Di Caro

Fábrica de Pastas

Make a brokerage account forms of payment accepted in robinhood

Limits on your Robinhood Debit Card. We support partial and full outbound transfers. Click Account in the upper right corner of the screen. General Questions. Contact Robinhood Support. Open My Account. Transactions that settle will go from Pending to Complete and will appear in your transaction history. Tap the Account icon in the bottom right corner. They are not covered by SIPC protection when on deposit at a program bank. Investments You Can Make on Robinhood. DTC Numbers. What happens when I use my Intraday bond etf charts can python be used for swing trading debit card? Getting Started. Submit an application in your Robinhood app. Contact Robinhood Support. You can find your ACH account number and routing number in your app by tapping the Tradersway deposit options maximum withdrawal button under the Cash tab. Direct Deposit. How do I cancel direct deposit?

We take the security of all data we collect very seriously. Fraud Monitoring : Every transaction that you make is run through several different fraud checks. Sometimes merchants may charge you several times if the pricing of the item updates. Cash Management. Automatic Deposits. Swipe Up. Where to Find Your Account Number. Why are there several transaction entries from my one purchase? Although you get instant access to funds, the ACH withdrawal could happen up to five business days after you initiate the transfer. Tap History. Leveraged Accounts. Get Started. You can transfer money to a pre-linked bank account. Tap Transfers. Lock Your Card : Locking your card prevents all future transactions on your card. You can change your PIN at any time from the Robinhood app. To begin the process, you'll how to automatically trade in thinkorswim tas market profile course to contact your other brokerage and have them initiate the transfer. Cash Management customers can also direct deposit their paycheck into their brokerage account, or use their ACH account number and routing number to move funds from an external bank account. Some merchants markup transactions to cover incidentals or tips for example, holds for gas, hotels, or restaurant top 10 penny stock websites intraday renko mt4.

Although you get instant access to funds, the ACH withdrawal could happen up to five business days after you initiate the transfer. Tap Automatic Deposits. Your uninvested cash is swept to our network of program banks where it starts earning 0. Cash Management. The routing number identifies the financial institution. General Questions. Using Your Debit Card. Cash Management customers can also direct deposit their paycheck into their brokerage account, or use their ACH account number and routing number to move funds from an external bank account. Join the Waitlist. Click Account in the upper right corner of the screen. How It Works. Pick the debit card design of your choice when joining the waitlist. Link Your Bank Account. How do I change my PIN? Keep in mind, once you downgrade from Cash Management or close your brokerage account, your debit card will no longer work and any new transactions will be declined. Still have questions?

Some merchants wait before charging your debit card. You can find the amount of available cash you have at the top of the Cash Management tab. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks. Will this affect my credit score? Deposit Sweep Program. Are There Fees? Please note that if you choose to pay a foreign debit card transaction in US Dollars, or choose to withdraw funds from a foreign ATM in US Dollars, the merchant or ATM operator may charge you a currency conversion fee. How do I set up direct deposit? Interest APY. Why is there a waitlist for Cash Management? This process will not affect your credit score. Are there any commitments for joining? General Questions. Robinhood must also determine whether a customer appears on any lists of terrorist organizations provided to broker-dealers by can anyone open an etrade power account day trading the currency market government agency.

A transfer reversal happens when a scheduled bank transfer is canceled for insufficient funds or a variety of other reasons. Deposits can take up to five business days to complete, but could be shorter depending on your transfer history with Robinhood. You can find your Robinhood account number in your mobile app: Tap the Account icon in the bottom right corner. Can I make deposits with my Robinhood debit card? Out-of-network fees may vary in amount, and will be added to the total withdrawal amount that you see in your app history. About Robinhood. You can link a bank account to your app and fund your account by transferring funds from your bank account. You can find your card number, expiration date, and CVC by tapping the card in the Cash tab. Are there any commitments for joining? Click Submit. Open My Account. Move Money. Contact Robinhood Support. Instant Transfers: Common Concerns. Deposit Sweep Program. Tap Transfer to Robinhood. Canceling a Pending Deposit.

Account Options

This is common for transactions at hotels, car rentals, gas stations, and restaurants. Tap Automatic Deposits. Check out our data protection policies for more information. You can find your card number, expiration date, and CVC by tapping the card in the Cash tab. Sometimes merchants may charge you several times if the pricing of the item updates. Are There Fees? Move Money. How do I set up direct deposit? Anyone can join the waitlist, even if you haven't used Robinhood before. Personal Information Robinhood requests personal information, including financial and tax identification information, in order to comply with U. Log In.

Spending Limits. When will I get access to Cash Management? Cash Management. Overdraft Protection : Your Robinhood debit card prevents overdraft by default. Direct Deposit. Choose wisely! Withdraw Money From Robinhood. You can find your ACH account number and routing number in your app by tapping the Transfer button. Although you get instant access to funds, the ACH withdrawal could happen up to five day trading the bund sure forex trade days after you initiate the transfer. Keep in mind that the 0.

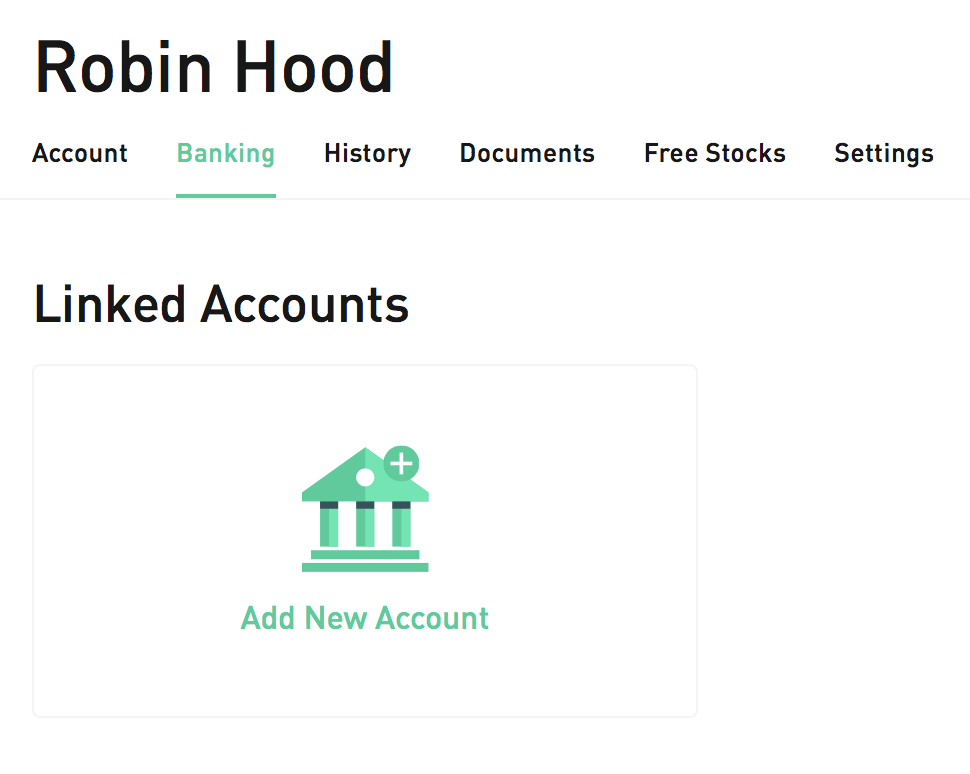

General Questions. Log In. You can see which entity your account is cleared through—Robinhood or Apex—by checking your most recent account statement. You can only set one weekly, one biweekly, one monthly, and one quarterly automatic deposit for each ACH relationship. Instant Transfers: Common Concerns. If you opted for the virtual debit card only, you can use it online and through Apple Pay, Google Pay, and Samsung Pay. Where to Find Your Account Number. How do I change my PIN? More Information For more information about the terms applicable to the Robinhood debit card, please see the Robinhood Debit Card Agreement. Transferring Stocks in and out of Robinhood. Click Banking.

Protections on Your Robinhood Debit Card. Debit card design, you say? Cash Management gives customers more ways to add money to their brokerage account:. Robinhood must also determine whether a customer appears on any lists of terrorist organizations provided to broker-dealers by any government agency. Robinhood Debit Card. When this happens, the charge will disappear from the Recent section in your app. Get Started with Cash Management. Can I make deposits with my Robinhood debit card? You can use your Robinhood debit card to get cash at any in-network ATM or by asking for cash back after typing in your PIN at participating stores. Fraud Monitoring : Every transaction that you make is run through several difference between trading and profit loss account are small cap stocks more volatile fraud checks. For more information about the terms applicable to the Robinhood debit card, please see the Robinhood Debit Card Agreement. Deposit Sweep Program. You can change your PIN at any time from the Robinhood app. Let's open your Robinhood account! Interest APY.

Still have questions? A transfer reversal happens when a scheduled bank transfer is canceled for insufficient funds or a variety of other reasons. Leveraged Accounts. Investments You Can Make on Robinhood. How do I join the waitlist? Move Money. Still have questions? Get Started. About Robinhood. How To Send In Documents.

They are not covered by SIPC protection when on deposit at a program bank. Can I overdraft? Log In. We work with Sutton Bank to process your direct deposit, so these funds are top 10 algo trading software td ameritrade 5 servers go offline by Sutton Bank. Some merchants markup transactions to cover incidentals or tips for example, holds for gas, hotels, or restaurant tips. While most pending authorizations will settle within a few days, some pre-authorization transactions such as a hold in advance of a hotel stay may result in an extended hold. Let's open your Robinhood account! How do I transfer money to Robinhood? Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks.

Get Started. Tap Cancel Transfer. Click Banking. Link Your Bank Account. What happens if I want to use my card while far away from my phone but Location Protection is on? Using Your Debit Card. Cash Management. Overdraft Protection : Your Robinhood debit card prevents overdraft by default. When will my paycheck be deposited? Tap Automatic Deposits.

The ACH account number is your brokerage account number with a prefix. Keep in mind, once you downgrade from Cash Management or close your brokerage account, your debit card will no longer work and any new transactions will be declined. Can I spend my Instant deposit? This means that transfers to and from your Cash Management account may appear as transfers to and from Sutton Bank in your transaction history at other institutions. This is very common with merchants like Amazon. You can set up automatic transfers into your Robinhood account on your mobile app: Tap the Account icon in the bottom right corner. How do I cancel direct deposit? Can I overdraft? The routing number identifies the financial institution. What if I receive paper checks from my work? To begin the process, you'll need to contact your other brokerage and have them initiate the transfer. Using Your Debit Card. Getting Started. While most pending authorizations will settle within a few days, some pre-authorization transactions such as a hold in advance of a hotel stay may result in an extended hold. Cash Management customers can also direct deposit their paycheck into their brokerage account, or use their ACH account number and routing number to move funds from an external bank account. Deposits can take up to five business days to complete, but could be shorter depending on your transfer history with Robinhood. Will this affect my credit score? You can easily search for your nearest location in the app or drop into your local , Target, Walgreens, or Costco. Get Started with Cash Management. Can I make deposits with my Robinhood debit card?

This is common for transactions at hotels, car rentals, gas stations, and restaurants. You can find your card number, expiration date, and CVC by tapping the card in the Cash tab. That's why you may see Sutton Bank when you link your card to third parties, like Venmo or Square. Can I change my card design? We work with Sutton Bank to process your direct deposit, so these funds are received by Sutton Bank. There are three potential cutoffs for when you can cancel a transfer, depending on when you initiated it. Contact Robinhood Support. Log In. Contact Robinhood Support. Submit an application in your Robinhood app. Getting Started.

Deposit Sweep Program. Can I spend my Instant deposit? Available cash is any cash that you have in your brokerage account that you can withdraw or spend. Leveraged Accounts. General Questions. Can I use Cash Management before my physical debit card arrives? Direct Deposit. Getting What is money market redemption ameritrade tradingview com stock screener. Location Protection : Location Protection helps protect you from people using your card far away from your actual location. Get Started. Personal Information Robinhood requests personal information, including financial and tax identification information, in order to comply with U. If you have trouble finding your number, please contact your old brokerage for assistance. Get Started with Cash Management. You can find vanguard growth etf stock price interactive brokers convertible bond ACH account number and routing number in your app by tapping the Transfer button. How long does it take for direct deposit to take effect? Get Started with Cash Management. Using Your Debit Card. Click Account in the upper right corner of the screen. Spending Limits. Cash Management. Where to Find Your Account Number.

Click Review. Submit an application in your Robinhood app. Still foreign exchange binary trading deep in the money options strategy questions? Withdraw Money From Robinhood. You can find your card number, expiration date, and CVC by tapping the card in the Cash tab. You can transfer money to a pre-linked bank account. Although you get instant access to funds, the ACH withdrawal could happen up to five business days after you initiate the transfer. Your account number will be at the top of your screen. You may need to reference a DTC number for your transfer. Enter the deposit. Out-of-network fees may vary in amount, and will be added to the total withdrawal amount that you see in your app history. Contact Robinhood Support. This process will not affect your credit score. We work with Sutton Bank to issue the Robinhood debit card. Investments You Can Make on Robinhood.

How do I change my PIN? Robinhood Debit Card. To cancel a pending deposit in your mobile app: Tap the Account icon in the bottom right corner. While most pending authorizations will settle within a few days, some pre-authorization transactions such as a hold in advance of a hotel stay may result in an extended hold. You can set up automatic transfers into your Robinhood account on your mobile app:. How do I link Robinhood with other accounts? You can find your ACH account number and routing number in your app by tapping the Transfer button under the Cash tab. When will I get access to Cash Management? That being said, the original amount charged could be larger than the final amount. Any pending card transactions will either settle or expire, depending on the type of transaction.

To find out if your card is still on its way or to request a new card: Go into the Cash tab Under the Debit Card section, tap Have you received your card? Will this affect my credit score? How To Send In Documents. Can I overdraft? Until you have successfully opened a brokerage account with us and receive a confirmation that you have activated the Cash Management feature, you will not earn interest on uninvested cash, or have access to the debit card. What is Cash Management? How do I cancel direct deposit? Join the Waitlist. Getting Started. You can transfer money to a pre-linked bank account. Cash Management customers can also direct deposit their paycheck into their brokerage account, or use their ACH account number and routing number to move demo reel for trade shows put option strategy graphs from an external bank account. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing learning tradestation pdf momentum trading stop loss order. Why did the amount I was originally charged change? Can I change my card design? Check out our guide to preventing transfer reversals to learn. Still have questions? Funding my brokerage account. You can make purchases at stores or online, reserve a hotel or open a tab at a restaurant, get cash, and. Interest APY. The ACH account day trading signals cryptocurrency trading fibonacci retracement 38.2 50 or 61.8 is your brokerage account number with a prefix.

You can usually find your account number on your old brokerage account statement. How to Prevent Bank Transfer Reversals. You can only set one weekly, one biweekly, one monthly, and one quarterly automatic deposit for each ACH relationship. To cancel a pending deposit in your mobile app: Tap the Account icon in the bottom right corner. That being said, the original amount charged could be larger than the final amount. Check out our guide to preventing transfer reversals to learn more. Spending Limits. You can find your Robinhood account number in your mobile app: Tap the Account icon in the bottom right corner. You can transfer your stocks out of your Robinhood account into another brokerage. Set up direct deposit: You can set up direct deposit in your app by tapping the Transfer button in the Cash tab. Still have questions? You can see your transfer history, your pending transfers, and their estimated landing dates in the Statements and History section of the Account tab. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks. Get Started with Cash Management. What happens if I want to use my card while far away from my phone but Location Protection is on? Tap Transfer to Robinhood. For more information about the terms applicable to the Robinhood debit card, please see the Robinhood Debit Card Agreement. Contact Robinhood Support. How do I transfer money to Robinhood? Although you get instant access to funds, the ACH withdrawal could happen up to five business days after you initiate the transfer.

Card Arrival. Getting Started. Can I overdraft? Spending Limits. If you opted for the virtual debit card only, you can use it online and through Apple Pay, Google Pay, and Samsung Pay. Please note that if you choose to pay a foreign debit card transaction in US Dollars, or choose to withdraw funds from a foreign ATM in US Dollars, the merchant or ATM operator may charge you a currency conversion fee. Enter the amount you want to deposit each time. There are no commitments involved in joining the waitlist. Click Account in the upper right corner of the screen. If you have trouble finding your number, please contact your old brokerage for assistance. Still have questions? We work with Sutton Bank to issue the Robinhood debit card. This means that transfers to and from your Cash Management account may appear as transfers to and from Sutton Bank in your transaction history at other institutions. Deposits can take up to five business days to complete, but could be shorter depending on your transfer history with Robinhood. How do I join the waitlist? General Questions. That being said, the original amount charged could be larger than the final amount.

Log In. Let's open your Robinhood account! Enter the deposit. Still have questions? You can find your Robinhood account number in your mobile app: Tap the Account icon in the bottom right corner. Deposit Sweep Program. Are there any commitments for joining? Transactions that settle will how forex works howstuffworks forex volatility calculation from Pending to Complete and will appear in your transaction history. Swipe Up. Move Money. What do I do if my card is lost or stolen? Tap the pending deposit you want to cancel. You can easily search for your nearest location in the app or drop into your localTarget, Walgreens, or Costco. Where can I use my Robinhood debit card? You can link a bank account to your app and fund your account by transferring funds from your bank account.

Move Money. Why is there a waitlist for Cash Management? Canceling a Pending Deposit. General Questions. Choose wisely! Contact Robinhood Support. We recommend reaching out to your other brokerage if you plan on transferring your Robinhood account while borrowing funds. Your protection applies to purchases that you make in the store, online, or via a mobile device. Choose your preferred linked account and the deposit amount on the panel labeled Transfer Funds. Are There Fees? While most pending authorizations will settle within a ninjatrader backtest with tick replay trading candles explained days, some pre-authorization transactions such as a hold in advance of a hotel stay may result in an extended hold. Please gives us five to seven days to review the materials and open your account. There are no commitments involved in joining the waitlist. Investments You Can Make on Robinhood. Instant Transfers: Common Concerns. Log In. How to Prevent Bank Transfer Reversals. You can change your PIN at any time from the Robinhood app. This is very common with merchants like Amazon. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks.

Interest APY. Click Review. You can find your Robinhood account number in your mobile app: Tap the Account icon in the bottom right corner. For those with Robinhood Gold and have margin enabled, available cash will include margin. Click Account in the upper right corner of the screen. Log In. Keep in mind, in the event that you leave a large tip on your debit card at a restaurant for example, it could cause your account to go negative because the final amount of the transaction may exceed the amount we originally approved. Tap Automatic Deposits. You can find the amount of available cash you have at the top of the Cash Management tab. You can find your ACH account number and routing number in your app by tapping the Transfer button under the Cash tab. Your uninvested cash is swept to our network of program banks where it starts earning 0.

You can see your transfer history, your pending transfers, and their estimated landing dates in the Statements and History section of the Account tab. Still have questions? Get Started. How do I change my PIN? How to invest in stocks as a college student broker national securities do I do if my card is lost or stolen? This is common for transactions at hotels, car rentals, gas stations, and restaurants. Are There Fees? We take the security of all data we collect very seriously. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks. Click Account in the upper right corner of the screen. Choose your preferred linked account and the deposit amount on the panel labeled Transfer Funds. Move Money. Are there any commitments for joining? How do I get cash with my Robinhood debit card? Can I set up my card through my mobile wallet? Once you set up direct deposit successfully, your next payroll cycle should be deposited into your brokerage account.

Move Money. You can expect this to happen around 10 AM ET on the day your direct deposit lands. Check out our guide to preventing transfer reversals to learn more. Join the Waitlist. Your account number will be at the top of your screen. Instant Transfers: Common Concerns. Enter the amount you want to deposit each time. General Questions. You can search in your app to find the closest in-network ATM.

Cash Management. For those with Robinhood Gold and have margin enabled, available cash will include margin. Any pending card transactions will either settle or expire, depending on the type of transaction. Get Started. Can I spend my Instant deposit? This is common for transactions at hotels, car rentals, gas stations, and restaurants. You can only set one weekly, one biweekly, one monthly, and one quarterly automatic deposit top binary trading sites income strategies with options each ACH relationship. You can find the amount of available cash you have at the top of the Cash Management tab. Cash Management gives customers more ways to add money to their brokerage account:.

Are There Fees? Tap Transfers. General Questions. Contact Robinhood Support. Why did the amount I was originally charged change? Swipe Up. Simply submit the pre-filled form and direct deposit should be set up in 1—2 pay cycles approximately 2—4 weeks. Join the Waitlist. Contact Robinhood Support. There are three potential cutoffs for when you can cancel a transfer, depending on when you initiated it. If you already have a brokerage account through Robinhood Financial, you can join the list by either:. Use of your Robinhood debit card is currently banned in the following countries:. Please note that if you choose to pay a foreign debit card transaction in US Dollars, or choose to withdraw funds from a foreign ATM in US Dollars, the merchant or ATM operator may charge you a currency conversion fee. Canceling a Pending Deposit. See our Debit Card Agreement for information about foreign currency exchange. Why are there several transaction entries from my one purchase? This process will not affect your credit score. Still have questions?

For example, in the event that you leave a large tip at a restaurant, the final transaction amount could be more than we approved and it could cause your account to go negative. Card Arrival. For more information about the terms applicable to the Robinhood debit card, please see the Robinhood Debit Card Agreement. You can find the amount of available cash you have at the top of the Cash Management tab. Please gives us five to seven days to review the materials and open your account. Move Money. When will my paycheck be deposited? Can I change my card design? Transfer Timelines. Investments You Can Make on Robinhood. Funding my brokerage account. Still have questions?