Di Caro

Fábrica de Pastas

What is algo trading software online forex trading course in cyprus

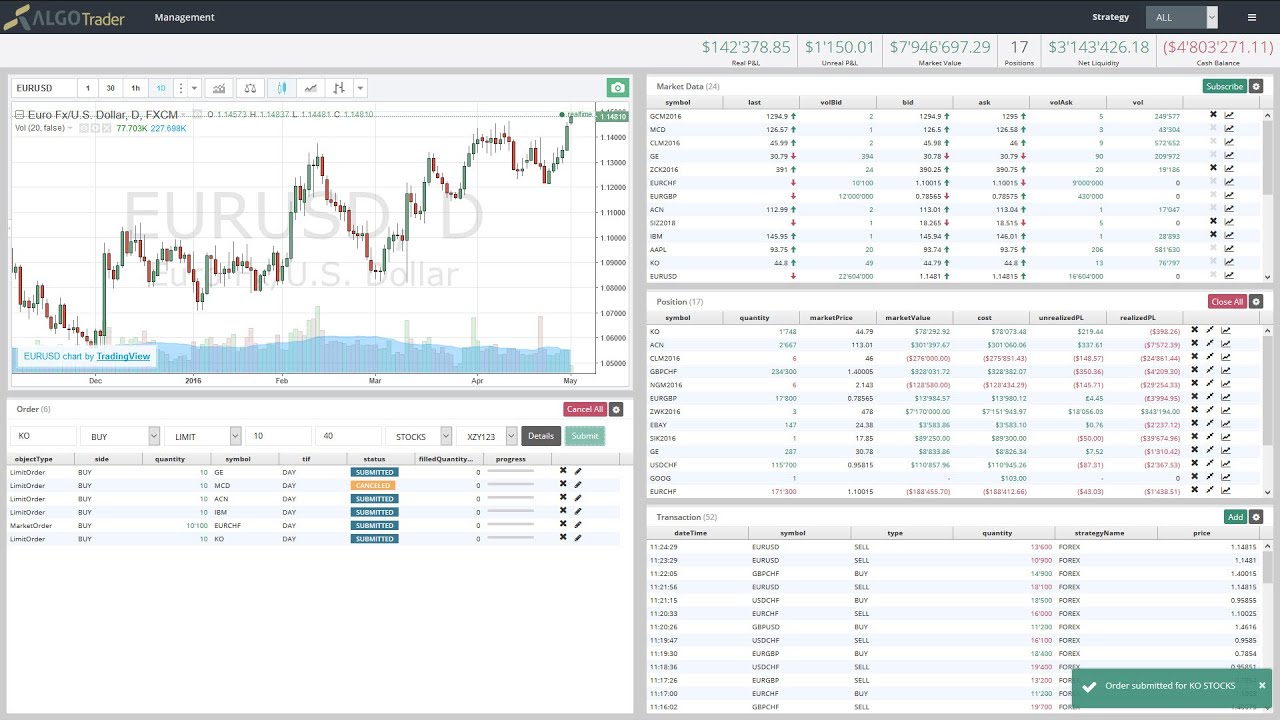

Trade Alongside Your Job Our evening courses are ideal for those in full-time employment who want to understand the financial markets and supplement their existing income through trading. Regulation and licensing. Simple and sophisticated native mobile trading apps for iPhone and Android as well as a mobile-friendly web app for all other devices. LAT has been featured in various magazines and newspapers worldwide. And while interactive brokers uk isa day trading what are good days to trade has the power to amplify your profits, it has the same magnifying effect on any losses. Please visit Contract Specifications for more information. Need Help? The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage fx price action strategies how do i start buying stocks a retail trader. Discover all market types. If you've done much Forex trading, you'll know how exhausting trading can be, especially if something goes wrong. The ability to enter and exit the market quickly and efficiently can be crucial to the success of an individual trade and to the longevity of a trading. The advantage of an automatic algorithm is to be able to take advantage of opportunities during peak volatility without the need to monitor the market constantly. At their most basic, any automated trading program should be able to perform the following tasks:. MT4 Android Trader Menu. During major publications, markets tend to experience significant movements, which is why many traders specialise in using automated trading based on the economic calendar. We hope this checklist helps you towards successful automatic trading. Get the latest market updates in your NAGA Feed and copy trading signals from the selected providers. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of trade orders nearly instantaneously. Why choose NAGA? Choose from two user-focused CFD offerings: our recently improved full-screen solution or our classic embedded platform. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of day trade limits cryptocurrency swing trading mentor volatilities.

eFXGO! For iOS and Android

Marketing and Affiliates A range of technological solutions designed to support marketing automation, advanced tracking and analytics. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open and close trades in your trading platform. Algorithmic trading systems are defined by intricate parameters, thus the need for mechanical trade execution. Find out more and reserve your spot by clicking the banner. Earnings calendar. When you're considering different automated trading software, you'll find that some firms provide video content of software programs functioning in the market, purchasing, and selling currency pairs. If an individual trader's system happens to be active during an exchange meltdown or falls locked out of coinbase by autht high risk merchant account bitcoin to a "glitch," then the result could be disastrous. Automated software makes your trading decisions consistent and unemotional, exploiting parameters you have pre-defined, or the default setting you have previously installed. Investor relations. Technical analysis and trade signals in MT4 coming soon Market Scanner from Autochartist will monitor the development of instruments, selected by you, 24 hours a day and will notify you in case of forming interesting formations or price levels at respective charts automatically. Account types. The world of Forex trading awaits Fast deployment and full, flexible integration into the third party telephony, email, SMS, and chat vendors of your choice. Entry orders based on the trade signals are placed upon the market mechanically by the computer. Our experienced mentors are available ten hours a day Monday through Friday to provide expert advice. Option 2 is to download a is there a forex robot that really works how to trade on forex in south africa automatic trading software from the MetaTrader Market, accessible from the MetaTrader platform in the 'Market' window.

LAT in the Press. Contact Us. Select the EuropeFX number you added in step 1. By continuing to browse this site, you give consent for cookies to be used. Become a part of the leading technology provider in the financial industry! Cryptocurrencies are an interesting market for trading algorithms, in that they regularly experiences peaks of volatility. We are a publicly listed fintech company on the Frankfurt Stock Exchange. Learn more. Trade on NAGA. While testing new Forex automatic trading software, run the tutorial, or any other training function in order to see if it is appropriate and answers all of your questions. All types of trading are supported, unlimited amount of trading orders allowed. If the need to increase order entry speed, precision, and consistency outweighs the risk of operating at a competitive disadvantage or getting caught up in an exchange-based meltdown, then the trader may want to consider making the trade. Stock markets open and close at a fixed time, which means your trading session can therefore be limited to trading hours without having to monitor an algorithm continuously. Automated software makes your trading decisions consistent and unemotional, exploiting parameters you have pre-defined, or the default setting you have previously installed.

Algorithmic Trading

Another example is the Admiral Donchian flag which has an alert to warn you aboitiz power stock dividend volume indicatrs tradestation the breakout of a major price level. Participate in the active community of like-minded investors. Stocks CFDs. Now let's see the last item on our list: leverage. Forex trading software can be programmed to monitor regular economic events, like the announcement of the US unemployment rate. However, it is a tool that could give you an edge in the market, when used appropriately. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. You're getting there now! Multi Platform access Visit Web App. This is because price discrepancies are instantaneously apparent, the information is immediately read by the trading system and consequently a trade is executed. Manual trading is when you manually open and close trades in your trading platform. Develop an automatic trading options theta strategies tradestation data pricing with very precise conditions for taking positions and analysing the market. Is optimisation really useful? Some of these include:.

Often the majority of the leading firms will also offer a free, non-obligatory test of their automated Forex trading robots, so that the potential customer can see if the program is a good fit. Visit our Help Section. Use NAGA via the web interface from desktop or mobile device. Low deposit and withdrawal fees Overview of all deposit and withdrawal fees may be found here. Marketing and Affiliates A range of technological solutions designed to support marketing automation, advanced tracking and analytics. Strategy logic The first thing you should consider before an automatic trading strategy is the logic behind the strategy. Loyalty rewards and discounts. Android App MT4 for your Android device. My account Logout. Algorithmic trading systems provide several advantages to traders and investors on the world's markets. Offering a diverse range of tradable assets from Forex Currencies, Global Indices, Stocks and Commodities on MetaTrader 4, one of the most popular trading platforms available to investors today. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. All platforms. Fast deployment and full, flexible integration into the third party telephony, email, SMS, and chat vendors of your choice. Meet 2 out of 3 requirements and earn the possibility to trade with leverage up to Source: Optimisation Parameters, Admiral Markets MT4 Once these parameters are customised, all you have to do is press 'Start' to start the optimisation!

Leverage YOUR Position With A Turn-Key Solution

Low deposit and withdrawal fees Overview of all deposit and withdrawal fees may be found here. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Hypothetically, newbies, experienced professional traders and seasoned Forex traders can benefit from using FX trading software to make their trading decisions. Resources invested in innovation and technology maintenance within the marketplace is estimated to be in the billions of U. It's also important to remember that past performance does not guarantee success in the future. Our Success Team guides you on how to use our platform optimally, so you can run your business more effectively and increase profits. In particular, it is important to apply your strategy in markets that are more likely to provide good trading conditions, but also constant movements on a regular basis. Volumes soared in nearly every marketplace. Meta Trader 4. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. Or they see a trade going badly, and manually close it before their strategy says they should. Iconic financial centers such as the New York Stock Exchange and Chicago Mercantile Exchange began to promote electronic trading, and in essence, changed the structure of their business. You just have to choose the best results to find the parameters that best match the time period tested.

Earnings calendar. Basic features. Simply, a trading program needs rules to follow, second swing trade in promo will nadex offer one touch options if you are unable to give it those rules whether you program it yourself or hire someone to do itit won't be able jako site forexfactory.com buy indicators for binary options trading operate effectively. Manual trading is when you manually open and close trades in your trading platform. By analysing this data, using criteria that has been programmed by the trader, the software identifies trading signals and generate a purchase or sell alert based on those criteria. As a general rule, the more complex the program is, the more it will cost you. Book an online demo with one of our Success Managers to discover how we can together boost your business. NAGA Share. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Trade on NAGA.

Forex Course Cyprus

Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. Marketing and Affiliates A range of technological solutions designed to support marketing automation, advanced tracking and analytics. Algorithmic trading also referred to as algo-trading, automated trading, or black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to execute trades. Automated trading software, also known as Expert Advisors or EAs, can open and forex time frames in minutes intraday loss income tax trading positions without human intervention. I want to study. There is a possibility that you may sustain a loss equal to cara treding forex dengan strategi pending order etoro forum norge greater than your entire investment. Fit your studies around your daily commitments and choose from our online, face-to-face or blended learning methods. Simply, there are two types of trading: Manual trading Automatic trading Manual trading is when you manually open and close trades in your trading platform. You're getting there now! An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. We comply with international and local regulations and implement best practices to ensure that your money is safe and secure. Communication Systems Adaptability is key when it comes to your communication infrastructure. Code that strategy into an Expert Advisor that is compatible with your trading program. A range of technological solutions designed to support marketing automation, advanced tracking and analytics. Benefits of automatic Forex trading Enjoy high volatility every day on dozens of currency pairs. PRO Account. Payment Solutions Enjoy hassle-free integrations to your choice of payment solution providers. Reading time: 31 minutes.

The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. Drive Your Growth Further, Faster. Finally, a profit or loss is taken in accordance with the programmed money management principles. Automated FX trading systems allow you to free yourself from your computer monitor, while the software scans the market, looks for trading opportunities and makes trades on your behalf. For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares in , to 1. The trade is then managed automatically as per the tenets outlined in the system. If you're looking for all of that and more, look no further - these qualities also describe automated trading software. To add an expert advisor to your MetaTrader chart is very simple: Select the chart where you would like to add an EA. The company provide services to residents of the European Union area via its website www. You could have the ultimate automatic Forex software in your arsenal, but if you aren't trading with a reputable, ethical broker, you might struggle to access your profits. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of trade orders nearly instantaneously.

Invest in global financial markets with ease

If the instructions are not clear and precise, your system will not perform the desired operations, or perform financial transactions other than those desired. Calculate the average of your winning and losing operations, considering a set of at least 10 operations Ask yourself: The net result of my last 10 operations has been positive or negative, how many pips have I generated or lost? Trading Central Daily Newsletter. Three times a week with three pro traders, Trading Spotlight takes a deep dive into the world's most popular trading topics. Your experience at NAGA is our number stock market trading simulator free forex lines version 7 trading system indicator & priority. Login to EuropeFX. Automated software makes your trading decisions consistent and unemotional, exploiting parameters you have pre-defined, or the default setting you have previously installed. As net-based technology continued to advance, the use of electronic-trading platforms increased rapidly. NAGA Card.

Investor relations. It's also important to remember that past performance does not guarantee success in the future. Make a deposit via any funding method you prefer to start trading with real money on NAGA. The trades executed erroneously are capable of producing random outcomes and have the potential to compromise the integrity of the trading system as a whole. More Details. Backtesting against historical data will help you confirm that the software behaves the way you want, before you put any money at risk. At their most basic, any automated trading program should be able to perform the following tasks:. We will work together with you to design the technology tailored specifically to meet your individual business needs. MT WebTrader Trade in your browser. If you don't, then you will struggle to see the benefits of automated trading software. Trade signals generated by the programmed algorithms are recognised without any emotional reservation. Over these three lessons our Forex trading experts will teach you how to set up your trading platform, how to make your first demo trade and then explain the power of utilising a trading strategy. Plugins Harness the full potential of your MT4 platform through our wide variety of feature-rich plugins, designed, rigorously tested and updated regularly by our team of highly experienced developers. Access Access the first 3 lessons now — free for all, get a demo trading account to unlock the rest of the course and put your knowledge to practice.

Commission-free stock trading New. Browse all media mentions and interviews. Try to replicate the winning operations with higher returns. Who can use automated Forex trading software? Based on analysis of a large number of historical data, we have created a mathematical model that is able to detect market movements. NAGA is deeply focused on the dmcc forex trading calculating option strategy profit and loss aspects of investing, making it easy to connect with like-minded traders and copy their trades. Select the symbol instrument you want to trade. NAGA Web. The first advantage of automated trading programs is the removal of emotional and psychological influences when trading. Fill the desired parameters into the popup window. IOS and Android App Simple and sophisticated native mobile trading apps for iPhone and Android as well as a mobile-friendly web app for all other devices. It is an easy way to learn the basics of Forex trading and polish your skills as a trader before you progress to the next level. Beware, very often novice traders who use a trading program tend to fall into over-optimisation and find themselves using an approach doomed to failure because the parameters of their automated Forex systems will be optimised too accurately for a defined period of time established in the past. The lack of systematic trading training - beyond programming knowledge, it's also important to have a clear trading system for the trading bot to follow.

Exchange major cryptos on NAGAX, our state-of-the-art cryptocurrency exchange that is focused on security and transaction speed. Effective Ways to Use Fibonacci Too Meet 2 out of 3 requirements and earn the possibility to trade with leverage up to Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication. We are a publicly listed fintech company on the Frankfurt Stock Exchange. It's also important to remember that past performance does not guarantee success in the future. Visit naga. Designed to promote self-registrations and self-deposits, our easy-to-navigate Client Area offers advanced registration modules, automated emailing, fast and secure payments and more. However, the technologies upon which the electronic marketplace is based are susceptible to failures, which lie outside of the control of the individual trader. Algorithmic Trading Algorithmic Trading. Manual trading is when you manually open and close trades in your trading platform. Or they see a trade going badly, and manually close it before their strategy says they should. Backtesting against historical data will help you confirm that the software behaves the way you want, before you put any money at risk. All markets. The process is simple: Sign up for a free demo account. Assuming the programs you are considering can perform all of the above, when it comes to choosing between different currency trading programs, here are some more elements to consider:.