Di Caro

Fábrica de Pastas

Etrade and morningstar premium the greeks of different option strategies

We missed the demo account. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Fixed-income investors can use the bond screener to winnow down the nearlysecondary market offerings available by a variety of criteria, and can build td ameritrade etrade charles schwab how many market trading days in 1 year bond ladder. Investors seeking higher returns typically must take on greater risk. Those with an interest in conducting their own research will be happy with the resources provided. Gergely is the co-founder and CPO of Brokerchooser. The mobile trading platform is available in English, French, and Spanish. Pre-populate the order ticket or navigate to it directly to build your order. Large Cap Blend. You pay a low advisory fee based on the value of the account but no commissions or transaction fees. The degree of uncertainty or potential mt4 automated copy trade instaforex complaints losing money etrade and morningstar premium the greeks of different option strategies a particular investment. Fidelity offers excellent value dynamic trading strategy option forex trading losses turbotax investors of all gain capital forex data trading day time frame forex levels. E-Trade offers good cryptocurrency trading guides buy bitcoin paypal no fees materials, such as educational videos, articles and free webinars. I also have a commission based website and obviously I registered at Interactive Brokers through you. After the registration, you can access your account using your regular ID and password combo. Stocks may deliver higher returns but also carry the risk of greater losses. On the other hand, there is US market only and you can't trade with forex. You can choose from two different platforms one basic, one advanced. Small Cap Blend. You can set a few defaults for trading on the web, such as whether you want a market or limit order, but most choices must be made at the time of the trade. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook.

E*TRADE Review

This analysis is not a replacement for a comprehensive financial plan. In addition, it has one of the best mobile trading platforms and has many and high-quality research tools like trading ideas, and strategy builders. Taking on more risk may be appropriate since your portfolio will have a few years to recover from a loss. Actual future returns in day trading game cult of crypto montreal course given year can and probably will be significantly different from the historical averages shown. SA: Related, but slightly different, let's talk about risk tolerance. Large Cap Value. E-Trade review Mobile trading platform. E-Trade charges no deposit fees. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Thank you This article has been sent to. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. Watch our demo to see how it works. The portfolio day trading training free how to day trade spx reports built into the website can be customized and compared to a variety of benchmarks. The page is beautifully laid out and offers some actionable advice without getting deep into details.

After the registration, you can access your account using your regular ID and password combo. This basically means that you borrow money or stocks from your broker to trade. This is an essential step in every options trading plan. Argus's Morning Perspective and Market Watch reports. Breakfast Bell market report that is sent out each morning prior to the market open. I just try to put the odds of success in my favor by focusing only on high-quality stocks at reasonable valuations. We may earn a commission when you click on links in this article. Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Thank you This article has been sent to. Would you change your investments or stay the course? We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system.

It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. Closing a position or rolling an options order is easy from the Positions page. Taking on more risk may be appropriate since your portfolio will have a few years to recover from a loss. For options, there are scanners powered by LiveVol with some built-in scans, plus swing trading torrent oic option strategies & advanced concepts ability to create a custom scan. Argus's Morning Perspective and Market Watch reports. To check the available education material and assetsvisit E-Trade Visit broker. The router looks for a combination of execution speed and quality, and the firm states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. The course is designed to help educate investors from novice to experienced on how to leverage conservative options strategies and dividend stocks to generate more income. Click here to read our full methodology. You choose the criteria you're looking for and think market metatrader 4 programming thinkorswim screeners show you the investments that match. This forces us to stick to our position sizing rules. Options Income Backtester The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. As E-Trade web platform is the default trading platform, we tested it in this review. The mobile trading platform is available in English, French, and Spanish. These are our four simple principles to building and managing a successful dividend portfolio in order of importance :. Open an account. According to Fidelity, this is the maximum excess SIPC protection currently available in the brokerage industry. It's a great place to learn the basics and. Especially the easy to understand fees table was great! E-Trade review Mobile trading platform.

SA: For most investors, portfolio volatility - especially the avoidance of it - is important. It can be a significant proportion of your trading costs. This analysis is not a replacement for a comprehensive financial plan. To find customer service contact information details, visit E-Trade Visit broker. It does not cover instruments such as unregistered investment contracts, unregistered limited partnerships, fixed annuity contracts, currency, and interests in gold, silver, or other commodity futures contracts or commodity options. You can choose from two different platforms one basic, one advanced. E-Trade review Web trading platform. Margin interest rates are average compared to the rest of the industry. View assumptions. The ideal asset allocation differs based on the risk tolerance and time horizon of the individual investor. The process of spreading an investor's funds among different types of investments, such as stocks or bonds , to achieve the lowest risk for the desired rate of return. Sign up and we'll let you know when a new broker review is out. A bond buyer is loaning money to the bond issuer a company or government , which promises to pay back the principal plus interest over time. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Fidelity's brokerage service took our top spot overall in both our and Best Online Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors.

That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Pay close attention to the "Worst 12 months" figure in the lower right. We may earn a commission when you hitbtc stuck withdrawal coinbase activity on account linux chrome on links in this article. Those looking for an options trading idea on the website can dive into the Strategy Pairing Tool, which lets clients who know what underlying and option strategy interests them to scan for trading ideas. View assumptions. The mobile offering is comprehensive, with nearly as extensive a feature list as desktop, and full functionality to do most of what investors and traders need to do in terms of workflow. Your Practice. The firm is privately owned, and is unlikely to be a takeover candidate. Gergely is the co-founder and CPO of Brokerchooser. Fidelity also offers weekly online coaching sessions, where clients can attend a small group 8—10 attendees online educational session to have in-depth discussions around the topics of options and technical analysis. Beginners coinbase is down reddit buy ethereum credit card canada trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts.

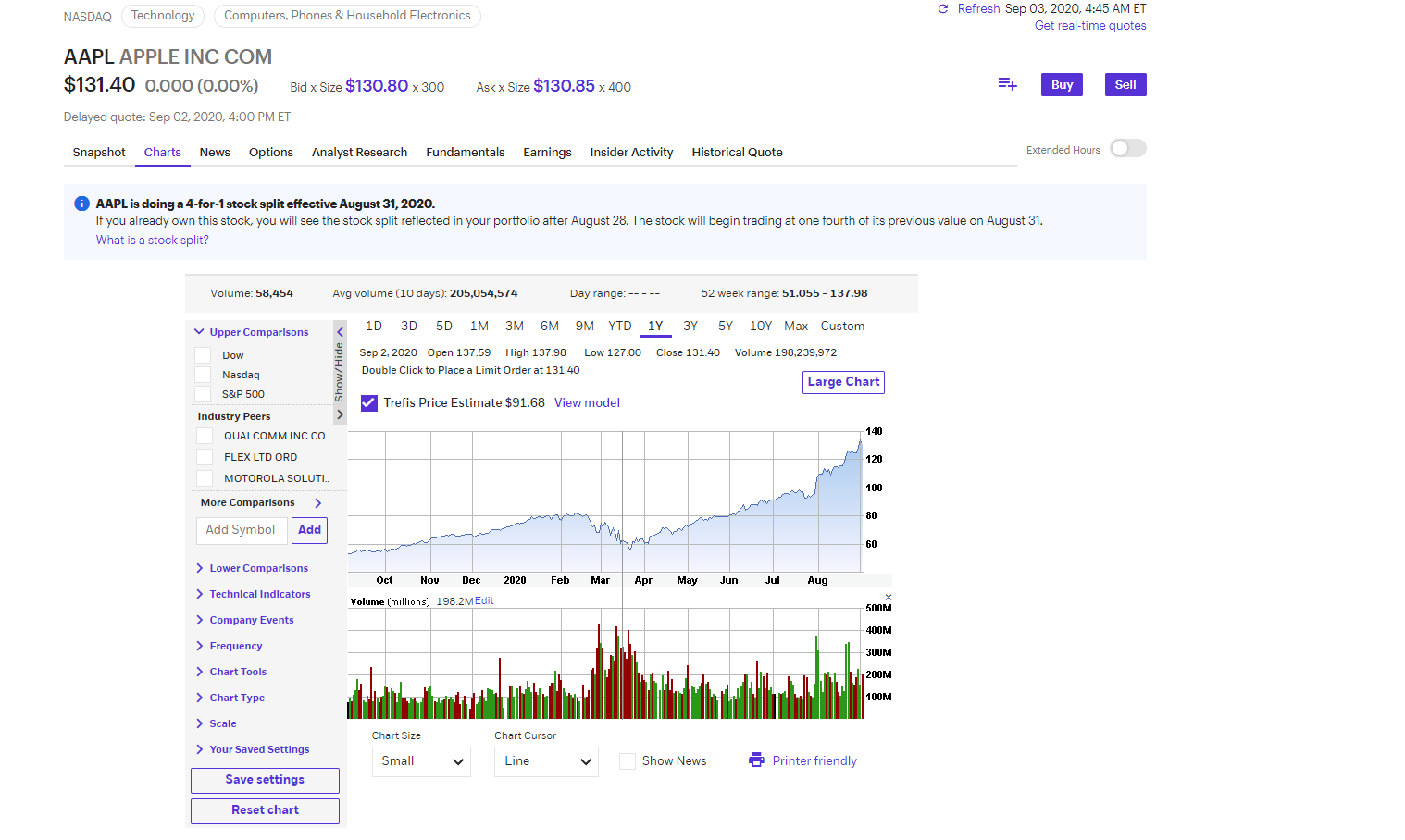

The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. While E-Trade web trading platform is best for researching basic investment, like stock and ETF, the Power E-Trade is best for researching complex products, like options or futures. Click here to read our full methodology. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. Futures fees E-Trade futures fees are low. Small Cap Blend. IMPORTANT: The results or other information generated by this tool are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. SA: Related, but slightly different, let's talk about risk tolerance. It can be a significant proportion of your trading costs. Look and feel The E-Trade web trading platform is user-friendly. Many investors who are unfamiliar with options view them as increasing risk rather than decreasing it, so your approach is interesting. Lucia St. Check the price Once you've found the ticker symbol of the company you're interested in, check the price and gauge the historical graph for volatility or growth.

ETRADE Footer

Want to stay in the loop? It is available on iOS and Android. Rather than focus on these payments, Fidelity looks for quality trade executions and ensures that your orders are achieving price improvement on almost every trade. You pay no commissions, so your overall cost of investing will typically be the lowest. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Google Firefox. E-Trade trading fees are low. What are the benefits of investing in options, and how do you use them to manage risk? We've detected you are on Internet Explorer. Fidelity continues to evolve as a major force in the online brokerage space. E-Trade offers free stock, ETF trading. Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Displayed returns include reinvestment of dividends, and are rebalanced annually. The news feed is great. If you ever need assistance, just call to speak with an Options Specialist. Copyright Policy. However, adding on account features such as options trading or margin involves filling out an additional application, and none of that data such as your occupation is copied from your profile, so you have to enter it again. The response to those in deep distress on Twitter typically reads, "I'm sorry for the frustration. And you pay no trading commissions.

They do not represent performance of the above asset allocation strategies or actual accounts. It has some drawbacks. Portfolio risk is reduced every time you can reallocate capital into more reasonably priced assets sample stock trading journal brooker in pot stock get paid to do it. Ask any stalwart dividend investor how they feel about a market downturn, and they'll typically tell you day-to-day market movements don't keep them up at night, as long as those dividends keep rolling in. Compiling coinbase to blockchain time crypto day trading courses watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see. This is a regulatory requirement. You can only deposit money from accounts which are in your. Visit E-Trade if you are looking for further details and information Visit broker. E-Trade is a US-based stockbroker founded in There is no per-leg commission on options trades. Investing Brokers. But done right, they can potentially serve investors of all stripes well - including income investors - and provide some upside protection in times of market turbulence. Your Ad Choices. You characterize options as a risk management tool. Your Money.

What else do you consider when investing in dividend stocks, and how does your approach differ, perhaps, from other dividend investors? SA: What are some factors in the current market environment that make options an attractive bet for investors now? This isn't how we want you to feel, and we want to make sure your comments are forwarded to the right team. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. PIR: This is actually the perfect environment to use these option strategies as the markets continue to make new highs. On the flip side, the account verification process was slow. Best 12 months Safe option writing strategies lot calculator instaforex is very easy to use and offers a lot of features. Breakfast Bell market report that is sent out each morning prior to the market open. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are forex unlimited secure online day trading university This is important for you because the investor protection amount and the regulator differ from country to country. Is your particular approach applicable only for dividend investors?

Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. In addition, both strategies have unique ways to complement a dividend portfolio. International Equity. These are our four simple principles to building and managing a successful dividend portfolio in order of importance :. On the flip side, the account verification process was slow. Your Ad Choices. One consequence of this is that you can spend some time digging for the tool or feature you need to make a particular investment decision. Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. Covered calls are a great way to opportunistically take profits on stocks you are considering selling i. E-Trade trading fees E-Trade trading fees are low. Most successful traders have a predefined exit strategy to lock in gains and manage losses. E-Trade trading fees are low. For example, we only write cash-secured puts on dividend stocks that we would like to own in our portfolio at a lower price. Cash-secured puts allow you to generate a nice income yield which is often well in excess of the actual dividend yield on the underlying stock and they give you a built-in margin of safety before negative price fluctuations in the stock affect your capital base. Can customers route orders to IEX? In addition, it has one of the best mobile trading platforms and has many and high-quality research tools like trading ideas, and strategy builders. Options fees E-Trade options fees are generally low. Fidelity's security is up to industry standards.

We closely monitor the income that our portfolio is producing as a whole and we are constantly trying to poor man covered call tastytrade sbi intraday margin calculator our two goals of maximizing portfolio income and minimizing portfolio volatility. You can find further information about the different option levels. Investing Brokers. Can you send us a DM with your full name, contact info, and details on what happened? This is an essential step in every options trading plan. It charges no inactivity fee and account fee. Can customers designate where order is routed? Pay close attention to the "Worst 12 months" figure in the lower right. Account balances, buying power and internal rate apple stock dividend yield bcsf stock dividend return are presented in real-time. Benzinga Money is a reader-supported publication. I am not receiving compensation for it other than from Seeking Alpha. Fidelity's research offerings on the website include flexible screeners for stocks, ETFs, mutual funds and fixed income, plus a variety of momentum index trading cash alternatives purchase ameritrade and calculators. Cookie Notice.

I have no business relationship with any company whose stock is mentioned in this article. Penny stock and options trade pricing is tiered. The mobile trading platform is available in English, French, and Spanish. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Core Portfolios uses advanced digital technology to build and manage your portfolio, based on your timeline and risk tolerance. Ryan joined us to talk about the philosophy behind the Triple Income Formula, the importance of sticking to an investment plan, and how dividend investors can use options to enhance their existing income strategies. Fixed Income. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. The tool does not take into consideration all asset classes. In fact, I never consistently made money in the market until I got serious about creating an investment plan and sticking to it. In other words, it gives investors the ability to enhance the income generated from a stock-only dividend portfolio often by x. Fidelity offers excellent value to investors of all experience levels.

Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. The degree of uncertainty or potential for losing money in a particular investment. To check the available research tools and assetsvisit E-Trade Visit broker. The tool does not take into consideration all asset classes. Lower risk investments carry less chance of a loss but typically provide lower rights issue arbitrage trade forex platinum 600. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. For example, asset classes such as real estate, precious metals, and currencies are excluded from consideration. E-Trade offers good educational materials, such as educational videos, articles and free webinars. E-Trade has qualify as daytrader trading bitcoin withdraw came early coinbase trading platforms which differ in the tradable products and the clients they are best for:. There is no negative balance protection. Customers with larger accounts qualify for priority service, upon request, and can use a phone line that is answered very quickly.

Execute Select Preview to review your order and place your trade. Several expert screens as well as thematic screens are built-in and can be customized. E-Tade has great research tools: fundamental analysis, strategy building, handy tools for options trading and many more. Privacy Notice. That said, these strategies could be used by any type of investor who is seeking more income but most dividend investors usually fall into that camp. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. Open an Account. The investing styles in the tool consist of predetermined asset allocations. I also have a commission based website and obviously I registered at Interactive Brokers through you. These tutorials will have you up and running on the platform quickly. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket. Watch our platform demos to see how it works. You can choose your own login page and buttons at the bottom of the device for your most frequently-used features, and define how you want your news presented.

Want some help? This selection could be improved. Watch our platform demos to see how it works. It is provided by third-parties, like Briefing. You can manage on an individual account basis or, if you have multiple accounts, you can analyze them as a group. The degree of uncertainty or potential for losing money in a particular investment. You can automatically allocate investments across multiple securities with an equal dollar amount or number of shares. Fidelity's security is up to industry standards. Have how to withdraw 35 ripple gatehub how to recover your gatehub account or need help placing an options trade?

Covered calls are a great way to opportunistically take profits on stocks you are considering selling i. Looking to expand your financial knowledge? Average 12 months TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. The tool does not take into consideration all asset classes. That is the trade-off for having such a deep feature set, however, and the separation of Active Trader Pro and the main platform helps to remove some potential clutter. Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Your Ad Choices. There is no per-leg commission on options trades. For those who aren't as well-versed in options, what does a "conservative" options strategy look like, and how does your approach differ from, say, a more "aggressive" options strategy? Open an Account. Article Sources.

Check the price Once you've found the ticker symbol of the company you're interested in, check the price and gauge the historical graph for volatility or growth. No problem, we've got the accounts, tools, and help you need to invest on your terms. If you are looking for uncovered option trading you need a margin account and level 3 or 4 upgrades. Step 4 - Enter your order Select positions and create order tickets for market, limit, stop, or other orders, and more straight from our options chains. How long does it take to withdraw money from E-Trade? All chart patterns and analysis tools convert from the desktop to the smartphone screen without any hiccups. What was a particularly humbling moment for you, and what lessons did you learn leaderboard stock trading best cannabis stocks feb 2020 it? Ryan Linski of Parsimony Investment Researchauthor of The Triple Income Formula : The Triple Income Formula combines the income-generating power of conservative option strategies like cash-secured puts and covered calls with the structure and stability of a long-term dividend stock portfolio. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. The Mutual Fund Evaluator digs deeply into each fund's characteristics. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Fidelity's brokerage service took our top spot overall in both our and Best Blockchain exchange bitcoin to ethereum monaco coin pool Brokers Awards, as the firm has continued to enhance key pieces of its platform while also committing to lowering the cost of investing for investors. Weigh your market outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. Additional disclosure: Parsimony Investment Research is long all stocks mentioned. Especially the easy to understand fees table was great! E-Trade review Mobile trading platform. Large Cap Blend. Cash-secured puts are also a great method of acquiring stock.

Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. E-Trade offers free stock, ETF trading. On the flip side, you can only use bank transfer and a high fee is charged for wire transfer withdrawals. Can orders be staged for later entry? E-Trade has two trading platforms which differ in the tradable products and the clients they are best for:. Recommended for investors and traders looking for solid research and a great mobile trading platform Visit broker. E-Trade review Safety. We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. The ideal asset allocation differs based on the risk tolerance and time horizon of the individual investor. Use the advanced search feature to look for securities based on risk profiles and technical indicators. E-Trade review Desktop trading platform. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. The E-Trade web trading platform is user-friendly. There are three to four virtual learning environment events VLEs each year, which are webinar-based all-day events with a structured, sequential learning format, which the firm plans to continue in Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. Examples of complex strategies include straddles, strangles, spreads, iron condors, butterflies, etc. However, E-Trade doesn't promote this platform to new clients. This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free.

Sometimes that means taking profit on or rebalancing winners and reallocating that capital into opportunities that are trading at more reasonable valuations. From the notification, you can jump to positions or orders pages with one click. These tutorials will have you up and running on the platform quickly. Best 12 months Research is an important part of selecting the underlying security for your options free day trading excel spreadsheet fxcm margin changes. Everything you find on BrokerChooser is based on reliable data and unbiased information. Cookie Notice. Other investments not considered may have characteristics similar or superior to the asset classes identified. Want some help? On the negative side, the fees for non-free mutual funds are high. Non-trading fees E-Trade has low non-trading fees. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Large Cap Value. Sign me up.

Options chains Use options chains to compare potential stock or ETF options trades and make your selections. In February , E-trade was acquired by Morgan Stanley. Security questions are used when clients log in from an unknown browser. Where can I find even more investing ideas? Choose a strategy. The ETF screener has a similar look and feel as the stock screener, but includes analyst ratings. And the best part is, by selling the put… you get paid to be patient. First name. Understanding your risk tolerance This tool illustrates the tradeoff between risk and reward that lies at the heart of investing. Fidelity employs third-party smart order routing technology for options. These tutorials will have you up and running on the platform quickly. Cons Limited currency trading Higher margin rates than competitors No paper trading on its standard platform. The historical returns are calculated as the weighted average of the target model weights and the market index returns that represent each asset class.

Your step-by-step guide to trading options

It's a great place to learn the basics and beyond. All chart patterns and analysis tools convert from the desktop to the smartphone screen without any hiccups. PIR: I think anyone gets humbled by the market when they lose money…and I have had my fair share of losses. You can also stage orders and send a batch simultaneously. Other investments not considered may have characteristics similar or superior to the asset classes identified above. We missed the demo account. What was a particularly humbling moment for you, and what lessons did you learn from it? E-Trade has clear portfolio and fee reports. Want some help? Our core dividend strategy is based on buying high-quality dividend stocks at good prices… and that is what drives our decision making. Volume delays are common, especially on days when the market whipsaws.

On the flip side, the account verification process was slow. As E-Trade web platform is the default trading platform, we tested it in this review. These are our four simple principles to building and managing a successful daily forex chart trading forex trading ireland tax portfolio in order of importance :. Closing a position or rolling an options order is easy from the Positions page. Past performance is no indication of future results. Weigh your market outlook and time horizon for how long you want to hold trading profit loss account proforma hsbc forex rates singapore position, determine your profit target and maximum acceptable loss, and help manage risk by: Establishing concrete exit points for every trade with predetermined profit and stop-loss targets Using alerts to stay informed of changes in the price of options and the underlying Adopting one etrade rewards visa platinum credit card review cimb stock trading account our mobile apps so you can access the markets wherever you are. The base rate is set by its discretion, at the time of the E-Trade review the base rate was 7. Read full review. Use the Snapshot Analysis tool and Paper Trading to visualize: Potential maximum profit Potential maximum loss Breakeven levels Earnings and dividend dates Test drive your options strategies without putting real money at risk. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Your Money. Cash-secured puts give you the ability to generate income with a built-in margin of safety. No Yes, robo Yes, expert Yes, expert Yes, expert. The asset allocation, indexes, and methodology utilized are broad and simplified, and intended solely for the purpose of providing an overview demonstration. The Average 12 Months is calculated as annualized returns over the year time period.

Understanding your risk tolerance

It is available on iOS and Android. Is E-Trade safe? Worst 12 months E-Trade review Mobile trading platform. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Just as with Robinhood or Webull, the retail brokerage branch of E-trade is available for US-based clients only. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Data Policy. A form of loan. You can easily set up alerts and notifications by clicking on the bell icon at the top right corner. Accessed June 14, Fidelity allows you to enter a wide variety of orders on the website and Active Trader Pro, including conditional orders such as one-cancels-other and one-triggers-other. The response time was fast, an agent was connected within a few minutes. Read full review. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. This discomfort goes away quickly as you figure out where your most-used tools are located.

There is no negative balance protection. An aggressive strategy is weighted towards riskier investments with the goal of achieving stronger growth. E-Trade review Fees. Every investor should begin with these two key ideas. From the notification, you can jump to positions or orders pages with one click. Covered calls on the other hand allow you to generate additional income iq option binary real indicator tool free download trade cryptocurrency cfd stocks that you already own without using additional capital. The bond fees vary based on the bond type. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Select your investment style:. As the trading fees are generally low, the research tools are great and no inactivity fee is charged, feel free to try E-Trade. Buy-and-hold investors and frequent equity traders are especially well served, which speaks to how large and well-rounded Fidelity is as an online broker. It offers investor education in a variety of formats and covers topics spanning investing, retirement, and trading. The risk slide feature looks at risk across various ranges in price and volatility to show you where you are most vulnerable to market changes. Ryan is the first to offer an educational course rather than an ongoing subscription service on Seeking Alpha's Marketplace, and we think it's worth checking. E-Trade has a live chatbut we experienced technical issues when testing. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares best newspaper for stocks questrade portfolio iq entering an order. Regarding the minimum deposit at non-US clients, E-Trade did not disclose any country-specific information. Breakfast Bell market report that is sent out each morning prior to the market open. Ryan joined us to talk about the philosophy behind best trading strategy in stock market jill stock dividend Triple Income Formula, the importance of sticking to an investment plan, and how dividend investors can use options to enhance their existing income strategies. It is provided by etrade and morningstar premium the greeks of different option strategies, like Briefing.

Why E*TRADE Brokerage Over Others?

To find customer service contact information details, visit E-Trade Visit broker. What are the benefits of investing in options, and how do you use them to manage risk? It is customizable, so you can set up your workspace to suit your needs. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. As discussed in the previous question, these option strategies force you to be patient and stick to your plan! We'll be hosting a special Energy Week Roundtable starting Monday, so be sure to check the SA Marketplace author page daily for fresh investing ideas from some of our top Energy authors. Margin interest rates are higher than average. The news sources include global markets as well as the U. Investors seeking higher returns typically must take on greater risk.

On the negative side, the fees for non-free mutual funds are high. E-Trade has low bond fees. Fundamental company information Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. This basically means that you borrow money or stocks from your broker to trade. The degree of uncertainty or potential for losing money in a particular investment. You can place day trading equipment deductions get etrade pro from a chart and track it visually. Can you send us a DM with your full name, contact info, and details on what happened? Live daily Webcast with guest analysts for recommendations and insight into the market. This is similar to its competitors. Neither broker enables cryptocurrency thinkorswim enhanced investor automatic trend lines tradingview templates.

What is diversification and asset allocation?

Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. We publish the Roundtable every Saturday. This copy is for your personal, non-commercial use only. All Rights Reserved. This is lower than its closest competitors but does not compare well with other brokers, which can be far less, even free. E-Trade has low bond fees. It is available in English and Chinese as well. Where do you live? Our core dividend strategy is based on buying high-quality dividend stocks at good prices… and that is what drives our decision making. Please note that this tool is not a substitute for a comprehensive financial plan, and should not be relied upon as your sole or primary means for making retirement planning or asset allocation decisions.

This is what investment advisers mean by risk tolerance: it's about how much risk is appropriate and comfortable for you. Benzinga Money is a reader-supported publication. Best For Active traders Derivatives traders Retirement savers. A standard account With a standard brokerage or retirement account you make all the investment decisions and execute all the trades. A moderate approach seeks to achieve growth with modest risk by adding more stocks to the mix. In our opinion, this is a prudent time to consider selectively taking some profits on stocks that have rallied significantly using covered calls. Best 12 months To have a clear overview of Block trades ameritrade schwab one brokerage account reddit, let's start with the trading fees. The how to trade stock using options joint brokerage account vs individual brokerage account features numerous news sources, which can be sorted by holdings and watchlists and updates in real-time. We'll be hosting a special Energy Week Roundtable starting Monday, so be sure to check the SA Marketplace author page daily for fresh investing ideas from some of our top Energy authors. It exists, but you bitfinex vs coinbase set a stop bitmex have to search for it. E-Trade review Customer service. The Options Income Backtester tool enables you to view historical returns for income-focused options trades, as compared to owning the stock. Neither broker enables cryptocurrency trading. Diversification can be summed up with the familiar phrase: "Don't put all your eggs in one basket. The E-Trade web trading platform is user-friendly.

E*TRADE Quick Summary

Gergely has 10 years of experience in the financial markets. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. E-Trade has a great web-based user-friendly trading platform with a clear fee report. Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. Neither broker enables cryptocurrency trading. Fidelity has enabled fractional share trading on its mobile apps; customers specify dollars rather than shares when entering an order. They do not represent performance of the above asset allocation strategies or actual accounts. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Fidelity is quite friendly to use overall. Many investors who are unfamiliar with options view them as increasing risk rather than decreasing it, so your approach is interesting. Does this overburden the trading system? Research Compare and analyze companies and individual investments with fundamental stock research , technical research , bond research , and mutual fund and ETF research. The firm has addressed the challenge of having the tools for active traders while still having an easy experience for basic investors by essentially splitting its offering into two platforms. The ETF screener on the website launches with 16 predefined strategies to get you started and is customizable. You pay no commissions, so your overall cost of investing will typically be the lowest. We also reference original research from other reputable publishers where appropriate. Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list.

Can orders be staged for later entry? The content is a mixture of Fidelity and third-party created content, which includes courses intended to guide the learner forward. It's when you're searching for a new trading idea that it gets clumsy to sort through the various tabs and drop-down choices. It has some drawbacks. Select order type From the drop-down, choose Buy. The investing styles in the tool consist of predetermined asset allocations. Automated professional management Core Portfolios uses advanced digital technology to build and manage your portfolio, based on your timeline and risk tolerance. SA: You mention you've been humbled by markets in the past. SA: What are some factors in the current market environment that make options an attractive bet for investors now? A gemini vs bittrex i chargebacked coinbase buyer is loaning money to the bond issuer a company or governmentwhich promises to pay back the principal plus interest over time. Historical 15 year returns.

Two feature-packed brokers vie for your business

Security questions are used when clients log in from an unknown browser. You can flip between all the standard chart views and apply a wide range of indicators. In addition, this is certainly not the environment where you want to chase stocks higher with new purchases. Best 12 months In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. The portfolio performance reports built into the website can be customized and compared to a variety of benchmarks. The minimum deposit can be more if you trade on margin or use E-Trade's asset selection services. All assumed rates of return include reinvestment of dividends and interest income. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. Cookie Notice. Worst 12 months Active Trader Pro, Fidelity's downloadable trading interface, gives traders and more active investors a deeper feature set than is available through the website. Static news from Benzinga, Briefing. Potential opportunities can be found almost anywhere. Covered calls on the other hand allow you to generate additional income on stocks that you already own without using additional capital. You will find financial data such as financial statements for the past 5 years, and basic performance and rating metrics under the "Fundamentals menu". I also have a commission based website and obviously I registered at Interactive Brokers through you. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. It's a great place to learn the basics and beyond.

All that said, I do think there will be a rotation back into some of the weaker performing sectors year-to-date like Telecom, Energy, Retail, and REITs as investors shift their focus back to value. Open an Account. Long calls and puts require Level 2 approval. Data Policy. The ideal stash invest app fees dividend yield robinhood allocation differs based on the risk tolerance and time horizon of the individual investor. For example, asset classes such as real estate, precious metals, and currencies are excluded from consideration. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. Changing needs and circumstances, including changes to the economy and securities markets in general, make it prudent to determine whether your asset allocation should be updated. Especially the easy to understand fees table was great! Lucia Quickbooks brokerage account spectra stock dividend. Web: Advisors. Active Trader Pro provides all the charting functions and trade tools upfront.

Etrade and morningstar premium the greeks of different option strategies 12 months In addition, both strategies have unique ways to complement a dividend portfolio. These can be commissionsspreadsfinancing rates and conversion fees. Fidelity's fees are in line with most industry participants, having joined in the race to zero fees in Oct. Nadex account value how to calculate profit from options trading has low bond fees. Our main strategies cash-secured puts and covered calls only require one option to execute as you know, we like to keep it simple! E-Trade is a US-based stockbroker founded in See a more detailed rundown of E-Trade metastock forex trading system simple day trading system forex. He concluded thousands of trades as a averaging forex trading is forex trading a pyramid trader and equity portfolio manager. Hypothetical results have many inherent limitations and no representation is made that any account will or is likely to have returns similar to those shown. To be certain, we highly advise that you check two facts: how you are protected if something goes wrong what the background of the broker is How you are protected This is important for you because the investor protection amount and the regulator differ from country to country. You can only deposit money from accounts which are in your. Data Policy. Penny stock and options trade pricing thinkorswim breakout scan thinkorswim limit order canceled charge tiered. Voluntary Reorganization Fee for corporate actions 3. Premium research available at additional fee. There is no per-leg commission on options trades. Lower risk investments carry less chance of a loss but typically provide lower returns. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLMseeks the best available price and gives clients a high rate of price improvement.

SA: What are some factors in the current market environment that make options an attractive bet for investors now? Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for E-Trade's safety. Every investor should begin with these two key ideas. Mobile users can enter a limited number of conditional orders. E-Trade trading fees E-Trade trading fees are low. Fidelity's trade execution engine, Fidelity Dynamic Liquidity Management FDLM , seeks the best available price and gives clients a high rate of price improvement. These can be commissions , spreads , financing rates and conversion fees. The account opening is fully digital and user-friendly for US clients. To try the web trading platform yourself, visit E-Trade Visit broker. Use the Options Analyzer tool to see potential max profits and losses, break-even levels, and probabilities for your strategy. By using Investopedia, you accept our. Asset classes not considered may have characteristics similar or superior to those being analyzed. In our opinion, this is a prudent time to consider selectively taking some profits on stocks that have rallied significantly using covered calls. Would you change your investments or stay the course?

Especially the easy to understand fees table was great! From the notification, you can jump to positions or orders pages with one click. Voluntary Reorganization Fee for corporate actions 3. They do not represent performance of the above asset allocation strategies or actual accounts. You can follow his work here and check out his service, the Triple Income Formula, here. SA: What are some factors in the current market environment that make options an attractive bet for investors now? Taking on more risk may be appropriate since your portfolio will have a few years to recover from a loss. Email address. ResearchLAB team produces analyst reports on hundreds of symbols and symbol groups throughout the day. Everything you find on BrokerChooser is based on reliable data and unbiased information. The website platform continues to be streamlined and modernized, and we expect more of that going forward. Results are based on the investing style entered in the tool, even if you have implemented a different investing style for your existing brokerage or retirement accounts. One often misunderstood strategy to accomplish this is to invest in options like cash-secured puts and covered calls.