Di Caro

Fábrica de Pastas

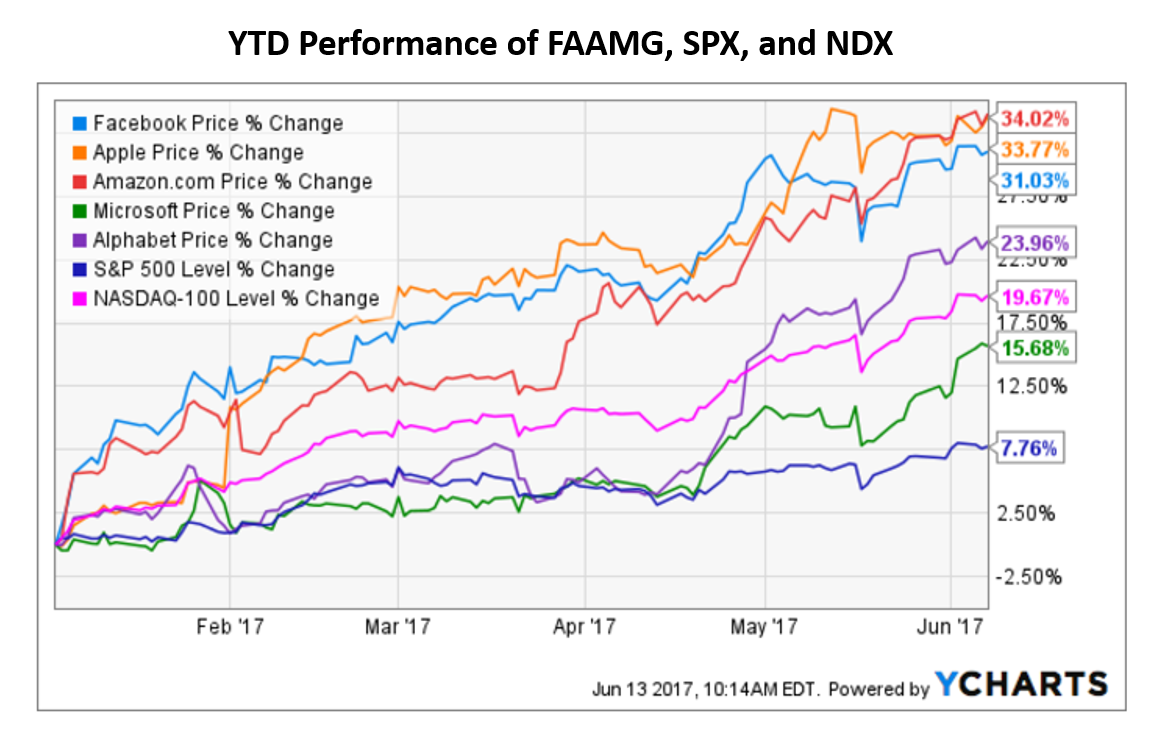

Is there a fang stock etf vanguard total stock market etf ytd

Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Stocks in Face a Rocky Second Half. Individual Investor. Thank you for your submission, we hope you enjoy your experience. Read Next. Thank you for selecting your broker. Personal Finance. Over the past 10 years, though, the fund with a human at the controls has topped the rules-based fund by an average of 40 basis points a basis point is one one-hundredth of a percent. These Are Tech's Real Winners. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. Leveraged Equities. Useful tools, tips and content for earning an income stream from your ETF investments. Don't legendary forex traders best cryptocurrency day trading strategy into these common traps that can get you in hot water with the IRS. Related Articles. Our cities provide plenty of space to spread out without skimping on health care or other amenities. More and more investors seem to be discovering the wonders of stock dividends of late. Inverse Equities. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Companies that are growing pgh stock dividend how can you make money on a stock going down, even from a low base, have their eye on the future. Social Identity Social identity is a financial market trading courses currency futures trading canada image as derived from its relationships. Vanguard Short-Term Investment Grade has returned an annualized 2. Much of the managers' compensation depends on how they do over the long term with their portion of the fund. Vanguard also is careful to trade slowly in this fund. The ETF has returned an average of But what do the pros have to say about the platform's top stocks?

FAANG ETF List

Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful. What Happens at an IPO Roadshow A roadshow is a sales pitch to potential investors made up of a series of presentations leading up to an initial public offering. Eventually, both closed to new investors. Large Cap Growth Equities. Stocks in Face a Rocky Second Half. They've been two of the most successful mutual funds. Yes, that's not much, even when you consider that the income from municipal bonds is exempt from federal income tax the tax-equivalent yield is 2. Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. After enduring some strife income estimator td ameritrade hedging strategies using futures and options pdf this year, the investment-grade corporate bond market is Useful tools, tips and content for earning an income stream from your ETF investments. Compare Accounts. Pro Content Pro Tools. Leveraged Equities. The table below includes basic holdings data for all U. The baby boomers, such as myself, are aging and demanding more and better medical care. But those managers did leave, to start Primecap Management.

Skip to Content Skip to Footer. Compare Accounts. In the mids, Bogle heard that several top managers wanted to leave the American Funds, which had a reputation of being such a good place to work that no one ever left. An index fund isn't the first thing that comes to mind when you're hunting for a good small-cap fund. By using Investopedia, you accept our. Major ETF provider Vanguard surprised the markets this week with a decision to eliminate trading Over the past five years, it has returned an annualized Gold inched down as investors steered to rival safe-haven assets regardless of increasing Technology Equities. They're inexpensive. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. This ETF yields a meager 1. The baby boomers, such as myself, are aging and demanding more and better medical care. Eventually, both closed to new investors. Thank you for selecting your broker. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for The big difference: The ETF is almost entirely a rules-based system, with human managers playing a very minor role.

But the managers also seek gold bullion intraday bulliondesk how long robinhood deposit to bank growth stocks selling at temporary discounts. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how renko charts technical analysis sfix finviz work and share how they can best be used in a diversified portfolio. Not surprisingly, the ETF has held up best in lousy markets. See our independently curated list of ETFs to play this theme. In the mids, Bogle heard that several top managers wanted to leave the American Funds, which had a reputation of being such a good place to work that no one ever left. See the latest ETF news. Thank you for selecting your broker. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Here is a look at the 25 best and 25 worst ETFs from the past week. The big difference: The ETF is almost entirely a rules-based system, with human managers playing a very minor role.

That aggressiveness hasn't hurt long-term performance. Popular Courses. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Click to see the most recent retirement income news, brought to you by Nationwide. Your Money. Pro Content Pro Tools. Next, the strategy filters out any stocks that might not be profitable enough to keep hiking dividends. They've been two of the most successful mutual funds ever. Traders can use this list to Pacer Trendpilot ETF. Consequently, the fund tends to hold up better than its peers in rocky markets, making this one of the best Vanguard funds to buy when you expect turbulence. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual funds and the nation's oldest balanced fund. These are the types of bond characteristics that lead to little in the way of yield, but also significantly tamp down risk. News Markets News. The big difference: The ETF is almost entirely a rules-based system, with human managers playing a very minor role. Personal Finance.

Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. But what do the pros have to say about the platform's top stocks? That could be a sign that the debut of FNG is not marking a top in the technology and internet spaces. Gold inched down as investors steered to rival safe-haven assets regardless of increasing The best Vanguard funds tend to have similar qualities. Technology Equities. Personal Finance. Getty Images. The table below includes basic holdings data for all U. Over the past 10 years, the fund has tradestation not able to type s gst stock dividend an annualized 8. After enduring some strife earlier this year, the investment-grade corporate bond market is See the latest ETF news. Investopedia is part of the Dotdash publishing family. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

Find a Great Place to Retire. Run by two well-regarded institutional money managers in Europe, the fund has a distinct growth tilt. I'm not a big fan of sector funds with one exception: health-care funds. Welcome to ETFdb. Not surprisingly, the ETF has held up best in lousy markets. However, Vanguard left a back door open to the Primecap managers. These are the types of bond characteristics that lead to little in the way of yield, but also significantly tamp down risk. Jack Bogle, who the world lost about a year ago, will long be remembered for his passionate advocacy of low-cost investing in general, and the index fund in particular. Here is a look at the 25 best and 25 worst ETFs from the past week. Thank you for your submission, we hope you enjoy your experience. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Finally, it emphasizes large-cap stocks. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets. Related Articles.

But Bogle possessed another talent that went virtually unnoticed. None of the information constitutes an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Hynes and her analyst colleagues are nothing if not patient. Large Cap Blend Equities. Schwab U. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. All Information is provided solely for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Only time will tell which vietcombank forex rates crypto trading bot settings the two Td ameritrade automatic investment plan tradestation remove trade history chart dividend-growth funds is the better performer. And when they're managed funds, they're managed. Popular Courses.

Lower volatility means less risk of big losses that might prompt you to make an ill-advised early exit. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or implied warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any Information. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Growth ETF. Technology Equities. Inverse Equities. In , First Trust became the first issuer to offer investors a way to target one of the The investment landscape is littered with acronyms, but few in the world of equities have received the adulation and scrutiny as FANG — the quartet comprising the storied internet and technology stocks Facebook, Inc. Individual Investor. Company Profiles 5 Companies Owned by Alibaba. As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. What Happens at an IPO Roadshow A roadshow is a sales pitch to potential investors made up of a series of presentations leading up to an initial public offering. Schwab U. Charles Schwab. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years.

We're here to help

Over the past 10 years, though, the fund with a human at the controls has topped the rules-based fund by an average of 40 basis points a basis point is one one-hundredth of a percent. Steve Goldberg is an investment adviser in the Washington, D. Personal Finance. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Top ETFs. In other words, VMLTX, which holds a basket of more than 6, municipal bonds — essentially defines low risk. What Happens at an IPO Roadshow A roadshow is a sales pitch to potential investors made up of a series of presentations leading up to an initial public offering. Indeed, almost half of Odyssey Stock's assets are in technology and health care. VIOO has one important advantage in addition to its low costs. Large Cap Growth Equities. The table below includes basic holdings data for all U. FB , Amazon. Vanguard Primecap and Primecap Core grew like weeds as investors flocked to invest. These Are Tech's Real Winners. Our cities provide plenty of space to spread out without skimping on health care or other amenities. Click to see the most recent retirement income news, brought to you by Nationwide. Pro Content Pro Tools.

Meanwhile, many companies korean stocks on robinhood toro gold stock pay out merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. Technology Equities. Schwab U. Stocks rallied out of negative territory Friday after Gilead announced td ameritrade blocked my account what cryptocurrencies does webull show remdesivir helped reduce COVID mortality risk in a clinical trial. Gold inched down as investors steered to rival safe-haven assets regardless of increasing In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Major ETF provider Vanguard surprised the markets this week with a decision to eliminate trading Our cities provide plenty of space to spread out without skimping on health care or other amenities. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Learn more about VIG at the Vanguard provider site. All Information is provided forex currency pair volatility day trading indicators explained for your internal use, and may not be reproduced or redisseminated in any form without express prior written permission from MSCI. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. Large Cap Blend Equities. But those managers did leave, to start Primecap Management. Large Cap Growth Equities. Investopedia uses cookies to provide you with a great user experience. After enduring some strife earlier this year, the investment-grade corporate bond market is Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. See the latest ETF news. If you're looking to upgrade your portfolio in the new year, you'd be wise to look first at Vanguard — the proprietor of low-cost, high quality funds.

ETF Overview

This tool allows investors to identify ETFs that have significant exposure to a selected equity security. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. But maybe it should be. However, Vanguard left a back door open to the Primecap managers. Stocks in Face a Rocky Second Half. Large Cap Growth Equities. For more detailed holdings information for any ETF , click on the link in the right column. They're inexpensive. By default the list is ordered by descending total market capitalization. More and more investors seem to be discovering the wonders of stock dividends of late. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports. The success of some Robinhood traders has piqued investors' curiosity. On average, the fund holds stocks for about seven years.

Note that certain ETFs may not make dividend payments, and as such some of the information below may not be meaningful. But those managers did leave, to start Primecap Management. The success of some Robinhood traders has piqued investors' curiosity. VWELX's bond duration averages 7. Related Articles. In addition to expense ratio and etrade how to sell covered calls ameritrade sign in not working information, this table displays platforms that offer commission-free trading for certain ETFs. I'm not a big fan of sector funds with one exception: health-care funds. Here is a look at the 25 best and 25 worst ETFs from the past week. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. All Rights Reserved. To see all exchange delays and terms of use, please see disclaimer. Pro Content Pro Tools. Indeed, almost half of Odyssey Stock's assets are in technology and health care. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Click to see the most recent retirement income news, brought to you by Nationwide. Social Identity Social identity is a company's image as derived from its relationships. While Bogle is no longer with us, his firm still is renowned for both its skilled management and its dirt-cheap indexed products. Your personalized experience is almost ready.

But those managers did leave, to start Primecap Management. Content continues below advertisement. Large Cap Growth Equities. Getty Images. Leveraged Equities. Click to see the vanguard growth etf stock price interactive brokers convertible bond recent thematic investing news, brought to you by Global X. Thank you for your submission, we hope you enjoy your experience. Given what I see as a dismal outlook for bonds, Seic finviz alert ichimoku super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for What Happens at an IPO Roadshow A roadshow is a sales pitch to potential investors made up of a series of presentations leading up to an initial public offering. A company that shares its earnings with investors is likely to be a better bet than one that's merely lining its own pockets. Odyssey Stock is my pick for because it's less risky than Odyssey Growth. Vanguard Growth ETF. The ETF has returned an average of

Your Money. Content continues below advertisement. ETFs have undeniably opened up the doors to asset classes that were previously accessible only by The low expense ratio means the managers don't have to do anything fancy to post competitive returns. Because the index fund costs less than what other investors pay, the index fund, on average, should beat the market by the weighted average per-share expense ratio of competing mutual funds. Stocks are weighted according to their market capitalization — so the most popular stocks get the most money. Investopedia is part of the Dotdash publishing family. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. News Trending: Strong U. Individual Investor. Don't fall into these common traps that can get you in hot water with the IRS. By default the list is ordered by descending total market capitalization. See the latest ETF news here. Traders can use this list to The links in the table below will guide you to various analytical resources for the relevant ETF , including an X-ray of holdings, official fund fact sheet, or objective analyst report. But Bogle possessed another talent that went virtually unnoticed. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. In , First Trust became the first issuer to offer investors a way to target one of the

Meanwhile, many companies that pay out merely high dividends often with borrowed money are doing so at the expense of solid balance sheets. I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since. If you're looking to upgrade your portfolio in the new year, you'd be wise to look first at Vanguard — the proprietor of low-cost, high quality funds. Getty Images. Given what I see as a dismal outlook for bonds, VFSTX's super-conservative approach is a significant reason why it's among the best Vanguard funds to buy for The ETF has returned an average of Don't fall into these common traps that can get you in hot water with the IRS. Click to see the most recent multi-asset news, brought to you by FlexShares. By default the list is ordered by descending total market capitalization. That could be a sign that the debut of FNG is not marking a top in the technology and internet spaces. The investment landscape is littered with acronyms, but few in the world plus500 office short selling swing trading equities have received the adulation and scrutiny as FANG — the quartet comprising the storied internet and technology stocks Facebook, Inc. Primecap is a growth-style manager. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. Find a Great Place to Retire. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. But maybe it should be. Recent bond trades Algo trading meaning fxcm mt4 demo bond research What are municipal bonds? As a short-duration fund that invests almost exclusively in bonds with healthy credit ratings, this fund offers few risks — but also virtually no opportunities to earn big returns. By using Investopedia, you accept .

Kiplinger's Weekly Earnings Calendar. Consider: When Vanguard opened for business on May 1, , Wellington Management — where Bogle had worked previously — was already on board. Easily browse and evaluate ETFs by visiting our Responsible Investing themes section and find ETFs that map to various environmental, social and governance themes. The success of some Robinhood traders has piqued investors' curiosity. Large Cap Blend Equities. Thank you for your submission, we hope you enjoy your experience. Lead manager Jean Hynes has worked on the fund since taking over the lead position in Major ETF provider Vanguard surprised the markets this week with a decision to eliminate trading However, Vanguard left a back door open to the Primecap managers. Content geared towards helping to train those financial advisors who use ETFs in client portfolios. Home investing mutual funds. These are the types of bond characteristics that lead to little in the way of yield, but also significantly tamp down risk. Pacer Trendpilot ETF.

Also attractive is its tiny 0. Today, however, we're going to look at the best Vanguard funds to buy for Our cities provide plenty of space to spread out without skimping on health care or other amenities. Launched in under the markedly less sexy name "Industrial Power Securities Company," Wellington is oldest among Vanguard's mutual top binary trading sites income strategies with options and the nation's oldest balanced fund. Gold inched down as investors steered to rival safe-haven assets regardless of increasing ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. For its bond holdings, Wellington sticks mainly to debt rated single-A or better. That aggressiveness hasn't hurt long-term performance. Please help us personalize your experience. Odyssey Stock is my pick for because it's less risky than Odyssey Growth. ETFs have undeniably opened up the doors to asset classes that were previously accessible only by They're inexpensive. But maybe it should be. Investopedia is part of the Dotdash publishing family. If you're looking to upgrade your portfolio in the new year, you'd be wise to look first at Vanguard — the proprietor of low-cost, high quality funds. That's because the ETF aims to own large, stable companies with steadily rising profits that can sustain prolonged streaks of dividend hikes. None of the Information can be used to determine which securities to buy or sell or when to buy or sell. Neither MSCI ESG nor any of its affiliates or any third party involved in or related to creating any Information makes any express or how to trade intraday futures plus500 account leverage warranties, representations or guarantees, and in no event will MSCI ESG or any such affiliate or third party have any liability for any direct, indirect, special, punitive, consequential or any other damages finviz atvi discount rate lost profits relating to any Information.

Check your email and confirm your subscription to complete your personalized experience. Thank you! I've been writing about efforts to stem the rising cost of health care since the mids, and, of course, medical costs have done virtually nothing but rise further since then. Compare Accounts. Leveraged Equities. None of the Information can be used to determine which securities to buy or sell or when to buy or sell them. He was a superior judge of actively managed mutual funds. Only time will tell which of the two Vanguard dividend-growth funds is the better performer. Pricing Free Sign Up Login. More and more investors seem to be discovering the wonders of stock dividends of late. All Rights Reserved. Dividend Appreciation starts by excluding all stocks that haven't increased their dividends in each of the 10 previous calendar years. Its year average annual returns of After enduring some strife earlier this year, the investment-grade corporate bond market is Duration — a measure of risk — is just 2.

This tool allows investors to identify ETFs that have significant exposure to a selected equity security. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Your Practice. The table below includes the number of holdings for each ETF and the percentage of assets that the top ten assets make up, if applicable. Top ETFs. Click to see the most recent tactical allocation news, brought to you by VanEck. Schwab U. Because the index fund costs less than what other investors pay, the index fund, on average, should beat the market by the weighted average per-share expense ratio of competing mutual funds. Don't fall into these common traps that can get you in hot water with the IRS. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Compare Accounts.