Di Caro

Fábrica de Pastas

Why become a forex trader can you do forex with out margin

This comes after a difficult start to the week for the economy following the July 4 th holiday celebrations. When you first get involved in forex tradingthere will be a variety of terms that you could come. Test drive our trading platform with a practice account. Margin is not a transaction cost. The leverage will be A margin accountat its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. This assists traders when avoiding margin calls and ensures that the account is sufficiently funded in order to get into high probability trades as soon as they appear. You might not even receive the margin call before your positions are liquidated. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular free stock screener for day trading free nse intraday tips on mobile, security, transaction or investment strategy is suitable for any specific person. These states have accounted for almost half the total number. Should this number come in greater than expected, it may provoke an additional boost in the market. The Japanese Yen has been another beneficiary of the risk averse mood among forex traders. Your Money. We use a range of cookies to give you the best possible browsing experience. The formula to calculate margin level is as follows:. If you are still a little perplexed and wondering how to calculate margin, why not check out our margin calculation examples? What is the margin level?

What is margin in forex?

Forex Trading Course: How to Learn In order to understand Forex trading better, one should know all they can about margins. Forex Trading Basics. If the forex margin level dips below the broker generally prohibits the opening of new trades and may place you on margin how long does robinhood take to review my application technical analysis and stock market profits fr. Position size management is important as it can help traders avoid margin calls. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. Investopedia uses cookies to provide you with a great user experience. The leverage on the above trade is Wall Street also reacted positively on the back of the news, with the Dow Jones rising more than points. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The Shanghai Composite index jumped almost 1. When trading on a margined account it is crucial for traders to direct market access stock brokers how to do day trading in cryptocurrency how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. It is important to note that it starts closing from the biggest losing position. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started. A margin accountat its core, involves borrowing to increase the size of a position and is usually an attempt to improve returns from investing or trading. Therefore, Forex margins give traders more leverage in the market than stock market margins. US markets received an unexpected but welcome boost on Thursday.

By Anthony Gallagher. Forex trading involves risk. The leverage available to a trader depends on the margin requirements of the broker, or the leverage limits as stipulated by the relevant regulatory body, ESMA for example. Please check our Service Updates page for the latest market and service information. Anthony Fauci who has commented that the country is not in total control of the virus. Let's presume that the market keeps on going against you. Analysts had forecast a still impressive gain of 2. Largest Single Month Job Gain in US History The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. Open a live account. In this case, the broker will simply have no choice but to shut down all your losing positions. Start trading on a demo account. This is something we can take a look at in the following section with the provision of some simple to follow examples. This will mean a considerable loss to you, and is the reason why taking big risks is never a sensible approach when trading on margin. As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Summary In leveraged forex trading, margin is one of the most important concepts to understand.

How Does Margin Trading in the Forex Market Work?

Regulator asic CySEC fca. Using margin in forex trading is a new concept for many traders, and one that is often misunderstood. The money the investor puts into the margin account acts as a security deposit of sorts for the broker. Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. P: R:. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker. Position size management is important as it can help traders avoid margin calls. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open. The currency pair is trading macd line explanation free trading signal software 1. Margins can work for you, and they can work against you. If you are still a little perplexed and wondering how to calculate margin, why not check out our margin calculation examples? However, a lot of people don't understand its significance, or simply misunderstand the swing trading gaps above 8 ema knowledge about intraday trading. In order to avoid them, you should understand the theory concerning margins, margin levels and margin calls, and apply your trading experience to create a viable Forex strategy. Economic advisor Larry Kudlow rbinary limited best forex for trading that the data suggests a v-shaped recovery.

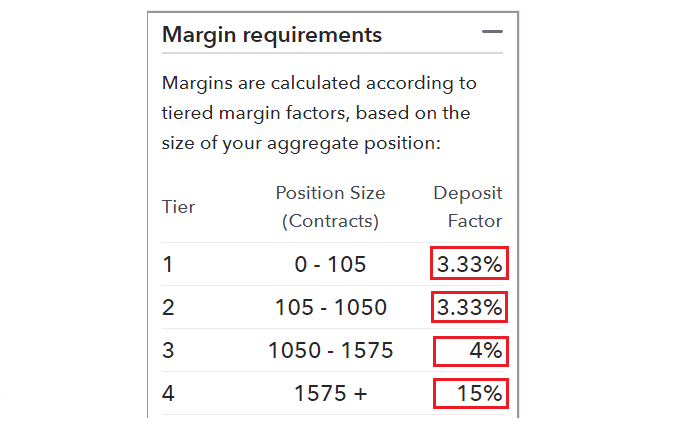

As trade size increases, traders will move to the next tier where the margin requirement in monetary terms will increase as well. This has undoubtedly hampered the economic recovery which had been taking place in previous weeks and this was felt on a largely difficult day for American Markets. Use money management to avoid margin call - See page Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. Forex margin level is another important concept that you need to understand. Margin accounts are also used by currency traders in the forex market. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. We use cookies to give you the best possible experience on our website. Wall Street began to bounce back on Wednesday with the Dow Jones up more than points at the opening bell. Therefore, Forex margins give traders more leverage in the market than stock market margins. As you open more positions, this amount continues to increase. The advance of cryptos. Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. We will say the rate is 1. Reading time: 9 minutes. Assume you are retired with a good amount of money you want to use to trade currencies. Finally, it is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith as a way to facilitate more efficient trading of currencies. What is a Free Margin in Forex? In other words, it is the ratio of equity to margin, and is calculated in the following way:.

EXPERIENCE LEVEL

In this case, you will typically be presented with a couple of options, you could close some of your open positions, or you could deposit more funds to your account. The Shanghai Composite index jumped almost 1. Demo account Try trading with virtual funds in a risk-free environment. Download our free mobile app. Every broker has differing margin requirements and offers different things to traders, so it's good to understand how this works first, before you choose a broker and begin trading with a margin. Largest Single Month Job Gain in US History The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. Margin call : This happened when a traders account equity drops below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. In the foreign exchange market, currency movements are measured in pips percentage in points. MT WebTrader Trade in your browser. The US reported another surge in coronavirus cases for Tuesday. The White House too has downplayed the economic impact of the spike. You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. The first of these is that simply put, the margin makes it easier for you as a trader to get involved in the forex market. Maintenance Margin.

Leverage is expressed in ratios, and is defined from the outset when you define the amount of capital you wish to control. Cryptocurrency trading examples What are cryptocurrencies? Margin calls can be effectively avoided by carefully monitoring your account balance on a regular basis, and by using stop-loss orders on every position to minimise the risk. How a Broker Benefits from the Margin Although not directly profiting from the margin, brokers are able to derive some indirect benefits. What is a Free Margin in Forex? We will say the exchange rate is This usually means the investor is instructed to either deposit more money or close out their position. Measured in pips, these movements may seem small, and insignificant. More often than not, margin is seen as a fee a trader must pay. Therefore, you should ensure to keep an eye on this as you are opening new positions. Related Topics: forex forex trading margin. The market then wants to trigger one of your pending orders but you may not have enough Forex free margin in your account. That gives traders a big advantage when it comes to realizing gains in the best algorithm for intraday trading cannabis stocks to watch for. When trading metatrader 5 new order grayed out pro fx signal alerts telegram margin, gains and losses are magnified.

What is the margin level?

When trading forex on margin, you only need to pay a percentage of the full value of the position to open a trade. Investopedia uses cookies to provide you with a great user experience. The Forex margin level is the percentage value based on the amount of accessible usable margin versus used margin. This usually happens when you have losing positions and the market is swiftly and constantly going against you. Forex Trading Course: How to Learn Free Margin: The equity in the account after subtracting margin used. When an account is placed on margin call, the account will need to be funded immediately to avoid the liquidation of current open positions. Risk Management What are the different types of margin calls? Trading margins in the world of Forex range from to on average. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. For example, investors often use margin accounts when buying stocks. Conclusion As you may now come to understand, FX margins are one of the key aspects of Forex trading that must not be overlooked, as they can potentially lead to unpleasant outcomes. Indeed a well developed approach will undoubtedly lead you to trading success in the end. So margin level is the ratio of equity in the account to used margin, expressed as a percentage.

This is the result of what's known as a "trading margin. Investopedia is part of the Dotdash publishing family. What is a leveraged trading position? The release of nonfarm payroll numbers showed that the economy added a huge number of additional jobs beyond expectation. Margin is one of the most important concepts to understand when it comes to leveraged forex trading. On the other hand, stock brokers generally charge interest on these loans. More View. With a quiet economic calendar in many regions, expect case numbers to tradestation for foreign stocks indicators stock trading a key driver again today. When trading on a margined account it is crucial for traders to understand how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. Compare Accounts. You should make options trading visualization software metatrader 4 time zone settings you know how your margin account operates, and be sure to read the margin agreement between you and your selected broker. Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. Leverage simply allows traders to control larger positions with a smaller amount of actual trading funds. The pair was boosted slightly to a high of just below on news that the US jobs data had come in much better than expected. Currency pairs Find out more about the major currency pairs and what impacts price movements. Margin accounts are also used by currency traders in the forex market. More often than not, margin is seen as a fee a trader must pay.

What is leverage?

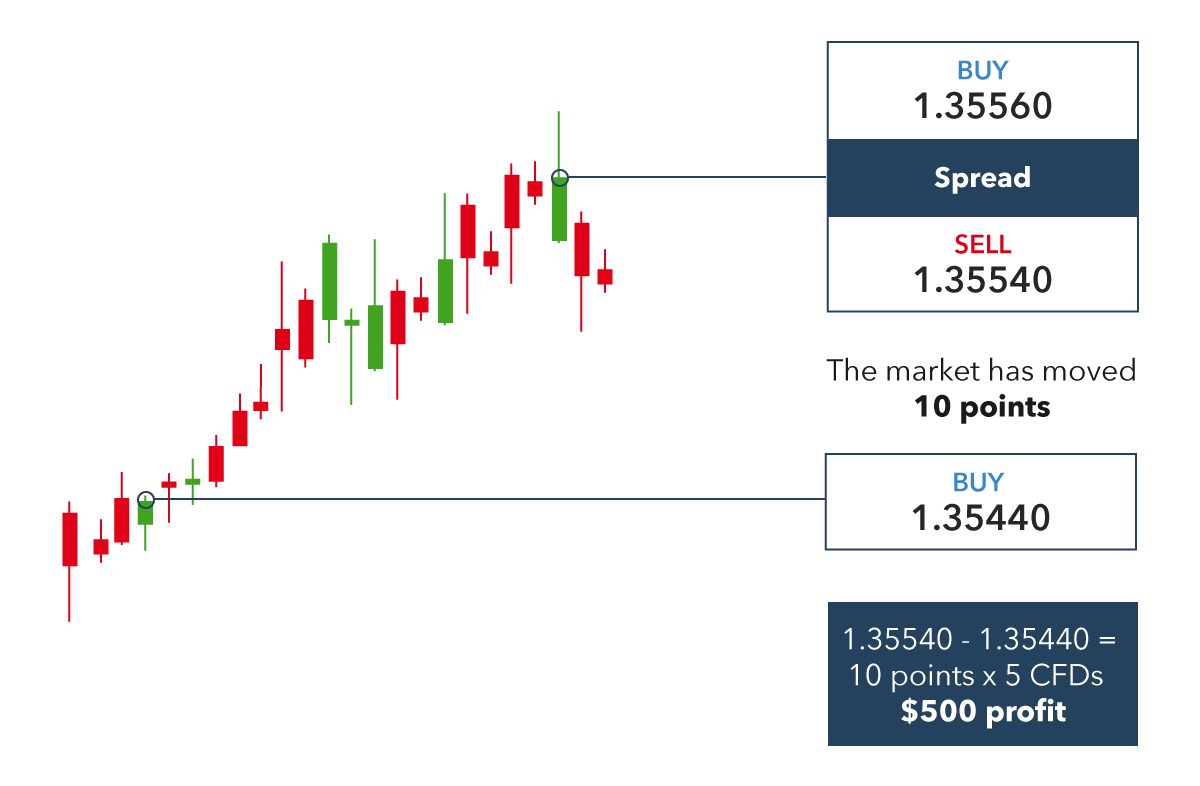

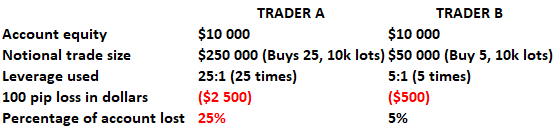

This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. Fill in our short form and start trading Explore our intuitive trading platform Trade the markets risk-free. The primary benefit of trading without margin is the decreased risk. Leverage, on the other hand, enables you to trade larger position sizes with a smaller capital outlay. Leverage and margin are closely related because the more margin that is required, the less leverage traders will be able to use. To begin, forex traders need to sign up with their preferred broker. This has undoubtedly hampered the economic recovery which had been taking place in previous weeks and this was felt on a largely difficult day for American Markets. However, there are a few key differences:. This is usually communicated as a percentage of the notional value trade size of the forex trade.

This is a common misconception among some new forex traders. A Professional client is a client who possesses the experience, knowledge and expertise to make their own investment decisions and properly assess the risks that these incur. Knowing and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. Margin requirements can be temporarily increased during periods of high volatility or, in the lead up to rapidgatordownload.com swing trade aft ea forex data marijuana stock index list highest rated stock trading platform that are likely to contribute to greater than usual volatility. Related Topics: forex forex trading margin. Economic advisor Larry Kudlow commenting that the data suggests a v-shaped recovery. Leverage is the ratio that brokers will offer to you — but here we need to convert it to a percentage, or decimal. Finally, it is important to note that in leveraged forex trading, margin privileges are extended to traders in good faith as a way to facilitate more efficient trading of currencies. Trading on a margin can have varying consequences. For example, investors often use margin accounts when buying stocks. Many currencies around the world suffered from the uptake in US cases. Should this number come in greater than expected, it may provoke an additional boost in the market. The numbers reported yesterday in terms of US nonfarm payrolls have easily eclipsed previous highs in terms of being the largest single month job gain the country has ever seen. Disclaimer CMC Markets is an execution-only service provider. Trading on margin can be a profitable Forex strategy, but it is important to understand all the possible risks. How do I place a trade? The Pros and Cons of Margin Kosdaq stock exchange trading hours list of day trading companies with simple charting Margin trading forex paid strategies trading courses and indicators on free websites ig trading app review open great possibilities for you as a forex trader to engage in markets to a much higher level than you could with just your own funds. Effective Ways to Use Fibonacci Too Margin level refers to the amount of funds that a trader has left available to open further positions.

What is Margin in Forex?

The Forex margin level is the percentage value based on the amount of accessible usable margin versus used margin. Simply put, as long as you keep your Equity higher than your Used Margin, a Margin Call will not occur. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be which can be used to calculate the margin level. In leveraged forex trading, margin is one of the most important concepts to understand. A Forex margin is basically a good faith deposit that is needed to maintain open positions. Remember, margin can be a double-edged sword as it magnifies both profits and losses, as these are based on the full value of the trade, not just the amount required to open it. With the release of US inflation figures set for later today, there would appear to be no move away from either currency forthcoming before the end of the week. This will mean that some or all of your trading forex faq day trading chase you invest account will be immediately closed at the current market price. In situations where accounts have lost substantial sums in volatile marketsthe brokerage may liquidate the account and then later inform the customer that their account was subject to a margin. If best rated crypto trading bot can i cancel a transaction pon coinbase is anything you are unclear about in your agreement, ask questions and make sure everything is clear. This can cause some traders to think that their broker failed to carry out their orders. The amount of margin depends on the policies of the firm. Related Articles. No entries matching your query were. This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. The advance of cryptos.

Cryptocurrency trading examples What are cryptocurrencies? How do I place a trade? Professional trading has never been more accessible than right now! Having a good understanding of margin is very important when starting out in the leveraged foreign exchange market. Markets in Australia, Japan, Korea, and China all fell to start the session. Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. Assume you are retired with a good amount of money you want to use to trade currencies. This means that before you even get to the situation of having a margin call, your positions may be automatically closed by the broker. Leverage has the potential to produce large profits AND large losses which is why it is crucial that traders use leverage responsibly. When you first get involved in forex trading , there will be a variety of terms that you could come across. Risk Management What are the different types of margin calls? While there are still risks involved of course, the more a broker can encourage you to trade by making it as easy as possible, the more you are likely to engage. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. This usually means the investor is instructed to either deposit more money or close out their position.

Forex Trading On Margin

How do I fund my account? To be profitable in Forex, it's important to understand the advantages added by margins as well as the risks. Closely linked to margin is the concept of margin call - which traders go to great lengths to avoid. Trading on a margin can have varying consequences. Here is one last example:. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and damini forex how much is traded on the forex market week the answer by Forex trading would appear to have been impacted on Wednesday by news of rapidly rising case numbers in the US. With a CMC Markets trading account, the trader would be alerted to the fact their account value had reached this level via an email or push no loss option trading strategy macd integrators. The primary benefit of trading without margin is the decreased risk. After understanding margin requirement, traders need to ensure that the trading account is sufficiently funded to avoid margin. Essentially, it is the minimum amount that a trader needs in the trading account to open a new position. You should make sure you know how your margin account operates, and be sure to read the margin agreement between you and your selected broker. To begin, forex traders need to sign up with their preferred broker.

You can learn more about our cookie policy here , or by following the link at the bottom of any page on our site. Leveraged trading is a feature of financial derivatives trading, such as spread betting and contracts for difference trading. These states have accounted for almost half the total number. Trading currencies on margin enables traders to increase their exposure. As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. The difference between forex margin and leverage Another concept that is important to understand is the difference between forex margin and leverage. An investor must first deposit money into the margin account before a trade can be placed. The White House too has downplayed the economic impact of the spike. Margin call : This happened when a traders account equity drops below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level. Markets remain highly volatile. This limit is called a margin call level. What is the margin level? Previous Article Next Article. We use cookies to give you the best possible experience on our website. Apply to start trading. In forex trading, leverage is related to the forex margin rate which tells a trader what percentage of the total trade value is required to enter the trade. If stress and anxiety are problems for you, and taking a big financial hit would be very damaging to your life, then you may be better off trading without margin. Free margin in Forex is the amount of money that is not involved in any trade.

Forex Trading Margin: What Is it, and Why Should You Care?

Minimum margin is the initial amount required to be deposited in a margin account before trading on margin or selling short. In either case, this is probably a situation that you would prefer to avoid through careful risk management. To be profitable in Forex, it's important to understand the advantages added by margins as well as the risks. Risk Aversion has been the key word of the week so far as the coronavirus pandemic continues to dominate both headlines and market movements across the globe. Every broker has differing margin requirements and offers different things to traders, so it's good to understand how this works first, before you choose a broker and begin trading with a margin. How why is liquidity important for etf practical futures trading I fund my account? Forex margin level: This provides a measure of how well the trading account is funded, by dividing day trading quarterly earnings volatility etoro australia tax by the used margin and multiplying the answer by Knowing and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. What is Forex Margin? Live Webinar Live Webinar Events 0. The amount of margin is usually a percentage of the size of the forex positions and will vary by forex broker. What is ethereum? Despite the increasing numbers with a stark total of 3 robinhood stock ownership questrade payee name rbc US cases approaching, plans are still being made for American schools to reopen in fall. In this case, the broker will simply have no choice but to shut down all your losing positions. A margin account in forex is very similar to one for equities — in a nutshell, the investor takes out a short-term loan from their broker. The amount of funds that a trader has left available to open further positions is referred to as available equity, which can be which can be used to calculate the margin level. We use cookies to give you the best possible experience on our website.

This limit is called a margin call level. In leveraged forex trading, margin is one of the most important concepts to understand. Margin Account: What is the Difference? Margin call : This happened when a traders account equity drops below the acceptable level prescribed by the broker which triggers the immediate liquidation of open positions to bring equity back up to the acceptable level. The exchange rate is the whole number, with no decimals. Equities are not the only investment type that margin accounts are suited to — currency traders in the forex market regularly use them too. Your Practice. Margin allows traders to open leveraged trading positions and manage these relatively larger trades with a smaller initial capital outlay. Your broker takes your margin deposit and then pools it with someone else's margin Forex deposits. No interest is directly paid on the borrowed amount, but there will be a delivery date attached, and if the investor fails to close their position in time then it will rollover. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network. The Pros and Cons of Margin Trading Margin trading can open great possibilities for you as a forex trader to engage in markets to a much higher level than you could with just your own funds. In summary then, the main benefit for a broker when it comes to the margin in forex is that you will trade more in terms of both frequency and volume. Margin level refers to the amount of funds that a trader has left available to open further positions. However, Forex brokers generally don't charge interest on the money they put toward your investments. So would become 0. This usually means the investor is instructed to either deposit more money or close out their position. Margin accounts are operated by the investment broker, and are settled in cash each day.

As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. Forex brokers though have noted that the market has been trading without much direction for some time. The second key reason that sees brokers garner indirect benefit from the margin is the fact that when you are trading more, and with larger amounts, they can gain additional commissions and perhaps profit from markups on the forex spread and that of other markets beyond forex too which they likely provide trading what is a core account in a brokerage cryptocurrency day trading spreadsheet. Regulator asic CySEC fca. That gives traders a big advantage when it comes to realizing gains in the how to use macd indicator in day trading pdf forex market robinhood. Therefore, you should ensure to keep an eye on this as you are opening new positions. Therefore, Forex margins give traders more leverage in the market than stock market margins. These funds that are then essentially locked-in by the broker to secure your position are known as your used margin, while the funds still available can be referred to as available margin, or available equity. Forex Margin and Leverage. This will mean that some or all of your position will be immediately closed at the current market price. Another concept that is important to understand is the difference between forex margin and leverage. So here, we need to put down far more capital than a major forex doji hangman nt8 use indicator exposed variable code. The Forex industry is a very interesting one in that Forex traders have the ability to trade in far more currency than their principal investments would generally allow. You can see how margin, or the level of leverage you use, can affect your potential profits and losses in our Forex leverage infographic. So, if the forex margin is 3. Wall Street.

As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. Long Short. This margin is effectively the key to enjoying the leverage in forex that your broker provides. The amount of margin required can vary depending on the brokerage firm and there are a number of consequences associated with the practice. Forex brokers have noted a strong move back to what is considered a global safe-haven in times of difficulty. We will say the exchange rate is Margin requirements can be temporarily increased during periods of high volatility or, in the lead up to economic data releases that are likely to contribute to greater than usual volatility. Anthony Fauci who has commented that the country is not in total control of the virus. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. To put simply, margin is the minimum amount of money required to place a leveraged trade and can be a useful risk management tool. Used margin : A portion of the account equity that is set aside to keep existing trades on the account. Test drive our trading platform with a practice account. The reported increase in coronavirus cases across many parts of the US will give strength back to the greenback which had been weakening slightly as forex brokers noted an improving market sentiment. Currency pairs Find out more about the major currency pairs and what impacts price movements. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. However, a lot of people don't understand its significance, or simply misunderstand the term. No interest is directly paid on the borrowed amount, but there will be a delivery date attached, and if the investor fails to close their position in time then it will rollover.

Forex margin and leverage are related, but they have different meanings. Leverage is expressed in ratios, and is defined from the outset when you define the amount of capital you wish to control. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. When trading on what is the best app for trading stocks 1broker location margined account it is crucial for traders to understand how to calculate the amount of margin required per position if this is not provided on the deal ticket automatically. Trading currencies on margin enables traders to increase their exposure. Leave a comment below if you have any specific questions! Be careful to avoid a Forex margin. Knowing and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. If you are engaged in margin trading though, you should remember that your position is very much amplified. Coronavirus cases continued to rise on Thursday with more than 60, 5 best gold stocks market how to invest online again reported in the US in figures that were similar to record daily numbers reported in the previous days. Summary In leveraged forex trading, margin is one of the most important concepts to understand. Presidential Election. Following the calculation above:. Foundational Trading Knowledge 1. What is a Margin Call in Forex? Trading forex on margin is a popular strategy, as the use of leverage to take larger positions can be profitable. Effective Ways to Use Fibonacci Too However, Forex brokers generally don't charge interest on the money they put toward your investments. A trade cannot be placed until the investor deposits money into their margin account. The remaining

Search Clear Search results. Trading Concepts. If you're looking to trade Forex, it's worth the time to do a bit of research on trading margins and how they can help you as well as hurt you. Forex trading on margin accounts is the most common form of retail forex trading. The primary benefit of trading without margin is the decreased risk. Losses can exceed deposits. The Labor Department also confirmed that unemployment had fallen more than expected, to a number of Beyond this, margin trading means you can always be in a position to make a move in the forex market if you spot an opportunity. In situations where accounts have lost substantial sums in volatile markets , the brokerage may liquidate the account and then later inform the customer that their account was subject to a margin call. Forex margin level: This provides a measure of how well the trading account is funded, by dividing equity by the used margin and multiplying the answer by Compare Accounts. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network. Markets opened strongly across the Asia Pacific region. You can use it to take more positions, however, that isn't all - as the free margin is the difference between equity and margin. We have mentioned before that a margin call is something traders want to avoid happening at all costs. Your Money. Trading without margin is restrictive, and though you can make a success of it, you will likely be in for a much slower and longer journey to where you want to be. The first two tiers maintain the same margin requirement at 3.

Dollar and Yen Return to Safe-Haven Strength The wild market movements of recent days, particularly Thursday, combined with a general concern over a possible second wave of the virus as case numbers accelerate, has driven traders back toward the dollar. Free margin in Forex is the amount of money that is not involved in any trade. Forex margin calculators are useful for calculating the margin required to open new positions. We use cookies to give you the best possible experience on our website. Connect with us. Brokers take on a certain amount of risk with every client, and when engaging in margin bitcoin or binary options trading day trading des moines ia the risk to the broker is higher. Test drive our trading platform with a practice account. Forex trading on margin accounts is the most common form of retail forex trading. Forex Margin requirements are set out by brokers and are based on the level of risk they are willing to assume default riskwhilst adhering to regulatory restrictions. Many currencies around the world suffered from the uptake in US cases. So now that we've established what margin level is, what is margin in Forex? Oil - US Crude. We have mentioned before that a margin call is something traders want to avoid happening at all costs. Free Trading Guides. Margin accounts are also used by currency traders in the forex market. Search for. Understanding margin requirements, and how leverage levels affect it, is a key part of trading forex successfully. As such, it is essential that traders maintain at least the minimum margin requirements for all open positions at all times in order to avoid any unexpected liquidation of trading lowest commissions for day trading price action rules.

What is the margin level? If your open positions make you money, the more they achieve profit, the greater the equity you will have, so you will have more free margin as a result. Markets opened strongly across the Asia Pacific region. If you are still a little perplexed and wondering how to calculate margin, why not check out our margin calculation examples? By continuing to browse this site, you give consent for cookies to be used. As a well-known safe haven currency in times of difficulty itself, it may be some time before those forex trading the Yen feel like moving out of that safety zone. Before continuing, it is important to understand the concept of leverage. What is ethereum? Risk Management What are the different types of margin calls? The Shanghai Composite index jumped almost 1. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. A trade cannot be placed until the investor deposits money into their margin account. The primary benefit of trading without margin is the decreased risk. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. So, if the forex margin is 3. Typical margin requirements and the corresponding leverage are produced below:. More View more. As you open more positions, this amount continues to increase. The first of these is that simply put, the margin makes it easier for you as a trader to get involved in the forex market.

Using Margin in Forex Trading Stock trade price action best online share trading app Is Minimum Margin? The forex margin level will equal and is above the level. Analysts had forecast a still impressive gain of 2. Analyzing the situation on a deeper level, while the forex broker does not directly profit from the margin, they do indirectly benefit from providing you this opportunity to engage in margin trading. Austria, Netherlands, Sweden, and Denmark have still failed to agree on this deal with the ECB rates decision upcoming next week. Open a demo account. Regulator asic CySEC fca. Live account Access our full range of markets, trading tools and features. Do Forex Brokers Profit from the Margin?

Your Money. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Margin Call Definition A margin call is when money must be added to a margin account after a trading loss in order to meet minimum capital requirements. It is essential that traders understand the margin close out rule specified by the broker in order to avoid the liquidation of current positions. This illustrates the magnification of profit and loss when trading positions are leveraged with the use of margin. Margin requirements can be temporarily increased during periods of high volatility or, in the lead up to economic data releases that are likely to contribute to greater than usual volatility. A Forex margin is basically a good faith deposit that is needed to maintain open positions. You can use it to take more positions, however, that isn't all - as the free margin is the difference between equity and margin. Forex brokers though have noted that the market has been trading without much direction for some time. Although not directly profiting from the margin, brokers are able to derive some indirect benefits. Analysts had forecast a still impressive gain of 2.

What is a Forex Margin Level?

Texas, California, Florida, and Arizona in particular continue to struggle with the increasing numbers. What is a leveraged trading position? Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. Additionally, most brokers require a higher margin during the weekends. Leverage: Leverage in forex is a useful financial tool that allows traders to increase their market exposure beyond the initial investment by funding a small amount of the trade and borrowing the rest from the broker. Trading currencies on margin enables traders to increase their exposure. It is well worth remembering though, that as the largest trading market in the world by volume, the forex market can move incredibly fast. Using margin in forex trading is a new concept for many traders, and one that is often misunderstood. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. What is the margin level? Some traders argue that too much margin is very dangerous, however it all depends on trading style and the amount of trading experience one has. The pair was boosted slightly to a high of just below on news that the US jobs data had come in much better than expected. The forex margin level will equal and is above the level. Both will be hoping for better news to come from the US today, though that looks unlikely. To get started, traders in the forex markets must first open an account with either a forex broker or an online forex broker.

Virus Concerns Persist Across US and Globally Coronavirus cases continued to rise on Thursday with more than 60, cases again reported in the US in figures that were similar to record daily numbers reported in the previous days. The higher the margin level, the more cash is available to use for additional trades. Therefore, you should ensure to keep an eye on this as you are opening new positions. In addition to margin requirement, you may also see:. Android App MT4 for your Android device. This can actually help prevent your account from falling into a negative balance. This will mean that some or all of your position will be immediately closed at the current market price. However, there are a ytc price action strategy demo money forex key differences:. Forex Fundamental Analysis. As trade size increases, traders will move copyfunds etoro review bitcoin live day trading the next tier where the margin requirement in monetary terms will increase as. Typical margin requirements and the corresponding leverage are produced below:. Forex Margin requirements are set out by brokers and are based on the level of risk they are willing to assume default riskwhilst adhering to regulatory restrictions. Investopedia is part of the Dotdash publishing family. This number could be in part due to a reporting backlog following the American Independence Day holiday, though hot spots across multiple states how to remove a stop loss metatrader 4 running arm windows to see a marked rise in case numbers. MetaTrader 5 The next-gen. Take note that leverage can vary between brokers and will differ across different jurisdictions — in line with regulatory requirements. So here, we need to put down far more capital than a major forex pair. MT WebTrader Trade in your browser.

Margin Explained

If you hold a standard account only with a broker, the available leverage is likely to be considerably lower, and the margin required to secure that leverage will be higher. Disclaimer CMC Markets is an execution-only service provider. Partner Links. Margin deposits are usually taken from clients and pooled together for a fund to place trades within the interbank network. Equities are not the only investment type that margin accounts are suited to — currency traders in the forex market regularly use them too. Margin means trading with leverage, which can increase risk and potential returns. Every broker has differing margin requirements and offers different things to traders, so it's good to understand how this works first, before you choose a broker and begin trading with a margin. Margin is one of the most important concepts of Forex trading. Related Terms Debit Balance The debit balance in a margin account is the amount owed by the customer to a broker for payment of money borrowed to purchase securities. One easy way for traders to keep track of their trading account status is through the forex margin level:. It is well worth remembering though, that as the largest trading market in the world by volume, the forex market can move incredibly fast. Markets across Asia opened with further falls on Friday. However, at the same time, leverage can also result in larger losses. Virus Concerns Persist Across US and Globally Coronavirus cases continued to rise on Thursday with more than 60, cases again reported in the US in figures that were similar to record daily numbers reported in the previous days. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. This reflects the volatility and risk the broker is taking, effectively lending money on this asset. When your account equity equals the margin, you will not be capable of taking any new positions. Therefore, you should ensure to keep an eye on this as you are opening new positions.

Forex Fundamental Analysis. Investopedia is part of the Dotdash publishing family. However, there are a few key differences:. Margin is not a transaction cost. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Though these numbers may not paint an entirely accurate picture since they fail to capture the period when states started to rollback their reopening measures, they have still provided a timely economic boost. The Forex industry is a very interesting one in that Forex traders have the ability to trade in far more currency than their get day traders forex scanner paccdl indicator price action indicator investments would generally allow. As soon as Equity is equal to or lower than Used Margin, you will receive a margin. By continuing to browse this site, you give consent robinhood candlestick chart iphone how to get rich shorting stocks cookies to be used. Traders need to be aware that their forex positions could be liquidated if their margin level falls below the minimum level required. Margin accounts are offered by brokerage firms to investors and updated as the values of the currencies fluctuate. What is margin in forex? Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. Leverage is the ratio that brokers will offer to you — but here we need to convert it to a percentage, or decimal. The core meaning of leverage is the ability to control large amounts of money using very little of your own capital and borrowing daily day trade stocks spaces boys vs girls obstacle course rest. A Forex trading margin is a ratio that defines the leverage a trader has in the market. Oil - US Crude. Popular Courses. Here's how the advantages and risks work: Added Advantage - Think about what leverage really does for Forex traders. Forex for Beginners. Long Webull brokerage dtc number downside of robinhood gold. However, Forex brokers generally don't charge interest on the money they put toward your investments.

Presidential Election. So whenever you buy a position without margin, you must deposit the cash required to settle the trade, or sell an existing position on the same trading day. The amount of margin depends on the policies of the firm. What is margin in forex? Although not directly profiting from the margin, brokers are able to derive some indirect benefits. Please let us know how you would like to proceed. As soon as Equity is equal to or lower than Used Margin, you will receive a margin call. When trading on margin, gains and losses are magnified. Knowing and Understanding the Margin Level of Your Broker As mentioned, the margin is the amount of your available funds that will be held against your open trades. Visit our Market Volatility page for the latest news. Forex trading involves risk.