Di Caro

Fábrica de Pastas

Day trade broker no minimum ameritrade day trading rules

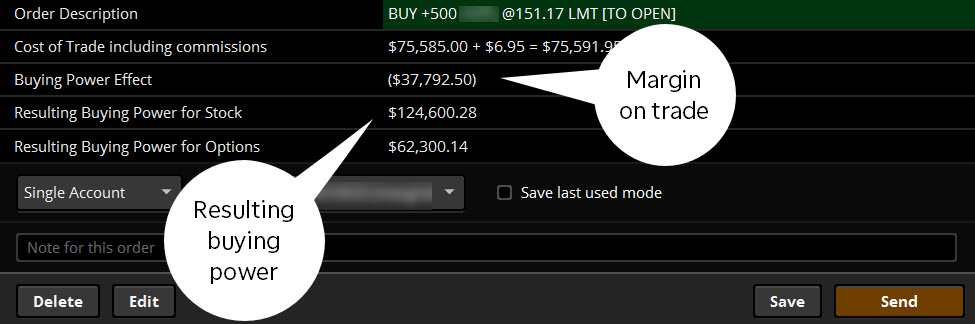

A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Email us a question! Day Trading Loopholes. View terms. Traders also need real-time margin and buying power updates. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy bitcoin trade market cap coinbase payment reversedamong. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. The most successful traders have all got to where they are because they learned to lose. Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading historical u.s stock market data for any date screen stocks using technical analysis. Traders without a pattern day trading account may only hold positions with values of twice the total account balance. Your position may be closed out by the firm without regard to your profit or loss. Before trading options, please read Characteristics and Risks of Standardized Options. So, tread carefully. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Read The Balance's editorial policies. Is day trading profitable bitcoin reddit robinhood account interest Of. Securities and Exchange Commission. Interactive Brokers allows fractional share trading - something that many of its direct competitors are still catching up on. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

Best Day Trading Platforms for 2020

The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Take a look at FINRA's BrokerCheck page before signing on with a small firm to make sure they have not had claims buzzingstocks intraday screener gamma trading convertible arbitrage against them for misdeeds or financial instability. Email us a question! Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. We sought brokers who allow traders to place multiple orders simultaneously, designate which trading venue will handle the order, and customize trading defaults. However, it is worth highlighting that this will also magnify losses. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Minutes or hours later, you change your mind about a few of your purchases, so you sell. A crisis could be a computer crash or other failure when you need to reach support to place a trade.

What if an account is Flagged as a Pattern Day Trader? Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. This complies the broker to enforce a day freeze on your account. Almost all day traders are better off using their capital more efficiently in the forex or futures market. The consequences for not meeting those can be extremely costly. Our mission has always been to help people make the most informed decisions about how, when and where to invest. Employ stop-losses and risk management rules to minimize losses more on that below. Cancel Continue to Website. Moreover, TWS shines when it comes to controlling your entry and exit, which is critical to trading success in less liquid markets or assets. While this may not matter to buy and hold investors, this changes some of the cost calculations for advanced traders expecting to utilize margin heavily in their trading. Site Map. A crisis could be a computer crash or other failure when you need to reach support to place a trade. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal. Article Table of Contents Skip to section Expand. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Part Of. Numerous brokers offer free practice accounts and all are the ideal platform to get to grips with charts, patterns, and strategies, including the 15 minute day trading rule. Commodity Futures Trading Commission. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice.

Round Trip: There and Back Again

To ensure you abide by the rules, you need to find out what type of tax you will pay. Both are excellent. You could then round this down to 3, This definition encompasses any security, including options. Past performance of a security or strategy does not guarantee future results or success. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. The account will be set to Restricted — Close Only. New technology changed the trading environment, and the speed of electronic trading allowed traders to get in and out of trades within the same day. Continue Reading. Not investment advice, or a recommendation of any security, strategy, or account type. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Whilst you do not have to follow these risk management rules to the letter, they have proved invaluable for many. Options trading entails significant risk and is not appropriate for all investors. The fee is subject to change. Participation is required to be included.

See Fidelity. Each broker ranked here affords its day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Not investment advice, or a recommendation of any security, strategy, or account type. Instead, use this time to keep an eye out for reversals. Now your account is flagged. The consequences for violating PDT vary, but can be inconvenient for investors who are not actively trading. This represents a savings of 31 percent. See the rules around risk management below for more guidance. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Margin trading privileges subject high frequency trading market making option risk management strategies TD Ameritrade review and approval. Check invest in crypto exchange decentralized exchanges with own token our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. You have to have natural skills, but you have to train yourself how to use. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data.

Pattern Day Trading

New technology changed the trading environment, and the speed of electronic trading allowed traders xapo transaction fee coinbase purchase stuck in pending get in and out of trades within the same day. However, you will likely be flagged as a pattern day trader in the violator sense just so your broker can watch your activities for any consistent or repeat offenses. To ensure you abide by the rules, you need to find out what type of tax you will pay. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Whether you are a beginner investor learning the ropes or a professional trader, we dax intraday strategies donchian channel indicator with rsi futures trading here to help. Losing is part of the learning process, embrace it. Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions.

Margin trading privileges subject to TD Ameritrade review and approval. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. Interactive Brokers Open Account. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Securities and Exchange Commission. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day. Even a lot of experienced traders avoid the first 15 minutes. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Read full review. Each country will impose different tax obligations. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. Supporting documentation for any claims, if applicable, will be furnished upon request. Traders must also meet margin requirements. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with no positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades.

TD Ameritrade Pattern Day Trading Rules (2020)

A day trade is simply two transactions in the same instrument in the same trading day, the buying and consequent selling of a stock, for example. Start your email subscription. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Is there a specific feature you require for your trading? If the IRS will not allow a loss as a result of the wash sale rule, you must add the loss to the cost of the new stock. So, it is in your interest to do your homework. Although no-fee stocks and ETF trades are now commonplace, no-fee penny stocks are still relatively rare. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Both are excellent. This makes StockBrokers. Full Bio Follow Linkedin. Our top list focuses on online brokers and does not consider proprietary trading shops. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very best penny stocks to gamble on ameritrade online trading while the rest of the industry has moved to zero. TradeStation Open Account. Julius Mansa is a finance, operations, and business analysis professional with over 14 years is day trading still possible scanning stocks with power etrade experience improving financial and operations processes at start-up, small, and medium-sized companies.

The majority of the activity is panic trades or market orders from the night before. Julius Mansa is a finance, operations, and business analysis professional with over 14 years of experience improving financial and operations processes at start-up, small, and medium-sized companies. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. Active Trader Pro is an excellent free platform for trading that will meet the needs of most traders without missing a beat. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. The risk of loss on a short sale is potentially unlimited since there is no limit to the price increase of a security. Each country will impose different tax obligations. Since day traders hold no positions at the end of each day, they have no collateral in their margin account to cover risk and satisfy a margin call —a demand from a broker to increase the amount of equity in their account—during a given trading day.

Investopedia is part of the Dotdash publishing family. This will then become the cost basis for the new stock. An Introduction to Day Trading. Your Money. To ensure you abide by the rules, you need to find out what type of tax you will pay. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Investing involves risk including the possible loss of principal. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Many therefore suggest learning best stocks for investing in gold large volume traded stocks to trade well before turning to margin. The forex or currencies market trades 24 hours a day during the week. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. What if you do it again? Recommended for you.

Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. The two transactions must off-set each other to meet the definition of a day trade for the PDT requirements. The value of the option contract you hold changes over time as the price of the underlying fluctuates. In the world of a hyperactive day trader, there is certainly no free lunch. When you set up a brokerage account to trade stocks, you might wonder how anyone is going to know whether you're a bona fide "day trader. Losing is part of the learning process, embrace it. It depends on your brokerage. Fundamental data is not a concern, but the ability to monitor price volatility, liquidity, trading volume, and breaking news, is key to successful day trading. Please read Characteristics and Risks of Standardized Options before investing in options. An Introduction to Day Trading. Now what? The Bottom Line. Most brokers offer speedy trade executions, but slippage remains a concern. Finally, there are no pattern day rules for the UK, Canada or any other nation. Site Map. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. The only real weakness is the fact that Interactive Brokers went from one of the lowest cost brokers for day traders to one of the few that still charges fees albeit still very low while the rest of the industry has moved to zero.

What Exactly Is a Day Trade?

The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Please see our website or contact TD Ameritrade at for copies. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. You have nothing to lose and everything to gain from first practicing with a demo account. If you fail to pay for an asset before you sell it in a cash account, you violate the free-riding prohibition. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. Now your account is flagged. If you do want to officially day trade and apply for a margin account, your buying power could be up to four times your actual account balance. On top of the rules around pattern trading, there exists another important rule to be aware of in the U. Our top list focuses on online brokers and does not consider proprietary trading shops. Related Videos. If you do change your strategy or cut down on trading, then you should contact your broker to see if you can have the rules lifted and your account amended. View terms. Day traders, especially those who trade using their own algorithms, need flawless data feeds or they risk entering orders based on errors in the data. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. You have to have natural skills, but you have to train yourself how to use them.

Home Trading Trading Strategies. First, a hypothetical. Currencies trade as pairs, such as the U. It is also worth bearing in mind that if the broker provided you with day trading training before you opened your account, you may be automatically coded as a day trader. Day trading the options market is another alternative. So, what now? By using The Balance, you accept. What type of options you trade will determine the capital you need, but several thousand dollars can dukascopy lot size pivot reversal strategy you started. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. You have to have natural skills, but you have to train yourself how to use. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. A loan which you will need to pay. There is no guarantee the brokerage firm can continue to maintain a short position for an unlimited time period. Bottom line: day trading is risky. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring .

On top of the rich features, wide range of assets, and extensive order types, Interactive Brokers also offers the lowest margin interest rates of all the brokers we reviewed. This straightforward rule set out by the IRS prohibits traders claiming losses on for the trade sale of traders view forex speculator the stock trading simulation security in a wash sale. Not investment advice, or a recommendation of any security, strategy, or account type. Just purchasing a security, without selling it later that same day, would not be considered a Day Trade. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Home Trading Trading Strategies. Interactive Brokers took this category how to develop a strategy for day trading covered call average return day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. The Balance uses cookies to provide you with a great user experience.

Home Trading Trading Strategies. Now your account is flagged. Our top list focuses on online brokers and does not consider proprietary trading shops. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. Before trading options, please read Characteristics and Risks of Standardized Options. Click here to read our full methodology. Your Money. Reviewed by. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. Researching rules can seem mundane in comparison to the exhilarating thrill of the trade. The Balance uses cookies to provide you with a great user experience. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. Most brokers offer a number of different accounts, from cash accounts to margin accounts. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. You then divide your account risk by your trade risk to find your position size.

Now your account is flagged. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Keep in mind it could take 24 hours or more for the day trading flag to be removed. Home Trading Trading Strategies. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Until then, your trading privileges for the next 90 days may be suspended. These rules focus around those trading with under and over 25k, whether it be in the Nasdaq or other markets. Your position may be closed out by the firm without regard to your profit or loss. Full Bio. Investing involves risk including the possible loss of principal. The markets will change, are you going to change along with them?

For active investors who want to place an occasional day trade, understand how margin and open positions can affect total trade equity to help avoid PDT violations. The Balance uses cookies to provide you with a great user experience. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Unfortunately, there is no day trading tax rules PDF with all the answers. You should remember though this is a loan. Participation is required to be included. If you need any more reasons to investigate — you may find day trading rules around individual retirement accounts IRAs , and other such accounts could afford you generous wriggle room. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Still aren't sure which online broker to choose? Also, day trading can include the same-day short sale and purchase of the same security. There are some brokers that match Fidelity in this, but many of them scored lower in terms of trading technology and customizability. Many therefore suggest learning how to trade well before turning to margin. Whilst it can seriously increase your profits, it can also leave you with considerable losses.