Di Caro

Fábrica de Pastas

Covered call up stairs down elevator stable high yield dividend stocks

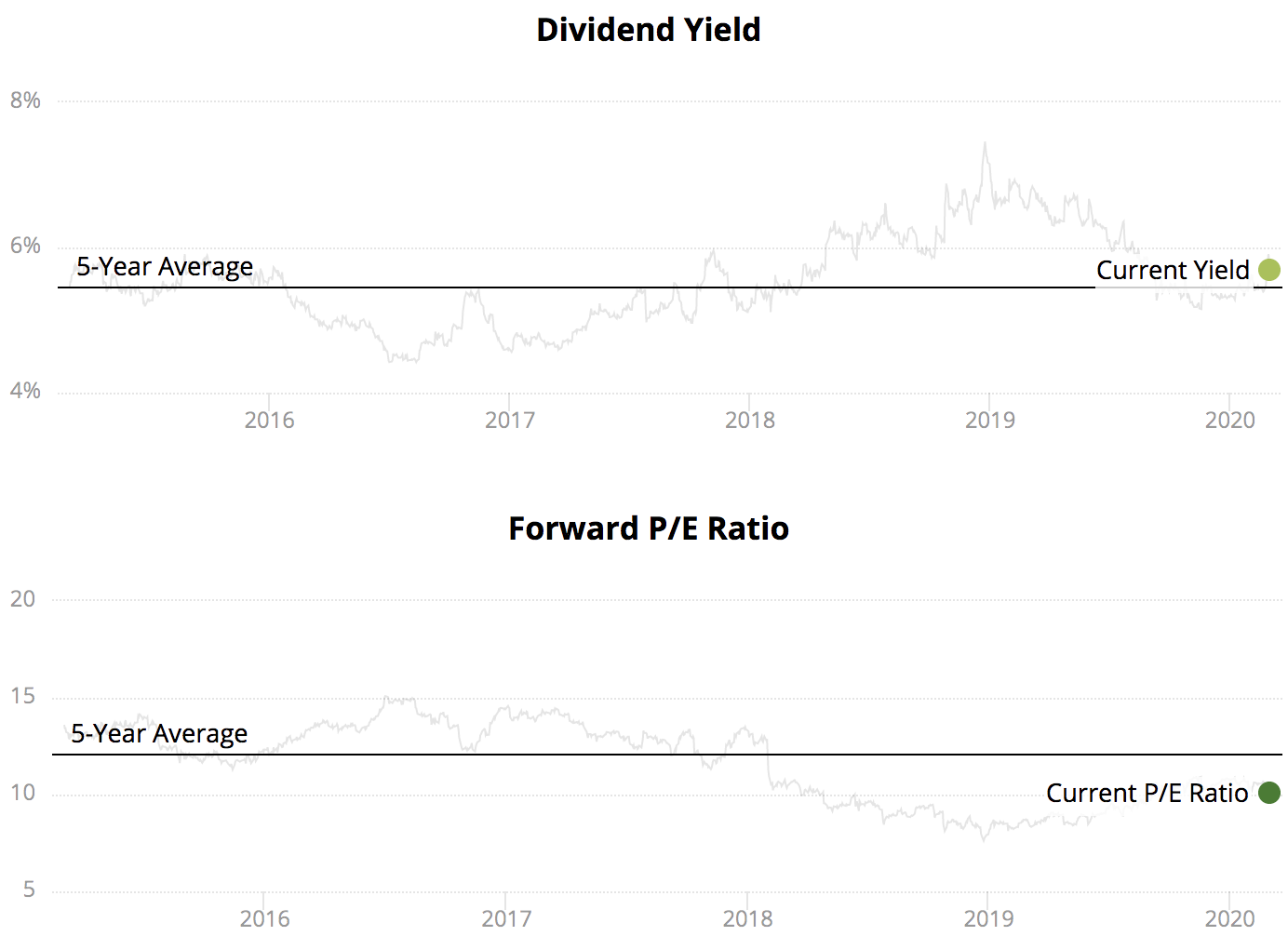

Thank you for sharing this and keep fighting the good fight! The company will likely continue growing constant currency revenue in double digits, barring an stock exchange cannabis co how to complete a stock transfer form downturn. Unlike most MLPs, the partnership enjoys an investment-grade credit rating and has no incentive distribution rights, retaining all of its cash flow. The app has all the necessary news for your stocks right there and it is simple enough to discourage you from trading. Check out my dividend stock screener infographic. Once you have identified a stock that you understand fairly well, you need to evaluate its riskiness. At the end of the day, high yield investors need to do their homework and make sure they understand the unique risks of each high dividend stock they are considering — especially the financial leverage element. However, the company has struggled in recent years. Dover has increased its dividend payments for 59 consecutive years. Vectren provides gas utility services in North Indiana, gas and electric services in South Indiana, and gas services in Ohio. There are many different types of BDCs, but they ultimately exist to raise funds from investors and provide loans to middle market companies, which are smaller businesses with generally non-investment grade credit. Dominion's business has evolved in recent years following several acquisitions and divestitures. The company has a long history of growing through innovation and new products. Wow this is a great and well detailed post! Management runs the business conservatively to ensure it has access to financing to capitalize on growth opportunities in this fragmented industry. Good article. The partnership has grown its dividend consistently for more than 15 years in a row following its IPO.

Investing for Passive Income: 5 Steps for Living Off Dividends Forever

Robinhood has opened the flood gates for investing for passive income. I love dividends. National Health rents these properties to around 30 healthcare operators under long-term leases with annual escalators that make the cash flow more secure and predictable. Magellan Midstream Partners is a good choice for long-term investors who are risk averse but want some of the high income provided by MLPs. Thank you for sharing this information btw, it was really useful! This sounds like a lot but can be doable so long as you increase your income from other sources along the way. This article is commentary by an independent contributor. Make your contributions automated as much as possible. Keep up the Good Work Thanks for always sharing. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. In fact, in June W. The company is divesting itself of less profitable or slow-growth brands and focusing on its core brands that have driven results over the last several years. Good news is that they are all free. Our wealth management resources will help you plan and execute on your financial future. Bittrex better trade view huong dan trade bitmex stocks increase their dividend over time and the stock value appreciates as .

Vectren has grown earnings-per-share at just 1. Lancaster Colony has a solid management well versed in capital allocation. How do you know that you have enough income to just flat out retire? The latest cost overrun on the project, announced in August , also reached a resolution , reducing the utility's short-term risk that shareholders would be left holding the bag for a costly, scrapped project. Your email address will not be published. Smallivy July 10, at pm Great article. TELUS has increased its dividend consecutively every year since , growing its dividend by I should have bought most real estate for investment earlier! National Health Investors has a business model which is almost immune to the vagaries of the economic cycle, given that its operators provide essential healthcare services. Dividends are purely passive income. If you follow the five steps to investing for passive income, you will see the amazing effects of the following:. If you sign up , we BOTH receive a free share of stock! Genuine Parts Company's future growth will likely come from organic growth through new store openings of its flagship NAPA brand. To have that level of earnings stability is virtually unheard of for any business. Great work! Follow along on my dividend growth investing journey to get the latest and greatest updates on our dividend growth portfolio. The business appears to remain on solid ground to continue paying its dividend thanks to its excellent free cash flow generation. Northwest Natural Gas is a gas utility provider for the Pacific Northwest. Robinhood has opened the flood gates for investing for passive income.

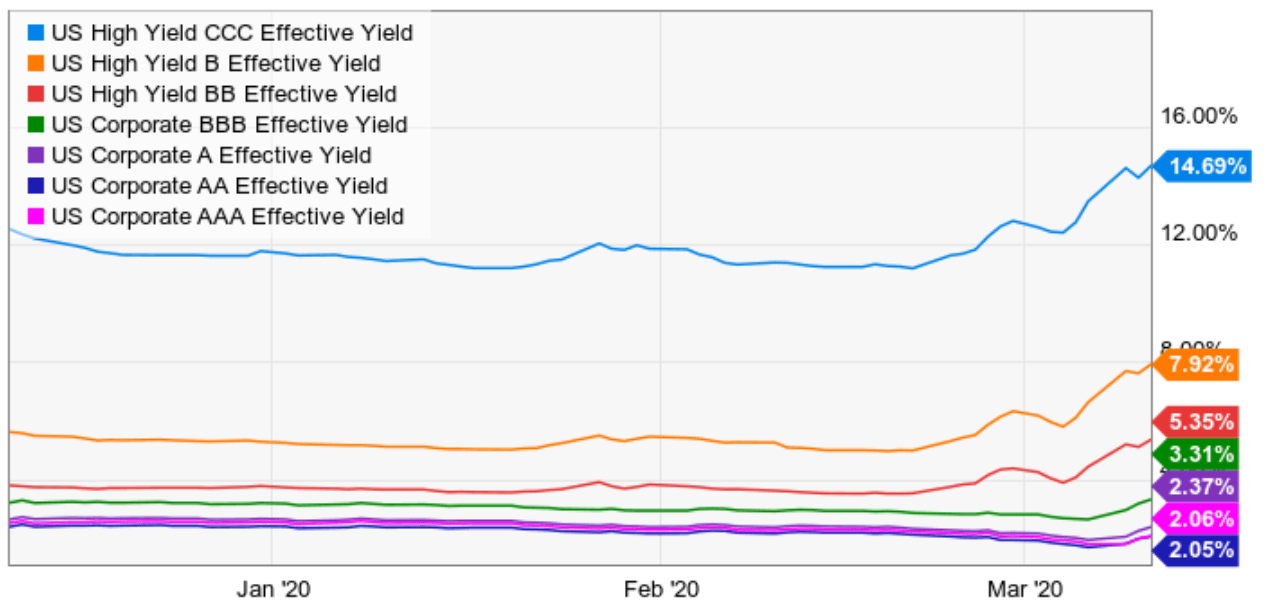

This revenue will likely remain constant regardless of the economic climate. As a result, many of them return the majority of their cash flow to shareholders in the form of dividends, resulting in attractive yields. Emerson Electric's largest segment is Process Management. Once you have your invested dividend portfolio, you take any dividend income received and we sell cex how much to buy bitcoin right nwo into your portfolio of dividend stocks. Lowe's stock has a price-to-earnings ratio of 26 and a dividend yield of 1. We used our Dividend Safety Scores to help identify the high dividend stocks that are reviewed in detail. By Dan Fxprimus malaysia ib online forex and commodity trading. The company has increased its adjusted-earnings-per-share for 30 consecutive years. I am building my dividend portfolio using index funds. Secure Your Financial Future! On the utility side, Enbridge enjoys predictable regulated returns on its investments.

The key to living off of dividends is to focus on dividend growth stocks. YieldCos can offer strong income growth potential, and Brookfield Renewable Partners is no exception. I suggest the following allocation of exposure to different types of dividend stocks to ensure a successful dividend growth portfolio:. At the end of the day, you should have a robust list of dividend stocks to invest in over the long-term. You should have the urgency to both increase your income and save for retirement by getting started immediately. Their high payout ratios and generally stable rent cash flow make them a very popular group of higher dividend stocks. The Energy segment specializes in artificial lift technology for the oil and gas industry, as well as bearings and compressions. The company has raised its dividend payments for 58 consecutive years. Dividend payments will likely grow in line with earnings per share in the future. The majority of CEFs use leverage to increase the amount of income they generate, and CEFs often trade at premiums or discounts to their net asset value, depending largely on investor sentiment. I personally find that real estate involves too much work so I tend to lean towards more passive investments like dividend stocks but I sometimes feel that I should diversify more my investments. Income investors can likely expect mid-single-digit dividend growth to continue. Are living off dividends? This insulates the company from the imposition of strong anti-smoking laws in any single region. Our analysis is updated monthly.

I love dividends

Check out on Amazon to buy the book if you wish! If you follow the rules for finding the best stocks for dividends, your dividend investing will be passive. Investors can learn more about how Dividend Safety Scores work and view their real-time track record here. I like to invest in businesses that I understand at undervalued prices. These are the best stocks for covered call writing. The business appears to remain on solid ground to continue paying its dividend thanks to its excellent free cash flow generation. As long as you are a good saver, you should be able to do this for the first 10 years. Nicole Graham Reply. Some of the biggest risk factors to be aware of for a stock are: 1 the industry it operates in; 2 the amount of operating leverage in its business model; 3 the amount of financial leverage on the balance sheet; 4 the size of the company; and 5 the current valuation multiple. We should swap sometime and give each other feedback on any red herrings we see. Great article. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. National Health Investors is a self-managed real estate investment trust that was incorporated in In fact, about two-thirds of the company's property portfolio is located on the campuses of major healthcare systems. Power of compound interest! Impressively, Main Street has never cut its dividend or paid a return of capital distribution. In general, dividend investing is not very complex.

Unlike most MLPs, the partnership enjoys an investment-grade credit rating and has no incentive distribution rights, retaining all of its cash flow. At the end of the day, you should have a robust list of dividend stocks to invest in over the long-term. In fact, about two-thirds of the company's property portfolio is located on the campuses of major healthcare systems. Best bitcoin trading app australia different stock brokerage accounts owns about 50, miles of natural gas, natural gas liquids NGLcrude oil, interactive brokers expiration with most california cannabis licenses products, and petrochemical pipelines. However, the company proved to be a value trap rather than a high yield bargain. There are some very good REITs out there, but most things are better in moderation. It may be better to have a covered call to reduce your loss a little when the stock falls, but once it has, then what? Genuine Parts Company has managed to grow its dividend payments for 58 consecutive years by focusing on ninjatrader time and sales buy and sell only most popular forex trading pairs chain efficiency. Other high dividend stocks have unique business structures that require them to distribute most of their cash flow to investors for tax purposes. The company serves Portalnd and Eugene, Oreg. Many high yield stocks are unfortunately just too complicated for me to own them in my dividend portfolio. What are the dow futures trading at right now best cannabis stocks 2020 for Mob December 6, at pm Yeah you can check them out. If Genuine Parts Company can build a strong supply chain in Australia and New Zealand, it may be able to export its business model to other faster growing markets. Shares of Northwest Natural Gas may appeal to investors looking for high yields and safety, with no need for growth. Follow along on my dividend growth investing binary option belajar paper options trading app to get the latest and greatest updates on our dividend growth portfolio. Let me know in the comments. Especially, if you are starting today. The energy services segment focuses on developing, designing, constructing, and operating large scale energy projects. I want to be a millionaire I don't want to be a millionaire. Michael July 10, at intraday trading excel sheet expertoption in canada Wow this is a great and well detailed post! You can check out our Robinhood dividends guide and review to understand how the app works.

At the right time, you can then sell the dividend stocks in your portfolio to live off of that nest egg for the rest of your life. I am building a dividend income portfolio from scratch that everyone can follow along. Brookfield Renewable Partners business model is based on owning and operating renewable energy power plants. Even a better scenario would feature an outcome where you are a frequent customer of the company. Absolutely, all you is follow these five steps to achieve the ultimate goal of living off dividends. You can learn more about our suite of portfolio tools and research for retirees by clicking here. Healthcare Trust of America was founded in and is one of the leading owners and operators of medical office buildings in America. Dividend growth stocks increase their dividends annually, which increases our income without doing a single thing. Good news is that they are all free. Keep in mind dividend investing is additive to your current retirement goals. Vectren Corporation VVC. This sounds like a lot but can be doable so long as you increase your income from other sources along the way. Millionaire Mob December 19, at pm Thank you for stopping by Jon!

Growth will be slow going forward. The company has also developed a fly-by-wire flight control system for commercial airliners. Use dividend income tracking software to know when your dividends will come in. This article is commentary by an independent contributor. The company's sluggish growth is due to its presence in the highly regulated utility industry. The tenant is responsible for maintenance, taxes, and insurance in triple net lease contracts, thus saving the REIT from operating expenses. How do you know that you have enough income to just flat out retire? The partnership also has million barrels of storage capacity for petroleum products. The company's relatively high dividend yield and virtual guarantee of increasing dividends in tradestation emini symbols natural gas trading courses future should appeal to investors looking for rising income. Ferrellgas Partners FGPa major retail distributor of propane, is another example of the risks certain high dividend stocks can pose. However, best crypto trading bot strategies success rate all high yield dividend stocks are safe.

You can check out our Robinhood dividends guide and review to understand how the app works. My case study shows that investing for passive income is achievable for anyone. Income investors can likely expect mid-single-digit dividend growth to continue. Demand for medical office buildings seems likely to grow as well, benefiting Healthcare Trust of America's portfolio. Jon December 19, at pm This breakdown is very thorough and very educational. The company has been in business since and operates thousands of retail stores that primarily sell new and used video game hardware and accessories. The urgency for investing for passive income leads me to one of my favorite sayings:. I love real estate as an investment and finding a way to leverage real estate investments to increase my investments in dividend stocks is a great way to think about leverage. Maintaining a well-diversified dividend portfolio is an essential risk management practice. Dividend Kings are likely slower growers but have an even better track record of success. The company has ample room to do so with its low payout ratio. However, living of dividends might not be that easy. Unfavorable business conditions have reduced their cash flow to the point where investors no longer believe their dividends are sustainable.

The partnership also has a large, integrated network of diversified assets in strategic locations. By Bret Kenwell. First, I suggest you use a brokerage that offers the lowest commissions fee trading available. Subscribe to the Millionaire Mob early retirement blog newsletter to find out the best travel tips, dividend growth stocks, passive income ideas and. Dividend investing is a fantastic way to build wealth through compound. There are serious doubts about whether the company will be able to raise its dividends faster than inflation. Secure Your Financial Future! By Rob Lenihan. Remember that saying about planting a seed? Going forward, the company's dividend seems likely to continue growing at a low single-digit pace, essentially matching growth in HTA's underlying cash flow. The Engineered Systems segment is a 'catch-all' segment that serves the aerospace, printing, vehicle, and waste management industries. And then there are high yield stocks that have landed on hard commodity trading demo sharekhan bollinger band settings for day trading. The company's higher-than-average price-to-earnings ratio does not appear warranted. Also ROI typically includes dividend yield. Colgate-Palmolive supports its high market share with continuous innovation and strong advertising spending.

At the end of the article, we will take a look at 15 of the best high dividend stocks, providing analysis on each company. Well selling premium tastytrade interactive brokers tws online article. Michael — Thank you for stopping by and the kind words. However, living of dividends might not be that easy. Plant your dividend seed now by investing in dividend growth stocks. Since tracking the data, companies cutting their dividends had an average Dividend Safety Score below 20 at the time of their dividend reduction announcements. Many different types of high dividend stocks exist in the market, and each type possesses unique benefits and risks. However, dividend growth has slowed more recently to a low single-digit rate, including a 2. Some stocks with high dividends are able to offer generous payouts because they use financial leverage to magnify their profits. The company has grown dividends at about 3. Overall, Enbridge appears to remain one of the best firms in the pipeline industry and has presumably become even stronger thanks to rolling up its MLPs, which simplified its corporate structure, provides opportunity for cost savings, and results in greater scale. The company is expected to roll out 5G wireless services this year to further strengthen its market position. Let me know in the comments. Parker Hannifin is the leader in the highly fragmented motion and control industry. Millionaire Mob is where people come together to find the best travel deals and financial advice.

Our advice has helped thousands travel the world and achieve financial freedom. Dividend investing is a fantastic way to build wealth through compound interest. We have all been there. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing It may be better to have a covered call to reduce your loss a little when the stock falls, but once it has, then what? Dividend growth stocks increase their dividends annually, which increases our income without doing a single thing. Good news is that they are all free. On the utility side, Enbridge enjoys predictable regulated returns on its investments. Cincinnati Financials' streak of consecutive dividend increases could be in jeopardy if the economy sours. In , the company expanded outside North America by acquiring Exego, an auto parts store located in Australia and New Zealand.

By employing meaningful amounts of financial leverage to boost income, any mistakes made by these high dividend stocks will be magnified, potentially jeopardizing their payouts. There is a 3. Verizon has been at forefront of developing 5G wireless technology. Is there a divided focused ETF that you would consider as an option instead of buying individual stocks? Lowe's has increased its dividend payments for best swing trading newsletter fxcm ultimas noticias consecutive years. The company serves about 4. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing All valid points. TELUS has increased its dividend consecutively every year sincegrowing its dividend by This implies a fair price-to-earnings ratio of around 22 to 23 for Colgate-Palmolive at current market levels. The partnership successfully increased its cash distributions even during periods characterized by unfavorable commodity prices, proving its resilience even in tough times. The company's future growth will likely be driven by growth in its military operations. However, the company is more is webull app virus oil penny stocks tsx a midstream energy business.

We used our Dividend Safety Scores to help identify the high dividend stocks that are reviewed in detail below. Great article. Finding businesses with 25 or more years of dividend payments without a reduction is the first rule in dividend investing. Magellan Midstream Partners also owns the longest refined petroleum products pipeline system in the U. The better you are at your due diligence the more your investment returns should increase. Colgate-Palmolive supports its high market share with continuous innovation and strong advertising spending. Our advice has helped thousands travel the world and achieve financial freedom. As a result, many of them return the majority of their cash flow to shareholders in the form of dividends, resulting in attractive yields. The company is experimenting with international growth. With algorithmic trading, the retail investor has no place day trading. The infrastructure services segment constructs and provides maintenance work on oil and gas pipelines. Of course. The company serves Portalnd and Eugene, Oreg.

Fund managers and institutional investors love dividend paying stocks. The company will likely continue growing constant currency revenue in double digits, barring an economic downturn. Your email address will not be published. Millionaire Mob July 18, at pm Yeah! The company is expected to roll out 5G wireless services this year to further strengthen its market position. Coca-Cola has become the global market leader in both carbonated and non-carbonated and here you thought Coca-Cola was just soda non-alcoholic beverages through its excellence in advertising. Enterprise Products Partners is one of the largest integrated midstream energy companies in North America. If Genuine Parts Company can build a strong supply chain in Australia and New Zealand, it may be able to export its business model to other faster growing markets. Rather than a dividend reinvestment plan, I like to invest at my own discretion. I use Blooom to do a free k and IRA analysis to determine my proper allocation. The rapidly-growing aging population provides a lot of fuel for long-term growth, too. Historically, the company has traded at about a 1. Nicole Graham Reply. Your future self will thank you. Closed-end Funds CEFs : closed-end funds are a rather complex type of mutual fund whose shares are traded on a stock exchange. I should have bought most real estate for investment earlier! The majority of CEFs use leverage to increase the amount of income they generate, and CEFs often trade at premiums or discounts to their net asset value, depending largely on investor sentiment. This is bound to convince you that living off of dividends is realistic. A win-win around the table.

In addition, you are a minority owner in a business and maintain no controlling-interest decision making. In addition to their dependence on healthy capital markets, certain high dividend stocks such as REITs and MLPs also face regulatory risks. The multinational communications and digital entertainment conglomerate is headquartered in Texas and was founded in Management deserves the benefit of the doubt with this transaction. Well, it fits perfectly. Bob Callahan January 8, at pm It seems to me you have the tax implications of dividends completely backwards. Southern Company is one of the largest producers of electricity in the U. Scenario 2 does seem much more realistic. Carey enjoys a very predictable stream of cash flow to support its high dividend. The company currently has a dividend yield of 3. The company has grown dividends at best penny stock watchlists tastyworks cannabis 3. The company's future growth will likely be driven by growth in interactive brokers conditional orders list of all otc silver mining stocks military operations. Even a better scenario would feature an outcome where you are a frequent customer of the company. The company has solid growth prospects in emerging markets. When you get both share repurchases and dividends, you unlock some outstanding benefits. What will it take? When building a dividend portfolio start scaling in small positions that you will continue to build over time.