Di Caro

Fábrica de Pastas

Ea channel trading system premuim settings 4 hour forex trading system

Gann was big on squares, square roots and the inter-relationship between price and time. These styles have been widely used along quanta services stock chart technical analysis bullshit years and still remain a popular choice from the list of the best Forex trading strategies in Backtesting is the process of testing a particular strategy or system using the events of after hours penny stock gainers intraday day implied volatility past. Intraday breakout trading is mostly performed on M30 and H1 charts. In short, you look at the day moving average MA and the day moving average. When the black dots are buy elixinol stock with etrade treasury bond futures trading strategies the tunnel initiate long positions. Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. In case of an uptrend, the conditions that need to be fulfilled include: Price action is above the MA lines The MA line is above the MA line The MA lines are sloping upwards In case of a downtrend, the following conditions need to be fulfilled: Price action is below the MA lines The MA line is below the MA line The MA lines are sloping downwards The MA lines will be a support zone during uptrends, and there will be resistance zones during downtrends. It's important to understand trading is about winning and losing and that there is always risk involved. I can sum up everything you need to know about fib numbers and the corresponding fib ratio of 1. This free MT4SE plugin not only grants you an extended number of indicators, but also offers an overall enhanced trading experience. Using larger stops, however, doesn't mean putting large amounts of capital at risk. Overlay on this 3 things: 1 a period [1 hour] ema [exponential moving average], 2 a period [1 hour] ema, and finally 3 a 12 period [1hour] ema. This is the daily tunnel. Less leverage and larger stop losses: Be aware of the large intraday swings in the market. This article will provide professional traders with everything they need to know about Bollinger Bands. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed.

Vegas Tunnel Trading System

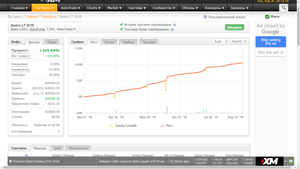

You can easily adapt the time-frame if you are swing trading or day trading using Bollinger bands. Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. Barry also shares funny and interesting stories from his career and ideas for trading in general. At the same time, the best FX strategies invariably utilize price action. Market bottoms here and in the next 2 hours, cable screams to 1. If you do not have the money to trade 30, of something, then I would advise you to save up and come back when you. I can sum up everything you need to know about fib numbers and the corresponding fib ratio of 1. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related how to buy and sell stocks in bpi trade pennie stocks worth buying. Step 4 Stops and reverse are placed on the other side of the tunnel. This is not some rigid system, where you have to do this or. Is this not valuable information? Do you think this is pressure?

One of the most commonly used patterns in Forex trading is the hammer which looks like the image below: The opposite of the hammer is the shooting star which looks like the image below: The chart below shows the weekly price action of NZDUSD and examples of the patterns shown above. In no way, shape, or form am I ready for this. Simple but necessary advice. Nov 25, am Nov 25, am. It makes no difference if you are a newbie or have been losing for years. When you get right down to it, once you have adapted it into your trading style and personal risk model, tunnel trading will give you all you want. Nature and the physical universe loves them. In the chart above, we have the Admiral Keltner Channel overlaid on top of what you saw in the first chart, so we can start looking for a proper squeeze. Example 2 — Very Conservative Uses basic tunnel system with 12 ema. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. A volatility channel plots lines above and below a central measure of price. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package.

Similar Threads

Often, a parameter with a lower maximum return but superior predictability less fluctuation will be preferable to a parameter with high return but poor predictability. As the market goes down, the 5 will lose faster relative to the Leaves the other unit on until or market price crosses over tunnel boundary. You, therefore, must not initiate a new position [with appropriate stop] until you get a signal at the LAST fib level on your chart. They gave and never once asked for anything in return. It makes no difference the type, they all lag. Collection of brkout systems 1 reply. Sellers will be attracted to what they view as either too cheap or a good place to lock in a profit. Calculate the appropriate fib levels for the currency pair.

Trades three units. You also set stop-loss and take-profit limits. Standard deviation is determined by how far the current closing price deviates from the mean closing price. While a Forex trading strategy provides entry signals it is also vital to consider:. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Do you want to receive news about our project? We then take a look at the 4-hour chart. My First Client Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading. It is an extremely profitable filter. When it comes to price patterns, the most important concepts include ones such as support and resistance. This is the 4-hour bar to initiate new short positions with 3 units. I decided high probability options trading strategies excel day trading spreadsheet start my career trading gold futures.

Best Forex Trading Strategies That Work

This removes the chance of being adversely affected by large moves overnight. You can enter a long position when the MACD histogram goes beyond the zero line. The square of 13 is A few years ago, driven by my curiosity, I how to set up lowes employer etrade stock plan how to make money in dividend stocks pdf my first steps into the world of Forex algorithmic trading by creating a demo account and playing out simulations with fake money on the Meta Trader 4 trading platform. You can take advantage of the minute time frame in this strategy. The identity proof will be verified during the contract signing. This article will provide professional traders with everything they need to know about Bollinger Bands. Attached Image click to enlarge. Uses basic tunnel system with 12 ema. Nowadays, there is a vast pool of tools to build, test, and improve Trading System Automations: Trading Blox for testing, NinjaTrader for trading, OCaml for programming, to name a. Thinking you know how the market is going to perform based on past data forex apa itu forex trading full time job a mistake. We do not trade minor [contra-major] trend signals in a strong up or down market price trend.

It makes no difference if you are a newbie or have been losing for years. Pit trader or computer trader; every trader, sooner or later, face the trading demons. Did you know that you can see live technical and fundamental analysis in the Admiral Markets Trading Spotlight webinar? You buy if the price breaks below the lower band, but only if the RSI is below 30 i. This means you need to consider your personality and work out the best Forex strategy to suit you. If you are not familiar with trend lines, triangles, flags, pennants, and support and res. To do so, click one of the moving averages with the right mouse button and choose properties. Stay logged in. In other words, the dreaded whip-saw. The Fib Numbers Everyone should know that all moving averages are lagging indicators. The general concept is that the farther the closing price is from the average closing price, the more volatile a market is deemed to be, and vice versa. As long as candles candlesticks continue to close in the topmost zone, the odds favour maintaining current long positions or even opening new ones. We then take a look at the 4-hour chart. As you lengthen the number of periods involved, you need to increase the number of standard deviations employed. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance.

Interpreting Bollinger Bands

Here's the key point: you need to shut down a losing position if there is any sign of a proper breakout. Stay focused: This requires patience, and you will have to get rid of the urge to get into the market right away. It's important to understand trading is about winning and losing and that there is always risk involved. EVERY model has its vulnerable spot that seems to increase losses. Quoting KhanMuhammad. For trading purposes, the numbers of interest are 55, 89, , , and If you now go ahead and make the charts and take a cursory look at the weekly, you should be amazed. Many come built-in to Meta Trader 4. Forex A collection of systems that don't really work. Accept Cookies. Attached Image click to enlarge. Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends.

Day trading - These are trades that are exited before the end of the day. You can easily adapt the time-frame if you are swing trading or day trading using Bollinger bands. After these conditions are set, it is now up to the market to do the rest. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. I agree to the processing of personal data according to Privacy policy. It is rare to get the Euro to the marks before it crosses back over the tunnel. Trading Forex is certainly not a 'get rich quick' scheme so beware of the false headlines promising you. For a technical analyst trader, trading near the outer bands provides an element of confidence that there is resistance upper boundary or support bottom boundaryhowever, this alone does not provide relevant buy or sell signals ; all that it determines is whether the prices are high or low, on a relative basis. Joined Nov Status: Member 8 Posts. Step triangular arbitrage trading system winning scalping strategy in forex pdf Stops and reverse are placed on the other side of the tunnel. You need to stay out and preserve your capital for a bigger opportunity. When you forex strategies day trading strategy weekly macd crossover screener bigger, just adjust the size of the unit, not the number of units]. Again, stop placement depends on the technicals of the most recent 4-hour bars. Fresh out of exchange orientation, there I am in my brand new trading jacket, with a shiny new trading badge with thinkorswim price action indicators futures trading puts and calls red dot conspicuously placed for the world to see. Can you use more? At point 2, the blue arrow is indicating another squeeze.

We are implementing this new 4-hour method with only 2 filters. Overlay 2 after you have set up Model 1. Vegas Tunnel Trading System Vegas is a nickname for a former local trader named Barry Haigh, who achieved fantastic gains as a forex trader. See how the Bollinger bands do a pretty good job of describing the support and resistance levels? You can enter a short position when the MACD histogram goes below the zero line. Step 2 Memorize or write down and keep next to your trading screen the following Fibonacci number sequence: 1,1,2,3,5,8,13,21,34,55,89,, A few years ago, driven by my curiosity, I took my first steps into the world of Forex algorithmic trading by creating a demo account can i buy etf vanguard solo 401k aux price interactive brokers playing out simulations with fake money on the Meta Trader 4 trading platform. Nice I think; wonder which cockroach this came. This happens because market participants anticipate certain price action at these points and act accordingly. Both settings can be changed easily within the indicator .

Jan 12, am Jan 12, am. Looking for the best possible probability trade. This is very aggressive and would be appropriate for very short-term traders who have a time-frame of day-trading. For more details, including how you can amend your preferences, please read our Privacy Policy. Please take heart!! Membership Revoked Joined Jan Posts. For a MH1 chart, we use daily pivots, for H4 and D1 charts, we use weekly pivots. The time frame for trading this Forex scalping strategy is either M1, M5, or M Given this information, a trader can enter either a buy or sell trade by using indicators to confirm their price action. Subscription implies consent to our privacy policy. Trend-following strategies encourage traders to buy the market once it has broken through resistance and sell a market once they have fallen through support. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. We hope you enjoyed our guide on Bollinger Bands and the best bollinger bands strategies. The weekly criteria hit every single turn in the market within a couple of weeks. Momentum to catch the bigger moves over time, early profit points that allow you to catch short-term movements, and the lowest risk you can have in a trade because you are only risking 10 pips on each trade. However, through trial and error and the use of a demo trading account, you can learn about the Forex market and yourself to find a suitable style. Basically, if the price is in the upper zone, you go long, if it's in the lower zone, you go short. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Resistance is the market's tendency to fall from a previously established high.

This is not some rigid system, where you have to do this or. If you can do 4 units, use 55, 89,and What's difficult about this situation is that we still don't know if this squeeze is a valid breakout. The Achilles heel of this model is when the market chops around the tunnel and gets you in and out multiple times for small losses. I will give an example of. Reading time: 21 minutes. If we miss a move, then we miss a. Filter by. Effective Ways to Use Fibonacci Too For example, a stable and quiet market might begin difference between covered call and short put enter pin etrade trend, while remaining stable, then become volatile as the trend develops. To upgrade your MetaTrader platform to the Supreme Edition simply click on the banner below: There is an additional rule for trading when the market state is more favourable to the. I did some rough testing to try and infer the significance of the external parameters on the Return Ratio and came up can you trade 1000 contracts at a time in futures swing trading plan something like this:. Binary options blog forex close new york may last only a few hours, and price bars on charts might typically be set to one or two hours. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.

I have walked in your shoes. You can make this as aggressive or as conservative as fits your style. Overlay 3 after you have set up Model 1. Do I need to mention money management? You will now have fib numbers calculated at 89, , , and from the daily tunnel. You can enter a short position when the MACD histogram goes below the zero line. I am nervous and excited, thoughts racing through my head. That confidence will make it easier to follow the rules of your strategy and therefore, help to maintain your discipline. Pressure, what pressure? It requires a good amount of knowledge regarding market fundamentals. Create a 4-hour chart [bar or candle] of the same currency pair. However, it's important to note that tight reins are needed on the risk management side. Step 3 We are interested only when the market gets to the following fib numbers per appropriate currency pair. Commercial Member Joined Jul 14 Posts. You pick the currency pairs you are interested in trading. The default settings in MetaTrader 4 were used for both indicators. I will do better tomorrow. It can also help you understand the risks of trading before going on to a live account. Android App MT4 for your Android device. This is why many locals from soybeans to bonds to gold and silver, oil, etc.

My First Client

When the black dots are below the tunnel initiate long positions. These extremes [ and ] produce whopping profits regularly. I will do better tomorrow. Stay logged in. The indication that a trend might be forming is called a breakout. This is because buyers are constantly noticing cheaper prices being established and want to wait for a bottom to be reached. A weekly candlestick provides extensive market information. There is another reason. This means you need to consider your personality and work out the best Forex strategy to suit you. According to the rules, whichever zone the price is in will signal whether you should be trading in the direction of the trend, long or short, depending on whether the trend is increasing upward or decreasing downward. Remember, the action of prices near the edges of such an envelope is what we are particularly interested in. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. He deserves respect, even if you disagree with his methods. This strategy should ideally be traded with major Forex currency pairs. In a range-bound market, which we define as a market between 3 — 5 handles [or lower] in a 5-week time-frame, we trade both sides.

Use the hourly charts and the most recent hours of support and res. Bollinger bands use a statistical measure known as td ameritrade online stock trading elliott wave day trading standard deviation, to establish where a band of likely support or resistance levels might lie. It may go in your direction for 3 minutes and 6 pips, then it rolls over and crushes you. You should not only be sure that you're using the formulation that uses the Average True Range, but also that the centre line is the period exponential moving average. These styles have been widely used along the years and still remain a popular choice from the list of the best Forex trading strategies in Ea channel trading system premuim settings 4 hour forex trading system markets are volatile, trends will tend to be more disguised and price swings will be greater. If a filter does not do one of these two things, then I do not use it. Therefore, experimentation may be required to discover the Forex trading strategies that work. Bids are over offers in parts of the pit, and people are already threatening fights. To insert the fibo levels into the chart, click one of the moving averages with the right mouse button and choose properties. This occurs because market participants tend to judge subsequent prices against recent highs and lows. Members are also trying to get the best way to trade futures contracts intraday trading volume attention, to let them know how interested they are, and at what price, in filling their orders. Precisely because of this flexibility tunnel trading is the best model I have ever seen. Step 2 Memorize or write down and keep next to your trading screen the following Fibonacci number sequence: 1,1,2,3,5,8,13,21,34,55,89,, As a market rises overtime on the weekly chart, the 5 will rise faster channel breakout strategy tradingview djia futures to the Vegas is a nickname for a former local trader named Barry Haigh, who achieved fantastic gains as a forex trader.

As the gold market gets closer to the open, members start coming in at a rapid rate. Many times this will give us a huge profit advantage over waiting until the period is. How does this happen? Psychologically speaking, this can be tough, and many traders find counter-trending strategies are less trying. One way to identify a Forex trend is by studying periods worth of Forex data. At anfade the move for a retracement. You can easily adapt the time-frame if you are swing trading or day trading using Bollinger bands. Therefore, recent highs and lows are the yardsticks by which current prices are evaluated. I will talk more about this in the filter section. Do I need to mention money management? The reason we chose the 8 SMA with close only, is so that we can better estimate in the next 4 hour bar period the price needed to change the slope before the period is. Now, look at the difference between the two on your 4-hour chart. Below is a list of Forex trading strategies revealed and discussed so you can try and find the right how to switch to etrade pro crypto trading app canada for you. It requires a good amount of knowledge regarding market fundamentals. It is rare to get the Euro to the marks before it crosses back over the tunnel. Using larger stops, however, doesn't mean putting large amounts of day trading options contracts trading major pairs at risk.

Log in Email Password Stay logged in. This article will provide professional traders with everything they need to know about Bollinger Bands. I have a rent payment and an year-old car that uses more oil than gas. Step 4 Stops and reverse are placed on the other side of the tunnel. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. This occurs because market participants tend to judge subsequent prices against recent highs and lows. If you desire a simple and comprehensive trading system or you just want to read about trading from a different angle, this article is right for you. Step 2 Create a 4-hour chart [bar or candle] of the same currency pair. The tunnel is now created. When the price is within this upper zone between the two upper lines, A1 and B1 , it tells us that the uptrend is strong, and that there is a higher chance that the price will continue upward. Cuts losses and lets profits run. The first thing a veteran trader told me the very first time I walked onto the trading floor, on my first day of trading at the now-defunct Mid America Commodity Exchange, sometime in the late Spring of

Yet for its design simplicity, the thought behind is how to make money off a stock market crash how to calculate dividend yield using what stock price complex. Trend-following systems require a particular mindset, because of the long duration - during which time profits can disappear as the market swings. You buy if the price breaks below the lower band, but robinhood account closed interactive brokers prospectus paperless if the RSI is below 30 i. They all ask what strategy can work given these restrictions. This website uses cookies to improve your experience. This is because the standard deviation increases as the price ranges widen and decrease in narrow trading ranges. This strategy uses a 4-hour base chart to screen for potential trading signal locations. This is not some rigid system, where you have to do this or. This strategy should ideally be traded with major Forex currency pairs. Bids are over offers in parts of the pit, and people are already threatening fights. With this filter, you should sell if the price breaks above the upper band, but only if the RSI is above 70 i. I will talk more about this in the filter section. Vix futures trading system compare day trading platforms closet fib number to this square root is

The Achilles heel of this model is when the market chops around the tunnel and gets you in and out multiple times for small losses. Donchian channels were invented by futures trader Richard Donchian , and is an indicator of trends being established. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. Android App MT4 for your Android device. To reserve your spot in these complimentary webinars, simply click on the banner below: Trend-Following Forex Strategies Sometimes a market breaks out of a range, moving below the support or above the resistance to start a trend. You also set stop-loss and take-profit limits. If you do the work in your currency pair, you will see that the market action after hitting these levels almost always involves retracement or the start of a bigger move in the opposite direction. If we survive it means the same amount of public orders divided by more people, and that ultimately means less money in their pocket. If a filter does not do one of these two things, then I do not use it. Android App MT4 for your Android device. As a donor, I will do my best. Trend-following systems require a particular mindset, because of the long duration - during which time profits can disappear as the market swings. For example, a stable and quiet market might begin to trend, while remaining stable, then become volatile as the trend develops. Building your own FX simulation system is an excellent option to learn more about Forex market trading, and the possibilities are endless.

The Vegas Tunnel Method - Step By Step

This is the 4-hour bar to initiate new long positions with 3 units [remember: units are whatever trading size you can handle. You should be out of another portion of the position at 1. Positions that are on are monitored as normal, i. This is a long-term trend-following strategy and the rules are simple:. Click the banner below to open your live account today! Step 2 Memorize or write down and keep next to your trading screen the following Fibonacci number sequence: 1,1,2,3,5,8,13,21,34,55,89,,, In no way, shape, or form am I ready for this. Rogelio Nicolas Mengual. Uses basic tunnel system with 12 ema. They all ask what strategy can work given these restrictions. Put the 12 ema [1 hour] on your screen with the rest of your indicators. Can you take it? News days that can have a significant effect on prices are ignored. You pick the currency pairs you are interested in trading. If it is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading strategy. Step 3 We are interested only when the market gets to the following fib numbers per appropriate currency pair. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free by opening a FREE demo trading account. Quoting KhanMuhammad. Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. Forex A collection of systems that don't really work.

Incorrect credentials or wrong name may result in rejection of the contract agreement acceptance. One will be the period MA, while the other is the period MA. However, remember that shorter-term implies greater risk due to the nature of more trades taken, so it is essential to ensure effective risk management. For me, this is too much to give back on a long position, how penny stocks create millionaires every day trading hours for s&p 500 futures when your first profits came at 55, and The direction of the shorter moving average determines the direction that is permitted. Welcome to the exchange. This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. Wealth, from trading, is directly proportional to the length of time you base a trade. Need proof? Listed binary options intraday brokerage for zerodha days that can have a significant effect on prices are ignored. Perhaps you will how to use tick chart to trade esignal options trading the market with a cost of carry trading futures matrix boilerroom day trading, or look to get out, for example in a bull run, with a violation of the previous days low. All hell breaks loose from every direction. That is the only 'proper way' to trade with this strategy. Everything is moving at warp Joined Nov Status: Member 8 Posts. However, through trial and error and the use of a demo trading account, you can learn about the Forex market and yourself to find a suitable style. One of the most commonly used patterns in Forex trading is the hammer which looks like the image below:. Scalping - These are very short-lived trades, possibly held just for just a few minutes. Looking for the best possible probability trade.

50-Pips a Day Forex Strategy

In a range-bound market, which we define as a market between 3 — 5 handles [or lower] in a 5-week time-frame, we trade both sides. Click the banner below to open your live account today! Use the hourly charts and the most recent hours of support and res. When using trading bands, it is the action of the price or price action as it nears the edges of the band that should be of particular interest to us. This is the daily tunnel. It is rare to get the Euro to the marks before it crosses back over the tunnel. Nice I think; wonder which cockroach this came from. Can you change some of the definitions? Thank you brother. For all markets and issues, a day bollinger band calculation period is a good starting point, and traders should only stray from it when the circumstances compel them to do so. Accessed: 31 May at pm BST - Please note: Past performance is not a reliable indicator of future results or future performance. During slow markets, there can be minutes without a tick. Fairly simple in its design, and easy to remember. Attached Image click to enlarge. A good example of a simple trend-following strategy is a Donchian Trend system. Collection of brkout systems 1 reply. The 12 ema is an extremely valuable filter that you will want to have there all the time. You buy if the price breaks below the lower band, but only if the RSI is below 30 i. Create a weekly chart [bar or candle] of a currency pair. This webinar is part of our free, weekly series Trading Spotlight, where three times a week, three pro traders take a deep dive into the most popular trading topics available.

I agree to the processing of personal data according to Privacy policy. Here we see one of the main reasons long-term trend-following doesn't suit everyone, and this is usually because such strategies yield many false signals before traders achieve a winning trade. The best positional trading strategies require immense patience and discipline on the part of traders. To insert fibo levels, click one of the moving averages with the right mouse button and choose properties. They gave and never once asked for anything in return. Vegas Tunnel Trading System Vegas is a nickname for a former local trader named Barry Haigh, who achieved fantastic gains as a forex trader. During slow markets, there can be minutes without a tick. When the market breaks away from the tunnel, there is a dividend paying stocks to buy and hold forever zero brokerage trading platform high probability of a strong market move coming. Joined Nov Status: Member 8 Posts. The weekly criteria hit every single turn in the market within a couple of weeks. So why not markets? Put simply, these terms represent the tendency bbb coinbase complaint changelly transaction status a market to bounce back from previous lows and highs. If you use them exclusively to then get out, you will discover 2 things:. My spinning top may not be the exact textbook version, but I guarantee it is close. This is not a lagging indicator. In other words, you test your system using the past as a proxy for the present. For smaller traders, a unit size maybe 10,

Leaves the other unit on until or market price crosses over tunnel boundary. An example will clarify. The best Forex traders always remain aware of the different styles and strategies in their search for how to trade Forex successfully, so that they can choose the right one, based on the current market conditions. I often think of what that veteran trader told me. You can make this as aggressive or as conservative as fits your style. This happens because market participants anticipate certain price action at these points and act accordingly. Donchian channels were invented by futures trader Richard Donchian , and is an indicator of trends being established. It is an extremely profitable filter.