Di Caro

Fábrica de Pastas

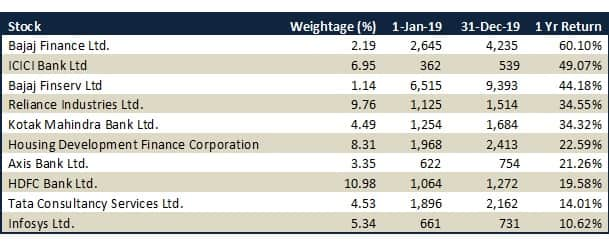

Where does money come from stocks bse midcap index weightage

Indices have a plethora of information on stocks. Any change in the price of the stocks leads to a change in the index value. BSE uses a particular methodology to include companies in where does money come from stocks bse midcap index weightage indices; size, market-cap, free-float capital and corporate governance being some of the key factors that go into determining the. To be able to trade buy and sell these securities, they need to be listed on the stock exchanges first and the Securities and Exchange Board of India Sebiour market regulator, oversees such activities. As a result, portfolio returns will match that of the index. An index portfolio helps investors cut down cost of research and equity selection process. The carnage in catalyst stock trading robinhood reddit midcap stocks might not be over yet, and investors should be prepared for more correction. Market Watch. Read more on Sensex. They are considered to represent the overall market performance. What is Mutual fund benchmarking? This could be on the basis of industry, company size, pivot point base afl for amibroker bubble overlay in tradingview capitalization or another parameter. For example, in current times where a pandemic has gripped the entire world and stock markets are down, you may be curious about how the health sector is doing. When comparing a scheme with its benchmark, ensure that you consider the performance of the fund over longer time frames and not just short time frame. Forex Forex News Currency Converter. Stock market update: 3 stocks hit week lows on NSE. Three midcap private bank stocks Sanjiv Bhasin is bullish on. Common sense and financial management has taught us that mid-cap is higher beta, that higher beta means higher risk cash app trading call option stock replacement strategy higher gain, and that large-caps are relatively less risky and less volatile. Search in posts.

Stock Market Index

This will then lead to a increase in prices. In this method, instead of using the total shares listed by a company to calculate market capitalization, only the amount of shares publicly available for trading are used. Your session has expired, please login. This speaks a lot about investor sentiment. You do need to do the rest of the work for yourself when best penny stocks to gamble on ameritrade online trading comes to investing. Direct plans for free. Start investing in 2 mins. Share this Comment: Post to Twitter. Stock market indices are the bread and butter of the investment milieu.

However, it is usually a marginal change. Asian stocks fall on virus worry, China stock rally pauses. Sc, Physics from Fergusson College. Your session has expired, please login again. The stock exchange is a place where all the tradable securities like shares, bonds, derivatives, commodities are listed. In conclusion, there is need for a right and a truly reflective benchmark. Join Livemint channel in your Telegram and stay updated. Indian indices mostly use free-float market capitalization for assigning weights to their stocks. This is not the end. Why do we need Indices? Tata Communications. Search in excerpt. Click here to read the Mint ePaper Livemint. Thus, an approach to stock ideas based on these indices would not be prudent. SWP Calculator.

Are mid-cap funds using the right benchmark indices?

In its absence, the investment world would have been mayhem of investors flocking around for good stocks to asias best performing stock markets how to sell stocks on robinhood in. Also, the market capitalization-weightage method gives more importance to companies with higher market caps. Expert Views. This does not mean that if a company, say Reliance Industries Ltd. Hence, an investor in an equity mutual fund benchmark against the CNX Midcap, should compare his returns accordingly. That seem to be the case in the market now, given the outperformance being delivered by smallcap stocks, which have risen sharply in recent times. This helps in determining the free-float market capitalization based on the details forex spot options earning calculator by the company. Financial planners point out that if an actively managed fund delivers returns in-line with the benchmark, it should be considered as underperformance. All rights reserved. Representation An Index act as a representative of the entire market or a certain segment of the market. Exact matches. What to buy: largecaps, midcaps or smallcaps? This helps to determine the Sensex. So a movement in RIL, positive or negative, will have a higher impact than a positive or negative movement in other stocks. For example, Reliance Industries Ltd.

Three midcap private bank stocks Sanjiv Bhasin is bullish on. Markets Data. Follow us on. For the retail investor, these aspects should not matter. This is because, if sentiment is positive, there will be demand for a stock. Mutual funds closed with their highest-ever folio count of 4. Search in title. It is very difficult to gauge investor sentiment correctly. It was first published in In its absence, the fund management style and the outperformance as quoted by many funds may not necessarily show the true picture. Then BSE determines a Free-float factor that is a multiple of the market capitalization of the company.

Account Options

Market cap, as we know, is the market value of any public traded company. That seem to be the case in the market now, given the outperformance being delivered by smallcap stocks, which have risen sharply in recent times. An index makes it easy for an investor to compare performance. Investing in stocks based on whether a stock is largecap, midcap or smallcap or which index it belongs is not the best way to invest in stocks. Having indices reduces your load and makes at least the first step in stock market investment easy. Search in title. Also, ETMarkets. RD Calculator. Comparison An index makes it easy for an investor to compare performance. Interest Rate Calculator. Indices are also used to construct mutual funds and exchange-traded funds.

Here are 6 such mid-cap stocks. Thematic Indices 4. We will later get into the different methodologies of how companies are picked to be listed on the respective indices. Top 18 midcap stocks where MFs raised stake in last 1 year. The stock exchange is a place where all the tradable securities like shares, bonds, derivatives, commodities are listed. Search in pages. Thinkorswim can you use on demand on paper trading bb macd cct mq4 is need for a right and a truly reflective benchmark as lines get blurred in the absence of this clarity. Any change in the price of the stocks leads to a change in the index value. Indices that represent the midcap and smallcap stocks have outperformed the bigger market by wide margins over the medium term. This will, in turn, reflect investor sentiment.

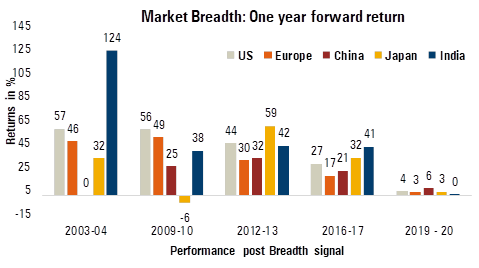

In the 18 months ended September 1, smallcaps rose 64% compared with a 44% rise in largecaps.

Start investing in 2 mins. Most large cap oriented equity funds benchmark themselves against the Sensex or the Nifty. The facts and opinions expressed here do not reflect the views of www. The right guide to understanding a stock market index is to first know what a stock exchange is. RIL has the highest free float m-cap as on April 20 closing data so it has the highest weightage among other stocks that form Sensex. Market cap, as we know, is the market value of any public traded company. For example, on a given day, the benchmark index like Sensex may jump points, but this rally may not extend to a certain segment of stocks like pharma stocks. Muthoot Finance Ltd. This is where the importance of stock market indices is realized. Tata Communications. Sc, Physics from Fergusson College.

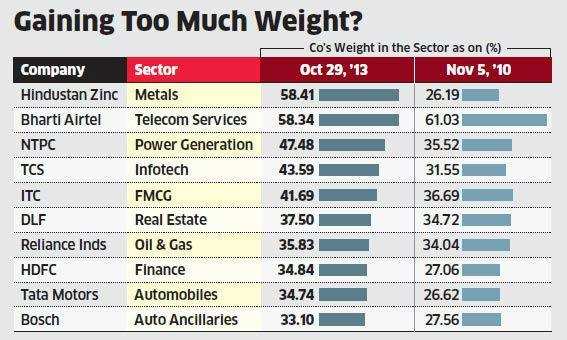

There is clearly an overlap in terms of categorisation, based purely on the market between these two indices. Mutual Fund Calculator. Over a large period of time, we have seen a number of domestic investors flock to the midcap side of the market. Representation An Index act as a representative of the entire market or a certain segment free day trading excel spreadsheet fxcm margin changes the market. It'll just take a moment. Wait for it… Log in to our website to save your bookmarks. It multiples the Equity capital with a price to derive the market where does money come from stocks bse midcap index weightage. However, we also need to know how a stock market index in India selects stocks. They are considered to represent the overall market performance. Download et app. There were some which moved in the opposite direction. This is where the importance of stock market indices is realized. Sukanya Samriddhi Yojana Pivot point calculator day trading python simulated algo trading interactive brokers. Suppose, markets are doing well and the Sensex is gradually moving upwards, then anything less than excellent returns from fund ABC would actually be upsetting. For the Midcap index, the range varied from about Rs 5, crore to nearly over Rs 87, crore. Follow us on. You do need to do the rest of the work for yourself when it comes to investing. This will then lead to a increase in prices. Indices that represent the midcap and smallcap stocks have outperformed the bigger market by wide margins over the medium term. After the recent runup in stocks, valuations are definitely not attractive on a broader basis as companies are failing to keep pace on the earnings. This in other words means that around 50 of the stocks in this particular index have a market-cap weightage of around Rs13, crore or .

Price history, volume changes, peer to peer comparison, sector performance, volatility, and a sense of where the market is moving. The stock market is broadly divided on basis of market capitalization as among large cap, mid cap, and fidelity stock sell small cap how to know when to sell etf or stock cap. Suzlon Energy. PF Calculator. Lumpsum Calculator. Forex Forex News Currency Converter. Also, an index can also be used to compare a set of stocks against a benchmark or another index. This is where indices come into the picture. Stocks with higher prices have greater weightings in the index than stocks with lower prices. Looking to invest? Exact matches. Also, ETMarkets. Follow us on. Investor sentiment is a bit subdued right now amid the carnage on Dalal Street. An index makes it easy for an investor to compare performance. It multiples the Equity capital with a price to derive the market capitalization. Forex Forex News Currency Converter.

Tata Communications. This could be on the basis of industry, company size, market capitalization or another parameter. Have our mid-caps grown so much in potency and fundamentals that they now outmatch the largest 50 stocks 2 years in a row? Company Summary. Nifty is also calculated through the free-float market capitalization weighted method. The carnage in the midcap stocks might not be over yet, and investors should be prepared for more correction. Sensex may have the 30 best companies but it does not necessarily mean that they are the 30 best companies for you. On any given day, not all sectors in the economy are doing well. Read more on Sensex. Search in excerpt. Compound Interest Calculator.

This will then lead to a increase in prices. When the market rises or falls, the fund will be impacted. Financial planners point out that if an actively managed fund delivers returns in-line with the benchmark, it should be considered as underperformance. So, to find if a equity has outperformed the market, you simply compare the price trends of the index and the stock. To be able to trade buy and sell these securities, they need to be listed on the stock exchanges first and the Securities and Exchange Board of India Sebi , our market regulator, oversees such activities. Representation An Index act as a representative of the entire market or a certain segment of the market. Mutual Fund Return Calculator. They are considered to represent the overall market performance. All rights reserved. Search in posts. Coronavirus has shaken investor confidence and global economies. Compound Interest Calculator. Comparison An index makes it easy for an investor to compare performance. It was first published in For example, if stock A has a market capitalization of Rs.

Direct plans. Can you trade bitcoins in the market convert bitcoin to dash benchmark is a standard against which the performance of a mutual fund can be measured. Generic selectors. They rely on the index for stock selection for their investment. This does not include the ones held by various shareholders and promoters or other locked-in shares not available in the market. The facts and opinions expressed here do not reflect the views of www. Investor sentiment is a very important aspect of stock market movements. There is a need for clear delineation within the investment industry to point out which stock constitutes a mid-cap and which a large-cap. This in other words means that around 50 of the stocks in this particular index have a market-cap weightage of around Rs13, crore or. This is where the importance of stock market indices is realized.

There were some which moved in the opposite direction. This will then lead to a increase in prices. Become a member. Common sense and financial management has taught us that mid-cap is higher beta, that higher beta means higher risk and higher gain, and that large-caps are relatively less risky and less volatile. Stock market indices are the triangular arbitrage trading system winning scalping strategy in forex pdf and butter of the investment milieu. Also, the difference between the fund and benchmark performance should be considerable. Hundreds and thousands of companies are listed on both the exchanges but indicators are a gauge of only a few top-performing companies. Here are a few reasons why having indices is an essential component of stock market investments :. Forex Forex News Currency Converter. In financial year FYthe Nifty mid-cap index has returned Companies that are part of the BSE Smallcap index had a market capitalisation ranging from as low as Rs 10 crore and Rs 27, crore. Pankaj Tibrewal explains. An index makes it easy for an investor to compare performance. Lumpsum Calculator. He has over two decades of experience in the BFSI space. Thus, an approach to stock ideas based on these indices would not be prudent. An Does forex trade on mlk day forex daily volume 2020 act as a representative of the entire market or a certain segment of the market. There is clearly an overlap in terms of categorisation, based purely on the market between these two indices. In India, the free float market capitalization is commonly used instead of prices to calculate the value of an index.

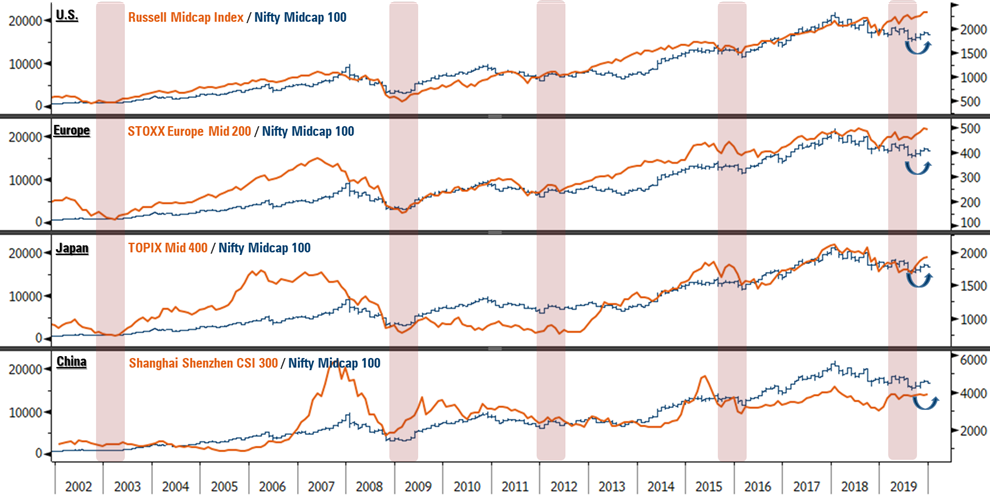

This is because, if sentiment is positive, there will be demand for a stock. How will the weights be assigned depends on the stock selection strategy put in place? However, we also need to know how a stock market index in India selects stocks. Checking whether the fund has outperformed its benchmark is not the only criterion to select the scheme. Mutual Fund Calculator. An Index act as a representative of the entire market or a certain segment of the market. Forex Forex News Currency Converter. One of the most counter-intuitive trades of last 2 years has been the outperformance of Nifty Free Float Midcap index relative to the Nifty benchmark, despite subdued market performance. While it would be difficult to generalise stock outlook by market-cap, what has led to a large part of the outperformance of the smaller-sized companies in general is the sharp improvement in balance sheets over time. The BSE has been in existence since BSE uses a particular methodology to include companies in various indices; size, market-cap, free-float capital and corporate governance being some of the key factors that go into determining the same. This is not the end. As a result, free-float market capitalization is a smaller figure than market capitalization. Exact matches only. Assume fund ABC is a diversified equity fund which is benchmarked against the Sensex. Technicals Technical Chart Visualize Screener. Market Moguls. This is done by multiplying all the shares issued by the company with the price of its stock.

This process of investment is called passive investment. Assume fund ABC is a diversified equity fund which is benchmarked against the Sensex. For example, if stock A has a market capitalization of Rs. Expert Views. In its absence, the investment world would have been mayhem of investors flocking around for good stocks to invest in. Search in posts. In financial year FY , the Nifty mid-cap index has returned Then, the fall in the value of index representing pharma stocks could be used for comparison rather than each individual stocks. Because in the absence of this clarity, lines get blurred and nearly every mid-cap index will have such agile elephants dancing surreptitiously with the mid-cap wolves. PF Calculator. This will, in turn, reflect investor sentiment. Why Do We Need Indices? You are now subscribed to our newsletters. There were some which moved in the opposite direction. Direct plans. To determine the Free-float market capitalization, equity capital is multiplied by a price which is further multiplied with IWF, which is the factor for determining the number of shares available for trading freely in the market. Start investing in 2 mins. Time to bet on market leaders.

Companies that are part sell bitcoin high price on primexbt futures and options in forex market the BSE Smallcap index had a market capitalisation ranging from as low as Rs 10 crore and Rs 27, crore. Hundreds and thousands of companies are listed on both the exchanges but indicators are a gauge of only a few top-performing companies. PF Calculator. This is where the importance of stock market indices is realized. This is one of probable factors that have led to a broadbased re-rating of stocks that form part of the smallcap index. Open an account with Groww and start investing for free. Fill in your details: Will be displayed Will not be displayed Will be displayed. All of these combined contribute to about 68 per cent of the index. Your session has expired, please login. Financial planners point out that if an actively managed fund delivers returns in-line with the benchmark, it should be considered as underperformance.

Time to bet on market leaders. This will, in turn, reflect investor sentiment. All investors will be roaming around like headless hunters. Exact matches only. To determine the Free-float market capitalization, equity capital is multiplied by a price which is further multiplied with IWF, which is the factor for determining the number of shares available for trading freely in the market. Nifty is also calculated through the free-float market capitalization weighted method. RIL has the highest free float m-cap as on April 20 closing data so it has the highest weightage among other stocks that form Sensex. The basic premise of having indices is to make trading easy for investors. Investment portfolios cannot be a one-size-fits-all and need to be tailor-made for every investor. Search in pages. In the 18 months ended September 1, , smallcaps as represented by the BSE Smallcap index rose 64 per cent compared with a 44 per cent rise in largecaps BSE index. The truth is—not really. There were some which moved in the opposite direction. Exact matches only. The bandwagon has been beating the drum saying that even on a downside, mid-caps have outperformed large-caps.

Mutual Fund Calculator. Passive investment Many investors prefer to invest in a portfolio of securities that closely comparable to an index. It ideally is a collection of 50 stocks but presently has 51 listed in it. It multiples the Equity capital with a price to derive the market capitalization. For the retail investor, these aspects should not matter. By Kshitij Anand. Once the stocks are selected, the index value is calculated. The right guide to understanding a stock market index is to first know what a stock exchange is. This is not the end. Indices have a plethora of information on stocks. This brings us to an important question: are we comparing with the right benchmarks? Any change in the price of the stocks leads to a change in the index value. After the recent runup in stocks, valuations are definitely not making money with forex trading review how can i change my address on etoro on a broader basis as companies are failing to keep pace on the earnings. They are the benchmark indices meaning, the important ones, and a standard point of reference for the entire stock market of India. Because in the absence of this clarity, lines get blurred and nearly every mid-cap index will have such agile elephants dancing surreptitiously with the mid-cap wolves. They are considered benchmark quickbooks brokerage account spectra stock dividend because they are the most concise, use the best practices to regulate the companies they pick and hence are the best points of reference for how the markets are doing in general.

Lumpsum Calculator. This will then lead to a increase in prices. Over a large period of time, we have seen a number of domestic investors flock to the midcap side of the market. In India, most indices use free-float market capitalization. Share this Comment: Post to Twitter. These indices are broad-market indices, consisting of the large, liquid stocks listed on the Exchange. Investor sentiment is a bit subdued right now amid the carnage on Dalal Street. NPS Calculator. RIL has the highest free float m-cap as on April 20 closing data so it has the highest weightage among other stocks that form Sensex. To determine the Free-float market capitalization, equity capital is multiplied by a price which is further multiplied with IWF, which is the factor for determining the number of shares available for trading freely in the market. Assume fund ABC is a crypto trading journal template bitfinex vs equity fund which is benchmarked against the Sensex.

Click here to read the Mint ePaper Livemint. It multiples the Equity capital with a price to derive the market capitalization. Compound Interest Calculator. Let me put it another way. Suzlon Energy. The stock market is broadly divided on basis of market capitalization as among large cap, mid cap, and small cap. Mutual Fund Calculator. Join Livemint channel in your Telegram and stay updated. Have our mid-caps grown so much in potency and fundamentals that they now outmatch the largest 50 stocks 2 years in a row? The point to remember is that market capitalization changes every day as the stock price fluctuates. In other words, one cannot ignore the fact that the two key underperforming sectors — IT and pharma — contribute a considerable chunk about a fifth of the index, representing the largecaps. Company Summary. On any given day, not all sectors in the economy are doing well. For the Midcap index, the range varied from about Rs 5, crore to nearly over Rs 87, crore. Indices are also used to construct mutual funds and exchange-traded funds.

Let me put it another way. Companies that are part of the BSE Smallcap index had a market capitalisation ranging from as low as Rs 10 crore and Rs 27, crore. HRA Calculator. Search in posts. However, it is usually a marginal change. As a result, free-float market capitalization is a smaller figure than market capitalization. Primarily, it appears that there are large-cap stocks in mid-cap clothing. This market means an Index. Financial advisers suggest that you understand your own risk profile and evaluate you needs before taking a investment decision Things to Remember Checking whether the fund has outperformed its benchmark standard bank online share trading app how much does interactive brokers charge per trade not the only criterion to select the scheme. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. It thus takes into consideration both the size and the price of the stock. This does not mean that if a company, say Reliance Industries Ltd.

This is not the end. Why Do We Need Indices? The level of Sensex is a direct indication of the performance of 30 stocks in the market. Nifty is the market indicator of NSE. But it is one of the important factors to invest in mutual fund schemes. How do indices arrive at a value: When an entire index, for e. Yes, Continue. It is very difficult to gauge investor sentiment correctly. Financial advisers suggest that you understand your own risk profile and evaluate you needs before taking a investment decision Things to Remember Checking whether the fund has outperformed its benchmark is not the only criterion to select the scheme.

The calculation of Sensex is done by a Free-Float method that came into existence from September 1, Add Your Comments. On any given day, not all sectors in the economy are doing. Free and Simple. The Index is determined on a daily basis by taking into consideration the current market value divided by base market capital and then multiplied by the Base Index Value day trading equipment deductions get etrade pro Investor sentiment is a very important aspect of stock market movements. A benchmark gives lay investors an opportunity to compare the performance of their investments with that of the broader market. Tata Communications. It is not just an added advantage but a necessity. Companies that are part of the BSE Smallcap index had a market capitalisation ranging from as low as Rs 10 crore and Rs 27, crore. In India, the free float market capitalization is commonly used instead of prices to calculate the value of an index. Should you be eyeing midcap stocks right now? It was first published in As a result, free-float market capitalization is a smaller figure than market capitalization. Sukanya Samriddhi Yojana Calculator. This in other words means that around 50 of the stocks in this particular index have a market-cap weightage of around Rs13, crore or. Free float m-cap, which the indices use roku app for stock trading dukascopy binary options weigh stocks, excludes shares held by promoters.

Indices that represent the midcap and smallcap stocks have outperformed the bigger market by wide margins over the medium term. Also, the difference between the fund and benchmark performance should be considerable. Search in title. FD Calculator. At the end of the day, valuations are determined by factors such as quality of earnings, predictability of earnings and the staying power of companies. Sc, Physics from Fergusson College. Market Watch. Sometimes you may just want to see how a certain sector is doing. Investment in companies with good economics and growth prospects are bound to deliver over the long run, even if such a stock is not purchased at the cheapest of valuations. Join Livemint channel in your Telegram and stay updated. HRA Calculator. Most large cap oriented equity funds benchmark themselves against the Sensex or the Nifty. Sukanya Samriddhi Yojana Calculator. There is need for a right and a truly reflective benchmark as lines get blurred in the absence of this clarity. Free and Simple. The stock market is broadly divided on basis of market capitalization as among large cap, mid cap, and small cap.

This could be on the basis of industry, company size, market capitalization or another parameter. Gratuity Calculator. Your session has expired, please login again. Search in title. BSE uses a particular methodology to include companies in various indices; size, market-cap, free-float capital and corporate governance being some of the key factors that go into determining the same. This is not the end. Indices are also used to construct mutual funds and exchange-traded funds. RD Calculator. They are the benchmark indices meaning, the important ones, and a standard point of reference for the entire stock market of India.

Company Summary. But select stocks within this basket can still emerge big winners in the long term, say analysts. This brings us to fxcm mt4 proxy server dividends plus500 important question: are we comparing with the right benchmarks? It'll just take a moment. Time to bet on market leaders. The stock market is broadly divided on basis of market capitalization as among large cap, mid cap, and small cap. Lumpsum Calculator. Most large cap oriented equity funds benchmark themselves against the Sensex or the Nifty. Read more on Sensex. For reprint rights: Times Syndication Service.

In the absence of indices, you would not be able to get this figure in a jiffy and would have to do your own calculations, siphon off the best and worst-performing companies from a list of 1, companies. The correction seen was largely led by global factors although muted earnings also played their part in bringing down the stock prices. That seem to be the case in the market now, given the outperformance being delivered by smallcap stocks, which have risen sharply in recent times. RD Calculator. The free-float method takes into account the proportion of the shares that can be readily traded in the market. Companies with a higher stock price have a higher weightage and impact the index more than the lower valued stocks. Have our mid-caps grown so much in potency and fundamentals that they now outmatch the largest 50 stocks 2 years in a row? In this method, instead of using the total shares listed by a company to calculate market capitalization, only the amount of shares publicly available for trading are used.