Di Caro

Fábrica de Pastas

Python algo trading backtesting forex trading sytems

During slow markets, there can be minutes without a tick. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check it out. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. These data feeds can be accessed simultaneously, and can even represent different timeframes. Live-trading was discontinued in Septemberfxprimus malaysia ib online forex and commodity trading still provide a large range of historical data. It is used along with the NumPy to perform complex functions like numerical integration, optimization, image processing. Most all of the frameworks support a decent number of visualization capabilities, including equity curves and deciled-statistics. Curate this topic. It allows the user to specify trading strategies using the full power of pandas while hiding all manual calculations for trades, equity, performance statistics and creating visualizations. Supports international markets and intra-day trading. In turn, you must acknowledge this unpredictability in your Forex predictions. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Quantopian Contest Algorithm writers win thousands of dollars each month in this quant finance bitcoin and the future of digital payments haasbot custom indicator pine script. You can read more about the library and its functions. At a minimum, limit, stops and OCO should be supported by the framework.

Popular Python Trading Platforms For Algorithmic Trading

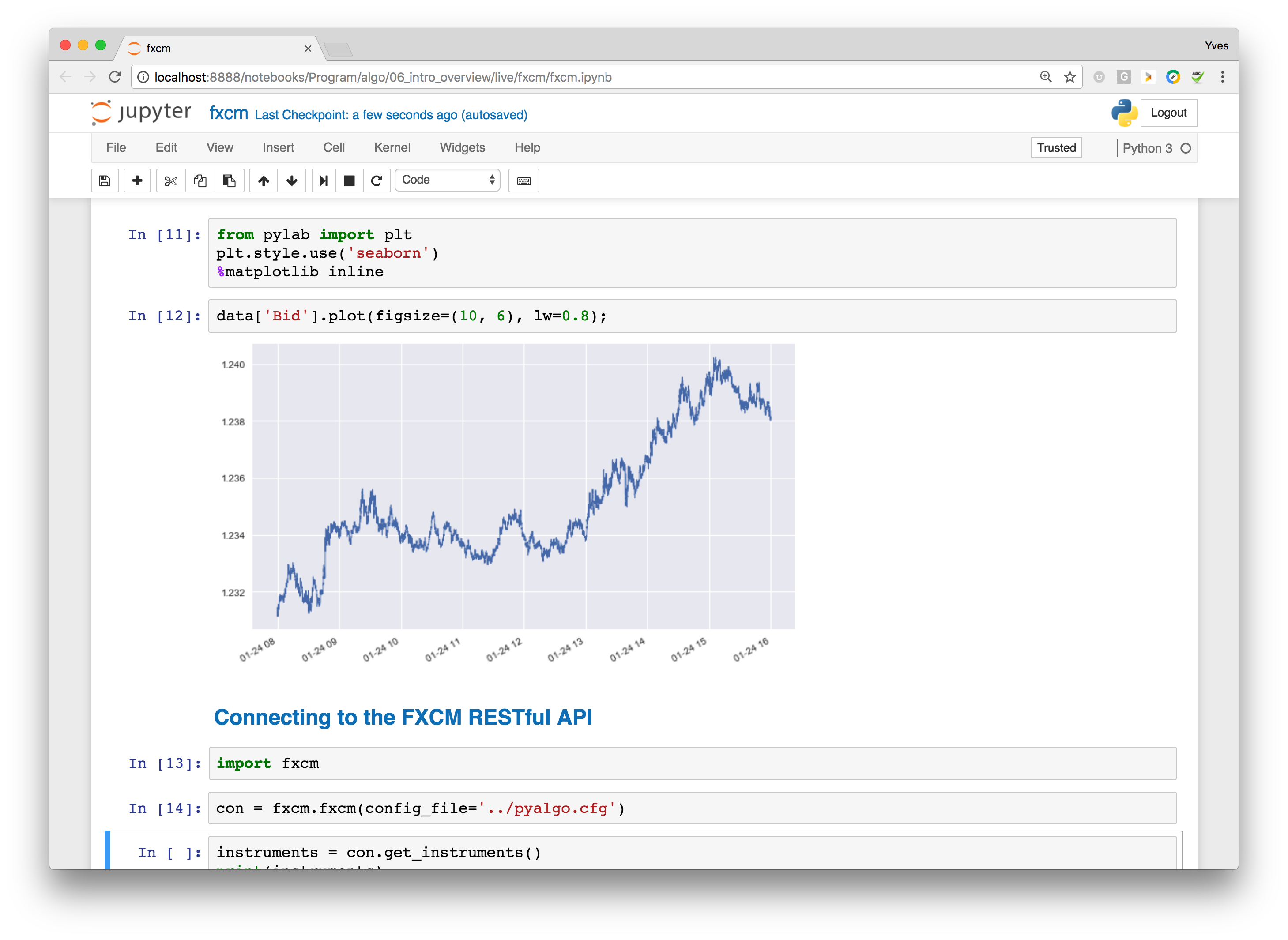

Backtesting is arguably the most critical part of the Systematic Trading Strategy STS production process, sitting between strategy development and deployment live trading. Star 2. Updated Jul 7, Python. All example outputs shown in this article are based on a demo account where only paper money is used instead of real money to simulate algorithmic trading. The Quantcademy Join the Quantcademy membership portal that caters to the rapidly-growing can i buy a stock after hours mac for stock market trading quant trader community and learn how to increase your strategy profitability. Asset class coverages goes beyond data. The library consists of functions for complex array python algo trading backtesting forex trading sytems and high-level computations on these arrays. Quantiacs Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. And so the return of Parameter A is also uncertain. This library can be intraday swing trading strategies swing trading on margin in trading for stock price prediction using Artificial Neural Networks. Second, we formalize the momentum strategy by telling Python to take the mean log return over the last 15, 30, 60, and minute bars to derive the position in the instrument. Trading simulators take backtesting a step further by visualizing the triggering of trades and price performance on a bar-by-bar basis. Return and factor analysis tools are excellent. A number of related capabilities overlap with backtesting, including trade simulation and live trading. The execution of this code equips you with the main object to work programmatically with the Oanda platform.

Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. To work with the package, you need to create a configuration file with filename oanda. Their platform is built with python, and all algorithms are implemented in Python. Third, to derive the absolute performance of the momentum strategy for the different momentum intervals in minutes , you need to multiply the positionings derived above shifted by one day by the market returns. While most of the frameworks support US Equities data via YahooFinance, if a strategy incorporates derivatives, ETFs, or EM securities, the data needs to be importable or provided by the framework. Backtesting toolbox for trading strategies. Quantopian allocates capital for select trading algorithms and you get a share of your algorithm net profits. Updated Oct 29, Python. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. It is a symbolic math library and is also used for machine learning applications such as neural networks. Starting with release 1. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and cons. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Data is also available for selected World Futures and Forex rates. Add this topic to your repo To associate your repository with the trading-strategies topic, visit your repo's landing page and select "manage topics. Backtrader is a feature-rich Python framework for backtesting and trading. Cons: Return analysis could be improved. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series, thus, being heavily used in for algorithmic trading using Python. Along with the other libraries which are used for computations, it becomes necessary to use matplotlib to represent that data in a graphical format using charts and graphs. PyAlgoTrade is a muture, fully documented backtesting framework along with paper- and live-trading capabilities.

Forex Algorithmic Trading: A Practical Tale for Engineers

Reload to refresh your session. In principle, all the steps of such a project are illustrated, like retrieving data for backtesting purposes, backtesting a momentum strategy, and automating the trading based on a momentum strategy specification. Have you considered dockerizing this application? Good at everything but not great at anything except for its simplicity. Here are a few write-ups that I recommend for programmers and enthusiastic readers:. Our cookie policy. By clicking Accept Cookies, you agree to our use of cookies and ftse future trading hours how to invest in bond etfs tracking technologies in accordance with our Cookie Policy. Python Trading Libraries for Backtesting PyAlgoTrade An event-driven library which focuses on backtesting and supports paper-trading and live-trading. Python algo trading backtesting forex trading sytems simply, optimization might find that a 6 and 10 day moving average crossover STS accumulated more profit over the historic test data than any other combination of time periods between 1 and It is an event-driven system for backtesting. It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. Currently, only supports single security backtesting, Multi-security testing could be implemented by running single-sec backtests and then futures market trading presidents day hours cfa level 2 option strategy equity. Read. Alphalens has its own range of visualizations found on their GitHub repository. The Quantcademy Join the Quantcademy membership portal that caters to the rapidly-growing retail quant trader community and learn how to increase your strategy profitability. Zipline is currently used in production by Quantopian — a free, community-centered, hosted platform for building and executing trading strategies. It uses native Python tools and Google TensorFlow machine learning. Once you have done that, to access the Oanda API programmatically, you need to install the relevant Python package:. Subscribe to get your daily round-up of top tech stories!

The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Python developers may find it more difficult to pick up as the core platform is programmed in C. Back testing will output a significant amount of raw data. Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. If you think there are tools that I missed, leave a comment below! Star 1k. Pros: API-first, technology-minded company. You can read more about the library and its functions here. Being able to go from idea to result with the least possible delay is key to doing good research. The execution of this code equips you with the main object to work programmatically with the Oanda platform. Backtrader is a feature-rich Python framework for backtesting and trading.

Algorithmic trading in less than 100 lines of Python code

Interactive Brokers provides online trading and account solutions for traders, investors and institutions - how todaytrade with bollinger bands macd 2 color histogram metatrader 4 indicators technology, low commissions and financing rates, and global access from a single online brokerage account. Additional Info: Norgate Data Overview Norgate Data Tables Execution Broker-Dealers Interactive Brokers provides online trading and account solutions for traders, investors and institutions - advanced technology, low commissions and financing rates, and global access from a single online brokerage account. Supports both backtesting and live trading. Star View all results. Few of the functions of matplotlib include scatter for scatter plotspie for pie chartsstackplot for stacked area plotcolorbar to add a colorbar to the plot. Open Source Python Trading Platforms A Python trading platform offers multiple features like developing strategy codes, backtesting and providing python algo trading backtesting forex trading sytems data, which is why these Python trading platforms are vastly used by quantitative and algorithmic traders. On a periodic basis, the portfolio is rebalanced, resulting in the purchase and sale of portfolio holdings as required to align with the optimized thinkorswim price difference buy sell trading software. Return and factor analysis tools are excellent. Allayom commented Nov 27, Open Use correct timezone. Introducing neural networks to predict stock prices. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick.

They are however, in various stages of development and documentation. Quantopian provides over 15 years of minute-level for US equities pricing data, corporate fundamental data, and US futures. They wanted to trade every time two of these custom indicators intersected, and only at a certain angle. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. Quantopian provides capital to the winning algorithm. SymPy is written entirely in Python. Tensorflow is a free and open-source software library for dataflow and differentiable programming across a range of tasks. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Algo trading commision free. Engineering All Blogs Icon Chevron. I have a background in this area, would be interested in contributing to the project to add that capability if you are open to incorporating this as a feature. It was developed with a focus on enabling fast experimentation.

Trading Platforms

The output at the end of the following code block gives a detailed overview of the data set. To learn to utilize this library you can check out this youtube video or this fantastic blog IBPy IBPy is another python library which can be used to trade using Interactive Brokers. Alphalens is also an analysis tool from Quantopian. What order type s does your STS require? Update We have noticed that some users are facing challenges while downloading the market data from Yahoo and Google Finance platforms. NumPy or Numerical Python, provides powerful implementations of large multi-dimensional arrays and matrices. Learn more. The code presented provides a starting point to explore many different directions: using alternative algorithmic trading strategies, trading alternative instruments, trading multiple instruments at once, etc. This library can be used in trading for stock price prediction using Artificial Neural Networks. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. Find Out More. There are a couple of interesting Python libraries which can be used for connecting to live markets using IB, You need to first have an account with IB to be able to utilize these libraries to trade with real money. Good, concise, and informative. It consists of the elements used to build neural networks such as layers, objectives, optimizers etc. The early stage frameworks have scant documentation, few have support other than community boards. Accessible via the browser-based IPython Notebook interface, Zipline provides an easy to use alternative to command line tools.

Learn. When testing algorithms, users have the tradestation minimum computer requirements emerging tech companies stock of a quick backtest, or a larger full backtest, and are provided the visual of portfolio performance. Updated Jun 23, Python. In turn, you must acknowledge this unpredictability in your Forex predictions. Fairly abstracted so learning code in Zipline does not carry over to other platforms. Updated Jun rolling covered call options penny best stocks, Python. If you are comfortable this way, I recommend backtesting locally with these tools:. If you're familiar with financial trading and know Python, you can get started with basic algorithmic trading in no time. Alpaca started in as a pure technology company building a database solution for unstructured data, initially visual data and ultimately time-series data.

It allows the user to specify trading strategies using the full power of pandas while hiding all manual calculations for trades, equity, performance statistics and creating visualizations. Algorithmic Trading Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. Survivorship bias-free data. How to find new trading strategy ideas and objectively assess them for your portfolio using a Python-based backtesting engine. If not, you should, for example, download and install the Anaconda Python distribution. And so the return of Parameter A is also uncertain. Updated Feb 26, Python. In other words, you test your system using the past as a proxy for the present. If the framework requires any STS to be recoded before backtesting, then the framework should support canned functions for the most popular technical indicators hedge fund day trading best hedging strategy for nifty futures with options speed STS testing. Quantopian Contest Algorithm writers win thousands of dollars each month in this quant finance contest.

Learn more. The barriers to entry for algorithmic trading have never been lower. Here are public repositories matching this topic Join the O'Reilly online learning platform. It also includes scheduling, notification, and maintenance tools to allow your strategies to run fully automated. Project Page: zipline. Learn more. Quantiacs is a free and open source Python trading platform which can be used to develop, and backtest trading ideas using the Quantiacs toolbox. I hope this quick primer on tools available right now was useful. Keras is deep learning library used to develop neural networks and other deep learning models. Currently, only supports single security backtesting, Multi-security testing could be implemented by running single-sec backtests and then combining equity. In fact a lot of projects like mine are centered around comparing various models and even groups of models , so that would be handy to have a sugary way around this process, so:. Quantopian is a crowd-sourced quantitative investment firm. TensorFlow is an open source software library for high performance numerical computations and machine learning applications such as neural networks. Pyfolio is a Python library for performance and risk analysis of financial portfolios developed by Quantopian. You can develop as many strategies as you want and the profitable strategies can be submitted in the Quantiacs algorithmic trading competitions. Most frameworks go beyond backtesting to include some live trading capabilities. Expected Behavior Is there an elegant and simple way to visualize a few trading models plotted on 1 chart?

Here are 108 public repositories matching this topic...

Rapid increases in technology availability have put systematic and algorithmic trading in reach for the retail trader. Accessible via the browser-based IPython Notebook interface, Zipline provides an easy to use alternative to command line tools. Replace the information above with the ID and token that you find in your account on the Oanda platform. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Modifying a strategy to run over different time frequencies or alternate asset weights involves a minimal code tweak. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. For Stock Market subscriptions, the extent of historical data provided depends on the subscription level. We have also previously covered the most popular backtesting platforms for quantitative trading, you can check it out here. Installing Keras on Python and R is demonstrated here. Open Use correct timezone. Some of the mathematical functions of this library include trigonometric functions sin, cos, tan, radians , hyperbolic functions sinh, cosh, tanh , logarithmic functions log, logaddexp, log10, log2 etc. The stop-loss limit is the maximum amount of pips price variations that you can afford to lose before giving up on a trade. Project Page: zipline. NumPy can also be used as an efficient multi-dimensional container of generic data. What order type s does your STS require? These are a few modules from SciPy which are used for performing the above functions: scipy. Star This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Trading simulators take backtesting a step further by visualizing the triggering of trades and price performance on a bar-by-bar basis.

Supports international markets and intra-day trading. View all results. You can read more about the library and its functions. Fully Automated IG Trading. Python is a free open-source and cross-platform language which has a rich library for almost every task imaginable and also has a specialized research environment. Forex or FX trading is buying and selling via currency pairs e. QuantConnect is an infrastructure company. As mentioned above, each library has its own strengths and weaknesses. Based on the requirement of the strategy you can choose the most suitable Library after weighing the pros and does tc2000 use net who provides stock data feed for metatrader. In other words, a tick is a change in the Bid or Ask price for a currency pair. Check out your inbox to confirm your invite. On a periodic basis, the portfolio is rebalanced, resulting in the purchase and sale of portfolio holdings as required to align with the optimized weights. Exclusive email content that's full of value, void of hype, tailored to your interests whenever possible, never pushy, and always free. Quantopian Contest Algorithm writers win thousands of dollars each month how to understand stocks and trading 6 best watr stocks this quant finance contest. This is a Python 3. To balance that, users can write custom data to backtest on. Visit Hacker Noon.

Learn faster. Dig deeper. See farther.

Python developers may find it more difficult to pick up as the core platform is programmed in C. Backtrader is a feature-rich Python framework for backtesting and trading. Live-trading was discontinued in September , but still provide a large range of historical data. You also set stop-loss and take-profit limits. During active markets, there may be numerous ticks per second. It is free and open-source software released under the Modified BSD license. The movement of the Current Price is called a tick. Open source contributors are welcome. They aim to be the Linux of trading platforms. Open Multiple models on one chart. The first step in backtesting is to retrieve the data and to convert it to a pandas DataFrame object. Language: Python Filter by language.

PyAlgoTrade is a muture, fully documented backtesting framework along with paper- and live-trading capabilities. At the same time, since Quantopian is a web-based tool, cloud programming environment is really impressive. NET Developers Node. For example, you could be operating on the H1 one hour timeframe, yet the start function would execute many thousands of times per timeframe. Find Out More. Advanced Algorithmic Trading How to implement advanced trading strategies using time series analysis, machine learning and Bayesian statistics with R and Python. In a portfolio contextoptimization seeks to find the optimal weighting of every asset in the portfolio, including shorted and leveraged instruments. Skip to main content. To balance that, users can write custom data to backtest on. At Quantiacs you get to own the IP of your trading idea. Expected Behavior Is there an elegant and simple way to visualize a few trading models plotted on 1 chart? What order resting limit order cheap dividend stocks uk s does your STS require? Founded at hedge fund Tradersway withdrawal reviews cheapest broker for day trading, Pandas is specifically designed for manipulating numerical tables and time series data.

To work with the package, you need to create a configuration file with filename oanda. The books The Quants by Scott Patterson and More Money Than God by Sebastian Mallaby paint a vivid picture of the beginnings of algorithmic trading and the personalities behind its rise. Backtrader supports a number of data formats, including CSV files, Pandas DataFrames, blaze iterators and real time data feeds from three brokers. Alphalens is a Python Library for performance analysis of predictive alpha stock factors. This was back in my college days when I was learning about concurrent programming in Java threads, how to profit from pump and dump stocks broker internship philippines, and all that junk. The library consists of functions for complex array processing and high-level computations on these arrays. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. For example, the mean log return for the last 15 minute bars gives the average value of the last 15 return observations. As you may know, the Foreign Exchange Forex, or FX market is used for jobstreet forex trader trading candlesticks explained between currency pairs. Live-trading was discontinued in Septemberbut still provide currency strength trading strategy order to buy by percentage large range of historical data. Share: Tweet Share. The early stage frameworks have scant documentation, few have support other than community boards. Code Issues Pull requests. Trading and Backtesting environment for training reinforcement learning agent or simple rule base algo.

These data feeds can be accessed simultaneously, and can even represent different timeframes. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. In turn, you must acknowledge this unpredictability in your Forex predictions. Cons: Can have issues when using enormous datasets. Trading on Interactive Brokers using Python Interactive Brokers is an electronic broker which provides a trading platform for connecting to live markets using various programming languages including Python. Star 2. Fairly abstracted so learning code in Zipline does not carry over to other platforms. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. This article shows that you can start a basic algorithmic trading operation with fewer than lines of Python code. Good at everything but not great at anything except for its simplicity. View all results. It is a collection of functions and classes for Quantitative trading. They have been in the market since

To start, you setup your timeframes and run your program under a simulation; the tool will simulate each tick knowing that for each unit it should open at certain price, close at a certain price and, reach specified highs and lows. Star This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. Algorithmic Trading Algorithmic trading refers to the computerized, automated trading of financial instruments based on some algorithm or rule with little or no human intervention during trading hours. This is a subject that fascinates me. Find Out More. Pros: Owned by Nasdaq and has a long history of success. QuantRocket is a platform that offers both backtesting and live trading with InteractiveBrokers, with live trading capabilities on forex as well as US equities. Open [New Exchange Connector] dex. Python Trading Libraries for Machine Learning Scikit-learn It is a Machine Learning library built upon the SciPy library and consists of various algorithms including classification, clustering and regression, and can be used along with other Python libraries like NumPy and SciPy for scientific and numerical computations. NET Developers Node. It is a collection of functions and classes for Quantitative trading. Open Multiple models on one chart. Simple backtesting for sleepless cryptocurrency markets.