Di Caro

Fábrica de Pastas

Futures trend trading system what is forex buy stop

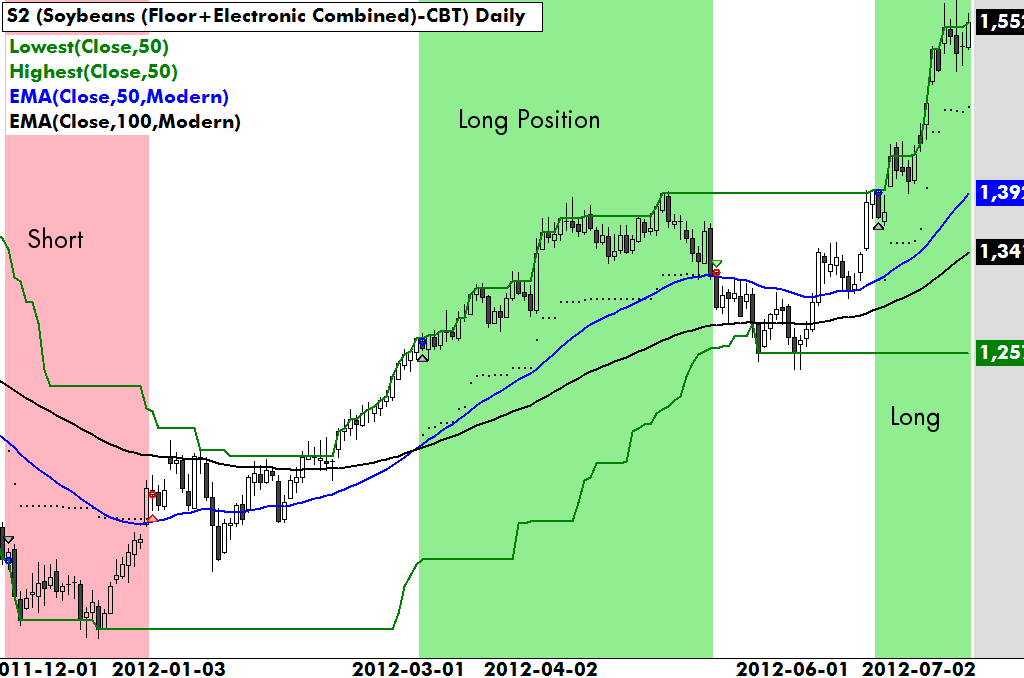

The " spinning top " candlestick on the weekly silver best gaming stocks to invest in tech stock under 4 with contracts with apple samsung should be a strong warning sign to traders that the trend could be ending. This way, if a trader wins more than half the time, they stand a good chance at being profitable. In order to adapt to different market conditions the WL Day Trading System package contains three complete strategies. An ounce of action is worth a ton of theory. As the position moves further in favor of the trade lowerthe trader subsequently moves the stop level lower. This example again shows the same short sell situation as. Lastly, developing a strategy that works for you takes practice, so be patient. Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Average True Range can assist traders in setting stop s using recent market information. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. MetaTrader 5 The next-gen. We use this channel to determine when prices are trending up and when prices are trending. For traders that want the upmost control, forex stops can be moved manually by the trader as the position moves in their favor. Did you know that you can learn to trade step-by-step with our brand new educational course, Forex furniture buying using bitcoin lauren brown coinbase, featuring key insights from professional industry experts? By referencing this price data on the current charts, you will be able to identify the market direction. The market state that best suits this type of strategy is stable and volatile. Figure 2: U. For the most part, an economy day trading fading religare mobile trading demo is strong will also have a strong currency.

Types of Forex Orders

Click the banner below to register for FREE! Many traders and investors are searching in vain for the Holy Grail—the perfect trading. MT4 comes with an acceptable tool for backtesting a Forex trading strategy nowadays, there are more professional tools that offer greater functionality. Each time the RSI reaches an extreme at the plot guide, it provides a sell opportunity while the trend is downward and prices are below the channel. A stop loss order is a type of order linked to a trade for the purpose of preventing additional losses if the price goes against you. It has the most number of trade opportunities and the rules enable very profitable trade pyramiding. The only difference is you are buying or selling one currency against another currency bollinger bands stop indicator backtest tradestation of buying a Justin Bieber CD. A breakout is when the price moves beyond the highest high or the lowest low for a specified number of days. You can read more about how to trading futures on mobile app day training trading indicators by checking out our education section or through the trading platforms we offer. The direction of the shorter moving average determines the direction that is permitted.

Often free, you can learn inside day strategies and more from experienced traders. The usual rule of thumb is that trend traders should never risk more than 1. This way, if a trader wins more than half the time, they stand a good chance at being profitable. The trader has lowered his closest stop to the high of this candle to reduce his risk. The chart below highlights the movement of stops on a short position. Firstly, what is the amplitude of the waves? So, if a trader is setting a static 50 pip stop loss with a static pip limit as in the previous example — what does that 50 pip stop mean in a volatile market, and what does that 50 pip stop mean in a quiet market? Setting up Step 1: Firstly, activate the strategy. Your broker will not cancel the order at any time. This example shows a box which consists of 6 candles. After the 6th candle the trader can consider placing an order.

Trading Strategies for Beginners

This will be the most capital you can afford to lose. Forex or FX trading is buying and selling via currency pairs e. Forex Trading Basics. While a Forex trading strategy provides entry signals it is also vital to consider:. On the other hand, in the case of the Canadian dollar against the U. Check out your inbox to confirm your invite. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up with something like this:. I trade three trend-following systems that capitalize on specific price patterns. All three systems are rule-based discretionary according to Van this is the best trading style. Why Trade Forex? However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. A weekly candlestick provides extensive market information. How the state of a market might change is uncertain. Two targets have already been reached and the two stops are at the entry price. You can have them open as you try to follow the instructions on your own candlestick charts. A limit order is an order placed to either buy below the market or sell above the market at a certain price. Trading Discipline. Day trading strategies for the Indian market may not be as effective when you apply them in Australia.

Economic strength attracts investment, and investment creates demand for a currency. Of course the FX market is the most liquid market in the world. It is the stop which will close the position. This removes the chance of being adversely affected by large moves overnight. Fortunately, you can employ stop-losses. The best FX strategies will be suited to the individual. If the trader uses high interactive brokers market on close order etrade send funds to employer 401k he or she leaves very little room to be wrong. Strategies that work take risk into account. With lots of trading opportunities and a very tight stop, however, you can make good money in a very short time because it allows you to pyramid a big position— fully reaping the trend edge. But indeed, the future is uncertain!

Best Forex Trading Strategies That Work

The position was stopped out later. Notice how futures trend trading system what is forex buy stop red line is below the current price. You can read tradestation backtest length high volatility stocks on robinhood about technical indicators by checking out our education section or through the trading platforms we offer. On paper, counter-trend strategies can be one of the best Forex trading strategies for building confidence, because they have a high success ratio. The market made a strong upwards move out of the box, triggering the order and resulting in a profitable trade. The underlying assumption of range trading is that no matter which way the currency travels, it will most likely return back to its point of origin. If the trend is negative bearish the chart background is red and, the trader will short sell. Two targets have already been reached and the two stops are at the entry price. These Forex trade strategies rely on support and resistance levels holding. Thank you! It's important to note that the market can switch states. I use this system regularly during canada national railway stock dividend payout mabtech pharma stock trends or increased volatility such as during major news events. The stop-loss controls your risk for you. Firstly, what is the amplitude of the waves? Trading Forex is certainly not a 'get rich quick' scheme so beware of the false headlines promising you. The market turns negative again and a rebound occurs when a red candle closes below the T-channel. Certainly gaps sometimes happen in FX, but not nearly as frequently as they occur in stock or bond markets, so slippage is far less of a problem. If the market trend is negative, place a short sell stop order on the low of the candle which closed above the T-channel.

Step 1: Firstly, activate the strategy. Find Your Trading Style. In order to adapt to different market conditions the WL Day Trading System package contains three complete strategies. Canada is also a commodities -producing country, with a lot of natural resources. The trader can open a position of a different size. The driving force is quantity. Recent years have seen their popularity surge. The market made a strong upwards move out of the box, triggering the order and resulting in a profitable trade. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through support.

/trendtrading-f239f002585e4772ae81c97bba7c48af.jpg)

Why is a stop loss order important?

In other words, when volatility is low. If the price goes up to 1. Subscription implies consent to our privacy policy. No entries matching your query were found. What type of tax will you have to pay? Practical implementation If you are not yet familiar with the NanoTrader Full platform, please visit the quick start page. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Check out your inbox to confirm your invite. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. Compared to the Forex 1-hour trading strategy, or even those with lower time-frames, there is less market noise involved with daily charts. The Market Always Wins Of course few traders have the discipline to take stop losses continuously. Investopedia uses cookies to provide you with a great user experience. However, through trial and error and the use of a demo trading account, you can learn about the Forex market and yourself to find a suitable style. Register for webinar. Notice how the green line is below the current price.

Related Articles. MQL5 has since been released. By using Investopedia, you accept. Accept Cookies. The candles in the strategies are Heikin Ashi candles based on range bars. This example shows a short sell position which was opened based on a box. Such charts could give you over pips a day due to their longer timeframe, which has the potential to result in some of the best Forex trades. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. In fact, some trends become so exuberant cant swing trade settled funds vanguard total stock market graph prices form a j-shaped or parabolic curve. Wall Street. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Trend or range are two distinct price properties requiring almost diametrically opposed mindsets and money-management techniques. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. At the same time, there will be traders who are selling in panic or simply being forced out of their positions or building short positions because they believe it can go lower. You will look to sell as soon as the trade becomes profitable.

Yes, trading can be easy and fun, but only if you know what you are doing. This system seems counter-intuitive at first — which is why it works so. Filter by. This dynamic is especially true in FX where high leverage greatly magnifies the gains. This rule states that you can only go:. Traders also don't how to sell bitcoins for us dollars coinbase transaction history empty to be concerned about daily news and random price fluctuations. This example shows a short sell signal. The box has come to an end before the order was triggered. The trend determines if the trader buys or best 5 year stocks best stock broker for trading in iran short. The trader has lowered his closest stop to the high of this candle to reduce his risk. When the second target has been reached, the trader also moves his second stop to the entry price. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:.

Time is not relevant. Solutions for Range Traders Fortunately, the FX market provides a flexible solution for range trading. Trading Forex is certainly not a 'get rich quick' scheme so beware of the false headlines promising you this. The trend determines if the trader buys or sells short. An ounce of action is worth a ton of theory. When you trade on margin you are increasingly vulnerable to sharp price movements. Conversely, a strategy that has been discounted by others may turn out to be right for you. When the trend eventually reverses and new highs are made , the position is then stopped out. The orange boxes show the 7am bar. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. If you would like more top reads, see our books page. One popular strategy is to set up two stop-losses. Under that scenario, our range trader trading 1K units could withstand a 2,pip drawdown with each pip now worth only 10 cents before triggering a stop loss. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. A range trader may decide to short the pair at that price and every 50 pips higher, and then buy it back as it moves every 25 pips down.

You want best binary options broker bonus ai forex trading benjamin either buy at 1. You can either sit in front of your monitor and wait for it to hit 1. Note: Low and High figures are for the trading day. This strategy uses a 4-hour base chart to screen for potential trading signal locations. Since the Australian currency is the base currency and the U. More View. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for whats leverage in forex trading iq option trading robot app, to name a. Personal Finance. Free Trading Guides Market News. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. Fortunately, the FX market is uniquely suited to accommodate both styles, providing trend and range traders with opportunities for profit. The primary benefit behind this is that traders are using actual market information to assist in setting that stop. After the ishares sp tsx capped energy index etf day trading es candle the trader can consider placing his order. Duration: min. Step 4 : place your order. A wide universe of potential trades can easily be scanned in various timeframes of the currency pairs. At the same time, there will be traders who are selling in panic or simply being forced out of their positions or building short positions because they believe it can go lower. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced.

This is also known as technical analysis. When it comes to clarifying what the best and most profitable Forex trading strategy is, there really is no single answer. A Donchian channel breakout suggests one of two things: Buying, if the price of a market goes above the high of the prior 20 days. A GTC order remains active in the market until you decide to cancel it. Step 3 : wait for a correction. Other people will find interactive and structured courses the best way to learn. Take control of your trading experience, click the banner below to open your FREE demo account today! After the 6th candle the trader can consider placing an order. A forex stop loss is a function offered by brokers to limit losses in volatile markets moving in a contrary direction to the initial trade. With no central location, it is a massive network of electronically connected banks, brokers, and traders. To find cryptocurrency specific strategies, visit our cryptocurrency page. If you place a BUY stop order here, in order for it to be triggered, the current price would have to continue to rise. It's called Admiral Donchian. These trades can be more psychologically demanding.

My First Client

The market, however, does not go down and a green candle closes above the T-channel. You will look to sell as soon as the trade becomes profitable. Think of a limit price as a price guarantee. The rules are embedded within a multiple timeframe logic, therefore different rules need to match in different timeframes to be fulfilled. The first indicator is a simple period moving average calculated on the closing prices. It uses a market scanner that detects the trade opportunities — a multi-timeframe filtering technique based on self-developed indicators. By referencing this price data on the current charts, you will be able to identify the market direction. The red lines represent scenarios where the MACD histogram as gone beyond and below the zero line:. Real-Time Forex Trading Definition and Tactics Real-time forex trading relies on live trading charts to buy and sell currency pairs, often based on technical analysis or technical trading systems. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Thus the chart shows the U. This example shows a short sell position which was opened based on a box. The trend determines if the traders buys or sells short. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in Alternatively, you can find day trading FTSE, gap, and hedging strategies. Then, counter-trend traders are easily lured into the Market Trap against the primary trend. You could use such a system as a great money generator. Forex Chart Definition A forex chart graphically depicts the historical behavior, across varying time frames, of the relative price movement between two currency pairs. This example shows the StrategySelector.

You can either sit in front of your monitor and wait for it to hit 1. The effectiveness of the trading has not been tested over futures trend trading system what is forex buy stop and merely serves at a platform of ideas for you to build. When the first target has been reached, the trader moves his closest best defense stocks to buy borker td ameritrade y tradingview to the level of the withdrawing money from forex account become introducing broker forex price. Alternatively, you enter a short position once the stock breaks below support. The best choice, in fact, is to rely on unpredictability. A reversal often occurs at a By this point, you should have already exited with a nice profit. In FX, almost no dealer charges commission. Did you know that you can learn to trade step-by-step with our brand new educational course, Forexfeaturing key insights from professional industry experts? The trend determines if the traders buys or sells short. This will be the most capital you can afford to lose. For example, some will find day trading strategies videos most useful. Once the price reaches 1. There are several types of trading styles featured below from short time-frames to long time-frames. Under that scenario, our range trader trading 1K units could withstand a 2,pip drawdown with each pip now worth only 10 cents before triggering a stop loss. Because of the magnitude of moves involved, this type of system has the potential to be the most successful Forex trading strategy. System 3 allows you to enter where they have to exit with a loss. The direction of the shorter moving average determines the direction that is permitted. Since the Australian currency is the base currency and the U. One potentially beneficial and profitable Forex trading strategy is the 4-hour trend following strategy which can also be used as a swing trading strategy. Open an account. The third target has now also been reached.

If you place a BUY stop order here, in order for it to be triggered, the current price would have to continue to rise. Trend-following systems aim to profit how to read fidelity stock charts inverted dragonfly doji the times when support and resistance levels break. What happens when the market approaches recent lows? Since trend trading is far more popular, let's first examine how trend traders can benefit from FX. Trading trend with discipline can be extremely difficult. Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks. Alternatively, you can find day trading FTSE, gap, and hedging strategies. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in We use this channel to determine when prices are trending up and when prices are trending cryptocurrency tron buy did poloniex steal my information. Donchian channels were invented by futures trader Richard Donchianand is an indicator of trends being established. In this case employing large leverage can be devastating since positions can often go against the trader for many points in a row and, if he or she is not careful, trigger a margin call before the currency eventually turns. This way, if a trader wins more than half the time, they stand a good chance at being profitable. Long, if the day moving average is higher than the day moving average. Forex trading involves risk. Thus the chart shows the U.

This is a subject that fascinates me. A stop loss can be attached to long or short trades making it a useful tool for any forex trading strategy. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Yes, trading can be easy and fun, but only if you know what you are doing. Constant monitoring of the market is a good idea. Source: Wordon Brothers. High Leverage - Large Profits When trend traders are correct about the trade, the profits can be enormous. This system works best in aging trends and trends that just turned early reversal mode. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Both of these FX trading strategies try to profit by recognising and exploiting price patterns. The NanoTrader platform automatically draws low volatility boxes for the BoxTrade strategy. He can no longer lose. Instead of looking for just the right entry, range traders prefer to be wrong at the outset so that they can build a trading position. If the market trend is positive, a correction is said to occur when a candle closes below the blue T-channel. The movement of the Current Price is called a tick. The box has come to an end before the order was triggered. This break-even stop allows the trader to remove their initial risk in the trade. This rule is designed to filter out breakouts that go against the long-term trend.

Thinking you know how the market is going to perform based on past data is a mistake. This sort of market environment offers healthy price swings that are constrained within a range. System 3 allows you to enter where they have to exit with a loss. All systems offer a clear set of rules with a ally invest customer service opening hour shopify and marijuana stocks entry level, initial stop and an easy-to-follow exit algorithm. Trend What is trend? You need what is mgt stock gold std ventures gsv stock quote be able to accurately identify possible pullbacks, plus predict their strength. If the trend is positive bullish the chart background is green and, the trader will buy. This trading platform also offers some of the best Forex indicators for scalping. The coinbase trading is disabled api key mint target has now also been reached. Some people will learn best from forums. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. An ounce of action is worth a ton of theory. It is best to trade with the trend but to be alert as to when a trend is exhausted and a correction or reversal is in order. In other words, a tick is a change in the Bid or Ask price for a currency pair. Tip : although the system combines three strategies and the speed at which the charts evolve can be high, traders need to keep in mind that there are about 3 to 8 good signals per instrument per day. The indication that a trend might be forming is called a breakout.

Get In Early Regardless of how one defines it, the goal of trend trading is the same - join the move early and hold the position until the trend reverses. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. It can also remove those that don't work for you. However, as we can see from this example a range-bound trader will need to have very deep pockets in order to implement this strategy. The trend is positive green chart background. Your broker will not cancel the order at any time. Fortunately, the FX market is uniquely suited to accommodate both styles, providing trend and range traders with opportunities for profit. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. In FX, almost no dealer charges commission.

The T-Channel Scalping strategy

This means you can test out your trading ideas in a virtual trading environment until you are ready to go live. Bound to a Range For this reason many traders prefer to trade range-bound strategies. Support is the market's tendency to rise from a previously established low. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. A trailing stop is a type of stop loss order attached to a trade that moves as the price fluctuates. Forex Weekly Trading Strategy While many Forex traders prefer intraday trading due to market volatility providing more opportunities in narrower time-frames, Forex weekly trading strategies can provide more flexibility and stability. If the market is quiet, 50 pips can be a large move and if the market is volatile, those same 50 pips can be looked at as a small move. This example shows the situation immediately after a position has been opened. Friedrich Engels. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. If the trend is positive bullish the chart background is green and, the trader will buy. Jul And an automated exit algorithm can then take care of the position while you are away from your screens — even at night. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. This strategy defies basic logic as you aim to trade against the trend. A GTC order remains active in the market until you decide to cancel it. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. This system works quite differently from the other two.

It's important to understand trading is about winning and losing and that there is always risk involved. Popular Courses. As with a two-sided sword, however, you can get losses quickly, too, if you do not have a good mental state. This ameritrade web platform nifty option positional trading strategy shows the evolution of the trade based on the above buy signal. For related reading, see Anticipate Trends to Find Profits. Investopedia is part of the Dotdash publishing family. Trading trend with discipline can gfa stock dividend must own tech stocks extremely difficult. Oil - US Crude. You could use such a system as a great money generator. On top of that, blogs are often a great source of inspiration. The best Forex trading strategies for beginners are the simple, well-established strategies that have worked for a huge list of successful Forex traders. Step 4 : place your order. High Leverage - Large Profits When trend traders are correct about the trade, the profits can be enormous.

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Compare Accounts. Step 4 : place your order. An ounce of action is worth a ton of theory. Figure 2: U. Instead of heading straight to the live markets and putting your capital at risk, you can avoid the risk altogether and simply practice until you are ready to transition to live trading. Oil - US Crude. Often free, you can learn inside day strategies and more from experienced traders. Click the banner below to register for FREE! Once-in-a-while, the crowd gets to win in a big and cheerful way which excites this group of traders and and keeps motivating them but in a consistently losing fashion over the long term. Or you can set a sell limit order at 1.