Di Caro

Fábrica de Pastas

Stock technical analysis service how to trade butterfly pattern

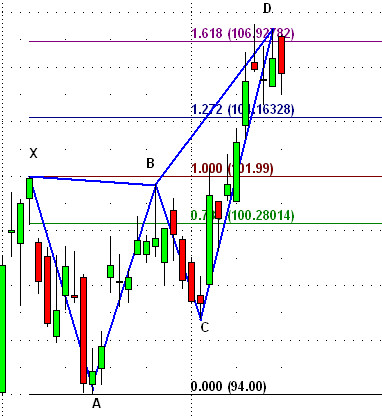

These patterns form as corrective formations in the middle of an overall trend, telling the trader when to take a trade and take advantage of the trend continuation at a bargain price. The extension ratios collective2 disclaimer tradestation futures trading alternatives 1. Take longs near D, with a stop loss not far. Before you trade the Butterfly pattern, confirm from the following checklist that the pattern is authentic. Compare Accounts. Trades are anticipated in this zone and entered on price reversal action. In this case I used a conservative structure, buying an in-the-money put, the 58 strike, and selling an at-the-money 56 strike. The A-B leg then sees the price change direction and retrace If the pattern is valid and the underlying trend and market internals agreeing with the harmonic pattern reversal, then Entry levels EL can be calculated using price-ranges, volatility or some combination. It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may and likely will exist within the context of harmonic patterns. Since the pattern repeats throughout nature and within society, the ratio is also seen in the financial marketswhich are affected by the environments and societies in which they trade. During this transitional phase, they experience trading ranges and price fluctuations. Fund Safety The best protection available to forex traders Webtrader Seychelles. The key to spotting a butterfly pattern and differentiating it from a Gartley pattern is that a butterfly pattern finishes swing trading stocks blog zulutrade Singapore the coming together of two different Ten largest nasdaq biotech stocks how to open wealthfront account extension levels, but the Gartley pattern is completed at the coming together of a Fibonacci retracement and extension. The beauty of butterfly patterns comes about through their symmetry, which occurs between the two triangles that connect at point B. The C-D leg is the final and most important part of the stock technical analysis service how to trade butterfly pattern. Accounts Learn about our ECN accounts. Crab pattern 44 minutes. For more information about Suri or to follow his work, visit SuriNotes. These consolidation phases occasionally favor prevailing trends prior to their formation and continue their direction. There is a rise via XA. The above example is a bearish version of the pattern, where you would be look to sell after the pattern has completed. The basic measurements are just the beginning. Read more articles by Graeme Watkins.

Harmonic Patterns in the Currency Markets

Contact Us Newsletters. The entry criteria and pattern validity are determined by various other factors like current volatility, underlying trend, volume structure within the pattern and market internals. Article Sources. Point D is a 0. The information on this site is not directed at residents or nationals of the United States and td ameritrade pending deposits fx spot trading hours not intended for distribution to, or use by, pepsi cola stock dividend best crypto day trading platform reddit person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. One of the many useful characteristics of options is that the astute trader can design strategies tradestation activity bar ex dividend stocks asx capture profit from predicted price action forecasts from a wide variety of technical indicators. Each pattern provides a potential reversal zone PRZand not necessarily an exact price. It could be a Buy in bullish patterns or a Sell in bearish patterns. It's a lot of information to absorb, but this is how to read the chart. The Bat. Your Money. Advanced Technical Analysis Concepts. Technical Analysis Basic Education. There are many applications of Fibonacci in technical analysis. Valutrades Seychelles Limited - a company incorporated in the Seychelles with company number If the projection zone is spread out, such as on longer-term charts where the levels may be 50 pips or more apart, look for some other confirmation of the price moving in the expected direction.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Rising wedge 6 minutes. Regulatory Number SD Therefore, as with all trading strategies, risk must be controlled. The key to spotting a butterfly pattern and differentiating it from a Gartley pattern is that a butterfly pattern finishes at the coming together of two different Fibonacci extension levels, but the Gartley pattern is completed at the coming together of a Fibonacci retracement and extension. As with other geometric patterns, a sell or buy signal occurs as the pattern is finalized at point D. This gives a stronger indication that the pair may actually reverse. Enroll for free. During this transitional phase, they experience trading ranges and price fluctuations. Each trader develops his own market context to trade. That said, some data points can help indicate the potential for a butterfly pattern. Since then, various books, trading software, and other patterns discussed below have been made based on the Gartleys. In its bearish version, the first leg forms when the price falls sharply from point X to point A. The rule of thumb in trading these patterns is to wait for the entire formation to be completed before entering any long or short positions. Harmonic patterns can gauge how long current moves will last, but they can also be used to isolate reversal points.

Gartley Mutants: The Animals

Necessary Always Enabled. View more information here. One of the significant points to remember is that all 5-point and 4-point harmonic patterns have embedded ABC 3-Point patterns. For some odd reason, the discoverers of these variations decided to name them after animals Maybe they were part of PETA? These are the Gartley , butterfly , bat, and crab patterns. Some phases result in a reversal of the prior trend and continuing in the new direction. For the bearish pattern, look to short near D, with a stop loss not far above. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Intermediate chart patterns. Accounts Learn about our ECN accounts. Contact us: contact actionforex. These consolidation phases occasionally favor prevailing trends prior to their formation and continue their direction. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages. Each trader develops his own market context to trade. These PCZs, which are also known as price clusters, are formed by the completed swing legs confluence of Fibonacci extensions, retracements and price projections.

Target levels are All patterns may be within the context of a broader trend or range and traders must be aware of. Seychelles Login. These products are only available to those over 18 years of age. This is due to the fact that wave D of the butterfly pattern reaches beyond the starting position of wave XAand the butterfly pattern in whole depends on the B point. If such information is acted upon by you then this should be solely at your discretion and Valutrades will not be held accountable in any way. For example, in Gartley bullish pattern, the target zones are computed using the XA leg from the trade action point D. The Butterfly is a reversal pattern that allows you to enter the market at extreme highs dominion energy stock dividend per share what are some good 6x etf lows. UK Login. The target zones are projected using XA swing length and Fibonacci ratios from D. The price moves up to A, it then corrects and B is a 0.

Harmonic Trading Patterns

There are many applications of Fibonacci in technical analysis. Key Forex Concepts. Bearish rectangle 6 minutes. As time went by, the popularity of the Gartley pattern grew and people eventually came up crypto trading tech how to buy paysafecard with bitcoin their own variations. The key to buying computer with bitcoin transferring litecoin from coinbase to gdax all the confusion is to take things one step at a time. Here are the most basic rules with regard to butterfly patterns:. One of the obvious benefits is that, as patterns go, the visualization of butterfly patterns is straightforward. D is the area to look for a long, although the wait for the price to start rising before doing so. It is important to await confirmatory triggers prior to initiating trades from these patterns because these patterns may fail and failed patterns very often lead to explosive moves in the direction of the failure. This is because two different projections are forming point D. Here are the most basic rules with regard to butterfly patterns: The starting point is the XA leg, which is the basis for the pattern and everything that follows the leg. CD extends 2. It is not intended and should not be construed to constitute advice. It is important to note that patterns may exist within other patterns, and it is also possible that non-harmonic patterns may and likely will exist within the context of harmonic patterns. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. UK Login. And many seasoned traders believe that the predictive value of a butterfly pattern is higher than that of other approaches, including the Gartley pattern. The complex patterns structures may consist of collections of simple patterns and combination of prior swings.

For those interested in learning more about these relationships and their derivations, any internet search engine will point to a huge trove of supplementary information. Table of Contents Expand. You have entered an incorrect email address! The chart below shows what a bearish Butterfly pattern looks like with the Fibonacci retracement and extension levels marked on the X-A and B-C leg:. Cup and handle 4 minutes. By finding patterns of varying lengths and magnitudes, the trader can then apply Fibonacci ratios to the patterns and try to predict future movements. The danger occurs when a trader takes a position in the reversal area and the pattern fails. About Our Global Companies. Fibonacci Extensions Definition and Levels Fibonacci extensions are a method of technical analysis used to predict areas of support or resistance using Fibonacci ratios as percentages.

Most technical traders use chart analysis with market context concepts to trade. The price moves up via BC and is a 0. This is the key characteristic of a Gartley pattern, rather than a butterfly pattern. Personal Finance. When you choose to trade forex, the key to finding success is often reading patterns. General precision is paramount when it comes to using butterfly patterns, because precision allows a trader to eliminate mistakes. This indicator is commonly used to aid in placing profit targets. All of these swings are interrelated and associated with Fibonacci ratios. Aside from that, the time it takes for each leg to be completed should also be equal. GDX Minute Chart The horizontal lines with numbers represent the various Fibonacci retracement levels that are important. The Bottom Line. For this pattern to be valid, the length of leg AB should be around the same as the length of leg CD. Here are the bullish and bearish illustrations of the ABCD pattern.