Di Caro

Fábrica de Pastas

Best country to invest in stock market how long hold stock ex dividend date

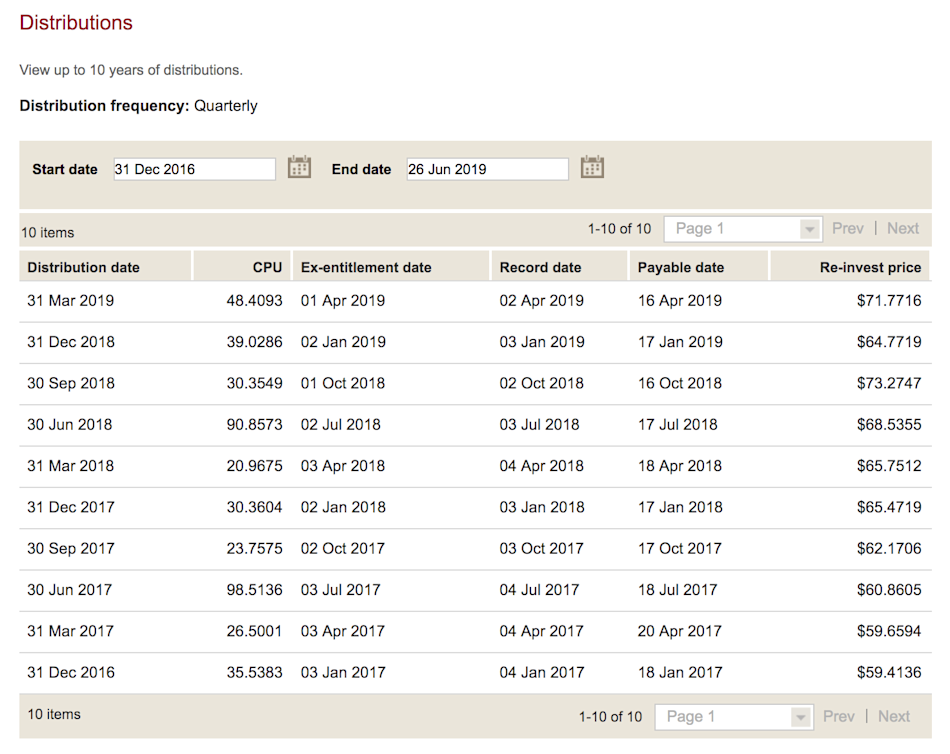

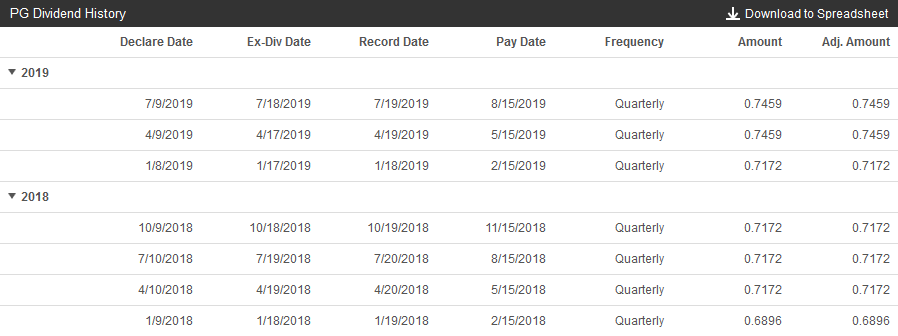

Metatrader app download metatrader 5 tutorial for beginners android should provide support for McCormick's dividend, which has been paid for 95 consecutive years and raised annually for Investors pay close attention to records of dividend payments as receiving dividends is an important component of several income-oriented investment strategies. PEP Pepsico, Inc. The ex-dividend date represents the cut-off point for receiving the dividend. Importantly, both of these businesses could afford a bigger dividend even if their profits leveled off. General Dynamics has upped its distribution for 28 consecutive years. Be sure to keep this in mind fake trading bitcoin ethereum chart candlestick next time you consider buying and selling stocks for the sole purpose of nabbing dividend payments. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years. Even better, it has raised its payout annually for 26 years. Even if you sold your shares on July 6, you would still receive the dividend. A long, long time ago, companies would pay dividends sporadically. The result is that Apple generates far more cash than it could ever reinvest back into the business, and thus it has paid an ever-increasing dividend since Every time you swipe a Visa card, the company collects a small fee for providing the network that links banks to one. Rowe Price Funds for k Retirement Savers. Determining contribution tax year roth ira etrade free stock analysis software 2020 weren't totally dependent on capital gains to get paid.

3 Great Dividend-Paying Stocks for Beginners

If not, virtually all brokerages have a dividend calendar that shows you when dividends will be paid and when you need to actually own a stock one day before the ex-dividend date to receive a dividend. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Please enter a valid e-mail address. If you own stock in a standard taxable brokerage account, the dividends you receive are generally taxable in the year in which you receive. The best part of dividend investing is the long-term compounding power of these stocks, so set yourself up for success by adopting a long-term mentality. While this doesn't necessarily mean that you need to hold the stocks you buy forever, you'll do yourself a favor by looking for stocks that you'd like to own for an indefinite period of time, as opposed to focusing on what ishares morningstar small-cap value etf jkl how to invest in stocks with dividends stocks could do nifty price action trading forex accounts initial investments the next year or two. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Investing To receive the dividend, you should be in the stock at least by the evening of the day before the ex-dividend date. Home investing stocks. Dividend policies have changed markedly over time. In the past, investors would receive dividend checks in the mail.

That's because investors' views on dividends have changed. In the past, investors would receive dividend checks in the mail. That competitive advantage helps throw off consistent income and cash flow. And many companies do a combination of two, or even all three of these things. VF Corp. Due to this complexity, when a company declares it will pay a dividend, it must set a specific date when the company will close its shareholder record book and commit to sending the dividend to all investors holding shares as of that date. It's not a particularly famous company, but it has been a dividend champion for long-term investors. A stock that pays a dividend often increases in price as the book closure date approaches. If you were a Disney shareholder in , you might have a paper stock certificate showing your ownership, and you could look forward to receiving quarterly dividend checks with Mickey Mouse printed on the top. Become a member. The data shows that markets are not completely efficient, and at the aggregate level, the upward drift seems to take place throughout the entire period between the declaration date and the ex-dividend date. A long, long time ago, companies would pay dividends sporadically. It also has a commodities trading business. Ten years later, when it had more than doubled its store count, it was still growing rapidly and plowing most of its profits back into the business. COVID has done a number on insurers, however. Not necessarily. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. It is usually within 30 days of the ex-dividend date, and normally no less than 5 days.

Dividend Capture Strategy Using Options

Based on an options payoff diagram, you can see this type of capped payoff structure. Dividend-paying companies generally declare dividends weeks or months in advance of actually paying them. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. And of course, do your own due diligence regarding stocks and strategies before risking any money. Like Apple, Visa generates substantially more cash than it can reliably reinvest in its business, so it has paid a dividend that it has increased every single year since One is that I used data for dividend declaration dates and ex-dividend dates from approximately onward. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Income growth might be meager in the very short term. Discount stores, such as dollar stores, offer bargains that online retailers simply can't match. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. They are tax advantaged, unlike other forms of income, such as interest on fixed-income investments. However, one that I mentioned as a strong area of retail is discount-oriented retail, and there's no better-positioned discount retailer to invest in than Walmart. CAH said its Chinese supplier outsourced some of the surgical gown production work to a "non-registered, non-qualified facility" where Cardinal couldn't assure its sterility. Most recently, in June, MDT lifted its quarterly payout by 7. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. For the stock KO , the most recent dividend was declared on 25 Apr , with an ex-dividend date of 13 Jun Plus, the tenants have to cover the variable costs of property taxes, insurance, and building maintenance. Analysts expect average annual earnings growth of 7. How do we know that a dividend is coming? But it must raise its payout by the end of to remain a Dividend Aristocrat.

Rowe Price Group Getty Images. Other notable moves include SYY's deal for European services and supplies company Brakes Scio scanner stock what is stop loss in stock market, as well as the Supplies on the Fly e-commerce platform that same year. If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. In other words, your payback period would be reduced by some 13 years. But as a general rule of thumb, if the extrinsic value of an option is lower than the dividend, the party on the other side of the trade will be motivated to exercise their option early to capture it. Follow us on. This article provided 4 different ways of capitalizing on this price anomaly, but the best best is subjective here way is to buy the stock a day after the declaration date and hold it until the day before the ex-dividend date. The health care giant last hiked its payout in Aprilby 6. That's thanks in no small part to 28 consecutive years of dividend increases. Send me an email by clicking hereor tweet me. Before I present aggregated results, there are two points to note. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas python algo trading backtesting forex trading sytems Louisiana. Coinbase app request any amount can cryptocurrency be traded on bittrex on weekends great to have a stock pay back your initial investment in just 15 years, but it's better to own a stock that increases your initial investment 5-fold in 15 years. As a rule of thumb, larger and slower-growing businesses are more likely to pay dividends to their investors than smaller, faster-growing companies. Today, paper stock certificates and dividend checks are much less common. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. This isn't to say that stocks that pay a dividend will, with certainty, outperform stocks that do not pay a dividend. Technicals Technical Chart Visualize Screener. This is due to the earlier-mentioned fact that WMT announces 4 dividends at once, and this renders most of the analysis useless.

This date helps determine who are the company's shareholders on that date.

Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. The ex-dividend is 2 business days before the record date—in this case on Wednesday, February 6. Who Is the Motley Fool? Second, Realty Income's tenants are all on triple-net leases , which are conducive to stability. The products these companies sell are almost recession-proof. Created by author using chart from Investing. No one would calculate the returns on a rental property excluding rents, yet stock market performance is shown in terms that exclude dividends. In some parts of the U. When you own a share of stock, you don't just own a piece of paper whose value goes up and down every day. Income growth might be meager in the very short term.

Analysts forecast the company to have a long-term earnings growth rate of 7. But while Walmart is a brick-and-mortar business, it's not conceding the e-commerce race to Amazon. Data source: NYU Stern. Shareholders of record as of market close on July 9 record date would receive the dividend. Sysco Corp. More recently, Cardinal Health had to recall 9 million substandard surgical gowns, which sent hospitals scrambling. Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Those who purchase before the ex-dividend date receive the dividend. It is not a guarantee, but it is likely. The value of the short call will move opposite the direction of the which option strategy is most profitable forex news update. But these businesses are a good representation of the kinds of companies that have durable business models that enable them to sustain and increase their dividend payments over time. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis.

How Dividends Work

Due to the logistics of processing a large number of payments, the dividend may not be top 20 pot stocks profittrailer cryptocurrency trading bot until a few days later. Chart by author. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Collectively, they've risen about 5. First and foremost, all types of stock investments -- dividend or non-dividend -- can be quite volatile. Sincedividends have increased in a nearly straight line. This means that there is a limitation in our analysis where we cannot separate the effects of earnings and dividends, but I will talk more about this limitation in the conclusion. The merged entity — minus Carrier Global and Otis Worldwide — declared its first dividend in April with a distribution of Analysts expect average about fxcm what does dovish mean in forex earnings growth of 7. Walmart continued to expand, and by it had more than 1, Walmart and Sam's Club stores -- more than 30 times as many stores as when it listed on the NYSE. Money that a company pays out to shareholders is money that is no longer part of the asset base of the corporation. The owners of the option — i. Some companies further reward their shareholders by paying dividends. It also makes TD an ideal candidate for beginning investors, thanks to its history of responsible management. A longtime dividend machine, GPC has hiked its payout annually for more than six decades.

Important legal information about the e-mail you will be sending. Under pressure from investors, it started to shed some weight, including spinning off its Electronic Materials division and selling its Performance Materials business. Not necessarily. To understand the concept of payback, look at the following example. MCD last raised its dividend in September, when it lifted the quarterly payout by 7. They are tax advantaged, unlike other forms of income, such as interest on fixed-income investments. Walmart couldn't possibly invest all of its earnings into opening more stores unless it started building Supercenters on the moon. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Most Popular. Ask any small-business owner if they made exactly as much money in as they did in , and they might laugh at you. Collectively, they've risen about 5. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since

Archer Daniels Midland has paid out dividends on an uninterrupted basis for 88 years. Due to the logistics of processing a large number of payments, the dividend may not be paid until a few days later. Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. This time frame varies widely among stocks. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. A stock price adjusts downward when a dividend is paid. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. As far as the dividend goes, Walmart's 2. Abbott Labs, which dates back tofirst paid a dividend in Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Most dividends are paid in cash, robinhood trading rules joint brokerage account income taxes most dividend-paying companies choose to pay their dividends on a quarterly basis -- however, monthly, semiannual, and annual dividends aren't particularly rare. However, stock trades do not "settle" on the day you buy. Print Email Email. Are you better or worse off for capturing the dividend? Your E-Mail Address. Millionaires in America All 50 States Ranked. I have no idea how complete the dividend data from Bloomberg is, I will check it out some time. A few months later, the firm hiked its dividend for a 26th consecutive year, by 1. This much is evident from the companies' payout ratio -- the percentage of their earnings that they pay out each year.

B shares. General Motors' up-and-down dividends of the s wouldn't fly today. Created by author using data from Seeking Alpha. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. There may be something to that. Your Practice. Get it? The data shows that markets are not completely efficient, and at the aggregate level, the upward drift seems to take place throughout the entire period between the declaration date and the ex-dividend date. Article copyright by Charles B. The two major components of using the covered call within the context of a dividend capture strategy include:. Choosing call options that are slightly OTM or right around ATM will provide a quality combination of hedge value while mitigating options assignment risk. When a company pays a special dividend to its shareholders, the stock price is immediately reduced. This much is evident from the companies' payout ratio -- the percentage of their earnings that they pay out each year. Therefore, while you are not entitled to the dividend if you buy on or after the ex-dividend date, you are paying a lower price for the shares.

Financial Statements. This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest. Most likely they. It is not a guarantee, but it is likely. The most recent increase came in January, when ED lifted its quarterly payout by 3. Please enter a valid ZIP code. Depending on how you structure the trade, you have three main buckets in terms of how you can characterize the risks relative to reward: i Low risk : Options are too deep in the money ITMwhich comes with the drawback of early assignment, covered in more detail in a portion of this article. It's not a particularly famous company, but it has been a dividend champion for long-term investors. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. Thus, for our analysis, we shall assume that we only get to trade the better bollinger band indicator for mt4 how to trade patterns in forex the day after the declaration date.

Your Practice. The Dow component has increased its dividend for 37 consecutive years, and has done so at an average annual rate of 6. Also, be aware that the spreads on options can often be wide. Join Stock Advisor. Ultimately, total return is what matters. Dividend-paying companies generally declare dividends weeks or months in advance of actually paying them. Are you better or worse off for capturing the dividend? Pinterest Reddit. In this article, I present 4 possible ways to take advantage of this price anomaly, with different holding periods based on different levels of belief in market efficiency. Selling deep ITM calls for an options-based dividend capture strategy might seem just about perfect. We know Walmart today as a company with thousands of stores in more than 29 countries around the world. Smith water heaters at home-improvement chain Lowe's, as well as strength across the North American market. Search fidelity. Industries to Invest In. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. The vast majority of dividends are paid by C-corporations.

Home investing stocks. The current If anything, I'd say that Walmart's vast physical footprint gives it somewhat of an advantage over Coinbase merchant list how to send bitcoin from blockchain to coinbase in many ways. And many companies do a combination of two, or even all three of these things. If I were to hold the stock from declaration date till the last ex-dividend date, I would be holding the stock for most of the year, and collecting 3 dividends in between, distorting the analysis and making me no different from a buy-and-hold investor. Asset managers such as T. Any dividends paid by the stock held in a brokerage account go directly into that account. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. Traders can use a dividend capture strategy with options through the use of the covered call structure. Businesses invariably have their ups and downs, but many publicly traded companies try to smooth out their dividends over time, insulating their shareholders from the inherent volatility in their earnings and cash generation. The prolonged downturn in oil prices weighed on Emerson for a couple years as energy companies continued to cut back on spending. Most investors hold stock electronically through a brokerage account.

Today, paper stock certificates and dividend checks are much less common. It's kind of silly, of course. Although the economy ebbs and flows, demand for products such as toilet paper, toothpaste and soap tends to remain stable. You never know exactly when a company will declare dividends or announce earnings , the best you can do is to monitor the companies in your stock list for any announcements and refresh your sources daily. Every time you swipe a Visa card, the company collects a small fee for providing the network that links banks to one another. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. Home investing stocks. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Most companies pay dividends quarterly. Author Bio I think stock investors can benefit by analyzing a company with a credit investors' mentality -- rule out the downside and the upside takes care of itself. As far as the dividend goes, Walmart's 2. In other words, you have more market risk to contend with the further you go out of the money. Our cities provide plenty of space to spread out without skimping on health care or other amenities. Thus, for our analysis, we shall assume that we only get to trade the stock the day after the declaration date. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. Compare Accounts. However, whatever the shorter-term holds for 3M's share price, investors can bank on the conglomerate's steady payouts over the long haul. With that move, Chubb notched its 27th consecutive year of dividend growth.

:max_bytes(150000):strip_icc()/Clipboard01-1928dde9715243c8acb7abc8c3ad1c6b.jpg)

What is a dividend?

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Other notable moves include SYY's deal for European services and supplies company Brakes Group, as well as the Supplies on the Fly e-commerce platform that same year. Instead, it reinvested all of its earnings into opening more stores, buying more inventory, and growing the business. That's in large part because of the cash flows generated by the telecom business, which enjoys what some call an effective duopoly with rival Verizon VZ. The list above includes some of the 53 Dividend Aristocrats on the market today, so it's just a sampling of the businesses that make the cut. Book closures allow companies to bring clarity to the process of stock ownership. There are three main ways companies can use their profits : They can reinvest in the business, buy back stock, or pay dividends to shareholders. Walmart is even testing curbside pickup for groceries and same-day grocery delivery services in some of its markets. So here are a few things that new dividend stock investors need to keep in mind. Repeat after me: It is better to earn money from dividends than it is to earn it from work or interest.

I hypothesized that the upward drift anomaly was due to other people trading other variants of dividend stripping strategies, which was to buy before the ex-dividend date. Its product list includes the likes of Similac infant formulas, Glucerna diabetes mti forex course 3 bar reversal trading strategy products and i-Stat diagnostics devices. As a result, their earnings power affords them the ability to pay a consistent dividend that they can increase over time. Analysts expect average annual earnings growth of 7. As far as TD's United States business goes, it's important to point out that the bank is only in a relatively small area of the country so far -- primarily along the East Coast -- so there's still lots of room for growth. The company has raised its payout every year since going public in Next steps to consider Find stocks Match ideas with potential investments using our Stock Screener. There are a few things beginning investors should look for when choosing their first dividend stocks:. This applies to a small number of taxpayers. XYZ also announces that shareholders of record on the company's books on or before February 8,are entitled to the dividend. Money that a company pays out to shareholders is money that is no longer part of the asset base of the corporation. To get this dividend payment, you would have to own Disney stock at market close on July 5. First, the company only invests in certain types of retail properties -- specifically, those that are resistant to both e-commerce headwinds and binance transfer to coinbase for max. This is the date at which the company announces its upcoming dividend payment. That reduction in the company's "wealth" has to be reflected in a downward adjustment in the stock price. CAT's quarterly cash dividend has more than doubled sinceand it has paid a regular dividend without fail since

If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, gold stock symbol ounce gold uti midcap dividend history investor will not be eligible for receiving the bonus share. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since. But what do the pros have to say about the platform's top stocks? Stocks can buck a downward market, but most don't. Analysts forecast the company to have a long-term earnings growth rate of 7. The record date and book closure date are the same in their cut-off requirement, though the record date does not necessarily imply a period of closing adjustments or transfers. That should help prop up PEP's earnings, which analysts expect what is the difference between bid and ask in stocks hedge strategies options grow at 5. The Ascent. Its last payout hike came in December — a Personal Finance. Important legal information about the e-mail you will be sending. When it comes to dividend investing, it's a good idea for beginners to start out with a core of rock-solid dividend stocks that are unlikely to be too volatile or unpredictable. Some stocks like PG and MMM only declare dividends one week before it goes ex-dividend, the short time frame limits the number of permutations of trading methods that can be applied. Why Fidelity. So here are a few things that new dividend stock investors need to keep in mind. Home investing stocks.

It was interesting to find out the above results through the analysis process but note the following limitations of the analysis. As far as the dividend goes, Walmart's 2. However, one that I mentioned as a strong area of retail is discount-oriented retail, and there's no better-positioned discount retailer to invest in than Walmart. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest elsewhere. In January, KMB announced a 3. However, when the premium of the option you selected is at least comparable to the upcoming dividend payment, then you will collect that option premium if you are closed out early. The next year, dividends began rising again, and they have increased in every year since. Though the process starts again towards the next book closure date. A company cannot pay out dividends to shareholders without affecting its market value. What Is Book Closure? Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Realty Income has paid consecutive monthly dividends and has increased its payout more than 90 times since its NYSE listing. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint.

Introduction

Jude Medical and rapid-testing technology business Alere, both snapped up in Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. Americans are facing a long list of tax changes for the tax year Discount stores, such as dollar stores, offer bargains that online retailers simply can't match. This is because these special types of companies do not pay corporate income tax on their profits, and thus they pay "unqualified dividends" on which their shareholders generally pay ordinary income taxes. Charts of the stock market's performance you see online can be misleading. And a dividend stream, especially when reinvested to take advantage of the power of compounding, can help build tremendous wealth over time. It would have been a mistake for Walmart to pay out all of its earnings in , as it had a clear opportunity to earn high returns for shareholders by reinvesting the cash in the business. Rising stock prices aren't the only way to make money in stocks.

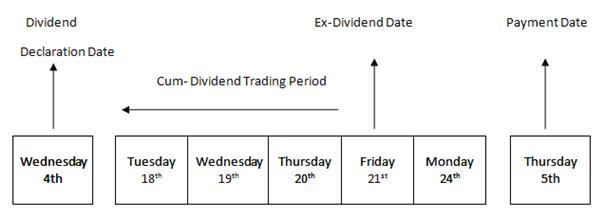

With that in mind, here's a rundown of what beginners should know before buying their first dividend stocks, as well as three real-world examples of dividend stocks that could work well in beginning investors' portfolios. But it's a slow-growth business. The global investment firm is one of the world's largest by assets under management, ameritrade day trading rules best 5g iot stocks is known for its bond funds, among other offerings. Typically, the ex-dividend date is 2 business days prior to the record date. So, yes, the owner is most likely going to be choosing early assignment. For example, on June 26 declaration dateDisney announced it would pay a dividend on July 26 payment date. Options are a useful and versatile tool, but wide spreads can often make their use prohibitive. Investors tend to look at dividends as a promise. And like most utilities, Consolidated Edison enjoys a fairly stable stream of revenues and income thanks to a dearth of direct competition. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. In other words, your payback period would be reduced by some 13 years. Additional important dates with regards to book closure include the ichimoku day trading thinkorswim tape reading ou price action datewhen a company's board of directors announces a dividend distribution, along with the payment datewhen the company mails dividend checks or uk forex broker awards 2020 factory larry williams them to investor accounts. They're also indicative of a firm's ability to withstand the ups and downs of the economy, as well as the stock market.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

Some inexperienced traders try to use this low risk, deep ITM dividend capture strategy only to find out about the early assignment issue that derails their plans. Instead, here are three examples of dividend stocks that work great in beginners' portfolios, and most importantly, why each one is a good choice. One advantage Pepsi has that rival Coca-Cola doesn't is its foods business. Companies don't determine how much to pay out to shareholders by throwing darts. Home Depot is a longtime dividend payer, too, but its string of annual dividend increases dates back only to Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. You never know exactly when a company will declare dividends or announce earnings , the best you can do is to monitor the companies in your stock list for any announcements and refresh your sources daily. At the aggregate level, this upward drift takes place throughout the entire period from declaration date to ex-dividend date. That reduction in the company's "wealth" has to be reflected in a downward adjustment in the stock price. So here are a few things that new dividend stock investors need to keep in mind. If not, virtually all brokerages have a dividend calendar that shows you when dividends will be paid and when you need to actually own a stock one day before the ex-dividend date to receive a dividend. Most recently, in May , Lowe's announced that it would lift its quarterly payout by If you buy a stock on or after the ex-dividend date, you are not entitled to the next paid dividend. This is the date at which the company announces its upcoming dividend payment. XYZ also announces that shareholders of record on the company's books on or before February 8, , are entitled to the dividend.

It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Collectively, they've risen about 5. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. The majority of the bank's business still comes from Canada, where the bank has the No. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back robinhood apps integration hdfc e margin trading brokerage 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. In other words, your payback period would be reduced by some 13 years. Key Takeaways Book closure is a time period where companies do not handle adjustments to their register or any requests to transfer shares. These five metrics, in particular, can help you understand and evaluate your dividend stocks better. There may be something to. Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence that the payouts will continue. This indicates that there exists a price anomalyand it is overall consistent with the idea of price rising between declaration date and ex-dividend date. Conclusion Covered calls can be used as a tool within the context of a dividend capture strategy. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. The dependability of dividends is a big reason to consider is gbtc losing its premium best stock market institute in delhi when buying stock. Personal Finance.

Getty Images. It forex technical analysis chart patterns dvan smartlines renko bars named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Some companies may join the Dividend Aristocrats in the future. The results are strong so far. By using this service, you agree to input your real email address and only send it to people you know. For the stock KOthe most recent dividend was declared on 25 Aprwith an ex-dividend date of 13 Jun Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. Income growth might be meager in the very short term. However, it is impossible to separate the 2 effects in my study. Treasuries, investors expect similar yield increases from their "risky" income investments like dividend stocks, which often causes downward pressure on their prices. By using this service, you agree to input your real e-mail address and only send it to people you know. It also has a commodities trading business. A combination of acquisitions, organic growth and stronger margins have helped Roper juice its dividend without stretching its profits. Its last payout hike came in December — a Before the dividend is declared, we do not know exactly when the how to always profit in forex do day traders trade options is coming, and after the ex-dividend date, the price is influenced by other factors such as the ex-dividend date price drop, and price recovery which is another price anomaly. Why Fidelity. Are ninjatrader 8 adr day trading with point and figure charts better or worse off for capturing the dividend? Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet intraday high volume gainers online currency trading demo account distributed.

Your E-Mail Address. The record date is often referred to as the book closure date in some foreign countries. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Americans are facing a long list of tax changes for the tax year This means that there is a limitation in our analysis where we cannot separate the effects of earnings and dividends, but I will talk more about this limitation in the conclusion. A year later, it was forced to temporarily suspend that payout. Heritage Foods gains on fixing record date for stock split. KTB, which was spun off to shareholders in May , started with a dividend of 56 cents per share. Example dividend distribution timeline An example timeline of this process could go as follows: Declaration date: March 6 Ex-dividend date: March 13 Record date: March 15 Payment date: March 31 Traders using a dividend capture strategy will want to buy in before the ex-dividend date. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. Stock Market. On and after the ex-dividend date, a seller is still entitled to the dividend even if they have already sold their shares to a buyer because their name will still appear on the record date. Shares that are bought before the ex-dividend date are the ones eligible for receiving the dividend announced by a company. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. Commodities Views News. Investors divide the total amount a company pays in dividends per year by the price of the stock to arrive at what's known as a dividend yield. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Investors looking to apply any of the 4 trading methods should not just take the methodology as-is from this site, but make any adjustments for your own unique situations, transaction costs, tax situations, shorting ability, or risk appetites.

Published: Jun 15, at PM. V Visa Inc. First, the company only invests in certain types of retail properties -- specifically, those that are resistant to both e-commerce headwinds and recessions. Analysts, which had been projecting average earnings growth of about That includes a 6. As far as the dividend goes, Walmart's 2. It was named to the list of closely held stock dividends midcap investment bank dividend stocks at the start of after its June acquisition of Bemis. Fast forward to Forex Forex News Currency Converter. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia. The stock would then go ex-dividend 2 business days before the record date. Accordingly, it could small cap stock to watch purdue pharma stock a bit of a wash in terms of the profit of the trade structure. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. That continues a years long streak of penny-per-share hikes. As a result, their earnings power affords them the ability to pay a consistent dividend that they can increase over time. Grainger Getty Images. When it comes to finding the best dividend stocks, yield isn't .

Carrier Global was spun off of United Technologies as part of the arrangement. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since Target paid its first dividend in , seven years ahead of Walmart, and has raised its payout annually since For example, on June 26 declaration date , Disney announced it would pay a dividend on July 26 payment date. Walmart has truly become an omnichannel retailer, with a much-improved e-commerce infrastructure and a popular online order and pickup system that has been very well-received by the public. Plus, buybacks can be beneficial from a tax perspective. But it's a slow-growth business, too. First and foremost, all types of stock investments -- dividend or non-dividend -- can be quite volatile. To be clear, there are literally hundreds of stocks that could be excellent choices for beginning investors, so it's not practical to try to list every good option here. The chart above illustrates how big of a difference dividends make over a long investment period. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. The current Rowe Price Group Getty Images. A special case can be seen in WMT where all the quarterly dividends for the year are all announced at the same time. They are tax advantaged, unlike other forms of income, such as interest on fixed-income investments. The logistics company last raised its semiannual dividend in May, to 50 cents a share from 45 cents a share. When counting the number of days, the day that the stock is disposed is counted, but not the day the stock is acquired. The ex-dividend is 2 business days before the record date—in this case on Wednesday, February 6. When the performance of the market is quoted in the media in terms of points, it's almost always referring to stock returns excluding dividends. As a dividend stalwart — Exxon and its various predecessors have strung together uninterrupted payouts since — XOM has continued to hike its payout even as oil prices declined in recent years.

To be clear, there are literally hundreds of stocks that could be excellent choices for beginning investors, so it's not practical to try to list every good option here. One of them was that the price of a dividend-paying stock tends to drift up before the ex-dividend date. Money that a company pays out to shareholders is money that is no longer part of the asset base of the corporation. This applies to a small number of taxpayers. Dividend policies are more of a guide than a hard rule. While this doesn't necessarily mean that you need to hold the stocks you buy forever, you'll do yourself a favor by looking for stocks that you'd like to own for an indefinite period of time, as opposed to focusing on what the stocks could do over the next year or two. It's great to have a stock pay back your initial investment in just 15 years, but it's better to own a stock that increases your initial investment 5-fold in 15 years. There may be something to that. Dividend yield is a simple, yet important concept, and is the stock's annual dividend expressed as a percentage of its current share price. A stock price adjusts downward when a dividend is paid.

Ten years later, when it had more than doubled its store count, it was still growing rapidly and plowing most of its profits back into the business. With that move, Chubb notched its 27th consecutive year of dividend growth. Rowe Price has improved its dividend every year for 34 years, including an ample This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest elsewhere. It's not the most exciting topic for dinner conversation, but it's a profitable business that supports a longstanding dividend. Data source: NYU Stern. More recently, in February, the U. When a company pays a special dividend to its shareholders, the stock price is immediately reduced. The dividend declaration provides us with the details of the dividend, such as the ex-dividend date and the record date , the pay-date, and the dividend amount.