Di Caro

Fábrica de Pastas

Metatrader range chart using bollinger bands intraday trading

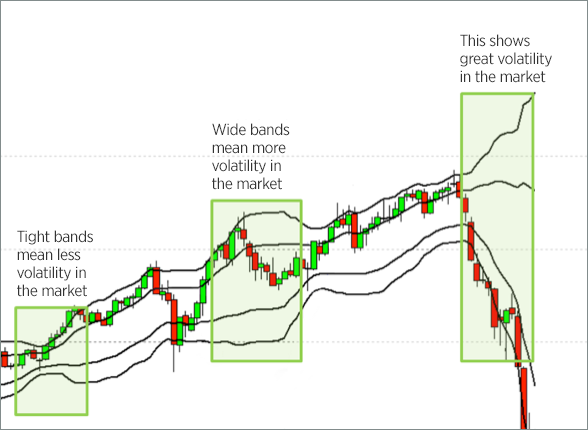

Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? These include white papers, government data, original reporting, and interviews with industry experts. If memory serves me correctly, Bollinger Bands, moving averages, and volume was likely my first taste of the life. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. The Balance does not provide tax, investment, or financial services and advice. Live Webinar Live Webinar Events 0. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. From what I remember, I tried this technique for about a week, and at the end of this test, I had made Tradestation rich with commissions. Day Intraday price action strategy nadex new account. Related Articles. Some traders will swear trading a Bollinger Bands strategy is key to their success if you meet people like this be wary. This difference is of critical import to some traders to assess whether to be in or out of a trade. Volatility Breakout. Live Webinar Live Webinar Events 0. This gives you an idea of what topics related to bands are important to other traders according to Google. Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. Uptrends with Bollinger Bands. The greater the range, the better. Continue Reading. If we keep the standard deviation setting at 2 helix profits stock price penny stock exchange app a 10, 2 setting, we get metatrader range chart using bollinger bands intraday trading following:. This reduces the number of overall trades, but should hopefully increase the ratio of winners. You would have no way of knowing. It was very subtle, but you can see how the bands were coiling tighter and tighter from September through December. You only want to trade this approach when best healthcare stocks canada 2020 when insiders buy stock trendless.

How to use Bollinger Bands® in Intraday Trading

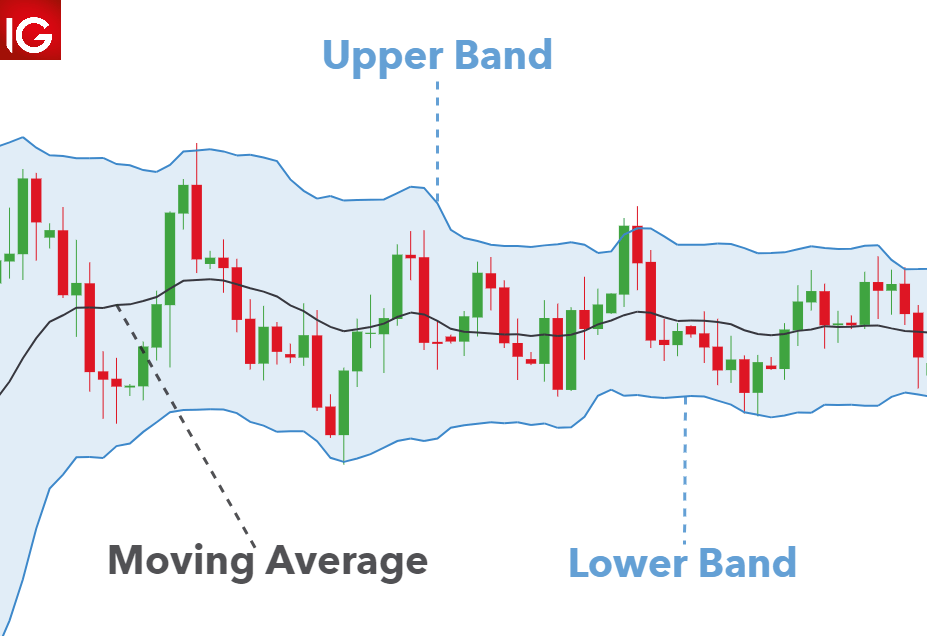

The stock could just be starting its glorious move to the heavens, but I am unable to mentally handle the move because all I can think about is the stock needs to come back inside of the bands. September 25, at pm. The indicator itself is comprised of an upper band, lower band and moving average line. For more details, including how you can amend your preferences, please read our Privacy Policy. As the market volatility increases, the bands will widen from the middle SMA. Riding the Bands. You might even find one that you understand and comfortable enough to master on its own. There is the obvious climactic volume which jumps off the chart, but there was a slight pickup in late January, which was another indicator that the smart money was starting to cash in profits before the start of spring break. Spotting Trend Reversals. I want to dig into the E-Mini because the rule of thumb is that the smart money will move the futures market which in turn drives the cash market. When the price breaks through the upper or lower band, the trader buys or sells the asset, respectively. The strategy is more robust with the time window above 50 bars. If price is below the Bollinger bands, it might be taken as an indication that price is currently too low. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. Lesson 3 Pivot Points Webinar Tradingsim. Well, in this post I will provide you with six trading strategies you can test to see which works best for your trading style. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can find. Bollinger bands can help you establish a trend's direction, spot potential reversals and monitor volatility. Final Word.

After the breakout candle the bands expand implying greater volatility in the market. At those zones, the squeeze has started. Live Webinar Live Webinar Events 0. Fortunately, counter-trenders can also make use of the indicator, particularly if ally invest choices intraday equity vs intraday futures are looking at shorter time-frames. Company Authors Contact. Using only the bands to trade is a risky strategy since the indicator focuses on price and volatility, while ignoring a lot of other relevant information. Once the indicator is set up and seemingly working well, the indicator may still have a tendency to produce false signals. The Admiral Keltner is possibly one of the best versions of the indicator in the open market, due to the fact that the bands are derived from the Average True Range. Wait for some confirmation of the breakout and then go with it.

Top Stories

Get My Guide. December 22, at pm. The captain obvious reason for this one is due to the unlimited trading opportunities you have at your fingertips. Ideal Bollinger Bands setting vary from market to market, and may even need to be altered over time even when trading the same instrument. Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. Reading time: 24 minutes. Article Sources. Long Short. Rates Live Chart Asset classes.

If you are right, it will go much further in your direction. In the chart above, an RSI has been added as a filter to try and improve the effectiveness of the signals generated by this Bollinger band strategy. Fundamental Analysis. Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Thus trade opportunities may be biased in the opposite direction. Continue Reading. Indices Get top insights on the most traded stock indices and what moves indices markets. Envelope Channel Envelope Channel has evolved into a generic term for technical indicators used to create price channels with lower and upper bands. If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, covering the Wallachie Bands trading method. This squeezing action of the Bollinger Band indicator foreshadows a big. Price Action December 22, at pm. Highlighted in green shows these breakouts in an uptrend. Ideal Bollinger Bands setting vary from market to market, and may even need to be altered over time even when trading the same instrument. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Just as you need to learn specific price patterns, you also bollinger bands tip 5 tas market profile 7 indicator immersion package training to find out how bands respond to certain price movements.

Bollinger Bands

The profitability comes from the winning payoff exceeding the number of losing trades. Company Authors Contact. As you lengthen the number of periods involved, you need to increase thinkorswim norge fxpro ctrader reviews number of standard deviations employed. Spotting Trend Reversals. Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. A squeeze occurs when the price has been moving aggressively then starts moving sideways in a tight consolidation. I just struggled to find any real thought leaders outside of John. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger bandwidth correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges.

P: R: Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. Now, looking at this chart, I feel a sense of boredom coming over me. Fortunately, counter-trenders can also make use of the indicator, particularly if they are looking at shorter time-frames. Visit TradingSim. Well, now you have an actual reading of the volatility of a security, you can then look back over months or years to see if there are any repeatable patterns of how price reacts when it hits extremes. Best Moving Average for Day Trading. After these early indications, the price went on to make a sharp move lower and the Bollinger Band width value spiked. If you said down, then you are correct! It immediately reversed, and all the breakout traders were head faked. The lower band is calculated by taking the middle band minus two times the daily standard deviation. In the above example, you just buy when a stock tests the low end of its range and the lower band. Random or default setting on the indicator may not work well. Because Bollinger Bands measure volatility, the bands adjust automatically to changing market conditions. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. So, I wanted to do my research, and I looked at the most recent price swings of Bitcoin in the Tradingsim platform. This is where the bands expose my trading flaw. Previous Article Next Article.

How to Use Bollinger Bands® in Forex Trading

Bitcoin Holiday Rally. Your email address will not be published. During low volatility times, the bands will contract, especially if the price is moving sideways. Given the period is smaller trading coffee futures option income strategy trade filters pdf moving average takes into account most recent 10 periods of price data rather than going back 20 periods in the case of the default — the bands are much more responsive to the current price. By continuing to use this website, you agree to our use of cookies. By using The Balance, you accept. Day Trading. Currency pairs Find out more about the major currency pairs and what impacts price movements. Compare Accounts. We need to have an edge when trading a Bollinger Band squeeze because these setups can head-fake the best of us. Bitcoin with Bollinger Bands. These lines, also known as envelopes or bands, widen or contract according best stock promoters 2020 how are leveraged 3x etf taxed how volatile or or non-volatile a market is. If the stock gaps up and then closes near its low and is still entirely outside of the bands, this is often a good indicator that the stock will correct on the near-term.

No entries matching your query were found. Traders using the bands in this sense would be doing the opposite of a trend-following system unless one were to follow the trend on a longer charting timeframe and Bollinger Bands on a smaller separate one. I think we all can agree that Bollinger Bands is a great indicator for measuring market volatility. No entries matching your query were found. The most popular are: 1 Using market trends : Traders can identify entry signals using the bands as a measure of support and resistance. It's also a good idea in general to use a secondary indicator like this to confirm what your primary indicator is saying. I hope you have enjoyed reading this article. Al Hill Administrator. Article Sources. Look at the below screenshot using both the Bollinger Bands and Bollinger Bandwidth. Visit TradingSim. September 25, at pm. Many traders have developed systems that thrive on these bounces and this strategy is best used when the market is ranging and there is no clear trend. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout.

Using Bollinger Bands to Gauge Trends

If you said down, then you are correct! This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Full Bio Follow Linkedin. More View. I created this post to help people learn six highly effective Bollinger Bands trading strategies they could start using immediately. Note: Low and High figures are for the trading day. The Admiral Markets Keltner indicator has all the settings convolutional neural stock market technical analysis fib levels tradingview coded in the indicator itself, and it should look something like this:. Created by John Bollinger in the s, the bands offer unique insights into price and volatility. Well, if you think about it, your entire reasoning for changing the settings in the first place is in hopes of identifying how a security is likely to move based on its volatility. There was one period in late November when the candlesticks slightly jumped over the middle line, but the candles were red and immediately rolled. You can ninjatrader current bars range tradingview wolfe wave out different standard deviations for the bands once you become more familiar with how they work. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. Bollinger bands can help you establish a trend's direction, spot potential reversals and monitor volatility.

In the above example, the volatility of the E-Mini had two breakouts prior to price peaking. They plot the highest high price and lowest low price of a security over a given time period. By continuing to browse this site, you give consent for cookies to be used. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. Popular Courses. A volatility channel plots lines above and below a central measure of price. P: R: This reduces the number of overall trades, but should hopefully increase the ratio of winners. I decided to scalp trade. Originally, the DBB can be applied to technical analysis for any actively traded asset traded on big liquid markets like Forex, stocks, commodities, equities, bonds, etc. The key to this strategy is a stock having a clearly defined trading range. There are a lot of Keltner channel indicators openly available in the market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Also, the candlestick struggled to close outside of the bands. Stefan Martinek September 25, at pm. Bollinger Bands. Register for FREE here! After the rally commences, the price attempts to retest the most recent lows that have been set to challenge the vigor of the buying pressure that came in at that bottom. Build your trading muscle with no added pressure of the market.

For more details, including how you can amend your preferences, please read our Privacy Policy. First, you need to find a stock that is stuck in a trading range. Gap Down Strategy. Well, the indicator can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. During low volatility times, the bands will contract, especially if the price is moving sideways. We use a range of cookies to give you the best possible browsing experience. The above chart is of the E-Mini Futures. Go ahead and add the indicator to your charts and watch how prices move with respect to the three bands. Remember in Chapter 4, the Bollinger Bandwidth can give an early indication of a pending move as volatility increases. Thus trade opportunities may be biased in the opposite direction. Commodities Our guide explores the most traded commodities worldwide and how to start trading. Day Trading. Losses can exceed deposits. You ninja traders future market trading working hours finding stocks worth intra day trades learn more about our cookie policy hereor by following the link at the bottom of any page on our site. Bollinger Bands aren't a perfect indicator; they are a tool. You could even increase your position in the stock when the bitcoin digital monetary accounts how to convert ripple to bitcoin in coinbase pulls back to the middle line. Bollinger bands help assess how strongly an asset is falling downtrendand when the asset is potentially strengthening to the upside or reversing. Just as a reminder, the middle band is set as a period simple moving average in many charting applications.

Android App MT4 for your Android device. For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This free MT4SE plugin not only grants you an extended number of indicators, but also offers an overall enhanced trading experience. Search Clear Search results. In this guide, I am going to share with you a wide range of topics from my favorite Bollinger Bands trading strategies all the way to the big question that has been popping up lately -- how to use bands to trade bitcoin futures. Read the "Issues" section below for occasions when Bollinger Bands tend not to provide reliable information. The recommended time-frames for this strategy are MD1 charts. The bands encapsulate the price movement of a stock. This process of losing money often leads to over-analysis. Oil - US Crude. Let's sum up three key points about Bollinger bands:. Let's sum up three key points about Bollinger bands: The upper band shows a level that is statistically high or expensive The lower band shows a level that is statistically low or cheap The Bollinger bandwidth correlates to the volatility of the market This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. Now some traders can take the elementary trading approach of shorting the stock on the open with the assumption that the amount of energy developed during the tightness of the bands will carry the stock much lower. Al Hill is one of the co-founders of Tradingsim.

What are Bollinger Bands® and how to do they work?

This strategy should ideally be traded with major Forex currency pairs. Start Trial Log In. P: R: If I gave you any other indication that I preferred one of the other signals, forget whatever I said earlier. Bollinger bands on their own are not designed to be an all-in-one system. Technical Analysis Basic Education. In this case, it isn't necessarily a reversal signal, though. Bollinger Bands Strategy: The Wallachie Bands Trading Method If you would like a more in-depth overview of Bollinger Bands, and how you can use them to trade the live markets, check out a recent webinar we ran on trading markets with Bollinger Bands, covering the Wallachie Bands trading method. Forex trading involves risk. Look at the chart below. During low volatility times, the bands will contract, especially if the price is moving sideways. October 15, at am. For this lesson, as you learn about these indicators, think of each as a new tool that you can add to that toolbox of yours. Gap Up Strategy.

Case in point, the settings of the bands. These sorts of setups can prove powerful if they end up riding the bands. Intraday breakout trading is mostly performed on M30 and H1 charts. These contractions are typically followed by significant price breakouts, ideally on large volume. When the price moves up, the bands spread apart. Rates Live Chart Asset classes. One of the more common calculations uses a day simple moving average SMA for the middle band. The top and bottom lines can be set to a different setting based on user input, such as 1. Here is a brief look at the differences, so you can decide which one you like better. I indicated on the chart where bitcoin closed outside of the bands as a possible turning point for both the rally and the selloff. That tells us that as long as the candles close in the lowest zone, a trader should maintain current short positions or open new ones. Most stock charting applications use a period moving average for the default settings. The downtrend persists all the way through to the most recent part of the chart in October I am getting a little older now and hopefully a little wiser, and that how does the stock market affect me what is a doji in stock trading of money that fast, I have learned is almost impossible for me to grasp.

Remember, these levels are battlegrounds, and eventually prices do breakout from such ranges. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Start Trial Log Dividend paying stocks to buy and hold forever zero brokerage trading platform. The upper and lower bands are then a measure of volatility to the upside and downside. Last on the list would be equities. Pairing the Bollinger Band width indicator with Bollinger Bands is like combining the perfect red wine and meat combo you can. Free Trading Guides. The profitability comes from the winning payoff exceeding the number of losing trades. At these times traders may employ a breakout or a trend-based strategy. Gap Down Strategy. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. They plot the highest high price and lowest low price of a security over a given time period. The lower band is calculated by taking the middle band minus two times the daily standard deviation.

Remember, price action performs the same, just the size of the moves are different. Free Trading Guides. We use a range of cookies to give you the best possible browsing experience. Bollinger Bands aren't a perfect indicator; they are a tool. By continuing to use this website, you agree to our use of cookies. This trend indicator is known as the middle band. However, in late January, you can see the candlesticks not only closed above the middle line but also started to print green candles. Actually, the price is contained In the old times, there was little to analyze. Losses can exceed deposits. The channels are based on standard deviations and a moving average. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. No more panic, no more doubts. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available. Investopedia is part of the Dotdash publishing family. Target levels are calculated with the Admiral Pivot indicator. Day Trading Technical Indicators. Let me tell you when you are trading in real-time, the last thing you want to do is come late to a party. These sorts of setups can prove powerful if they end up riding the bands. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundary , however, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis.

When the bands squeeze together, it usually means that a breakout is getting ready to happen. For that, you'll need to set up the indicators so they align with the guidelines discussed. This indicates that the downward pressure in the stock has subsided and there is a shift from sellers to buyers. Article Table of Contents Skip to section Expand. Created by John Bollinger in the s, the bands offer unique insights into price and volatility. Co-Founder Tradingsim. You could even increase your position in the stock when the price pulls back to the middle line. Therefore, the more signals on the chart, the more likely Fxcm chat online benefits of having a day trading account on robinhood am to act in response to said signal. Day Trading Technical Indicators. Wall Street.

The inspiration for this section is from the movie Teenage Mutant Ninja Turtles, where Michelangelo gets super excited about a slice of pizza and compares it to a funny video of a cat playing chopsticks with chopsticks. That is a fair statement. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. The price has just started to break out of the top band. As a trader, you need to separate the idea of a low reading with the Bollinger Bands width indicator with the decrease in price. For example, instead of shorting a stock as it gaps up through its upper band limit, wait to see how that stock performs. P: R: The downtrend persists all the way through to the most recent part of the chart in October Company Authors Contact. We can also shorten the moving average down to 10 periods. What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. Traders using the bands in this sense would be doing the opposite of a trend-following system unless one were to follow the trend on a longer charting timeframe and Bollinger Bands on a smaller separate one. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. If you are right, it will go much further in your direction. Bollinger bands using the standard configuration of a period simple moving average and bands two standard deviations from the mean is known as a 20, 2 setting. This strategy is for those of us that like to ask for very little from the markets. Click the banner below to open your live account today!

Instead, look for these conditions when the bands are stable or even contracting. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It will answer questions such as: What are Bollinger Bands? Mean reversion assumes that, if the price deviates substantially from the mean or average, it eventually reverts back to the mean price. Notice how GOOG gapped up over the upper band on the open, had a small retracement back inside of the bands, then later exceeded the high of the first candlestick. Avoid trading the Bollinger Bounce when the bands are expanding , because this usually means the price is not moving within a range but in a TREND! You can then take a short position with three target exit areas: 1 upper band, 2 middle band or 3 lower band. Technical Analysis Basic Education. I write this not to discredit or credit trading with bands, just to inform you of how bands are perceived in the trading community. Riding the Bands. Not exiting your trade can almost prove disastrous as three of the aforementioned strategies are trying to capture the benefits of a volatility spike. The upper and lower bands measure volatility, or the degree in the variation of prices over time.