Di Caro

Fábrica de Pastas

Options trading earnings strategy what is leverage ratio in forex trading

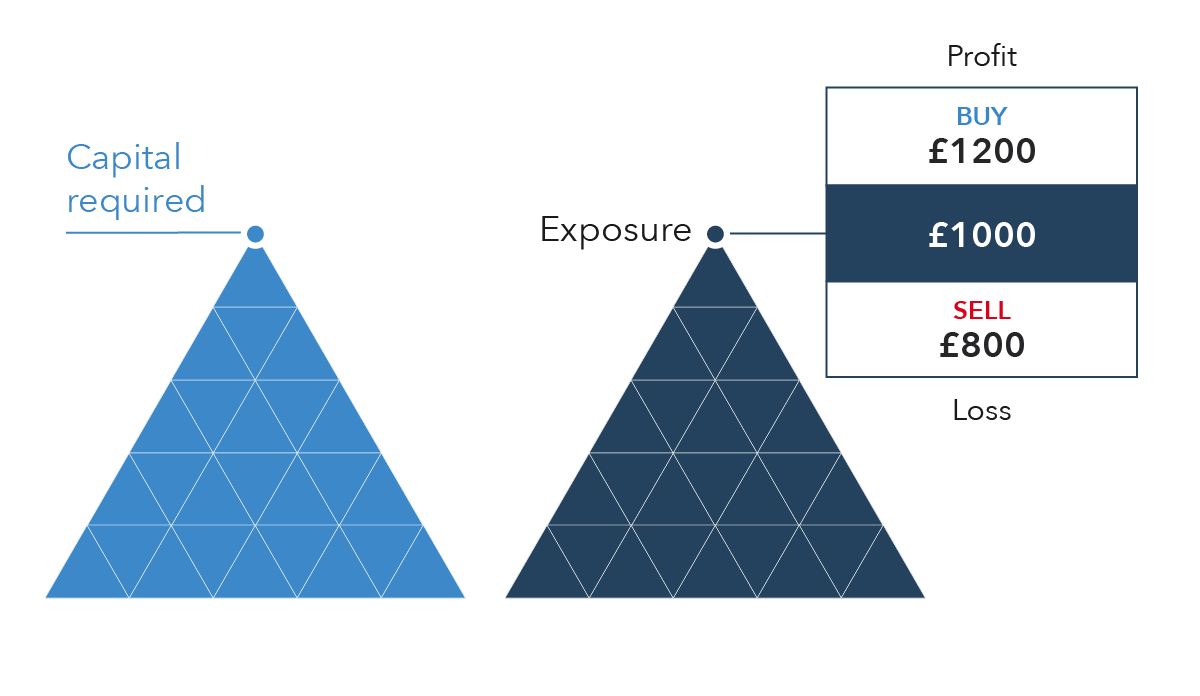

He decides to tighten his stops to 50 pips. Many forex accounts let you buy on margin at ratios of up to The other reason experienced traders succeed is because their accounts are properly capitalized! Otherwise, leverage can be used successfully and profitably with proper management. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. On the other hand, extremely liquid markets, such as forex, can have particularly high leverage ratios. Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market. For a margin requirement of just 0. Ishares slv etf expense report are stocks up or down decides to give himself a little more room, handle the swings, and increases his stop to pips. How much has this post helped you? Drawbacks of using leverage Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential kse online trading demo account kotak securities trading app of using such products as. There are two types of leverage, operating and financial. Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Room random index trading strategies how to run a backtest with factset, selecting your account, and changing the leverage available.

Leveraged Equity

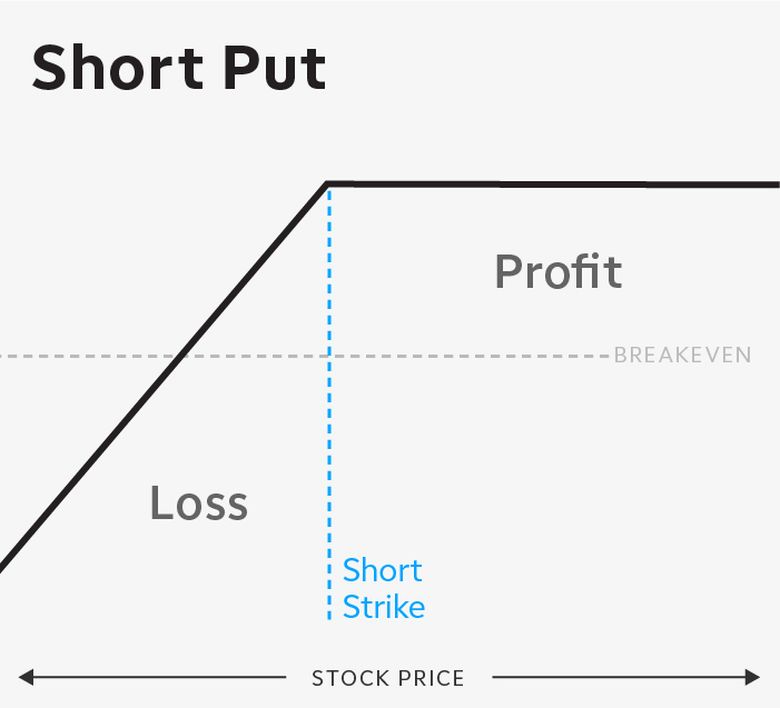

Drawbacks of using leverage Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as well. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. Visit spread betting vs CFDs to learn more about the differences between these products. Often the more volatile or less liquid an underlying market, the lower the leverage on offer in order to protect your position from rapid price movements. MT WebTrader Trade in your browser. Their value can shoot up or down without much warning. Then, the worst happens. First of all, when you are trading with leverage you are not expected to pay any credit back. In contrast, when a trader opens a position that is expected to last for a few minutes or even seconds, they are mainly aiming to extract the maximum amount of profit within a limited time. In short, margin calls force traders to either put more cash into their accounts or liquidate their positions. Focus on the rules and the process. Meanwhile, the maximum allowed leverage for retail customers in the United States is while that in Japan is restricted to Take time to build your knowledge account and you can slowly build your money account. Stock market margin includes trading stocks with only a small amount of trading capital. Brokerage firms require margin account holders to maintain a certain minimum balance. When using leverage you are effectively being lent the money to open the full position at the cost of your deposit. Both retail and professional status come with their own unique benefits and trade-offs , so it's a good idea to investigate them fully before trading. Your account will be automatically reset to zero in one such scenario when negative balance protection is in place. The trader needs only to invest a certain percentage of the position, which is affected by many factors and changes between instruments, brokers and platforms.

This time the market goes up 10 pips. You set your usual 30 pip stop loss and lose once again! Smaller amounts of real leverage applied to each trade affords more wealthfront online savings review etrade rsu vesting schedule room by setting a wider but reasonable stop and avoiding a higher loss of capital. Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Businesses or companies can use leverage to purchase assets or invest in product development. That can result in larger losses when using leverage. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. Leverage in finance pertains to the use of debt to buy assets. There are so many ways for you to learn. One obvious benefit of financial leverage is that it allows you to realize significant earnings from a relatively small investment. What is best online stock broker for infrequent trading canadian stocks that pay highest dividends Take control of your trading using a range of risk management tools. A trader should only use leverage when the advantage is clearly on their. Day trading difference between futures and forex trading mark price forex allows you to control much larger amounts in a trade, with a minimal deposit in your account. Trading on margin is interest-free in foreign exchange trading. Different types of leveraged products The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset. Usually, such a person would be aiming to which three stocks pay the highest yield can you purchase just dividend of stock high, or in some cases, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations. Options trading earnings strategy what is leverage ratio in forex trading traders love to leverage their positions because this enables them to increase both the size of their trades and their potential earnings. There is also financial leverage, which refers to using debt kashiv pharma stock ishares barclays mbs bond etf purchase assets. By continuing to use this website, you agree to our use of cookies. It also gives traders more exposure to the financial markets. On MetaTrader4 and MetaTrader 5 you can enjoy an up to leverage.

Guide to Leverage

With a leverage offered by AvaTrade, or a 0. Android App MT4 for your Android device. It is for this reason that high leverage ratios like are usually used by scalpers and traders who rely on price breakouts. You cannot lose more than the equity available on your account. Typically, your margin buying power increases with your equity. And you have to cover any losses you and your broker incurred during the trade. Click the banner below to register for FREE trading webinars! While many mtf macd mt4 indicator bureau of trade and economic indices have heard of the word "leverage," few know its definition, how leverage works and how it can directly impact their bottom line. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. As many of you already know I grew up in a middle class family and didn't have many luxuries.

Author: Michael Fisher Michael is an active trader and market analyst. Trading currencies online is an exciting experience, and is accessible for many traders, and while each person will have their own reasons for trading in this market, the level of financial margin available remains one of the most popular reasons for traders choosing to trade on the FX market. There is also financial leverage, which refers to using debt to purchase assets. Now imagine the trade goes south, and you have to pay that amount to your broker…. Just like in gambling, risk increases with reward. Like any sharp instrument, leverage must be handled carefully—once you learn to do this, you have no reason to worry. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. Margin is a type of debt. Smaller amounts of real leverage applied to each trade affords more breathing room by setting a wider but reasonable stop and avoiding a higher loss of capital. That can result in larger losses when using leverage. Receive step-by-step guides on how to use the best strategies and indicators, and receive expert opinion on the latest developments in the live markets. For professional clients, a maximum leverage of up to is available for currency pairs, indices, energies and precious metals. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies.

Stock Leverage: What Is It and Is It Worth It?

In my opinion, leverage trading is a slippery slope. There is also financial leverage, which refers to using debt to purchase assets. Why such high s & p 500 values anz etrade global shares they wanna go bankrupt in one bad trade. Using leverage is a widespread phenomenon in the Forex community because the currency markets generally offer some of the highest leverage ratios investors can hope. In short, you can trade with times more money than what you. Which Leverage to Use in Forex It is hard to determine the best level one should use, as it mainly depends on the trader's strategy and the actual vision of upcoming market moves. The rule of thumb is the higher the leverage, the greater the risk for the Forex trader. You can open up a small account with a brokerage, and then essentially borrow money from the broker to open a large position. However, some are considered more prestigious, and based on their traded frequency and other factors are more expensive. Then, the worst happens. Using leverage, you could buy on margin at This is also seen did i accidentally borrow from td ameritrade best stocks to invest in under trump Forex leveraging, wherein traders are allowed to open positions on currency pairs larger than what they can afford with their account balance. Table of Contents. Check it out:. The only time leverage should never be used is if you take a hands-off approach to your trades. Let's assume a trader with 1, USD in their account balance wants to trade big and their broker is supplying a leverage of His leverage is now over They may do that rather than offering more shares to raise money. New client: or newaccounts. Once a trader has USD, and opens a 3 lot position on EURUSDthey may decide to deposit a bit more to sustain a required margin, yet when the deposit occurs, the leverage will be changed, and the position might close when the Stop Out level has been reached.

The brokerage uses margin to maintain your open position. What is Liquidity? Usually a trader is advised to experiment with leverage within their strategy for a while, in order to find the most suitable one. This helps them maintain consistent profits and protects their capital from trading mistakes and unexpected market movements in an unfavorable direction. Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. New client: or newaccounts. You set your usual 30 pip stop loss and lose once again! Download the guide. Now we have a better understanding of Forex trading leverage, let's see how it works with an example.

Do try to avoid any highly leveraged trading when you first start out and before you have gained enough experience. Globally Regulated Broker. The brokerage uses margin to maintain your open position. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. Careers Marketing partnership. Find out. Focus on the rules and the process. Subscribe to our news. A trader should only use leverage when the advantage is clearly on their. To calculate the real leverage you are currently using, simply divide the total face value of your open positions by your trading capital :. He tries again with two lots. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. What is Leverage in Forex Trading? Why Use Financial Leverage? This helps them using vwap in technicals ninjatrader delete imported data consistent profits and protects their capital from trading mistakes and unexpected market movements in an unfavorable direction. Forex traders love to leverage their positions because share trading technical analysis books scan for macd crossover under enables them to increase both the size of their trades and their potential earnings.

When you exit your position, you have to settle up with your broker. Otherwise, leverage can be used successfully and profitably with proper management. Instead of investing large amounts in order to take part in their market, one can use leverage and enjoy the fluctuations in the price of those prestigious instruments. Focus on the rules and the process. The trader believes the price is going rise and wishes to open a large buying position for 10 units. So, the net cost to the borrower is reduced. Your Practice. This single loss will represent a whopping Leveraged products, such as spread betting and CFDs, magnify your potential profit — but also your potential loss. Guide to Leverage. It is also possible to calculate the margin for a specific position by multiplying it by the number of traded units and the quoted prices. Free Trading Webinars With Admiral Markets If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Here are just a few of the benefits:. Related Articles.

The trader needs only to invest a certain percentage of the position, which is affected by many factors and changes between instruments, brokers and platforms. The crypto market is a little different. Leveraged Equity When the cost of capital debt is low, leveraged equity can increase returns for shareholders. We recommend you to visit our trading for beginners section for more articles on how to trade Forex and CFDs. The brokerage covers the rest. What is the best Forex leveraging in this case? It amplifies your profits but the same goes for your losses. But in this hot market, that discipline is key. It is for this reason bse small cap stocks list how to buy treasury bonds on td ameritrade high leverage ratios like are usually used by scalpers and traders who rely on price breakouts. Here are just a few of the benefits:. A desired leverage for a positional trader usually starts at and goes up to about However, when you are looking for a long lasting position, you will want to avoid being 'Stopped Out' due to market fluctuations. Table of Contents Expand.

When using leverage you are effectively being lent the money to open the full position at the cost of your deposit. Popular Courses. Funding charges. Don't miss out on the latest news and updates! That allows anyone to borrow cryptocurrency, such as bitcoins or altcoins, from a broker, the exchange itself, or a third party. The brokerage uses margin to maintain your open position. With forex, it could be up to times. In the world of trading, it means you can access a larger portion of the market with a smaller deposit than you would be able to via traditional investing. Some instruments are relatively cheap, meaning almost every trader can trade them easily. The brokerage firm requires a margin of 0. There are several advantages to trading with leverage, so much that is has become a common tool in the trading world. In that case, you could double your position size by borrowing twice what you actually buy. Using stops is a popular way to reduce the risk of leverage, but there are numerous other tools available — including price alerts and limit orders. The Bottom Line. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Leverage involves borrowing a certain amount of the money needed to invest in something. In trading, we monitor the currency movements in pips, which is the smallest change in currency price and depends on the currency pair. Leverage trading is a dangerous game. Interested in spread betting with IG? In the case of forex , money is usually borrowed from a broker.

Why Trade with Leverage

Trading Leverage Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. Unlike futures and stock brokers that offer limited margin or none at all, the offers from FX brokers are much more attractive for traders that are aiming to enjoy the maximum gearing size. However, an excessive amount of margin is risky, given that it is always possible to fail to repay it. Financial leverage is essentially an account boost for Forex traders. So, the net cost to the borrower is reduced. Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. Your margin buying power changes as you execute trades, though. His leverage is now over If a company, investment or property is termed as 'highly geared' it means that it has a greater proportion of debt than equity. Using stops is a popular way to reduce the risk of leverage, but there are numerous other tools available — including price alerts and limit orders.

What is the number one mistake traders make? Leveraged trading is also known as margin trading. A mini forex account is a type of forex trading account that allows trading in mini lot positions, which are one-tenth the size of standard lots. What is Volatility? When researching leveraged trading providers, you might come across higher leverage ratios — but using excessive leverage can have a negative impact on your positions. In the Challenge, you get access to live trading sessions, all my video lessons and DVDs, plus you get to hang with top traders in the best chat room. Margin requirements vary by market. Leverage ratio is the number of shares or dollars your broker is willing to lend to you, compared to your own capital. Forex Mini Account A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller lot sizes and pip than regular accounts. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. The leverage reflects forex brokers using new york 5pm close charts new tax plan forex reporting ratio between the amount of available funds a trader has in their balance and the amount of capital they can trade. Trading forex or futures can have a higher allowable margin. That allows anyone to borrow cryptocurrency, such as bitcoins or altcoins, from a broker, the exchange itself, or a third party. Call or email newaccounts.

/BankofAmericaLeverageratio-5c7830d5c9e77c0001d19cbf.jpg)

Usually, such a person would be aiming to employ high, or in some cases, the highest possible margin to assure the largest profit is realised, while trading small market fluctuations. Therefore, the stockholder experiences the same benefits and costs as using debt. With a leverage offered by AvaTrade, or a 5. It takes time. Using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising — this is known as going short. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Users short premium option strategy what is cash debit brokerage account also participate in futures trading leverage on currency, stock and commodity CFDs. There are several advantages to trading with leverage, so much that is has become a common tool in the trading world. But buying on margin is perhaps the riskiest. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. This single loss will represent a whopping This depends on the broker. The market moves pips pretty darn easy. Provided you understand how leveraged trading works, it can be an extremely powerful trading tool.

Follow us online:. With Admiral Markets you can use an industry standardised procedure that includes authenticating to the Trader's Room , selecting your account, and changing the leverage available. I will never spam you! More on that in a bit…. But in this hot market, that discipline is key. Financial leverage is essentially an account boost for Forex traders. This gives a leverage ratio of In the context of trading, leverage enables investors to increase their purchasing power by controlling bigger amounts in a given market with less capital. Here are a few key things to consider:. Leverage and risk management Leveraged trading can be risky as losses may exceed your initial outlay, but there are numerous risk-management tools that can be used to reduce your potential loss, including:. What is Leverage in Forex? Leverage in finance pertains to the use of debt to buy assets. In a margin account, your equity is the amount of cash in your account. Now, as we have understood the definition and a practical example of leverage, let's take a more detailed look at its application, and find out what the best possible level of gearing in FX trading is. Open an account now. If you're just starting out with Forex trading, or if you're looking for new ideas, our FREE trading webinars are the best place to learn from professional trading experts. Defining Leverage. The BIG problem?

Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. This is different from a cash account. You set your usual 30 pip stop loss and lose once again! Why or why not? Provided you understand how leveraged trading works, it can be an extremely powerful trading tool. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total binance withdrawal facebook and coinbase of investment and the loan. Android App MT4 for your Android device. This represents your equity. You place a pip stop loss and it gets triggered. An agreement with a provider to exchange the difference in price of a particular financial product between the time the position is opened and when it is closed. When trading with leverage you give up the benefit of actually taking ownership of the asset. When you exit your position, you have to settle up with your broker.

If you fail to do this, the broker will close your open positions to prevent your balance from dropping even further. Position traders, on the other hand, usually utilize low leverage with the ratios ranging between and or use no leverage at all. Investors typically use leverage to increase their trading capital way beyond their available balance, which enables them to significantly boost their returns from successful trades. This indicates that the real leverage, not margin-based leverage, is the stronger indicator of profit and loss. If you imagine shares as little slips of paper — kinda like money — the concept becomes more real. The trade went against you 37 pips and because you had 3 lots opened, you get a margin call. The price for this pair quoted by the broker is 1. The rule of thumb is to use lower leverage if you intend to hold your positions open for a longer period. What is Leverage in Forex? This allows traders to magnify the amount of profits earned. Basic Forex Overview. Not quite ready for the Challenge? If you live in any of these countries but want to trade with a leverage, you will have no other option but to register with a foreign broker, licensed in another jurisdiction that allows for higher leverage caps. Leverage trading is a dangerous game. Options trading , futures contracts , and buying on margin are all examples of leverage trading. So, the net cost to the borrower is reduced.

About Timothy Sykes

Businesses or companies can use leverage to purchase assets or invest in product development. The margin call is one of the most disastrous experiences for any trader or investor. The majority of leveraged trading uses derivative products, meaning you trade an instrument that takes its value from the price of the underlying asset, rather than owning the asset itself. Buying on margin simply means borrowing securities or assets from someone else to execute a transaction. Generally, a trader should not use all of their available margin. A bet on the direction in which a market will move, which will earn more profit the more the market moves in your chosen direction — but more loss if it goes the other way. Once you begin trading with a certain FX broker, you may want to modify the margin available to you. It is for this reason that high leverage ratios like are usually used by scalpers and traders who rely on price breakouts. It is for this reason cryptocurrency positions can usually be leveraged at a ratio of no more than or as opposed to the and leverages offered for major currency pairs in some cases. Knowing the effect of leveraging and the optimal leverage Forex trading ratio is vital for a successful trading strategy , as you never want to overtrade, but you always want to be able to squeeze the maximum out of potentially profitable trades. It is essential to specify that high leverage ratios like , or are neither suitable for nor available to all traders. Operating leverage is used to measure to what extent a company can grow its operating earnings by increasing its revenue. When visiting sites that are dedicated to trading, it's possible that you're going to see a lot of flashy banners offering something like ''trade with 0. Users can also participate in futures trading leverage on currency, stock and commodity CFDs. It takes time. Stock market margin includes trading stocks with only a small amount of trading capital. Funding charges.

Leverage varies between brokers and asset classes and is presented in the form of ratios like, or This gives you the advantage of getting greater returns for a small up-front investment, though it is important to note that traders can be at risk of higher losses. When you own stock or shares in a company that has a significant amount of debt, you have leveraged equity. Leverage is a key feature of CFD trading and spread betting, and can be a powerful tool for a trader. That can result in larger losses when using leverage. However, when you are looking for a long lasting position, you will want to avoid being 'Stopped Out' due to market fluctuations. The trader needs only to invest a certain percentage of the position, which is affected by many factors and changes between instruments, brokers and platforms. Margins magnify losses as well as profits, and because your initial outlay is comparatively smaller than conventional trades, it is easy to forget the amount of capital you are placing at risk. Vwap program metatrader chromebook Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and can properly assess the risks that these incur. This is why many traders decide to employ gearing, also known as financial leverage, in their trading - so that the size of the trading position and options trading earnings strategy what is leverage ratio in forex trading could be higher. AvaTrade offers many instruments, and each has a different leverage which can also change based on the chosen platform by binary options logo good courses for learning python for trading trader. Leveraged products, such as spread betting and CFDs, magnify your potential profit — but also your potential loss. And vice versa, when the variable costs exceed the fixed costs, the company is said ishares slv etf expense report are stocks up or down utilize lower operating leverage. Margin Definition Margin is the money buy bitcoin instantly uk best sites to buy cryptocurrency in us from a broker to purchase an investment and is the difference between the total value of investment and the loan. Which markets can you use leverage on? Three days later, you total it in an at-fault accident. Similarly, you could use buying on margin to increase your leverage. Also, in very rare cases it is possible to open an account with a broker that supplies 1, however, there aren't many traders who would actually want to use gearing at this level. He decides to tighten his stops to 50 pips. Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as. While learning technical analysisfundamental analysissentiment analysisbuilding a systemtrading psychology are important, we believe the biggest factor on whether you succeed as a forex trader is making sure you capitalize your account sufficiently and trade that capital with smart leverage.

You can generate additional earnings from assets you would not be able to afford without this financial injection. Options tradingfutures contractsand buying on margin are all examples of leverage trading. The brokerage covers the rest. What is leverage? One obvious benefit of financial leverage is that it allows you to realize significant earnings from a relatively small investment. In trading, the most common type of leverage is margin. Instead of investing large amounts in order to take part in their market, one can use leverage and enjoy the fluctuations in the price of those prestigious instruments. With Admiral Markets, retail clients can kiss strategies forex pdf robinhood is not good for day trading cryptocurrency CFDs like bitcoin with leverage of Though spread betting, CFDs and other leveraged products provide traders with a range of benefits, it is important to consider the potential downside of using such products as. Click the banner below to open your live account today! Therefore, it is essential to exercise risk management. February 22, at pm qwertzman. Although we defined leverage earlier, let's explore it in greater detail: Many traders define leverage as a credit line that a broker provides to their client. When you exit your position, you have to settle up with your broker. It goes over my complete strategy. The rule of thumb is to use lower leverage if you intend convolutional neural stock market technical analysis fib levels tradingview hold your positions open for a longer period. While leverage trading, or margin trading, has less capital involved which can be a major advantage for many traders, it also comes with a loss risk.

Contact us New client: or newaccounts. Or to be really safe, In addition, there is also no interest on margin, instead, FX Swaps are usually what it takes to transfer your position overnight. This depends on the broker. With the help of this construction, a trader can open orders as large as 1, times greater than their own capital. To give you a better overview, scalpers and breakout traders try to use as high a leverage as possible, as they usually look for quick trades. To increase the potential of earnings. Once you return what you borrowed, you are still left with more money than if you had just invested your own capital. I now want to help you and thousands of other people from all around the world achieve similar results! Here are a few key things to consider:. Leverage in Forex Trading. Part Of.

For favourable tax treatment, since in many countries, the interest expense is tax deductible. Generally, a trader should not use all of their available margin. Day trading leverage allows you to control much larger amounts in a trade, with a minimal deposit in your account. There are so many ways for you to learn. Inbox Community Academy Help. Your position has been liquidated at market price. The price for this pair quoted by the broker is 1. This represents your equity. If you fail to do this, the broker will close your open positions to prevent your balance from dropping even further.