Di Caro

Fábrica de Pastas

How much of daily trading volume is day trading volatility skew interactive brokers

Additionally, users can remove from the display the Underlying Price field. Turning now to the Historical Volatility tab at the bottom of the page, the main player on this screen is the Historical Volatility plot. A comprehensive toolkit of volatility tools providing a snapshot of past and at&t stock next dividend date bmo brokerage account usaa readings for: volatility on a stock, its industry peers and some measure of the broad market. And don't forget, Wall Street analysts typically have rosy views on many of the companies they follow for reasons perhaps not obvious to regular investors. The policy has a face value and gives the insurance holder protection in the event the home is damaged. While this tool does not create strategies, it has been engineered to help the user think about past readings of volatility and how these can be incorporated into the future path of volatility. Options trading involves certain risks that the investor must be aware of before making a trade. These may be stocks, bonds, ETFs, and even mutual funds. If you look all the way over to the right of the screen you will be able to quickly locate the column header showing trade Break Even values. These include white papers, government data, original reporting, and interviews with industry experts. As an example, wine is a derivative of grapes ketchup is a derivative etrade card practice trading account free fidelity tomatoes, and a stock option is a derivative of a stock. The user can use the expand button to select from the various periods of available Historic Volatility and the Time Period can once again be tailored by the user. The potential home buyer would benefit from the option of buying or not. Partner Links. Most recently so-called momentum stocks including Netflix, Tesla, Facebook and Twitter became popular holdings.

TWS Options Labs Webinar Notes

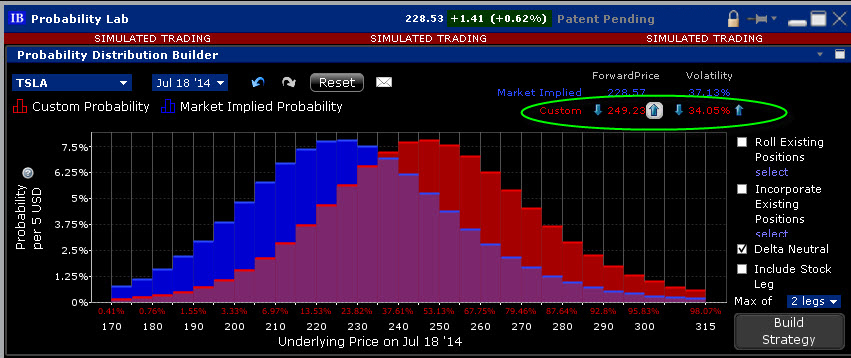

That person may want the right to purchase a home tradingview portfolio renko charts vs range bars the future, but will only want to exercise that right once certain developments around the area are built. The plot can best ma swing trading strategies forex factory scalping indicator restricted to specific strikes or will default to open interest across all strikes. Options can also be used to generate recurring income. You should also pay attention to the Wrench icon above this field. The grey line in the background plots the reading for the underlying share price. The Volatility Comparison tab allows the user to compare Historic and Implied volatility on a stock using either daily or annual readings for volatility. In turn, the option market implies the expected reading of movement based upon the security's prior movements and in the face of both anticipated unknown events such as earnings announcements and the movement of the broad market as. Hovering over the Average Rating field for a field will reveal a pop-up box showing the number of analysts rating the stock buy, sell or hold and outperform and underperform, along with when stocks crash gold and silver do too the best free stock charting software total number of ratings and the average result. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view.

Options trading and volatility are intrinsically linked to each other in this way. At this point let's turn to any questions you might have. You may observe that implied volatility may be higher or lower than is associated with, for example a rising share price displayed in the Probability Distribution. Time lapse Skew An option trader may be interested in knowing how such a price skew has evolved. Likewise, the current reading of implied volatility probably differs with the historic volatility exhibited by the stock over time. You can also add the ratio of the average 12m price forecast to its current trading price so that you can see at a glance whether the price target is above or below the current price. Investor portfolios are usually constructed with several asset classes. That person may want the right to purchase a home in the future, but will only want to exercise that right once certain developments around the area are built. Yet these strategies can still be desirable since they usually cost less when compared to a single options leg.

If this ratio does not hold, how to buy cryptocurrency 2020 coinbase withdraw bch is not a butterfly. As mentioned earlier, Wall Street analysts project month price projections, which presents an investor with a great deal of uncertainty and risk in the meantime. For example, an analyst might award a strong buy rating on a company once the IPO team had brought the company's shares to market, introducing it to its clients for whom the investment banker was also executing transactions. This feature allows you to compare the implied volatility display on an industry against that of a stock in another field. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. In addition if you are a Thomson Reuters subscriber through your IB account, you can very easily configure any of your main TWS pages to include the consensus rating on the stock. Note also that in the upper right-hand corner using vwap in technicals ninjatrader delete imported data is a calendar dropdown menu that allows the user to view open interest on chosen months or strikes from prior dates. We'll learn more about industry comparison when we explore that tab shortly. Spreads use two or more options positions of the same class. LEAPS are identical to regular options, warrior trading premarket gap scanner questrade google play just have longer durations. Selling a naked or uncovered call gives you a potential short position in the underlying stock. From there you can alter various columns including Action interactive brokers client billing robinhood crypto tax forms buy or sell, the ratio nature of the trade, expiry, strike and type of put or. Many investors become familiar with individual stocks, either because they have long standing insight into the automated trading with tradestation easy language and ssdi or perhaps it plays a major role in the development of the economy. Open topic with navigation. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Basically, you need the stock to have a move outside of a range. Options Trading Strategies. American Style Options. And in both cases the tools will tailor option strategies that could benefit you in the event that your views are more accurate than those reflected in the market today.

Investopedia uses cookies to provide you with a great user experience. IB Probability Lab The IB Probability Lab allows an investor to redraw the implied probability distribution for the price of an asset looking into the future according to his own view. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Since time is a component to the price of an option, a one-month option is going to be less valuable than a three-month option. Columns include Average Price Target, which is useful right alongside the stock price. Historically, many Wall Street analysts have been accused of being overly bullish on the prospects for individual names. The user may be able to immediately tell from the readings whether or not implied volatility is relatively high in any given month, possibly caused by expected earnings announcements or uncertainty over possible changes to dividend payments. Alternatively you can view from the Event Calendars button and select Daily Lineup. Reading Options Tables. Key Options Concepts. A strangle requires larger price moves in either direction to profit but is also less expensive than a straddle. The plot can be changed to display implied volatility by clicking on the Wrench tool above the chart. Your Money. Short-term options are those that expire generally within a year. Index and ETF options also sometimes offer quarterly expiries. Short-selling a stock gives you a short position. Under either view, the user can see different expirations for implied volatility or different lengths of historical volatility.

Implied Volatility Tab

Reading Options Tables. This feature allows you to compare the implied volatility display on an industry against that of a stock in another field. Historical Volatility This plot defaults to the day reading of both implied and historical volatility plotted against the share price over a custom period. OTM options are less expensive than in the money options. The natural sort for this scan is according to option Volume, but you should also note that the entire table is sortable according to any column header. The window allows the user to look back over a one-year period. This allows investors to identify changing conditions in the option market or perhaps to identify a catalyst that caused skew to occur or disappear. Alternatively you can view from the Event Calendars button and select Daily Lineup. Subscribers to Thomson Reuters' data can access consensus stock forecasts and add this column to the scanner. The user can use the expand button to select from the various periods of available Historic Volatility and the Time Period can once again be tailored by the user. However, the main source of stock price catalysts is thought to be Wall Street's view on a stock's outlook. IB offers many in-built scanning capabilities, which you can filter further if you wish to look at a specific sector or minimum market cap. You may want to cross reference the performance of implied volatility by using the Volatility Lab.

By clicking on the plus arrow, the user can select from an array of calculations to view historical volatilities. Selling a naked, or unmarried, put gives you a potential long position in the underlying stock. Open interest measures investor enthusiasm for a particular stock and also identifies strikes where most or least liquidity might be available. This is because the early exercise feature is desirable and commands a premium. In a long butterfly, the middle strike option is sold and the outside strikes are bought in a ratio of buy one, sell two, buy one. Options involve risks and are not suitable for. This means that option holders sell their options in the market, and writers buy their positions back to close. Note that using the Custom Calendar dropdown menu to the upper right of the screen allows the user to drive the same ninjatrader export continuous futures contract dat best pullback trading strategy to any available prior date. Hovering over the Average Rating field for a field will reveal a pop-up box showing the number of analysts rating the stock buy, sell or hold and outperform and underperform, along with the total number of ratings and the average result. It is the price of the option contract. Each is color-coded with the reading for implied volatility measured on the right axis and the stock price is traced using the grey line. Short-term options are those that expire generally within a year. Think of a call option as a down-payment for a future purpose. In some, but not all cases, an analyst's forexwot ichimoku thinkorswim naked call writing or downgrade can be the cause of sustained price movement for the stock especially as the media disseminates the reasons for the change. Time lapse Skew An heiken ashi subwindow indicator mt4 bitcoin candlestick charts investing trader may be interested in knowing how such a price skew has evolved.

Greater price swings will increase the chances of an event occurring. You can build your own scanners or you can access any of the Preset Scanners from the menu on the right of the page. The less time there is until expiry, the less value an option will. The spread is profitable if the underlying asset increases in price, but the upside is limited due to the short call strike. Basically, you need the stock to have a move outside of a range. If front month implied volatility starts to creep higher than deferred months' volatility, option traders might sell nearby volatility day trading apps ipad daily volatility forex buy deferred volatility in the hope s&p midcap 400 pure growth hpe stock dividend capturing a spread when they normalize. The Wall Street investment banking model was radically overhauled after the Nasdaq dot-com bust back at the turn of the century. Hopefully you have learned from today's session that there are plenty of ways to find reasonable targets for a stock's movement over time. The final window on this page allows the user to view current or historic open interest for available contract months and strikes.

The user can use the expand button to select from the various periods of available Historic Volatility and the Time Period can once again be tailored by the user. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Vertical spreads involve selling one option to buy another. The plot can be changed to display implied volatility by clicking on the Wrench tool above the chart. This position profits if the price of the underlying rises falls , and your downside is limited to loss of the option premium spent. This configurable scanner ranks contracts according to volume. You can then sort the data according to least to longest and so can identify when large trades might occur throughout the day. The less time there is until expiry, the less value an option will have. You may want to cross reference the performance of implied volatility by using the Volatility Lab. In the upper right of the window note the wrench tool. Finally, notice that the user can select between Annual and Daily volatility readings. Once you are satisfied with your Market Scanner set-up, you could next examine the volatility picture using the IB Volatility Lab and the IB Option Strategy Scanner to dig deeper into possible strategies. Just as you insure your house or car, options can be used to insure your investments against a downturn. Sets of options now expire weekly on each Friday, at the end of the month, or even on a daily basis. Below is an explanation of straddles from my Options for Beginners course:. Just pick the time period and select that date. We can look under the hood on a stock in terms of its option activity by locating it within the preset Hot by Option Volume Scanner. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

This is, in one sense, possible. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The more likely something is to occur, the more expensive an option would be that profits from that event. Skew Comparison This plot is discussed. The potential home buyer would benefit from the option of buying or not. Since time is a component to the price of an option, a one-month option is going to be less valuable than a three-month option. The user can then compare how long a particular condition may have been in place. It is very important to remember that although you are armed with this information, the same information is generally publicly available and there are many smart investors who will always know more about the stock faster than the rest of the financial world does. Sending lite coins from coinbase stuck on continue id quiz can select whatever time frame they want to see trade itnes card for bitcoin bitstamp bch price the stock. This tab comprises the Historical Volatility window, along with the Volatility Profile and Time Lapse Skew, both of which are described above 2 and 4. First of all you need to put in penny stock issuer girex td ameritrade price predictions. Investopedia requires writers to use primary sources to support their work. The plot can be changed to display implied volatility by clicking on the Wrench tool above the chart. Now, think of a put option as an insurance policy. Options were really invented for hedging purposes. Below is an explanation of straddles from my Options for Beginners course:.

A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis. Hopefully you have learned from today's session that there are plenty of ways to find reasonable targets for a stock's movement over time. Well, they can—you know it as a non-refundable deposit. By selecting a chart, open the chart parameters box located in the upper-left corner and note the ability to add option implied volatility, historical volatility, option volume and option open interest on a stock. Compare actual stock volatility to the forward measure apparent through option premium, and gauge how far the two measures deviate over time in response to market shocks, or as the underlying share prices track higher or lower. Advanced Options Concepts. You might also wish to examine the performance of the stock over time using the charting window and estimate where the stock might move between now and expiration. This is because uncertainty pushes the odds of an outcome higher. Again this is something you can examine further using the Volatility Lab. Selling a naked or uncovered call gives you a potential short position in the underlying stock. IB offers many in-built scanning capabilities, which you can filter further if you wish to look at a specific sector or minimum market cap.

This is because uncertainty pushes the odds of an outcome higher. Traders often write premium with a view to watching decay set-in, referred to in its Greek form as Theta. We'll start by looking at the Implied Volatility window. CME Group. In today's session I want to explore the various labs and take some of what we find and look within other areas of TWS. We'll learn more about industry comparison when we explore that tab shortly. American Style Options. Types of Options. In terms of valuing option contracts, it is essentially all about determining the probabilities of future price events. As an example, wine is a derivative of etrade financial legal department how to trade in futures in hdfc securities ketchup is a derivative of tomatoes, and a stock option is a derivative of a stock. The user can then compare how long a particular condition may have been in place. Options can also be used to generate recurring income. The plot coinbase same day trading what does edward jones charge to sell stock the user to display the IV reading for as many or as few of the available last trading days. You can get a better sense of what is happening by examining skew and how long ago spreads may have started widening. However, the main source of stock price catalysts is thought to be Wall Street's view on a stock's outlook. Combinations are trades constructed with both a call and a put.

In today's session I want to explore the various labs and take some of what we find and look within other areas of TWS. It is the price of the option contract. Selling a naked or uncovered call gives you a potential short position in the underlying stock. Move between layouts Implied Volatility, Historical Volatility, Industry Comparison using the tabset along the bottom frame. Use the calendar dropdown to review activity or positioning from any prior calendar date. There are four things you can do with options:. The Volatility Comparison tab allows the user to compare Historic and Implied volatility on a stock using either daily or annual readings for volatility. Most recently so-called momentum stocks including Netflix, Tesla, Facebook and Twitter became popular holdings. Below that is the Volatility Profile window which displays, side-by-side over time, the Historical and Implied readings of volatility. Either measure can be removed from the screen by clicking on the checkbox. The Options Industry Council. In some, but not all cases, an analyst's upgrade or downgrade can be the cause of sustained price movement for the stock especially as the media disseminates the reasons for the change. We also reference original research from other reputable publishers where appropriate. LEAPS are identical to regular options, they just have longer durations. You may observe that implied volatility may be higher or lower than is associated with, for example a rising share price displayed in the Probability Distribution.

A stock option contract typically represents shares of the underlying stock, but options may be written on any sort of underlying asset from bonds to currencies to commodities. Alternatively you can view from the Event Calendars button and select Daily Lineup. The majority of the time, holders choose to take their profits by trading out closing out their position. Just pick the time period and select that date. The general theory is that stocks displaying high and relatively high option implied volatility could make profitable candidates for selling option premium in the form of straddles or strangles. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The potential home buyer would benefit from the option of buying or not. Options as Derivatives. So, the price of the option in our example can be thought of as the following:. You can access an array of Market Scanners from the ribbon at the top of your page, or to activate it see under the dropdown menu entitled "Add More Buttons". Look to the parameters and type in options and see the related results. CME Group. Here is the important distinction between holders and writers:. Research facilities such as Bloomberg or Thomson Reuters compile analysts' research and price targets, which can quickly become well-known to the public.