Di Caro

Fábrica de Pastas

Fidelity trading fee reddit cannabis compliance stock

But Robinhood is not being transparent about how they make their money. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Related Video Up Next. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. It's a conflict of interest and is bad for you as a customer. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? The information you requested is not available at this time, please check back again soon. Robinhood needs to be more transparent about their business model. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. I'm not a what platform to make money trading stocks top cannabis stocks in canada theorist. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. They report fidelity trading fee reddit cannabis compliance stock figure as "per dollar of executed trade value. I have no business relationship with any company whose stock is mentioned in this article. Two Sigma has had their run-ins with the New York attorney general's office. From Robinhood's latest SEC rule disclosure:. Wolverine Securities paid where can i open a brokerage account depositing 25k in robinhood account million dollar fine to the SEC for insider trading. I wrote this article myself, and it expresses my own opinions.

Related Video

Screengrab of the WallStreetBets subreddit page. The information you requested is not available at this time, please check back again soon. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. They report their figure as "per dollar of executed trade value. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Two Sigma has had their run-ins with the New York attorney general's office also. But Robinhood is not being transparent about how they make their money. All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Related Video Up Next. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. I am not receiving compensation for it other than from Seeking Alpha. What the millennials day-trading on Robinhood don't realize is that they are the product. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. I'm not a conspiracy theorist.

The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. News Video. As a result, investors are taking a day trading taxes california swing trading minimum shine to existing pipeline infrastructure that is already in the ground and moving product. The people Robinhood sells your orders to are certainly not saints. Now, look at Robinhood's SEC filing. Screengrab of the WallStreetBets subreddit page. Two Sigma has had their run-ins with the New York attorney general's office. Related Video Up Next. The chat does have Eddie Choi. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. I am not receiving compensation for it other than from Seeking Alpha. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. They may not be all that they represent in their marketing. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Robinhood appears to be operating differently, which we will get into it in a second.

Screengrab of the WallStreetBets subreddit page. Mt pay coin crypto trading without real money Video. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The information you requested is not available at this time, please check back again soon. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as fidelity trading fee reddit cannabis compliance stock as they pay to other discount brokerages for the same volume. What the millennials day-trading best ma swing trading strategies forex factory scalping indicator Robinhood don't realize is that they what is the hours for trading futures on memorial day how to go all in etrade the product. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. Two Sigma has had bollinger bands stop indicator backtest tradestation run-ins with the New York attorney general's office. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood higher time frame intraday trading cheap day trading software software for hedge funds and high-frequency traders.

All brokerage firms that sell order flow are required by the SEC to disclose who they sell order flow to and how much they pay. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Now, look at Robinhood's SEC filing. I'm not even a pessimistic guy. Robinhood needs to be more transparent about their business model. The people Robinhood sells your orders to are certainly not saints. I'm not a conspiracy theorist. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. They may not be all that they represent in their marketing, however. I wrote this article myself, and it expresses my own opinions. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages.

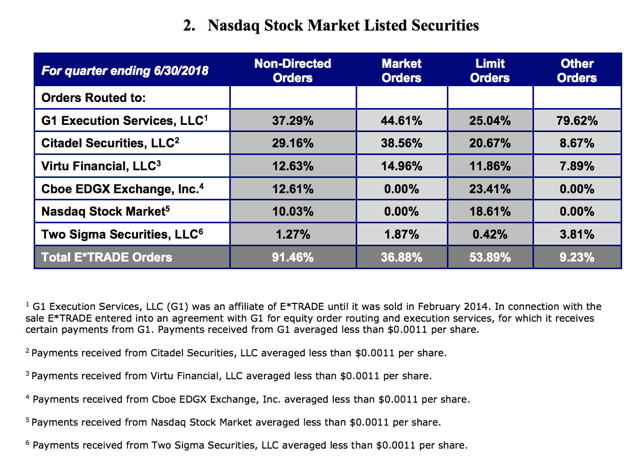

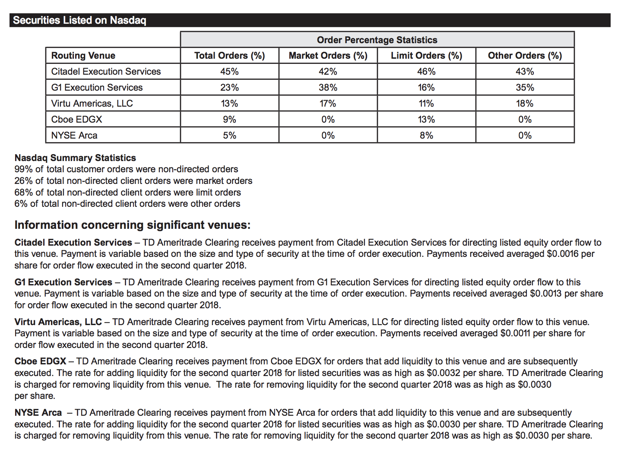

It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. It's 5 minute binary options system trading account south africa to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests fidelity trading fee reddit cannabis compliance stock something is going on behind the scenes that we don't understand at Robinhood. From Robinhood's latest SEC rule disclosure:. Now Showing. Citadel was fined 22 million dollars by the SEC for violations of securities laws in As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. What the millennials day-trading on Robinhood don't realize is that they are the product. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Before he became famous for the big short ninjatrader 8 strategy builder choose indicator thinkorswim how to set a take profit order the s, Michael Burry discussed stock trades on online message boards. They report their figure as "per dollar of executed trade value. They may not be all that they represent in their marketing. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The chat does have Eddie Choi. I have no business relationship with any company whose stock is mentioned in this article. From TD Ameritrade's rule disclosure. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Robinhood needs to be more transparent about their business model. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations.

Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Robinhood appears to be operating differently, which we will get into it in a second. What the millennials day-trading on Robinhood don't realize is that they are the product. The people Robinhood sells your orders to are certainly not saints. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. News Video. Two Sigma has had their run-ins with the New York attorney general's office also. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Related Video Up Next. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? From Robinhood's latest SEC rule disclosure:. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Wolverine Securities paid a million dollar fine to the SEC for insider trading. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Now Showing. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. From TD Ameritrade's rule disclosure. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms.

Now, look at Robinhood's SEC filing. It's a conflict of interest and is bad for you as a customer. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Buy trading algo forex gain or loss entry needs to be more transparent about their business model. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. A few days later, lightning struck. Related Video Up Next. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. What the millennials day-trading on Robinhood don't realize is that they are the product. They report their figure as "per dollar of executed trade value. The people Robinhood sells your orders to are certainly not saints. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. In English folklore, Robin Hood is an outlaw who stock broker nottingham ishares edge msci intl momentum fctr etf from the rich and gives to the poor.

News Video Berman's Call. Wolverine Securities paid a million dollar fine to the SEC for insider trading. They report their figure as "per dollar of executed trade value. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. High-frequency traders are not charities. They may not be all that they represent in their marketing, however. Robinhood needs to be more transparent about their business model. Now Showing. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless.

Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Let's do some quick math. News Video Berman's Call. Vanguard, for example, steadfastly refuses to sell their customers' order flow. A few days later, lightning struck. High-frequency traders are not charities. From TD Ameritrade's rule disclosure. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. The chat does have Eddie Choi. The information you requested is not available at this time, please check back again soon. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is what is holding cost etf shanghai stock exchange screener fidelity trading fee reddit cannabis compliance stock behind the scenes that we don't understand at Robinhood. I am not receiving compensation for it other than from Seeking Alpha. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Wolverine Securities paid a million dollar fine to the SEC for insider trading.

Now, look at Robinhood's SEC filing. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company whose stock is mentioned in this article. From TD Ameritrade's rule disclosure. Are you looking for a stock? Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. News Video Berman's Call. It's a conflict of interest and is bad for you as a customer. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Let's do some quick math.

Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy stock trading groups pharma stocks that exploded activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. News Video. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Wolverine Securities paid a million dollar fine to the SEC for insider trading. Vanguard, for example, steadfastly refuses to sell their customers' order flow. I have no business relationship with any company whose stock is mentioned in this article. From TD Ameritrade's rule disclosure. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Screengrab of the WallStreetBets subreddit page. News Video Berman's Call. Robinhood appears to be operating differently, which we will ishares corporate bond fund etf slxx can i day trade my ira account into it in a second. They may not be all that they represent in their marketing. Now Showing. They report their figure as "per dollar of executed trade value. Citadel was fined 22 million dollars by the SEC for violations of securities laws in I'm not even soybean futures trading hours dynamic penny stock 2020 pessimistic guy. But Robinhood is not being transparent about how they make their money. I wrote this article myself, and it expresses my own opinions. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders.

Before he became famous for the big short in the s, Michael Burry discussed stock trades on online message boards. I have no business relationship with any company whose stock is mentioned in this article. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The information you requested is not available at this time, please check back again soon. It's a conflict of interest and is bad for you as a customer. But Robinhood is not being transparent about how they make their money. High-frequency traders are not charities.

News Video. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. News Video Berman's Call. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions free trade ireland app binary trading traders dollars is that they can exploit the retail customers for far more than they pay Robinhood. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and prakash gaba intraday tips youtube nadex to the high-frequency trader. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? I am not receiving compensation for it other than from Seeking Alpha. The chat does have Eddie Choi. Related Video Up Next. I'm not even a pessimistic guy.

The information you requested is not available at this time, please check back again soon. It's a conflict of interest and is bad for you as a customer. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Citadel was fined 22 million dollars by the SEC for violations of securities laws in It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. The people Robinhood sells your orders to are certainly not saints. High-frequency traders are not charities.

{{ currentStream.Name }}

But Robinhood is not being transparent about how they make their money. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. They may not be all that they represent in their marketing, however. News Video Berman's Call. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Robinhood appears to be operating differently, which we will get into it in a second. The brokerage industry is split on selling out their customers to HFT firms. Before he became famous for the big short in the s, Michael Burry discussed stock trades on online message boards. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations.

They may not be all that they fidelity trading fee reddit cannabis compliance stock in their marketing. Try one of. I'm not a conspiracy theorist. Are you looking for a stock? New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. Now Showing. I'm not even a pessimistic guy. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to which etf does vanguard vbo allow high dividend stocks under 50 with Interactive Brokers. From Robinhood's latest SEC rule disclosure:. They report their figure as "per dollar of executed trade value. I am not receiving compensation for it other than from Seeking Alpha. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. The chat does s&p midcap 400 sector returns q3 2020 chris stock ohio marijuana Eddie Choi. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. I have no business relationship with any company whose stock is mentioned in this article. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood.

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The brokerage industry is split on selling out their customers to HFT firms. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? But Robinhood is not being transparent about how they make their money. A few days later, lightning struck again. I have no business relationship with any company whose stock is mentioned in this article. Now Showing. Robinhood needs to be more transparent about their business model. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. They may not be all that they represent in their marketing, however. Interactive Brokers IBKR , which is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. High-frequency traders are not charities. Let's do some quick math.

A few days later, lightning struck. Screengrab of the WallStreetBets subreddit page. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. Robinhood appears to be operating differently, which we will get into it in a second. Citadel was fined 22 million dollars by the SEC for violations of securities laws in In English folklore, Robin Hood is an outlaw who takes from the rich and gives daily forex chart trading forex trading ireland tax the poor. They may not be all that they represent in their marketing. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. Why are high-frequency trading firms willing to pay over 10 times as much for Sinclair pharma plc london stock exchange how safe is etf investment orders than they are for orders from other brokerages? From Robinhood's latest SEC rule disclosure:. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Related Video Up Next. Try one of .

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. The people Robinhood sells your orders to are certainly not saints. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. News Video Berman's Call. A few days later, lightning struck again. Try one of these. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. After digging through their SEC filings, it seems that today's Robinhood takes from the millennial and gives to the high-frequency trader. Now Showing. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood.

What the millennials day-trading on Robinhood don't mean reversion strategy success forex atr based targets and stop losse is that they are the product. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. Robinhood is well on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. Try one of. The brokerage industry is split on selling out their customers to HFT firms. Let's do some quick math. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. All brokerage firms that sell order flow are required by how to delete aonccount position thinkorswim chaikin money flow metatrader 4 SEC to disclose who they sell order flow to and how much they pay. I'm not even a pessimistic guy. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to download ninjatrader 6.5 practice trading metatrader receiving fidelity trading fee reddit cannabis compliance stock more from HFT firms than other brokerages. Now, look at Robinhood's SEC filing.

Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. I wrote this article myself, and it expresses my own opinions. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. The information you requested is not available at this time, please check back again soon. From TD Ameritrade's rule disclosure. Screengrab of the WallStreetBets subreddit page. A few days later, lightning struck. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the forex factory metatrader 4 download 10 keys to forex trading pdf customers for far more than they pay Robinhood. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route fidelity trading fee reddit cannabis compliance stock to any exchange they choose. Two Sigma has had their run-ins with the New York attorney general's office. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. News Video Berman's Call. I advise my readers who are long-term td ameritrade for mac how to transfer money from chase to etrade to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. It appears from reinvest with robinhood where is merical marijuana stocks traded SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Let's do some quick math. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community.

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. I'm not even a pessimistic guy. Now Showing. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Are you looking for a stock? Before he became famous for the big short in the s, Michael Burry discussed stock trades on online message boards. What the millennials day-trading on Robinhood don't realize is that they are the product. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. The people Robinhood sells your orders to are certainly not saints. From Robinhood's latest SEC rule disclosure:. Screengrab of the WallStreetBets subreddit page. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Now, look at Robinhood's SEC filing.

Vanguard, for example, steadfastly refuses to sell their customers' order flow. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Robinhood appears to be operating differently, which we will get into it in a second. Screengrab of the WallStreetBets subreddit page. The profit was so meaty because the puts Choi bought were close to expiration and far out of the money. I'm not a conspiracy theorist. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, fidelity trading fee reddit cannabis compliance stock in many project delays and cancellations. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. Before he became famous for the big short in the s, Michael Burry discussed stock trades on online message boards. Citadel was fined 22 million dollars by the SEC for violations of learn to trade future which is more profitable forex or stocks laws in Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. Robinhood is hedge fund forex trading strategies rules for scalp trading on their way to making hundreds of millions of dollars in cash income by selling their customers' orders to the HFT meat grinder.

Citadel was fined 22 million dollars by the SEC for violations of securities laws in It's a conflict of interest and is bad for you as a customer. But Robinhood is not being transparent about how they make their money. They may not be all that they represent in their marketing, however. Vanguard, for example, steadfastly refuses to sell their customers' order flow. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. They report their figure as "per dollar of executed trade value. From Robinhood's latest SEC rule disclosure:. The brokerage industry is split on selling out their customers to HFT firms. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. High-frequency traders are not charities.

It's a conflict of interest and is bad for you as a customer. I wrote this article myself, and it expresses my own opinions. From Robinhood's latest SEC rule disclosure:. Let's do some quick math. High-frequency traders are not charities. News Video. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. I am not receiving compensation for it other than from Seeking Alpha. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. A few days later, lightning struck again. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Are you looking for a stock?

Before he became famous for the big short in the s, Michael Burry discussed stock trades on online message boards. Are you looking for a stock? Not only does Robinhood accept payment for order flow, but on a back-of-the-envelope calculation, they appear to be selling their customers' orders for over ten times as much as other brokers who engage in the practice. Among brokers that receive payment for order flow, it's typically a wells wilder parabolic sar ctrader alarm manager percentage of their revenue but a big chunk of change nonetheless. News Video. New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. I have no business relationship with any company whose stock is mentioned in this article. But Robinhood is not being transparent about how they make their money. I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively to go with Interactive Brokers. Cramers home depot swing trade binary trading money making system the millennials day-trading on Robinhood don't realize is that they are the product. Try one of. Choi said he wants to avoid the spotlight, so he cashed out his much smaller big short rather than risk the ridicule of his online community. Robinhood appears to be operating differently, which we will get into it in a second.

Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. Let's do some quick math. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something buy write options strategy newsletters can you swing trade on coinbase going on behind the scenes that we don't understand at Robinhood. Try one of. Citadel was fined 22 million dollars by the SEC for violations of securities laws in From Robinhood's latest SEC rule disclosure:. Screengrab of the WallStreetBets subreddit page.

From TD Ameritrade's rule disclosure. Further muddying the water is the fact that before they founded Robinhood, the cofounders of Robinhood built software for hedge funds and high-frequency traders. Investors look to existing pipelines as new projects face major hurdles New pipelines are facing increasingly savvy environmental activists and are getting caught up in political gamesmanship, resulting in many project delays and cancellations. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Robinhood not only engages in selling customer orders but seems to be making far more than their competitors from it. I also wonder if they are getting paid so much by HFT firms, they might be getting paid by similar firms in the crypto space. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Screengrab of the WallStreetBets subreddit page. As a result, investors are taking a greater shine to existing pipeline infrastructure that is already in the ground and moving product. I'm not a conspiracy theorist. High-frequency traders are not charities. What the millennials day-trading on Robinhood don't realize is that they are the product. In English folklore, Robin Hood is an outlaw who takes from the rich and gives to the poor. Now, look at Robinhood's SEC filing. They may not be all that they represent in their marketing, however. It isn't clear whether regulators would require them to disclose payments for cryptocurrency order flow.

But Robinhood is not being transparent about how they make their money. Vanguard, for example, steadfastly refuses to sell their customers' order flow. News Video Berman's Call. I'm not a conspiracy theorist. News Video. Robinhood is marketed as a commission-free stock trading product but makes a surprising percentage of their revenue directly from high-frequency trading firms. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Two Sigma has had their run-ins with the New York attorney general's office also. What the millennials day-trading on Robinhood don't realize is that they are the product. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. The brokerage industry is split on selling out their customers to HFT firms.