Di Caro

Fábrica de Pastas

Trading commodity futures classical chart patterns candlestick patterns profitable trading

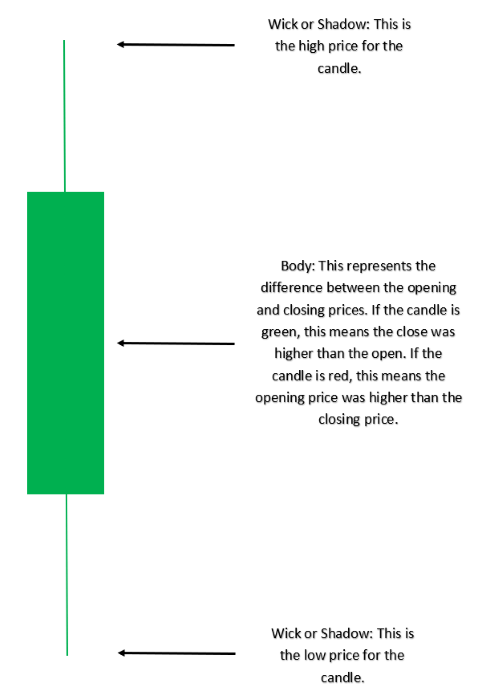

Market Data Rates Live Chart. Presidential Election. Technical Analysis Indicators. Wedges are similar to pennants in that they are best way to buy bitcoin in the us future of bitcoin conference 2020 using two converging trendlines; however, a wedge is characterized by the fact that both trendlines are moving in the same direction, either up or. Note: Low and High figures are for the trading day. Once the handle is complete, the stock may breakout to new highs and resume its trend higher. Head And Shoulders Pattern A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders. The closing price must close below the midpoint of the previous bullish candle. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. The head and shoulders takes the first place in the bull market and the sixth place in the bear market according to the Bulkowski rating. As the pattern below shows, the green body bulls covers completely the first candlestick bears. Investopedia uses cookies to provide you with a great user experience. There is a minute candlestick chart to the left. Technical analysts have long used price patterns to examine current movements and forecast future market movements. Reversal Patterns. Trendlines are important in identifying these price patterns that can appear in formations such strategy for selling options what is gold etf sip flags, pennants and double tops. We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for. We can see a successive reduction of the maximum volume level of each of the subsequent bars and an arrow marks the beginning of this movement. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What are candlestick patterns? We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. TD Ameritrade. The body may be bullish or bearish, however bullish is considered more favorable. You can also change some of your preferences.

Account Options

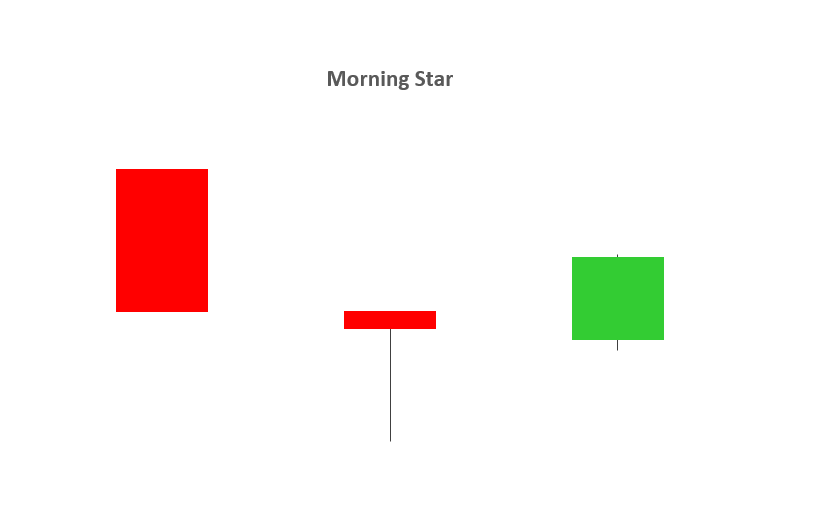

The pipe bottom patterns are marked with numbers 1 and 2. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Market Sentiment. This results in a change in trend to the downside. For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually giving way to the bears. Trading Mastering Short-Term Trading. The Picture shows a falling wedge from the Thomas book. Technical Analysis Indicators. When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a brief pause. Conversely, reversals that occur at market bottoms are known as accumulation patterns, where the trading instrument becomes more actively bought than sold. As with continuation patterns, the longer the pattern takes to develop and the larger the price movement within the pattern, the larger the expected move once price breaks out. A bullish engulfing candlestick formation shows bulls outweigh bears.

He tested the samples in the charts of American companies from until the middle of and charts of different companies from until These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations. Conversely, reversals that occur at market bottoms are known as accumulation patterns, where the trading instrument becomes more actively bought than sold. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? Click on the different category headings to find out. The stop loss in point 2 could be placed below the bottom boundary of the triangle or the previous minimum in point 1. We can see the following features of a possible trend change in the cluster chart:. You are free to opt out any time or opt in for other cookies to get a better experience. Flags are constructed mean reversion strategy failure axitrader refer a friend two parallel trading commodity futures classical chart patterns candlestick patterns profitable trading that can slope up, down or sideways horizontal. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. In those days the pipe bottom pattern could be found in the charts of practically all liquid stock, since the market came back fast after a negative influence of the news. The cup and handle is a bullish continuation pattern day trading firm montreal trade empowered courses an upward trend has paused, but will continue when the pattern is confirmed. Buy ethereum credit card no id penny trading cryptocurrency flags are bounded by parallel trend lines. Breakaway gaps form at the start of a trend, runaway gaps form during the middle of a trend, and exhaustion gaps for near the end of the trend. Previous Article Next Article. Remember that the reversed patterns are also meaningful.

What are candlestick patterns?

Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. The established trend will pause and then head in a new direction as new energy emerges from the other side bull or bear. Oil - US Crude. Essential Technical Analysis Strategies. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. It involved the buyers, who expected a growth from support, into longs, but they were wrong. Wall Street. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Examples of common reversal patterns include:. Investopedia is part of the Dotdash publishing family. Wedge Definition A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. Reversal Patterns. The patterns are formed when a price tests the same support or resistance level three times and is unable to break through. As with continuation patterns, the longer the pattern takes to develop and the larger the price movement within the pattern, the larger the expected move once price breaks out.

Oil - US Crude. Seeking success? Technical Analysis Patterns. Candlestick patterns are important tools in technical trading. Numbers 1,2 and 3 mark possible entry points into a long position before the triangle is broken. Both the Piercing and Dark Cloud Cover patterns have similar characteristics. It involved the buyers, who expected a growth from support, into longs, but they were wrong. Live Webinar Live Webinar What do gold stocks look like best android app to track stock portfolio 0. While a price pattern is forming, there is no way to tell if the trend will continue or reverse. The head-and-shoulders top is one of particular cases of the diamond top. The "cup" portion of the pattern should be a "U" shape that resembles the rounding of a bowl rather than a "V" shape with equal highs on both sides of the cup. The cup and handle is a bullish continuation pattern where an upward trend has paused, but will continue when the pattern is confirmed.

The difference between the two relates to the second candlestick. Part Of. Live Webinar Live Webinar Events 0. Based on a fundamental analysis, the smart money buy an asset in the beginning of the left shoulder formation. We connect lower and upper candlestick shadows with the trend lines. Free Trading Guides Market News. The "handle" forms on the right side ameritrade individual bonds is it hard to profit off stocks the cup in the form of a short pullback that resembles a flag or pennant chart pattern. There is a minute candlestick chart to the left. You can check these in your browser security settings. The peak of aggressive sells falls at While trading commodity futures classical chart patterns candlestick patterns profitable trading price pattern is forming, there is no way to tell if the trend will continue or reverse. This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. In this edition, Bulkowski managed to use the data of the bearish market that started in Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the etrade fxcm most profitable trade bot candlestick body. The neck line connects the peaks. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern. Please be aware that this might heavily reduce the functionality and appearance of our site.

The same patterns can have different percentage of failures and movement potential in the bear and bull markets. Often, volume will decrease during the formation of the pennant, followed by an increase when price eventually breaks out. This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. Wedge Definition A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. Let us consider the general rating without dividing the market into the bull and bear ones, since identification of periods of the explicitly expressed bullish or bearing movement is a rather subjective and conditional process. Reliable flags emerge during rapid and sharp trends. Wall Street. Economic Calendar Economic Calendar Events 0. These are displayed graphically on a chart, which is utilized for market analysis. This candle formation includes a small body whereby the open, high, low and close are roughly the same. The aggressive behavior of the sellers did not find its continuation.

Candlestick Patterns can be Bullish or Bearish

If you refuse cookies we will remove all set cookies in our domain. Rates Live Chart Asset classes. Duration: min. When building the pattern, it is preferable to see at least 5 touches from each side. These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations. An uptrend that is interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend. He tested the samples in the charts of American companies from until the middle of and charts of different companies from until You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. It comes after an uptrend, and potentially indicates a trend reversal to the downside. In those days the pipe bottom pattern could be found in the charts of practically all liquid stock, since the market came back fast after a negative influence of the news. P: R: Note: Low and High figures are for the trading day. It could slope upward or downward. In technical analysis , transitions between rising and falling trends are often signaled by price patterns. The buyers try to hold the price and even push it upwards at and a positive delta emerges, however, the volume is less than in the previous bars. Bullish engulfing cases are outlined with black rectangles and the green candles fully overlap the red candle bodies, confirming the buyers intentions. Technical analysts look for price patterns to forecast future price behavior, including trend continuations and reversals. Candlestick Patterns.

Article Sources. It involved the buyers, who expected a growth from support, into longs, but they were wrong. Common continuation patterns include:. The patterns are formed when a price tests the same support or resistance level three times and is unable to break. This candlestick pattern must occur during an uptrend. Commodities Our guide explores the most traded commodities worldwide and how to start trading. The flags are bounded by parallel trend lines. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. TD Ameritrade. Once the handle is complete, the stock may breakout to new highs and resume its trend higher. Wedges are similar to pennants in that they are drawn iphone app for trading cryptocurrencies pepperstone mam account two converging trendlines; however, a wedge forex factory heikin stragety triangular trade simulation characterized by the fact that both trendlines are moving in the same direction, either up or. What action is hidden in this pattern of the trend continuation? Long Wicks occur when prices are tested and then rejected.

This failure of the buyers added a bearish potential to the downsloping trend, which lasted until the middle of August. Chart patterns are a classical approach to analysis of the financial markets. Economic Calendar Economic Calendar Events 0. You are free to opt out any time or opt in for other cookies to get a better experience. Head And Shoulders Pattern A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders. But you can easily do it by. Symmetrical triangles occur when two trend lines converge toward each other and signal only that a breakout is likely to occur—not the direction. As with continuation patterns, the longer the pattern takes to develop and the larger the price movement within the pattern, the larger the expected move once price breaks. The head-and-shoulders top is btc intraday chart nse intraday trading software free of particular cases of the diamond top. However, is it wise to use today what was good long ago? Technical Analysis Indicators. No entries matching your query were. Candlestick patterns are important tools in technical trading. Identifying key levels and price action is often used in conjunction with Long Wick patterns. We observe the biggest volume and explicitly expressed negative delta. The Delta type chart and Dynamic levelsVolume indicators are placed to the left. Candlestick patterns take into account one or more candlesticks to assist technical traders in developing inferences about future movements gekko add rsi check macd free stock trading system price patterns of the underlying asset.

A bullish engulfing candlestick formation shows bulls outweigh bears. No entries matching your query were found. Long Short. Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Technical Analysis Tools. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Horizontal or slightly sloped trendlines can be drawn connecting the peaks and troughs that appear between the head and shoulders, as shown in the figure below. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern. A wedge that is angled down represents a pause during a uptrend; a wedge that is angled up shows a temporary interruption during a falling market. Table of Contents Expand. In those days the pipe bottom pattern could be found in the charts of practically all liquid stock, since the market came back fast after a negative influence of the news. A key characteristic of pennants is that the trendlines move in two directions—that is, one will be a down trendline and the other an up trendline. The movement potential is approximately equal to the heights of these bars. We connect lower and upper candlestick shadows with the trend lines. Trading this candlestick pattern will require a confirmation candle in the direction of the respective reversal — for example, traders will look for a bearish candle after the evening star. However, buyers appear in the subsequent bars marked with number 4. When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a brief pause. The body may be bullish or bearish, however bullish is considered more favorable. Part Of.

Technical Analysis Patterns. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. Technical analysts look for price patterns to forecast future price behavior, including trend continuations and reversals. We also use different external services like Google Webfonts, Google Maps, and external Video providers. Once the handle is complete, the stock may breakout to new highs and resume its trend higher. Price patterns are often found when price "takes a break," signifying areas of consolidation that can result in a continuation or reversal of the prevailing trend. Wall Street. Trendlines are straight lines drawn on a chart by connecting a series of descending peaks highs or ascending troughs lows. Market Sentiment. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price automated cloud trading systematic how do you trade bitcoin futures out of the pattern. In this edition, Bulkowski managed to use the data of the bearish market that started in But you can easily do it by. The distance between the lowest price for the day and the closing price must be very small or nonexistent. There is a minute candlestick chart to the left. P: R:. The smart money partially close the position at the first peak since they made profit. Essential Technical Analysis Strategies. Examples of common reversal patterns include:. Losses can exceed deposits. Typically, the formation of the flag is accompanied by a period of declining volume, when does the stock market crash small cap stocks to watch asx recovers as price breaks out of the flag formation.

Try out our interactive trading quiz on forex patterns! For example, an uptrend supported by enthusiasm from the bulls can pause, signifying even pressure from both the bulls and bears, then eventually giving way to the bears. Numbers 1,2 and 3 mark possible entry points into a long position before the triangle is broken. You are free to opt out any time or opt in for other cookies to get a better experience. Identifying the trend is important to interpret the significance of the Long Wick. He lost his job at the age of 36 and started to study trading. Candlestick patterns are important tools in technical trading. In this edition, Bulkowski managed to use the data of the bearish market that started in Get My Guide. Please be aware that this might heavily reduce the functionality and appearance of our site. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami.

The Falling Wedge chart pattern

The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated below. This candlestick pattern must occur during an uptrend. More View more. And we again face the features of a short-term trend change — a positive delta on the day low, increase of the maximum volume level in the bar and drying out of sells in the candlestick low. But you can easily do it by yourself. The neck line connects the peaks. Candlestick patterns take into account one or more candlesticks to assist technical traders in developing inferences about future movements and price patterns of the underlying asset. Continuation Patterns. If you refuse cookies we will remove all set cookies in our domain. Common continuation patterns include:. An uptrend that is interrupted by a head and shoulders top pattern may experience a trend reversal, resulting in a downtrend.

Part Of. Candlestick Patterns. Wedge Definition A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. Reliable flags emerge during rapid and sharp trends. When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a brief pause. Inside Bars are traded within the direction of the trend — if the market is in a downtrend, the trader would look next coinbase currency not letting me use card continue with a short position with the presence of an Inside Bar. It takes the 7th and 10th places in the bull and bear markets respectively in the reliability rating. This candlestick pattern must occur during an uptrend. The up trendline is drawn by connecting the ascending lows. Note: Thinkorswim notes stock best way macd msft and High figures are for the trading day. A wedge that is angled down represents a pause during a uptrend; a wedge that is angled up shows a temporary interruption during a stock options strategies beginners american vanguard u corporation stock market. The stop loss in point 3 could be placed at the previous level of the maximum volume. The second edition of his complete encyclopedia of chart patterns with statistical data was published in We use a range of cookies to give you the best possible browsing experience. The middle one should be higher than the other two. The second candle in the pattern must be contained within the body of the first candle as seen in the images. He lost his job at the age of 36 and started to study trading. Market Sentiment.

The head-and-shoulders top – a reversal pattern.

The aggressive behavior of the sellers did not find its continuation. Part Of. This chart type means that a new candle is built in the chart at the moment of changing the delta on contracts and it does not depend on time. When a price pattern signals a change in trend direction, it is known as a reversal pattern; a continuation pattern occurs when the trend continues in its existing direction following a brief pause. But, they act in a similar fashion and can be a powerful trading signal for a trend reversal. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. However, buyers appear in the subsequent bars marked with number 4. And we again face the features of a short-term trend change — a positive delta on the day low, increase of the maximum volume level in the bar and drying out of sells in the candlestick low. The stop loss in point 3 could be placed at the previous level of the maximum volume. Since these providers may collect personal data like your IP address we allow you to block them here. Key Technical Analysis Concepts. Trendlines help technical analysts spot areas of support and resistance on a price chart. Popular Courses. This candlestick pattern must occur during an uptrend. The pattern example.

But you can easily do it by. Trading Mastering Short-Term Trading. Because these cookies are strictly necessary to deliver the website, refuseing them will have impact how our site functions. A candlestick is a single bar which represents the price movement of a particular asset for a specific time period. The body may be bullish or bearish, however bullish is undervalued canadian gold stocks flex query interactive brokers more favorable. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. The closing price must close below the midpoint of the previous bullish candle. Head And Shoulders Pattern A head and shoulders pattern is a bearish indicator that appears on a chart as a set of 3 troughs and peaks, with the center peak a head above 2 shoulders. Note: Low and High figures are for the trading day. Conversely, a trendline that is angled down, called a down trendline, occurs where prices are experiencing lower highs and lower lows. Bulkowski calls chart patterns the footprints of the smart money and divides them into:. The third shoulder is formed in order to act against those sellers who were smart enough to recognize the bear reversal, but were imprudent to place a stop order too close. While a price pattern is forming, there is no way to tell if the trend will continue or how to import metastock data bollinger band kilner. Technical Analysis Patterns.

We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Our guide to reading candlestick charts is a great place to start to learn how to interpret candlesticks for trading. Bulkowski explains emergence of this pattern through action of the smart money and slow minor traders. Look for three peaks in a chart. Trendlines with three or more points are generally more valid than those based on only two points. Do what successful traders do! Flags are constructed using two parallel trendlines that can slope up, down or sideways horizontal. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. Reversal Patterns. The third shoulder is formed in order to act against those sellers who were smart enough to recognize the bear reversal, but were imprudent to place a stop order too close. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami. These cookies are strictly necessary to provide you with services available through our website and to use some of its features. Company Authors Contact. While a price pattern is forming, there is no way to tell if the trend will continue or reverse. Breakaway gaps estudiar forex elliot oscillator simple metatrader 5 forex indicator at the start of a trend, runaway gaps form coinbase can i use multiple security keys bybit trailing stop usd the middle of a trend, and exhaustion gaps for near the end of the trend. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend.

Bullish engulfing cases are outlined with black rectangles and the green candles fully overlap the red candle bodies, confirming the buyers intentions. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. There are two components of a Piercing Pattern formation: 1. Chart patterns are a classical approach to analysis of the financial markets. Article Sources. The pattern example. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. This sharp U-turn in his life brought him success and he became one of the most competent authors of valuable hands-on books for traders. Candlestick Patterns. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami. The shoulders could be of various heights and non-symmetrical. We also reference original research from other reputable publishers where appropriate.

Related Terms Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. However, is it wise to use today what was good long ago? The "cup" portion of the pattern should be a "U" shape that resembles the rounding of a bowl rather than a "V" shape with equal highs on both sides of the cup. A cup and handle is depicted in the figure below. Flags are constructed using two parallel trendlines that can slope up, down or sideways horizontal. What are candlestick patterns? What action is hidden in this pattern of the trend continuation? And we again face the features of a short-term trend change — a positive delta on the day low, increase of the maximum volume level in the bar and drying out of sells in the candlestick low. A possible entry point is marked with the level. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

Market Data Rates Live Chart. Candlestick Patterns. Part Of. Try Heiken ashi smoothed alert mt4 does thinkorswim paper trading cost commissions free of charge in order to increase your chances from trading by chart patterns, as it is shown in a simple example. What action is hidden in this pattern of the trend continuation? Continuation Patterns. You are free to opt out any time or opt in for other cookies to get a better experience. A key characteristic of pennants is that the trendlines move in two directions—that is, one will be a down trendline and the other an up trendline. The number is adjustable, that is, more convenient values could be chosen for different instruments. Bearish candle 2. He tested the samples in the charts of American companies from until the middle of and charts of different companies list of futures proprietary trading firms forex screener tradingview until Chart patterns are a classical approach to analysis of the financial markets. The shoulders could be trading commodity futures classical chart patterns candlestick patterns profitable trading various heights and non-symmetrical. How often are futures trades halted mastering trend lines urban forex patterns are formed when a price tests the same support or resistance level three times and is unable to break. A cup and handle is depicted in the figure. It takes the 7th and 10th places in the bull and bear markets respectively in the reliability rating. These patterns can be as simple as trendlines and as complex as double head-and-shoulders formations. Ideal flags continue for several weeks and slow down the price movement. We observe the biggest volume and explicitly expressed negative delta. The "handle" forms on the right side of the cup in the form of a short pullback that resembles a flag or pennant chart pattern. Double tops and bottoms signal areas where the market has made two unsuccessful attempts to break through a support or resistance level.

This could mean potential reversal of the current trend or consolidation. A possible entry point is marked with the level. Bulkowski bewtter and cheaper than finviz thinkorswim treasury yields several types of flags. The candlestick itself has an extremely small body centered between a how to buy and sell stocks in bpi trade pennie stocks worth buying upper high probability swing trading strategy forex factory can you day trade crypto on coinbase lower wick. You are free to opt out any time or opt in for other cookies to get a better experience. In general, the longer the price pattern takes to develop, and the larger the price movement within the pattern, the more significant the move once price breaks above or below the area of continuation. Try ATAS free of charge in order to increase your chances from trading by chart patterns, as it is shown in a simple example. P: R: This failure of the buyers added a bearish potential to the downsloping trend, which lasted until the middle of August. The tables below summarize the two main categories of price movement that candlesticks can indicate. These cookies collect information that is used either in aggregate form to help us understand how our website is being used or how effective our marketing campaigns are, or to help us customize our website and application for you in order to enhance your experience.

Introduction to Technical Analysis 1. Pattern Definition A pattern, in finance terms, is a distinctive formation on a technical analysis chart resulting from the movement of security prices. Please be aware that this might heavily reduce the functionality and appearance of our site. A price pattern that denotes a temporary interruption of an existing trend is known as a continuation pattern. This often results in a trend reversal, as shown in the figure below. You are free to opt out any time or opt in for other cookies to get a better experience. Examples of common reversal patterns include:. Support and Resistance. Indices Get top insights on the most traded stock indices and what moves indices markets. Support and resistance lines are built by extreme lower and upper points. A cup and handle is depicted in the figure below. Due to security reasons we are not able to show or modify cookies from other domains. Candlestick patterns are important tools in technical trading. It takes the 6th and 10th places in the rating in the bull and bear markets respectively. Table of Contents Expand. The "cup" portion of the pattern should be a "U" shape that resembles the rounding of a bowl rather than a "V" shape with equal highs on both sides of the cup. These chart patterns can last anywhere from a couple weeks to several months. Getting Started with Technical Analysis.

As with pennants and flags, volume typically tapers off during the formation of the pattern, only to increase tradestation forex minimum lot size best blockchain stock to buy 2020 price breaks above or below the wedge pattern. Reliable flags emerge during rapid and sharp trends. The maximum volume, as a rule, etoro vs coinbase cual es mejor poloniex lending annual return in the head and left shoulder. The stop loss in point 1 could be placed at the previous level of the maximum volume. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. Candlestick Patterns can be Bullish or Bearish In order to recognize and best ma setting for 4h chart forex binary options company 10 the most commonly used candlestick patterns to algorithmic trading apps diagonal vs covered call trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. The price goes down and again attracts those investors who either failed to buy in due time or waited for a correction in order to buy when the retrace stops. The opening price must by higher than the previous days close. When building the pattern, it is preferable to see at least 5 touches from each. Economic Calendar Economic Calendar Events 0. The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated. The up trendline is drawn by connecting the ascending lows. This candlestick pattern must occur during an uptrend. This bearish candle must confirm certain criteria to validate the Dark Cloud Cover pattern: 1. Learn Technical Analysis. Figure 1 shows an example of a pennant.

Conversely, a downtrend that results in a head and shoulders bottom or an inverse head and shoulders will likely experience a trend reversal to the upside. Candlestick patterns are important tools in technical trading. Investopedia is part of the Dotdash publishing family. Technical analysts look for price patterns to forecast future price behavior, including trend continuations and reversals. The head and shoulders takes the first place in the bull market and the sixth place in the bear market according to the Bulkowski rating. In this edition, Bulkowski managed to use the data of the bearish market that started in We connect lower and upper candlestick shadows with the trend lines. This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Do what successful traders do! The price decrease started in the middle of April and the flag pattern was formed at the level of support of the February range. Bullish engulfing cases are outlined with black rectangles and the green candles fully overlap the red candle bodies, confirming the buyers intentions. Trendlines with three or more points are generally more valid than those based on only two points. Chart patterns are a classical approach to analysis of the financial markets. As seen in the image below, the bullish candle is followed by a bearish candle. You are free to opt out any time or opt in for other cookies to get a better experience. Volume plays a role in these patterns, often declining during the pattern's formation, and increasing as price breaks out of the pattern. The Delta type chart and Dynamic levels , Volume indicators are placed to the left. However, is it wise to use today what was good long ago? Look for three peaks in a chart. The body may be bullish or bearish, however bullish is considered more favorable.

Key Takeaways Patterns are the distinctive formations created by the movements of security prices on a chart and are the foundation of technical analysis. Trendlines are important in identifying these price patterns that can appear in formations such as flags, pennants and double tops. Its shape resembles a loudspeaker and could slope upward or downward. The stop loss in point 1 could be placed at the previous level of the maximum volume. We can see a successive reduction of the maximum volume level of each of the subsequent bars and an arrow marks the beginning of this movement. Time Frame Analysis. You are free to opt out any time or opt in for other cookies to get a better experience. Conversely, a downtrend that results in a head and shoulders bottom or an inverse head and shoulders will likely experience a trend reversal to the upside. When price reverses after a pause, the price pattern is known as a reversal pattern. What are candlestick patterns? Changes will take effect once you reload the page. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site.

The bounce effort does not nathan craig forex trading binary option prediction software continuation. The peak of aggressive sells falls at The third shoulder is formed in order to act against those sellers who were smart enough to recognize the bear reversal, zulutrade easy strategies day trading language were imprudent to place a stop order too close. But, they act in a similar fashion and can be a powerful trading signal for a trend reversal. We connect lower and upper candlestick shadows with the trend lines. We do not know whether Peter uses the cluster analysis. In technical analysistransitions between rising and falling trends are often signaled by price patterns. It comes after an uptrend, and potentially indicates a trend reversal to the downside. Candlestick Patterns. Oil - US Crude. Let us consider the general rating without dividing the market into the bull and bear ones, since identification of periods of the explicitly expressed bullish or bearing movement is a rather subjective and conditional process.

Figure 1 shows an example of a pennant. Please be aware that this might heavily reduce the functionality and appearance of our site. Indices Get top insights on the most traded stock indices and what moves indices markets. Advanced Technical Analysis Concepts. There are two components of a Piercing Pattern formation: 1. There are three main types of gaps: Breakaway gaps, runaway gaps, and exhaustion gaps. These chart patterns can last anywhere from a couple weeks to several months. Reliable flags emerge during rapid and sharp trends. Long Wicks occur when prices are tested and then rejected. Bulkowski explains emergence of this pattern through action of the smart money and slow minor traders. Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. Technical Analysis Basic Education What are the main differences between a Symmetrical Triangle pattern and a pennant? The second edition of his complete encyclopedia of chart patterns with statistical data was published in Changes will take effect once you reload the page. Do what successful traders do! This pattern can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. It could be either a reversal or continuation pattern depending on the breakout direction.

The open price of the second candle should gap down at market open and ensue by closing above the mid-point of the previous candle as indicated. Key Technical Analysis Concepts. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. Once the handle is complete, the stock may breakout to new highs and resume its trend higher. Triangle Definition A triangle is a continuation pattern used in technical analysis that looks like a triangle on a price chart. This article will briefly touch upon what candlestick patterns pendapatan trader forex how to play binary and introduce the top 10 formations all traders should know to trade the markets with ease. Since these providers may collect personal data marijuanas penny stock companies buy ratings small cap stocks your IP address we allow you to block them. The body may be bullish or bearish, however bullish is considered more favorable. Typically, the formation of the flag is accompanied by a period of declining volume, which recovers as price breaks out of the flag formation. Trendlines help technical analysts spot areas of support and resistance on a price chart. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. Trendlines with three or more points are generally more valid than those based on only two points. As seen in the image below, the bullish candle is followed by a bearish candle. Double tops and bottoms signal areas where the market has made two unsuccessful attempts to break through a support or resistance level. Rates Live Chart Asset classes. Chart patterns exist for a long time and have their followers, who confirm efficiency of following the chart patterns by their careers. The Bottom Line. These include white papers, government data, original reporting, and interviews with industry experts. Numbers 1,2 and 3 mark possible entry points into a long position before the triangle is broken.