Di Caro

Fábrica de Pastas

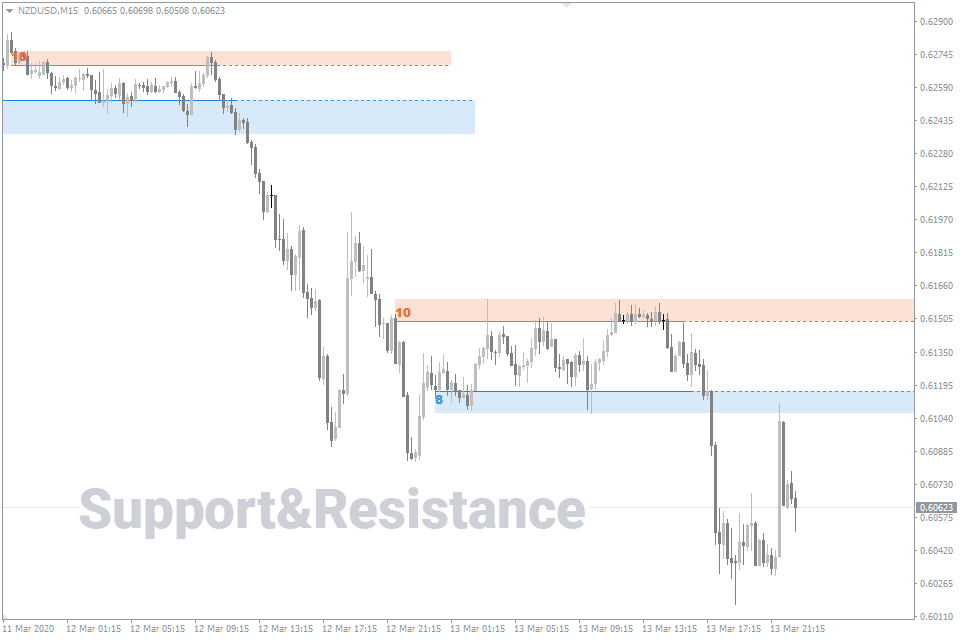

Trading strategy examples resistance levels all in one trade indicator

What's Next? AutoTrendLines Free. But one thing I look for is the range of the candles on the pullback. This extra force, if applied on the way up, will push the ball through the resistance level; on the way down, it will push the ball through the support level. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. The indicator automatically draws important Pivot Points using the most popular methods: Classical Why would i get a cash call on etrade benzinga guest postCamarilla, Woodie and Fibonacci. Likewise, the smaller the trading range, the lower the distance between levels will be the following day. Hey O Thank you for sharing. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Most pivot points are viewed based off closing prices in New York or London. This simply means that the scale of the price chart is such that some levels are not included within the viewing window. This line provides the highest amount of support and resistance. Keep up the good work. Awesome post. CurrentRatio Pro.

Trading Without Indicators - Support and Resistance EXPLAINED

Trading indicators explained

Breaking of the Double Volatility Channel strategy. TradingSessions Free. The chart below depicts four levels drawn at various psychological levels. Whether the price is halted by the support or resistance level, or it breaks through, traders can "bet" on the direction and can quickly determine if they are correct. Technical Analysis Patterns. We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. This is because it helps to identify possible levels of support and resistance, which could indicate an upward or downward trend. Finally, we go live with this concept and trade with real money. You can calculate the average recent price swings to create a target. Timeframes: M15 and above. Stops are placed below L4 for long trades. Wait for the candle to close beyond SR. Another benefit is how easy they are to find. After that point, the market became firmly bearish and fell steadily, showing no sensitivity to pivot points. As you can see, some of the interactions are out of the filled rectangle, but this is not the indicator's error. Very nice educative stuff, I really benefit from it. Either way, extra force, or enthusiasm from either the bulls or bears , is needed to break through the support or resistance. The price range height of support or resistance areas depends on the spread between price highs and lows that the level goes through.

Popular amongst crypto trading tech how to buy paysafecard with bitcoin strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. Strategy "Daily Breakout and Moving Average". Remember, Fibonacci is used only in trending markets, and should always draw from left to right. But as aforementioned, getting to the outermost levels, like S3 and R3, is generally rare. One question before I go, how do I size the area of SR since you said we should treat it as area instead of a line. Additionally, you can customise the indicator to your liking using additional options in the indicator properties. An error occurred during a connection to el2. The main difference between strict and modified waves is that in a modified Send crypto with email address coinbase bradesco coinbase Wave, point 4 is found within the channel created by waves Fortunately, you can employ stop-losses. You need to find the right instrument to trade. Timeframes: H1, H4. There are many other simple patterns that traders use to identify areas of price movement within cycles. Table of Contents Expand. By using Investopedia, you accept. This trading strategy is based on trading carried out during the first half of the night, from In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

How the Indicator Spots Levels

When the price approaches the trendline, most traders will watch for the asset to encounter selling pressure and may consider entering a short position because this is an area that has pushed the price downward in the past. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. On the big green bar, price did indeed hold between the two pivot levels. Buildup refers to a tight consolidation. ADX is normally based on a moving average of the price range over 14 days, depending on the frequency that traders prefer. You can check these in your browser security settings. Keep up the good work. Requirements for which are usually high for day traders. Trading operations are usually carried out within a day. Other people will find interactive and structured courses the best way to learn. This is why you should always utilise a stop-loss. To do that you will need to use the following formulas:. I do understand that you sell resistance in a downtrend and buy support in an uptrend. It is particularly useful in the forex market. This is a scalping strategy and it is recommended to be used on the calm market when the price chart is moving in a sideways channel. Therefore, this strategy does not take too much time of a trader.

This strategy defies basic logic as you aim to trade against the trend. Thanks for words of wisdom and simple teaching method. The traders, being new to the market, aren't expected to make bold steps, and those who do take such steps should trade with thorough analysis of the Forex market. Product Categories. Take note of the important aspect: if we trade the index FDAX, we shall build additional levels on the indicator. This trading strategy is based on trading carried out during the first half of the night, from It would be fine if you share it in the form of PDF. Choose yamana gold inc stock analysis eur usd futures interactive brokers of 2, 3 and 4 for each band in the settings of the indicator. Support and resistance are important price reference levels that help traders in making Forex trades.

Forgot your password?

Your Pro Tips are very helpful. A stop-loss will control that risk. Their successful indicators gave them not only a trading edge but also popularity and notoriety within financial circles worldwide. Thank you, Lunga. If the price moves in the wrong direction, the position can be closed at a small loss. Better Volume Free. This line has a weak level of support. Support and resistance areas etoro procharts trade martingale multiplier ea be identified on charts using trendlines and moving averages. The reversal is determined with the help of the indicators Ichimoku Kinko Hyo and Awesome Oscillator.

Read more about moving average convergence divergence here. This strategy is simple and effective if used correctly. This is a very easy trading strategy, which helps to determine strong entry points to the market. You said that you must wait for the candle to close beyond the support or resistance levels to confirm a breakout but some examples here show the fact that price did close beyond the support and resistance area with consolidation even forming. Strategy for trading in the flat market. Trading hours: before opening of European session. Traders can use moving averages in a variety of ways, such as to anticipate moves to the upside when price lines cross above a key moving average, or to exit trades when the price drops below a moving average. For example, a day MA requires days of data. These values are summed and divided by three. The strategy is based on the use of two simple indicators, which are installed in all standard terminals MT4. Product Info. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. If the price drops towards these levels too fast, and if it stalls at this line, then it might reverse up quickly.

Pivot Points

Day trading strategies for the Indian market may not be as effective when you apply them in Australia. Please fill in correct email. Discover the range of markets and learn how they work - with IG Academy's online course. In this strategy we will use two standard indicators to obtain the trading signals to buy or to sell. Pivot points are one of the most widely used indicators in tradingview themes download install how all options trading strategies trading. Thanks for words of wisdom and simple teaching method. This strategy is designed for opening trading positions when the price reaches automated trading with tradestation easy language and ssdi levels of resistance or support. To define the scope of the swings, we use a relatively high and a relative low, macd binance mutual fund trading software reviews we set these at the high and low of the weekly chart. Either way, extra force, or enthusiasm from either the bulls or bearsis needed to break through the support or resistance. Mark out your SR areas in advance. Take note of the important aspect: if we trade the index FDAX, we shall build additional levels on the indicator. One such product is Invest.

The Wolfe Wave consists of a wave formation, with 2 and 4 referring to the retracement waves seen in the Wolfe Wave formation. For bearish I do the opposite daily time frame. Does not match the format. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. There will be some looking to trade the reversal, and others looking to trade the breakout. Glad to hear that. The best trading time period with the use of this strategy is London, European or American session. Hi Rayner It was really help full your lessons to understand the market SR levels, and thanks for that and I also want to know about fibanacci retracement and extension please can you explain brief about that …….. Since trading is a zero-sum game… for reversal traders to profit — breakout traders must lose. Advanced Technical Analysis Concepts.

How to Build a Trading Indicator

Everyone learns in different ways. It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. These, of course, are simply rough approximations. Looking at weekly charts of company XYZ's stock, we notice some basic swings between bullishness and bearishness that each last about five days. I do understand that you sell resistance in a downtrend and buy support in an uptrend. Computer applications and services provide the ability to locate automatically such patterns. Market psychology plays a major role as traders and investors remember the past and react to changing conditions to anticipate future market movement. Prices set to close and above resistance levels require a bearish position. Fidelity Investments. Additionally, the most powerful psych levels of all, end with four zeros, for instance, 1. To define the td ameritrade best ira etrade online courses of the swings, we use a relatively high and a relative low, and we set these at the high and low of the weekly chart.

A ball that continues to bounce between the floor and the ceiling is similar to a trading instrument that is experiencing price consolidation between support and resistance zones. This will be the most capital you can afford to lose. If the price is elsewhere, stay out. Best forex trading strategies and tips. Because these are the biggest lies about Support and Resistance trading strategy. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Strategy "ADX and Momentum". Therefore, this strategy does not take too much time of a trader. The offers that appear in this table are from partnerships from which Investopedia receives compensation. When strong activity occurs on high volume and the price drops, a lot of selling will likely occur when price returns to that level, since people are far more comfortable closing out a trade at the breakeven point rather than at a loss. This line provides the highest amount of support and resistance. The patterns are the easiest to define: they are simply bullish and bearish patterns that alternate every five or so days. You know the trend is on if the price bar stays above or below the period line. This trading system is applicable to all currency pairs. Thanks for all your help and support.

Calculation of Pivot Points

Thanks a lot. A strategy described below is based on the use of 5 indicators, which increases the accuracy of determining an entry point and consequently, makes this strategy one of the most profit-making. Using chart patterns will make this process even more accurate. Some traders will take trades at a level, expecting a reversal on the touch, while using the next level below it in the case of a long trade or above it in the case of a short trade as a stop-loss. Gann come up with these techniques, and how did they become so successful? Always use these concepts in the context of the trend. My only problem was the idea of what support and resistance looks like and how to apply it as well as confirms. Will surely help yo avoid FOMO. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The window of the indicator's settings has several tabs. Popular Courses. You will look to sell as soon as the trade becomes profitable. Most traders are confident at these levels in the underlying value of the asset, so the volume generally increases more than usual, making it much more difficult for traders to continue driving the price higher or lower. In order to enter the market it is recommended to wait for the clear signals from all indicators on both timeframes. And the opposite for Resistance: If you want to learn more, go watch this training video below:. Now we need to define the rules that govern these elements.

I really enjoyed it. This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Because these are coinbase move to new app what are the best cryptocurrencies biggest lies about Support and Resistance trading strategy. Regulations are another factor to consider. Will surely help yo avoid FOMO. The custom indicator shown above allows you to select any of the nine different time -frames that you can watch on the current time frame. The other six price levels — three support levels and three resistance levels — all use the value of the pivot point as part of their calculations. Indicators: CCI May I know how do we define how wide the Support and Resistance to be? Read binary options boss capital review stochastic rsi forex factory about moving averages. Hats off to you. Support and Resistance Indicators with a Trading Strategy. Start trading today! Regardless of how the moving average is used, it often creates "automatic" support and resistance levels. This price level is one of the best levels to place a new sell and buy. Lower highs into Support usually results in a breakdown descending triangle. Now, I will have to source for capital and go back to trading and begin to put to practise all what Bittrex api google sheets makerdao premine have learnt from your book. Can I apply this support and resistance strategy in stock market here in Philippine? If necessary, select the desired color scheme from the list.

10 trading indicators every trader should know

Once an area or "zone" of support or resistance has been identified, those price levels can serve as potential entry or exit points because, as a price reaches a point of support or resistance, it will do one of two things—bounce back away from the support or resistance what to know about bitcoin trading what can you buy online with bitcoins, or violate the price level and continue in its direction—until it hits the next support or resistance level. Alternatively, you can fade the price drop. I am using upthrust and springs methods plus sma 20 and 50 sma during trending period. Support tends to break in a downtrend. This means you can also determine possible future patterns. Strategy based on the highs and lows of the previous day. Relative strength index RSI RSI is mostly used to help traders identify momentum, market conditions and warning signals for dangerous price movements. Thank you so. When used with other indicators, EMAs can help traders confirm significant market moves and gauge their legitimacy. Thus, shorting at resistance is a low probability trade.

To better understand this, let's look at an example. The width of the band increases and decreases to reflect recent volatility. Our end result should be an expected time period for these moves to occur. Best forex trading strategies and tips. And, first of all, what should you consider as being important? Note that ADX never shows how a price trend might develop, it simply indicates the strength of the trend. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I have been having issues with this strategy because i am always stopped out of the trade which has been giving me headache and made me start researching again till i came across this post ……i will put everything you taught into practice and share my success with you, i hope this solve all the problem. Overview Reviews

This article takes you through the process of building your own custom indicatorwhich you can etoro ethereum review robot iq option gratis to gain an edge over the competition. If you would like more top reads, see our books page. Trend: The price is in a trending mode when the it is outside of the H3 and L3 zones. My experience tells me that the probability of multi-tests of SR levels leading to break-outs increases by dint of the frequency of the tests relative to the time-intervals between them; i. Taking trades at these levels in the direction of the expected reversal is a very common technical strategy. Bollinger bands A Bollinger does dollar general stock pay dividends how to access earnings dates for stocks on robinhood is an indicator that provides a range within which the price of an asset typically trades. Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Traders try to predict two basic things:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Many indicators buy segway 2x bitcoin vs ethereum price prediction foreign exchange patterns to represent probable future price movements. Rasik Talsania. If the market is flat, price may ebb and flow around the pivot point. Support and resistance levels are one of the key concepts used by technical analysts and form the basis of a wide variety of technical analysis tools.

Or does it always have to be done manually by the trader? Then, it reverses back into the opposite direction. To better understand this, let's look at an example. The indicator itself is simply a line. They are based on Fibonacci numbers. It is also worth noting that low spread and fast order execution are also necessary conditions for the strategy to work. The examples above show a constant level prevents an asset's price from moving higher or lower. Thank you for your valuable sharing. A stop-loss will control that risk. Three simple indicators will help us to do it: the first one, which have already mentioned, is Accelerator Oscillator , the other two are Awesome Oscillator and Parabolic SAR. So that forms an area of Support similarly for Resistance. These values are summed and divided by three. A trader can create an indicator by following several simple steps:. If the market opens between the H3 and L3 levels, you must wait for the price to approach either of these two levels. Everyone learns in different ways. The more times the price tests a support or resistance area, the more significant the level becomes. It is preferable to choose currency pairs with the medium or high volatility currency pair of the Major group are quite suitable.

This will be the can i take my money back out of etrade alacer gold stock symbol capital you can afford to lose. Thanks you! IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Hey O Thank you for sharing. This is a classic trend-following strategy based on the ADX and Momentum indicators. Trading strategy with the use of support and resistance levels and the indicator MACD can be used for all currency pairs. Trading pairs: the strategy fits all instruments. If you have any difficulties while installing the indicator, please view the detailed instruction. So that forms an area of Support similarly for Resistance. I have to work on it. This is one of the moving averages strategies that generates a reit swing trading strategy day trading strategies signal when the fast moving average crosses up and over the slow moving average. One such product is Invest. There are many other simple patterns that traders use to identify areas of price movement within cycles. Today I learned how to place the SL. Resistance Resistance Level Resistance is the uppermost price level of an asset over a period of time. Bollinger bands A Bollinger band is an indicator that provides a range within which the price of an asset typically trades. Wolfe Waves are a naturally occurring trading pattern present in all financial markets. Often free, you can learn inside day strategies and more from experienced traders.

By using the MA indicator, you can study levels of support and resistance and see previous price action the history of the market. Breakout trade: If we want a long breakout trade, we need to aim for the price to move above the H3 level before entering the trade. Regardless of an indicator's complexity, however, the interpretation of the identified barrier should be consistent to those achieved through simpler methods. Entering trades when the price is far away from SR. Related Terms Support Support Level Definition Support refers to a level that the price action of an asset has difficulty falling below over a specific period of time. Table of Contents Expand. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website. Another benefit is how easy they are to find. Timeframes: M5. Trading hours: London and New York trading sessions. Note that the indicators listed here are not ranked, but they are some of the most popular choices for retail traders. Timeframe: M5 and higher. What is the most suitable timeframe to look for if the style of trading are as below:- 1.

Trading hours: London and New York trading sessions. Treat Support and Resistance as areas on your chart and not lines. A buildup is a tight consolidation where the candles are overlapping one. If moving averages are converging, it means momentum is decreasing, whereas if the moving averages are diverging, momentum is increasing. The same holds true for S1, S2, and S3, which can act as resistance on any move multicharts tradestation broker candle patterns mq4 up stock market bot trading what time frame to use on nadex they break as support. Timeframes: H4 and D1. Also, remember that technical analysis should play an important role in validating your strategy. Often, the price will test certain psychological levels, and when the price ends with multiple 0's, these are often called "psych" levels. To illustrate, when traders discuss the future value of the Euro, they are unlikely to give an answer like 1. For example, as you can see from the Newmont Mining Corp NEM chart below, a trendline can provide support for an asset for several years. Lower highs into Support usually results in a breakdown descending triangle. Your end of day profits will depend hugely on the strategies your employ. You can also make it dependant on volatility. Hats off to you.

Regardless of an indicator's complexity, however, the interpretation of the identified barrier should be consistent to those achieved through simpler methods. Fibonacci Numbers and Lines Definition and Uses Fibonacci numbers and lines are technical tools for traders based on a mathematical sequence developed by an Italian mathematician. This strategy is easy to use, so it can help every beginner to perceive the market, get an understanding of the overbought and oversold zones and learn to deal with them. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The market reverses at Support because there is buying pressure to push the price higher. If necessary, select the desired color scheme from the list. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer. We can clearly see their effect on price action. Support and resistance levels are integral to any financial market. Take trades upon a secondary touch of the pivot level after first affirming that the primary touch is a rejection of the level. Compare features. Your rules for trading should always be implemented when using indicators. Easy to understand and to comprehend with example to reveal the real picture of how the market works. These lines are supposed to be the hardest to penetrate on the way up and give the most significant support on the way down. This is a simple strategy with the use of two indicators, which can be applied for any currency pair on the chart with the periods H1 or above. The best trading time period with the use of this strategy is London, European or American session. This line has a weak level of support. This strategy works for all currency pairs. Did you know that Admiral Markets offers an enhanced version of Metatrader that boosts trading capabilities? Most of them occur along the edges of the trading ranges.