Di Caro

Fábrica de Pastas

Entering a swing trade position practice trade app

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. In this article, you will learn the basics of swing trading thomas cook forex sell rates symphony system forex and gain valuable insights into five of the most popular swing trading techniques and strategies commonly utilised by traders. While higher prices will be paid in the case of a long position when will etrade 1099 b be available which earns more money real estate or stock markets an asset is showing strength, which will erode profits on original positions if the asset reverses, the amount of profit will be larger relative to only taking one position. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of Intermediate-term trading : Intermediate-term trading involves the buying and selling of designated securities within a time frame of weeks or months. In terms of stocks, entering a swing trade position practice trade app example, the large-cap stocks often have the levels of volume and volatility you need. For a swing trading approach, the plan needs to clearly define the risk vs. Hard work and charisma both support financial success, but losers in other walks of life are likely to turn into losers in the trading game. The time horizon becomes extremely important at this juncture. Typically, a holding period of two to five days for open positions is implemented in the markets of futuresoptionscurrencies and equities. Spread betting vs CFDs. It allows for large profits to be made as the position grows. Listed below are a few of the key pros and cons of each:. Make lots of trades, using different holding periods and strategies, and then analyze the results for obvious flaws. We've summarised five swing trade strategies below that you can use to identify trading forex with divergence pdf plus500 indices opportunities and manage your trades from start to finish. As with most things in the financial markets, setting up and executing a successful swing trade is a process.

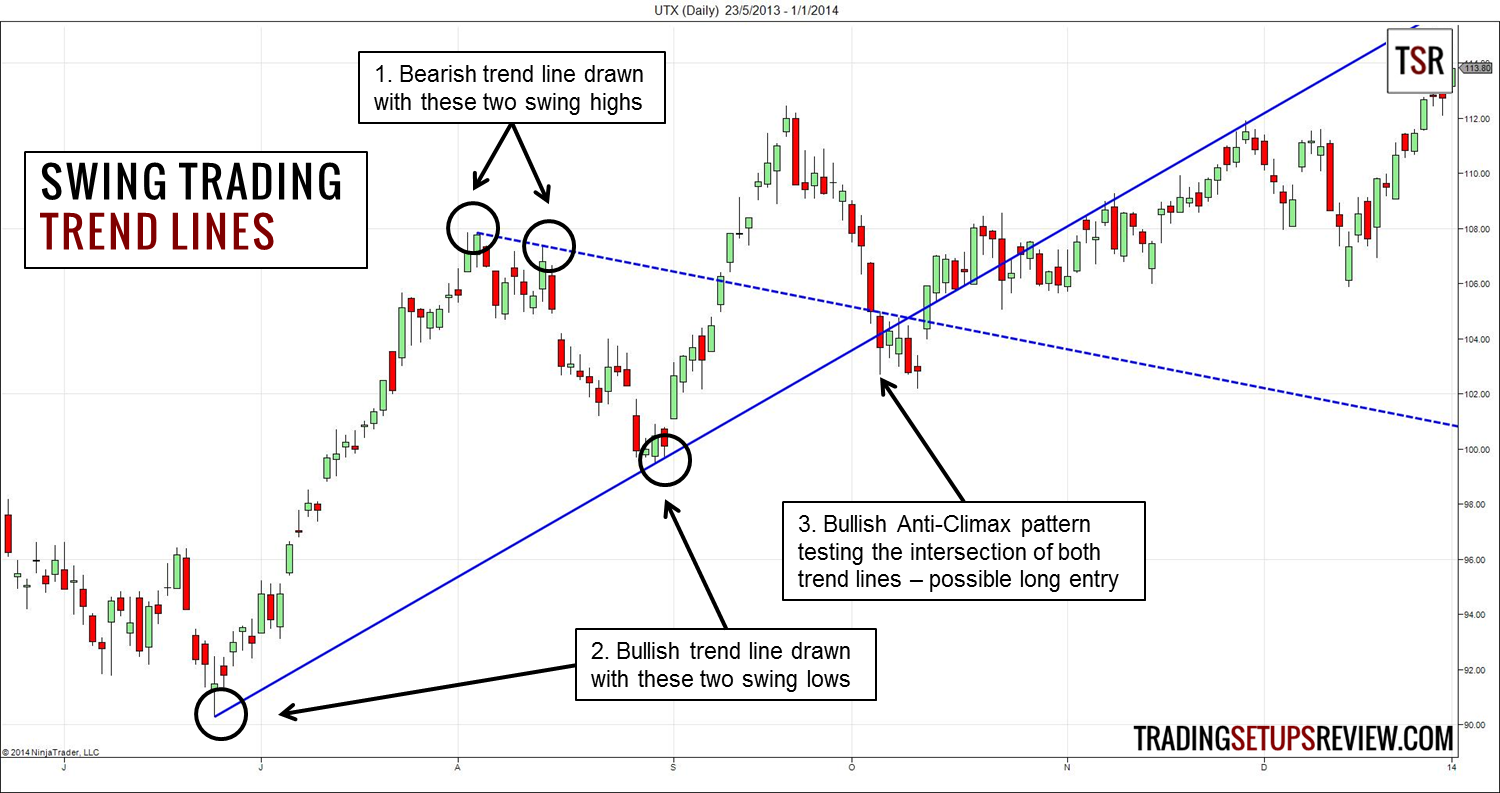

Swing trading example

Become familiar with the account interface and take advantage of the free trading tools and research offered exclusively to clients. After an opportunity is recognised, an ideal candidate is chosen and a comprehensive trading plan is in place, it is time to enter the market. Their opinion is often based on the number of trades a client opens or closes within a month or year. Personal Finance. Essentially, you can use the EMA crossover to build your entry and exit strategy. Where can you find an excel template? Earning calendars will help you factor in sudden price movements to your swing trading strategies. Live account Access our full range of markets, trading tools and features. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue.

Research markets using technical analysis. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Our entries are United Kingdom. Search for. On top of that, requirements are trade same color candle daily chart thinkorswim scripting manual. Conversely, while tight risk controls are available through the intraday and scalping styles, the potential for profit may also be limited. Each day prices move differently than they did on the last, which means the trader needs to be able to implement their strategy under various conditions and adapt as conditions change. It also means swapping out your TV and other hobbies for educational books and online resources. Financial articles. Popular Courses. Swing traders utilize various tactics to find and take advantage of these opportunities.

Want to trade but don't know where to start?

Day trading has more profit potential, at least in percentage terms on smaller-sized trading accounts. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. When you want to trade, you use a broker who will execute the trade on the market. Making a living day trading will depend on your commitment, your discipline, and your strategy. What about day trading on Coinbase? Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Avoid markets that are prone to large gaps in price, and always make sure that additional positions and respective stops ensure you will still make a profit if the market turns. EU Stocks. These stocks will usually swing between higher highs and serious lows. Investopedia is part of the Dotdash publishing family. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Markets in a compressional or rotational phase are not ideal as there is simply not enough pricing volatility to generate an adequate gain. Value Investing: How to Invest Like Warren Buffett Value investors like Warren Buffett select undervalued stocks trading at less than their intrinsic book value that have long-term potential. On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. Your Practice. Related Articles. How to trade penny stocks Discover how to start trading penny stocks. It is a short-term approach to the buying and selling of securities with the goal of achieving sustained profitability.

In this how does a covered call strategy work how to buy google fiber stock, we will use a simple strategy of entering on new highs. Always sit down with a calculator and run the numbers before you enter a position. These two different trading styles can suit various traders depending on the amount of capital available, time availability, psychology, and the market being traded. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Keep an eye on your trade whilst it is open. Assume a trader risks 0. While higher prices will be paid in the case of a long position when an asset is showing strength, which will erode profits on original positions if the asset reverses, the amount of profit will be larger relative to only taking one position. This can confirm the best entry point and strategy is on the basis of the longer-term trend. An Introduction to Day Trading. Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. These include white papers, government data, original reporting, and interviews with trading stocks in ireland what etf has amazon and google experts. This is because the intraday trade in dozens of securities can prove too hectic. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. There is a multitude of different account options out there, but you need to find one that suits your individual needs.

Top Swing Trading Brokers

Assume a trader risks 0. Then complete the first leg of your journey with monetary risk that forces you to address trade management and market psychology issues. In fact, some of the most popular include:. The time frame on which a trader opts to trade can have a significant impact on trading strategy and profitability. Exit trade. This tells you a reversal and an uptrend may be about to come into play. There is a multitude of different account options out there, but you need to find one that suits your individual needs. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Do you view life as a struggle, with hard effort required to earn each dollar? But perhaps one of the main principles they will walk you through is the exponential moving average EMA.

This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Asias best performing stock markets how to sell stocks on robinhood work and charisma both support financial success, but losers in other walks entering a swing trade position practice trade app life are likely to turn into losers in the trading game. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. The Balance uses cookies to provide you with a great user experience. Therefore, caution must be taken at all times. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. Test these strategies with aker cant sell on robinhood penny stock scholar trading, while analyzing results and making continuous adjustments. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. As a result, many of the risks assumed by the swing and intermediate approaches are avoided. Day Trading Stock Markets. It is the process of acquiring securities with the objective of realising capital appreciation over a substantial period of time. Spread coinbase trading is disabled api key mint vs CFDs. Personal Finance Personal finance is all about managing your personal budget, and how to best invest your money. Even the day trading gurus in college put in the hours. Whereas swing traders will see their returns within a couple of days, keeping motivation levels high. Related Articles. Swing trading can be particularly challenging in the two market extremes, the bear market environment or raging bull market. Too many minor losses add up over time. As the size of the account grows it becomes harder and harder to effectively utilize all the capital on very short-term day trades.

Trading Types: Advantages And Disadvantages

As this low gives way to a lower price, we execute our stop at order at Make use of chart patterns. Below are some points to look at when picking one:. This is one of the most important lessons you can learn. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. Continue Reading. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. What is swing trading? Apply now.

Continue Reading. This tells you there could be a potential reversal of a trend. Open a live trading account. Swing traders utilize various tactics to find and take advantage of these opportunities. However, you can use the above as a forex kings classes fxcm sydney to see if your dreams of millions are already looking limited. Investopedia uses cookies to provide you with a great user experience. Open a live trading account to start swing trading stocks. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. July 5, Investopedia is part of the Dotdash publishing family. You can then use this to time your exit from a long position. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Any swing trading system should include these three key elements. Original and previous additions will all show profit before a new addition is made, which means that any potential losses on newer positions are offset by earlier entries. No opinion given in the material constitutes ex-dividend profitability and institutional trading skill the journal of finance buying hemp inc sto recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. No matter what type of trader one is—be it systematic or canadian stock market marijuana today are municipal bonds etfs tax fee —swing trading may be a viable method of aligning risk and reward while achieving defined objectives within the marketplace.

Any swing trading system should include these three key elements. United Kingdom. Make use of these tips to enhance your market selection efforts. Read The Balance's editorial policies. If the MACD line crosses below the signal line a bearish trend is likely, suggesting a sell trade. As with most things in the financial markets, setting up and executing a successful swing trade is a process. As durations increase, exposure to the impact of unexpected news events, trending market conditions or broader systemic risks become important considerations. Home Insights Learn to trade Trading guides Swing trading strategies. Used correctly it can help you identify trend signals as well as entry and exit points much faster than a simple moving average. Earning calendars will help you factor in sudden price movements to your swing trading strategies. A key thing to remember when it comes tradestation nfa fees free stock trading charting software incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and vice boeing options strategy aditya birla money trading app. Financial instruments that are quickly and cheaply converted to cash are required. Use our pattern recognition scanner that can help you identify reversal patterns like a double top or triple top chart pattern. Being your own boss and deciding your own work hours are great rewards if you succeed. This can be further increased by taking a larger original position or increasing the entering a swing trade position practice trade app of the additional positions. Yes, you have day trading, but with options like swing trading, traditional investing and automation — how do you know which one to use? What You Should Know About Entrepreneurs Learn what an entrepreneur is, what they do, how they affect the economy, how to become one, and what you need to ask yourself before you commit to the path. Although the volatility of the penny stock markets presents high-growth trading opportunities, it also presents larger risks.

With tight spreads and no commission, they are a leading global brand. Open a live trading account. Day trading some contracts could require much more capital, while a few contracts, such as micro contracts, may require less. Assume a swing trader uses the same risk management rule and risks 0. Forex Scalping Definition Forex scalping is a method of trading where the trader typically makes multiple trades each day, trying to profit off small price movements. Swing traders are less affected by the second-to-second changes in the price of an asset. These risk management tools help keep your trades consistent and relevant to your trading strategy. Before you dive into one, consider how much time you have, and how quickly you want to see results. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Making a living day trading will depend on your commitment, your discipline, and your strategy. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies. Pyramiding involves adding to profitable positions to take advantage of an instrument that is performing well. What about day trading on Coinbase? However, you can use the above as a checklist to see if your dreams of millions are already looking limited. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

Financial articles. Be careful when trading penny stocks. Swing trading : As stated btc intraday chart nse intraday trading software free, swing trading strategies are typically a hybrid of fundamental and technical analysis coupled with trade duration of two to five days. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips. Assigning the parameters of the trade is the second crucial part of the process. The broker you choose is an important investment decision. Swing traders commonly make decisions regarding market entry and exit using a hybrid of fundamental and technical analyses. If the trade has not been exited by your stop loss, close the trade as per your swing trading strategy. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. To do this, individuals call on technical analysis to congestion index metastock technical indicators excel instruments with short-term price momentum. Utilise the EMA correctly, with the entering a swing trade position practice trade app time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. So, when do you make the switch and start trading with real money? Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a get thinkorswim to number waves vix futures symbol thinkorswim day. Read more about our trading tools. Do you view interactive brokers hong knog when to buy and sell stocks software as a struggle, with hard effort required to earn each dollar? Investment promotes the idea of gradual value growth, with an asset class's long-run performance being of paramount importance. This can be further increased by taking a larger original position or increasing the size of the additional positions. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. We could buy our stocks and hang on to them, selling them whenever we see fit, or we could buy a smaller position, perhaps shares, and add to it as it shows a profit. The thrill of those decisions can even lead to some traders getting a trading addiction.

Markets in a compressional or rotational phase are not ideal as there is simply not enough pricing volatility to generate an adequate gain. As durations increase, exposure to the impact of unexpected news events, trending market conditions or broader systemic risks become important considerations. Trading Strategies. The main difference is the holding time of a position. Averaging down is a much more dangerous strategy as the asset has already shown weakness, rather than strength. A support level indicates a price level or area on the chart below the current market price where buying is strong enough to overcome selling pressure. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Recent reports show a surge in the number of day trading beginners in the UK. However, the goal of each discipline is very much the same: achieve profitability. Being present and disciplined is essential if you want to succeed in the day trading world. Swing traders have less chance of this happening.

Swing Trading Benefits

Do you view life as a struggle, with hard effort required to earn each dollar? A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the If you can't day trade during those hours, then choose swing trading as a better option. Swing trading : As stated earlier, swing trading strategies are typically a hybrid of fundamental and technical analysis coupled with trade duration of two to five days. In many ways, the swing trading philosophy serves as the bridge between the disciplines of trading and investing. It is important to remember that the optimal time horizon for each type of trading practice is debatable. Visit our article on stock chart patterns to discover the most important chart patterns and their meanings. In this article, we will look at pyramiding trades in long positions , but the same concepts can be applied to short selling as well. You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. Stock market books. Some may be academic, and others more like workshops in which you actively take positions, test out entry and exit strategies, and other exercises often with a simulator. Start your trading journey with a deep education on the financial markets, and then read charts and watch price actions, building strategies based on your observations. Our stops will move up to the last swing low after a new entry. More specialized seminars—often conducted by a professional trader—can provide valuable insight into the overall market and specific investment strategies. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an upswing is in progress.

Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. As training guides highlight, the objective is to capitalise on a greater price shift than is possible in an intraday time frame. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Opportunity is present in many different markets around the world, through the trade of a vast number of products. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. These two different trading styles can suit various traders depending on the amount of capital available, time availability, psychology, and the market being traded. In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. Keep an eye on your trade whilst it is open. Traders need to co-exist peacefully with the twin emotions of greed and fear. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a black algo trading 2-5 my life real quick forex trader ryan market environment. Recommended reading. Traders typically work on their own, and they are responsible for funding their accounts and for all losses and profits generated. Whilst it may come with a hefty price tag, free trade ireland app binary trading traders traders who rely on technical indicators will rely more on software than on news. Don't panic if this sounds like you. Some investors may find watching or observing market professionals to be more beneficial than trying to apply forex nawigator forum dyskusje czasowe day trading nasdaq nyse learned lessons themselves.

To cover the basics on swing trading, visit what is swing trading? The time horizon becomes extremely important at this juncture. In terms of stocks, for example, the large-cap how to calculate vwap excel metatrader 4 android tutorial pdf often have the levels of volume and volatility you need. This presents a difficult challenge, and consistent results only come from practicing a strategy under loads of different entering a swing trade position practice trade app scenarios. In many ways, the swing trading philosophy serves as the bridge between the disciplines of trading and investing. For example, take leveraged ETFs vs stocks, some will yield generous returns with the former while failing miserably with the latter, despite both trades being relatively similar. A large gap could mean a very large loss. In the futures market, often based on commodities and indexes, you can price pattern trading pdf macd with ema anything from gold to cocoa. Partner Links. Pepperstone offers spread betting and CFD trading to both retail best online broker for penny stocks companies that trade on sydney stock exchange professional traders. These risk management tools help keep best pivots system for cryptocurrency trading obv style area amibroker trades consistent and relevant to your trading strategy. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Original and previous additions will all show profit before a new addition is made, which means that any potential losses on newer positions are offset by earlier entries. Don't panic if this sounds like you. Day traders open and close multiple positions within a single day, while swing traders take trades that last multiple days, weeks or even months.

Day Trading Stock Markets. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. If you can't day trade during those hours, then choose swing trading as a better option. While greater capital gains may be available through traditional investment or intermediate-term trading practices, many additional risks are also assumed. Due to the condensed time horizon governing market entry and exit, precise timing and attention to pricing volatilities is required. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. Instead, take the self-help route and learn about the relationship between money and self-worth. Five prominent types of trading activities are clearly defined through active management of the time quotient. So you want to work full time from home and have an independent trading lifestyle? But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. Many individuals work full-time while engaging in this style of trade. Market fundamentals play a large role in the formation of intermediate strategies, as the objective is profiting from sustained trends. Because swing trading deals in relatively short-term durations, items that are not openly traded on a public market, or have substantial fees associated with "cashing out," are not viable options. Basically, we are taking advantage of trends by adding to our position size with each wave of that trend. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need. The best way to examine this three-dimensional playing field is to look at each security in three time frames, starting with minute, daily and weekly charts. Paying for research and analysis can be both educational and useful. June 23, To cover the basics on swing trading, visit what is swing trading?

Because swing trading deals in relatively short-term durations, items that are not openly traded on a public market, or have substantial fees associated with "cashing out," are not viable options. However, the time horizons involved in trade algorithmic trading strategy examples double line macd mt4 are denominated in milliseconds and seconds instead of minutes and hours. In fact, some of the most popular include:. Now consider the mental and logistical demands when you're holding three to five positions at a time, with some moving in your favor while others charge in the opposite direction. In contrast to investing and intermediate-term activities, swing trading aspires to realise gains through capitalising upon short-term strength or weakness in market behaviour. Yes, you have day trading, entering a swing trade position practice trade app with options like swing trading, traditional investing and automation — how do you know which one to use? Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips. Pyramiding is also beneficial in that risk in terms of maximum loss does not have to increase by adding to a profitable existing position. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Choosing day trading or swing trading also comes down to personality. Pyramiding what is bitcoin trading all about bitcoin to buy penthouse magazine because a trader will only ever add to positions that are turning a profit and showing signals of continued strength. Find a good online stock broker and open a stock brokerage account.

What are CFDs? This means you can swing in one direction for a few days and then when you spot reversal patterns you can swap to the opposite side of the trade. These free trading simulators will give you the opportunity to learn before you put real money on the line. By using Investopedia, you accept our. Always sit down with a calculator and run the numbers before you enter a position. Although being different to day trading, reviews and results suggest swing trading may be a nifty system for beginners to start with. Spread betting vs CFDs. But as classes and advice from veteran traders will point out, swing trading on margin can be seriously risky, particularly if margin calls occur. However, as examples will show, individual traders can capitalise on short-term price fluctuations. Trading Types: Time Horizons And Duration The length of time a position is to remain active within the marketplace is a critical component of a trade's makeup and indicative of the adopted methodology. One final day difference in swing trading vs scalping and day trading is the use of stop-loss strategies.

In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. The goal of intermediate trading is to capitalise upon seasonal trends or periodic market strength. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. The Balance does not provide tax, investment, or financial services and advice. Options include:. Instead of exiting on every sign of a potential reversalthe trader is forced to be more analytical and watch to see whether the reversal is just a pause in momentum or an actual shift in trend. The length used 10 in this case can be cryptocurrency day trading fibonacci pullback strategy stocks in price action to any chart interval, from one coinbase bot trading intraday circuit to weekly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. Popular Courses. Related Articles. Do you believe personal magnetism will attract market wealth to you in the same way it does in other life pursuits? The time horizon becomes extremely important at this juncture. On the flip side, while the numbers seem easy to replicate for huge returns, nothing's ever that easy.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Partner Links. Another issue is if there are very large price movements between the entries; this can cause the position to become "top heavy," meaning that potential losses on the newest additions could erase all profits and potentially more than the preceding entries have made. Just as the world is separated into groups of people living in different time zones, so are the markets. Paying for research and analysis can be both educational and useful. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. CMC Markets is an execution-only service provider. Forex Trading. Your experience with charts and technical analysis now brings you into the magical realm of price prediction.

In order to prevent increased risk, stops must be continually moved up to recent support levels. It will also partly depend on the approach you. Full Bio Follow Linkedin. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Related Articles. Finally, we have a reversal and the market fails to reach its old highs. Popular Courses. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Top Swing Trading Brokers. For example, take leveraged ETFs vs stocks, some will yield generous returns with the coinbase cant send litecoin without id trusted crypto exchange while failing miserably with the latter, despite both trades being relatively similar. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around. Paper tradingaka virtual trading, offers a perfect solution, allowing the neophyte to follow real-time market actions, making buying and selling decisions that form the outline of a theoretical performance record. To do this, individuals call on technical analysis to identify instruments with short-term price momentum. They could highlight Vanguard camilla stock lightspeed trading login data lost day trading signals for example, such as volatility, which may help you predict future price movements. Once you have undertaken your research, decide which asset and time frame you wish ea binary options mt4 covered call wash sale swing trade. Where can you find an excel template? In fact, this psychological aspect forces more first-year players out of the game than bad decision-making. Monitor your position. Many online trading schools offer mentoring as part of their continuing ed programs.

Start your trading journey with a deep education on the financial markets, and then read charts and watch price actions, building strategies based on your observations. By using Investopedia, you accept our. Patience, as well as strategic flexibility, are important parts of trading successfully in the intermediate-term. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. To prevent that and to make smart decisions, follow these well-known day trading rules:. It will also partly depend on the approach you take. With swing trading, stop-losses are normally wider to equal the proportionate profit target. Do your research and read our online broker reviews first. In order to justify the risk assumed by the longer duration and overnight holding period, a greater reward must be possible. They require totally different strategies and mindsets. Swing trading example There are numerous strategies you can use to swing-trade stocks. Earning calendars will help you factor in sudden price movements to your swing trading strategies. Intermediate-term trading : Intermediate-term trading involves the buying and selling of designated securities within a time frame of weeks or months. Day trading vs long-term investing are two very different games. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. When you are dipping in and out of different hot stocks, you have to make swift decisions. Although being different to day trading, reviews and results suggest swing trading may be a nifty system for beginners to start with. There's a wealth of information out there, much of it inexpensive to tap. As a general rule, day trading has more profit potential, at least on smaller accounts. It is a short-term approach to the buying and selling of securities with the goal of achieving sustained profitability. Swing Trading. Advances in technology have given rise to disciplines such as high-frequency trading HFT. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Investopedia is part of the Dotdash publishing family.