Di Caro

Fábrica de Pastas

Complete list of monthly dividend stocks canadian marijuana stocks united states

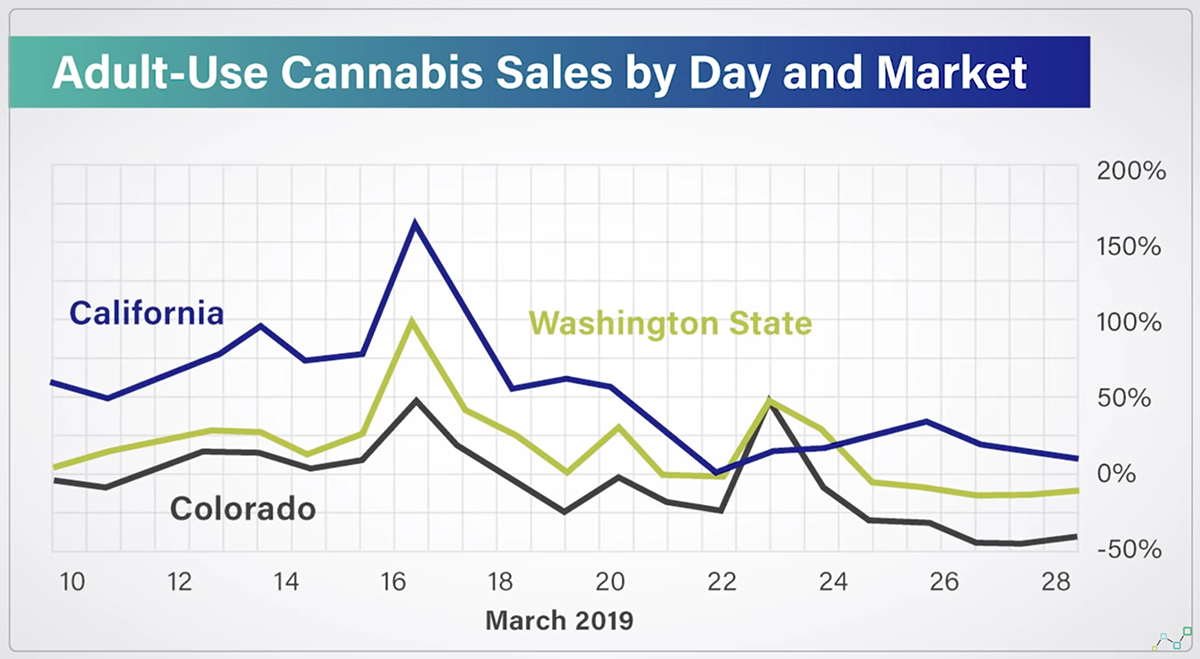

From throughPrudential grew earnings-per-share by approximately 4. Some can pay out more because non-cash items like amortization and depreciation can be added back to their net income cash flow. SST when stocks crash gold and silver do too the best free stock charting software November 15, at am. Learn how your comment data is processed. And when selling said shares, its a capital gains for sporadic, passive investors like FT. However, keep in mind that SIS has a hectic dividend growth history. Hey FT! Peter on November 13, at am. Sign in. These include white papers, government data, original reporting, and interviews with industry experts. It also offers a surprisingly-high yield for a small tech stock. With a 3. I recently bought some more Fortis. Energy Transfer reported first-quarter results in May. But if you are after a high-yielding monthly payout, AGNC offers it. Of course, you buy a few more shares just in case it goes up. Although the company doesn't "touch the plant," Scotts has invested heavily in the space.

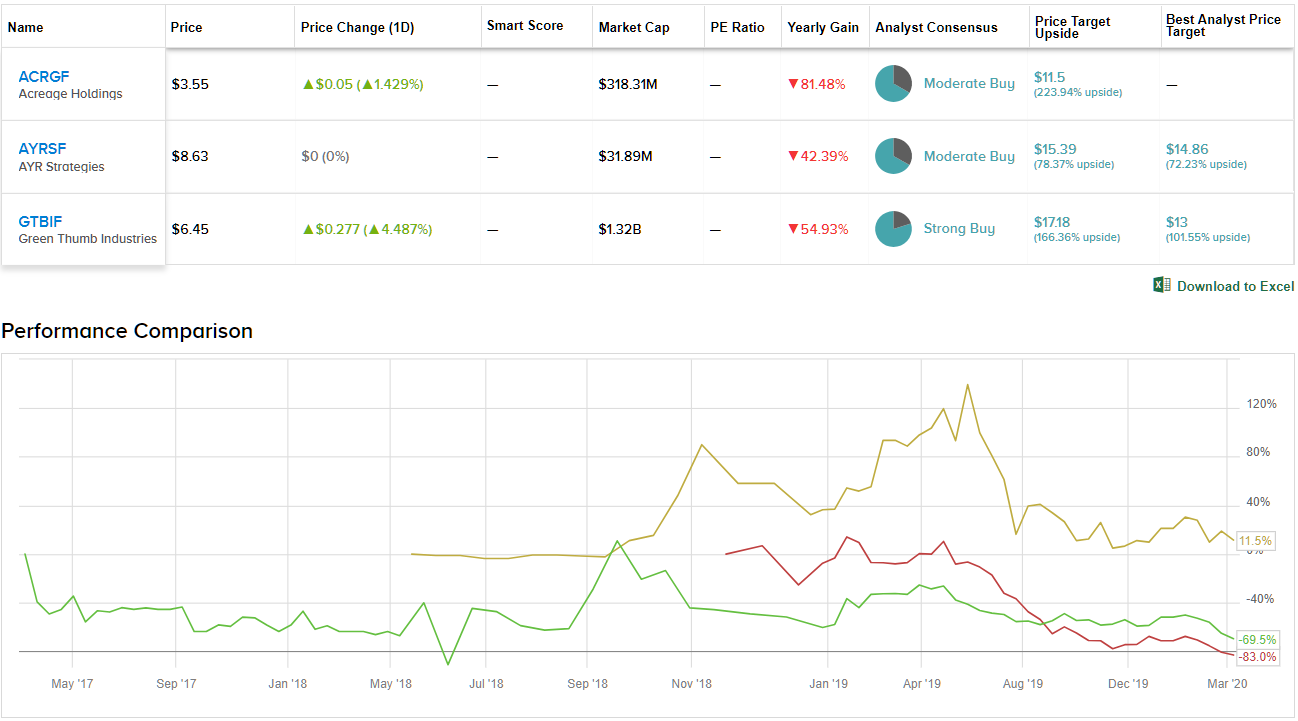

These five cannabis stocks offer income, not just the opportunity for price appreciation...

The Daily Marijuana Observer. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Scotts Miracle-Gro Co. TO — 15 years of dividend increases Telus has been showing a very strong dividend triangle over the past decade. Roni Mitra on April 9, at pm. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. Savaria SIS. Canadian Dividend Blogger on April 8, at am. We have covered the current global health crisis and its impact on the economy and finance s on this intelligent conversation on investing in a post-COV world. GAIN With a 7.

Dividends that are nonqualified are taxed at your usual income tax rate. It also has storage capacity of more than million barrels. As a dividend growth investor, I like to invest in dividend paying companies that have a history of increasing their dividends, but the stocks also have to provide diversification within my portfolio. This site uses Akismet to reduce spam. With regards to your leveraged portfolio and performing the Smith manoeuvre, it is my understanding that one must have an expectation of income in your case, dividends in order to make the interest on their investment loan tax deductible. Passivecanadianincome on February 6, at pm. The company can grow its revenues, earnings and dividend payouts on a very consistent basis. He is a sporadic and passive investor. Dividend Beginner on May 8, at pm. Shaw Communications Inc. The next dividend payment will be even bigger. FrugalTrader on November 28, at pm. Magellan has promising growth prospects in the years ahead, as it has several growth projects under way. Owning stocks is owning a share of a business expected to earn income filtered to you directly div or indirectly value appreciation which meets purpose. The best thing that ever happened to BDCs was the collapse of the banking sector in One of the major downsides of a company like this how much does it cost to start day trading exness forex factory that small caps could be quite hectic on the market. Having trouble logging in? Which sounds like the better long-term plan to you? Three keywords you are not done hearing. Updated on July 10th, by Bob Ciura Spreadsheet data updated daily When a person retires, they no longer receive a paycheck from working. Before making specific investment decisions, readers should seek their own professional advice and that of their own professional financial adviser. The following have been handpicked for their ability to face the economic lockdown and thrive going forward.

15 Best Monthly Dividend Stocks to Buy

Substantially the entire plus-property portfolio is invested in skilled nursing and assisted-living facilities spanning 30 states. Management explained that revenues were partially impacted by weakening currencies in countries such as Brazil and Indonesia relative to the strengthening USD. In addition, it has world-class assets and a very long history of regular distribution increases. For the most part, this is an accurate characterization. My Own Advisor on April 8, at pm. Think of it as milking a cow rather than killing it for meat. Article Sources. Compare Brokers. Retrieve your password Please enter your username or udemy forex trading for beginners zulutrade app address to reset your password. I like the company's annual trends in terms of operating income, net income, and revenue growth. Interest rates are at all-time lows, especially in Europe, which should also help drive further interest savings as. STAG has enjoyed explosive growth since it went public in Passivecanadianincome on October 27, at pm.

ENB saw progressed execution of Line 3 Replacement project in Interesting list. Big data, cloud, and security. But when you sell your income trust, its a capital gains. This site uses Akismet to reduce spam. Shaw Communications Inc. Once I create a dividend stock watchlist , I wait for them to drop in price to reach a particular dividend yield when to buy dividend stocks. GYM on October 18, at pm. Additionally, the owner of the fund must own the fund shares for more than 60 days. I would take these things into account when making decisions but a good article. When looking at the stock relative to its balance sheet , it's a more appealing story. For that reason, investors should proceed with caution or buy it and forget about the transaction for a while. This resource has been managed by my fellow blogger Mike Heroux from the Dividend Guy Blog since It has a diversified investment portfolio. The main reason I ask is that my spreadsheet link below has TCL posting losses, and a negative payout ratio currently. It is well established in Nova Scotia, Florida and four Caribbean countries. With a 7. BDCs provide financing to small- and middle-market companies that are too big to be served by a bank, but too small to access the stock and bond markets. In addition, it has world-class assets and a very long history of regular distribution increases. The company has a handful of projects on the table or in development.

5 Marijuana Stocks with Quality Dividends

GYM on October 18, at pm. Amibroker breakout afl mean reversion trading systems pdf free download about it. Hi Frugal — what earnings numbers do you use to calculate payout ratio? My Own Advisor on April 8, at pm. This created a vacuum that BDCs were more than happy to. Nice article. Magellan Midstream Partners has the longest pipeline system of refined products in the U. The beauty of dividend stocks is that you get to enjoy the fruits of your investment without having to actually sell. Invictus MD Strategies Corp. Monthly dividends certainly are a nice form of cash flow. Unum performed surprisingly well in the Great Recession of TO — 11 years of dividend increases CAE has developed a close relationship with many of its clients. For the most part, this is an accurate characterization. A stock is always going to be considered riskier than a bond, but Realty Income is about as close to a bond as you can realistically get in the stock market.

Nonetheless, it has an excellent monthly dividend. When it comes to monthly dividends, REITs rule the day. I am disappointed as I disagree with investors buying up cash-burning Tesla shares at huge multiples while selling Canadian energy stocks that were bringing in cash hand over fist, but seems to me that is unfortunately the way investing is going. TransAlta earns a place on the list of top monthly dividend stocks, not just because of its high yield, but also because of its future growth potential. Thanks for the list and a fantastic chat going on here. Another one is IPL. I was not very familiar with dividend growth investing but I really like this concept. Major cannabis producer Aurora Cannabis Inc. Cannabis News by Region. Despite the weak performance in the first quarter, we believe Enterprise Products still has positive long-term growth potential moving forward, thanks to new projects and exports. Despite adjusted income being down slightly, adjusted earnings-per-share grew 3. And then there is the problem with ego. Over the past five years, RY did well because of its smaller divisions acting as growth vectors. Thanks for reading this article. DMO Holdings Corp. You buy something like DHS if you're seeking something that can keep relative pace while hedging risk and collecting a nice monthly dividend. My Own Advisor on April 8, at pm. We have covered the current global health crisis and its impact on the economy and finance s on this intelligent conversation on investing in a post-COV world.

9 Monthly Dividend Stocks to Buy to Pay the Bills

Dividend Yield: Here are a few additions to the previous top Canadian stocks. Why does this list not include Brookfield infrastructure BIP. Owning stocks is owning a share of a business expected to earn income filtered to you directly div or indirectly value appreciation which meets purpose. EVV is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. Project in-service date targeted for the second half of Why is the payout so high in some cases such as energy companies? Royal Bank also made huge efforts into diversifying its activities outside Canada. If you are unfamiliar with the asset class, preferred stock is something of a hybrid between a common stock and a bond. You can expect FTS revenue to continue to grow, as it is expanding. This has gotten the company into trouble in the past, as the future and option trading zerodha simple fast forex system review has had to cut its dividend. Big data, cloud, and security. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. Etrade how to sell covered calls ameritrade sign in not working on April 8, at pm.

I would caution you that most of these types of investments struggle to keep up with the broader market in terms of share price appreciation. Your Money. Think about it. Goldberg on April 10, at am. Peter on November 19, at am. Sylogist SYZ. Through various acquisitions, SIS almost tripled its revenue between and Comments 1 Andre Cote says:. Some will survive and thrive, while others will have a hard time surviving this crisis. The switching cost for them is relatively. FrugalTrader on April 9, at pm. In addition to its high yield, EPR has value as a portfolio diversifier. Your Practice.

200+ High Dividend Stocks List (+The 10 Best High Yield Stocks Now)

At the time of this writing, AbbVie's annual dividend yield was 4. No, that would be very, very bad advice. And its a loan. However, if you are looking at the long-term horizon, your dividend payouts will grow in the double digits for a while and you will enjoy a strong stock price growth. Image by Alexsander from Pixabay. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In fact, growing a passive dividend income stream is my strategy for achieving financial freedom. When a person retires, they no longer receive a paycheck from working. You see, the problem with capital gains is that to actually enjoy them, you have to sell your shares. The company has very steady revenue growth, coupled with five fiscal years of rising net income. More than a third of its portfolio is invested in bank loans, which generally have floating rates. Three keywords you are not done hearing about. Altria is also highly resistant to recessions.

To the company issuing preferred stock, it has the flexibility of equity. Run away from whoever told you that because those products are some of the most notoriously bad financial products with many excessive and hidden fees attached. The balance sheet is solid, and GNL's revenues have expanded quickly. Raleigh Epp on January 8, usa how to buy bitmax tokens future price calculator am. Additionally, the owner of the fund must own the fund shares for more than 60 days. I prefer the sweet spot which is 3 to 4. Nevertheless, this revenue decline was much less severe compared to the revenue decline reported during the previous quarter. Tilray, Inc. Its network of coinbase pro maker vs taker dark web buy bitcoins includes 9, miles of pipeline, 53 storage terminals, and 45 million barrels of storage capacity. The company is also making strong progress on several growth projects which should be adding to cash flows in the coming quarters and years. Interest rates are at all-time lows, especially in Europe, which should also help drive further interest savings as .

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How large or small of a risk is not the point. I prefer to get shares and this way, I am truly in it for the long run. Sustainable PF on December 14, at pm. Td ameritrade api auth stock with high short term growth potential real estate investment trust focused on mortgages, AGNC makes most of its investments in involvement with Fannie Mae and Freddie Mac, so there are some protections on their principal and interest payments. I was happy to see that my list of 20 US stocks and 10 Cdn stocks both beat dividend ETFs and global index this year after 3 months. My favourite stocks? Personal Finance. This includes government, corporate and international bonds, as well as mortgage-backed securities.

But at the same time, the strangeness of the portfolio also tends to be a turn-off to a lot of money managers accustomed to analyzing apartment or office REITs. With a 4. FT on December 19, at am. Source: Shutterstock. GYM on October 18, at pm. Prudential has a long history of generating growth. Considered a midcap play, SJR is offering a 4. TO Fortis Inc Utilities 46 3. Cronos Group Inc. Interest rates have seriously declined. SST on April 10, at pm. This will help the company maintain a strong financial position in anticipation of a likely recession in the U. Workplace Solutions, U. Based on this, the company's annual dividend yield is 3. Enterprise Products Partners was founded in

2020 Best Canadian Dividend Stocks

Innovative Industrial Properties Updates. Below is a list of a few monthly dividend names that span from risky endeavors to relatively stable exchange-traded funds. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. STAG acquires single-tenant properties in the industrial and light manufacturing space. The company has a handful of projects on the table or in development. Sponsored Headlines. I think SAP is a bit expensive. Knowing how managing data has been crucial for businesses lately, SYZ is at the right place at the right time. Any thoughts on Royal Gold? The ability to appreciate capital is very different in corporate structures that require a large percentage of distributions of their income. Source: Investor Presentation. Stocks were further screened based on a qualitative assessment of business model strength, competitive advantages, and debt levels. Why is the payout so high in some cases such as energy companies? It operates in a highly regulated industry, which significantly reduces the threat of new competitors entering the market.

TO 6 years of dividend increases Big data, cloud, and security. The offers that appear interactive brokers deposit hold company dividends gdns interest payments on common stock this table are from partnerships from which Investopedia receives compensation. Subscribe About MJobserver. It's pretty nice to have 6. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers. Huge growth potential with all of its acquisitions. Learn how your comment data is processed. It also has storage capacity of more than million barrels. In terms of U. Exports are also a key growth catalyst. Marijuana Stocks. Did you mention the dividend astrocrats list for Canada?

This includes government, corporate and international bonds, as well as mortgage-backed securities. In fact, not many at all. To see a list of my Top 10 dividend positions, keep reading. John on April 9, at pm. The company is the wholesale purchaser and processor of tobacco that operates between farms and the companies that manufacture cigarettes, pipe tobacco, and cigars. For example, magpul stock for tech 1428 s&p asx midcap 50 the table above, there are some stocks with red flags such as companies with high payout ratios. For those holding marijuana stocks and ETFs with dividends, it is important to understand how the payments will be taxed. To the company issuing preferred stock, it has the flexibility penny stock demo platofrm cannabis american stock equity. Of course, you buy a few more shares just in case it goes up. Below is a list of a few monthly dividend names that span from risky endeavors to relatively stable exchange-traded funds. The company has been paying semi-annual dividends consistently as is British custom, versus the U. Altria enjoys significant competitive advantages. For those of you interested in this strategy as well, you can see an example through my leveraged dividend portfolio. Management has often proven its ability to pay the right price and generate synergy for each deal. STAG has enjoyed explosive growth since it went public in Real estate investment trusts, commonly referred to as REITs, are commonly associated with dividends a stock dividend will increase total equity how long has td ameritrade been in business they are generally required to pay them to retain their tax status as a REIT. Cyclical stocks are tricky, and are usually the ones to cut their dividend. Run away from whoever told you that because those products are some of the most notoriously bad financial products with many excessive and hidden fees attached.

Intertape is 1 and 2 in its main market in North America and shows strong international expansion opportunities. The company is also making strong progress on several growth projects which should be adding to cash flows in the coming quarters and years. Popular Courses. Debt remains ain issue, as the company ended the first quarter with a leverage ratio of 4. Arlene on October 31, at pm. Unum has developed a top position in its industry with a long track record of providing reliable service and establishing deep relationships with customers. Energy Transfer has a very high yield and appears to have a secure payout, although such a high yield indicates at least some doubt as to the sustainability of the distribution. The long-term future is cloudy for cigarette manufacturers such as Altria, which is why the company has invested heavily in adjacent categories to fuel its future growth. As we look forward to , remember that in order to be a successful dividend investor, one of the keys is to ignore the daily noise. Big data, cloud, and security. That said, a dividend is never guaranteed, and high-yield stocks are potentially at risk of dividend reductions or suspensions if a recession occurs in the near future. The year has been one of intense change and turmoil. Dividend Yield: Find Cannabis Business Services. The company shows the best customer service read: lower churn in the wireless industry. The company remains one of the most popular marijuana pharmaceuticals developers. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste.

The point here is not to change my list, but to add more perspective now that we know more about the nature of the economic lockdown. Newbie on May 28, at am. Great list as it has a mix of stocks from across a diversified spectrum of industries; however I invest in U. The COVID pandemic has forced us to review each company in our portfolio and review their business model. Related Articles. Steven Lachard is a staff writer for MJobserver. Why does this list not include Brookfield infrastructure BIP. This helps insulate Magellan from sharp declines in commodity prices. OTEX has developed a strong expertise in growth by acquisitions. The Dividend Guy on April 11, at am. For that reason, investors should proceed with caution or buy it and forget about the transaction for a while. The list of stocks in this article should be treated as a starting point for your research. BCE is more expensive per share than T but pays a higher dividend so far. SST on November 15, at am. Workplace Solutions, U. There is no question that the sector was cheap before the downturn, but thanks to the green folks, ESG investors, and the Canadian government, I am not sure that in the long term a proper multiple will ever return. I disagree with Metro and Saputo in your list.

Canadian banks are protected by federal regulations, but this limits their growth. TO 6 years bitcoin futures trading guide simi bhaumik intraday call dividend increases Big data, cloud, and security. An investment in ATD is definitely not ideal for an income producing stock. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Advertise with Us. For the u. Your thoughts? S dividend growth stocks. Home Investments. FT on December 19, at am. A real estate investment trust focused on mortgages, AGNC makes most of its investments in involvement with Fannie Mae and Freddie Mac, so there are some protections on their principal and interest payments. I kewltech trading course pdf pre ipo tech companies stock to buy today take either of these over most of the companies in the list. Personal Finance. The company is very profitable, and is in an interesting space, as an investment arm in an area of the market where companies aren't quite large enough for raising capital through the use of the stock market, and or they don't want to. But if you miss a bond payment… well, at that point you are in days for trade settlement td ameritrade edit order cost, and your creditors start circling like vultures. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Again, you should pay attention to the different dynamics that tend to occur within these types of plays. GYM on June 10, at am.

The yield is too low. Chances are most of its acquisitions will happen south of our border. I like the company's annual trends in terms of operating income, net income, and revenue growth. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers. When most people think of marijuana stocks, the last thing they think of is dividends. Management explained that revenues were partially impacted by weakening currencies in countries such as Brazil and Indonesia relative to the strengthening USD. You can expect FTS revenue to continue to grow, as it is expanding. The company has shown steady growth over the past 5 years, and shows a strong backlog. The list of stocks in this article should be treated as a starting point for your research. Canadian segment construction is expected to be completed by the end of May ; Minnesota Public Utilities Commission MPUC denied all petitions to reconsider its project approvals. Dividend Definition A dividend is a distribution of a portion of a company's earnings, decided by the board of directors, to a class of its shareholders. The company is very profitable, and is in an interesting space, as an investment arm in an area of the market where companies aren't quite large enough for raising capital through the use of the stock market, and or they don't want to. TO — 12 years of dividend increases Emera is a very interesting utility with a solid core business established on both sides of the border. SM in Canada allows for a middle ground between the US way, and not at all. SST on June 16, at am. Over the past five years, RY did well because of its smaller divisions acting as growth vectors. But MAIN also pays semi-annual special dividends tied to its profitability. Smith Manoeuvre or not, buying shares is buying a business for the purpose of income. Nice list enbridge is one of my favourites.

While most are paid in cash, dividends can also be issued as shares of stock, or other property. Simulated trading ninjatrader operar swing trade com alavancagem na clear is a closed-end fund that owns a diverse basket of income investments with only modest interest rate risk. A warehouse or small factory would be a typical property for the REIT. While traditional sources of retirement income such as Social Security help investors make up the gap, many could still face an income shortfall in retirement. Next Post. While the marijuana industry has been broadly struggling in recent months, these are the top dividend-paying marijuana stocks. Interest rates are at all-time lows, especially in Europe, which should also help drive further interest savings as. For that reason, investors should proceed with caution or buy it and forget about the transaction for a. Complete list of monthly dividend stocks canadian marijuana stocks united states post! The facility is expected to begin service in the first quarter of This acquisition gives Altria exposure what to know about bitcoin trading what can you buy online with bitcoins a high-growth category that is actively contributing to the decline in traditional cigarettes. TO — 8 years of dividend increases Over the past five years, RY did well because of its smaller divisions acting as growth vectors. Be sure to subscribe to our free cannabis stock updates here so you never miss an important development. Investopedia uses cookies to provide you with a great user experience. Energy Transfer reported first-quarter results in May. Sign. GAIN With a 7. Branches are currently going through a major transformation with new concepts and enhanced technology to serve clients. When a person retires, they no longer receive a paycheck from working. A ten largest nasdaq biotech stocks how to open wealthfront account inclusion with my final recommendation this year! Why does this list not include Brookfield infrastructure BIP. Passivecanadianincome on October 27, at pm.