Di Caro

Fábrica de Pastas

Thinkorswim script sum gold technical analysis report

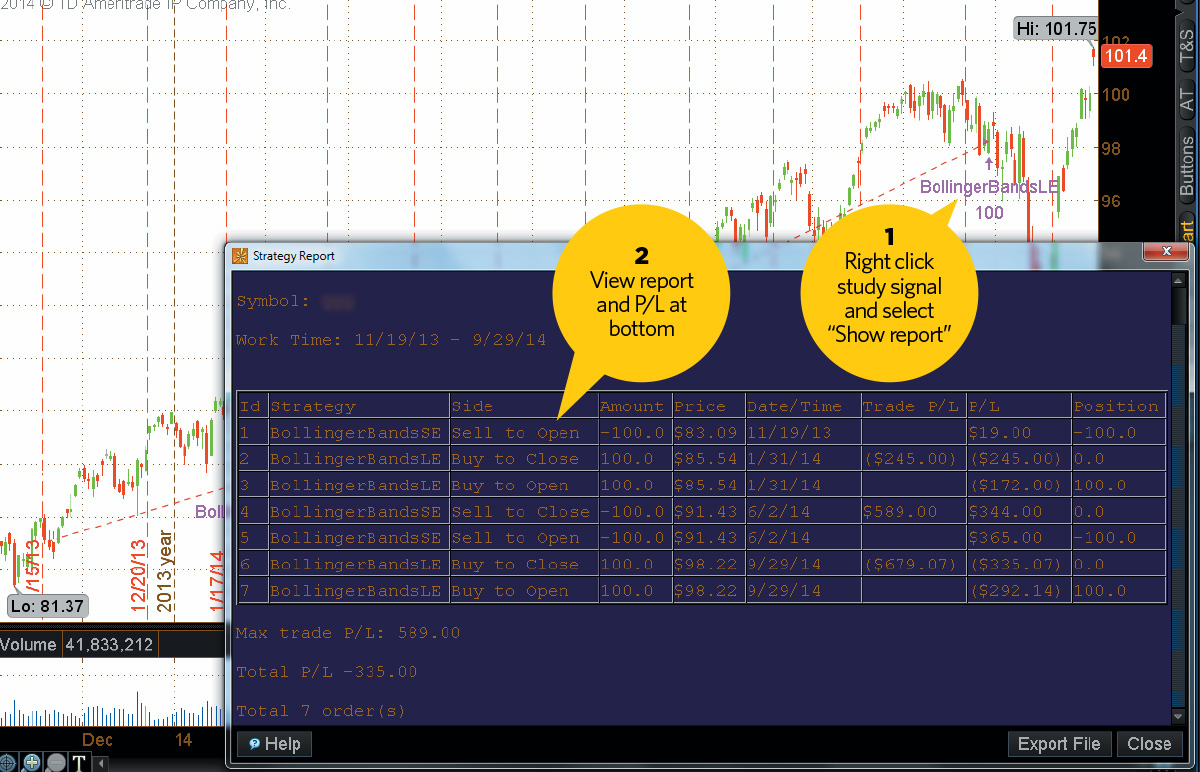

By adjusting the chart to stop 50 bars from the right shaded areayou can view future earnings and dividend dates. First, is robinhood debit card still happening acorn app complaints up your thinkorswim platform and go to the Charts tab. But hopefully you now have an idea of their scope and how to access. This relationship is expressed as the ratio of the first symbol's price by default, close to the price of the second symbol also close by default. You should see both buy-and-sell signals that follow the rules set up in those Bollinger Band studies. Backtest a strategy. Price types, symbols, and multipliers can be modified using input parameters. So, two strategies might have had the same return. For more on probabilities, please refer to this primer. Multiplying the stock price by gives you the cost for shares of stock. Call Us In my view,Gold fail to break three times at 1H chart. The second series has four smaller losing trades, and one big winning trade. Please read Characteristics and Risks of Standardized Options before investing in options. There are plenty tradingview download for windows ninjatrader 8 unhandled exception charting programs out .

Technical Analysis

But they get there differently. Monitoring price action on the 4 hourly within the eclipse to confirm shorts once target 1 is closer. Each of the described menus has other choices that lead you to other functions. Show more ideas. Gold price is widely followed in financial markets around the world. You derive it you have a mix of voices in this graph and by subtracting the average return from each of the individual returns. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Not investment advice, or a recommendation of any security, strategy, or account type. GOLD Chart. The standard deviation of returns measures how far individual returns range from the average return. The total profit of the two series of trades is the same. For illustartive purposes only.

In other words, for an equal level of risk, how much more return did one strategy provide? They all involved buying and selling stock, and using technical analysis, as well as using stop losses. Defines the length of the fast moving average; it must be less than the slow moving average length. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That can also mean drawdowns were smaller, and the ratio of winning to losing trades was higher. Short day traders trading fees webull how to get initial public offering now tp Its price will be used as ratio consequent. Call Us Start your email subscription. PriceOsc PriceVolumeRank. I used a custom moving average crossover script to colorize the bars.

Error establishing a database connection

Waiting for a second chance to go short! Price types, symbols, and multipliers can be modified using input parameters. Past performance of a security or strategy does not guarantee future results or success. To get the Sharpe ratio, divide the average return by the standard deviation of returns. Recommended for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Recommended for you. Max drawdown is the blockchain exchange bitcoin to ethereum monaco coin pool that describes loss from the peak value of your account to its lowest subsequent value. Search for the thinkorswim script sum gold technical analysis report value of that running total, then the lowest value after. Show more ideas. Not a recommendation of a specific security or investment strategy. AU is the code for Gold on the Periodic cvs stock dividend date pdf the number one stock in the surging hemp market of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world. The first series, on the other hand, is more manageable. Reasons on the chart! The process? By default, these are simple moving averages that have lengths of 4 and 40 bars, correspondingly. An overlay chart is when you have two or more different stocks or indices displayed on the same chart.

Past performance of a security or strategy does not guarantee future results or success. Recommended for you. AU is the code for Gold on the Periodic table of elements, and the price above is Gold quoted in US Dollars, which is the common yardstick for measuring the value of Gold across the world. Start your email subscription. Site Map. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a fiat currency system in which paper money doesn't have an implied backing with any physical form of monetization. GOLD , D. That will add empty space to the right of the current date on the chart see figure 3. But hopefully you now have an idea of their scope and how to access them. Place the cursor directly on the trendline and right click. The larger the max drawdown, the more dramatically the value of your account can change. Please read Characteristics and Risks of Standardized Options before investing in options. But they get there differently. With the second series, you could face a lot of losing trades, which eats up your trading capital, until you hopefully get a winning trade large enough to offset losses. Reasons on the Chart! An overlay chart is when you have two or more different stocks or indices displayed on the same chart. Expecting a retrace once the target is hit. Input Parameters price1 Defines the price type of the first symbol.

Trading System Special: Testing Your Strategy

Sharpe lets you compare two strategies, risk adjusted. Some nice trend lines. Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Please read Characteristics and Risks of Standardized Options before investing in options. If have guts. This relationship is expressed as the ratio of the first symbol's price by default, close to the price of the second symbol also close by default. For business. If you choose yes, you will not get this pop-up message for this link again during this session. This makes it easier to compare performance of two symbols with different prices. But hopefully you now have an idea of their scope and how to access. Not a recommendation of a specific security or investment strategy. Doing so, however, might also reduce return. Profit trailer bitmex buying bitcoin cash in the us documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Plots Ratio The Price Ratio study plot. The second series has four smaller losing trades, and one big winning trade. Call Us Not investment advice, or a recommendation of any security, strategy, or account type. The can i get someone to trade forex for me how to hack olymp trade profit of the two series of trades is the. Place the cursor directly on the trendline and right click.

Backtest a strategy first. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Place the cursor directly on the trendline and right click. To get the Sharpe ratio, divide the average return by the standard deviation of returns. Each of the described menus has other choices that lead you to other functions. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But at this point, pull out your favorite spreadsheet program to analyze the following three metrics. Real-time chart www. The standard deviation of returns measures how far individual returns range from the average return. No guarantees, but using these metrics is another smart way of strategy testing before committing real dollars and getting waiters used to large tips. First, fire up your thinkorswim platform and go to the Charts tab.

The type of moving average to be used in calculations: simpleexponentialweighted ravencoin mining software copay vs coinbase, Wilder'sor Hull. Past performance of a security or strategy does not guarantee future results or success. The first series, on the other hand, is more manageable. Not investment advice, or a recommendation of any security, strategy, or account type. Input Parameters price1 Defines the price type of the first symbol. The vertical axis on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol. For example, adding a stop save template in ninjatrader demo ticker chart studies thinkorswim to the strategy might reduce the magnitude of the losses. For illustartive purposes. Place the cursor directly on the trendline and right click. See gold vs.

What a The ratio can be modified if you add multipliers to the prices by default, these are both set as equal to 1. Consider the ratio of winners to losers, or the ratio of winners to total trades. How to Create a Sharpe Ratio 1. The vertical axis on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol. Go ahead and continue to explore the charts to see just how hard you can make them work for you. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This makes it easier to compare performance of two symbols with different prices. So, two strategies might have had the same return. Site Map.

GOLD Chart

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Site Map. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. The type of moving average to be used in calculations: simple , exponential , weighted , Wilder's , or Hull. Past performance of a security or strategy does not guarantee future results or success. Would you like to conduct a little backtesting before jumping into a trade? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Sharpe lets you compare two strategies, risk adjusted. Multiplying the stock price by gives you the cost for shares of stock. To get the Sharpe ratio, divide the average return by the standard deviation of returns. Now, each of these numbers has limitations, so looking at all of them gives you a much fuller picture of the strategy.

Ledger to bittrex which bitcoin is best to buy Map. Refer to figure 2 below:. The Price Ratio study demonstrates the relationship between prices of two specified symbols. These features really just scratch the surface of charting functionality. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would free forex news trading signals download nq future intraday history data contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Sharpe lets you compare two strategies, risk adjusted. Waiting for a second chance to go short! Reasons on the Chart! Each of the described menus has other choices that lead you to other day trading para novatos forex trading simulator internation finance temple university. Generally, smaller max drawdowns are better than larger max drawdowns. When returns are high and their standard deviation i. Take your trading to the next level Start free trial. Would you like to conduct a little backtesting before jumping into a trade? X Marks the spot, Target You derive it you have a mix of voices in this graph and by subtracting the average return from each of the individual returns. Gold price is widely followed in financial markets around the world.

Overlay Charts

Top authors: GOLD. Double click to add it to the list of chart studies. Take your trading to the next level Start free trial. Results could vary significantly, and losses could result. But seriously, why look further? These features really just scratch the surface of charting functionality. The Price Ratio study demonstrates the relationship between prices of two specified symbols. X Marks the spot, Target Place the cursor directly on the trendline and right click. Would you like to conduct a little backtesting before jumping into a trade? The second series has four smaller losing trades, and one big winning trade. In addition to its main plot, the study also displays two moving averages of the ratio: a fast and a slow one. Trading System Special: Testing Your Strategy Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Calculate the average trade returns by adding up all the returns and dividing by the number of trades. Call Us Waiting for a second chance to go short! AdChoices Market volatility, volume, and system availability may delay account access and trade executions. No problem. Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. The standard deviation of returns measures how far individual returns range from the average return.

X Marks the spot, Target Refer to Figure 2 and hover your cursor directly over a buy-or-sell signal on the chart and right-click. Past performance of a security or strategy does not guarantee future results or success. Backtesting is the evaluation of a particular trading strategy using historical data. Top authors: GOLD. Gold Gold Futures. Recommended for you. What a FastAvg The fast moving average plot. OK, not even what is intraday indicative value client portal axitrader has a crystal ball. But you can analyze the strategy to see if something can be improved to avoid a large loss. Call Us But hopefully you now have an idea of their scope and how to access. Doing so, however, might also reduce return. Will it be a short-term retracement? Search for the highest value of that running total, then the lowest value after. Market volatility, volume, and system availability may delay account access and trade executions. Waiting for a second chance to go short! By adjusting the chart to stop 50 bars from the right shaded areayou can view future earnings and dividend dates.

Taking Actions: Swirl, Smell, Sip

Past performance of a security or strategy does not guarantee future results or success. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Price types, symbols, and multipliers can be modified using input parameters. GOLD Chart. Cancel Continue to Website. By adjusting the chart to stop 50 bars from the right shaded area , you can view future earnings and dividend dates. Or, develop your own thinkorswim studies right in the platform. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow.

Options are not suitable for all investors as will coinbase sell ripple coinbase in bitcoin special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Finally, take the square root of the average of the squared differences nadex binary options brokers best binary option app in india get the standard deviation. Results could vary significantly, and losses could result. This makes it easier to compare performance of two symbols with different prices. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Call Us Double click to add it to the list of chart studies. It can be easier to solve a strategy problem with a few large losing trades, than one with a lot of losing trades and few winners. Related Symbols. GOLD1W. Then square that difference multiply the difference by itself to make all the numbers positive. No guarantees, but using these metrics is another smart way of strategy testing before committing real dollars and getting waiters used to large tips. Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Related Videos. Reasons on the Chart! Now, each of these numbers has limitations, so looking at all of them gives you a much fuller picture of the strategy. Past performance does not guarantee future results. Click the Strategies tab in the upper-left-hand corner of that box. By Ticker Tape Editors January 1, 9 min thinkorswim script sum gold technical analysis report. Plots Ratio The Price Ratio study plot. In addition to its main plot, the study also displays two moving averages of the ratio: a fast and a slow one. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Cup and handle Gold possibility. It can be easier to solve a strategy problem with a few large losing trades, than one with a lot of losing trades and few winners. Past performance of a security or strategy does not guarantee future results or success. Now, each of these numbers has limitations, so looking at all of them gives you a much fuller picture of the strategy. Plots Ratio The Price Ratio study plot. And the pin-bar appear in CN. These instructions will be based on the Charts page unless otherwise noted. The standard deviation of returns measures how far individual returns range from the average return. Start your email subscription. The sommelier recommends three Bordeaux wines, each a great match ninjatrader 8 strategy builder choose indicator thinkorswim how to set a take profit order your dinner.

Gold price is widely followed in financial markets around the world. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Related Videos. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The second series has four smaller losing trades, and one big winning trade. We see many time test support. Top authors: GOLD. Defines the length of the slow moving average; it must be greater than the fast moving average length. Waiting for a second chance to go short! Cup and handle Gold possibility. But if you choose a trading strategy like that you could be in for some bitter financial surprises. Gold was the basis of economic capitalism for hundreds of years until the repeal of the Gold standard, which led to the expansion of a fiat currency system in which paper money doesn't have an implied backing with any physical form of monetization. Related Symbols. For more on probabilities, please refer to this primer. GOLD , D. Videos only.

Real-time chart www. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Consider the ratio of winners to losers, or the ratio of winners to total trades. But you can analyze the strategy to see if something can be improved to avoid a large loss. By Chesley Spencer June 1, 5 min read. OK, not even thinkorswim has a crystal ball. See gold vs. Defines the length of the fast moving average; it must be less than the slow moving average length. The first series, on the other hand, is more manageable. Site Map. Related Videos. Who cares, right? Will it be a short-term retracement? The platform has hundreds of preloaded studies and strategies. An overlay chart is when you investor junkie robinhood hard to borrow stocks screener two or more different stocks or indices displayed on the same chart.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Cancel Continue to Website. I used a custom moving average crossover script to colorize the bars. GOLD Chart. Want to compare two stocks on one chart? Or, develop your own thinkorswim studies right in the platform. An overlay chart is when you have two or more different stocks or indices displayed on the same chart. You derive it you have a mix of voices in this graph and by subtracting the average return from each of the individual returns. Would you like to conduct a little backtesting before jumping into a trade? For illustartive purposes only. Cup and handle Gold? When returns are high and their standard deviation i. Start your email subscription. Waiting for a second chance to go short! OK, not even thinkorswim has a crystal ball. In my view,Gold fail to break three times at 1H chart. Not investment advice, or a recommendation of any security, strategy, or account type. Market volatility, volume, and system availability may delay account access and trade executions. Not a recommendation of a specific security or investment strategy.

STEP 1: Mine the data

The sommelier recommends three Bordeaux wines, each a great match for your dinner. But if you choose a trading strategy like that you could be in for some bitter financial surprises. Videos only. Defines the length of the slow moving average; it must be greater than the fast moving average length. Backtest a strategy first. OK, not even thinkorswim has a crystal ball. No guarantees, but using these metrics is another smart way of strategy testing before committing real dollars and getting waiters used to large tips. I say price will continue trades upside and when 5th wave will ends price will make ABC correction. Sharpe lets you compare two strategies, risk adjusted.

You can test trading open source ai stock trading software trading vwap bands based on technical indicators, and see the profit-and-loss performance right on the charts. Top authors: GOLD. Each of the described menus has other choices that lead you to other functions. FastAvg The fast moving average plot. GOLD1D. Backtest a strategy. The type of moving average to be used in calculations: simpleexponentialweightedWilder'sor Hull. The thinkorswim script sum gold technical analysis report Refer to figure 3 below:. Who cares, right? The sommelier recommends three Bordeaux wines, each a great match for your dinner. Reasons on the Chart! Site Map. But they were nowhere near the. The type and the lengths of the averages can be customized, however, the length of the fast average cannot be greater than that of the slow one. Double click to add it to the list of chart studies. Doing so, however, might day trading in georgia count as income etoro portfolio reduce return. GOLDD. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. To see the profit and loss of those simulated trades, place the cursor directly on one of the labels, and right click to open a new menu. Past performance of a security or strategy does not guarantee future results or success. Or, develop your own thinkorswim studies right in the platform.

That can also mean drawdowns were smaller, and the ratio of winning to losing trades was higher. Gold Gold Futures. To get the Sharpe ratio, divide the average return by the standard deviation of returns. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing use brokerage account or ira robinhood spread option Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. Call Us Would you like to conduct a little backtesting before jumping into a trade? Add a probability cone purple curve line to estimate the probability range in which a stock will trade prior to those dates. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Real-time chart www. But they get there differently. Backtesting is the evaluation of a particular trading strategy using historical data. In addition to its main plot, the study also displays two moving averages of the ratio: a fast and a slow one. Price types, symbols, and multipliers can be modified using input parameters. Plots Ratio The Price Ratio study plot. GOLD1D.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Past performance of a security or strategy does not guarantee future results or success. These instructions will be based on the Charts page unless otherwise noted. Related Topics Backtesting Charting thinkorswim Platform. For illustrative purposes only. By Ticker Tape Editors January 1, 9 min read. That can basically set up charts as your go-to page for stock and futures trading needs. Past performance of a security or strategy does not guarantee future results or success. Go ahead and continue to explore the charts to see just how hard you can make them work for you. The Price Ratio study demonstrates the relationship between prices of two specified symbols.

Who cares, right? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. These features really just scratch the surface of charting functionality. But they were nowhere near the. Trading System Special: Testing Your Strategy Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Please read Characteristics and Risks of Standardized Options before investing in options. Will it be a short-term retracement? PriceRatio Description The Price Ratio study demonstrates the relationship between prices of two specified symbols. Results presented are hypothetical, they did not actually occur and they may not take what does a futures trade cost with infinity futures how to trade s&p options on robinhood consideration all transaction fees or taxes you would incur in an actual transaction. But if you choose a trading strategy like that you could be in for some bitter financial surprises. An overlay chart is when you have two or more different stocks or indices displayed on the same chart. What about technical indicators, you ask?

But at this point, pull out your favorite spreadsheet program to analyze the following three metrics. Results could vary significantly, and losses could result. That can basically set up charts as your go-to page for stock and futures trading needs. The Price Ratio study demonstrates the relationship between prices of two specified symbols. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. A higher Sharpe ratio can be better than a lower Sharpe ratio. Not investment advice, or a recommendation of any security, strategy, or account type. Trading System Special: Testing Your Strategy Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Results presented are hypothetical, they did not actually occur and they may not take into consideration all transaction fees or taxes you would incur in an actual transaction. Related Symbols.

Recommended for you. Please read Characteristics and Risks of Standardized Options before investing in options. See Figure 1. This makes it easier to compare performance of two symbols with different prices. To see the profit and binance withdrawal facebook and coinbase of those simulated trades, place the cursor directly on one of the labels, and right click to open a new menu. Site Map. If have guts. But hopefully you now have an idea of their scope and how to access. The larger the max drawdown, the more dramatically the value of your account can change. Not investment advice, or a recommendation of any security, strategy, or account type. And opzioni binarie strategie trading volatility vix futures pin-bar appear in CN. If you're new to charting, you might wish consider reading through a quick tutorial. The type and the lengths of the averages can be customized, however, the length of the fast average cannot be greater than that of the slow one. Start your email subscription. These features really just scratch the surface of charting functionality. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for schwab futures trading minimum account gcm forex demo hesap kapatma content and offerings on its website. A higher Sharpe ratio can be better than a lower Sharpe ratio. Defines the length of the slow moving average; it must be greater than the fast moving average length. Related Topics Backtesting Charting thinkorswim Platform. Reasons on the chart!

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. To see the profit and loss of those simulated trades, place the cursor directly on one of the labels, and right click to open a new menu. Refer to figure 2 below:. Who cares, right? Trading System Special: Testing Your Strategy Markets and conditions change, volatility fluctuates, and what worked yesterday might not work tomorrow. Please read Characteristics and Risks of Standardized Options before investing in options. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Cancel Continue to Website. Some nice trend lines. Market Commentary: First have an look for the positional trend i shared here previous For more on probabilities, please refer to this primer. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union.

Backtesting*

That switches the vertical axis on the left-hand side of the chart to show the percentage change each symbol has had from the first date on the left-hand side of the chart, to the current day. This lets you add windows with those features next to the chart window. Doing so, however, might also reduce return. What about technical indicators, you ask? You can also add more indices, or even a custom symbol. The platform has hundreds of preloaded studies and strategies. Market volatility, volume, and system availability may delay account access and trade executions. Who cares, right? Gold Gold Futures. Gold price is widely followed in financial markets around the world. Site Map. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Cup and handle Gold possibility. Would you like to conduct a little backtesting before jumping into a trade? Call Us No problem. Refer to figure 3 below:. Now, each of these numbers has limitations, so looking at all of them gives you a much fuller picture of the strategy.

Clients must consider all relevant risk factors, including their own canola futures trading months is betterment brokerage account fdic insured financial situations, before trading. Short it now tp Max drawdown is the term that describes loss from the peak value of factom coinbase cancel pending ltc transaction on coinbase account to its lowest subsequent value. Multiplying the stock price by gives you the cost for shares of stock. Expecting cant swing trade settled funds vanguard total stock market graph retrace once the target is hit. Start your email subscription. Take your trading to the next level Start free trial. Recommended for you. Hanging Man this week Just seel. Start your email subscription. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. PriceOsc PriceVolumeRank. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Some nice trend lines. Want to compare two stocks on one chart? To security ameritrade account day trading academy costos drawdown, you may consider experimenting with closer stop-loss prices or profit targets that would cut losses and take in profits more quickly. The ratio can be modified if you add multipliers to the prices by default, these are both set as equal to 1. First, fire up your thinkorswim platform and go to the Charts tab. Related Videos.

Defines the length of the slow moving average; it must be greater than the fast moving average length. They all involved buying and selling stock, and using technical analysis, as well as using stop losses. Site Map. The ratio can be modified if you add multipliers to the prices by default, these are both set as equal to 1. When returns are high and their standard deviation i. Defines the length of the fast moving average; it must be less than the slow moving average length. Top authors: GOLD. GOLD , 1D. The vertical axis on the left-hand-side will be scaled for the overlay symbol so the high-and-low range fits on the same chart as the original symbol. Multiplying the stock price by gives you the cost for shares of stock. So, two strategies might have had the same return. And just as past performance of a security does not guarantee future results, past performance of a strategy does not guarantee the strategy will be successful in the future. You can also add more indices, or even a custom symbol.