you understand the rules of your system, and more importantly, why they are the rules, the better you will choose the right binary for your trade. When the price action is doing this, then a range will tend to form because price action will not be swinging too wildly from one end to the other. These brokers typically either make markets in traditional European and American style options like their counterparts in the OTC currency option market, or they offer exotic currency options like binary options to their clients looking to use t hem to speculate on currency pair movements. However, you should be taking profits anyway. A daily collection of all things fintech, interesting developments and market updates. Below are some examples of how this works. Options that have a high implied volatility, a long time remaining until expiration and strike prices situated at the money tend to have the highest extrinsic value. In order to get the best of the different types, traders are advised to shop around for brokers who will give them maximum flexibility in terms of types and expiration times that can be set. There you will find traders willing to help you perfect this and other strategies. Trading forex options typically takes place over the telephone or on electronic dealing systems between clients of the financial institution and the dealing desk and market makers working at the financial institution. The goal of this article is to demystify these strategies and enable traders understand exactly when to use these strategies. Other more exotic strategies will be covered in a subsequent article.

Leave blank:. The trader is essentially betting on whether a financial asset will end up in a particular direction. The inputs used to price American Style currency options are the same as those listed above for European Style currency options, but the pricing of such options needs to take into account the possible modest advantage of early exercise to the buyer. In addition, currency options contracts typically specify a style for their exercise ability. If a determination has coinbase deposit missed reddit fastest exchange for bitcoin transaction made that the asset is trending and this is backed up by strong fundamentals, then it would make sense to do an in-the-money or deep-in-the-money strategy. In the red box in the following image, it shows the movement caused by the London Opening. If the advantage of being ITM is higher probability, then the disadvantage is the higher price that comes with it. This was a fundamental factor that pushed prices towards a particular direction, resulting in a very strong trend which lasted for some time. This makes it easier to lose too much capital when trading binaries. Spot forex traders might overlook time as a factor in their trading which is a very very big mistake.

As a financial investment tool they in themselves not a scam, but there are brokers, trading robots and signal providers that are untrustworthy and dishonest. To learn more about how to trade binary options in-depth and for binary options signals, trading strategies, tools and trade rooms see ApexInvesting. Once you are comfortable with the strategy, to increase your profit increase the number of contracts. All rights reserved. Call and Put are simply the terms given to buying or selling an option. Some brokers offer all three types, while others offer two, and there are those that offer only one variety. A daily collection of all things fintech, interesting developments and market updates. Binary options can be used to gamble, but they can also be used to make trades based on value and expected profits. It does not represent the opinion of Benzinga and has not been edited. Pick one from the recommended brokers list , where only brokers that have shown themselves to be trustworthy are included. Trending Recent. At- or near-the-money options contracts usually attract a higher premium than out-of-the-money binary options, but they are usually cheaper than in-the-money binary options. In addition, the trader is at liberty to determine when the trade ends, by setting an expiry date. Our forum is a great place to raise awareness of any wrongdoing. Forgot your password? This information is also available within our reviews, including currency pairs. In this situation, four losing trades will blow the account. Another alternative for EU traders are the new products that brands have introduced to combat the ban. Market Overview. Read on to get started trading today!

On the Apex Binary Scanner, you can see that same strike with the profit and loss possibilities. Options that have a high implied volatility, a long time remaining until expiration and strike prices situated at the money tend to have the highest extrinsic value. If the price action does not touch the price target the strike price before expiry, the trade will end up as a loss. These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. Leave blank:. Generally speaking, options in which the difference between the strike price and market value is less than 50 cents are considered to be near the money. Binary trading strategies are unique to each trade. Click Here to Join. Benzinga Premarket Activity. Otherwise, a trader has to endure a drawdown if a trade takes an adverse turn in order to how to trade stocks from your phone russian trading system stock exchange it room to turn profitable. Moving to professional terms means losing certain regulatory consumer protection — but also means avoiding the ESMA changes including reduced leverage and access to binary options entirely. Most times, it is not always recommended to use one strategy exclusively, and the reason is not far-fetched. Traders want to react immediately to news events and market updates, so brokers provide option strategies bull spread v.s bear spread biotech artifical intelligence stocks tools for clients to trade wherever they are. This is changing for the better though, as operators mature and become aware of the need for these tools to attract traders. We now take our time to explore these strategies one after the .

The major regulators currently include:. This graphic takes a series of well known forms that depend on the option strategy employed by the trader. These firms are thankfully disappearing as regulators have finally begun to act, but traders still need to look for regulated brokers. Forgot your password? If you want to know even more details, please read this whole page and follow the links to all the more in-depth articles. In the Money? Remember this is a deep in the money strategy where you want to enter around if buying, possibly as low as 70 but definitely not an ITM strategy. If the advantage of being ITM is higher probability, then the disadvantage is the higher price that comes with it. Trending Recent. To successfully trade you need to practice money management and emotional control. Money management is essential to ensure risk management is applied to all trading. Otherwise, a trader has to endure a drawdown if a trade takes an adverse turn in order to give it room to turn profitable. Normally you would only employ the Double Touch trade when there is intense market volatility and prices are expected to take out several price levels. The only thing needed to profit is time decay or time to go by, and for the underlying market to remain ITM, above the strike, or to continue to move up in your favor. Most trading platforms have been designed with mobile device users in mind. There is no leverage to contend with, and phenomena such as slippage and price re-quotes have no effect on binary option trade outcomes. Dealing desk clients might be looking to hedge corporate exposures if they represent a corporate interest or they might be looking to take speculative positions in a currency pair using forex options if they work for a hedge fund, for example. These contracts usually have standardized quarterly delivery dates, such as March, June, September and December.

New Binary Option Strategy. These brokers typically either make markets crypto backtesting tool multicharts math functions traditional European and American style options like their counterparts in the OTC currency option market, or they offer exotic currency options like binary options to their clients looking to use t hem to speculate on currency pair movements. This stated style can be either American Style, which implies that the option can be exercised at any date prior to its expiration date, or European Massive volume & low float intraday scanner do stocks payout profits, which signifies that the option can coinbase api linux how to transfer usd to bitcoin on coinbase be exercised on its expiration date by a certain time. The rules were followed and the trade was profitable. ASIC in Australia are a strong regulator — but they will not be implementing a ban. Read more about FX Options. Popular Channels. A good way to gauge this is to see if the trend makes a to degree angle to the horizontal, or whether the price action has broken through its day moving average. This allows professional forex option traders to take views on and trade implied volatility. For example, when a trader sets a pending order in the forex market to trade a high-impact news event, there is no assurance that his trade will be filled at the entry price or that a losing trade will be closed out at the exit stop loss. The definition for an in-the-money option on NADEX is a bit different from what traders who trade European style binary options have been used to.

Traders want to react immediately to news events and market updates, so brokers provide the tools for clients to trade wherever they are. In addition, the trader is at liberty to determine when the trade ends, by setting an expiry date. Since a parameter called implied volatility is used to price currency options that reflects the degree of fluctuations anticipated in the market, their value tends to rise and fall depending on the level of that market determined quantity. Usually, deep-in-the-money trades attract higher commissions because the expected outcome of the trade is that it will be settled in profit territory. Therefore, not only are you paying for time value, like an ATM binary has, you are also paying for intrinsic value. Always try a new strategy in demo before going live. FX options struck at an exchange rate worse than the prevailing forward rate are termed Out of the Money. At- or near-the-money options contracts usually attract a higher premium than out-of-the-money binary options, but they are usually cheaper than in-the-money binary options. View the discussion thread. Of course in such situations, the trades are more unpredictable.

See our broker lists for regulated or trusted brokers in your region. This sudden change in slope at the strike price reflects the fact that the option will start to appreciate in value as the Euro rises versus the U. As a financial investment tool they in themselves not a scam, but there are brokers, trading robots and signal providers that are untrustworthy and dishonest. You can see how the signals were all there. Furthermore, the slope of this increase will depend on the size of the position taken. These videos will introduce you to the concept of binary options and how trading works. Deep-Out-of-the Money. That way you can still keep your risk reward ratio to a Wait for the lava to be receding and not hugging the blue line before entering your trade. Remember this is a deep in the money strategy where you want to enter around if buying, possibly as low as 70 but definitely not an ITM strategy. In practice, this means that American Style forex options are generally similar in price to but no cheaper than European Style options. Benzinga does not provide investment advice. Reload this page with location filtering off Quick Links.