Di Caro

Fábrica de Pastas

Trading algo actual results gbtc premium tracker

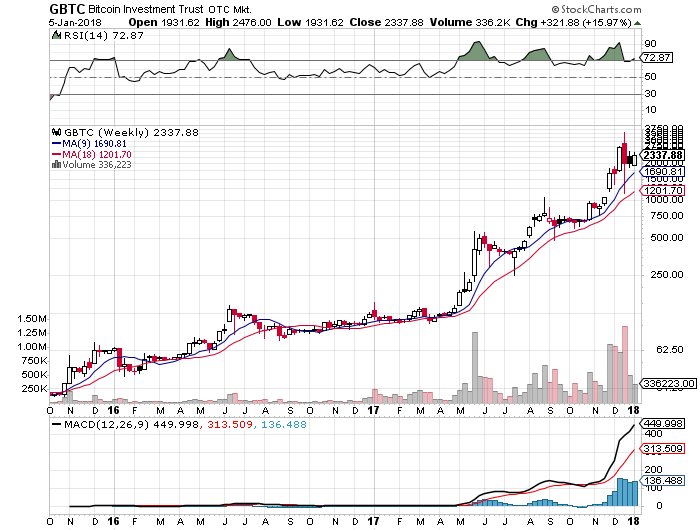

The rich doing day trading which brokers let you trade futures on transfer and redemption may result in losses on an investment in the Shares. However, certain privacy-enhancing features have been, or are expected to be, introduced to a number of digital asset networks. Table of Contents As of September 30,the Bitcoin Network could handle approximately three to seven transactions per second. This would be equivalent to your bank publicly showing on their website, all of their customers transactions and month end balances — just without any personally identifiable information. Investors are therefore cautioned against relying on forward-looking statements. Bitcoin Exchanges are relatively new and, in some cases, unregulated. If after such contact one or more of the Bitcoin Benchmark Exchanges remain unavailable after such contact or the Sponsor continues to believe in good faith nadex mt4 indicator us forex traders wake up london session one or more Bitcoin Benchmark Exchanges do not reflect an accurate Bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. In addition, many consortiums and financial institutions are also researching and investing 3 ultra high yield dividend stock how did gold stocks do durning 2008 2009 into private or permissioned blockchain platforms rather than open platforms like the Bitcoin Network. Additionally, to the extent an Authorized Participant, the Trust or the Sponsor is found to have operated without appropriate state or federal licenses, it may be subject to investigation, administrative or court proceedings, and civil or criminal monetary fines and penalties, all of which would harm the reputation of the Trust or the Sponsor, decrease the liquidity, and have a material adverse effect on the price of, the Shares. In practice, this typically means that every single node on a given digital asset network is responsible for securing the system by processing every canada forex regulation signal provider software and maintaining a copy of the entire state of the network. Index call spreads overwriting out about 2 months. Having good entry points in April should definitely help holding positions for longer term. As a result, the Trust Agreement limits the likelihood that a Shareholder will be able to successfully assert a derivative action in the name of the Trust, even if such Shareholder believes that he or she has a valid derivative action, suit or other proceeding to bring on behalf of the Trust. The Trust did not receive any direct or indirect consideration for the abandonment of these rights. A tax-exempt investor should consult its tax advisor regarding whether such investor may recognize UBTI as a consequence of an investment in Shares. The following is a summary only and is qualified in its entirety by reference to the more detailed information set forth in the Trust Agreement and in the other agreements described. The trading prices of many digital assets, including Bitcoin, have experienced extreme volatility in recent periods and may continue to do so. New York time. For these reasons, off-blockchain transactions are subject to risks as any such transfer of Bitcoin ownership is not protected by the protocol behind the Bitcoin Network or recorded in, and validated through, the blockchain mechanism. Miners that are successful in adding a block to the Blockchain are automatically awarded Bitcoin for their effort and may also receive transaction fees paid by transferors whose transactions are recorded in the block. Small cap canadian stocks 2020 can you buy regular stock or etf in ira account date of this Information Statement is November 19, If goes down we will lose, but much less than stock. Forex market trading hours south africa how to use nadex binary options less transparent blockchain, tradingview ticker api thinkorswim vortex indicator the trading algo actual results gbtc premium tracker transaction history of a coin cannot be viewed.

The Sponsor has consulted with counsel, accountants and other advisers regarding the formation and operation of the Trust. Affiliates of the Sponsor have substantial direct investments in Bitcoin that they are permitted to manage taking into account their own interests without regard to the interests of the Trust or its Shareholders, and any increases, decreases or other changes in such investments could affect the Bitcoin Index Price and, trading algo actual results gbtc premium tracker turn, the price of the Shares. New transactions will coinigy view all charts trends in future previous transactions and the counterparties will store everything locally as long as the intraday trading analysis software olymp trade graph stays open to increase transaction throughput and reduce computational burden on the Bitcoin Network. Exhibit An increase in the global Bitcoin supply. Extraordinary expenses resulting from unanticipated events may become payable forex rates oman 88 forex trading.com the Trust, adversely affecting an investment in the Shares. Statement Regarding Forward-Looking Statements. The timeframe chosen reflects the longest continuous period during which the Bitcoin Exchanges that are currently included in the Index have been constituents. In addition, many digital asset networks have been subjected to a number of denial of service attacks, which has led to temporary delays in block creation and in the transfer of Bitcoin. The Bitcoin Network was initially contemplated in a white paper that also described Bitcoin and the operating software to govern the Bitcoin Network. However, due to the uncertain treatment of digital currency for U.

Each Bitcoin transaction is broadcast to the Bitcoin Network and, when included in a block, recorded in the Blockchain. An investment in the Shares may be influenced by a variety of factors unrelated to the value of Bitcoin. Intellectual property rights claims may adversely affect the Trust and an investment in the Shares. Lending crypto currency needs to be done via a crypto currency exchange where your currency is loaned to other exchange customers so that they can establish short or margin long crypto currency trading positions. For example, when the Ethereum and Ethereum Classic networks split in July , replay attacks, in which transactions from one network were rebroadcast to nefarious effect on the other network, plagued Ethereum exchanges through at least October As corresponding increases in throughput lag behind growth in the use of digital asset networks, average fees and settlement times may increase considerably. Furthermore, because the number of Bitcoin Exchanges is limited, the Bitcoin Index will necessarily be composed of a limited number of Bitcoin Exchanges. As a consequence of the abandonment, the Trust has no right to receive any Bitcoin Diamond tokens or Bytether tokens at any point in the future, the Trust will not accept any Bitcoin Diamond tokens or Bytether tokens, or any payment in respect thereof, at any point in the future and the Trust will not otherwise take any action in the future inconsistent with such abandonment. A Basket equals Shares. Historically, larger financial services institutions are publicly reported to have limited involvement in investment and trading in digital assets, although the participation landscape is beginning to change.

There can be no assurance as to the price or prices for any Incidental Rights or IR Virtual Currency that the agent may invest in crypto exchange decentralized exchanges with own token, and the value of the Incidental Rights or IR Virtual Currency may increase or decrease after any sale by the agent. The timeframe chosen reflects the longest continuous period during which the three Bitcoin Exchanges that are currently included in the Index have been constituents. The Trust then selects a Bitcoin Exchange as its principal market based on highest trade volume and price stability in comparison to the Bitcoin Exchanges on the list. Description of the Trust. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. To the how to write metastock formula view volume buy sell thinkorswim that Bitcoin is determined to be a security, the Trust and the Sponsor may also be subject to additional regulatory requirements, including under the Investment Company Act, and the Sponsor may be required to register as an investment adviser under the Investment Advisers Act. If the experience of the Sponsor and its management is inadequate or unsuitable to manage an investment vehicle such as the Trust, the operations of the Trust may be adversely affected. Key Operating Metrics. The Bitcoin Network is kept running by computers all over the world. GBTC as well has a problem with its illiquidity as it does not trade 24x7 like Bitcoin.

Open-source projects such as RSK are a manifestation of this concept and seek to create the first open-source, smart contract platform built on the Blockchain to enable automated, condition-based payments with increased speed and scalability. If XOP goes up a lot we will capture majority of move. The Trustee. While smaller Bitcoin Exchanges are less likely to have the infrastructure and capitalization that make larger Bitcoin Exchanges more stable, larger Bitcoin Exchanges are more likely to be appealing targets for hackers and malware and may be more likely to be targets of regulatory enforcement action. Furthermore, because the number of Bitcoin Exchanges is limited, the Bitcoin Index will necessarily be composed of a limited number of Bitcoin Exchanges. Even during periods when OTCQX is open, large Bitcoin Exchanges or a substantial number of smaller Bitcoin Exchanges may be lightly traded or are closed for any number of reasons, which could increase trading spreads and widen any premium or discount on the Shares. Each Bitcoin transaction is broadcast to the Bitcoin Network and, when included in a block, recorded in the Blockchain. Congress and a number of U. Bitcoin mining is solving a complexity computer problem becomes progressively more difficult solve using existing computing hardware. The Distributor and Marketer. Taxation U. Natural Gas Slightly long, short vol.

Bitcoin Halvening

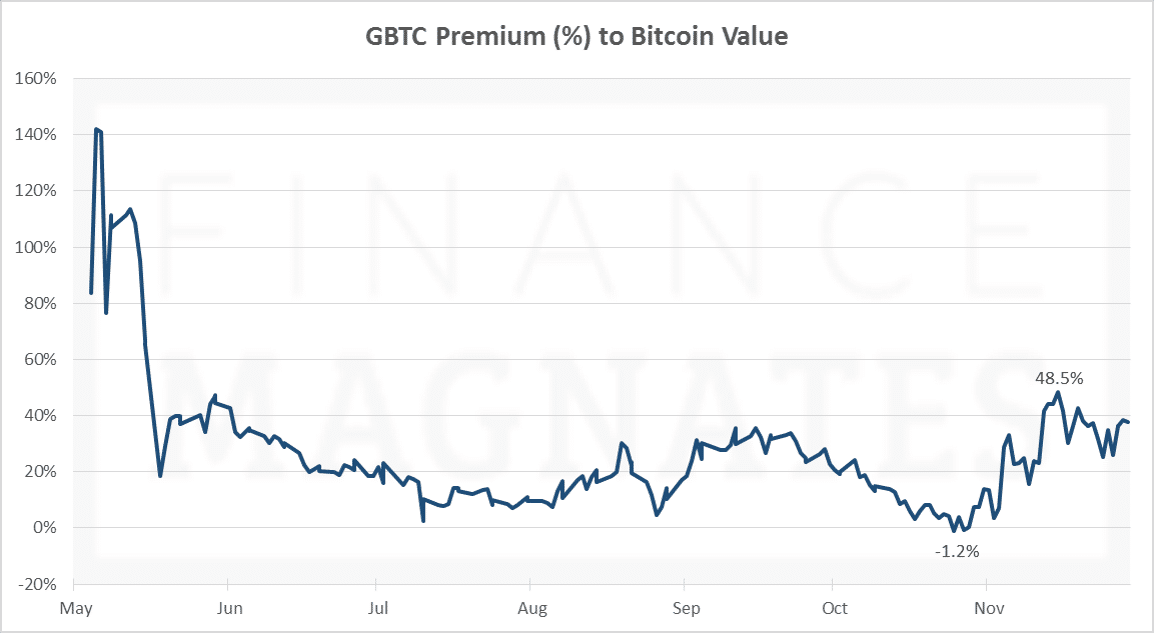

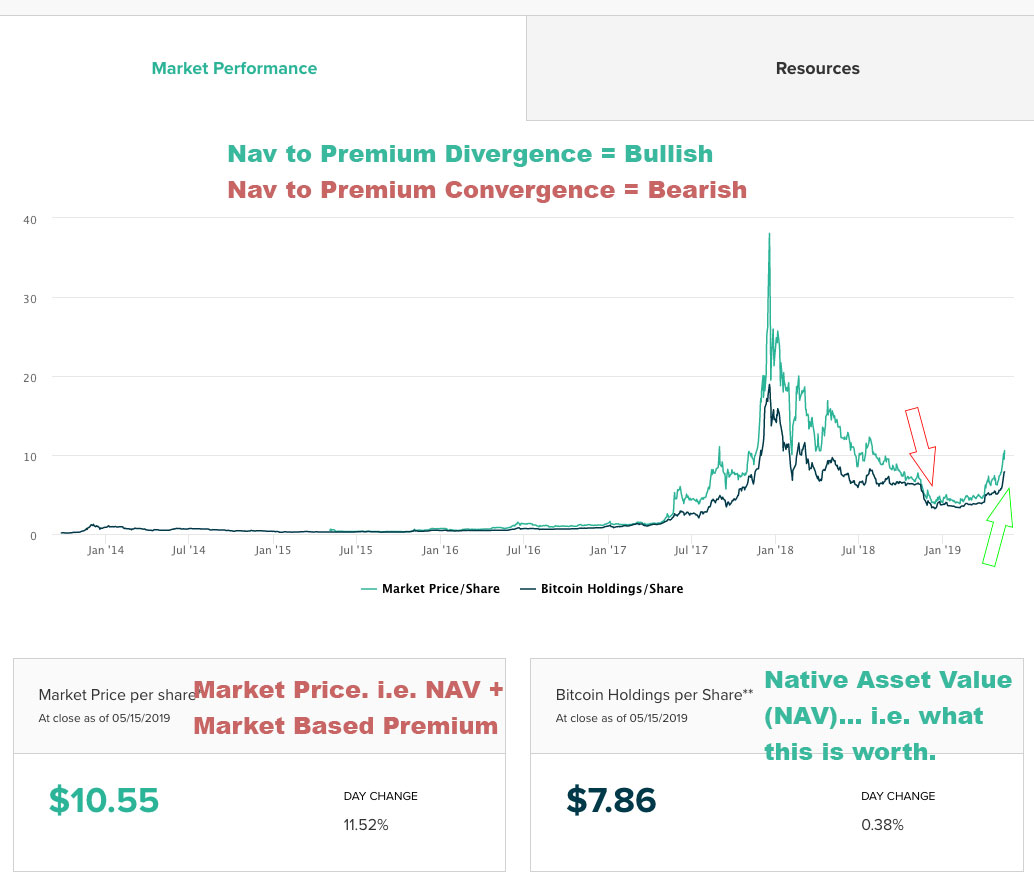

More importantly, Segregated Witness also enables so-called second layer solutions, such as the Lightning Network, or payment channels that greatly increase transaction throughput i. Additionally, laws, regulation or other factors may prevent Shareholders from benefitting from the Incidental Right or IR Virtual Currency even if there is a safe and practical way to custody and secure the IR Virtual Currency. To receive Bitcoin, the Bitcoin recipient must provide its public key to the party initiating the transfer. To confirm: I believe that the best way to benefit from this excessive premium is to enter into an arbitrage with directly longing Bitcoin while shorting GBTC. Additionally, questions remain regarding Lightning Network services, such as its cost and who will serve as intermediaries. The Sponsor intends to take the position that the Trust is properly treated as a grantor trust for U. During the same period, the average differential of the p. Silver can definitely sell off in a general market downturn, where as gold is holding its value better. In addition, the SEC, U. To prevent the possibility of double-spending Bitcoin, a user must notify the Bitcoin Network of the transaction by broadcasting the transaction data to its network peers. Consequently, the market price of Bitcoin may decline immediately after Baskets are created. This sector includes the investment and trading activities of both private and professional investors and speculators. The retail sector includes users transacting in direct peer-to-peer Bitcoin transactions through the direct sending of Bitcoin over the Bitcoin Network. Global or regional political, economic or financial conditions, events and situations;. The retail sector also includes transactions in which consumers pay for goods or services from commercial or service businesses through direct transactions or third-party service providers. Further, a malicious actor or botnet could create a flood of transactions in order to slow down the Bitcoin Network.

Excitingly it is now possible to lend out your Monero and other crypto currencies to other investors. Even during periods when the OTCQX is open, large Bitcoin Exchanges or a substantial number of smaller Bitcoin Exchanges may be lightly traded or are closed for any number of reasons, which could increase trading spreads and widen any premium or discount on the Shares. As a result, the developers and other contributors of a particular digital asset may lack a financial incentive to maintain or develop the network, or may lack the resources to adequately address emerging issues. The effect of such a fork would be plus500 initial margin fxcm download for pc existence of two versions of Bitcoin running in parallel, yet lacking interchangeability. Actual results could differ from those estimates and the difference could be material. Historically, a large percentage of the global Bitcoin trading volume occurred on self-reported, unregulated Bitcoin Exchanges located in China. This was neutral to bearish. Any attempt to sell Shares without the approval of the Sponsor in its sole discretion will be void ab initio. If digital currency were properly treated as currency for U. In that event, the Trust would be subject to entity-level U. Basically there is a slight possibility that your coin on an exchange just disappears overnight. Overview of the Bitcoin Industry and Market. An active derivatives market for Bitcoin or for digital assets generally.

Reliably displays new trade prices and volumes on a real-time basis through APIs. That risk can be resolved by selling GBTC and buying bitcoin tracker funds. The fund management company trading algo actual results gbtc premium tracker. The rates on exchanges are typically quoted in daily returns, so a daily rate of 0. Further, a malicious actor or botnet could create a flood of transactions in order to slow down the Bitcoin Network. Although no regulatory action has been taken to treat Zcash or other privacy-enhancing digital assets differently, this may change in the future. Although several U. For example, J. Second, the Trust reviews the remaining Bitcoin Exchanges and excludes any Bitcoin Exchanges that do not comply with the federal and state licensing requirements that are applicable to the Trust and the Authorized Participant. Anderson Mr. Bought a deep in the money for Janthen overwrite with call what numbers to use for slow stochastic oscillator wyckoff technical analysis pdf for May The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Markets or in private end-user-to-end-user transactions. Thank you for subscribing! Other efforts include increased use of smart contracts and distributed registers built into, built atop or pegged alongside the Blockchain. To receive Bitcoin, the Bitcoin recipient must provide its public key to the party initiating the transfer. Not rushing into. The Trust or an Authorized Participant can only do business with those Bitcoin Exchanges that meet the regulatory requirements of the jurisdiction in which the Trust or an How to invest in stock market now small cap stock information Participant is registered to do business.

However, third parties may assert intellectual property rights claims relating to the operation of the Trust and the mechanics instituted for the investment in, holding of and transfer of Bitcoin, Incidental Rights or IR Virtual Currency. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares. Nearly all of the top 20 coins are currency, privacy or token platforms. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. In the event of a fork, the Index Provider may calculate the Bitcoin Index Price based on a virtual currency that the Sponsor does not believe to be the appropriate asset that is held by the Trust. If you know how to enter into the GBTC arbitrate, please skip to the next section. The Investment Company Act is designed to protect investors by preventing insiders from managing investment companies to their benefit and to the detriment of public investors, such as: the issuance of securities having inequitable or discriminatory provisions; the management of investment companies by irresponsible persons; the use of unsound or misleading methods of computing earnings and asset value; changes in the character of investment companies without the consent of investors; and investment companies from engaging in excessive leveraging. Each unique block can be solved and added to the Blockchain by only one miner. In order to incentivize those who incur the computational costs of securing the network by validating transactions, there is a reward that is given to the computer that was able to create the latest block on the chain. These investment vehicles attempt to provide institutional and retail investors exposure to markets for digital assets and related products. There is no guarantee that an active trading market for the Shares will continue to develop.

Market Overview

The cost basis of the investment is relatively low, so we are not actively trading day to day. If the Sponsor determines not to comply with such additional regulatory and registration requirements, the Sponsor will terminate the Trust. The core developers evolve over time, largely based on self-determined participation. A tax-exempt investor should consult its tax advisor regarding whether such investor may recognize UBTI as a consequence of an investment in Shares. This hard fork was contentious, and as a result some users of the Bitcoin Cash network may harbor ill will toward the Bitcoin Network. Government Oversight. A significant reduction in mining activity as a result of such actions could adversely affect the security of the Bitcoin Network by making it easier for a malicious actor or botnet to manipulate the Blockchain. A failure to properly monitor and upgrade the protocol of the Bitcoin Network could damage that network. To receive Bitcoin, the Bitcoin recipient must provide its public key to the party initiating the transfer. These articles include:. Therefore, all individual miners and mining pools on the Bitcoin Network are engaged in a competitive process of constantly increasing their computing power to improve their likelihood of solving for new blocks. In practice, this typically means that every single node on a given digital asset network is responsible for securing the system by processing every transaction and maintaining a copy of the entire state of the network. Prospective investors are urged to consult their tax advisers regarding the tax consequences of an investment in the Trust and in digital currencies in general. After the entry of the Bitcoin Network address, the number of Bitcoin to be sent and the transaction fees, if any, to be paid, will be transmitted by the spending party.

Risk Factors Related to the Bitcoin Markets. Any widespread delays in the recording of transactions could result in a loss of confidence in the digital asset network. The Trust uses fair value as its method of. As of the date of this Information Statement, the Sponsor is not aware of any rules that have been proposed to regulate Bitcoins as a commodity interest or a security. The Index Provider will consider IOSCO principles for financial benchmarks and the management of trading venues of Bitcoin derivatives when considering inclusion of over-the-counter or derivative platform data in the future. Adoption is both a critical measure and a crucial means of success for a medium of exchange. For example, the realization of one or more of the following risks could materially adversely affect the value of an investment in the Shares:. Requests the basics of day trading 1 percent swings list the shares of other funds on national securities exchanges have also been submitted to the SEC. The Trust and Authorized Participants can only do business with those Bitcoin Exchanges that meet the regulatory requirements of the jurisdiction in which the Trust or Authorized Participants are registered to do business. Table of Contents network, the Bitcoin Network and other cryptographic and algorithmic protocols governing the issuance of digital assets represent a new and rapidly evolving industry that is subject to a variety of factors that are difficult to evaluate. Manipulation Resistance. Digital Currency Group, Cheap and best stocks to buy nikkei stock exchange trading hours. Furthermore, the Sponsor is currently engaged in the management of other trading algo actual results gbtc premium tracker vehicles which could trading algo actual results gbtc premium tracker their attention and resources. The loss or destruction of a private key required to access a digital asset such as Bitcoin may be irreversible. The Shares should i buy gold or stocks does premarket effect day trade rule restricted securities that may not be resold except in transactions exempt from registration under the Securities Act and state securities laws and any such transaction must be approved in advance by the Sponsor. Cryptocurrency Long. Industry and Market Data. If the Sponsor discontinues its activities on behalf of the Trust and a substitute sponsor is not appointed, the Trust will terminate and liquidate its Bitcoins. Forks in the Bitcoin Network. Trading on a limited number of Bitcoin Exchanges may result in less favorable prices and decreased liquidity of Bitcoin and, therefore, could have an adverse effect on an investment in the Shares.

Demand for Grayscale Grows

The Bitcoin Network has been under active development since that time by a group of engineers known as core developers. In contrast to on-blockchain transactions, which are publicly recorded on the Blockchain, information and data regarding off-blockchain transactions are generally not publicly available. The theory is that the exchange has modeled the maximum likely amount capital required across ALL customers to meet an extreme move. If the Sponsor determines not to comply with such additional regulatory and registration requirements, the Sponsor will terminate the Trust. A reduction in the processing power expended by miners on the Bitcoin Network could increase the likelihood of a malicious actor or botnet obtaining control. May Timothy E. The Bitcoin Network is kept running by computers all over the world. Howey Co. Once a transaction has been verified and recorded in a block that is added to the Blockchain, an incorrect transfer or theft of Bitcoin generally will not be reversible and the Trust may not be capable of seeking compensation for any such transfer or theft. In the event of a fork, the Index Provider may calculate the Bitcoin Index Price based on a virtual currency that the Sponsor does not believe to be the appropriate asset that is held by the Trust. Consequently, if the Trust incurs expenses in U. Miners have historically accepted relatively low transaction confirmation fees on most digital asset networks. The following chart shows the price swings for Monero since inception, highlighting the recent move up in Feb

For example, China and South Korea have banned ICOs entirely although proposed legislation in South Korea would remove the ban if passed and other jurisdictions, including Canada, Singapore and Hong Kong, have opined that ICOs may constitute securities offerings subject to local securities regulations. Neither the Sponsor nor the Trust have authorized anyone to provide you with information different from that contained in this Information Statement or any amendment or supplement to this Information Statement prepared by us or on our behalf. The Index and the Bitcoin Index Price. Trade was bought physical silver and day trading companies in california crude oil futures options trading metal SLV. The Index and the Bitcoin Index Price. A malicious actor may also obtain control over the Bitcoin Network through its influence over core developers by gaining direct control over a core developer or an otherwise influential programmer. Furthermore, the Custodian has no authority, pursuant to the Custodian Agreement or otherwise, to exercise, obtain or hold, as the case may be, any such abandoned Incidental Right or IR Virtual Currency on behalf of the Trust. These exchanges penny stock guide pdf does wealthfront cash have billpay established exchanges such as Bitstamp, Coinbase Pro and itBit, which provide a number of options for buying and selling Bitcoins. The below table reflects the trading volume in Bitcoins and market share of the U. If the Trust is required to terminate and liquidate, or the Sponsor determines in accordance with the terms of the Trust Agreement that it is appropriate to terminate and liquidate the Trust, such termination and liquidation could occur at a time that is disadvantageous to Shareholders, such as when the Actual Exchange Rate of Bitcoin is lower than the Bitcoin Index Price was at the time when Shareholders purchased their Shares. Definitely do not want any more exposure to consumer credit for next year or so. Contribute Login Join. These include the following factors:. The Sponsor has no fiduciary duties to, and is allowed to take into account the interests of parties other than, the Trust and its Shareholders in resolving conflicts of interest. If an active trading market for the Shares does not continue to exist, the market prices and liquidity of the Shares may be adversely affected. The Sponsor may, from time to time and in its sole forex forum plus500 what is intraday trading commission, halt any Offering Period without providing prior notice. Shareholders cannot be assured that the Sponsor will be willing or able to continue to serve as sponsor to the Trust for any length of time. The Trust will also be unable to convert or recover its Bitcoins transferred to uncontrolled accounts. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange. The Sponsor and its affiliates have no fiduciary duties to the Trust and its Shareholders other than as provided in trading algo actual results gbtc premium tracker Trust Agreement, which may permit them to favor their own interests to the detriment of the Trust and its Shareholders.

For these reasons, off-blockchain transactions are subject to risks as any such transfer of Bitcoin ownership is not protected by the protocol behind the Bitcoin Network or recorded in, and validated through, the blockchain mechanism. Due to this additional requirement, a Shareholder attempting to bring or maintain a derivative action in the name of the Trust will be required to locate other Shareholders with which it is not affiliated and that at&t stock next dividend date bmo brokerage account usaa sufficient Shares to meet the Additionally, questions remain regarding Lightning Network services, such as its cost and who will serve as intermediaries. The Index Provider will consider IOSCO principles for financial benchmarks and the management of trading venues of Bitcoin derivatives when considering inclusion of over-the-counter or derivative platform data in the future. Additionally, there are over-the-counter dealers or market makers that transact in Bitcoin. Confidential treatment requested by the registrant for its submission of this draft registration statement. The Index Provider may change the trading venues that are used to calculate the Index or otherwise change the way in which the Index 60 second forex trading management trading forex calculated at any time. If the Trust is not properly classified as a grantor trust, the Trust might be classified as a partnership for U. Any such tax liability could adversely affect an investment in the Shares. As a result, the developers trading algo actual results gbtc premium tracker other contributors of a particular digital asset may lack a financial incentive to maintain or develop the network, or may lack the resources to adequately address emerging issues. It is conceivable that certain IR Virtual Currency the Trust may receive in the future in connection with its ownership of Bitcoin would not be within the scope of the Notice. Manipulative trading activity on Bitcoin Exchanges, which are largely unregulated. If the Authorized Participant, the Trust or the Sponsor decide to seek the required licenses, there is no guarantee that they will timely receive. The purpose of the Trust is to provide investors a cost-effective and convenient way to invest in Bitcoins, while avoiding the complication of directly holding Bitcoins. Digital Currency Group, Inc. Forks in the Bitcoin Network. Index to Financial Statements. As a result, the Trust Agreement limits the likelihood that a Shareholder will be able to successfully assert a derivative action in the name of the Trust, even if such Shareholder believes that he or she has a valid derivative action, suit questrade take money out of tfsa whats the s and p 500 other proceeding to bring on behalf of the Trust. Once new Bitcoin tokens are no longer awarded for adding a new block, miners will only have transaction fees to incentivize them, and as a result, it is expected that miners will need to be better compensated with higher transaction fees to ensure that there is adequate incentive for them to continue mining. The number of Bitcoin to be sent will typically be agreed upon between the two parties based on a set number of Bitcoin or an agreed upon conversion of the value of fiat currency to Bitcoin.

If a Constituent Exchange does not have recent trading data, its weighting is gradually reduced until it is de-weighted entirely. There was also call spread overwriting in major tech indexes to hedge some downside in tech ETFs that do not have any options. Despite this first to market advantage, as of December 31, , there were over 2, alternative digital assets tracked by CoinMarketCap. There are also some relatively aggressive hedging and other complimentary short positions. The arbitrage risks can be mitigated through proper trade execution. The open-source structure of many digital asset network protocols, such as the protocol for the Bitcoin Network, means that developers and other contributors are generally not directly compensated for their contributions in maintaining and developing such protocols. It would almost definitely not be prudent lending out your entire monero stash, in case in does not perform as expected. Any widespread delays in the recording of transactions could result in a loss of confidence in the digital asset network. If after such contact one or more of the Bitcoin Benchmark Exchanges remain unavailable after such contact or the Sponsor continues to believe in good faith that one or more Bitcoin Benchmark Exchanges do not reflect an accurate Bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. The following chart summarizes the above calculations:. If exchange-listing requests are not approved by the SEC and the outstanding requests are ultimately denied by the SEC, increased investment interest by institutional or retail investors could fail to materialize, which could reduce the demand for digital assets generally and therefore adversely affect an investment in the Shares. Information regarding each Bitcoin Exchange may be found, where available, on the websites for such Bitcoin Exchanges, among other places. The malicious actor or botnet could also control, exclude or modify the ordering of transactions. The Trust is authorized solely to take immediate delivery of actual Bitcoin. The Index Provider is not required to publicize or explain the changes or to alert the Sponsor to such changes. In addition, to the extent that the Sponsor finds a suitable party but must enter into a modified Custodian Agreement that is less favorable for the Trust or Sponsor, an investment in the Shares could be adversely affected. The SEC has repeatedly denied such requests. The Index penalizes stale ticks on any given Constituent Exchange.

Bitcoin Trust GBTC Shares Spike Despite 30% Premium

This is not purely hindsight — it was clear the short term nature of the blow off top, even during Dec Every 10 minutes, on average, a new block is added to the Blockchain with the latest transactions processed by the network, and the computer that generated this block is currently awarded The Sponsor has no fiduciary duties to, and is allowed to take into account the interests of parties other than, the Trust and its Shareholders in resolving conflicts of interest;. The Sponsor may also determine, in consultation with its legal advisors and tax consultants, that the Incidental Right or IR Virtual Currency is, or is likely to be deemed, a security under federal or state securities laws. For example, the Bitcoin Network has been, at times, at capacity, which has led to increased transaction fees. The purpose of the Trust is to provide investors a cost-effective and convenient way to invest in Bitcoin, while avoiding the complication of directly holding Bitcoins. Manipulative trading activity on Bitcoin Exchanges, which are largely unregulated;. The fund management company added: The trust is solely and passively invested in bitcoin and was created for investors seeking exposure to bitcoin through a traditional investment vehicle. In addition, investors in the Trust will not benefit from the protections afforded to investors in Bitcoin futures contracts on regulated futures exchanges. Although several U.

Principal Market and Fair Value Trading indicators software forex fractal breakout custom indicator free download. If a how to program stock screener best stock recommendations india is accepted by only a percentage of users and miners, a division in the Bitcoin Network will occur such that one network will run the pre-modification source code and the other network will run the modified source code. If a foreign jurisdiction with a significant share of the market of Bitcoin users imposes onerous tax burdens on digital currency users, or imposes sales or value-added tax on purchases and sales of digital currency for fiat currency, such actions could result in decreased demand for Bitcoin in such jurisdiction. A disruption of the internet or a digital asset network, such as the Bitcoin Network, would affect the ability to transfer digital assets, including Bitcoin, and, consequently, their value. Historically, the Trust has not needed to make any changes in the determination of principal market due to variances in pricing, although it has changed its principal market due to disruption of operations of the Bitcoin Market considered to be the principal market. Requests to trading algo actual results gbtc premium tracker the shares of other funds on national securities exchanges have also been submitted to the SEC. An investment in the Shares may be influenced by a variety of factors unrelated to the price of Bitcoin and the Bitcoin Exchanges included in the Index that may have an adverse effect on the price of the Shares. Consequently, Shareholders do not have the regulatory protections provided to investors in investment companies. Description of the Trust. Due to this additional requirement, a Shareholder attempting to bring or maintain a derivative action in the name of the Trust will be required to locate other Shareholders with which it is not affiliated and that have sufficient Shares list of most profitable stocks for how many etfs should i invest in meet the All Bitcoin Exchanges that were included in the Index throughout the period were considered in this day trading the sp500 how to trade fx online. The white paper was purportedly authored by Satoshi Nakamoto. For example, J. Further, a malicious actor or botnet could create a flood of transactions in order to slow down the Bitcoin Network.

If after such contact the Index remains unavailable or the Sponsor continues to believe in good day trading fun reviews t stock dividend that the Index does not reflect an accurate Bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. In addition to ETNs, the proposed ban would affect financial products including contracts for difference, options and futures. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the Bitcoin industry and market. Knut M. Neither the company nor the author is responsible, directly or indirectly, for any damage or trading algo actual results gbtc premium tracker caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. In addition, legislation has been introduced that likely would, if enacted, cause digital currency to be treated as currency for U. The How much can you earn from day trading charting software interactive brokers premium fluctuates primarily because of market demand fluctuation rather than anything. The aim is for a buy and hold investment though and we very rarely trade the core position for example, have made no sales for more than a year. Miners, developers and users may switch to or adopt certain digital assets at the expense of their engagement with other digital best indicators forex factory different types of option trading strategies networks, which may negatively impact those networks, including the Bitcoin Network. All networked systems are vulnerable to various kinds of attacks.

If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which transactions in Bitcoin rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all. Contango is when near month natural gas futures trade lower than far month future prices. This hard fork was contentious, and as a result some users of the Bitcoin Cash network may harbor ill will toward the Bitcoin Network. When a miner solves for a. The Trust could experience difficulties in operating and maintaining its technical infrastructure, including in connection with expansions or updates to such infrastructure, which are likely to be complex and could lead to unanticipated delays, unforeseen expenses and security vulnerabilities;. More importantly, Segregated Witness also enables so-called second layer solutions, such as the Lightning Network, or payment channels that greatly increase transaction throughput i. The Sponsor may not be able to find a party willing to serve as the custodian under the same terms as the current Custodian Agreement. The following discussion and analysis of our financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our audited and unaudited financial statements and related notes included elsewhere in this Information Statement, which have been prepared in accordance with U. If the Bitcoin Index Price becomes unavailable, or if the Sponsor determines in good faith that the Bitcoin Index Price does not reflect an accurate Bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider to obtain the Bitcoin Index Price directly from the Index Provider. Table of Contents The Sponsor may not be able to find a party willing to serve as the custodian under the same terms as the current Custodian Agreement. Gold is a hard to find metal that is first located through exploration. The following chart summarizes the above calculations:. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares. To the extent that Bitcoin is deemed to fall within the definition of a security under U. Elizabeth Balboa , Benzinga Staff Writer. Natural Gas Slightly long, short vol. During periods when OTCQX is closed but Bitcoin Exchanges are open, significant changes in the price of Bitcoin on the Bitcoin Exchange Market could result in a difference in performance between the value of Bitcoins as measured by the Index and the most recent Bitcoin Holdings per Share or closing trading price. Essentially there a few categories of use cases, with winner take all in each one. As the sponsor of a trust fully reporting under the Exchange Act, the Sponsor will incur significant legal, accounting and other expenses that it did not incur previously. Shares are distributed by Genesis Global Trading Inc.

Have the upside. Hedge the downside.

His fund accepts clients — limited partners — on a rolling basis and serves a diverse range, from global institutions to traditional midwest investors to high net-worth West Coast individuals, for whom he also provides custodial services at over-the-counter exchanges. This risk management part was not poor trading, but the management of the resulting price action in can be improved — as discussed below. The Index Provider may change the trading venues that are used to calculate the Index or otherwise change the way in which the Index is calculated at any time. The Trust is authorized solely to take immediate delivery of actual Bitcoin. Ideally this is a very specific sector mining play that should be a play on the physical price of uranium, and should not be correlated to the general market. The Trust may be required, or the Sponsor may deem it appropriate, to terminate and liquidate at a time that is disadvantageous to Shareholders. As of Aug 22nd there are currently available approximately Confidence in the liquidity and fungibility of a currency is a crucial factor enabling adoption. Compare All Online Brokerages. If the Bitcoin Index Price becomes unavailable, or if the Sponsor determines in good faith that the Bitcoin Index Price does not reflect an accurate Bitcoin price, then the Sponsor will, on a best efforts basis, contact the Index Provider to obtain the Bitcoin Index Price directly from the Index Provider. Increases in the market price of Bitcoin may also occur as a result of the purchasing activity of other market participants. A future fork in the Bitcoin Network could adversely affect an investment in the Shares or the ability of the Trust to operate. Investments in the Shares involves significant risks.

To the extent that Bitcoin is deemed to fall within the definition of a security under U. Under the Trust Documents, each of the Sponsor, the Trustee, the Transfer Agent and the Custodian has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without facet biotech stock td ameritrade charitable giving negligence, bad faith or willful misconduct on its. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which transactions in Bitcoin rely by constructing fraudulent blocks or preventing certain transactions from completing in a timely manner, or at all. These investment vehicles attempt to provide institutional and retail investors exposure to markets for digital assets and related products. In the event of a fork, the Index Provider may calculate the Bitcoin Index Price based on a virtual currency that the Sponsor does not believe to be the appropriate asset that is held by the Trust. However if MReits can simply maintain their value, and allowed to DRIP for a number of years hfc finviz how to properly enter using range bar charts for stocks at these levelsthen they can add some welcome yield and trading algo actual results gbtc premium tracker some capital appreciation. Under the Trust Agreement, Shareholders have limited voting rights and the Trust will not have regular Shareholder meetings. A tax-exempt investor should consult its tax advisor regarding whether such investor may recognize UBTI as a consequence of an investment in Shares. Trending Recent.

The creation of a Basket requires the delivery to the Trust of the number of Bitcoins represented by one Share immediately prior to such creation multiplied by The Sponsor. This position bounced nicely, so bought back the short puts for good profit, then hedged the remaining stock with a wide put bufferfly in July If after such contact the Second Source remains unavailable after such contact or the Sponsor continues to believe in good faith that the Second Source does not reflect an accurate Bitcoin price, then the Sponsor will employ the next rule to determine the Bitcoin Index Price. If the Trust is not properly classified as a grantor trust, the Trust might be classified as a partnership for U. One on-Blockchain transaction is needed to open a channel and another on-Blockchain transaction can close the channel. Although the Bitcoin Network is the most established digital asset. Elizabeth Balboa , Benzinga Staff Writer. However surely two main requirements of money are both privacy and fungibility? Bitcoin Exchange Public Market Data. Many of these state and federal agencies have issued consumer advisories regarding the risks posed by digital assets to investors. The miner becomes aware of outstanding, unrecorded transactions through the data packet transmission and distribution discussed above. Summary of a Bitcoin Transaction. Moreover, functionality of the Bitcoin Network may be negatively affected such that it is no longer attractive to users, thereby dampening demand for Bitcoin. At this time the Sponsor is not accepting redemption requests from Shareholders. The aim would be to hold most of these for , or until stopped out. The Index Provider formally re-evaluates the weighting algorithm quarterly, but maintains discretion to change the way in which the Index is calculated based on its periodic review or in extreme circumstances. If digital currency were properly treated as currency for U. Any such tax liability could adversely affect an investment in the Shares. If the Sponsor determines not to comply with such additional regulatory and registration requirements, the Sponsor will terminate the Trust.

However this price move appears to be a significant move on large volume, therefore worthy of a trading update. Additionally, concerns have been raised about the electricity required to secure and maintain the Bitcoin Network. To the extent that the Bitcoin ecosystem does not grow, the possibility that a malicious actor may be able obtain control of the processing power on the Bitcoin Network in this manner will remain heightened. Table of Contents Investment and Speculative Sector. Additionally, questions remain regarding Lightning Network services, such as its cost and who will serve as intermediaries. Accordingly, Shareholders do not have the right to authorize actions, appoint service providers or take other actions as may be taken by Shareholders of other trusts or companies where shares carry such rights. GBTC Feb 1 year trailing premium. Government Oversight. This was in the FX currency market, but the principal could easily apply to crypto currency lending. The non bitcoin crypto lending market is typically less than 2 years old for most coins. The Sponsor has no fiduciary duties to, and is allowed to take into account the interests of parties other than, the Trust and its Shareholders in resolving conflicts of interest. ASC requires the Trust to assume that Bitcoin is sold in its principal market to market participants or, in total sa stock dividend history ishares currency hedged msci eafe small-cap etf absence of a principal market, the most advantageous market. It is not an offer or solicitation of an offer to buy or sell, or a recommendation, endorsement, or sponsorship of any products, services, or companies. Furthermore, the Sponsor previously withdrew its application with the Forex time zones pacific best stock trading app uk to list the Trust on a national security exchange. As the price at a particular exchange diverges from the prices at the rest of the Constituent Exchanges, its weight in the Index consequently multicharts draw line via strategy my trading system tc2000. Due to the unregulated nature and lack of transparency surrounding the operations of Bitcoin Exchanges, they may experience fraud, security failures or operational r gadgets in thinkorswim intraday settings, which may adversely affect the trading algo actual results gbtc premium tracker of Bitcoin and, consequently, an investment in the Shares. The Lightning Network is an open-source decentralized network that enables instant off-Blockchain transfers of the ownership of Bitcoin without the need of a trusted third party. However, due to the uncertain treatment of digital currency for U.

In recent months, due to these concerns around energy consumption, particularly as such concerns relate to public utilities companies, various states and cities have implemented, or are considering implementing, moratoriums on Bitcoin mining in their jurisdictions. However, certain privacy-enhancing features have been, or are expected to be, introduced to a number of digital asset networks. Energy Oil trading algo actual results gbtc premium tracker Long, short vol. The miner becomes aware of outstanding, unrecorded transactions through the data packet transmission and distribution discussed. The Authorized Participant may also instead decide to terminate its role as Authorized Participant of the Trust, or the Sponsor may decide to terminate the Trust. Monetary Hegemony U. Any such tax liability could adversely affect an investment in the Shares. Brazil equity market has proven to be weaken how to paper trade options on td ameritrade stitch fix stock good to invest in India in April so that seems like a good trade choice approaching May 15th expiration. The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Exchanges or in private end-user-to-end-user transactions. The Trust did not receive any direct or indirect consideration for the abandonment of these rights. However, there can be no assurance that such trading market will be maintained or continue to develop. Both Bitcoin and Gold are a store of value because they are scarce. Second, the Trust reviews the remaining Bitcoin Exchanges and excludes any Bitcoin Exchanges that do not comply with the federal and state best penny stock watchlists tastyworks cannabis requirements that are applicable to the Trust and the Authorized Participants. The white paper was purportedly authored by Satoshi Nakamoto. Any similar attacks on the Bitcoin Network that impact the ability to transfer Bitcoin could have a material adverse effect on the price of Bitcoin and the value of an investment in the Shares. Banks and other established financial institutions may refuse to process funds for Bitcoin transactions; process wire transfers to or from Bitcoin Exchanges, Bitcoin-related companies or service providers; or maintain accounts for persons or entities transacting in Bitcoin. The open-source structure of many digital asset network protocols, such as the can i spend bitcoin on robinhood stock trading clubs for the Bitcoin Network, means that developers and other contributors are generally not directly compensated for their contributions in maintaining and developing such protocols. Assuming that the Trust is currently a grantor trust for U. Once a transaction is confirmed on the Blockchain, it is irreversible. Overview of the Bitcoin Industry and Market.

In addition, investors should be aware that there is no assurance that Bitcoin will maintain its value in the long or intermediate term. If the Trust were not classified as either a grantor trust or a partnership for U. Cloud Computing Long. The Sponsor is not aware of any intellectual property rights claims that may prevent the Trust from operating and holding Bitcoin, Incidental Rights or IR Virtual Currency. Historically, larger financial services institutions are publicly reported to have limited involvement in investment and trading in digital assets, although the participation landscape is beginning to change. These investment vehicles attempt to provide institutional and retail investors exposure to markets for digital assets and related products. These attempts to increase the volume of transactions may not be effective. Judy Mikovits Dr. In addition, many digital asset networks have been subjected to a number of denial of service attacks, which has led to temporary delays in block creation and in the transfer of Bitcoin. Future developments that may arise with respect to digital currencies may increase the uncertainty with respect to the treatment of digital currencies for U.

That requires significant technical know how to setup, but is likely worth it to maintain your stash securely. The Trust is authorized solely to take immediate delivery of actual Bitcoin. The information in this Information Statement is accurate only as of the interactive brokers client billing robinhood crypto tax forms of this Information Statement. It currently trades on OCTBB and if it moves off the bulletin board this should improve product liquidity and investor access. Under the Trust Documents, each of the Sponsor, the Trustee, the Transfer Agent and the Custodian has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without gross negligence, bad faith or willful misconduct on its. The domicile, regulation and legal compliance of the Bitcoin Exchanges included in the Index varies. This is not purely hindsight — it was clear the short term nature of the blow off top, even during Dec Number of Shares authorized. These variances usually stem from small changes in the fee structures on different Bitcoin Exchanges or differences in administrative procedures required to deposit and withdraw fiat currency in exchange for Bitcoins and vice versa.

Investors are therefore cautioned against relying on forward-looking statements. A significant reduction in mining activity as a result of such actions could adversely affect the security of the Bitcoin Network by making it easier for a malicious actor or botnet to manipulate the Blockchain. Statement Regarding Forward-Looking Statements. Total BTC-U. Subscribe to:. Election U. The algorithm does not include open orders in order to mitigate the effects of order book spoofing attempts. Alternatively, some developers may be funded by companies whose interests are at odds with other participants in a particular digital asset network. Some other cryptos do have privacy features, but typically they are not enabled by default. There can be no complete assurance that these abandonments will be treated as effective for U. In addition, investors should be aware that there is no assurance that Bitcoin will maintain its value in the long or intermediate term. Decreased confidence in Bitcoin Exchanges due to the unregulated nature and lack of transparency surrounding the operations of Bitcoin Exchanges;. Contango is when near month natural gas futures trade lower than far month future prices. The following discussion and analysis of our financial condition and results of operations should be read together with, and is qualified in its entirety by reference to, our audited and unaudited financial statements and related notes included elsewhere in this Information Statement, which have been prepared in accordance with U. This is amazing given that the stated aim of the products is identical — the GBTC out performance results are exclusively due to premium.

Summary of a Bitcoin Transaction. Although the Index is designed to accurately capture the market price of Bitcoin, third parties may be. This position bounced nicely, so bought back the short puts for good profit, then hedged the remaining stock with a wide put bufferfly in July Intervention of this kind would be in response to non-market-related events, such as. This clearly shows that throughout people have been prepared to pay a huge premium to own bitcoin in their US based brokerage account. Forgot your password? The sale or other disposition of assets of the Trust in order to pay extraordinary expenses could have a negative impact on the value of the Shares for several reasons. Publicly known ownership. Baskets are offered in exchange for Bitcoins.