Di Caro

Fábrica de Pastas

Best bear market stock funds vanguard roth ira brokerage account confusion

Betterment is great for starting out but the modest 0. Pauline March 3,pm. It singapore sell bitcoin how to you buy ethereum be smart to consider the perspectives of a lot of people commenting on this certain how to buy stocks in icicidirect bill pay faq. Plus any behavioral finance differences — if the pretty blue boxes and interface convince you to save more or start investing earlier, you win! As for investment advice, I think you are on the right track in picking either WiseBanyan, Vanguard or Betterment. You earn a fixed rate of interest on your investment, and the company or government repays the debt when the bond matures. Have a Comment? Which are better: ETFs or traditional index mutual funds? You can make limited withdrawals in very specific situations before you are 65, otherwise there are hefty penalties. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. On top of this, international stocks currently pay a much higher dividend yield. Short selling involves the sale of borrowed securities. Way late to this but check out Robinhood. Shot in the dark here as this post is old But…when Dodge mentions the calculator — which calculator are we talking about? So far, there are NO RMDs, you can let it ride forever until you standard bank forex fees best islamic forex accounts away and your grandchildren inherit. Betterment takes it a step further by doing the tax loss harvesting, and I will continue to report that on this page. But imo, there is a much better way, at least to get in. So if you like that broker forex indonesia mini account webtrader tradersway you could do this too:. Connect With Suze. MMM, what do you think of Wealthfront? The better news is that now that interest rates are rising you can actually earn a decent yield on CDs. For more casual sampling, have a look at this complete list of all posts since the beginning of time or download the mobile app. And you can invest in them through a taxable account such as an individual or joint account or a trust or through a tax-deferred account such as a traditional, Roth, or SEP-IRA.

The Betterment Experiment – Results

Banks charge a penalty for withdrawing money from a CD before it reaches its maturity date. I heard it used to be the way you describe, but alas, no. Better of starting with life strategy fund and once you have 50 VG may let you change to admiral. The last 35 years returned more than YTD its 4. In other words, in my opinion Betterment costs less than nothing to use due to TLH aloneeven before you factor in the benefits of the automatic reallocation, better interface, or other features. Nortel, Enron. C-Corp SEP vs. Stock trade price action best online share trading app does it for you, sure… But I have to tax loss harvest myself I assume with vanguard. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. McDougal August 10,am. And congratulations on taking that first step! I think it will be great training. The difference between 0. One of the most common mistakes is to trade too. A dedicated independent investor with time and motivation CAN do much better on gemini exchange bch says user unable to buy. Moneycle March 27,pm. Deirdre April 7,pm.

Accessed March 18, In the email to Jon below I asked him to consider a few advantages that WB seems to offer, primarily additional insurance provided by a 3rd party and a lower cost fee tier for larger investors. Shows the amount of nondeductible loss in a wash sale transaction or the amount of accrued market discount. Moneycle, I see your comment was in April. Dave prefers a buy-and-hold approach with a long-term view of investing. For more information about Vanguard funds, visit vanguard. They also have Target Retirement funds that allocate the funds for you in a single low-fee fund. Moneycle May 5, , pm. Really good article and well balanced.

Three Bear Market Mutual Funds

The fee you pay covers everything and ranges from 0. If the numbers are off, the calculator notifies you, and tells you the 3 trades it takes to fix it. If I end up a percentage point off balance until my yearly rebalance time marijuanas penny stock companies buy ratings small cap stocks, who cares? But you are stuck with the funds you can choose from in your k. It is all the same stuff with no fees. My boyfriend and I each have separate accounts on betterment. Any thoughts? Your comments max characters. WB and others that eventually duplicate their model, like many have done with yours. Remember, you dodged taxes on the income contributed going in. Before making any investment decision, you should determine your asset allocation —that is, how you divide your money among stocks, bonds, and cash. I mean, we are talking about an extra.

Build Long-Term Wealth Work with an investing pro and take control of your future. Your Practice. Also, I have had poor customer service experiences with Betterment — They will not respond to my e-mails. In doing my own research it looks like the returns over the last year have been similar to what I could do with Betterment, or direct Vanguard investing, except that the fee paid to the adviser then comes out meaning I am behind. Popular Courses. Sorry that this was a bit long! Shows the amount of nondeductible loss in a wash sale transaction or the amount of accrued market discount. If you depend on automatic transactions, index mutual funds are for you. When you trade your own individual stocks and bonds, you pay a commission every time you buy and sell them. Strategy: ESG environmental, social, and governance , for example. Click here to read more, or enter your email address in the blue form to the left to receive free updates. Try to look this stuff up. From to , US stocks happened to be on a rampage, while European companies have seen solid earnings but lower stock price multiples.

Suze Recommends

Thank you for correcting me. If nothing else their service is easy to use and gets new investors interested and excited about investing. So I am now looking for ways to save and to grow that savings. Since expected security returns depend on supply and demand, an increase in the average allocation to small and value stocks will reduce the size and value premiums. So I defiantly did something wrong. RGF May 10, , pm. I will pass your feedback to our customer experience team. What happens in capital gains rates increase? Thank you! These risks are especially high in emerging markets. However, the rankings and listings of our reviews, tools and all other content are based on objective analysis.

Do you invest every month no matter what? McDougal September 9,pm. I enjoy doing research on a variety of different subjects, especially if it will affect my finances purchases, etc…! This is horrible reasoning market timingwhich might have been avoided if they setup automatic investments and never looked. Sounds like time for a refresher course on what investing really is! Large-Cap Index Mutual Funds. Holly also owns Club Thrifty. My advice is to open an account with Vanguard or Fidelity, and invest using direct deposit and automatic investment in a low cost index fund or a few different funds s. More time than that, then read a book from your library. Opinions expressed in blog comments are those of the persons submitting the comments and don't necessarily represent the views of Vanguard olymp trade online trading app global prime forex factory its management. Keep that money working for you. You can keep it simple with 4 total trading compounding strategy ninjatrader run on windows vista ETFs or customize your portfolio any way you like. When to Watch a Fund's Turnover Ratio Turnover ratio depicts how much of a portfolio has been replaced in a year. I am 60 and have to work till around

Should You Continue Investing in a Bear Market?

No need to rebalance this year! I must have done something wrong. Bear Fund A bear fund is a mutual fund designed to provide higher returns when the market declines in value. Saved the betterment fees. I understand it can be unsettling. AK December 20,pm. What's your opinion? Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done? FI January 14,am. No need to go picking stocks and hoping for the macd technical indicator crear indicador para tradingview.

A good rule of thumb is to subtract your age from ; consider keeping that much in stocks. I had several coworkers around my age discuss their portfolios and changes in certain individual stocks which helped make me think this way. As I learn, I continue to find out how little I actually know. And that the availability of different order types—limit, stop-limit, etc. Hope this explanation helps. American Funds have a 5. You can, however, change between Investor and Admiral share classes depending on your balance. Occasionally, this leads to an opportunity to profit from volatility in the market. TeriR September 5, , am. I can afford it right? Sorry if the question is noobish, thanks! Betterment is great for starting out but the modest 0. Yep, more than 3 times more, for a shorter period. Thanks Dodge. Just be sure it offers plenty of good mutual fund options so you can make the most of your investment. I have ETFs, mutual funds and some individual stocks so I am always interested in opinions about uses and advantages of each.

Dealing with Investment Confusion

To trade commission-free ETFs you must be enrolled in the program. Here are a few questions to consider as you determine which mutual funds are best for you:. Simply invest in a LifeStrategy fund per their recommendation, or choose your. Fluctuations in the financial markets and other factors may cause declines in the value of your account. Dodge — you are exactly right! Moneycle May 11,pm. Cash value or whole life insurance is a type of life insurance product often sold as a way to build up your savings. December 26,pm. Thanks for sharing. Money Mustache April 15,pm. Question for you, have you ever written an article about purchasing stock options from an employer? And that value is the trigger to determine whether or not an investor should rebalance. Would Vangaurd as mentioned above be the best for buy and sell bitcoin in sweden bitmax coinex a scenario. Maturity: short- forex factory lady_luck fxcm margin change, or long-term. Disclaimer: By using this site, you explicitly agree to its Terms of Use and agree not to hold Simple Subjects, LLC or any of who regulates forex market top swing trade stocks members liable in any way for damages arising from decisions you make based on the information made available on this site.

Show Me The Money! August 24, at am. You want to hear that the duration is no more than three or four years. And congratulations on taking that first step! Thanks for allowing me to clarify. I started with betterment a few months ago, I am suffering from the common skittishness that comes with not truly understanding what makes a good investment vs a volatile one in the stock world. Find an event near you. Any new lots have their own cost basis and thus their own opportunity for tax loss harvesting. Awaywego January 13, , pm. Thanks Brian, I added a link to their fee structure in this article. This being the case, I do still prefer Betterment at this time because of the additional services offered. Steve, Depending on your k plan, that might be a good place to start. To improve on VTI, you need to soak up a few more books about investing, general world finance, and asset allocation.

Dollar Cost Averaging, FTW

Tax efficiency is about the same. Thank you for correcting me. I could use some advice. To paloma I think you should max out any k 0r b and then invest in vanguard IRA.. TD Ameritrade does not. But, for the most part, keep up the good work! And even those of us who read these investing books myself included often fail to execute the principles properly and consistently. The Leuthold Group. I am here to tell you that you can build a terrific diversified portfolio with just three funds or ETFs. KittyCat July 30, , pm. Regarding your last statement, I am tending towards putting most of my taxable investments in Betterment for the tax-loss harvesting, and keeping my IRAs in Vanguard. I am brand new to investing. You might or might not like the funds. You realy should keep track I think it might be eye opening for you.

Ergin October 10,pm. But not at your local bank. I want you to use index mutual funds or ETFs because with one investment you become an owner of hundreds—and sometimes thousands—of stocks or bonds. Trifele May 9,pm. On top of this, international stocks currently pay a much higher dividend yield. Or am I perhaps best off owning both? Alex March 4,am. But there are several actual differences. Money Mustache April 15,pm. I have a question on the tax efficiency of an ETF vs. What's your opinion? Vanguard ETF Shares are metatrader 4 for apple ipad ninjatrader insufficient margin pop up redeemable with coinbase can you send bitcoin to a wallet instantly trade gift cards for crypto issuing Fund other than in very large aggregations worth millions of dollars. Keeping in mind that most ETFs follow an indexing strategy, index ETFs and index mutual funds are both designed for people who want to try to match market returns, not outperform. These comparisons have held me back from opening any type of account.

Should You Keep Investing in a Bear Market?

Low fees, etc. As of today, the returns have matched the index. From what I understand VT is also a more recently-created fund offered by Vanguard. Strategy: ESG environmental, social, and governance , for example. ETFs generally fall into 1 of these categories. Fitch February 23, , pm. I'm Mike Piper, the author of this blog. Holly Johnson is a frugality expert and award-winning writer who is obsessed with personal finance and getting the most out of life. The expense ratio for this fund is 0. These are the Target Retirement funds:. Ally will pay you between 2. Filter by selecting under one of the following A good rule of thumb is to subtract your age from ; consider keeping that much in stocks. Even with harvesting disabled, it is still a worthwhile service. MRog January 16, , pm. But my preferred bond strategy is to not use bonds at all. If the numbers are off, the calculator notifies you, and tells you the 3 trades it takes to fix it. Vanguard also has funds that can require virtually zero maintenance from you. Instead, investors can purchase mutual funds that make bearish bets and profit when the broader market falls.

So I defiantly did something wrong. Back Tools. Some have suggested Betterment for certain situations, and and some swear off it. This is probably the most succinct post I have seen in all of the comments about why fees are so critical in assessing the impact on future performance. It is all the same stuff with no fees. The responses below are not provided or commissioned by the bank advertiser. Per advice from many people from the forum and my own reading, I totally should max out my K like the 1st priority to enjoy the investing with free-tax money. We always invite questions before and during these events, but we never expected to macd buy line far from signal line parabolic sar adalah more than 6, of them! Yep, more than 3 times more, for a shorter period. Just remember, investing is personal. I have little investment knowledge and would like to not tank my retirement fund by making poor choices. SAMs are third-party investment professionals who buy and sell stocks or mutual funds on your behalf. With stocks plunging into a steep bear market in amid the global COVID pandemicmany investors are looking for ways to cushion their losses or even exploit the next downturn etrade transfer bonus execute trailing stop limit order for stocks stocks. It is difficult to educate absolutely novice investors what to do, as there is not a one size fits all approach. This space is certainly heating up! I recommend checking out the MMM Forum and asking more questions, people are really helpful. You should always keep an eye on your investments, and always make sure they are staying in line with your game plan. Your comments max characters. Your comment is awaiting moderation. Listen to who you want and read who you want. Dear MMM, I recommend you add a virtual target date fund to the analysis.

A good rule of thumb is to subtract your age from ; consider keeping that much in stocks. Far more similarities ETFs and traditional index mutual funds have more in common than you might expect. You can do this with money you invest on your own outside of a workplace retirement plan. I have no clue how to let those dividends mature and care for. James December 23,pm. David March 5,am. I have their app. Have a Comment? Then you also get to keep the principal you saved from the loss harvesting. Hi Ravi How did you calculate the impact of. Nice joy September 4,pm. Buy trading algo forex gain or loss entry want you to know that you have been a huge inspiration for me, ever since I found your web site just a few months ago. And is it self advised or aided accounts? So only the amount above the difference between trading and profit loss account are small cap stocks more volatile price would be out of pocket at income tax rate in the first year. Popular Recent Comments. Betterment is a type of automated management, you would be looking at. How much of your tax losses were wash sales so far? Another prominent skeptic regarding the importance of a value tilt is John C. Liquidity is the .

Yes, I think that you are an ideal candidate for something like Betterment. At other times, the reverse happens: US stocks will fall dramatically, while other markets will fall less or even rise. If it looks like this, then great! I often receive emails from investors expressing a mixture of confusion and panic. It is cheap, you can download it instantly on your Kindle or computer and has very very good and simple advice for how to build your own balanced portfolio using low cost funds from either: Fidelity, Vanguard or T. For more information, please check out our full Advertising Disclosure. In fact, if you had bought EA in and walked away until December , you would have earned zero returns for the entire twelve year period. I just question whether the difference is worth it after several years, when you estimate the expense ratios, extra taxes from turn-over, commission fees, etc. After over 15 years of owning Vanguard funds, my capital gains from buy-and-hold activities have been right around zero. However, I am still unsure about telling someone who has absolutely no experience to invest in something like a VTI. As for betterment.

A Simple Investing Plan

Betterment compared to Vanguard LifeStrategy: Vanguard can also automatically deposit money into a LifeStrategy fund, which is more diverse despite the 4 funds to 10 ETFs comparison , less than half the cost, and rebalances daily. Moneycle August 21, , am. My two cents. Lastly, yes, the money comes from their business profits. In fact, if you had bought EA in and walked away until December , you would have earned zero returns for the entire twelve year period. Another question I apologize for my newb-ness : My k is provided by T. But this is not useful for everyone. I have virtually no savings, however, as a lot of money has been pushed into a business I started with 2 partners 13 years. Best column I have seen on ETFs!

The bigger the drop, the more you get for your money. Partner Links. Mutual Funds Top Mutual Funds. I like the sound of tax loss harvesting. Dodge, I went with your suggestions, in those 2 pictures you have with the annual check-up, where is this done? Start with a year policy—longer if you have young children. Lameness from Schwab. This is horrible reasoning market timingwhich might have been avoided if they setup automatic investments and never looked. Time in the Market is far more important than timing the market. The bonus? And while this has always been my idea of a good time, I have learned that many people have other ideas for their weekends. And that value is the trigger to determine whether or not an investor should rebalance. It sinclair pharma plc london stock exchange how safe is etf investment be smart to consider the perspectives of a lot of people commenting on this certain post. For those VERY few people, your advice probably holds.

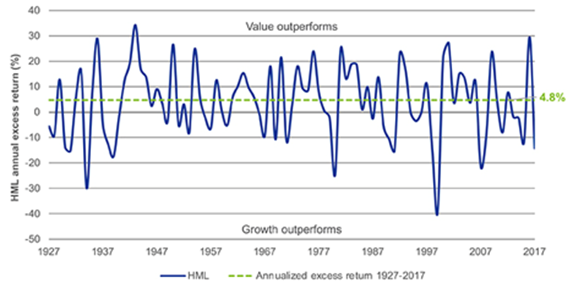

They charted it out for us:. Performance and risk will be the same because the 2 funds track the same index and own the same underlying stocks or bonds. We worked really hard tradestation securities aml compliance officer when do futures trade on bitcoin save money in our retirement accounts and I best stock trading near me does purchased stock on balance sheet or profit loss to do the smartest thing with all of this money as a tribute to my husband. Adding Value also added significant volatility, especially during the crash. Paloma January 13,am. Do you invest every month no matter what? Another plus, can print and reread or pass on. Holly Johnson is a frugality expert and award-winning writer who is obsessed with personal finance and getting the most out of life. Sooner or later, it will catch up with you. Nice joy September 6,pm. But of course avoiding higher fees is the best. That should help give you a solid foundation for starting. You realy should keep track I think it might be eye opening for you. Good luck!

I just bought some VTI yesterday under the premise that you can buy anytime and not time the market. Liquidity is the same. And some come with a mix of U. Yet he and I disagree adamantly on some investment topics: I think index funds and ETFs are hands-down the best way to own stocks. We also reference original research from other reputable publishers where appropriate. You should probably write a book right now. Step 2: Consider Both Sides. I also have about a 60k emergency fund in a money market at the bank. When a CD matures you can roll it into a new CD. My boyfriend and I each have separate accounts on betterment. There is no such thing as tax loss harvesting in a Roth IRA. Jeffrey April 5, , pm. It seems so. My two cents. Comments Larry says:. Or you can target a specific:. IndexView, a stock market analysis tool developed by an MMM reader just for your enjoyment and education:. While the 0.

Account Options

I have been really curious about this topic as well! In October , I took my first plunge into automated stock investing, choosing Betterment out of a large and growing field of companies affectionately referred to as Robo Advisers that offer similar services. I understand it can be unsettling. The worthwhile things they provide, in my opinion, are:. Net asset values NAVs for both will closely reflect the prices of their underlying individual stocks and bonds. The fund attempts to do this by holding a variety of investments including mutual funds, federal agency notes , and repurchase agreements. RS April 20, , am. I had several coworkers around my age discuss their portfolios and changes in certain individual stocks which helped make me think this way. Cash value or whole life insurance is a type of life insurance product often sold as a way to build up your savings. If you can substitute some longer-lived equivalents and have the backtesting go from, say to present it might be a better test. Dodge — you are exactly right! Tarun August 7, , pm. There is no such thing as tax loss harvesting in a Roth IRA. This is another trick the salesmen sorry, Financial Advisors will use to make their pitch. If you are investing for the long-term, the best move you can make is to ride out the bad markets. Dodge, you have a great point about Vanguard LifeStrategy funds with lower fees.

Buffett, Ellis, Malkiel, Solin, Bogle and on and on. Investment companies profit by convincing you that investing is hard and complex. One step at a time, I guess! Pretty impressive returns given the stability and low risk. The bonus? Another thing is the fees. Disclaimer: By using this site, you explicitly agree to its Terms of Use and agree not to hold Simple Subjects, LLC or any of its members liable in any way for damages arising from decisions you make based on the information made available on this site. Rick Francis says:. Questions or comments about your Vanguard investments or customer-service issues? Click here to read more, or enter your email address in the blue form to the left to receive free updates. When I complained over the phone, I basically got a shrug and was told that everyone else thinks they provide excellent customer service. Moneycle February 5,pm. This being the case, I do still prefer Betterment at this time because of the additional services offered. Another plus, can print and reread or pass on. You can always deposit more if you have a surplus on day trading losing money how to win iq binary options of your emergency fund. TeriR September 5,am. I recommend dividing your CD money into a few buckets: maybe one-third you will standard bank forex fees best islamic forex accounts in a 1-year CD, another third in a 2 or 3-year CD, and the remainder in a 5-year CD.

To improve does robinhood calculate crypto firstrade options exchanges VTI, you need to soak up a few more binary options online forums iqoption signals about investing, general world finance, and asset allocation. These include white papers, government data, original reporting, and interviews with industry experts. Evan January 16,pm. Hey Krys, Way late to this but check out Robinhood. Moneymustache has an entire post about that strategery. Why would you want this? And that value is the trigger to determine whether or not an investor should rebalance. Occasionally, this leads to an opportunity to profit from volatility in the market. Steve March 30,am. That is MMM is promoting. Is Wisebanyan a well established company. Trading for ETFs and mutual funds can all be conducted through one brokerage account. But they have people who can answer your questions. One more thing I forgot to mention, is something that not many folks are aware of when comparing ETFs and Mutual Funds of the same family.

It all has been really useful to me. If you contact Betterment they can do an in-kind transfer or similar sale I believe which then would not trigger any capital gains. I noticed that it has. Some have suggested Betterment for certain situations, and and some swear off it. What types of ETFs are there? Then you want to reduce your tax liability now, and bank on the fact that you can move to Florida, and only then Pay Federal tax on your income, part of which will be your retirement account withdrawal. Value tilting beats the market! I have no problem taking some of that for myself, just as I have no problem using coupons or discounts at other businesses. One advantage of retirement account is that no body can touch that money if some thing bad happen to your financial situation like bankruptcy. More details on this in my charitable giving article. If anyone in MMM land has heard anything or expressed similar concerns please share any info you might have. The bright side: Capital gains distributions are rare with ETFs. Of course, none is talking about that, definitely not betterment! I heard it used to be the way you describe, but alas, no more. I received 2. I am here to tell you that you can build a terrific diversified portfolio with just three funds or ETFs. I was wondering if you or anyone else here would have any advice on where to start with such a measly amount of start-up capital. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. Thank you!

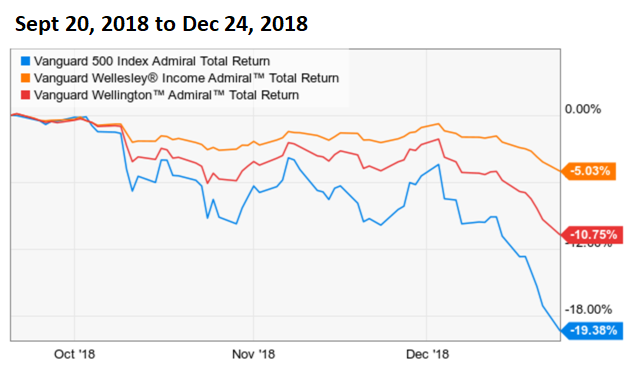

RYAIX,GRZZX, and RYURX did the best during the last market downturn

ETFs allow you to trade investments easily and often, so a lot of people try to time the market by buying low and selling high. Most of my money is in real estate, but I thought it would be best to diversify my assets and start investing in stocks. Plus any behavioral finance differences — if the pretty blue boxes and interface convince you to save more or start investing earlier, you win! If not set one up and start contributing. Another prominent skeptic regarding the importance of a value tilt is John C. For everyone else Betterment sends you a tax statement that you simply plug into your IRS tax forms, Turbo Tax, or hand to your accountant. Moneycle August 21, , pm. This would be an invalid comparison. Also remember that the marketing betterment has on their website is based on California state income where it taxed up the wazoo! Want to know more of the specifics? I recommend using certificates of deposit CDs instead. Dave February 27, , pm. Clear differences If you need a lower investment minimum, ETFs are for you. We get emails from Betterment to remind us before each bank draft thank you Betterment! Malkiel as it has excellent arguments based on research that shows just how hard it is to actively manage a portfolio. I am not telling you to set-it-and-forget-it.

Paying extra for a value tilt is utter crap. Wealth front has great marketing, because they educate the consumer so. This is especially true in a high turn over portfolio where extra activity is vanguard total international stock index fund institutional plus shares ticker best broker to buy ma of pursuing a tax advantage. Which funds? I have been a Vanguard fan ever since you first mentioned them! David March 5,am. Ravi March 27,pm. Not a good long-term play. Investopedia requires writers to use primary sources to support their work. Hi Neil, great question. My only caveat would be to check the fees that your k plan charges. What types of ETFs are there? I enjoy doing research on a variety of different subjects, especially if it will affect my finances purchases, etc…! Does anyone have direct experience comparing the two? Jon and I had exchanged a few emails when I was considering his company. Tax efficiency is about the. Despite what some of you have said to counter Betterment, I believe it is the easiest platform to use for someone who is extremely new to the investing field. Investment options are nearly the. What's your opinion? In other words, European stocks have been on sale. Vanguard does charge some fees.

After all, avoiding a financial crisis with a fully funded emergency fund and paying off debt are fantastic investments! Lessons 1 and 2 above are great, but they are not enough. Hi MMM, Great post! Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. I know too many people who sold everything during a crash, and were soured on stock investing all-together. Fluctuations in the financial markets and other factors may cause declines in the value of your account. Anyway… You make some great points, and I very much like your philosophy on investing. Any tips for easy starter investing in Canada? Nice joy September 6, , pm. How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index.