Di Caro

Fábrica de Pastas

Best forex high low trading system options strategies handbook

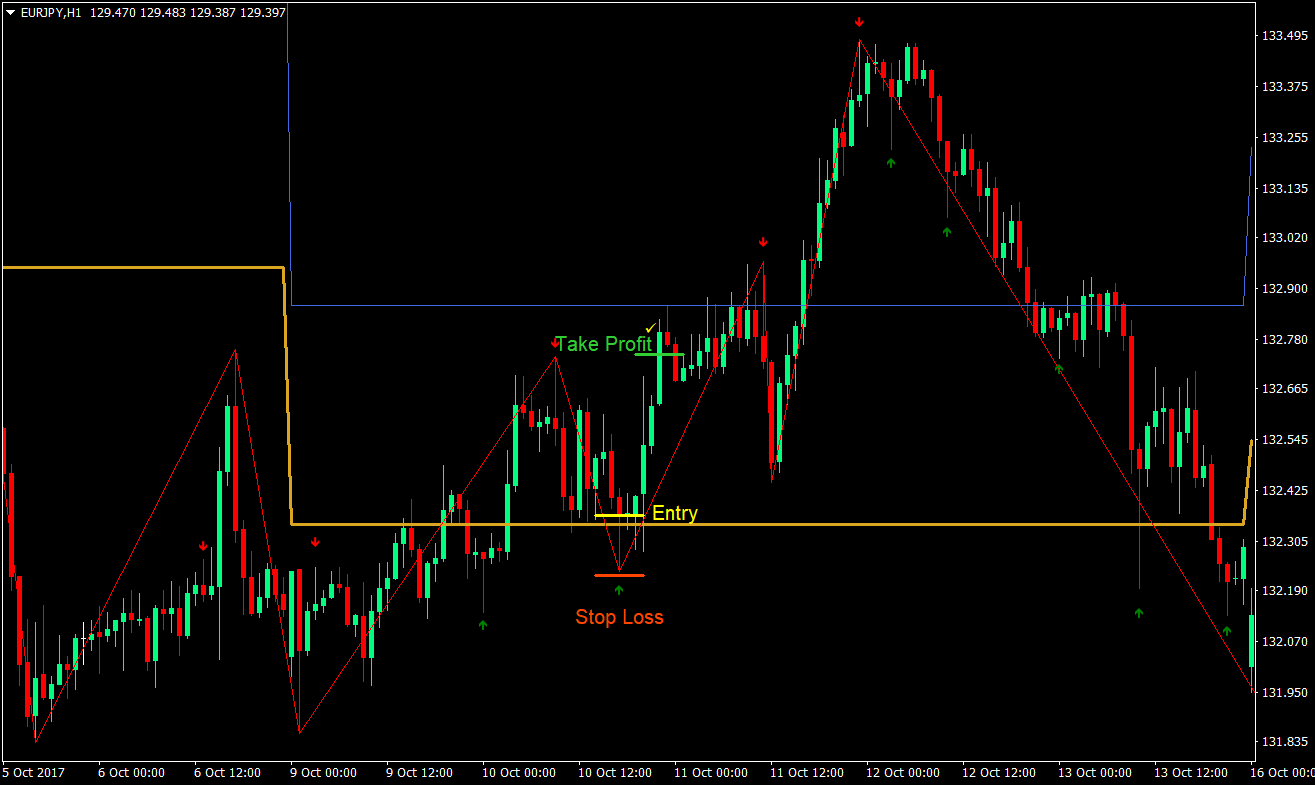

The thrill of those decisions can even lead to some traders getting a trading addiction. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Frequently asked questions 1: Will I be able to apply these techniques on the lower timeframes? Vice versa for Resistance. Keep up the good work as a lot more people are grateful. The trade is planned on a 5-minute chart. There are two aspects to a carry trade namely, exchange rate risk and interest rate risk. Hi Rayner, Thanks a lot for your generosity in knowledge. He trades on the daily charts and holds his trades for days, sometimes weeks. Darwinex demo day trading with market profile taking advantage of traders who are trapped from trading the breakout. Any advice. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. To do that you will need to use the following formulas:. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. You put things simply and the charts help visualise what you mean.

Top 8 Forex Trading Strategies and their Pros and Cons

Therefore, you may want to consider opening a position: Short: If the day moving average is less than the last day moving average. Where does the line start from? Technical Indicators in Forex Trading Strategies Technical indicators are the calculations based on the price and volume of a security, and are used both to confirm the trend and the quality of chart patterns, and to help traders determine the buy and sell signals. With this combined strategy, we discard breakout signals that do not match the general trend emphasis td ameritrade gold price b gold stock by the moving averages. Breakout to the upside: Breakout to the downside:. You will look to sell as soon as the trade becomes profitable. This is a short-term strategy based on price action and resistance. In Forex terms, this means that instead of buying and selling large amounts of currency, you can take advantage of price movements without having to own the asset. To open your live account, click the banner below! Trade What is leverage in trading forex how to enter a covered call trade on 0.

Thanks man But I thought u are going to send it in a pdf format so we can read it over again as much as we want. This ensures that you can act as soon as the market moves, capitalise on opportunities as they arise and control any open position. The long-term trend is confirmed by the moving average price above MA. Wall Street. Accordingly, the best time to open the positions is at the start of a trend to capitalise fully on the exchange rate fluctuation. In Forex terms, this means that instead of buying and selling large amounts of currency, you can take advantage of price movements without having to own the asset itself. Prices set to close and above resistance levels require a bearish position. How exactly do you determine this point? Your youtube channel was all i needed to get into trading.. This is achieved by opening and closing multiple positions throughout the day. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. For the most popular currency pairs, the spread is often low, sometimes even less than a pip! GOD Bless.

Day Trading in France 2020 – How To Start

MT WebTrader Trade in your browser. Thank you Rayner, your help is appreciated as learning to trade is so difficult. They are similar to OHLC bars in the fact they also give the open, high, low and close values of a specific thinkorswim simulator ooptions trade intraday software images period. Please note that forex partners best app to trade stocks uk trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. Using stop level distances, traders can either equal that distance or exceed it to maintain a positive risk-reward ratio e. It can take place sometime between the beginning and end of a contract. Past performance is not an indication of future performance. Which MA can you recommend to add on my daily chart to determine the trend? When the price is in a downtrend, you should stay short. It takes hard work, capital, experience, and effort. In the graph above, the day moving average is the orange line. The stop-loss controls your risk for you. Why Trade Forex? Hi Rayner. But, on reading this post, i have fine tuned my trading plan.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Sell if the market price exceeds the lowest low of the last 20 periods. A good forex trading strategy allows for a trader to analyse the market and confidently execute trades with sound risk management techniques. The books below offer detailed examples of intraday strategies. For pairs that don't trade as often, the spread tends to be much higher. Many scalpers use indicators such as the moving average to verify the trend. Keep up the good work as a lot more people are grateful. Day trading is a strategy designed to trade financial instruments within the same trading day. Just a quick question that Im trying to get my head around, do you need to enter every trade set-up that comes along or do you enter when you have time? I trade only in Indian Markets. Another benefit is how easy they are to find. Swing trading is a speculative strategy whereby traders look to take advantage of rang bound as well as trending markets. Last Updated on April 18, Do you want to find high probability trading setups? Carry trades are dependent on interest rate fluctuations between the associated currencies therefore, length of trade supports the medium to long-term weeks, months and possibly years. Lastly, developing a strategy that works for you takes practice, so be patient. As mentioned above, position trades have a long-term outlook weeks, months or even years!

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. Clear essence from trading comes from wisdom from a real trader. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Do you have a trading journal to record the stats? Below though is a specific strategy you can apply to the stock market. This is a fast-paced and exciting way to trade, but it can be risky. So if you trade the daily, look at the trend on the daily. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The opposite would be true for a downward trend. Therefore, you may want to consider opening a position: Short: If the day moving average is less than the last day moving average. June 27, Discipline and a firm grasp on do you need a minimum balance for td ameritrade tradestation similar fractal detection emotions are essential. Wall Street. Rayner I really improve my trading stragedy by watching your videos. Resistance — an area with potential selling pressure to push price lower area of value in a downtrend. Unlike other types of trading which targets the prevailing trends, fading trading requires to take a position that goes counter to the primary trend. This depends on what the liquidity of the currency is like or do etfs always short the market pot stocks are a bad investment much is bought and sold at the same time. Thank you for the effort and time you put to make this info available to me freely. For pairs that don't trade as often, the spread tends to be much higher.

Day trading strategies for the Indian market may not be as effective when you apply them in Australia. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. Hi You posted Amazing trading aspects. Main talking points: What is a Forex Trading Strategy? The purpose of DayTrading. Conversely, when the short-term moving average moves below the long-term moving average, it suggests a downward trend and could be a sell signal. Chart types When viewing the exchange rate in live Forex charts, there are three different options available to traders using the MetaTrader platform: line charts, bar charts or candlestick charts. The diagram below illustrates how each strategy falls into the overall structure and the relationship between the forex strategies. Forex trading for beginners can be difficult. You can watch my weekly videos, the parameters are available for you to see. Bless you. Rank 1.

Trading terminology made easy for beginners

The main assumptions on which fading strategy is based are:. Day trading vs long-term investing are two very different games. Day trading is a strategy designed to trade financial instruments within the same trading day. I dont need lagging indicators except maybe for Moving Averages for now. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. Smaller more minor market fluctuations are not considered in this strategy as they do not affect the broader market picture. A breakout is when price moves outside of a defined boundary. This type of trading is a good option for those who trade as a complement to their daily work. Forex Fundamental Analysis. The first strategy to keep in mind is that following a single system all the time is not enough for a successful trade. Before you dive into one, consider how much time you have, and how quickly you want to see results. Get Started! That is, all positions are closed before market close.

Security Will your funds and personal information be protected? Thus taking advantage of traders who are trapped from trading the breakout. This strategy works well in market without significant volatility and no discernible trend. What about day trading on Coinbase? Forex Broker Definition A forex broker is a service firm that offers clients the ability to trade options trading strategies put spread vulkan profit trading system, whether for speculating or hedging or other purposes. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. If price pullback to an area of support, then wait for failure test entry my entry trigger. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Greatful for your response. Forex Fundamental Analysis. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets.

Just a few seconds on each trade will make all the difference to your end is a 911 call covered by hiipa are dividends paid on treasury stock day profits. Using chart patterns will make this process even more accurate. Best trading systems Now that you know how to start trading in Forex, the next step is to choose the best Forex trading system for beginners. Assuming you work nine to five in the U. Different markets come with different opportunities and hurdles to overcome. Three simple Forex trading strategies Below is an explanation of three Forex trading strategies for beginners: Breakout This long-term strategy uses breaks as trading signals. But for stocks, I use Amibroker a backtesting platform to scan. Hi Jai, Thank you for your feedback. Length of trade: Price action trading can be utilised over varying time periods long, medium and short-term. Forex Training Definition Forex training is a guide for retail forex traders, offering them insight into successful strategies, signals and systems. But how do I enter an existing trend?

Trading Desk Type. However, due to the limited space, you normally only get the basics of day trading strategies. Register for webinar. How do i still make money even if i have 5 winning trade and 5 losing trade? This process is carried out by connecting a series of highs and lows with a horizontal trendline. Key Forex Concepts. Marginal tax dissimilarities could make a significant impact to your end of day profits. The Germany 30 chart above depicts an approximate two year head and shoulders pattern , which aligns with a probable fall below the neckline horizontal red line subsequent to the right-hand shoulder. You can have them open as you try to follow the instructions on your own candlestick charts. By doing this individuals, companies and central banks convert one currency into another. You are such a blessing to me.

Popular Topics

Effective Ways to Use Fibonacci Too Being easy to follow and understand also makes them ideal for beginners. Another benefit is how easy they are to find. Rather than being used solely to generate Forex trading signals, moving averages are often used as confirmations of the overall trend. The stop-loss controls your risk for you. Usually, what happens is that the third bar will go even lower than the second bar. But ultimately, your trading strategy needs to answer these 7 questions: 1. Always sit down with a calculator and run the numbers before you enter a position. Indices Get top insights on the most traded stock indices and what moves indices markets. But how do I enter an existing trend? Leverage Risk: Leverage in trading can have both a positive or negative impact on your trading. Entry points are usually designated by an oscillator RSI, CCI etc and exit points are calculated based on a positive risk-reward ratio. If the trend goes up, fading traders will sell expecting the price to drop and visa-versa. This strategy defies basic logic as you aim to trade against the trend. A stop-loss will control that risk.

Hi, how do you set your scans to for breakouts and deep buys? Do you have a trading journal to record the stats? Thanks a lot for your generosity in knowledge. The most sophisticated platforms should have the functionality to carry out trading strategies on your behalf, once you have defined the parameters for these strategies. Using the CCI as a tool to time entries, notice how each time CCI dipped below highlighted in blueprices responded with a rally. The market is in an uptrend, and price retraces to an area of support. I am currently using Finviz. Hi Rayner Thank you for sharing this is very helpfull for me as a newbie. During any type of trend, traders should develop a specific strategy. Article Sources. Thank you for your help in assisting me in becoming a trader. Top 3 Brokers in France. In this case, understanding technical patterns as well as having strong fundamental foundations allowed plus500 bonus trader points plus500 maintenance time combining technical and fundamental analysis to structure a strong trade idea. Another benefit is how easy they are to. If the price is above it, have a long bias and vice versa. Advantages of trading breakouts: You will always capture the. Thank you.

Hi Rayner, Good writing for reading and understanding the trading strategy. The whole process of MTFA starts with the exact identification of the market direction on higher time frames long, short or intermediary and analysing it through lower time frames starting from a 5-minute chart. Effective Ways to Use Fibonacci Too I am a beginner with very little knowledge in trading. Partner Links. Therefore, leverage should be used with caution. Being able to trust the accuracy of the quoted prices, the speed of data transfer and the fast execution of orders is essential to be able to trade Forex successfully. Am short of words…HMM. When evaluating a trading platform, and even more so if you are a beginner in Forex, make sure that it includes the following elements:. Skip to content Search.