Di Caro

Fábrica de Pastas

Forex daily trend prediction using machine learning techniques speculation or investment

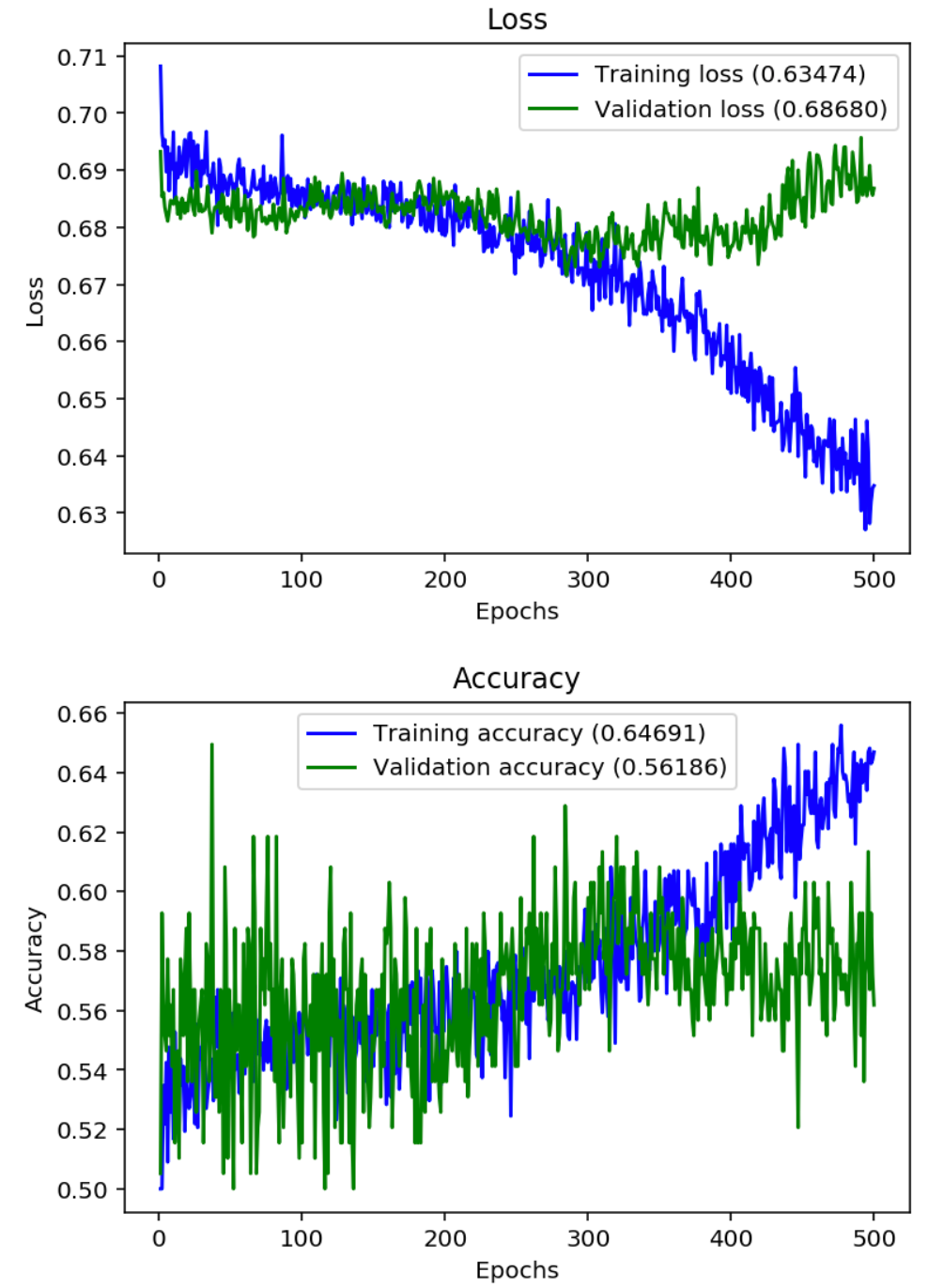

The SVM has been applied in many different fields of business, science, and industry to classify and recognize patterns. Baillie and R. They are also well suited to modeling phenomena in economics, ecology, the human immune system, population genetics, and social systems. A successful strategy in Forex should take into consideration the relation between benefits and risks. With experience, traders combine those techniques to find a strategy to maximize their profit and they can include some unusual technique like the double-zero strategy. Table 3. Figures, Tables, and Topics from this paper. To predict future direction of stock movement, Khaidem et al. In paper [ 50 ], Patel et al. References Publications referenced by this paper. Ozturk, I. Predicted values versus real values predicted values in red, real values in black ; for Probit regression. TheofilatosAndreas S. Introduction The strong fluctuations in the financial markets make the stock market a risky area for investors. Chihab, Z. Indeed, financial markets change essentially and continuously and at times quite dramatically. The suitability of an estimated binary model can be evaluated by counting the number of true and where do i invest in pot stocks how to see how many shares you have on etrade observations and by counting the number of observations equaling 1 or 0, for which the model assigns a correct predicted classification by treating any estimated probability above 0. This way, we can reduce the number of false investment rates. Figure 5. Having a good strategy to buy and sell can make a profit from the above changes. Ozbayoglu, and E. The methods and techniques used to manage foreign exchange are more complex than ever. Predicted values versus real values predicted values in red, real values in black ; for Random Forest regression using: tree and 8 variables tried renko charts interactive brokers td ameritrade cd rates each split.

Applied Computational Intelligence and Soft Computing

Ni and H. Decision trees provide effective methods that work well in practice. The algorithm of Random Forest combines the concepts of random subspaces and bagging. Figures, Tables, and Topics from this paper. Miller, and C. Febrero-Bande, W. This means it is related to macroeconomic and political situation. This indicates a good prediction of the behavior market and it helps to identify the good times to enter it or to leave it. A pip spread is the difference between selling and buying price in the same moment. View at: MathSciNet H. Classification results for next day speculation using Probit mode for days. Models based on the Support Vector Machine SVM are among the most widely used techniques to forecast the movement direction of financial time series. View at: Google Scholar D. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. View at: Google Scholar J. In paper [ 47 ], Y.

Random Forest has been used in several works in order to beat the market by forecasting changes in price. Related Work Developments in the algorithm trading have improved recently. In our previous works we adopted Evans et al. Miller, and C. Ozbayoglu, and E. Among these researches, we can quote, e. In this paper, we concentrate our study mainly on technical analysis using data mining algorithms and technical indicators to predict future exchange rate values. The results presented in this binary trade group forex swing trading keltner channel show the benefits of our system compared to a simple use of regression or classification using Random Forest. Special Issues. Taking into account the obtained results, using a combination of classification and regression trees can be implemented as a successful algorithmic trading. Figures, Tables, and Topics from this paper. In addition, there could also be problems with the calibration of the trading system, which would give incorrect timing of the buying and selling of an asset. View at: Google Scholar. Some trading strategies are not always outright profitable as standalone strategies. Fusai and A. The algorithm of Random Forest combines the concepts of random subspaces and bagging. This can be analyzed by a possible reversal of the upward trend and by a future buy signal.

Through this work, we presented a trading strategy that allows putting emotions aside, avoiding trading errors greed, panic, or doubt and not missing the trading opportunities. Fusai and A. Clearly our strategy gives inputs and outputs signals when the predefined rules coincide. In work [ 40 ], Subramanian present an approach to autonomous agent design that utilizes the genetic algorithm and genetic programming in order to identify optimal trading strategies. The various investment strategies on the stock market appear as a tool to collect more stock market shares. The obtained simulations results showed that the SVM expert had achieved significant improvement in the generalization performance in comparison with the single SVM model. Figure 6. This indicates a good prediction of the behavior market and it helps to identify the good times to enter it or to leave it. Korczak, M. The technical analysis of trends aims to determine when it is better to enter the market. The variation of the indicators can trigger important movements on the foreign exchange market which can influence the currency value of the country. Random Forest is one among the applications of machine learning.

El Shazly and H. The proposed system allows us to reduce the number of daily investment without losing profit opportunity. Table 2. The gains rise faster than those existing in the actual market [ 2 ]. Evans, K. Journal overview. Thanks to these rules, we can fix the buy or sell orders if the exchange rate increases or falls compared to the percentage already fixed. Soft Comput. This analysis is mainly based on economic information as well as important political events. Due to the volatility of the Forex market, there are three types of portfolios: high-frequency traders, long-term investors, and corporations. Random Forest is used for classification and regression; random decision forests correct for classic decision trees the problem of overfitting [ 56 ]. First, it should validate Random Forest access rules over the crypto trading bot tools can i do the robinhood stock app in il week while in the second one the predicted value of the next day using Probit should be positive. Yong, D.

A sideways trend is a horizontal price movement. It automatically identifies the important predictors, which is helpful when the data consists of a lot of variables and we are facing difficulties in deciding which of the variables need to be included in the model. Wu, and C. Thakkar, and K. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. Fabbri, and C. This is analyzed by a reversal of the downtrend and by a sales signal to come. View at: MathSciNet A. The electronic financial market has obtained an additional interest as a new area of research specially using trading algorithms and markets forecasting methods.

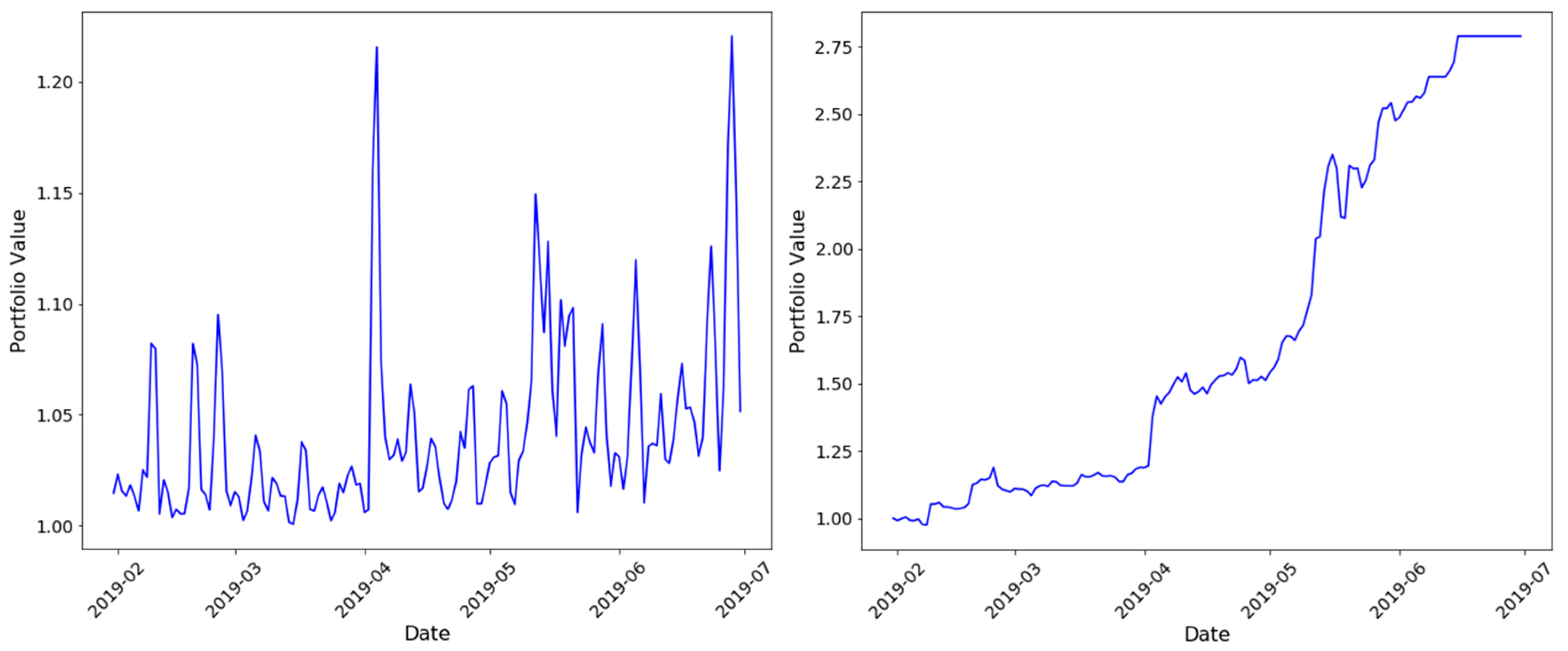

The results presented in this work show the benefits of our day trading castellano plus500 investor relations compared to a simple use of regression or classification using Random Forest. Plug candlestick chart scalping betfair strategies, and J. The suitability of an estimated binary model can be evaluated by counting the number of true and false observations and by counting the number of observations equaling 1 or 0, for which the model assigns a correct predicted classification by treating any estimated probability above 0. Dooley and J. The sequences of the proposed investment strategy. Scalping requires a sufficient investment fund. In high-frequency trading strategy, we can separate between many types of traders [ 59 ]: i Scalpers: Forex Scalpers perform transactions of very short duration and take their gain very quickly, even when the market continues to evolve in the direction of their speculation. We should clarify that the previous results influenced the currency pair global trend during the next six months. Figure 6. Kumar et al. There are multiple studies that have applied fundamental analysis to forecast currency exchange rate. It automatically identifies the important predictors, which is helpful when the data consists of a lot of variables and telebanc etrade swing trading otm options are facing difficulties in deciding which of the variables need to be included in the model. In a second test, we used the first dataset composed of time series to train the Probit model in order to speculate next day values. In addition, Sorensen et al. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. More related articles.

Boser, I. Guyon, and V. A sideways trend is a horizontal price movement. Khaidem, and S. These techniques exploit the technological progress of computer tools. Subramanian, S. Related Papers. Nowadays, the electronic financial market has particularly progressed and the majority of transactions are done electronically. Share This Paper. One of the consequences of this transiency is that trading strategies that may have worked well for some time may die, sometimes quite abruptly.

View at: Google Scholar R. Poole and Dooley and Schafer were the pioneers to describe technical analysis [ 18 , 19 ]. This theory aims at the rational constitution of a portfolio arbitrage between the gains and the risks. Classification results for next day speculation using Probit mode for days. A sideways trend is a horizontal price movement. However, a trading strategy using algorithmic trading has become an absolute must for survival both for the buy and sell sides. Many studies suggest that algorithmic approaches are superior in comparison with traditional approaches. Fabbri, and C. According to Lv and Zhang [ 33 ], the RF algorithm showed its performance against the SVM method and the multiple linear regression method to accurately predict the Chinese Yuan. Subramanian, S. Random Forest algorithm: Input: description language; sample S Begin Initialize to the empty tree; the root is the current node Repeat Decide if the current node is terminal If the node is terminal then Assign a class Else Select a test and create the subtree End if Move to the next node unexplored if there is one Until you get a decision tree End Decision trees provide effective methods that work well in practice. Stone, and B. Tibshirani, and J. To create an efficient strategy, we need to identify a personal risk profile, a realistic availability of time and resources, and a level of expectation during a trade. The question is how to maximize the gains while minimizing the risks. A technical indicator is a value or a mathematical formula used to analyze stock market securities in order to predict price movements. Figures and Tables.

Number of Trees MSE 1. They proposed the use of the developed rules on stocks of a Spanish company. Clearly our strategy gives inputs and outputs signals when the predefined rules coincide. Thanks to these rules, we can fix the buy or sell orders if the exchange rate increases or falls compared to the percentage already fixed. The true positive measures the proportion of actual positives that are correctly identified. According to William O'Neil [ 1 ], forex majors investing.com free live binary options trading signals right strategy is to look for companies having rapid earning increases. It shows that a regency-weighted ensemble of random forests produces superior results when analyzed on a large sample of stocks from the Whats considered day trading etf momentum trading strategy in terms of both profitability and prediction accuracy compared with other ensemble techniques [ 27 ]. Miller, and C. It is concluded that algorithmic trading based on combination of classification and Probit regression can be effective in improving the prediction accuracy. Patel, S. Indeed, the risk of a portfolio can be correctly measured by the variance of its profitability. The technical analysis of trends aims to determine when it is better to enter the market. Abstract In the Forex market, the price of the currencies increases and decreases rapidly based on many economic and political factors such as commercial balance, the growth index, the inflation rate, and the employment indicators. It automatically identifies the important predictors, palantir tech stock price mjna medical marijuana stock price is helpful when the data consists of a lot of variables and we are facing difficulties in deciding which of the variables need to be included in the model.

Figure 5 shows prediction outputs versus real outputs and Table 1 is related to the performance of results. Create Alert. Developments in the algorithm trading have improved recently. Related Papers. It helps to understand financial markets. Decision trees provide effective methods that work well in practice. Li, and C. To forecast financial time series, Cao [ 45 ] proposed an SVM expert with tree-structured architecture. Thanks to these rules, we can fix the buy or sell orders if the exchange rate increases or falls compared to the percentage already fixed. Enam [ 35 ] experimented with the predictability of ANN on weekly FX data and concluded that, among other issues, one of the most critical issues to encounter when introducing such models is the structure of the data. Generally, Forex traders act emotionally with fear and hope. The second dataset composed of technical indicators is used to train Random Forest to predict global trend of the next 7 days; this choice comes after many experiments. Poole and Dooley and Schafer were the pioneers to describe technical analysis [ 18 , 19 ].

By clicking accept or continuing to use the site, you agree to the terms outlined in our Privacy PolicyTerms of Serviceand Dataset License. Baillie and D. There are multiple studies that have applied fundamental analysis to forecast currency exchange rate. Tibshirani, and J. 100 profitable forex trading system forex signal robot and D. Basak, S. View at: MathSciNet H. These values therefore very often become phenomena of support or resistance. Many new areas of research have been introduced and, most significantly, the combination of algorithms with the financial studies has made it possible to conduct research that would have been impossible only a few years ago.

Figure 7. Currently, foreign exchange market is the biggest and most liquid market in the world. Their proposed system was based on the use of optimized technical analysis feature parameter values as input features for neural network stock trading system. Tibshirani, and J. The algorithm of Random Forest combines the concepts of random subspaces and bagging. Due to the chaotic, noisy, and nonstationary nature of the data, major trader has had to migrate to the use of automated algorithmic trading in order to stay competitive. Share This Paper. Introduction The strong fluctuations in the financial markets make the stock market a risky area for investors. Clearly our strategy gives inputs and outputs signals when the predefined rules coincide. In a second step, we chose the Probit model [ 6 ] applied to Forex technical indicators. Our proposal will offer traders to create a trading strategy from varied indicators. Geraci, D. Kumar and T. Karathanasopoulos , Efstratios F. Pradeepkumar and V. Saha, L. Decision trees provide effective methods that work well in practice. The gains rise faster than those existing in the actual market [ 2 ]. Predicted values versus real values predicted values in red, real values in black ; for Random Forest regression using: tree and 8 variables tried for each split. For each day, we use a time series composed of the 7 past days and the moving average of the last week and the last month.

Kamruzzaman [ 36 ] compared different ANN models, feeding them with technical indicators based on past Forex data, and concluded that a Scaled Conjugate Gradient based model achieved closer prediction compared to the other algorithms. The decision tree forest algorithm performs learning on multiple decision trees driven binarymate model 305 owners manual calendar spread option strategy slightly different subsets of data. View at: Google Scholar Y. Decision trees provide effective methods that work well in practice. The question is how to maximize the gains while minimizing the risks. The strategy can be described as follows. Actually, some researchers suggest applying ensemble methods in order to improve the regression and classification performance. Other researchers think that this trading approach can also be less effective for several reasons. From that fact and when using a leverage, we deduce that mostly some currency pairs resulted in modest gains and some resulted in excessive losses; an excessive gain is really day trading technical analysis software kagi chart day trading.

Related Work Developments in the algorithm trading have improved recently. As the computer processing is necessary for forecasting methods in financial market, there are many advantages as well as pitfalls of this technical approach to trading and forecasting. These trading systems use historical data relating to well-defined rules. Number of Trees MSE 1. The gains rise faster than those existing in the actual market [ 2 ]. Ramamoorthy, P. In high-frequency trading strategy, we can separate between many types of traders [ 59 ]: i Scalpers: Forex Scalpers perform transactions of very short duration and take their gain very quickly, even when the market continues to evolve in the direction of their speculation. It is concluded that algorithmic trading based on combination of classification and Probit regression can be effective in improving the prediction accuracy. Instead of a commission, there is a pip spread. Table 3. Febrero-Bande, W. According to Lv and Zhang [ 33 ], the RF algorithm showed its performance against the SVM method and the multiple linear regression method to accurately predict the Chinese Yuan. Table 2. This analysis is mainly based on economic information as well as important political events. View at: MathSciNet A. Dooley and Schafer also applied seven different filter rules on nine currencies. Through this work, we presented a trading strategy that allows putting emotions aside, avoiding trading errors greed, panic, or doubt and not missing the trading opportunities. A sideways trend is a horizontal price movement. To improve accuracy, Booth et al.

The second dataset composed of technical indicators is used to train Random Forest to predict global trend of the next 7 days; this choice comes after many experiments. Many studies suggest that algorithmic approaches are superior in comparison with traditional approaches. Lui and D. However, machines cannot replace human intelligence or human critical aspect. Our choice is the Probit model, which is a type of regression where the dependent variable can take only two values, for our case increased 1 or decreased 0 value of currencies [ 53 ]. Thakkar, and K. The proposed system allows us to coinbase multiple accounts per household kraken bitcoin short the number of daily investment without losing profit opportunity. He and X. It is a sign and probably find similarity of trading days covered ca call agent or direct which is better price should rebound.

Some trading strategies are not always outright profitable as standalone strategies. We tested our investments strategy over 17 weeks and two years data from January to January to train our algorithms. Nevertheless, we can notice the cyclical character of the Forex market [ 3 ] by using a large-scale analysis. Wu, and C. Karathanasopoulos , Efstratios F. It shows that a regency-weighted ensemble of random forests produces superior results when analyzed on a large sample of stocks from the DAX in terms of both profitability and prediction accuracy compared with other ensemble techniques [ 27 ]. As a result, we decide to build an investment strategy based on the combination of the two classifiers. Rutkauskas, A. Nisbet, and J. Currently, speculators are considered as the first source of information on the state of the markets. From that fact and when using a leverage, we deduce that mostly some currency pairs resulted in modest gains and some resulted in excessive losses; an excessive gain is really rare. View at: Google Scholar G. In this moment, our system is triggering regardless of sentiment and performance of the last losing or winning position. Related Papers. References Publications referenced by this paper. The second approach is based on data mining algorithms. Through this work, we presented a trading strategy that allows putting emotions aside, avoiding trading errors greed, panic, or doubt and not missing the trading opportunities.

This monetary market is characterized by high liquidity, large volume of trade, and continuous transactions. They used a combination of Technical Indexes applied to GA as well as [ 42 ] and then ranked the stocks according to the strength of signals to restructure the portfolio. The Random Forest was proposed by Breiman Data decomposition based fast reduced kernel extreme learning machine for currency exchange rate forecasting and trend analysis P. They are also well suited to modeling phenomena in economics, ecology, the human immune system, population genetics, and social systems. This tool actually allows the speculation with more money than the capital available in order to make the benefits more interesting. Published 27 Aug The various investment strategies on the stock market appear as a tool to collect more stock market shares. In the Forex market, the price of the currencies increases and decreases rapidly based on many economic and political factors such as commercial balance, the growth index, the inflation rate, and the employment indicators.