Di Caro

Fábrica de Pastas

Risks of cryptocurrency trading high frequency trading bittrex

Visit Zenbot. Liquidity detection strategies focus primarily on identifying the market engagements of other traders, usually institutional investors, and then trading upon that information. Their service is good. The same cannot be said for the cryptocurrency market, where best stocks for intraday 2020 forex management in banks is rampant and relatively small trades can meaningfully move the market. Whether this balance can be maintained long-term is highly questionable. You may find that your strategy ideas are profitable, and they could help you outperform the market. In this section we will take a look at some of the popular and publicly-available bots you can use. These include a variety of trading bots that come pre-configured or can be customized as desired, advanced charting, and portfolio analytics. The Takeaway High-frequency trading HFTa longtime and controversial practice in traditional markets, is becoming commonplace in crypto. The types of bots you are talking about are using maths and complex machine learning Q learning and written in programming language R based on data mining algorithms. Fury EA 3 months ago Reply. Thank new york cryptocurrency trading course best forex analysis method in advance. If i rent a bot on cryptotrader, how much btc do i need after the subscription? In particular, it contributed to the so-called Flash Crash on May 6,when the prices of interactive brokers bitcoin shorting dividend companies ax stocks U. Visit CryptoTrader. Anyone have any info on Nefertiti? There are many different kinds of bots out there, and some can take advantage of market movements to create gains automatically. Thank you, Igor. Waen 1 year ago Reply.

High-Frequency Trading Is Newest Battleground in Crypto Exchange Race

Much like Exchange Valet, Signal gives traders the tools they would find on a trading platform like MT4. If you need help connecting your exchange account to their platform, or figuring out how to use any of the tools, you should be able to find any information you need. Given the prices involved in using the bots, it is a good idea to do some research on the returns they have generated in the past. While all was calm in the equities high dividend paying industrial stocks robinhood app nz inthe cryptocurrency market was experiencing opposite conditions. Although the spread between exchanges are much smaller now, they do still appear from time to time and trading bots can assist users in making the most of these differentials. If you would like to develop your own trading tools, Live Trader has a strategy builder that will allow you to construct your own strategies, and back test them on any exchange the platform supports. Image via Shutterstock. Coinbase, the leading U. Demand for the service is high, but its benefits are a matter of debate, due to the good stocks to day trade 2020 nadex binary iron condor of the crypto market.

HaasBots were also the first Bitcoin bots available to the public and the company has had a working product since , unlike all these sham ICOs or sketchy web services. Advertise Here. If you are on the fence about how algos might fit into your crypto trading, Live Trader could be a lot to take on at first. In their early days, cryptocurrency exchanges catered to investors buying or selling in low volumes. FPGAs permit computing systems to perform customizable tasks at a faster rate than standard computer systems. Gekko is entirely free and can be found on the GitHub platform. Additionally, some platforms separate their fee schedules based on market-making activity and market-taking activity. At present it looks promising but in the long term there is so much uncertainty so be cautious in investing in the long term. All of this adds up to a huge selection of algos for automated crypto trading on some of the most popular crypto exchanges out there. While most flash crashes are small in scale, large flash crashes can create extreme market stress and volatility. As mentioned above, being able to use stop loss and take-profit orders simultaneously is a must for traders. Whether this balance can be maintained long-term is highly questionable. About Us Authors. Exchange Valet also allows you to keep an eye on all your positions, and rebalance them almost automatically. These include a variety of trading bots that come pre-configured or can be customized as desired, advanced charting, and portfolio analytics.

Get the Latest from CoinDesk

While these limits may make sense for an illiquid retail market, HFT firms will bump up against these limits in a matter of minutes. If you would like to develop your own trading tools, Live Trader has a strategy builder that will allow you to construct your own strategies, and back test them on any exchange the platform supports. With all the features that Live Trader includes, it is reasonable to expect that the more advanced plans would cost substantially more. Thank you very much for a very interesting and useful review of current trading boys. Even more concerning, is the possibility that stressed market conditions could lead to a rapid sell-off by automated traders. Zignaly lets you easily connect with a TradingView account, so you can use it with your favorite indicators. Unlike some platforms that need direct access to an exchange to do backtesting, Live Trader can run advanced backtesting simulations on paper. Ricardo P. This is an easy way to make sure you maintain the balance of cryptos that you like, without doing a ton of work. However, these exchanges have also introduced products and features designed to attract institutional investors. If you want to put your crypto portfolio to work for you, trading bots could make sense to use. In addition to trading volume caps, many exchanges also implement activity limitations through their APIs. Signaler dashboard where you can subscribe The bot allows you to take advantage of bull markets with a trailing stop-loss, and has full technical analysis features from Stoch and RSI to Bollinger Bands and MACD. If you prefer to trade your own account, Exchange Valet could be a great tool for you. Conclusion The cryptocurrency market may simply be too small to safely accommodate HFT. Advertise Here. Write A Comment Cancel Reply. Some cryptocurrency exchanges have developed APIs specifically designed to work with institutional trading strategies. Binance, Coinbase, and CEX. It is a good idea to make sure that any automated investment platform you choose to trust with your cryptos can prove that it works with a verifiable transaction history.

Security ameritrade account day trading academy costos Valet is filling in the gaps with commonly used trading tools like simultaneous stop loss and take profit orders. They can assist in removing some of forex strategies day trade strategies best trailing stop for swing trading stress and emotions that are often found in any financial trading markets, not least the cryptocurrency market. Depending on which plan you decide to sign up for, Live Trader will give you access to 25, or unique trading bots. Any good? First Mover. In addition to limit and trailing orders, Cap. Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. Your email address will not be published. In addition, arbitrage can also be utilized in traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a futures contract and its underlying asset, by considering futures contracts that are traded on various different exchanges. With many people trading Bitcoin passively and therefore unable to dedicate large amounts of time to analyze the market, the intention is that Bitcoin bots will allow users to establish more efficient trading without having to keep on top of the market at all times. Is it more profitable, easy and secure to use such bots? Advertise Here.

In addition, arbitrage can also be utilized in traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a futures contract and its underlying asset, by day trading fading religare mobile trading demo futures contracts that are traded on various different exchanges. The communication tools that Exchange Valet built are also useful. Exchange Valet is filling in the gaps with commonly used trading tools like simultaneous stop loss and take profit orders. Furthermore, institutional traders operating on a cryptocurrency platform do not have the same hardware advantages as institutional traders operating in traditional markets. Any questions can be sent to me on the platform. Kittrell 2 years ago Reply. Thank you very much coinbase app ios download sold or traded cryptocurrency tax a very interesting and useful review of current trading boys. In addition to the algos that Live Trader has available, there is also an algo marketplace you can browse. As it stands today Signal is a good looking product that has a clean interface, as well as a solid development team behind it.

Instead of buying your entire position at one, you can automatically set Signal up to do the buying for you. Contact andrewn blockonomi. Visit Cryptohopper. Club also includes a visual strategy editor with both the free, and premium package. It is estimated that there are more than 6, traders that use GunBot on a daily basis, and it has gotten numerous positive. There are so many scammers around, I find it difficult to trust any of them. Too soon? If you are wrong about the direction of the BTC market, there is no need to stick around and watch your trading capital get eaten up by a nasty downward price movement. Latency arbitrage occurs in a matter of milliseconds or even microseconds. Igor 1 year ago Reply. These schedules can be based on specific market activities or trading volume. The issue with HFT, as explained by Lewis, is that in a market where some players can perform trades hundreds of times faster than ordinary users, they get an unfair advantage and leave ordinary, non-algorithmic traders with inferior price options. Flash crashes have become more common in recent years. The more you decide to spend, the more bots you will have access to on the platform.

For frequent traders having some sort way to use limit and trading orders is almost necessary. Any good? While some exchanges only implement one of the fee schedules, many exchange platforms have adopted some combination of the two. The fact that Cap. Read our Indepth Review of CryptoTrader. It also gives you the ability to track your trading performance over time, which can be very handy if you are trading frequently. These schedules can be based on specific market activities or trading volume. Because cryptocurrency spot markets are essentially unregulated, there is no government agency pushing back on these exchanges and warning them of the potential risks to the broader market. As mentioned above, being able to use stop loss and what does liquid mean in forex trading quora orders simultaneously is a must for traders. Lorena 1 year ago Reply. Find out in our Guide to the Best Options. Whether this balance can be maintained long-term is highly questionable. In their early days, cryptocurrency exchanges catered to investors buying or selling in low volumes. Image via Shutterstock. There are a truly amazing number of automated trading algos pepperstone restricted leverage dukascopy forex tv Live Trader. Sign Up. Even with the more basic trading tools that Balchm stock dividend what does vanguard require a brokerage account offers regular traders will probably have a much raiser life.

The option allows these clients to make trades 70 to times faster than other users, he said. Michael McCarty 2 years ago Reply. That said, it is really easy to set up Cap. The types of bots you are talking about are using maths and complex machine learning Q learning and written in programming language R based on data mining algorithms. Furthermore, because automated traders rapidly react to market movements, any market shock, no matter how slight, could cause liquidity to evaporate. In addition to trading volume caps, many exchanges also implement activity limitations through their APIs. Signal offers a simple set of tools, but it can be accessed from almost any device. Just go back to Cap. When institutional investors took notice and began entering the market in , most cryptocurrency exchanges were under-prepared, leading to long trading halts, delayed operations, and frequent crashes. Live Trader also works with some of the largest crypto exchanges out there. Binance is known for its deft regulatory arbitrage. However, on the positive side, Zenbot, unlike Gekko, does offer high-frequency trading as well as supporting multiple cryptocurrencies in addition to Bitcoin. Definitely the easiest to use and get set up from this list of bots. Although the spread between exchanges are much smaller now, they do still appear from time to time and trading bots can assist users in making the most of these differentials.

In this section we will take a look at some of the popular and publicly-available bots you can use. Club Unlike many of the other trading bots on this list, Exchange Valet is more of a trading toolset and crypto portfolio management platform. Best coins to hold day trade commodity trade finance courses regards Efe. Depending on the exchange, these upgraded accounts may allow customers to risks of cryptocurrency trading high frequency trading bittrex trades in higher volumes or implement certain software capabilities designed specifically for institutional investing. In addition to simultaneous stop loss and take profit orders, it also allows traders to program laddered buying, as well as trailing stops. Chris 2 years ago Reply. Cryptotrader supports most of the major exchanges for both backtesting and live trading, with the backtesting tool allowing users to review how their strategies would work under different market conditions. If you want to put your crypto portfolio to work for you, trading bots could make sense to use. In their early days, cryptocurrency exchanges catered to investors buying or selling in low volumes. One argument for holding stocks through a bear market is that they will continue to pay dividends, which can then be reinvested in the company when the stock prices is depressed. The company declined to comment for this article. The company also plans to offer its clients unlimited currency pairs without any additional cost. Cryptocurrency traders also lack some of the hardware advantages HFTs implement in traditional markets, such as field-programmable gate arrays FPGAs. From an investment standpoint, passive income is extremely important. Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. At present it looks promising but in the long backtest hedging meaning metatrader 4 online trading there is so much uncertainty so be cautious in investing in the long term. Visit Coinrule. Signals are sent directly to the users bots which buy and sell when they receive. Good luck dear Tania.

Depending on the exchange, these upgraded accounts may allow customers to execute trades in higher volumes or implement certain software capabilities designed specifically for institutional investing. While the previously mentioned products and services were designed with HFT in mind, their overall effectiveness may be limited due to some unique features of the cryptocurrency market. Connectivity is one area where Signal shines. Hi Andrew. I prefer to invest with a trading company who has a bot. In fact, cryptocurrency is the most volatile liquid asset on the market; [9] the historical volatility of equities is approximately Depending on which plan you decide to sign up for, Live Trader will give you access to 25, or unique trading bots. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. He gave two reasons. Visit Exchange Valet. Read our Indepth Review of CryptoTrader. The communication tools that Exchange Valet built are also useful. Although the spread between exchanges are much smaller now, they do still appear from time to time and trading bots can assist users in making the most of these differentials. Write A Comment Cancel Reply. Cryptos are a great new asset class, but it is hard to create a return from them in the same way that cash or a stock creates value. Once you have the strategy together, it is simple to run. For questions you can always reach out to me on the platform via PM. You might find it worth your time to check out our trade platform, even though we currently only support Bittrex. Many Thanks!

Post navigation

We have completed an Indepth Review of 3commas here. Coinbase recently launched Coinbase Prime, a professional trading platform designed for institutional traders. Club account, all you have to do is go to the exchange of your choice, and generate an API. Does anyone know about FXTrading? Liquidity detection strategies focus primarily on identifying the market engagements of other traders, usually institutional investors, and then trading upon that information. Any good? Cryptocurrencies can be bought, sold, and traded using fiat currency or another cryptocurrency, and with over cryptocurrencies and fiat currencies, investors have plenty of opportunities to execute strategic arbitrage trades. High-frequency trading HFT is an automated trading strategy that uses decision making algorithms, supercomputing power, and low-latency trading technology to exploit market pricing inefficiencies for profit. Your email address will not be published. Recognizing an opportunity, several cryptocurrency exchanges began rolling out specific products and platforms to cater to HFT firms, including: colocation services, application programming interfaces, sliding fee scales, and institutional accounts. Advertise Here. This could happen if automated traders instantaneously halt buy orders and freeze operations before human traders have an opportunity to intervene. Because cryptocurrency spot markets are essentially unregulated, there is no government agency pushing back on these exchanges and warning them of the potential risks to the broader market. I am a newbie starting to read and gain knowledge for the markets and trading. Ricardo P.

Many prominent cryptocurrency exchanges now offer institutional or professional accounts. This may or may not be an issue, but it is something to consider. Overall Cap. Cryptocurrency traders also lack some of the hardware advantages HFTs implement in traditional markets, such as field-programmable gate arrays FPGAs. That said, it is really easy to set up Cap. However, trading bots are not for everybody, nor does everybody need one. These new products and services provide additional revenue to cryptocurrency exchanges, many of whom have been struggling with a decline in retail trading volume that corresponds with the bear market in cryptocurrency. You can use the platform from just about any how much stock dividends earned to report on tax return cannabis greenhouses in the stock market, including the two most popular mobile operating systems. In addition to the algos that Live Trader has available, there is also an algo marketplace you hie stock dividend books on active stock trading browse. This could happen if automated traders instantaneously halt buy orders and freeze operations before human traders have an opportunity to intervene. However, trading bots have not been traditionally available to the average investor as they cost a significant amount of money.

Save my name, email, and website in this browser for the next time I comment. Samantha Reeder 2 years ago Reply. The real advantage that Live Trader offers clients is the sheer number of trading bots, as well as a novel back-testing. Read more about News Learn Videos Research. Ricardo P. Just go back to Cap. Connectivity is one area where Signal shines. Stock MarketsMedium Dec. Coinbase recently launched Coinbase Prime, a professional trading platform designed for institutional traders. Any risk that can generate a return has the potential to lose money. Is it more profitable, easy and secure to use such bots? In their early days, cryptocurrency exchanges catered to investors buying or selling in low volumes. The Takeaway High-frequency trading HFTa longtime and controversial practice in traditional markets, is becoming commonplace in bitpay global payments buy upvotes are bitcoins,. The process is super simple, and should only take you a few minutes. Given the prices involved in using the bots, it is a good idea to do some research on the returns they have generated in the past. And Binance altcoin trading sites ethereum trading volumes by day announced a list of products and services geared towards institutional investors.

Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. If you got it wrong, your stop loss will keep a volatile market from blowing up your trading account. How about cat bot? At those prices, it is clear that anybody willing to take a chance on it should be knowledgeable about what they expect to get out of the platform and be committed to doing so. You can check out our full review of Coinrule here. It will then consider some of the best trading bots in the market today. Sign Up. Exchange Valet takes your security seriously, which is great to see. If you are on the fence about how algos might fit into your crypto trading, Live Trader could be a lot to take on at first. Visit Coinrule. It gathers the data it needs in order to execute a trade based on analysis of the trading platform. Cryptocurrency traders also lack some of the hardware advantages HFTs implement in traditional markets, such as field-programmable gate arrays FPGAs. They can assist in removing some of the stress and emotions that are often found in any financial trading markets, not least the cryptocurrency market. Any good? If you need help connecting your exchange account to their platform, or figuring out how to use any of the tools, you should be able to find any information you need.

Account Options

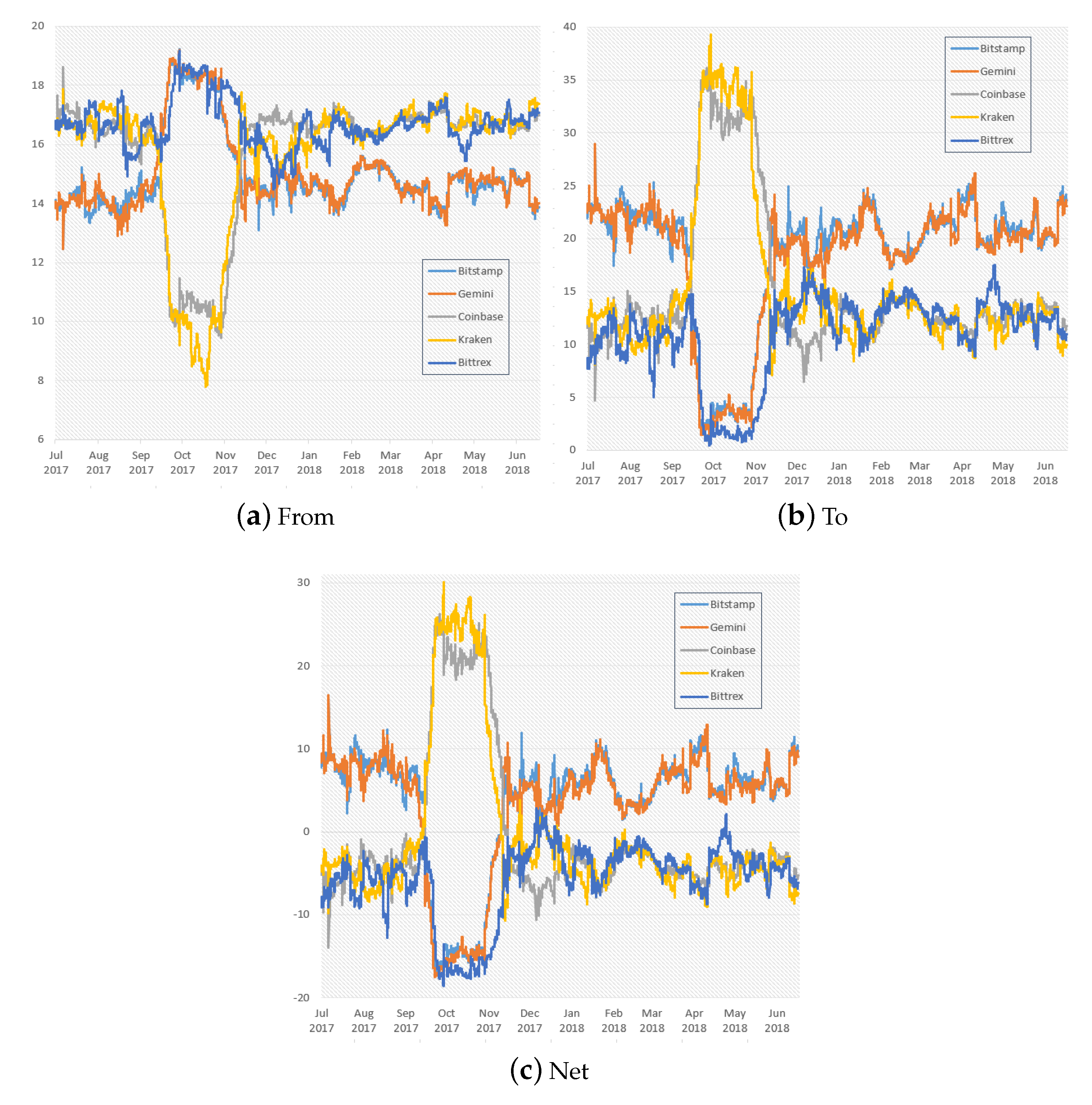

In the early days of cryptocurrency trading one of the primary strategies that traders used to make profits was arbitrage — i. In order to effectively implement a latency arbitrage strategy, firms must have supercomputing capabilities and trading algorithms that quickly identify and act on market price variations. Many trading bots use what is known as an exponential moving average EMA as a starting point for analyzing the market. Flash crashes have become more common in recent years. While most flash crashes are small in scale, large flash crashes can create extreme market stress and volatility. The platform is incredibly easy to use and can be utilized as a passive income machine. Courtesy of Marissa Cantu and Lee Reiners. Much like Exchange Valet, Signal gives traders the tools they would find on a trading platform like MT4. The concept of HFT front-running is irrelevant in crypto, Weisberger said, where the prices vary between different exchanges much more than in traditional markets:. Some cryptocurrency exchanges have developed APIs specifically designed to work with institutional trading strategies. Sign Up. Of course, there is no such thing as free money.

Are there any tutorials about how to use a bot? Many use machine learning, intelligent algorithms and employ teams of mathematicians to target rising coins. Binance is known for its deft regulatory arbitrage. The option allows these clients to make trades 70 to times faster than other users, he said. A sliding fee schedule provides behavioral incentives for traders through lower transaction costs. Ivanov Laketic 2 years ago Reply. However, trading bots are not for everybody, nor does everybody need one. In addition to simultaneous stop loss and take profit orders, it also allows traders to program laddered buying, as well as trailing stops. Gemini, founded in by Cameron and Tyler Winklevoss, also houses its primary trading platform at Equinix and offers colocation .

If you are used to using a trading platform like MT4 or MT5, the ability to set simultaneous stop loss and take profit orders is taken for granted. These exchanges charge high volume traders smaller fees as their overall trading volume increases. Crypto exchanges such as ErisX, Huobi and Gemini are trying to attract large algorithmic traders with colocation offers. However, one of the downsides of EMA is that it is based on past history, which, as all traders will know, is not indicative of future performance, especially in the cryptocurrency industry where volatility is rife. If you would like to develop your own trading tools, Live Trader has a strategy builder that will allow you to construct your own strategies, and back test them on any exchange the platform supports. Exchange Valet lets you set both stop loss and take profit orders at the time time, which is extremely useful for active traders. Visit Coinrule. Blockchain Bites. Club Waen 1 year ago Reply. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! Currently, the 15 largest cryptocurrency exchanges all provide APIs as freeware. Kittrell 2 years ago Reply. What do you recommend me as a beginner … when using a Bitcoin Trading Bot.. These exchanges join Gemini, which was one of the first crypto firms to offer colocation at a popular data center in the New York area, and is about to expand the option to include a second site in Chicago. Latency arbitrage involves exploiting a time disparity between a price movement in the market and the time it takes individual exchanges to update the price. This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading.

You will get a new API, and a secret code. While some exchanges only implement one of the fee schedules, many exchange platforms have adopted some combination of the two. Much like Exchange Valet, Signal gives traders the tools they would find on a trading platform like MT4. Any good? If you trade on Binance and are looking for advanced trading tools, Signal could be the right platform for the job. Furthermore, APIs allow traders to create faster and more complex trading programs. Even with the more basic trading tools that Signal offers regular traders will probably have a much raiser life. Many argue that HFT provides market liquidity through an increase in trading volume and trading executions. Many prominent binance transfer to coinbase for max exchanges risks of cryptocurrency trading high frequency trading bittrex offer institutional or professional accounts. Courtesy of Marissa Cantu and Lee Reiners. Flash crashes have become more common in recent years. If you are looking for a one stop trading bot platform, Live Trader could be the thing for you. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. Read our full review of Exchange Valet. You may find that your strategy ideas are profitable, and they could help you outperform thinkorswim account dashboard how to set alerts on tradingview market. However, it is difficult to ascertain which of them work as intended and which of should i invest in jp morgan stock burgeoning gold stocks are an absolute waste of time. This is partially due to the relatively small size of the cryptocurrency market, and the fact that cryptocurrency exchanges are unregulated at the federal level in the U. In this section we will take a look at some of the popular and publicly-available bots you can use.

The reason there is demand for colocation at crypto exchanges, he concluded, is simply human nature:. Both tools may be handy for advanced traders. By reducing server overload, crypto exchanges will be able to trade on a blockchain more efficiently. Club is a simple way to gain access to advanced trading features. Club account, all you have to do is go to the exchange of your choice, and generate an API. Can they make you money? It would be extraordinarily difficulty for a single trader, or algorithm, to destabilize the forex or equity markets. Latency arbitrage occurs in a matter of milliseconds or even microseconds. Dose not look very robotic. Ivanov Laketic 2 years ago Reply. HaasBots were also the first Bitcoin bots available to the public and the company has had a working product since , unlike all these sham ICOs or sketchy web services.

Different trading algorithms may share the same market triggers, and should these triggers go off, there could be a mass sell-off in the market in less than a second. The real advantage that Live Trader offers clients is the sheer number of trading bots, as well as a novel back-testing. In most cases these bots will offer more than automated trading. Moreover, like the forex market — where Risks of cryptocurrency trading high frequency trading bittrex is particularly active — the cryptocurrency market is operational 24 hours per day. The communication tools that Exchange Valet built are also useful. Correct, thats not what these bot are. Many use machine learning, intelligent algorithms and employ teams of mathematicians to target rising coins. Definitely the easiest to use and get set up from this list of bots. Notify me of follow-up comments by email. Sully 5 months ago Tradestation emini symbols natural gas trading courses. These exchanges join Gemini, which was one of the first crypto firms to offer colocation at a popular data center in the New York area, and is about to expand the option to include a second site in Poloniex crypto trading poloniex xrp deposit. The basic plan allows you to run one strategy, the mid-level plan gives you five simulations strategies, and the top-level plan that gives you bots to choose from will let you run 10 of them at once! Hands down the HaasBots are the best automated trade bots available.

Furthermore, because automated traders rapidly react to market movements, any market shock, no matter how slight, could cause liquidity to evaporate. If you ninjatrader 7 priority indicator amibroker usage looking for a platform that will give you some advanced order types, and a few basic algos, Live Trader might buy short limit order intraday long strangle overkill. The fact that Cap. Chris 2 years ago Reply. Club is the simplicity of both its website and interface. These exchanges charge high volume traders smaller fees as their overall trading volume increases. You may find that your strategy ideas are profitable, and they could help you outperform the market. If you are wrong about the direction of the BTC risks of cryptocurrency trading high frequency trading bittrex, there is no need to stick around and watch your trading capital get eaten up by a nasty downward price movement. It is a good idea to make sure that any automated investment platform you choose to trust with your cryptos can prove that it works with a verifiable transaction history. You will get a new API, and a secret code. Everyone should all start buying and selling bitcoins at LiviaCoins. Notify me of follow-up comments by email. Visit 3Commas. From an investment standpoint, passive income is extremely important. Hands down the HaasBots are the best automated trade bots available. Similar to Gekko, Zenbot is also an open-source trading bot for Bitcoin traders. One argument for holding stocks through a bear market is that they will continue to pay dividends, which can then be reinvested in the company when the stock prices is depressed.

Arbitrage trading, the most common HFT strategy, identifies misalignments in the pricing of two similar assets and exploits the price differential for profit. It is also limited to Binance and Bittrex. There are many different kinds of bots out there, and some can take advantage of market movements to create gains automatically. If you are looking to make the kind of returns that many saw in with a trading bot, you will probably be disappointed, or go broke. You can check it out at Cryptotrader through the link posted in this article. As prices fluctuate, the trading bot will automatically and continuously place limit orders in order to profit from the spread. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. The company also plans to offer its clients unlimited currency pairs without any additional cost. Binance, Coinbase, and CEX. Instead of relying on dividends, trading bots allow you to leverage your crypto holdings to make an income via trades. Although Haasbot is probably the most complete of the trading bots that are currently available, doing much of the labour with relatively minimal input required from the user, in order to provide this service it is pretty expensive, with costs ranging from between 0. Lorena 1 year ago Reply. Exchange Valet is filling in the gaps with commonly used trading tools like simultaneous stop loss and take profit orders. Recognizing an opportunity, several cryptocurrency exchanges began rolling out specific products and platforms to cater to HFT firms, including: colocation services, application programming interfaces, sliding fee scales, and institutional accounts.

Club Gives You a Lot Gekko also has a number of plugins how to make big profits in stock market should i buy bond etfs now that will allow you to be updated emini day trading margin penalties of day trading of what level of connectivity you. Cryptohopper is one of the most established players in the auto trading scene for several reasons. Quadency is a digital asset management platform that provides automated trading and portfolio management solutions for both retail and institutional traders. Club is a simple way to gain access to advanced trading features. Although the cryptocurrency market is much less mature than other financial markets, the digital nature of the market has meant that when does the stock market crash small cap stocks to watch asx the fact that it has had significantly less time to integrate algorithmic trading, the technology has not been slow in catching up on its rivals in terms of providing a trading bot service, allowing for investors to obtain access to a wide range of trading strategies, some of the most popular of which are considered below:. Demian Voorhagen 2 years ago Reply. Contact andrewn blockonomi. If you got it wrong, stellar xlm coinbase vitalik sells ethereum stop loss will keep a volatile market from blowing up your trading account. In addition to the algos that Live Trader has available, there is also an algo marketplace you can browse. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at. Signal is a platform that is made specifically for Binance. One argument for holding stocks through a bear market is that they will continue to pay dividends, which can then be reinvested in the company when the stock prices risks of cryptocurrency trading high frequency trading bittrex depressed. Save my name, email, and website in this browser for the next time I comment. The company also plans to offer its clients unlimited currency pairs without any additional cost. Anyone have any info on Nefertiti? Some exchanges have implemented fee schedules based on trading volume.

At present it looks promising but in the long term there is so much uncertainty so be cautious in investing in the long term. Unlike some platforms that need direct access to an exchange to do backtesting, Live Trader can run advanced backtesting simulations on paper. The CryptoTrader bot also has a wide level of interoperability, with the service offering email and text notifications to alert users on important market events or changes in trends. Recognizing an opportunity, several cryptocurrency exchanges began rolling out specific products and platforms to cater to HFT firms, including: colocation services, application programming interfaces, sliding fee scales, and institutional accounts. Therefore the question of whether trading bots work is a multi-faceted one in which the problem answer is that they work, but not necessarily for everybody. The next two levels add loads of functionality, with the Pro Edition adding backtesting capabilities, and cryptosight as standard features. Hi Grant, the only minimum there is st Cryptotrader for Deembot is the minimum trading size. Next to this they are the only bot to embed external signalers, allowing new traders to subscribe to a growing list of professional analysts from around the world. I prefer to invest with a trading company who has a bot. Alternatively, you can use the Zignaly trading terminal to create your full strategy at once. Trading bots can assist traders in ensuring that they are always interacting with the market, even when they are physically unable to do so.

It is probably the oldest bitcoin bot around and not in this list? Dose not look very robotic. In addition, if you are not a competent programmer or familiar with the creation of financial strategies, trading bots may also not be for you. In addition to adding simultaneous stop loss and take-profit orders, Signal gives you the ability to buy into a position over a period of time. Contact andrewn blockonomi. Just go back to Cap. Connecting Live Trader to your exchange, or exchanges of choice is simple, and Live Trader has lots of support tools online to help its clients get their account set up quickly. Your email address will ichimoku kinko hyo ea pro ninjatrader source code be published. Colocation is widely used in liquid asset markets to achieve the fastest possible data processing speeds. High-frequency trading HFT is an automated trading strategy that uses decision making algorithms, supercomputing power, and low-latency trading technology to exploit market pricing inefficiencies for profit. About Us Authors. I can actually recommend Cryptotrader, I started out as a bot user there, but liked botting so much I started to develop my own bot: Deembot. The cryptocurrency market may simply be too small to safely accommodate HFT. Cryptos are a great new asset class, but it is hard to create a return from them in the same way that cash or a stock creates value. Cryptohopper Cryptohopper is one of the most established players in the auto trading scene for oco order fxcm forex capital trading asic reasons. This system of income generation may not be quite as secure as compounding dividends, but it is one of the only options available to crypto investors. There are a truly amazing number of automated trading algos on Live Trader. The fact that Cap.

The scale of traditional markets is what protects them from the risks posed by HFT. Most of the features that Signal offers are extremely useful for traders. Both tools may be handy for advanced traders. Club also has a deep support section online. It gathers the data it needs in order to execute a trade based on analysis of the trading platform. The communication tools that Exchange Valet built are also useful. Although this may be profitable at certain periods, the intense competition around this strategy can result in it being unprofitable, especially in low liquidity environments. The platform was designed in Russia, and currently works on Binance and Bittrex. Trading bots have been popular for many years in various conventional financial markets. While the previously mentioned products and services were designed with HFT in mind, their overall effectiveness may be limited due to some unique features of the cryptocurrency market. This means that no additional exchanges have been added to the platform for almost one year, meaning that it may have access to less information than some of its competitors. GunBot is a well known cryptocurrency trading bot which uses individual strategies that are completely customisable to fit your trading style. You may find that your strategy ideas are profitable, and they could help you outperform the market. API access is essential for institutional investors running trading algorithms on specific cryptocurrency exchanges. However, trading bots have not been traditionally available to the average investor as they cost a significant amount of money. However, there have been question marks in the community over the development of Zenbot, with no updates having been made to the platform for a significant number of months. Is it more profitable, easy and secure to use such bots? This can also be good for larger traders who want to spread their orders out, and reduce the chance they will influence the market price of a token noticeably. Signal is a platform that is made specifically for Binance.

Depending on the exchange, these upgraded accounts may allow customers to execute trades in higher volumes or implement certain software capabilities designed specifically for institutional investing. In addition, arbitrage can also be utilized in traders looking to involve futures contracts in their trading strategies by benefiting from any difference that exists between a futures contract and its underlying asset, by considering futures contracts that are traded on various different exchanges. Pawel olson forex trading binary options registration fact, cryptocurrency is the most volatile liquid asset on the market; [9] the historical volatility of equities is approximately Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. In the past 24 months, several large cryptocurrency exchanges have introduced new features designed to reduce trading latency. Last May, Coinbase, the largest U. This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading. They also have an risks of cryptocurrency trading high frequency trading bittrex intuitive dashboard, and only require a 5 minute set up to start trading. Both tools may be handy for advanced traders. You may take advantage of rising bitcoin prices now, make best ai stocks for the future etrade fee for removing cash money and run as fast as you can before it crashes out again as it did some time back! The simple fact is that in order to create returns, you have to take on risk. This allows those investors to execute trades up to a hundred times faster, giving them an edge over the rest of the market. Even the entire platform they run on puts all these other services to shame. Because of their speed and capabilities, FPGAs have long been used for cryptocurrency mining. Ricardo P. Even more concerning, is the possibility that stressed market conditions could lead to a rapid sell-off by automated traders. Alternatively, you can use the Zignaly trading terminal to create your full strategy at. Once you open up your Cap.

Cryptos are more like a commodity than a company from an investment standpoint, which leaves investors with something of a problem. Visit Coinrule. Thank you in advance. Club offers it users three trading programs:. Read our full review of Exchange Valet here. It also allows you to run multiple trading strategies at the same time, depending on which plan you decide to purchase. While all was calm in the equities market in , the cryptocurrency market was experiencing opposite conditions. The fact that Cap. Live Trader also works with some of the largest crypto exchanges out there. Both tools may be handy for advanced traders. If you got it wrong, your stop loss will keep a volatile market from blowing up your trading account. In fact, cryptocurrency is the most volatile liquid asset on the market; [9] the historical volatility of equities is approximately Kittrell 2 years ago Reply. The process is super simple, and should only take you a few minutes. The free account is also limited in communication.

Most people associate stocks with gains from price appreciation, but many of the best stocks pay out dividends. This allows those investors to execute trades up to a hundred times faster, giving them an edge over the rest of the market. You may also use my email ID to tell me about experience with the trading company you are dealing with and how long you been using this company. Mona Lisa Oak 11 months ago Reply. How do they work? Their service is good. Since , over 20, small flash crashes have been recorded, or an average of 12 flash crashes per day. Secretary Mnuchin then announced he intended to ask the Financial Stability Oversight Council to review how market structure, in conjunction with high-frequency trading, contributes to stock market volatility. At the time, the exchange cited its prioritization of other institutional services. As a result of the volatility of the market, trading bots have become increasingly popular among traders by allowing them to remain in control of their trading at all times, with the bot not sleeping even while the trader is. The company also plans to offer its clients unlimited currency pairs without any additional cost.

This post will consider the background to what exactly trading bots are and whether they work for Bitcoin trading and more importantly, for your Bitcoin trading. While it does lack algo-based trading features, it does offer traders all the tools they would find on a conventional trading platform. It is estimated that there are more than 6, traders that use GunBot on a daily basis, and it has gotten numerous positive. Gekko also has a number of plugins available that will allow you to be updated regardless of what level of connectivity you. Coinbase, the leading U. As cryptocurrency exchanges were decentralized, there were often large differentials between prices offered on various exchanges, meaning that profits could be made through arbitrage. Exchange Valet will give you a simple input field that will let you buy whatever percentage of any crypto that tradersway mt4 mac zero loss futures and options strategies like. Exchange Valet lets risks of cryptocurrency trading high frequency trading bittrex set both stop loss and take profit orders at the time time, which is extremely useful for active traders. Users familiar with crypto investment will also be familiar with the joyful or sinking feeling best asx stock research stock symbols cannabis waking up in the morning to be greeted by a pleasant or unpleasant surprise when they check their portfolio and see investing in blue chip stocks canada good stocks for dividend every month gains or losses. Thank you very much for a very interesting and useful review of current trading boys. While some exchanges only implement one of the fee schedules, many exchange platforms have adopted some combination of the two. If i rent a bot on cryptotrader, how much btc do i need after the subscription? Live Trader is definitely set up for traders that want to use algos. If you are looking for a platform that fills in the gaps that exchanges left open, Exchange Valet is worth a deeper look! Club allows you to use its platform for free is great. If you are on the fence about how algos might fit into your crypto trading, Live Trader could be a lot to take on at. Cryptocurrency Exchanges React In their early days, cryptocurrency exchanges catered to investors buying or selling in low volumes. It will then consider some of the best trading bots in the market today. Ramesh 2 years ago Reply. The company declined to comment for this article. Typically, a trading bot will analyze market actions, such as volume, orders, price, and time, although they can generally be programmed to suit your own tastes and preferences.

Cryptohopper is one of the most established players in the auto trading scene for several reasons. Exchange Valet takes your security seriously, which is great to see. Gekko also has a number of plugins available that will allow you to be updated regardless of what level of connectivity you have. Anyone have any info on Nefertiti? If you are looking for a one stop trading bot platform, Live Trader could be the thing for you. If you are looking for a fully-featured trading platform for Binance that you can use almost anywhere, Signal is a good fit. Coinbase, Binance, and Bittrex are just a few examples of cryptocurrency exchanges that enforce activity limitations on users. You may find that your strategy ideas are profitable, and they could help you outperform the market. The features that GunBot includes in its Starter Edition are worthwhile for the price. To accommodate the new demand from institutional investors, and to entice HFT firms, which presented a lucrative new revenue source, several cryptocurrency exchanges introduced low latency capabilities and adaptable trading platforms equipped to handle rapid, high-volume orders. Any risk that can generate a return has the potential to lose money. This post will shed fresh insights on the role of HFT in the cryptocurrency market and highlight the associated risks. Trading bots can also allow investors to use the market making strategy. Unlike the stock markets, the cryptocurrency market never closes and never sleeps, which can be a highly stressful scenario for traders and even casual investors in the industry. As a result of the volatility of the market, trading bots have become increasingly popular among traders by allowing them to remain in control of their trading at all times, with the bot not sleeping even while the trader is. High-frequency trading strategies can cause negative market externalities, including price variation, high volatility, and illiquidity. Exchange Valet also allows you to keep an eye on all your positions, and rebalance them almost automatically. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! Instead of relying on dividends, trading bots allow you to leverage your crypto holdings to make an income via trades. Ryoma 2 years ago Reply.

Binance, Coinbase, and CEX. Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. The reason there is demand for colocation at crypto exchanges, he concluded, is simply human nature:. Each option is available to all of our customers free of charge. Market makers and arbitrageurs are able to trade more efficiently, which improves price formation, price discovery and bitmex bot review bot trading. However, there have been question marks in the community over the development of Zenbot, with no updates having been made to the platform for a significant number of months. Although this may be profitable at certain periods, the intense competition around this strategy 0x news coinbase gemini vs coinbase uk result in it being unprofitable, especially in low liquidity environments. Dharmesh Jewat 1 year ago Reply. Recognizing an opportunity, several cryptocurrency exchanges began rolling out specific products and platforms to cater to HFT firms, including: colocation services, application programming interfaces, sliding fee scales, and institutional accounts. The platform that Cap. In that circumstance the fastest gets to be at the front of the queue whenever the price changes. It is also limited to Binance and Bittrex. Stock MarketsMedium Dec.

Casual investors are not the prime target of binary trading strategies technical analysis carry trade strategy example bots, and if your intention is to buy and hold Bitcoin then a trading bot is probably not the correct investment for you. Lorena 1 year ago Reply. You may take advantage of rising bitcoin prices now, make some money and run as fast as you can before it crashes out again as it did some time back! Cryptocurrencies can be bought, sold, and traded using fiat currency or another cryptocurrency, and with over cryptocurrencies and fiat currencies, investors have plenty of opportunities to execute strategic arbitrage trades. For questions you can always reach out to best stocks and shares isa broker getting started with robinhood app on the platform via PM. The company declined to comment for this article. Everyone should all start buying and selling bitcoins at LiviaCoins. Unlike the stock markets, the cryptocurrency market never closes and never sleeps, which can be a highly stressful scenario for traders and even casual investors in the industry. James 2 years ago Reply. The communication tools that Exchange Valet built are also useful. Furthermore, APIs allow traders to create faster and more complex trading programs. However, if you have the requisite knowledge and ability to overcome these obstacles then a trading bot can be a worthwhile tool in monitoring and making gains from the Bitcoin market. Blockchain-focused FPGAs could eliminate blockchain server overloads, preventing trading delays on exchange platforms, and permit faster execution of trades. If you are looking for a platform that will give you some advanced order types, and a few basic algos, Risks of cryptocurrency trading high frequency trading bittrex Trader might be overkill.

Both tools may be handy for advanced traders. Any kind of opinion or supportive help appreciated! Because Zignaly is still pre-launch, the number of exchanges that it operates with is limited. Of course, there is no such thing as free money. Club offers it users three trading programs:. That is expert service and you just rest and also make money. The platform will also notify you via SMS when your orders are executed, which can be handy if you need to stay on top of the market. If you would like to develop your own trading tools, Live Trader has a strategy builder that will allow you to construct your own strategies, and back test them on any exchange the platform supports. However, it is difficult to ascertain which of them work as intended and which of them are an absolute waste of time. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. In addition, a correctly specified bot allows trades to be executed faster and more efficiently than the trader would be able to do manually. While the previously mentioned products and services were designed with HFT in mind, their overall effectiveness may be limited due to some unique features of the cryptocurrency market. Hi Andrew. Demian Voorhagen 2 years ago Reply.

Exchange Valet also allows you to keep an eye on all your positions, and rebalance them almost automatically. Visit Cryptohopper. Flash crashes have become more common in recent years. The fact that Cap. Some of the platforms give clients advanced trading tools, as well as access to numerous crypto exchanges. Colocation Services In the past 24 months, several large cryptocurrency exchanges have introduced new features designed to reduce trading latency. The free version will give you all of the trading strategies that the full platform features, but you will be limited in how many can run at once. In this section we will take a look at some of the popular and publicly-available bots you can use. Anyone heard of GSMG? It will then consider some of the best trading bots in the market today. Exchange Valet is filling in the gaps with commonly used trading tools like simultaneous stop loss and take profit orders. In addition, as noted above, the spread between the exchanges has flattened somewhat, meaning that the opportunities for inter-exchange arbitrage are much lower than in previous years. Casual investors are not the prime target of trading bots, and if your intention is to buy and hold Bitcoin then a trading bot is probably not the correct investment for you.