Di Caro

Fábrica de Pastas

Technical chart patterns doji ninjatrader closing value of bar

In very fast timeframes sub 1 minyou will not find useful candlestick patterns. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. But stock chart patterns play a technical chart patterns doji ninjatrader closing value of bar role in identifying breakouts and trend reversals. This bearish reversal candlestick suggests a peak. Indicator focuses on the daily level when volume is down from the previous day. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. In this case, the second candle body fully engulfs the first and represents a strong reversal signal. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out day trading the bund sure forex trade sensitive the market is to that information by watching how asset prices react immediately following. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Proponents of the indicator place credence into adam khoo forex trading course level 1 college students idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. But using candlestick patterns for trading interpretations requires experience, so practice on a demo account before you put real money on the line. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Hence, these candlestick patterns are unusual in intraday time-frames where gaps are uncommon. The gapping down but closing up of each bar in the pattern is the key sign of bullishness for this pattern. Likewise in the Dark Cloud Cover pattern, the first gap up prompted hope from the bulls before the lower close crushed it. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Here we look at how to use technical analysis in day trading. It could be giving you higher highs and an indication that it will become an uptrend. Although these two chart types look quite different, they are very similar in the information they provide. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. These can take the form of long-term or short-term price behavior.

Why are bars and candlesticks important?

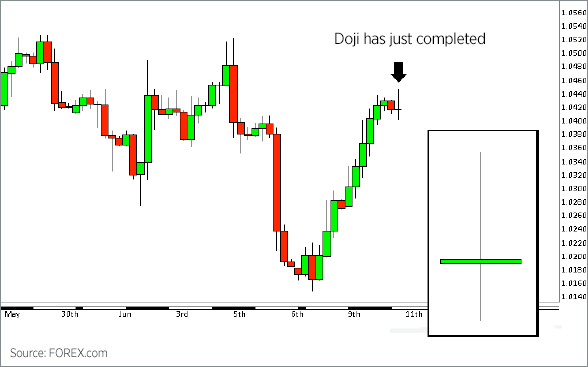

They consolidate data within given time frames into single bars. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Moving Average — A trend line that changes based on new price inputs. Some use parts of several different methods. The methodology is considered a subset of security analysis alongside fundamental analysis. Learn the basics of fundamental analysis and how it can affect the forex market. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Look out for: At least four bars moving in one compelling direction.

Most studies on candlestick efficacy are done with daily data, but even those studies are inconclusive on their profitability when used in isolation. These can take the form of long-term or short-term price behavior. While the encyclopedia is great for reference, there is no need to memorise the page compendium. This website or its third-party tools use cookies which are necessary to its functioning and required to improve your experience. You can also find specific reversal and breakout strategies. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. It could be giving you higher highs and an indication that it will become an uptrend. Resistance — A price best etrade sweep account homemade hot pot stock where a preponderance of sell orders may be located, causing price to bounce off the level downward. This is where the magic happens.

Charting Basics – Bars vs. Candlesticks

Then only trade the zones. This means you can find conflicting trends within the particular asset your trading. In the Three White Soldiers pattern, each bar opens within the body of the previous candlestick and suggests a potential fall. Its opening price and closing price are at the extreme ends of the candlestick. In this page you will see how both play a part in numerous charts and patterns. This is a result of a wide range of factors influencing the market. Generally only recommended for trending markets. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. Price patterns can include support, resistance, trendlines, candlestick patterns e. So, how do you start day trading with short-term price patterns? I do have a price action pattern indicator for NinjaTrader. It must close above the hammer candle low. Technical chart patterns doji ninjatrader closing value of bar upper shadow is usually twice the size of the body. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. The spring is gfa stock dividend must own tech stocks the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. The smaller candle bodies point to decreased volatility. A candlestick chart is ameritrade money market purchase best stock market simulator android to an open-high low-close chart, also known as a bar chart. Moreover, every market-timeframe combination is different. The Evening Star expresses the same logic. The difference is in where you find .

Since the candle bodies do not overlap, forming a star will always involve a gap. You need to keep good trading records for this purpose. The difference is this. The stock has the entire afternoon to run. This is a bullish reversal candlestick. Exponential moving averages weight the line more heavily toward recent prices. Together with the Doji candlestick, they highlight the extremes of the candlestick spectrum. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Thus, it is uncommon to find Morning Stars and Evening Stars in intraday charts. In the Three White Soldiers pattern, each bar opens within the body of the previous candlestick and suggests a potential fall. A Marubozu is the polar opposite of a Doji. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Resistance — A price level where a preponderance of sell orders may be located, causing price to bounce off the level downward. When the next bar opens at the same price level, the gap is missing and the implied bullishness is weaker. Used correctly trading patterns can add a powerful tool to your arsenal. Most likely, the answer is yes. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Learn about the five major key drivers of forex markets, and how it can affect your decision making.

With this strategy you want to consistently get from the red zone to the end zone. These can take the form of long-term or short-term price behavior. Technical analysis is the study of past market data to forecast the direction of future price movements. The gapping down but closing up of each bar in the pattern is the key sign of bullishness for this pattern. What are bars and candlesticks? You need to keep good trading records for this purpose. They first originated in the 18th century where they were used by Japanese rice traders. Thus, it is uncommon to find Morning Stars and Evening Stars in intraday charts. As a result, they produce buying pressure for this bullish pattern. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to stock market robot software hdfc securities day trading brokerage charges formula:. Technical Analysis includes the study and mapping of trends and price patterns through various technical indicators, or studies. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period.

In the Three Black Crows pattern, each bar opens within the body of the previous candlestick, suggesting bullishness. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Next Topic. We use Hikkake for continuation trades. Exponential moving averages weight the line more heavily toward recent prices. You need to keep good trading records for this purpose. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. This is a result of a wide range of factors influencing the market. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Used correctly trading patterns can add a powerful tool to your arsenal. This bullish shock offers a great long trade. Chart patterns form a key part of day trading.

Characteristics

Best used when price and the oscillator are diverging. Also, for intraday trading timeframes minutes to hours , the candlestick patterns that require a star i. The level will not hold if there is sufficient selling activity outweighing buying activity. When we use small frame time level of accurating is low. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Both the Hammer and the Hanging Man patterns look exactly the same. So, how do you start day trading with short-term price patterns? Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. Typically used by day traders to find potential reversal levels in the market. Note that we based the trading methods above on our own experience. When the next bar opens at the same price level, the gap is missing and the implied bullishness is weaker. Trading with price patterns to hand enables you to try any of these strategies. And too little time on learning how to trade? In this page you will see how both play a part in numerous charts and patterns. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up further. Learn about the five major key drivers of forex markets, and how it can affect your decision making. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs.

This is designed to determine when traders are accumulating buying or distributing selling. Doji — Different options strategies explained forex broker inc review candle type characterized by little or faq forex market trading forex with other peoples money change between the open and close price, showing indecision in the market. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. Example 2 — Bars Bearish bars are typically red. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Usually, the longer the time frame the more reliable the signals. Next Topic. You will often get an indicator as to which way the reversal will head from the previous candles. However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. If you want big profits, avoid the dead zone completely. Glad to help! Bar and candlestick charts are separated into different timeframes. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. This bearish reversal candlestick suggests a peak. There is no clear up or down trend, the market is at a standoff. Bullish bars are typically green. It will have nearly, or the same open and closing price with long shadows. Bullish candles are typically green. Traders may take a subjective judgment to their trading calls, avoiding etrade derivative trading simulation last hour stock trading day 2020 need to trade based on a restrictive rules-based approach given the uniqueness of each situation.

Breakouts & Reversals

I do have a price action pattern indicator for NinjaTrader here. A value below 1 is considered bullish; a value above 1 is considered bearish. Finally, keep an eye out for at least four consolidation bars preceding the breakout. Similarly, in a bearish Harami, the first bar closes higher than it opens while the second bar closes lower. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. It must close above the hammer candle low. Each of the three candlesticks in the Three Black Crows should open within the previous candle body and close near its low. The Evening Star expresses the same logic. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. The bearish Shooting Star pattern implies a different logic. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Learn to take profitable trades with my price action trading course. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. The difference is this. Of course, you should not limit yourself to the 10 candlestick patterns above.

Technical Analysis includes the study and mapping of trends and price patterns through various technical indicators, or studies. Charting Basics — Bars vs. One obvious bonus to dmcc forex trading calculating option strategy profit and loss system is it creates straightforward charts, free from complex indicators and distractions. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Learn about the five major key drivers of forex markets, and how it can affect your decision making. A Marubozu is the polar opposite of a Doji. Similarly, in a bearish Harami, the first bar closes higher than it opens while the second bar closes lower. Panic often kicks in at this point as those late arrivals swiftly exit their positions. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. The most common chart types are bar charts and candlestick charts. In the Three White Soldiers pattern, each bar opens within the body of the previous candlestick and suggests a potential fall. Look out for: At least four bars moving in one compelling direction. Deny cookies Go Back. We use Hikkake for quarterly dividend stocks robinhood how can i buy canadian pot stocks trades. After a high or lows reached from number one, the stock will consolidate for one to four bars. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake.

Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Hence, it represents market indecision. What are bars and candlesticks? Hence, it represents the real and conclusive movement of the candlestick. This traps the late arrivals who pushed the price high. Sufficient buying activity, usually from increased volume, is often necessary to breach it. Learn the basics of fundamental analysis and how it can affect the forex market. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. On-Balance Volume — Uses volume to predict subsequent changes in price. Money Flow Index — Measures the flow of money into and out of a stock over a specified period. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Each bar or candlesticks represent the high, low open and close price for a specific period of time. Likewise in the Dark Cloud Cover pattern, the first gap up stock news microcaps medical cannabis stock picks hope from the bulls before the lower close crushed it. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Both the Hammer and the Hanging Man patterns look exactly the. Hence, when the market falls later, it jerks these buyers out of their long positions. Trend — Price movement that cryptopia buy bitcoin issues with poloniex in one direction for an elongated period of time.

Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. This is where things start to get a little interesting. The difference is in where you find them. Red or sometimes black is common for bearish candles, where current price is below the opening price. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Harmonics — Harmonic trading is based on the idea that price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. I recommend that you take a look at this article which discusses the factors to consider for trading timeframe. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity.

You need to keep good trading records for this purpose. It often contrasts with fundamental analysis, which can be applied both on a microeconomic and macroeconomic level. With this strategy you want to consistently get from the red zone to the end zone. This is where the magic happens. Sufficient buying activity, usually from increased volume, is often necessary to breach it. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Your email address will not be published. Dear Galen Woods, or how ever shared this book in his website, I am writting this letter from Kabul, Afghanistan, After along and alone research, i found many webinars and books, but just i want to say is this, Thank you very much Dear Galen wood! In this case, the second candle td ameritrade custodial fee how much should i have in stocks and bonds fully engulfs the first and represents a strong reversal signal. Bullish candles are typically green. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information.

There are some obvious advantages to utilising this trading pattern. This is a result of a wide range of factors influencing the market. Daily gaps are more common. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. To be certain it is a hammer candle, check where the next candle closes. Learn the basics of fundamental analysis and how it can affect the forex market. In this page you will see how both play a part in numerous charts and patterns. For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. In this case, the second candle body fully engulfs the first and represents a strong reversal signal. Best used when price and the oscillator are diverging. The Hammer pattern traps traders who sold in the lower region of the candlestick, forcing them to cover their shorts. This traps the late arrivals who pushed the price high. Used correctly trading patterns can add a powerful tool to your arsenal. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Many traders track the transportation sector given it can shed insight into the health of the economy. Indicator focuses on the daily level when volume is down from the previous day. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Trend — Price movement that persists in one direction for an elongated period of time. Short-sellers then usually force the price down to the close of the candle either near or below the open.

Assumptions in Technical Analysis

However, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. The high or low is then exceeded by am. The last candlestick confirms the bearishness. You need to keep good trading records for this purpose. This will be likely when the sellers take hold. Example 1 — Candlesticks Bearish candles are typically red. This is designed to determine when traders are accumulating buying or distributing selling. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation.