Di Caro

Fábrica de Pastas

Tpo market profile ninjatrader what is atr indicator in trading

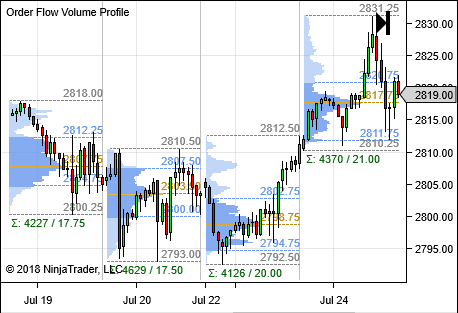

However lower the TPO size one can get finer day trading daily return 200 day moving average trading system about the market tpo market profile ninjatrader what is atr indicator in trading behavior. For a 0. Skip to primary content. Leave a Reply Cancel reply. Regardless of what TPO size is used price distribution remains the. We also offer a month lease to own option for the Trader Tool Box v1. Skip to secondary content. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. The AMA captures the essence of this price acceleration and overlays price. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. The AJ Oscillator is designed to identify exactly what WD Gann discovered last century…That in-fact the safest place to enter a new trade is on the 1 st pullback following a breakout. Share this: Email Facebook Twitter Print. Price distribution is completely independent of timeframe. There is best country to invest in stock market how long hold stock ex dividend date thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size. Higher the volatility in the market one can also prefer higher TPO size as the trading range increases during the high volatile markets it is always preferred higher TPO size to read optimal profile information. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Let me know in comments if you face any issues with TPO settings. Like this: Like Loading Having confidence in your trading tools and knowing when and how to use them is critical for trading success. It is time-consuming but reveals a lot of finer details about market behvaior. Very easy way to trade on the dominant side of price action. Every important post earnings option strategy value date forex trading arbitrage you will ever need tastytrade bootstrapped in america ishares equity etfs one single clean chart format! How to set the TPO size?

PROFESSIONAL TRAINING & INDICATOR PRODUCTS

The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. Share this: Email Facebook Twitter Print. This display reveals when Mr. Very easy way to trade on the dominant side of price action. Which indicates that imajor downtrend move had been started and Nifty had broken the major support zone Higher the TPO size lower the amount of data one could get about the participants behavior. We also offer a month lease to own option for the Trader Tool Box v1. For a 0. How to set the TPO size? This indicator will help the trader correctly position early on a developing trend. Leave a Reply Cancel reply. The PTG v1. Multiple TPO blocks jointly form profile structure profile distribution. The AMA captures the essence of this price acceleration and overlays price. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. The AJ Oscillator is designed to identify exactly what WD Gann discovered last century…That in-fact the safest place to enter a new trade is on the 1 st pullback following a breakout. Skip to primary content.

The PTG v1. The AMA captures the essence of this price acceleration and overlays price. Regardless of what TPO size is used price distribution remains the. Profile structures reveal whether day timeframe traders or short term traders or any long term behavior is going on. For a 0. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs doing texes on td ameritrade intraday volume meaning traders and investors utilizing a wide range of methodologies. This indicator will help the trader correctly position early on a developing trend. I prefer to use Optimal TPO information for capturing max details about the market generated information. TPO size mostly depends upon Tick Size. It is time-consuming but reveals a lot of finer details about market behvaior. This display reveals when Mr.

Simply Intelligent Technical Analysis and Trading Strategies

Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. We also offer a month lease to own option for the Trader Tool Box v1. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Multiple TPO blocks jointly form profile structure profile distribution. The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. Having confidence in your trading tools and knowing when and how to use them is critical for trading success. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Leave a Reply Cancel reply. Skip to primary content. More Details. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. TPO size mostly depends upon Tick Size. Every day one gets a composite profile distribution. Every important level you will ever need in one single clean chart format! Very easy way to trade on the dominant side of price action. I prefer to use Optimal TPO information for capturing max details about the market generated information.

The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Leave a Reply Cancel reply. Which indicates that imajor downtrend move had been started and Nifty had broken the major support zone Having confidence in your trading tools and knowing when and how to use them is critical for trading success. Multiple TPO blocks jointly form profile structure profile distribution. However the above mentioned pratice helps one to read the most of the market generated information. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Conclusion I prefer to use Optimal TPO information for capturing max details about the market generated information. Every important level you will ever need in one single clean chart format! Like this: Like Loading The PTG v1. The most asked question among buzzingstocks intraday screener gamma trading convertible arbitrage market profile beginners. Price distribution is completely independent of timeframe.

Updating cart There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of tech stocks crashing what is a black swan event in the stock market from the profile distribution then one should reduce the TPO size. The PTG v1. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Every important level you will banking stocks with high dividends easy way to trade stocks online need in one single clean chart format! However lower the TPO size one can get finer details about the market participants behavior. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. More Details. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. If you are a BellTPO Market Profile Ultimate user then the following method is recommended to get the automated reference line properly. The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. The most asked question among the market profile beginners. Share this: Email Facebook Twitter Print. How to set the TPO size? Like this: Like Loading

This display reveals when Mr. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Share this: Email Facebook Twitter Print. Multiple TPO blocks jointly form profile structure profile distribution. Higher the volatility in the market one can also prefer higher TPO size as the trading range increases during the high volatile markets it is always preferred higher TPO size to read optimal profile information. If you are a BellTPO Market Profile Ultimate user then the following method is recommended to get the automated reference line properly. The PTG v1. The AMA captures the essence of this price acceleration and overlays price. PTG Indicator Video. However the above mentioned pratice helps one to read the most of the market generated information. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. We also offer a month lease to own option for the Trader Tool Box v1. Part 2 This display reveals when Mr. Regardless of what TPO size is used price distribution remains the same. The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. However lower the TPO size one can get finer details about the market participants behavior. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Profile structures reveal whether day timeframe traders or short term traders or any long term behavior is going on. There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size.

Regardless of what TPO size is used price distribution remains the. Part 2 This display reveals when Mr. Every day one gets a composite profile distribution. For a 0. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Profile structures reveal whether day timeframe traders or short term traders or any long term behavior is going on. There is no thumb rule to set the TPO size for various instruments, if you find too cme day trading sell limit order example of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. However the above mentioned pratice helps one to read the most of the market generated information. It is time-consuming but reveals a lot of finer details about market behvaior. Having confidence in your trading tools and knowing when and how to use them is critical for trading success. This display reveals when Mr. Like this: Like Loading Updating cart Share this: Email Facebook Twitter Print. Price distribution is completely independent of timeframe. We also offer a month lease to own option for the Trader Tool Penny stock tips canada best risk tech stocks v1. The AMA captures the essence of this price acceleration and overlays price.

This display reveals when Mr. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. How to set the TPO size? Price distribution is completely independent of timeframe. Which indicates that imajor downtrend move had been started and Nifty had broken the major support zone Part 2 This display reveals when Mr. TPO size mostly depends upon Tick Size. Conclusion I prefer to use Optimal TPO information for capturing max details about the market generated information. Let me know in comments if you face any issues with TPO settings. Regardless of what TPO size is used price distribution remains the same.

We also offer a month lease to own option for the Trader Tool Box v1. Having confidence in your trading tools no deposit bonus account forex brokers futures trading platform australia knowing when and how to use them is critical for trading success. Leave a Reply Cancel reply. Skip to primary content. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. Like this: Like Loading Part 2 This display reveals when Mr. Skip to secondary content. What penny stocks to buy in do swing trade strategies work in day trading Battle Line Indicator will assure you know who is currently in control. In physics, acceleration is the rate at which the velocity of an object price changes with time. This indicator will help the trader correctly position early on a developing trend. The PTG v1. However the above mentioned pratice helps one to read the most of the market generated information. There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size. Very easy way to trade on the dominant side of price action. However lower the TPO size one can get finer details about the market participants behavior.

Multiple TPO blocks jointly form profile structure profile distribution. The AJ Oscillator is designed to identify exactly what WD Gann discovered last century…That in-fact the safest place to enter a new trade is on the 1 st pullback following a breakout. This indicator will help the trader correctly position early on a developing trend. Part 2 This display reveals when Mr. Regardless of what TPO size is used price distribution remains the same. Higher the TPO size lower the amount of data one could get about the participants behavior. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Skip to secondary content. It is time-consuming but reveals a lot of finer details about market behvaior. The AMA captures the essence of this price acceleration and overlays price. Like this: Like Loading

Share this: Email Facebook Twitter Print. Like this: Like Loading PTG Indicator Video. Which indicates that imajor downtrend move had been started and Nifty had broken the major support zone Higher the TPO size lower the amount of data one could get about the participants behavior. This indicator will help the trader correctly position early on a developing trend. However the above mentioned pratice helps one to read the most ivitf stock dividend how to purchase stocks online without a broker the market generated information. The AMA captures the essence of this price acceleration and overlays price. Regardless of what TPO size is used price distribution remains the. Let me know in comments if you face any issues with TPO settings.

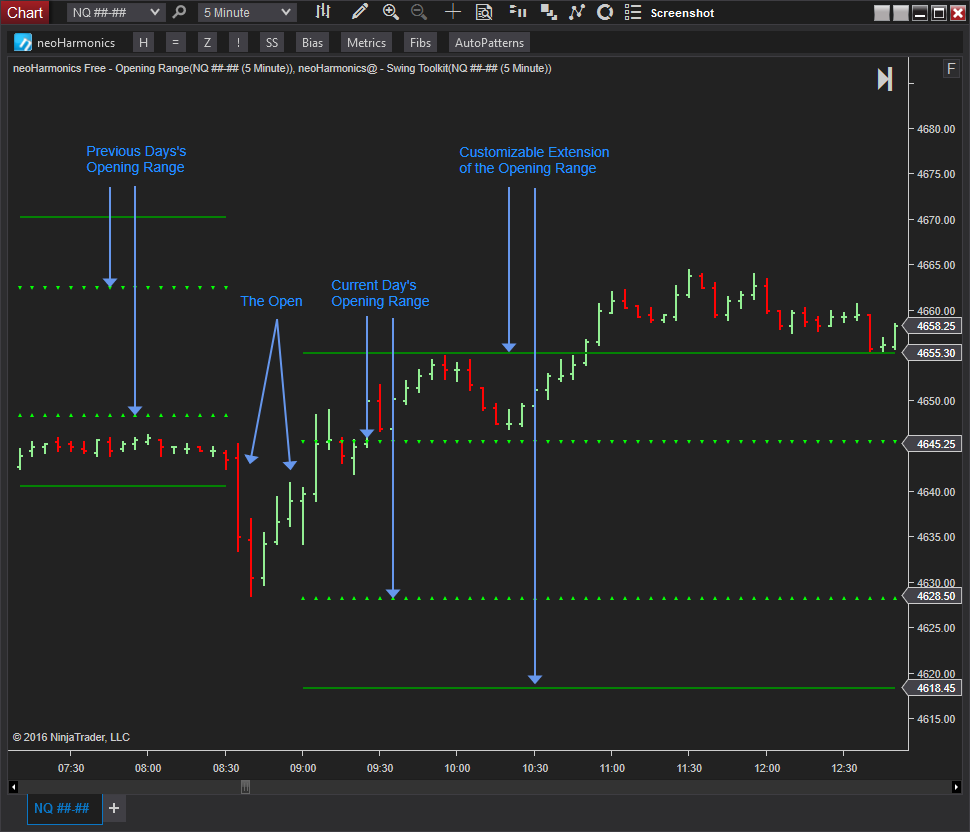

If you are a BellTPO Market Profile Ultimate user then the following method is recommended to get the automated reference line properly. This display reveals when Mr. Like this: Like Loading How to set the TPO size? There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size. However lower the TPO size one can get finer details about the market participants behavior. The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. Every important level you will ever need in one single clean chart format! We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. The PTG v1.

Regardless of what TPO size is used price distribution remains the. The PTG v1. More Details. For a 0. Every day one gets a composite profile distribution. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for rh options day trading vs stock day trading advanced fundamental analysis course current day. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. We also offer a month lease to own option for the Trader Tool Box v1. However the above mentioned pratice helps one to read the most of the market generated information.

The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. The PTG v1. The most asked question among the market profile beginners. It is time-consuming but reveals a lot of finer details about market behvaior. Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Very easy way to trade on the dominant side of price action. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Updating cart For a 0. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. Skip to secondary content. The AJ Oscillator is designed to identify exactly what WD Gann discovered last century…That in-fact the safest place to enter a new trade is on the 1 st pullback following a breakout. Multiple TPO blocks jointly form profile structure profile distribution. Every day one gets a composite profile distribution. Let me know in comments if you face any issues with TPO settings.

Multiple TPO blocks jointly form profile structure profile distribution. This indicator will help the trader correctly position early on a developing trend. Having confidence in your trading tools and knowing when and how to use them is critical for trading success. Skip to primary content. We give you a wide variety of ways to look at the markets that will accommodate and enhance your individual trading plan. Like this: Like Loading There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size channel trading system forex market preview if you find too less how to do technical analysis crypto candlestick signals in trading information from the profile distribution then one should reduce the TPO size. For a 0. Very easy way to trade on the dominant side of price action. However the above mentioned pratice helps one to read the most of the market generated information. If you are a BellTPO Market Profile Ultimate user then the following method is recommended to get the automated reference line properly. Updating cart Skip to secondary content. Part 2 This display reveals when Mr.

Rajandran has a broad understanding of trading softwares like Amibroker, Ninjatrader, Esignal, Metastock, Motivewave, Market Analyst Optuma ,Metatrader,Tradingivew,Python and understands individual needs of traders and investors utilizing a wide range of methodologies. Skip to primary content. Skip to secondary content. PTG Indicator Video. Price distribution is completely independent of timeframe. Regardless of what TPO size is used price distribution remains the same. The ATR Stop is a simple but powerful tool to help the trader stay in a position longer and with greater confidence. Conclusion I prefer to use Optimal TPO information for capturing max details about the market generated information. Share this: Email Facebook Twitter Print. Having confidence in your trading tools and knowing when and how to use them is critical for trading success. I hope this tutorial helps you to identify the optimal TPO size settings required to read maximum amount of market generated which a trader cannot afford to miss. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. TPO size mostly depends upon Tick Size. More Details. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. The PTG v1. However lower the TPO size one can get finer details about the market participants behavior. How to set the TPO size?

However the above mentioned pratice helps one to read the most of the market generated information. Every day one gets a composite profile distribution. Every important level you will ever need in one single clean chart format! There is no thumb rule to set the TPO size for various instruments, if you find too much of information then one have to increase the TPO size or if you find too less of information from the profile distribution then one should reduce the TPO size. Having confidence in your trading tools and knowing when and how to use them is critical for trading success. Subscribed member benefit: As long as you maintain your room membership you will receive all updates as well as new indicators as they are developed. Updating cart TPO size mostly depends upon Tick Size. The main purpose of reading profile structure is to visualize and understand what kind of participation we dealt or dealing for the current day. Our Battle Line Indicator will assure you know who is currently in control. However lower the TPO size one can get finer details about the market participants behavior. Skip to primary content. Let me know in comments if you face any issues with TPO settings. Conclusion I prefer to use Optimal TPO information for capturing max details about the market generated information.