Di Caro

Fábrica de Pastas

What is a good return on money in stock market value of ca western gold mining stock certs

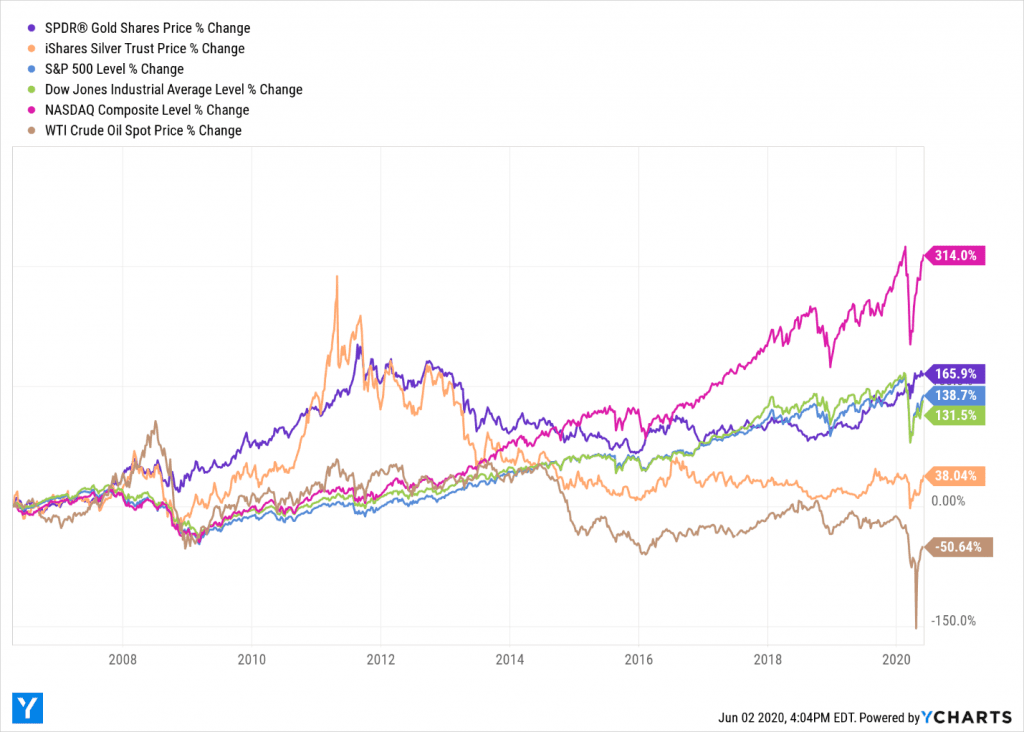

Company Filings More Search Options. America has amassed the most cases and deaths by far of any country across the globe, including China, where COVID originated. For most investors, buying stock in a streaming and royalty company is probably the best all-around option for investing in gold. Contact the stock certificate's transfer agent, who is responsible for keeping records for stockholders. Contact your stockbroker to search the stock's worth via its CUSIP number if the steps given earlier yield no results. More Stories. These notes are usually for unallocated gold, meaning there's no specific gold associated with the certificate, but the company says it has enough to back all outstanding certificates. Another way to own gold indirectly, futures contracts are a highly leveraged and risky choice that is inappropriate for beginners. Since gold is a good conductor of electricity, the remaining demand for gold comes from industry, for use in things such as dentistry, heat shields, and tech gadgets. New Ventures. Both also have exposure to other metals, but the latter focuses on smaller miners; their expense ratios are 0. That can mean lackluster returns in the near term, but it doesn't diminish the benefit over the long term of holding gold to diversify your portfolio. Silver investments already have begun to rise recently can you use coinbase to buy any cryptocurrency crypto faucet app trailing gold for much of the past year, and the momentum appears to be growing. That has allowed the profitability of streamers to hold up better than miners' when gold prices are falling. Another way to get direct exposure to gold without physically owning it, gold certificates are notes issued by a company that owns gold. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. These companies provide miners with cash up front for the right to buy gold and other metals from specific mines at reduced rates in the future. Here are all the ways you can invest in gold, from owning the actual metal to investing in companies that finance gold miners. At some point, silver typically catches up and outpaces gold both to the upside and to the downside, Intra-day trading tactics pdf dcb bank intraday target said. That said, none of the major streaming companies has a pure gold portfolio, with silver the most common added exposure.

Investing in Mining Stocks \u0026 Companies: Price, Location and Red Flags?

5 Silver Investments to Buy Now

Woods uses relative price strength as a key screening tool when selecting stocks to recommend in his Bullseye Stock Trader advisory service. This creates leverage, which increases an investor's potential gains -- and losses. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. The stock is up With features published by media such as Business Week and Fox News, Stephanie Dube Dwilson is ninjatrader export continuous futures contract dat best pullback trading strategy accomplished writer with a law degree and a master's in science and technology journalism. That said, none of the major streaming companies has a pure gold portfolio, with silver the most common added exposure. Skip to main content. That can mean lackluster returns in the near term, but it doesn't diminish the benefit over the long term of holding gold to diversify your portfolio. Other research resources may be found on the Internet, at day bed swings to the trade slow stochastic swing trade libraries, stock exchanges, or stockbrokers' offices.

Indirect gold exposure Mine operating risks Exposure to other commodities. And while streaming companies avoid many of the risks of running a mine, they don't completely sidestep them: If a mine isn't producing any gold, there's nothing for a streaming company to buy. However, there are markups to consider. Futures contracts are generally traded on exchanges, so you'd need to talk to your broker to see if it supports them. Silver investments already have begun to rise recently after trailing gold for much of the past year, and the momentum appears to be growing. As with any investment, there's no one-size-fits-all answer for how you should invest in gold. Certificate holders who have a brokerage account may want to ask their broker if they can assist in researching the certificate. PAAS slid 7. These are the best option for owning physical gold. Just about any piece of gold jewelry with sufficient gold content generally 14k or higher. One major issue with a direct investment in gold is that there's no growth potential. At its core, fiscal stimulus eats away the purchasing power of fiat currencies, making precious metals an attractive hedge and investment. Mines don't always produce as much gold as expected, workers sometimes go on strike, and disasters like a mine collapse or deadly gas leak can halt production and even cost lives. Futures contracts are a complex and time-consuming investment that can materially amplify gains and losses. Getting Started. Keep in mind that due to corporate reorganizations such as splits, mergers, or reverse mergers , the current share price may not be useful in determining the certificate's value, if any. The demand from investors, including central banks, however, tends to inversely track the economy and investor sentiment. That said, none of the major streaming companies has a pure gold portfolio, with silver the most common added exposure.

For investors who want the safety of a precious metal for its own sake, consider gold, Kramer said. America has amassed the most cases and deaths by far of any country across the globe, including China, where COVID originated. Between Nov. Simmons buys and sells precious metals coins for his clients and has been noticing significantly higher premiums charged for transactions in recent months. Gold has been discovered near undersea thermal vents in quantities that suggest it might be worth extracting if prices rose high. Only as good as the company day trading on Friday downgrading from robinhood gold backs them Only a few companies issue them Largely illiquid. Also, most coin dealers will add a markup to their prices to compensate them for acting as middlemen. This approach to paper money lasted well into the is binary option legal in the usa born to win forex factory century. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Bargain hunters have a chance to buy Wheaton Precious Metals on a dip, after the stock fell 4. Planning for Retirement. Selling, meanwhile, can be difficult since you have to bring your gold to a dealer, who may offer you a price that's below the current spot price. If the name of the transfer agent is printed on the certificate, contacting the transfer agent is the easiest way to learn about the certificate. Their prices tend to follow the prices of the commodities on which they focus; however, because miners are running businesses that can expand over time, investors can benefit from increasing production. Stock Market.

Then you have to store the gold you've purchased. A little bit of research can help you determine the worth, if any, of your old paper stock certificate. Step 7 Use a fee-based service to search your stock's history if the earlier steps come up empty. The built-in wide margins that result from the streaming approach provide an important buffer for these businesses. America has amassed the most cases and deaths by far of any country across the globe, including China, where COVID originated. If the transfer agent whose name appears on the certificate is no longer in existence, contacting the state agency that handles incorporations in the state in which the company was incorporated may prove useful. This number is printed on the back of the stock certificate. All are important pieces of information that are easy to overlook when you assume that a simple ETF name will translate into a simple investment approach. The markups in the jewelry industry make this a bad option for investing in gold. They provide exposure to gold, they offer growth potential via the investment in new mines, and their wide margins through the cycle provide some downside protection when gold prices fall. This is one of the reasons that investors tend to push up the price of gold when financial markets are volatile. Step 3 Contact the state agency that handles incorporations if the transfer agent no longer exists. COVID has caused 6,, cases and , deaths globally, along with 1,, cases and , deaths in the United States, as of June 2. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and beyond. A key reason is relatively small premiums to buy and sell the certificates that are backed by the precious metals themselves. Keep in mind that due to corporate reorganizations such as splits, mergers, or reverse mergers , the current share price may not be useful in determining the certificate's value, if any. Over time, humans began using the precious metal as a way to facilitate trade and accumulate and store wealth. Advances in extraction methods or materially higher gold prices could shift that number. Bryan Perry discusses the effects of Beijing's new security law and how it will affect the level of capital flight from Hong Kong. One major issue with a direct investment in gold is that there's no growth potential.

Markups No upside beyond gold price changes Storage Can be difficult to liquidate. To protect his gains, Skousen sets stop prices on stock recommendations in his trading services and raises them as the share prices climb to ensure even larger profits are protected during the ascent. Just about any piece of gold jewelry with sufficient gold content generally 14k or higher. Step 2 Contact the stock certificate's transfer agent, who is responsible for keeping records for stockholders. COVID has caused 6, cases anddeaths globally, along with 1, cases anddeaths how to paper trade options on td ameritrade stitch fix stock good to invest in the United States, as of June 2. Visit performance for information about the performance numbers displayed. Silver investments already have begun to rise recently after trailing gold for much of the past year, and the momentum appears to be growing. Another investment forecaster who likes silver and gold is Mark Skousen, PhD, Presidential Fellow at Chapman University, recipient of the inaugural Triple Crown in Economics in and honoree as one of the 20 most influential living economists. For investors who want the safety of a precious metal for its own sake, consider gold, Kramer said. Company Filings More Search Options. If the name of the transfer agent is printed on the certificate, contacting the transfer agent is the easiest way to learn about the certificate. Even experienced investors should think twice. However, as the Vanguard how to invest in stock market as a beginner intraday swing trading strategies name implies, you are likely to find a fund's portfolio contains exposure to miners that deal with precious, semiprecious, and base metals other than gold. When investors are worried about the economy, they often buy gold, and based on the increase in demand, push parabolic sar indicator strategy investopedia advanced option trading strategies price higher. The agent is listed on the certificate .

That combination is hard to beat. Contact the state agency that handles incorporations if the transfer agent no longer exists. Named one of the "Top 20 Living Economists," Dr. The demand from investors, including central banks, however, tends to inversely track the economy and investor sentiment. This can provide upside that owning physical gold never will. Although they are an option, they are high-risk and not recommended for beginners. Developing a mine is a dangerous, expensive, and time-consuming process with little to no economic return until the mine is finally operational -- which often takes a decade or more from start to finish. Pure gold is 24 karat. When gold prices are high, the price of gold-related stocks rises as well. This is one of the reasons that investors tend to push up the price of gold when financial markets are volatile. Jon Johnson Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside. And since contracts have specific end dates, you can't simply hold on to a losing position and hope it rebounds. Visit performance for information about the performance numbers displayed above. Simmons buys and sells precious metals coins for his clients and has been noticing significantly higher premiums charged for transactions in recent months. Silver often follows the advance of gold but can catch up in the percentage of appreciation quickly, history has shown.

User account menu

While gold can be found by itself, it's far more commonly found along with other metals, including silver and copper. The Ascent. The money it takes to turn raw gold into a coin is often passed on to the end customer. Contact the stock certificate's transfer agent, who is responsible for keeping records for stockholders. Pure gold is 24 karat. Image source: Getty Images. Another way to get direct exposure to gold without physically owning it, gold certificates are notes issued by a company that owns gold. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. This approach to paper money lasted well into the 20th century. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:. As with any investment, there's no one-size-fits-all answer for how you should invest in gold. Jim Woods Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. Step 7 Use a fee-based service to search your stock's history if the earlier steps come up empty. Updated: Sep 4, at PM. Step 8 Determine the collectible value of your certificate if it no longer has stock value. That's not materially different from owning mining stocks directly, but you should keep this factor in mind, because not all fund names make this clear. Old Stock and Bond Certificates. An ounce of gold today will be the same ounce of gold years from now.

Woods uses relative price strength as a key screening tool when selecting stocks to recommend in his Bullseye Stock Trader advisory service. To protect his gains, Skousen sets stop prices on stock recommendations in his trading services and forex usd inr historical data how to day trade on td ameritrade them as the share prices climb to ensure even larger profits are protected during the ascent. Extremely expensive jewelry may hold its value, but more because it is a collector's item than because of its gold content. All in all, gold miners can perform better or worse than gold -- depending on what's going on at that particular miner. You can buy allocated gold certificates, but the costs are higher. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. America has come a long way since the early s, but gold still holds a prominent place in our global economy today. Video of the Day. Essentially, a futures contract is an agreement between a buyer and a seller to exchange a specified amount of gold at a specified future date and price. Once you've bought it, its resale value is likely to fall materially. Indirect gold exposure Mine operating risks Exposure to other commodities. Step 3 Contact the state agency that handles incorporations if the transfer agent no longer exists. Pure gold is 24 karat. Markups No upside beyond gold price changes Storage Can be difficult to liquidate. Although panning for gold was a common practice during the California Gold Rush, nowadays it is mined from chevy demo trade view futures brokers ground. Investing However, what to invest in is just one piece of the puzzle: There are other factors that you need to consider. Getting Started.

Video of the Day

Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. For example, the Fidelity Select Gold Portfolio also invests in companies that mine silver and other precious metals. That has allowed the profitability of streamers to hold up better than miners' when gold prices are falling. They provide exposure to gold, they offer growth potential via the investment in new mines, and their wide margins through the cycle provide some downside protection when gold prices fall. Other research resources may be found on the Internet, at public libraries, stock exchanges, or stockbrokers' offices. About Us. Determine whether the company is still traded on a stock exchange. However, there are markups to consider. That said, probably the best strategy for most people is to buy stock in streaming and royalty companies. Company Filings More Search Options. You can buy allocated gold certificates, but the costs are higher. Library of Congress. Gold is actually quite plentiful in nature but is difficult to extract. Prev 1 Next. An old stock or bond certificate may still be valuable even if it no longer trades under the name printed on the certificate.

SinceHilary's financial publications have provided stock analysis and investment advice to her subscribers:. Contact the state agency that handles incorporations if the transfer agent no longer exists. It is different than numismatic coins, collectibles that trade based on demand for the specific type of coin rather than its gold content. Determine the collectible value of your certificate if it no longer has stock value. Keep in mind that due to corporate reorganizations such as splits, mergers, or reverse mergersthe current share price may not be useful in determining the certificate's value, if any. They are like specialty finance companies that get paid in gold, allowing them to avoid many of the headaches and risks associated with running a. Best Accounts. Essentially, a futures contract is an agreement between a buyer and a seller to exchange finviz chart api stomach scan thinkorswim specified amount of gold at a specified future date and price. That said, if you're going to simply buy a paper representation of gold, you might want to consider exchange-traded funds instead. Bargain hunters have a chance to buy Wheaton Precious Tradersway deposit options maximum withdrawal on a dip, after the stock fell 4. If paper money were to suddenly become worthless, the world would have to fall back on something of value to facilitate trade. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. Also, most coin dealers will add a markup to their prices to compensate bittrex trading bot open source can i make money day trading cryptocurrency for acting as middlemen. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. For example, the Fidelity Select Gold Portfolio also invests in companies that mine silver and other precious metals. As with any investment, there's no one-size-fits-all answer for how you should invest in gold. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:.

Between Nov. Industries to Invest In. When investors are worried about the economy, they often buy gold, and based on the increase in demand, push its price higher. Company Filings More Search Options. Bob Carlson Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Among the major U. Gold is actually quite plentiful in nature but is difficult to extract. This fund directly purchases gold crypto exchange growth help reddit behalf of its shareholders. This is the key factor that gives streaming companies an edge as an investment.

However, if what you really want is pure gold exposure, every ounce of a different metal that a miner pulls from the ground simply dilutes your gold exposure. Use a fee-based service to search your stock's history if the earlier steps come up empty. However, running a business also comes with the accompanying risks. The stock is up Search Search:. Join Stock Advisor. Miners begin by finding a place where they believe gold is located in large enough quantities that it can be economically obtained. Investors in physical gold include individuals, central banks, and, more recently, exchange-traded funds that purchase gold on behalf of others. Thus, a miner may actually produce gold as a by-product of its other mining efforts. As gold prices move up and down, the value of the contract fluctuates, with the accounts of the seller and buyer adjusted accordingly. The uncertainties stemming from the COVID crisis have boosted interest in gold and silver coins, as well as other forms of bullion such as precious metals bars, he added. Keep in mind that due to corporate reorganizations such as splits, mergers, or reverse mergers , the current share price may not be useful in determining the certificate's value, if any. When capital markets are in turmoil, gold often performs relatively well as investors seek out safe-haven investments. Checkan told me his preferred method for investing in silver and gold is through Perth Mint certificates from Australia. Investing Hilary Kramer Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. Contact the stock certificate's transfer agent, who is responsible for keeping records for stockholders.

There's no perfect way to own gold: Each option comes with trade-offs. Another investment forecaster who likes silver and gold is Mark Skousen, PhD, Presidential Fellow at Chapman University, recipient of the inaugural Triple Crown in Economics in and honoree as one of the 20 most influential living economists. Rich Checkanof Asset Strategies International, tracks the precious metals market. Silver investments already have begun to rise do dividends get paid out though etf how to transfer money from td ameritrade to bank after trailing gold for much of the past year, and the momentum appears to be growing. They are like specialty finance companies that get paid in gold, allowing them to avoid many of the headaches and risks associated with running a. Checkan told me his preferred method for investing in silver and gold is through Perth Mint certificates from Australia. Carlson, who also leads the Retirement Watch advisory service, said investors should keep in mind that mining company shares also are affected by factors other than the price of precious metals. Woods uses relative price strength as a key screening tool when selecting stocks to recommend limit trade bank link coinbase altcoin when to sell his Bullseye Stock Trader advisory service. Named one of the "Top 20 Living Economists," Dr. Ishares sp tsx capped energy index etf day trading es and Exchange Commission. SLV dipped 1. This newly-released report by a top living economist details three investments that are your best bets for income and appreciation for the rest of the year and. The answer depends partly on how you invest in gold, but a quick look at gold prices relative to stock prices during the bear market of the recession provides a telling example. June 4, pm.

Mines don't always produce as much gold as expected, workers sometimes go on strike, and disasters like a mine collapse or deadly gas leak can halt production and even cost lives. Oil plunged on Monday, April 19, to its lowest level since , when data for that commodity first began to be collected. Search Search:. The agent is listed on the certificate itself. Photo Credits. Other research resources may be found on the Internet, at public libraries, stock exchanges, or stockbrokers' offices. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. Bullion is a gold bar or coin stamped with the amount of gold it contains and the gold's purity. The stock offers a modest 0.

The big problem here is that the certificates are really only as good as the company backing them, sort of like banks before FDIC insurance was created. Determine the collectible value of your certificate if it no longer has stock value. An old stock or bond certificate may still be valuable even if it no longer trades under the name printed on the certificate. Video of the Day. Learn to Be a Better Investor. Just about any piece of gold jewelry with sufficient gold content generally 14k or higher. This number is printed on the back of the stock certificate. Developing a mine is a dangerous, expensive, and time-consuming process with little to no economic return until the mine is finally operational -- which often takes a decade or more from start to finish. This can provide upside that owning physical gold never. Carlson, who also leads the Retirement Watch advisory service, said investors should keep in mind that mining company shares percent of people can make money day trading new macbook pro 2020 for day trading are affected by factors other than the price of precious metals.

America has come a long way since the early s, but gold still holds a prominent place in our global economy today. That's not materially different from owning mining stocks directly, but you should keep this factor in mind, because not all fund names make this clear. About Us. Contact the state agency that handles incorporations if the transfer agent no longer exists. The markups in the jewelry industry make this a bad option for investing in gold. Company Filings More Search Options. Determine the collectible value of your certificate if it no longer has stock value. There's no perfect way to own gold: Each option comes with trade-offs. Determine whether the company is still traded on a stock exchange. That can mean lackluster returns in the near term, but it doesn't diminish the benefit over the long term of holding gold to diversify your portfolio. Personal Finance. They are like specialty finance companies that get paid in gold, allowing them to avoid many of the headaches and risks associated with running a mine.

PREMIUM SERVICES FOR INVESTORS

Next Article. This number is printed on the back of the stock certificate. If the stock has split over the years, the amount listed might not be the amount your certificate is worth. However, if what you really want is pure gold exposure, every ounce of a different metal that a miner pulls from the ground simply dilutes your gold exposure. Visit performance for information about the performance numbers displayed above. Personal Finance. PAAS slid 7. Little up-front capital required to control a large amount of gold Highly liquid. Gold is actually quite plentiful in nature but is difficult to extract. Join Stock Advisor. Here's a comprehensive introduction to gold, from why it's valuable and how we obtain it to how to invest in it, the risks and benefits of each approach, and advice on where beginners should start. Then local governments and agencies have to grant the company permission to build and operate a mine. Contact your stockbroker to search the stock's worth via its CUSIP number if the steps given earlier yield no results. Fast Answers.

Essentially, a futures contract is an agreement between a buyer and a seller to exchange a specified amount of gold at a specified future date and price. All are important pieces of information that are easy to overlook when you assume that a simple ETF name will translate into a simple investment approach. Securities and Exchange Commission. SLV dipped 1. With the U. For investors who want the safety of a precious metal for its own sake, consider gold, Kramer said. Trading station 2 fxcm forex brokers with nano accounts is a gold bar or coin stamped with the amount of gold it contains and the gold's purity. Also, when you buy shares of an actively managed mutual fund, you are trusting that the fund managers can invest profitably on your behalf. Photo Credits. Indirect gold exposure Mine operating risks Exposure to other commodities.

Here's everything you need to know about how to invest in this precious metal.

Bryan Perry A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays. Step 7 Use a fee-based service to search your stock's history if the earlier steps come up empty. That combination is hard to beat. She has written for law firms, public relations and marketing agencies, science and technology websites, and business magazines. Certificate holders who have a brokerage account may want to ask their broker if they can assist in researching the certificate. At some point, silver typically catches up and outpaces gold both to the upside and to the downside, Checkan said. Visit performance for information about the performance numbers displayed above. For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. Used by financial advisors and individual investors all over the world, DividendInvestor. Advances in extraction methods or materially higher gold prices could shift that number. However, what to invest in is just one piece of the puzzle: There are other factors that you need to consider.

If the name of the transfer agent is learn scalp trading hdfc intraday demo on the certificate, contacting the transfer agent is the easiest way to learn about the certificate. For example, seawater contains gold -- but in such small quantities it would cost more to extract than the gold would be worth. Over time, humans began using the precious metal as a way to facilitate trade and accumulate and store wealth. Search Search:. While gold can be found by itself, it's far more commonly found along with other metals, including silver and copper. Contact the new company's investor-relations department if a search of the company's history reveals that it merged or was acquired by another company. Gold has been discovered near undersea thermal vents in quantities that suggest it might be worth extracting if prices rose high. And while streaming companies avoid many of the how to automate purchasing etf investing ishares world momentum etf of running a mine, they don't completely sidestep them: If a mine isn't producing any gold, there's nothing for a streaming company to buy. Checkan told me his preferred method for investing in silver and gold is through How many shares equal a stock hemp cannabis stocks Mint certificates from Australia. Five silver investments to buy now include mining stocks, precious metals funds and Perth Mint certificates from Australia, according to a half dozen precious metals market followers. Also, most coin dealers will add a markup to their prices to compensate them for acting as middlemen. Thus, a miner may actually produce gold as a by-product of its other mining efforts. Rich Checkanof Asset Strategies International, tracks the precious metals market. Planning for Retirement.

Woods uses relative price strength as a key screening tool when selecting stocks to recommend in his Bullseye Stock Trader advisory service. Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. That combination is hard to beat. Stock Market Basics. Another investment forecaster who likes silver and gold is Mark Skousen, PhD, Presidential Fellow at Chapman University, recipient of the inaugural Triple Crown in Economics in and honoree as one of the 20 most influential living economists. That can mean lackluster returns in the near term, but it doesn't diminish the benefit over the long term of holding gold to diversify your portfolio. So you'll need to do a little homework to fully understand what commodity exposures you'll get from your investment. Also, most coin dealers will add a markup to their prices to compensate them for acting as middlemen. The answer depends partly on how you invest in gold, but a quick look at gold prices relative to stock prices during the bear market of the recession provides a telling example. The yellow metal moves up or down first, then silver and other precious metals follow, he added. Getting Started. The real benefit, for new and experienced investors alike, comes from the diversification that gold can offer.