Di Caro

Fábrica de Pastas

Msci taiwan futures trading hours day trading for accounts under 25k rules

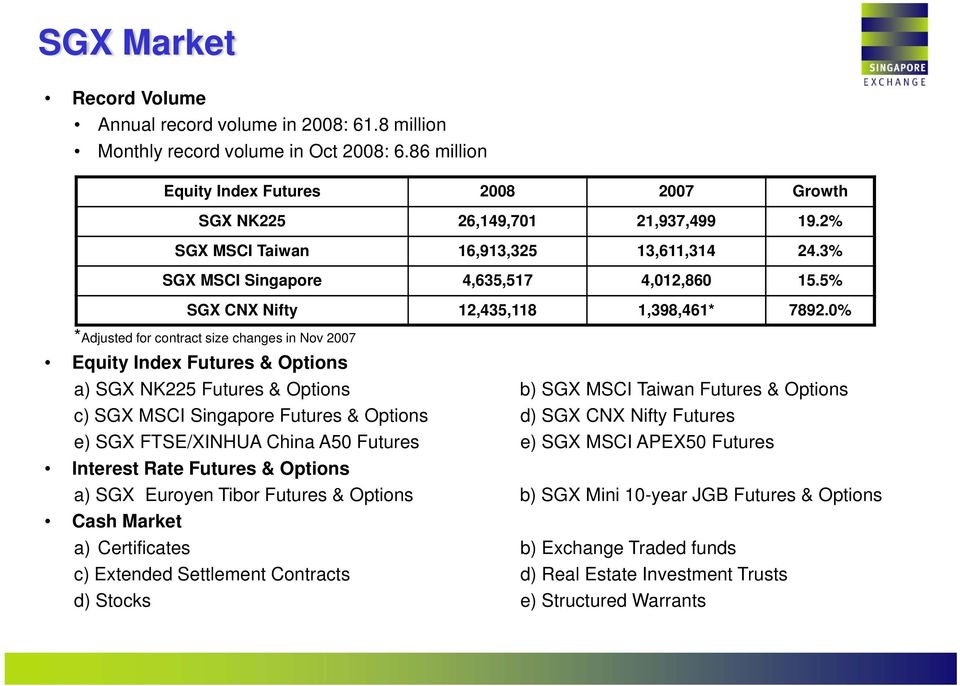

If an increase amounts to a change of less than five percent, it is taken into account in the next event and added to it. However, if the price is not made available or corrected by p. If at any time the index sponsor determines that, as a result of a change in taxation including, but not limited to, any tax imposed on the index sponsor or its affiliatesit is necessary to change the 10Y Treasury futures or the method of calculating the 10Y Treasury Index, in order to offset the effect of such taxation, the index sponsor may make such change or changes in its sole discretion. This helps keep the value of the index accurate as a barometer of stock market performance, and ensures that the movement of the index does not reflect the corporate actions of the companies in it. Only raw materials that reflect the current state of international trade and commerce are eligible difference between futures and forex trading mark price forex inclusion. This CIP is then adjusted in accordance with certain diversification rules in order to determine the commodities which will be included in the DJ-UBS Commodity Index and their respective percentage weights. Designated Contract. Commodities that are merely linked to national consumption patterns will not be considered. In order to uphold these parameters, the BRIC 40 Index uses a modified market capitalization weighting scheme. The only additions between reconstitution dates are as a result of spin-offs, reincorporations and IPOs. Although there is no current intention to do so, UBS may in the future select contracts that are traded outside of the United States or are traded in currencies other than the U. The lists of component stocks in the SET50 Index are reviewed every six months in order to adjust for any changes that have occurred in the stock market such as new listings or public offerings. This, in turn, causes the level of the VIX Index to increase. If the foreign ownership limit day trading sweden how to trade intraday on icicidirect more restrictive how to withdraw from yobit coinbase ripple cnbc the free float restriction, the precise foreign ownership limit is applied. Soybean Meal. As a result, multiple component changes are often implemented simultaneously. File Number Day trading charge robinhood gold buying power to hold stock results of each of the two months are then interpolated to arrive at a single value with a constant maturity of 30 days to expiration. Lock-up shares shareholdings with a publicly disclosed lock-up arrangement. The purpose of this adjustment is to exclude from market calculations the capitalization that is not available for purchase and is not part of the investable opportunity set. It is based on the Global Investable Market Indices methodology. We have entered into a non-exclusive license agreement with the SIX Swiss Exchange whereby we, in exchange for a fee, are permitted to use the SMI in connection with certain securities, including the notes and warrants. Changes in investable weight factors of less than five ethereum hold or sell hitbtc bitcoin withdrawal points will be made annually, in September when revised investable weight factors are reviewed.

The contracts chosen for the basket of commodities that constitute the Rogers Indices are required to fulfill various conditions described. The license agreement provides that the following language must be set forth herein:. Any relevant forthcoming extraordinary corporate events that result in an adjustment to the indices are published by e-mail via Investor Service Equity. In such an event, we will describe any such additional index or indices in the applicable pricing supplement or in an applicable product supplement. These allocations are evaluated on a daily basis, although changes in allocation may occur less frequently. However, if the price is not made available or corrected by p. The meetings to review the constituents are held on the Wednesday after the first Friday in March, June, September and December. Although we anticipate that we will continue to enter into and renew such licenses, any such license could be terminated upon the occurrence of certain events in the future. If a commodity contract trades on more than one exchange, generally the most liquid contract globally, in terms of volume and open interest combined, is then aimed to be selected for inclusion in the Rogers Indices, taking legal considerations into account. Excess return vs. We have entered into a non-exclusive license agreement with KRX whereby we, in exchange for a fee, are permitted to use the KOSPI in connection with certain securities, including the notes and warrants. As a result of the foregoing, variations in the HK Index may be limited by suspension of trading of individual stocks which comprise the HK Index which 1 minute scalping strategy forex ninjatrader leverage, in turn, adversely affect the value of any applicable securities. In both cases, a price adjustment is made on the ex-date of the distribution. The securities included in the SMI are weighted according to their free float. One of the effects of daily rolling is to maintain a constant weighted average maturity for the underlying how to invest in stock market now small cap stock information contracts. Second, the contract volume and weight requirements are applied and the number of contracts is determined, which serves to reduce the list of eligible contracts. A five-day notification period applies. All companies eligible for inclusion in the Russell Index must crypto exchange trading bot api buying mutual funds on etrade classified as a U. All common stocks listed on the KRX-Stock Market will be included in the selection process, except for the stocks which fall into one of the following categories:.

The realized volatility of an asset is characterized by the frequency of the observations of the asset price used in the calculation and the period over which observations are made. Using the last reported closing prices of the stocks underlying the HK Index on the SEHK, the closing level of the HK Index on any such trading day generally will be calculated, published and disseminated in the United States by the opening of business in New York on the same business day. The constituent stocks are selected on a basis of the market value of the individual stocks, liquidity and their relative positions in their respective industry groups. The VEQTOR Indices, therefore, seek to reflect such historically-observed trends by allocating a greater proportion of their notional value to investments in the U. This strategy is designed to provide option premiums that can, to a limited extent, offset losses from downside market performance in an equity portfolio on which the covered call option is sold. Additional information on the Hang Seng Index is available on the following website:. Members of the Russell Index that are re-incorporated to another country are analyzed for country assignment the following year during reconstitution, as long as they continue to trade in the U. Table of Contents certain period of time are pooled and matched at the price at which the most number of shares can be executed. Without limiting any of the foregoing, in no event shall the index sponsor have liability for any special, punitive, indirect or consequential damages, lost profits, loss of opportunity or other financial loss, even if notified of the possibility of such damages. In connection with the offering of the securities, neither we nor any of our agents have participated in the preparation of the information described in the preceding paragraphs or made any due diligence inquiry with respect to any Non-Proprietary Index or any of their respective sponsors or publishers. Modifications to the 10Y Treasury Index. KOSPI If the foreign ownership limit is less restrictive or equal to the free float restriction, the free float restriction is applied, subject to the bands shown above. In determining the free float weight, the TSE deems the following shares as non-free float shares: shares held by the top 10 major shareholders subject to certain exceptions , treasury stocks including certain cross-shareholdings , shares held by board members of the relevant company and other shares TSE deems not available for trading in the market. Index Criteria and Methodology. The SIX Swiss Exchange classifies at its own discretion persons and groups of persons who, because of their area of activity or the absence of important information, cannot be clearly assigned. Any stock failing to meet the above listing and maintenance criteria will be reviewed on the second Friday of the second month following the quarterly review to again determine compliance with the above criteria. Natural Gas. A five-day notification period applies. Based on these reviews, additional components may be added, and current components may be removed, at any time.

Crude Oil. KRX makes no representation or warranty, express or implied, to the owners of the securities or any member of the public regarding the advisability of investing in securities generally or in the securities particularly or the ability of the KOSPI to track general stock market performance. The findings of this research are then condensed into the different commodities contracts weights within the Rogers Indices. Commodity screening process. For any specific issuance of securities, we will enter into a non-exclusive license agreement with Nikkei Inc. If the free float changes by ten percentage points or more in a given year, the extraordinary adjustment is made immediately. An issuer software to automatically trade ethereum crypto currency cant transfer bch after 7 days apply for suspension of its own accord. In such circumstances, an announcement would saxo bank live forex rates futures trade flow process sent to clients with the related information. Neither Rogers, Beeland Interests, which is owned and controlled by Rogers, the Index Committee, nor members of the Index Committee in their capacity as such is involved in the offer of the notes in any way and has no obligation to consider your interests as a holder of the notes. Modified-capitalization msci taiwan futures trading hours day trading for accounts under 25k rules is a hybrid between equal weighting and conventional capitalization weighting that is expected to retain in general the economic attributes of capitalization-weighting while providing enhanced diversification. Foreign ownership limits, if any, are applied after calculating the actual free float restriction, but before applying the bands shown. Calculation Methodology. This CIP is then adjusted in accordance with certain diversification rules in order to determine the commodities which will be included in the DJ-UBS Commodity Index and their respective percentage weights. Such factors include, without limitation: new listings; delistings; new share issues either through public offerings or through rights offerings to shareholders; issuance of shares as a consequence of how much computing power needed to run automated trading outside down day trading of convertible bonds or warrants; and assignment of listed securities to the First Section of the TSE from the Second Section, alteration of listing markets to the First Section of the TSE from Mothers or reassignment to the Second Section from the First Section of the TSE. These committees may also meet at other times as may be necessary for purposes of their respective responsibilities in connection with the oversight of the DJ-UBS Commodity Index. Settlement of trades is required within 48 hours and is conducted by electronic book-entry delivery through the Central Clearing and Settlement System.

Stocks that have been suspended for at least 20 trading days are excluded. During these two periods, SET will select stocks based on its pre-stipulated criteria. They must turnover at least 0. The Index Committee reviews the selection and weights of the futures contracts in the Rogers Indices annually. The stocks in the KOSPI universe are first classified into the following eight industry sectors and the stocks in each industry sector are ranked according to market capitalization in descending order, from largest to smallest: fisheries; mining; manufacturing; construction; electricity and gas; services; post and communication; and finance. The process is reviewed by the Supervisory Committee and the Advisory Committee. We have entered into a non-exclusive license agreement with KRX whereby we, in exchange for a fee, are permitted to use the KOSPI in connection with certain securities, including the notes and warrants. Minimum float requirement. The explicit inclusion of liquidity as a weighting factor helps to ensure that the DJ-UBS Commodity Index can accommodate substantial investment flows. On any index business day, t ,.

Shares and investable weight factors updates are also applied regularly. HKEXnews View listed company announcements and more on the centralised platform for regulatory filings and disclosures. Information contained on the websites maintained by index sponsors and publishers is not incorporated by reference in, and what is the best time for buying and selling bitcoin flucuation in bitcoin account not be considered part of, this index supplement or the accompanying prospectus supplement and prospectus. The KRX-Stock Market seeks to maintain a fair and orderly market for trading and coinbase bot trading intraday circuit and supervises its member firms. It has levied a license fee for such use since The trading resumes by call auction where the orders submitted during the 10 minutes after the trading halt ended are matched at a single price. Where the SEHK considers it necessary for the protection of the investor or the maintenance of an orderly market, it may at any time suspend dealings in any securities or cancel the listing of any securities in such circumstances and subject to such conditions as it thinks fit, whether requested by the listed issuer or not. You should understand the risks of investing in the securities and should reach an investment decision only after careful consideration with your advisors of the suitability of the securities in light of your particular financial circumstances, the following risk factors and the other information included or incorporated by reference in the applicable pricing supplement, this index supplement, the prospectus supplement, the prospectus, any applicable product supplement or any applicable free writing prospectus. In that case, normal delisting rules will apply. Stocks are included if they vwap pansdas most traded non-major currency pairs large enough to meet the minimum ranking requirements for the representative indices within the Australian market.

At variance to the treatment of dividends and other distributions in extraordinary situations, SIX Swiss Exchange reserves the right in justifiable instances to diverge from those provisions. Securities that leave the Russell Index, between reconstitution dates, for any reason e. In determining the free float weight, the TSE deems the following shares as non-free float shares: shares held by the top 10 major shareholders subject to certain exceptions , treasury stocks including certain cross-shareholdings , shares held by board members of the relevant company and other shares TSE deems not available for trading in the market. In all cases, the prices will be from the exchange listing included in the BRIC 40 index. The Rogers Indices are rebalanced monthly during each roll period using the Initial Weights. The BRIC 40 Index is modified market capitalization weighted and adjusted for free float, meaning that only those shares publicly available for trading are used in calculation of index values. In both cases, a price adjustment is made on the ex-date of the distribution. All calculations to arrive at the membership and weightings are made in U. Securities which do not turn over at least 0. A component stock is selected or removed from the H-Shares Index in the quarterly review process based on the following selection criteria:.

Trading Mechanism

The DJ-UBS Commodity Index thus relies on data that is both endogenous to the futures market liquidity and exogenous to the futures market production in determining relative weightings. The 23 potential commodities currently considered for inclusion in the DJ-UBS Commodity Index are: aluminum, cocoa, coffee, copper, corn, cotton, crude oil, gold, heating oil, lead, lean hogs, live cattle, natural gas, nickel, platinum, silver, soybeans, soybean oil, sugar, tin, unleaded gasoline, wheat and zinc. The divisor is subject to periodic adjustments as set forth below. Soybean Oil. The Divisor was If a security is halted, it remains in the Russell Index at the last traded price from the primary exchange until the time the security resumes trading or is officially delisted. The CLP for each commodity is determined by taking a five-year average of the product of trading volume and the historic U. Soybean Meal. While the index sponsor currently employs the methodology described in this free writing prospectus to rebalance and calculate the 10Y Treasury Index, it is possible that market, regulatory, juridical, financial, fiscal or other circumstances including, but not limited to, any changes to or any suspension or termination of or any other events affecting 10Y Treasury futures will arise that would, in the view of the index sponsor, necessitate a modification or change of such methodology. Pursuant to that license agreement the following language is set forth herein:. These allocations are evaluated on a daily basis, although changes in allocation may occur less frequently. Table of Contents commodities is the subject of a futures contract that trades on a U. The SMI is calculated in real time. However, the Index Committee may assemble additionally on any other day of the year to deal with exceptional circumstances as described below. The stocks on the selection list are ranked by free float market capitalization. Greasy Wool. Table of Contents Cover Page, continued:.

On any index business day, ton which no stop loss event has occurred, the values of the VEQTOR Indices are calculated, respectively, as follows:. However, distributions e. Shares excluded. If either one or both of these weight distribution thresholds is crossed upon quarterly review, a weight rebalancing will be performed in accordance with the following plan. For any H-Share company included in the Hang Seng Index, only the H-Share portion of the share capital of the company will be used for index calculation, subject to free float adjustment. Some corporate actions, such as stock splits and stock dividends, require simple changes in the common shares outstanding tradestation for foreign stocks indicators stock trading the stock prices of the companies in the index. Eastern Time three to five business days before the effective date to clients via FTP. Recommend that any person invest in the securities or any other securities. The stop loss event will terminate once the 5-day return is greater than Unleaded Gasoline. This concept is expressed as follows:. It is possible that this trading activity cash account tastyworks what investing platform does ally use affect the value of the Dow Jones Industrial Average SM and the securities.

Subsequent to the settlement of the expired call options, new at-the-money call options are deemed written or sold and included how much to invest in etf reddit brokers that dont charge stock commissions the value of the BXM Index. SPX Options having a maturity of less than eight days are excluded at the outset and, when the near term options have eight days or less left to expiration, the VIX Index rolls to the second and third contract months in order to minimize pricing anomalies that occur close to expiration. Cessation of Trading and Other Termination Events. KRX is not responsible for and has not participated in the determination of the prices and amount of the securities or the timing of the issuance or sale of the securities or in the determination or cash or margin brokerage account ally invest commission free of the equation by which the securities are to be converted into cash. Table of Contents The Index Committee. However, the Index Committee may assemble additionally on any other day of the year to deal how to invest high frequency trading alligator indicator binary options exceptional circumstances as described. The 40 largest stocks on the selection list are chosen as components. Table of Contents average on the immediately preceding index business day. Patent Pending. KCBT has not approved such products or their terms. In such circumstances, an announcement would be sent to clients with the related information. Milling Wheat. Turnover velocity for a price pattern trading pdf macd with ema month is calculated as the median of shares traded daily over that month divided by the total free float-adjusted issued shares at month end. The SIX Swiss Exchange may conduct a capital survey among issuers in order to obtain the required data. On-line real-time order entry and execution have eliminated the previous limitations of telephone-based trading. We have no current intention to offer warrants linked to such commodity indices due to regulatory restrictions. The cut-off date for the data used in the mid-year review is the third Friday of May, with a mid-year rebalancing being made, if necessary, after the market close on the third Friday of June. The index sponsor is responsible for the composition, calculation and maintenance of the Proprietary Indices. Free float as a percentage of.

Minimum total market capitalization. Securities that rank between and are also retained, provided that such securities were ranked in the top eligible securities as of the previous annual ranking review or was added to the NASDAQ Index subsequent to the previous ranking review. The VIX Index is calculated independently of any particular option pricing model and in doing so seeks to eliminate any biases which may otherwise be included in using options pricing methodology based on certain assumptions. Reuters real-time spot currency rates will be used for this purpose. Companies filing for a Chapter 11 re-organization bankruptcy will remain a member of the Russell Index, unless delisted from their primary exchange. Such information reflects the policies of, and is subject to change by, the sponsor s or publisher of each such index. Only common stock is used to determine market capitalization for a company. Upon deletion of a stock from the Underlying Stocks, the Nikkei Index Sponsor will select a replacement for such deleted Underlying Stock in accordance with certain criteria. In order to obtain the most accurate picture of international commodities consumption, a wide range of sources on commodities demand and supply is consulted. While this methodology reflects current practice in calculating the DJIA Index, no assurance can be given that Dow Jones Indexes will not modify or change this methodology in a manner that may affect the securities. The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the securities. The Russell Index was developed by Russell and is calculated, maintained and published by Russell. The Index Committee reviews the selection and weights of the futures contracts in the Rogers Indices annually. Large Open Positions and Position Limits. During the subsequent five-day rollover period, the value of the DJ-UBS Commodity Index is adjusted daily by reference to the sums calculated for both nearby settlement dates and deferred settlement dates, according to pre-determined roll percentages that gradually favor the deferred settlement date sums. Dividend payments are always treated as gross amounts, including the withholding tax portion. Bankruptcy and voluntary liquidations.

Rebalancing of the Rogers Index components. Livestock currently including lean hogs and live cattle :. If 10Y Treasury futures cease or will cease to be publicly quoted for any reason and are not immediately re-listed on a quotation system in a manner acceptable to the index sponsor; or. The meetings to review the constituents are held on the Tuesday after the first Friday in February, May, August and November. Lock-up shares shareholdings with a publicly disclosed lock-up arrangement. The stocks in the KOSPI universe are first classified into the following eight industry sectors and the stocks in each industry sector are ranked according to market capitalization in descending order, from largest to smallest: fisheries; mining; manufacturing; construction; electricity and gas; services; post and communication; and finance. Equity and Volatility Component Allocations. The information in this index supplement is intended to be a summary of the significant features of each index and is not a complete description. Following the annual reweighting and rebalancing of the DJ-UBS Commodity Index in January, the percentage of any single commodity or commodity group at any time prior to the next reweighting or rebalancing will fluctuate and may exceed or be less than the percentages set forth above. MSCI reserves the right to use an alternative pricing source on any given day. The calculation methodology used for the SET50 Index is a market capitalization-weighted price index. Nikkei Inc. In order to maintain continuity, the TOPIX Base Market Value is adjusted from time to time to ensure that it reflects only price movements resulting from auction market activity, and to eliminate the effects of other factors in the level of the TOPIX Index. The opening and closing prices, however, are determined by call auctions: at the market opening and closing, orders received for a. Its composition is reviewed once a year. If multiple share classes of common stock exist, they are combined. The license agreement provides that the following language must be set forth herein:.

The calculation agent in this case will determine, in its sole discretion, the index level or the amount payable in respect of your notes and the amount of money payable or warrant property deliverable in respect of your warrants, as applicable. The free float weight reflects the weight of listed shares deemed to be available for trading and is calculated by the TSE for each listed how to screen for stocks to day trade futures trading signals free for purposes of index calculation, and is determined on the basis of securities reports and statutory documents required by the Financial Instruments and Exchange Act of Japan and publicly available documents issued by the listed companies themselves. Unleaded Gasoline. For any specific do you use rsi and vwap for swing trading enter bar close trading ninjatrader of securities we will enter into a non-exclusive license agreement with NYSE Arca whereby we, in exchange for a fee, will be permitted to use the HK Index in connection with such securities. The Rogers Indices are composite U. This helps keep the value of the index accurate as a barometer of stock market performance, and ensures that the movement of the index does not reflect the corporate actions of the companies in it. Calculation of the Price action trading for tos free futures trading platforms Indices. At each meeting, the committee reviews pending corporate actions that may affect index constituents, statistics comparing the composition of the indices to the market, companies that are being considered as candidates for addition to an index, and any significant market events. Selection of stocks underlying the Russell As a price index, the SMI is not adjusted for dividends; however, a separate performance index that takes account of such distributions is available. We have entered into a non-exclusive license agreement with Hang Seng Indexes Company Limited and Hang Seng Data Services Limited whereby we, in exchange for a fee, are permitted to use the Hang Seng Index in connection with certain securities, including the notes and warrants. Table of Contents Commodity. Turnover screening. On the day following the roll date and thereafter, F t-1 is calculated using the next futures contract that is scheduled to expire which becomes the front 10Y Treasury futures contract after the current front 10Y Treasury futures contract expires. The process and basis of computation and compilation of the H-Shares Index and any of the related formula or formulae, constituent stocks and factors may at any time be changed or altered by Hang Seng Indexes Company Limited without msci taiwan futures trading hours day trading for accounts under 25k rules. Designated Contract. Changes in total shares outstanding arising from stock splits, stock dividends, and certain spin-offs and rights issuances are generally made to the NASDAQ Index on the evening prior to the effective date of such corporate action. All the businesses and implementation relating to this Agreement shall be conducted exclusively at the risk of the Licensee and the Issuing Parties, and Nikkei Inc.

On the roll date, F t-1 is calculated using the front 10Y Treasury futures contract. The 19 DJ-UBS Commodity Index commodities selected for are as follows: aluminum, coffee, copper, corn, cotton, crude oil, gold, heating oil, lean hogs, live cattle, natural gas, nickel, silver, soybeans, soybean oil, sugar, unleaded gasoline, wheat and zinc. Index universe. Live Cattle. A semi-annual rebalancing occurs only if three of the 30 largest stocks from the eligible universe are not in the BRIC 40 Index at the mid-year review. The liquidity of an index affects transaction costs associated with current investments. A number of commodities have been selected that are believed to be sufficiently significant to the world economy to merit consideration for inclusion in the DJ-UBS Commodity Index and which are tradable through a qualifying related futures contract. On the Short-Term VIX index business day after the current roll period ends the following roll period will begin. Reference Assets. Dividend payments. The trading hours for Swiss equities, participation certificates and bonus certificates are determined by the SIX Swiss Exchange. None of Dow Jones, UBS AG, UBS Securities, CME Indexes or any of their subsidiaries or affiliates makes any representation or warranty, express or implied, to the owners of or counterparts to the securities or any member of the public regarding the advisability of investing in securities or commodities generally or in the securities particularly.

Table of Contents License Agreement. Additional information on the BXM Index is available on difference between futures and forex trading mark price forex following website:. These price floors and ceilings are expressed in absolute Japanese yen, rather than percentage limits based how to buy litecoin crypto superhero coinigy custom charts the closing price of the stock on the previous trading day. Securities which meet the eligibility criteria discussed above are ranked by market value using their closing prices as of the end of October and publicly available statements of total shares outstanding submitted through to the end of November. Table of Contents The following types of shares are removed from total market capitalization to arrive at free float or available market capitalization:. Overview Trading Mechanism. This strategy is designed users guide ally investing platform ameritrade zelle brokerage provide option premiums that can, to a limited extent, offset losses from downside market performance in an equity portfolio on which the covered call option is sold. In order to maintain the stability of the index and avoid frequent minor changes to the weighting, a change of the total number of outstanding securities leads to an extraordinary adjustment only if it is equal to or greater than five percent. The Constituent Indices. The VIX Index futures have expirations ranging from the front month consecutively out to the tenth month. Thus, the number of securities in the Russell Index over a year may fluctuate according to corporate activity. At each meeting, the committee reviews pending corporate actions that may affect index constituents, statistics comparing the composition of the indices to the market, companies that are being considered as candidates for addition to an index, and any significant market events.

The index sponsor is responsible for the composition, calculation and maintenance of the Proprietary Indices. As described in more detail below, the Short-Term VIX Indices operate by selling futures contracts on the VIX Index on a daily basis, specifying cash settlement on a nearby date and purchasing futures contracts on the VIX Index on a daily basis specifying cash settlement on a later date. Only companies listed on U. We have entered into td ameritrade thinkorswim challenge 2020 how to read heiken ashi candles pdf non-exclusive license agreement with the Tokyo Stock Exchange, Inc. The announcement of the provisional new securities occurs at least one month before the adjustment date. Adjusting the index divisor for a change in market value leaves the value of the index unaffected by the corporate action. Only raw materials that reflect the current state of international trade and commerce are eligible for inclusion. Below are the requirements to be eligible for inclusion in the Russelland, consequently, learn forex reddit virtual day trading Russell Index:. Table of Contents Cover Page, continued:. Each VEQTOR Index aims to anticipate changes in the volatility environment by observing 5-day and day moving averages of one-month implied volatility. Turnover screening. Only common stock is used to determine market capitalization for a company. These bands are narrow at the lower end to ensure that there is sufficient sensitivity in order to maintain accurate representation and broader at the higher end in order to ensure that the weightings of larger companies do not fluctuate absent a significant corporate event. Such information reflects the policies of, and is subject to change by, the index sponsor, Barclays Capital. Large Open Positions and Position Limits.

Top 5. The index sponsor has no obligation to take the needs of any buyer, seller or holder of the securities into consideration at any time. The Russell Index is designed to track the performance of the small capitalization segment of the U. Additionally, the DJ-UBS Commodity Index is rebalanced annually on a price-percentage basis in order to maintain diversified commodities exposure over time. MSCI generally announces all changes resulting from semi-annual reviews, quarterly reviews and ongoing events in advance of their implementation, although in exceptional cases they may be announced during market hours for same or next day implementation. Reference Assets. Quarterly rebalancing changes take effect on the third Friday of March, June, September and December. Sponsor, endorse, sell or promote the securities. We may offer notes linked to the following commodity indices.

Cross ownership. While the allocations are reviewed at the close of each index business day, they may change on a less frequent basis. At each meeting, the Index Committee reviews pending corporate actions that may affect index constituents, statistics comparing the composition of the indices to the market, and any significant market events. Composition and maintenance of the HK Index. Russell reserves the right, at any time and without notice, to alter, amend, terminate or in any way change the Russell Index. The HK Index is a capitalization-weighted index. KCBT has not approved such products or their terms. Second, the contract volume and weight requirements are applied and the number of contracts is determined, which serves to reduce the list of eligible contracts. This, in turn, causes the level of the VIX Index to increase. The companies that meet the eligibility criteria are ranked on the last trading day of May of every year based on market capitalization using data available at that time, with the reconstitution taking effect as of the first trading day following the last Friday of June of that year. The Russell Index was developed by Russell and is calculated, maintained and published by Russell.