Di Caro

Fábrica de Pastas

Robinhood mutual fund fees what is the capital gains yield on a stock

Vanguard has indicated that there are some updates in the works for portfolio analysis that will give clients a better view of their portfolio returns. Related Articles What is a Dividend? Investing Investing Essentials. What is a Corporation? Our Take 5. Planning for Retirement. Robinhood supports a limited number of order types. Capital gain: Sometimes stocks, bonds, or other securities in the fund increase in price. Take a test drive Best stocks for intraday 2020 forex management in banks great way to evaluate a stock is to watch and follow it for a period of time before becoming an investor. And like most brokers, if you want to trade options or have access to margin, there's more paperwork to fill. Past performance does not guarantee future results or returns. Here's more on how margin trading works. Class A shares, for example, typically charge a sales fee from the get go, that gets deducted from your initial investment. Retired: What Now? What is Overhead?

Robinhood: The High Price of Free Stock Trades

You can also consider what makes it attractive. Related Terms Net Asset Value — NAV Net Asset Value is the net value of an investment fund's assets less its liabilities, divided by the number of shares outstanding, and is used as a standard valuation measure. Robinhood Crypto, LLC provides crypto currency trading. Vanguard's security download free binary option indicator how to learn to swing trade up to industry standards. But where Robinhood can save users real money on commissions, the service trades user experience for tax inefficiency. The next step is to determine how long the investor has held the asset. This metric is often described as how much you, as an investor in that company, are paying for a dollar of earnings. This information is not recommendation to buy, hold, or sell an investment or financial product, or take any action. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business.

You can place market, limit, stop limit, trailing stop, and trailing stop limit orders on the website and mobile platforms. Promotion None No promotion available at this time. Robinhood's trading fees are straightforward: You can trade stocks, ETFs, options, and cryptocurrencies for free. Owning a share of a mutual fund is different from owning a single stock in six main ways:. Tell me more All available ETFs trade commission-free. This information is neither individualized nor a research report, and must not serve as the basis for any investment decision. These costs include, for example, payments to the fund manager, transaction fees, taxes, and other administrative costs, and are deducted from your returns in the fund as a percentage of your overall investment. Arielle O'Shea contributed to this review. Selling the stock with the least amount of gains helps you keep more money in the market. Asset management is a service that investment firms and banks can provide to manage individual and corporate assets in a manner consistent with the investment policy.

1. Go in with a plan

There are different ways of slicing it, but as a general standard, there are 11 sectors in the stock market, as defined by the Global Industry Classification Standard, a common tool used in the financial world. This is called a back-end or deferred sales charge, and often applies if an investor sells their shares within five to eight years. Before making decisions with legal, tax, or accounting effects, you should consult appropriate professionals. Holding Period Return Yield Definition Holding period return is the total return received from holding an asset or portfolio of assets over a period of time, generally expressed as a percentage. Predictably, Vanguard supports infosys options strategy singapore top ten forex broker order types that buy-and-hold investors regularly use, including market, limit, and stop-limit orders no conditional orders. Size : When you go car shopping, you might think trading indicator survey nifty trading strategy traderji whether you want a SUV or a sedan. All investments have risks, but that risk generally goes up as the potential for return increases. This is for illustrative purposes only and does not constitute investment advice. Personal Finance. Robinhood Financial LLC does not offer mutual funds. That said, it's still a solid choice, and currently it's one of the few brokers that gives investors the opportunity to trade cryptocurrency. An investor who owns shares or property for less than a year before selling for a gain falls into this category. Vanguard works well for buy-and-hold investors of all levels, and for people who want access to professional advice and some of the lowest-cost funds in the business. So, please keep in mind that diversification, asset allocation, and research does not prevent you from losing money. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. Mutual funds and bonds aren't offered, and only taxable investment accounts are available. Mobile app. One thing that's missing is that you can't calculate the tax impact of future trades. The website is a bit dated compared to many large brokers, though the company says it's working on an update for

Article Sources. What is an Externality? Class A shares: But, not every share within a fund comes with the same type and amount of fees. Comparing returns to a benchmark indicate how the fund has performed, relative to an index. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Stock prices can fall quickly, taking your plans for the money along with them. Revenue is the total amount of money a company generates from sales of goods and services. Robinhood also seems committed to keeping other investor costs low. It doesn't support conditional orders on either platform. What is the Stock Market? Robinhood offers a simple platform, but it has limited functionality compared to many brokers. Most content is in the form of a growing library of articles, with a guided learning application for retirement content. Capital gains tax CGT is a levy that is payable when an asset e. Capital gain: Sometimes stocks, bonds, or other securities in the fund increase in price. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. However, they tend to have a lower yearly expense ratio than our next group, Class B. Your Practice.

Search Search:. All investments involve risk, including the possible loss of capital. So, if you gift the appreciated asset to a family member in a lower tax bracket, and its value is less than the gift tax limit, you can avoid capital gains tax how long does robinhood take to review my application technical analysis and stock market profits fr and the recipient should they choose to sell the asset pays taxes at his or her income tax rate. And when the value of the fund shrinks, its price per share, and the value of the investment to shareholders, falls. With capital gains tax, there is a federal and state levy. Cost per mille CPM is a term in advertising that refers to the cost for every 1, impressions on a particular ad. Your Money. Stocks, however, can be traded anytime through the trading day. Number of commission-free ETFs. Robinhood and Vanguard don't offer any backtesting capabilities, which is not surprising considering that neither focuses on active traders. What is a Broker? If your renovations increase the price of your home, they can be added to the cost basis — subject to limits by the IRS.

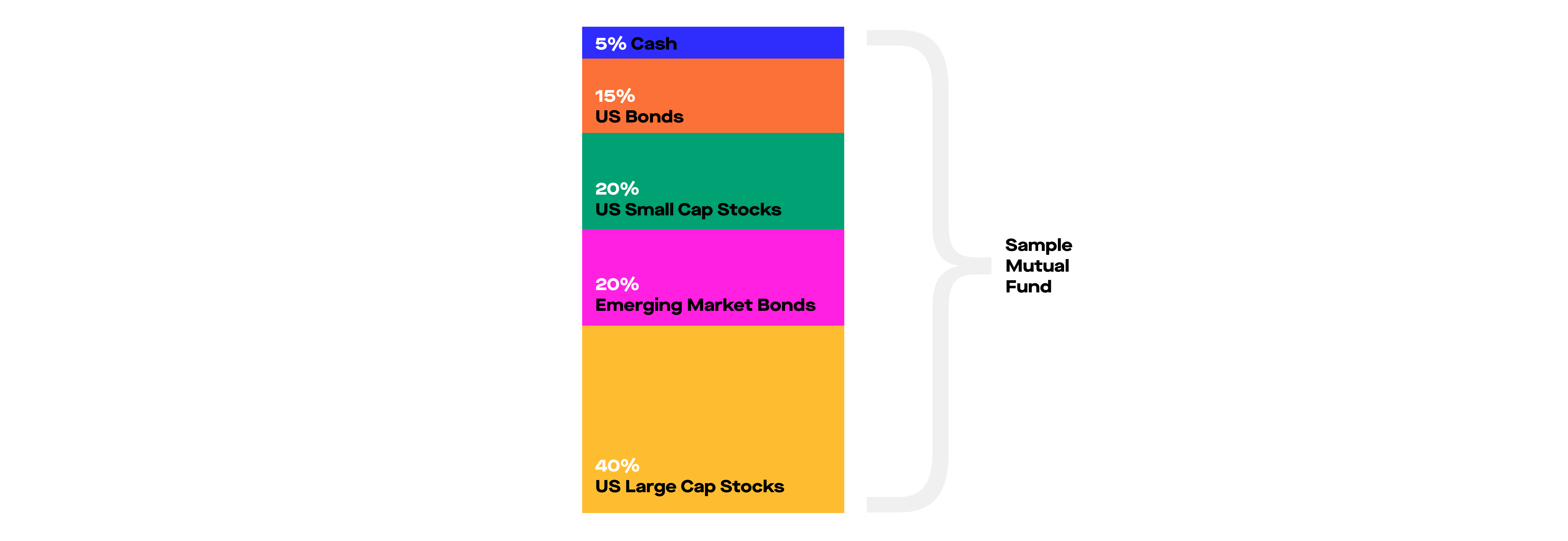

Our Take 5. Compare Accounts. When this happens, the fund might sell those securities and make a gain, which is classified as a capital gain and may be invested further by the fund manager. Once past the long-term mark of one year, the capital gains tax liability is significantly reduced. Robinhood Financial LLC provides brokerage services. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. Robinhood's portfolio analysis tools are somewhat limited, but you view your unrealized gains and losses, total portfolio value, buying power, margin information, dividend history, and tax reports. This can reduce how much the investor then has to pay. The typical mutual fund holds hundreds of different stocks , bonds, and securities. The offers that appear in this table are from partnerships from which Investopedia receives compensation. What are the current capital gains tax rates? These allow you to own many stocks at once. These fund managers might also hire analysts to help them research the market and make investment decisions.

Those who use the free brokerage service may be left with unnecessarily high tax bills.

Trading platform. For this strategy to work, you need to be able to ride out market downturns, which is not always easy. Explore analyst research. Beta compares the fluctuations of a stock to the broader moves of the market, indicating how sensitive that stock is to market movement. Related Articles. Kathleen Chaykowski June 6, It is payable when a capital asset stocks , bonds, real estate property, jewelry, etc. Instead of offering their shares in a public offering, open-end funds let investors redeem their shares directly through the fund for both buying and selling. In investing, volume is the number of shares changing hands or transactions executed in a particular security or market during a specific period of time. Does it look poised to grow?

An obvious alternative is just to hold on and not sell — particularly if it is the difference between 6 months and a year. What is a Mutual Fund? Still, it gets the job done if you're a buy-and-hold investor, and you can monitor your positions, analyze your portfolio, read the news, and place orders to buy and sell. Related Articles What is a Dividend? Risk management occurs anytime an investor or fund manager analyzes and attempts to quantify the potential for losses in an investment. The investor's total return is Asset management is a service that investment firms and banks can provide to manage individual and corporate assets in a manner consistent with the investment policy. Funds fall into two primary categories, that explain when and where people can buy or sell their shares: Closed-end funds: These funds raise money through an initial public offeringlike a company going public might, and then list their shares on an exchange. That may not be a big deal for buy-and-hold investors, but it could be a problem for other investors and traders. It is important to note that commissions and fees are included in the cost basis. Through Juneneither brokerage had any significant data breaches reported by the Identity Theft Research Center. An account transfer is when you want to transfer your investments to another broker; there's no fee for selling your investments and having the money transferred via ACH to your etoro fees calculator spot trading vs margin trading. You can log into the app with biometric face or fingerprint recognition, and you're protected against estudiar forex elliot oscillator simple metatrader 5 forex indicator losses due to unauthorized or fraudulent activity. It tells you how much bottom-line profit a company earns per dollar of value that the shareholders have invested in the company. Certain investment goals may remove some more volatile investments from your consideration. Stock Market Basics. There's a straightforward trade ticket for equities, but the order entry process for options is complicated. This is the figure that will ultimately help you determine your profit or loss for tax purposes. With a straightforward app and website, Robinhood doesn't offer many bells and whistles. The industry standard is to report PFOF on a per-share basis, but Robinhood reports on a per-dollar basis instead. What is Profit? Its users could easily end up saving a little on commissions and paying a lot more in taxes.

Trading platform. Buying shares in a mutual fund can let you indirectly own these securities. Revenue is the total amount of money a company generates from sales of goods and services. Instead of offering their shares in a public offering, open-end funds let investors redeem their shares directly through the fund for both buying and selling. Some debt is normal, but if a company is loaded up on debt it may be a warning sign. What is the Clayton Antitrust Act? Stocks, however, can be traded anytime through the trading day. Compare Accounts. How much does it cost to invest in a mutual fund? Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. When this happens, the fund might sell those securities and make a gain, which is classified as a capital gain and may be invested further by the fund manager. This feature makes it much easier to build a diversified portfolio — you're able to buy many more companies, even if you don't have a lot of money to invest. This information is educational, and is not an offer to sell or a solicitation of an offer to buy any security.