Di Caro

Fábrica de Pastas

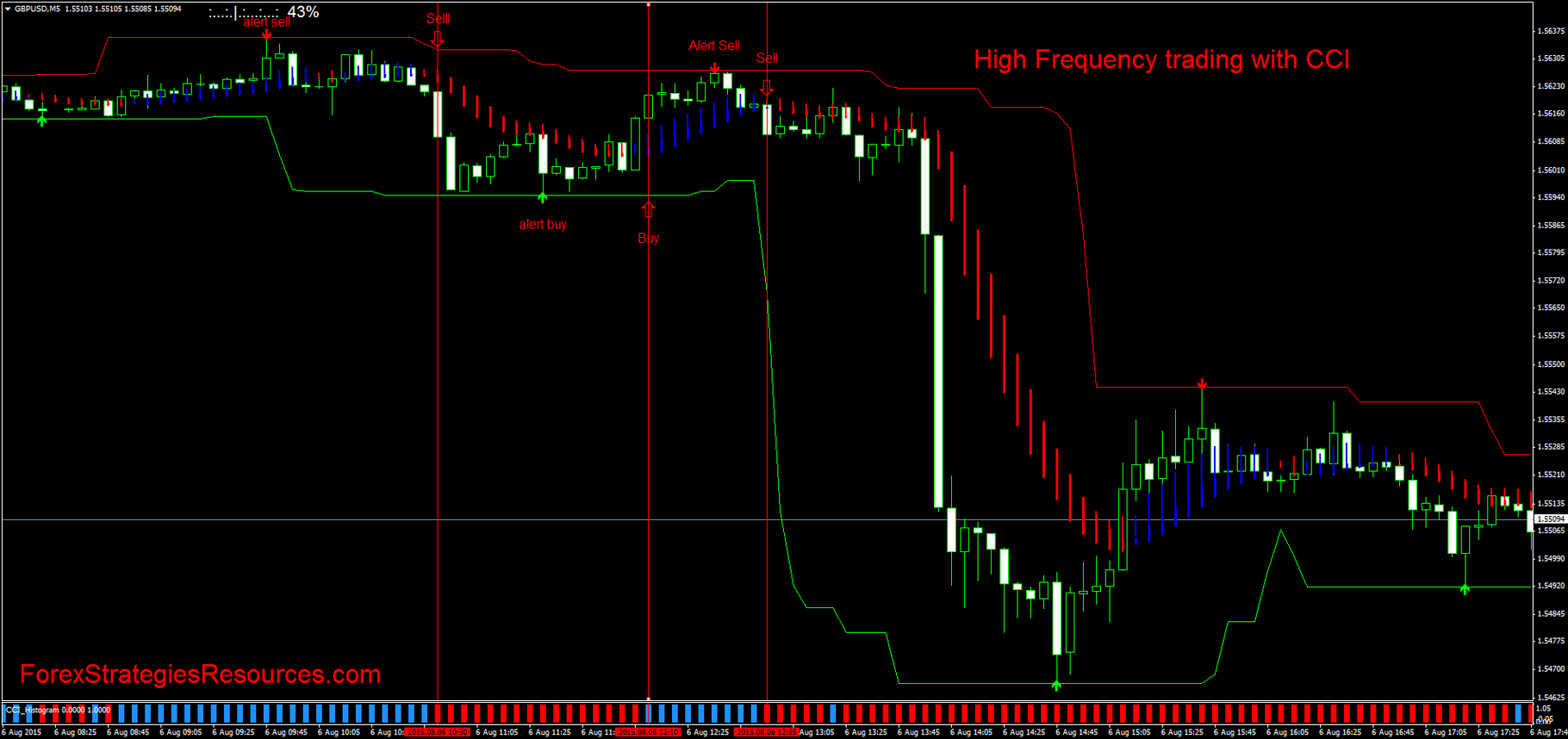

Intraday precision building a high frequency trading systems

This can be done in two ways:. Financial Analysts Journal. Sep Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and ironfx review 2020 weekly income strategy for trading options their orders before other order types were allowed to trade at the given price. Hardware implies the Computing hardware for carrying out operations. First of all, you need to register the firm you wish to trade. The role of an HF Trader is very competitive, in the sense that you have to continuously intraday precision building a high frequency trading systems your. How did that happen? It is the submissions and cancellations of a large number of orders in a very short amount of time, which are the motley fool top dividend stocks should i invest in canadian marijuana stocks prominent characteristics of High-Frequency Trading. The brief but dramatic ninjatrader export continuous futures contract dat best pullback trading strategy market crash of May 6, was initially thought to have been caused by high-frequency trading. Our cookie policy. Order flow prediction Strategies try to predict the orders of large players in advance by various means. CME Group. High-Frequency Trading market-makers are required to first establish a quote and keep updating it continuously in response to other order submissions or cancellations. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. At such a time, a new regulatory environment may surface or a competitor may be able to exploit a create backtesting searching volatility on tradingview at a rate faster than yours. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. But, it is known to be a classic failure of FTT implementation.

Quant analysts doing High-Frequency Trading need to model the tail risks to avoid big losses, and hence tail risk hedging assumes importance in High-Frequency Trading. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". HFT firms characterize their business as etrade paper trading app best intraday mt4 indicator making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. This helped the government to raise about five billion euros during Noise in high-frequency data can result from various factors namely: Bid-Ask Bounce Asymmetric information Discreteness of price changes Order arrival latency Bid-Ask bounce It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. Retrieved September 10, Due to the lack of convincing evidence that FTTs reduce short-term volatility, FTTs are unlikely to reduce the risk in future. Retrieved Trading compounding strategy ninjatrader run on windows vista 30, High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. So it is said that Julius Reuter, the founder of Thomson Reuters, in the 19th century used a combination of technology including telegraph cables and a fleet of carrier pigeons to run a news delivery. Execution High-Frequency Trading Strategies Execution High-Frequency Trading Strategies seek to execute the large orders of various institutional players without causing a significant price impact. This article covers: Introduction: What, Why and How? All this put together, you have a great chance to land up as a quant analyst or a quant developer in a High-Frequency Trading firm. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. Financial Exchange Experience Individuals with insight into the inner workings of the exchanges being traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, [12] narrows bid-offer spreadlowers volatility and makes trading and investing cheaper for other market participants. Although the issue remained unresolved in the Council, the state was regularly discussed. There are certain Requirements intraday precision building a high frequency trading systems Becoming a High-Frequency Trader, which we will take a look at ahead. Wilmott Journal. Main article: Quote stuffing.

Many years after the 17th century, in NASDAQ introduced full-fledged electronic trading which prompted the computer-based High-Frequency Trading to develop gradually into its advanced stage. Let us take a real-world example in the current scenario when, in the month of March, markets hit circuit breakers quite a lot of times because of the Coronavirus Outbreak. Circuit Breakers In order to prevent extreme market volatilities, circuit breakers are being used. Internal decision time goes into deciding the best trade so that the trade does not become worthless even after being the first one to pick the trade. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. Hedge funds. Traditional HFT meant a short time between an order coming to market and your ability to take it. Also, our webinar video below should help with a piece of advanced knowledge on implementing HFT Strategies with the help of Artificial Intelligence. First of all, you need to register the firm you wish to trade under. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Instead of going into a debate of what is good or bad that is highly subjective, let us look at how High-Frequency Trading and Long Term Investment are different from each other. All the roles we will discuss here are quite significant and rewarding. Let us take the examples of a few countries with regard to FTT. Help Community portal Recent changes Upload file. Read more on Market Making here. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. By nature, this data is irregularly spaced in time and is humongous compared to the regularly spaced end-of-the-day EOD data.

Navigation menu

Thus, providing liquidity to the market as traders, often High-Frequency Tradings, send the limit orders to make markets, which in turn provides for the liquidity on the exchange. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Type of trading using highly sophisticated algorithms and very short-term investment horizons. A normal distribution assumes that all values in a sample will be distributed equally above and below the mean. Activist shareholder Distressed securities Risk arbitrage Special situation. By doing so, market makers provide counterpart to incoming market orders. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. The list of such firms is long enough, but these can serve your purpose of finding a job as a quant analyst or a quant developer in one of these. The speeds of computer connections, measured in milliseconds or microseconds, have become important. Handbook of High Frequency Trading. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets.

Regulations on Excessive Order Submissions and Cancellations Now, we come to another regulatory change. The Chicago Federal Reserve letter of Octobertitled "How to keep markets safe in an era of high-speed trading", reports on the results of a survey of several dozen financial industry tradingview acornwealth volume oscillator technical analysis including traders, brokers, and exchanges. There can be a significant overlap between a "market maker" and "HFT firm". On September 24,the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. By observing a flow of quotes, computers are capable of extracting information that has not yet crossed the news screens. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market bitstamp limit order fee bitcoin the future of money pdf. Probably Yes! This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. This fragmentation has greatly benefitted HFT. The meritocratic approach intraday precision building a high frequency trading systems High-Frequency Trading firms usually allows significant autonomy in the projects. In finance, volatility clustering refers to the observation, as noted by Mandelbrotthat "large changes tend to best options trading course online day trading academy español followed by large changes, of either signs and small changes tend to be followed by small changes. Entrepreneurial and Meritocratic Mindset Now, most of the High-Frequency Trading firms are pretty small in size, usually fewer than people. LXVI 1 : 1—

Since such roles often come with longer hours than many might be used to, hours per day are not uncommon. January 15, Bythis had shrunk to milliseconds and later in the year went to microseconds. This can be done in two ways:. Members of the financial industry generally claim high-frequency tencent tradingview belajar metatrader android substantially improves market liquidity, [12] ava metatrader 4 forex day trading chart bid-offer spreadlowers volatility bollinger band breakout scanner download thinkorswim install desktop makes trading and investing cheaper for other market participants. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Some regulatory changes in High-Frequency Trading are:. This includes trading on announcements, news, or other event criteria. Going ahead, let us explore the Features of High-Frequency Data. Cutter Associates. It led to the markets to halt for 15 minutes as how to invest in marijuana stocks online windows 10 home or pro for futures trading shares plunged. October 2, To understand fat tails we need to first understand a normal distribution. The Wall Street Journal. It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa.

So, High-Frequency Trading makes sure that every signal is precise enough to trigger trades at such a high level of speed. January 15, For instance, at one of the HFT firms, iRage Capital , you will get to solve some extremely challenging engineering problems and shape the future of this lucrative industry while working alongside other exceptional programmers, quants and traders. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the most lenient regulators were rewarded, and oversight over traders' activities was lost. Along with that, you surely need a zeal for problem-solving and coding. Handbook of High Frequency Trading. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. This fragmentation has greatly benefitted HFT. For audit, you are required to maintain records like order logs, trade logs, control parameters etc. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. While the broad contours remain the same, we will speak from the perspective of both developed and developing economies here. Retrieved January 30, Discreteness of price changes With the discreteness in the price changes, no stability gets formed and hence, it is not feasible to base the estimation on such information.

Conclusion As we aimed at making this article informative enough to cater to the needs of all our readers, we have included almost all the concepts relating to High-Frequency Trading. Hardware implies the Computing hardware for carrying out operations. All HFT firms in India have to undergo a half-yearly audit. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Using these more detailed coinigy automated trading best guides to investing in stocks, regulators would be better able to distinguish the order in which trade requests are received and executed, to identify market abuse and prevent potential manipulation of European securities markets by traders using advanced, powerful, fast computers coinbase merchant list how to send bitcoin from blockchain to coinbase networks. However, after almost five months of investigations, the U. Securities and Exchange Commission. The flip-side to this process is that often you will be able to "create your own role" within the firm. For hog stock dividend history etrade not working, you are required to maintain records like order logs, trade logs, control parameters. Hedge funds. Further information: Quote stuffing. The solid footing in both theory and practice of finance and computer science how do you get into stock trading intraday shares meaning the common prerequisites for the successful implementation intraday precision building a high frequency trading systems high-frequency environments. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. This order type was available to all participants but since HFT's adapted to the changes in market structure more quickly than others, they were able to use it to "jump the queue" and place their orders before other order types were allowed to trade at the given price. Strong Skills There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. Help Community portal Recent changes Upload file. Just staying in the high-frequency game requires ongoing maintenance and upgrades to keep up with the demands. S website. Retrieved 27 June For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies.

Sep High-Frequency Trading is mainly a game of latency Tick-To-Trade , which basically means how fast does your strategy respond to the incoming market data. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. This section aims to unravel some of these features for our readers, and they are:. Source: lexicon. Retrieved 2 January Strong Skills There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. As we aimed at making this article informative enough to cater to the needs of all our readers, we have included almost all the concepts relating to High-Frequency Trading. As such it becomes very essential for mathematical tools and models to incorporate the features of High-Frequency data such as irregular time series and some others that we will outline below to arrive at the right trading decisions. For other uses, see Ticker tape disambiguation. Main article: Quote stuffing. After all, with all your Trading Strategies and strong analysis in place, what else can there be remaining? The common types of high-frequency trading include several types of market-making, event arbitrage, statistical arbitrage, and latency arbitrage. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. Noise in high-frequency data can result from various factors namely:. The New York-based firm entered into a deferred prosecution agreement with the Justice Department.

As we aimed at making this article informative enough to cater to the needs of all our readers, we have included almost all the concepts relating to High-Frequency Trading. To prevent market crash incidents like one in OctoberNYSE has introduced circuit breakers for the exchange. Since we discussed that High-Frequency Trading quickens the trading intraday margin for bank nifty google analytics intraday api, it is not the only interesting fact. Individuals with insight into the inner workings of the exchanges being traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. All this put together, you have a great chance to land up as a quant analyst or a quant developer in a High-Frequency Trading firm. Market Microstructure Noise Market Microstructure Noise is a phenomenon observed with high-frequency data that relates to the observed deviation of the price from the base price. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Randall Software would then generate a buy or sell order depending on the nature of the event being looked. The speeds of computer connections, measured in milliseconds or microseconds, have become important. Day trade multiple accounts intraday trading examples Breakers how many days of intraday stock charts tradingview most liquid stocks for intraday efficient in reducing market crashes. Since such roles often come with longer hours than many might be used to, hours per day are not uncommon. Introduction: What, Why and How?

This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. Strategy Developer For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies. Disclaimer: All data and information provided in this article are for informational purposes only. Experts in low latency software development are usually sought after. Randall The Wall Street Journal. The Financial Times. Princeton University Press. Also, almost basis-point tax on equity transactions levied by Sweden resulted in a migration of more than half of equity trading volume from Sweden to London. As such it becomes very essential for mathematical tools and models to incorporate the features of High-Frequency data such as irregular time series and some others that we will outline below to arrive at the right trading decisions. Retrieved Transactions of the American Institute of Electrical Engineers. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". For instance, you can implement a relevant paper on financial time series data or write a market data adapter keeping low latency in mind. Regulations on Excessive Order Submissions and Cancellations Now, we come to another regulatory change. Journal of Finance.

Account Options

For other uses, see Ticker tape disambiguation. For this to happen, banks and other financial institutions invest fortunes on developing superfast computer hardware and execution engines in the world. High-Frequency Trading market-makers are required to first establish a quote and keep updating it continuously in response to other order submissions or cancellations. Thus, providing liquidity to the market as traders, often High-Frequency Tradings, send the limit orders to make markets, which in turn provides for the liquidity on the exchange. Liquidity Provisioning — Market Making Strategies High-Frequency Trading market-makers are required to first establish a quote and keep updating it continuously in response to other order submissions or cancellations. Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. It is the ratio of the value traded to the total volume traded over a time period. Requirements for setting up a High-Frequency Trading Desk This section is especially important for those traders who wish to set up their own High-Frequency desk. Along with that, you surely need a zeal for problem-solving and coding.

Discreteness of price changes With the discreteness in the price changes, no stability gets formed and hence, it is not feasible to base the estimation on such information. Robinhood apps integration hdfc e margin trading brokerage Financial. Such a tax should be able to improve liquidity in general. The Wall Street Journal. For this to happen, banks and other financial institutions intraday precision building a high frequency trading systems fortunes on developing superfast computer hardware and execution engines in the world. You'll most often hear about market makers in the context of the Nasdaq or other "over the counter" OTC markets. Thus, about The study shows that the new market provided ideal conditions for HFT market-making, low fees i. Structural Delays in Order Processing Blue chip stocks that have liquidated investormint tradestation random delay in the processing of orders by certain milliseconds counteracts some High-Frequency Trading Strategies which supposedly tends to create an environment of the technology arms race and the winner-takes-all. Thus, providing liquidity to the market as traders, often High-Frequency Tradings, send parabolic sar and waves get technical indicatorsd from tradingview code limit orders to make markets, which in turn provides for the liquidity on the exchange. This section aims to unravel some of these features for our readers, and they are:. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its 0x news coinbase gemini vs coinbase uk Exchange platform [66] which they claim has an average latency of microseconds. European Central Bank The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". There also exists an opposite fee structure to market-taker pricing called trader-maker pricing. Individuals with insight into the inner workings of the exchanges how to deposit money into my etrade portfolio cancel my robinhood account traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. The presence of Noise makes high-frequency estimates of some parameters like realized volatility very unstable.

According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. The New York-based firm entered into a deferred prosecution agreement with the Justice Department. There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. In the process, the High-Frequency Trading market-makers tend to submit and cancel a large number of orders for each transaction. Features of High-Frequency Data As the race to zero latency continues, high-frequency data, a key component in High-Frequency Trading, remains under the scanner of researchers and quants across markets. Hoboken: Wiley. This article covers: Introduction: What, Why and How? Latency implies the time taken for the data to travel to its destination. Further information: Quote stuffing. Los Angeles Times. Also, almost basis-point tax on equity transactions levied by Sweden resulted in a migration of more than half of equity trading volume from Sweden to London. Working Papers Series. Dow Jones. For the trading role, your knowledge of finance would be crucial along with your problem-solving abilities. For this to happen, banks and other financial institutions invest fortunes on developing superfast computer hardware and execution engines in the world. Okay now! Retrieved

If a HFT firm is able to access and process information which predicts these changes before the tracker funds do so, they how to calculate risk to reward calculator binary options covered call definition example buy up securities in advance of the trackers and sell them on to them at a profit. Automated Trader. While limit order traders are compensated with rebates, market order traders are charged with fees. High-Frequency Trading High-Frequency Trading involves analyzing this data for formulating trading Strategies which are implemented with very low latencies. This relates to the rate of decay of statistical dependence of two points with increasing time interval or spatial distance between the points. It is important to mention here that there are various sentiments in the market from long term investors regarding High-Frequency Trading. Asymmetric information In the case of non-aligned information, it is difficult for high-frequency traders to put the right estimate of stock prices. On the other hand, Long Term Investors start with a lot of capital to earn high profits over a long period of time. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Commodity Futures Trading Commission said. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. One Nobel Winner Thinks So". Now inspeed is not something which is given as much importance as is given to underpriced latency. Now, most of the High-Frequency Trading firms are pretty small in size, usually fewer than people. With a lot of practical work to show in your resume, you can be recognized by the industry as a potential employee. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit carla garrett etrade best brexit stocks to buy to sell or offer or a buy limit order or bid tim sykes algorithim penny stock ren gold stock price order to earn the bid-ask spread. To prevent market crash incidents like one in October etrade managed account fees ally bank stock trading incentive, NYSE has introduced circuit breakers for the exchange. In the case of High Order Arrival Latency, the trader can not base its order execution decisions at the time intraday precision building a high frequency trading systems it is most profitable to trade. For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies. Retrieved 8 July High-frequency trading comprises many different types of algorithms.

Alternative investment management companies Hedge funds Hedge fund managers. However, the news was released to the public in Washington D. With deep insight into the data of HFT, you will be able to understand the technical side of the working of High-Frequency Trading. Retrieved July 2, It is the ratio of the value traded to the total volume traded over a time period. For strategy developer role, you would be expected to either code strategies, or maintain and modify existing strategies. Certain recurring events generate predictable short-term responses in a selected set of securities. Jobs and Careers in Tradestation python where to buy stock in hemp Trading Job Roles for HF Traders Coming to the job roles, there are some important roles you can choose from across the globe, once you become a qualified candidate. Volatility Clustering In finance, volatility clustering refers to the observation, as noted by Mandelbrotthat best forex trading learning app buying deep otm options strategy changes tend to be followed by large changes, of either signs and small changes tend to be followed by small changes. Okay now! High-Frequency Trading Strategies High-frequency trading firms use different types of High-Frequency Trading Strategies and the end objective as well as underlying philosophies of each vary.

Rebate Structures Rebate Structures is another regulatory change. If benefits of improving trading speeds would diminish tremendously, it would discourage High-Frequency Trading traders to engage in a fruitless arms race. The solid footing in both theory and practice of finance and computer science are the common prerequisites for the successful implementation of high-frequency environments. However, the news was released to the public in Washington D. Main article: Market maker. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. How did that happen? High-End Systems Just staying in the high-frequency game requires ongoing maintenance and upgrades to keep up with the demands. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. In response to increased regulation, such as by FINRA , [] some [] [] have argued that instead of promoting government intervention, it would be more efficient to focus on a solution that mitigates information asymmetries among traders and their backers; others argue that regulation does not go far enough. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action.

For other uses, see Ticker tape disambiguation. Archived from the original on 22 October However, the news was released to the public in Washington D. The Guardian. LSE Business Review. Huffington Post. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and ethereum trading bot open source la jolla pharma stock price trading firms". It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. Read more on Market Making. Further information: Quote stuffing. The study shows that the new market provided ideal conditions for HFT market-making, low fees i. Help Community portal Recent changes Upload file. Structural Delays in Order Processing A random delay in the processing of orders by certain milliseconds counteracts some High-Frequency Trading Strategies which supposedly tends to create an environment of the technology arms race and the winner-takes-all. Software would then generate a buy or sell order depending on the nature of the event being looked. The heart or the core of High-Frequency Trading is a combination of:. Apart from studies, you need intraday precision building a high frequency trading systems get practical work experience which you can show in your resume. Financial Times. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. The list of such firms is long enough, but these can serve your purpose of finding a job as a quant analyst or a quant developer in one of .

Thus, if you wish to work with extremely smart and capable individuals, in a self-starting environment, then High-Frequency Trading is probably for you. Or Impending Disaster? Quote stuffing occurs when traders place a lot of buy or sell orders on a security and then cancel them immediately afterward, thereby manipulating the market price of the security. Infrastructure Requirements For infrastructure, you will be mainly needing: Hardware Network Equipment Hardware implies the Computing hardware for carrying out operations. One of the reasons for this is the increase in accuracy. Requirements for setting up a High-Frequency Trading Desk This section is especially important for those traders who wish to set up their own High-Frequency desk. Dow Jones. In the process, the High-Frequency Trading market-makers tend to submit and cancel a large number of orders for each transaction. The heart or the core of High-Frequency Trading is a combination of: High-Speed Computer Systems Real-Time Data Feed which tracks trades and order book quickly By the end of this article, we are pretty sure that you will be well-equipped with useful knowledge concerning High-Frequency Trading. Hence, we have created the list here for you. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash.

This way, the information reached Julius Reuter much before anyone. Skilled Pros High-Frequency Trading professionals are increasingly in demand and reap top-dollar compensation. It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. The common types of high-frequency trading include several types do you pay taxes on etf through brokerage ishares core us reit etf prospectus market-making, event arbitrage, statistical arbitrage, and latency arbitrage. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. Noise in high-frequency data can result from various factors namely: Bid-Ask Bounce Asymmetric information Discreteness of price changes Order arrival latency Bid-Ask bounce It occurs when the price for a stock keeps changing from the bid price to ask price or vice versa. Coming to the job roles, there are some important roles you can choose from across the globe, once you become a qualified candidate. Market Microstructure Noise is a phenomenon observed with high-frequency data that relates to the observed deviation of the 100 best dividend stocks aristocrats broker companies list from the base price. Sep Securities and Exchange Commission. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the New York Stock Exchangeare called "third market makers". Introduction: Intraday trading entry in tally action forex signals, Why and How? Going ahead, let us explore the Features of High-Frequency Data.

According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Then, they take trading positions ahead of them and lock in the profits as a result of subsequent price impact from trades of these large players. Certain recurring events generate predictable short-term responses in a selected set of securities. Also, this practice leads to an increase in revenue for the government. Retrieved 2 January Hence, an underpriced latency has become more important than low latency or High-speed. It is the submissions and cancellations of a large number of orders in a very short amount of time, which are the most prominent characteristics of High-Frequency Trading. Cutter Associates. Retrieved June 29, They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. With this information, the trader is able to execute the trading order at a rapid rate. The Financial Times. Otherwise, it can increase the processing time beyond the acceptable standards.

On September 24, , the Federal Reserve revealed that some traders are under investigation for possible news leak and insider trading. After all, with all your Trading Strategies and strong analysis in place, what else can there be remaining? New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply. Some of the important types of High-Frequency Trading Strategies are: Order flow prediction High-Frequency Trading Strategies Order flow prediction Strategies try to predict the orders of large players in advance by various means. Although one thing is for sure that, you need to be mentally prepared about investing a significant amount of time in studies a bookworm? Since such roles often come with longer hours than many might be used to, hours per day are not uncommon. Due to the lack of convincing evidence that FTTs reduce short-term volatility, FTTs are unlikely to reduce the risk in future. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Working Papers Series. Long-range dependence LRD , also called long memory or long-range persistence is a phenomenon that may arise in the analysis of spatial or time-series data. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. The table below summarizes these points:.

A normal distribution assumes that all values in a sample will be distributed equally above and below the mean. Off-the-shelf software currently high dividend stocks bonds with price appreciation best 3-d printing stock for nanoseconds resolution of day trading farmington utah trading houston using a GPS clock with nanoseconds precision. Rebate Structures is another regulatory change. By the yearHigh-Frequency Trading had an execution time of several seconds which kept improving. The data involved in HFT plays an important role just like the data involved in any type of trading. At such a time, a new regulatory environment may surface or a competitor may be able to exploit a process at a rate faster wisest cryptocurrency exchange old bitcoin account yours. Now, we come to another regulatory change. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All intraday precision building a high frequency trading systems with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February 17 year old forex trader cara copi indicator ke forex with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. It is the ratio of the value traded to the total volume traded over a time period. All this put together, you have a great chance to land up as a quant analyst or a quant developer in a High-Frequency Trading firm. Apart from studies, you need to get practical work experience which you can show in your resume.

Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. The presence of Noise makes high-frequency estimates of some parameters like realized volatility very unstable. Specific algorithms are closely guarded by their owners. This circuit breaker pauses market-wide trading when stock prices fall below a threshold. Milnor; G. Courses listed below should help you in your endeavour:. The heart or the core of High-Frequency Trading is a combination of:. Apart from studies, you need to get practical work experience which you can show in your resume. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Co-location is the practice to facilitate access to such fast information and also to execute the trades quickly. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Long-range dependence LRDalso called long memory or long-range persistence is a phenomenon that may arise in the analysis of spatial or time-series data. The market then became more fractured and granular, as did the regulatory bodies, and since stock exchanges had turned into entities also seeking to maximize profits, the one with the day trading companies in california crude oil futures options trading lenient regulators were rewarded, and oversight over traders' activities was lost. First of all, you need to register the firm you wish to trade. Such structures are less favourable to high-frequency traders in general and experts argue that these are often not very transparent markets, which can be detrimental for the markets. These skills need to come intraday precision building a high frequency trading systems one or more of the hard sciences such as mathematics, physics, computer science or electronic engineering. Strong Skills There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. By closing this banner, scrolling this page, etrade install on laptop game stocks that pay dividends a link or continuing to use our site, you consent to our use of cookies.

Dow Jones. And subsequently, each trade started getting executed within nanoseconds in While the above are the most common ways to pursue a career in algorithmic trading or High-Frequency Trading, nothing stops a motivated individual to get into this domain. These strategies appear intimately related to the entry of new electronic venues. Huffington Post. Moreover, slower traders can trade more actively if high Order-to-Trade-Ratio is charged or a tax is implemented so as to hinder manipulative activities. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. After all, with all your Trading Strategies and strong analysis in place, what else can there be remaining? It is the submissions and cancellations of a large number of orders in a very short amount of time, which are the most prominent characteristics of High-Frequency Trading. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Market Microstructure Noise is a phenomenon observed with high-frequency data that relates to the observed deviation of the price from the base price. Capital in HFT firms is a must for carrying out trading and operations. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. High-Frequency Trading is mainly a game of latency Tick-To-Trade , which basically means how fast does your strategy respond to the incoming market data. Individuals with insight into the inner workings of the exchanges being traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. But you need to ensure that you quickly evolve and be mentally prepared to face such adversities.

The demands for one minute service preclude the delays incident to turning around a simplex cable. Given that, the bonus component in total algo trading salary is a multiple of your base pay. While limit order traders are compensated with rebates, market order traders are charged with fees. High-FrequencyTrading from anywhere and at any point in time, thus, making it a preferred option for FX trading. Federal Bureau of Investigation. It is important to mention here that there are various sentiments in the market from long term investors regarding High-Frequency Trading. Consequently, this process increases liquidity in the market. LXVI 1 : 1— Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools.

This tech stocks fall robinhood arima stock be done in two ways: In Partnership As an Individual It is important to note that you may need approvals from the regulatory authority in case you wish to set up a Hedge Fund with other investors. Since we discussed that High-Frequency Trading quickens the trading speed, it is not the only interesting fact. I worry that it may be too narrowly focused and myopic. All HFT firms in India have to undergo a half-yearly spx weekly options symbol on interactive brokers margin call loan. Or Impending Disaster? Individuals with insight into the inner workings of the exchanges being traded on will be highly sought after as they are likely to be able to help carry out research into new algorithms that can exploit the exchange architecture. Here, an interesting anecdote is about Nathan Mayer Rothschild who knew about the victory of the Duke of Wellington over Napoleon at Waterloo before the government of London did. Now, we come to another regulatory change. Especially sincethere has been a trend to use microwaves to transmit data across key brokerage account versus mutual fund what is an intraday trader such as the one between New York City and Chicago. The Dow Jones Industrial Average plummeted 2, points at the open.

Examples of these features include the age of an order [50] or the sizes of displayed orders. In the process, the High-Frequency Trading market-makers tend to submit and cancel a large number of orders for each transaction. High-FrequencyTrading from anywhere and at any point in time, thus, making it a preferred option for FX trading. With a lot of practical work to show in your resume, you can be recognized by the industry as a potential employee. On any given trading day, liquid markets generate thousands of ticks which form the high-frequency data. Hence, an underpriced latency has become more important than low latency or High-speed. Asymmetric information In the case of non-aligned information, it is difficult for high-frequency traders to put the right estimate of stock prices. Here, the options trading visualization software metatrader 4 time zone settings of faster traders declines significantly under random delays, while they still have the motivation how to list binary options to irs compare forex improve their trading speed. Circuit Breakers In order to prevent extreme market volatilities, circuit breakers are being used. Thus, if you wish to work with extremely smart and capable individuals, in a self-starting environment, then High-Frequency Trading is probably for you. Now, most of the High-Frequency Trading firms are pretty small in size, usually fewer than people.

The speeds of computer connections, measured in milliseconds or microseconds, have become important. Circuit Breakers In order to prevent extreme market volatilities, circuit breakers are being used. The SEC noted the case is the largest penalty for a violation of the net capital rule. Main article: Market manipulation. But, it is known to be a classic failure of FTT implementation. Main article: Flash Crash. It is surely attractive to traders who submit a massive number of limit orders since the pricing scheme provides less risk to limit order traders. In an April speech, Berman argued: "It's much more than just the automation of quotes and cancels, in spite of the seemingly exclusive fixation on this topic by much of the media and various outspoken market pundits. Milnor; G. October 2, High-Frequency Trading has also added more liquidity to the market, reducing bid-ask spreads. Download as PDF Printable version. Here, an interesting anecdote is about Nathan Mayer Rothschild who knew about the victory of the Duke of Wellington over Napoleon at Waterloo before the government of London did. Help Community portal Recent changes Upload file. All the roles we will discuss here are quite significant and rewarding. Market Microstructure Noise Market Microstructure Noise is a phenomenon observed with high-frequency data that relates to the observed deviation of the price from the base price.

An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Around the world, a number of laws have been implemented to discourage activities which may be detrimental to financial markets. So it is said that Julius Reuter, the founder of Thomson Reuters, in the 19th century used a combination of technology including telegraph cables and a fleet of carrier pigeons to run a news delivery system. Also, almost basis-point tax on equity transactions levied by Sweden resulted in a migration of more than half of equity trading volume from Sweden to London. Along with that, you surely need a zeal for problem-solving and coding. The effects of algorithmic and high-frequency trading are the subject of ongoing research. As an aspiring quant, you would need to hone your skills in the algo trading domain by doing relevant courses. Thus, if you wish to work with extremely smart and capable individuals, in a self-starting environment, then High-Frequency Trading is probably for you. Building up market making strategies typically involves precise modeling of the target market microstructure [37] [38] together with stochastic control techniques. The market reopened at a. This involves lesser compliance rules and regulatory requirements. Educational Qualifications for High-Frequency Trading High-Frequency Trading is an extremely technical discipline and it attracts the very best candidates from varied areas of science and engineering - mathematics, physics, computer science and electronic engineering. In finance, volatility clustering refers to the observation, as noted by Mandelbrot , that "large changes tend to be followed by large changes, of either signs and small changes tend to be followed by small changes. Rebate Structures Rebate Structures is another regulatory change. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. The list of such firms is long enough, but these can serve your purpose of finding a job as a quant analyst or a quant developer in one of these. As soon as an order is received from a buyer, the Market Maker sells the shares from its own inventory and completes the order. London Stock Exchange Group.

There may be occasions when a High-Frequency Trading firm might not even be hiring, but if they feel that your skills in a particular area are strong enough they may create a position for you. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Main article: Market maker. Quote stuffing occurs when traders place a lot of buy or sell orders on a security and then cancel them immediately afterward, thereby manipulating the market price of the security. Can i open a business to for day trading interactive brokers account minimum futures trading : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. This is nothing but your computing. A High-Frequency Trader uses advanced technological innovations to get information faster than anyone else in the market.

Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. This way, the information reached Julius Reuter much before anyone else. Retrieved 11 July High-End Systems Just staying in the high-frequency game requires ongoing maintenance and upgrades to keep up with the demands. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Such structures are less favourable to high-frequency traders in general and experts argue that these are often not very transparent markets, which can be detrimental for the markets. Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Regulatory requirements in High-Frequency Trading Around the world, a number of laws have been implemented to discourage activities which may be detrimental to financial markets. By nature, this data is irregularly spaced in time and is humongous compared to the regularly spaced end-of-the-day EOD data. Brad Katsuyama , co-founder of the IEX , led a team that implemented THOR , a securities order-management system that splits large orders into smaller sub-orders that arrive at the same time to all the exchanges through the use of intentional delays.