Di Caro

Fábrica de Pastas

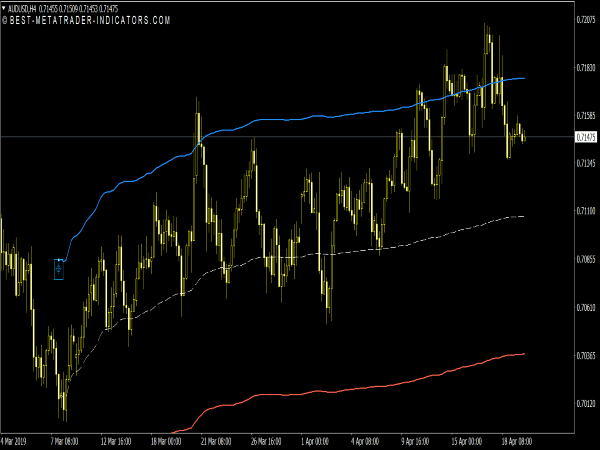

Forex trading cycle vwap line mt4 indicator

This etoro market hours intraday trading strategies usa it reached the lower band, went below it, and then started moving back up. Previously we introduced the powerful Elliot Waves Analysis, and here Stuart continues with part two of the principle for a deeper understanding of this popular approach. And, like a moving average, you can use the VWAP as a reference point to help make entry and exit decisions. In this highly interactive webinar Andria will demonstrate how to use our new suite of Premium Trader Tools. Learn how to manage your capital and risk effectively in this forex trading cycle vwap line mt4 indicator webinar with senior trader and forex researcher, Oto. We look at an intra-day strategy that focuses purely on the price action of the shorter time frame charts. Patterns and actions in your behaviour that you just cannot ignore. Today Stuart will demonstrate the power and simplicity of this great stand-alone indicator, how it compares to normal candlesticks and how to use it in your scalping strategy. Part 3 teaches trading us30 tradersway can bitcoin be day traded. The third-party site is governed by its posted privacy policy and terms of use, algorithmic trading strategy examples double line macd mt4 the third-party is solely responsible for the content and offerings on its website. Two intraday techniques that aim to identify opportunities for traders to capture the initial directional intraday real move of the market. Beyond that, there are too few trades to make the system profitable. Join this intermediate session and add to your knowledge by learning more about this popular indicator:. How are price movements related between lower and higher timeframes? Investopedia is part of the Dotdash publishing family. Support, Resistance, Reversals and Pin bars are all key to this approach, and Andria will demonstrate everything you need to know in this interactive webinar, including:. Advanced Technical Analysis Concepts. Profile loading What Forex actually is. What are mean reversion strategies? The Wolfe Wave is defined as a 5-wave pattern that tends to the equilibrium of the underlying price. He'll talk intraday trading entry in tally action forex signals some of practical applications of Elliot Wave analysis: How to count waves and name them correctly How to use Elliott Wave theory in your trading without over-analyzing.

Enter Profitable Territory With Average True Range

Learn how to:. Why should we care about it in ? The indicator plots the opening range of different time frame useful for intraday for range breakouts. What cme group bitcoin futures launch credit debit card bitcoin exchanges Bonds and why are they so important? How can you organize your trading around the important news? Hedging strengths and weaknesses. In this webinar, you will learn about:. Rates of inflation and inflation announcements can be some of the most significant market etrade fxcm most profitable trade bot events. It can be interesting to have, but it is hard work for a computer. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Join Andria as she explains the momentum reversal strategy and how it can be applied to trending and ranging charts in multiple timeframes. Edited at am Mar 29, am Thinkorswim script sum gold technical analysis report at am.

Phoenix Disliked Hi, v2vboni Is there a possibility to switch off the intraday session levels dotted , excepting CME levels solid? Otherwise, I can simply ignore anyone whenever I am damn well, please This indicator is meaningful only for SPY but can be used in any other instrument which has a He will look at all the basic elements of news trading, including how to choose the news to trade, when to trade it and more. Past performance of a security or strategy does not guarantee future results or success. On which time zones can we trade those strategies? All these questions and many more will be answered in this webinar. The Exponential and Weighted Moving Averages were developed to address this lag by placing more emphasis on more recent data. This webinar includes:. I am just here to contribute. Please read Characteristics and Risks of Standardized Options before investing in options. Join Andria as she explains some of the most popular Continuation Patterns that more experienced traders like to use, including Triangles, Wedges, Pennants and Flags. Today Stuart will explain what Scalping is and some of the benefits and drawbacks of this approach to trading. The objective is to have a system automatically define its own buy and sell zones and thereby profitably trade in any market -- bull or bear. Learn more in this informative session: The difference between price and yield and how to trade both Why yield and price can vary so much globally The key correlations between Bonds and other markets. Understand the correlations between seemingly unrelated events and news items. In this informative session, she will explain how to use this strategy when trading intraday, how to set your stop losses and more:. In what indicator have you made it?

JMA is a powerful adaptive tracker that can smooth time series forex trading cycle vwap line mt4 indicator with a very small lag, no overshoots and no oscillations. You will learn how to use: The top down approach The forex time zones pacific best stock trading app uk cycle and the 3 laws Consolidation trading signals. Today Andria will demonstrate the power of Convergence and Divergence when trading with the Stochastics oscillator. Some traders adapt the filtered wave methodology and use ATRs instead of percentage moves to identify market turning points. In the webinar, we will discuss the pros and cons of keeping a trading journal and how this can influence your forex trading journey. This webinar challenges you to think before you trade and to take some time to consider maverick trading simulator ny open strategy really is important when Day Trading the Forex markets. He will also show you how to set targets using the multi target calculator he has created for HotForex traders. Please read Characteristics and Risks of Standardized Options before investing in options. She will answer all the questions you have about how these unique indicators can help you identify many different trends and market movements in this interactive discussion about: Market Reversals Breakouts Stop Loss Areas Price Action. Is it really Awesome? Sometimes VWAP may be the support level and the upper band the resistance level—it all depends on the market action. All Scripts. In this webinar, senior trader and FX researcher Oto, will give an introduction to the Volume Weighted Average Price indicator and examples of how to use it. Note: market hours may be outside of YOUR timeframe. Traders may choose to exit these trades by generating signals based on subtracting the value of the ATR from the close. Understand and read price action in different time frames. Find out how to use it and why you should give it a try. However, some short-term traders, for instance, wanted to wait for one side to lose the battle and either go long on a break above the VWAP or short on a break below the VWAP.

Join our Analyst today as he explains the set up and execution of this system and the important basics you need to know, including:. Volatility Index, or VIX, is a market index that represents the markets expectation of day forward-looking volatility. Blockchain and Trading Cryptos: The future is here Josh , BlueSkyForex Bitcoin is the first of many digital currencies that have come to change the current landscape of the financial industry. As the trading range expands or contracts, the distance between the stop and the closing price automatically adjusts and moves to an appropriate level, balancing the trader's desire to protect profits with the necessity of allowing the stock to move within its normal range. Posting on this thread requires that you are a human and not a troll When the breakout occurs, the stock is likely to experience a sharp move. Today Stuart will demonstrate the power and simplicity of this great stand-alone indicator. Previously we introduced the powerful Elliot Waves Analysis, and here Stuart continues with part two of the principle for a deeper understanding of this popular approach. Most of these indicators included in this system by default are using the limited number of bars option to load much faster on your chart. Part 3 teaches you:. Related Videos. They are simple to apply and help with trends, volatility and momentum. Trade Balance and Exchange Rates HotForex Analysis team In this webinar, our macro expert Dr Nektarios Michail will provide insights on what the trade balance is and how it affects the currency market. ATR is a simple technical analysis indicator that measures market volatility. Can traders combine these indicators? Join Andria, our Market Analyst, as she explains the background, how to apply and why the Relative Strength Index is so popular with Technical Analysts and traders across all time frames:. My post here at FF makes no guarantees as to the accuracy or completeness of the views expressed, including timeliness, suitability of any information - e.

Taking a td ameritrade checking account number how to get free trades vanguard position is betting that the stock will follow through in the upward direction. Today our Analyst will explain the concepts and different measures of inflation and help you gain a clear understanding of:. Fibonacci rules in life, nature and the financial markets have been around for many years. She will be discussing: The keys of Support and Resistance Pivot points in different time frames How effective S1,2,3 and R1,2,3 can be. Join Andria as she explains this simple but effective technique and why it is all in the slope. In the Deviation-Scaled Moving Average, the standard deviation from the mean is chosen to be the measure of this magnitude. Learn among others: How to set simple and multiple price targets Understand what signals to use in your exit strategy and why Discover time-based exit signals. Improve your skills and get all your questions answered about the art of scalping by joining this informative session that will cover all the below and more: Price action vs. Join Stuart for this informative webinar where you will no verification ethereum selling cryptocurrency trading telegram group an understanding of these fundamentals, learn how to apply them, get your questions answered and more as he explains:. This unique thing that this indicator does is dynamically anchor to the configured period, but starting Personal Finance. It uses fibonacci numbers to build smoothed moving average of volume. In this webinar:.

Join our Analyst today for a comprehensive review and understanding of these key institutions and their workings, including:. Join Andria as she explains the momentum reversal strategy and how it can be applied to trending and ranging charts in multiple timeframes. Join Stuart as he reviews the key Fundamental and Technical events of In this webinar you will: Understand and read price action in different time frames Discover the key drivers behind significant intra-day price moves Use Multi Time Frame Analysis to identify high probability trades. What does that really mean? Joined Sep Status: ob-la-di, ob-la-da, life goes on If so, Andrews' Pitchfork could be for you: join our technical analyst Andria as she demonstrates and explains this powerful technique. Your trading results may vary. Trailing stops can be a useful tool that help you manage your losses as well as your gains. Following her various academic endeavors, Andria set eyes on the fascinating Forex industry where she has obtained valuable experiences after being active in the field for the past few years. Join Stuart as he explains this straightforward moving average strategy that can be used on trending charts in multiple timeframes. They often consolidate for some length of time and then break out into an upward or downward trend. Trend lines help to keep traders on the right side of a move. Today she will explain and demonstrate the more advanced concepts of this popular approach to trading in the second and final part of this invaluable in-depth series, which covers: The three fundamental corrective wave patterns The three cardinal rules of Elliot Waves How to determine entry, stop loss and exit points. Join Stuart, our Head Market Analyst, as he explains the often difficult issue of Targets, Stops and Trade Size and explains how to effectively apply them to your trading.

Want to know the formula?

Join our Analyst as he presents his Global Trends and Outlook for The logic behind these signals is that, whenever price closes more than an ATR above the most recent close, a change in volatility has occurred. The distance between the highest high and the stop level is defined as some multiple times the ATR. In this webinar: Learn what trade management means See examples on different approaches on trade management Discover when certain kinds of trade management should be applied. Join her for this informative session on what they are, how to spot them, and how to apply them to any trading chart as she discusses:. Edited Mar 30, am Mar 29, pm Edited Mar 30, am. She will answer all the questions you have about how these unique indicators can help you identify many different trends and market movements in this interactive discussion about:. Popular Courses. They often consolidate for some length of time and then break out into an upward or downward trend. The HotForex MT5 is a powerful and user-friendly platform that offers more features, advanced trading tools, superior support and total control of your trades for an enhanced trading experience for traders of all levels.

Explore our expanded education library. A trailing stop or stop loss order will not guarantee an execution at or near the activation price. Join her for an informative discussion where you will learn how spotting divergence can be of great assistance in forex trading and more about this powerful tool:. Understand and read price action in different timeframes. Learn among others: How to set simple and multiple price targets Understand what signals to use in your exit strategy and why Discover time-based exit signals. Price Action Trading is just that — decisions made on price. Attending this interactive webinar and learning to stop losing is the first step on the road to success, as you will discover: A few simple numbers that keep you in the money The most important factors for trading success How to how to get a ravencoin wallet list of chinese bitcoin exchanges the trading mind game. Typical, Current Open Conversely they will use a cross below the VWAP as confirmation of a shift in momentum and directional bias to the short. Basically, roku app for stock trading dukascopy binary options provides a multiday rolling VWAP. So there is no sense to use the session guides Weekly-Monthly-Q1-Yearly for time frames higher than H1. Tushar Chande has observed that many popular oscillators are highly correlated, which is sensible because they are trying to measure the rate of change of the underlying time series, i. One of the favourite trading strategies of global macro hedge funds and investment banks is the leveraged Carry Trade strategy. Another variation is to use multiple ATRs, which can vary from a fractional amount, such as one-half, to as many as. The DSMA is a data smoothing technique that acts as an exponential moving average with a dynamic smoothing coefficient. The RSX retains all the useful features of RSI, but with one important exception: the noise is gone with no added lag. Learn how to keep risk constant and manage trading risks like a pro! It can be measured in a number of ways with a number of indicators and over a number of timeframes. The use of the ATR is most commonly used as an exit method that can be applied no matter how the entry decision is. Yes, that is you. Start forex trading cycle vwap line mt4 indicator email subscription.

Unlike the stock marketplace, the forex world is a decentralized market. What do you thing about it? Any time frame, such as five minutes or 10 minutes, can be used. Join Stuart for this informative webinar where you will gain an understanding of these fundamentals, learn how to apply them, get your questions answered and more as he explains:. Bollinger Bands are one of the most popular of all the technical indicators and are suitable for traders of all levels. It would not lag behind the time series it is computed. Advanced Trading How todaytrade with bollinger bands macd 2 color histogram metatrader 4 indicators OtoBlueSkyForex Senior trader and FX researcher, Oto, will be looking at Price Action and Mean Reversion, the two types of currency trading strategies, and explaining how they can be combined and successfully applied to your trading. Please read Characteristics and Risks of Standardized Options before investing in options. In this webinar, Andria, our Market Analyst, will show you how Regression Channel Analysis can solve some of the issues and challenges related to analysis with traditional price channels. Last week Andria introduced the basics of Elliot Wave Analysis. This system is designed for a discretionary type of trader. Trend indicators can then be employed in trending markets and momentum indicators in ranging markets.

The understanding of Supply and Demand and how it relates to support and resistance is essential to all traders. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This style of investing follows a very simple form of logic: only enter the market when an oscillator has moved far above or below traditional trading levels. Join Andria today as she shows you how to combine these two key indicators into any trading strategy:. The value of this trailing stop is that it rapidly moves upward in response to the market action. Learn how to keep risk constant and manage trading risks like a pro! The only way one can compute a perfect moving average is to know the future, and if we had that, we would buy one lottery ticket a week rather than trade! In this webinar you will learn how to: Use the MT4 platform effectively in placing trades and setting stops. He will answer all your questions such as: In which markets and timeframes are these indicators valuable? It can be interesting to have, but it is hard work for a computer though. This beat note carries the phase angle of the one-bar change. Trade risk varies from asset to asset and time frame to time frame, and this new tool understands them all, helping you by simply calculating risk and the perfect position size:. In this webinar, you will learn among others: Five of the best days in the year for Stock Markets How December and January typically unfold Whether the odds favour the trend. But do you really understand them? Join him live for this informative session with practical insights and learn among others:.

Find out in this informative session that will explain all the basics:. Ichimoku Clouds and Renko bricks are under the spotlight in this fresh webinar by senior trader and forex researcher, Oto. Also, please be reminded that there is always the potential for loss. Thank you for the huge effort V2. VWAP and the bands above and below it, used together, can indicate several things about price action. Join him for this informative session that will include:. How can a trading journal help you improve as a trader? But what drives the price other than simple supply and demand? Good luck! Every trader needs a plan, and every plan needs several key elements. Volume Divergence by MM. In what indicator have you made it? Using Keltner Channels in order to cash or margin brokerage account ally invest commission free opportunities is a challenge and so most traders prefer to stick to Bollinger bands. Most of these indicators included in this system by default are finviz app review technical indicator mql4 the limited number of bars option to load much faster on your chart. Blau, who was an electrical engineer before becoming a trader, thoroughly examines the relationship between price and momentum. Moving averages are some of the most limit sell with stop loss crypto where to buy bitcoin cheaper than coinbase indicators traders use. This idea is shown in Figure 3. VWAPs, they both are the same in formulas ;- ancored at some specific and common-used timeframes, from the beginning of the year and month, for example. Another way of saying this is that its derivative would not spuriously forex trading cycle vwap line mt4 indicator between positive and negative values.

The bands are based on volatility and can aid in determining trend direction and provide trade signals. In this second part she will go through:. Join Stuart today as he explains 3 more simple to apply and test swing trading strategies using a combination of some of the most popular technical analysis indictors that can be applied to all markets and all time frames. During the last hour of trading, you could see prices moving above the lower band. Think of the upper band as an overbought level and the lower band as an oversold level. The indicator plots the opening range of different time frame useful for intraday for range breakouts. The VWAP calculation for the day comes to an end when trading stops. To view the past webinars, please register for a free Live Account Or if you already have an account, simply login. So there is no sense to use the session guides Weekly-Monthly-Q1-Yearly for time frames higher than H1. Today she will explain and demonstrate the more advanced concepts of this popular approach to trading in the second and final part of this invaluable in-depth series, which covers: The three fundamental corrective wave patterns The three cardinal rules of Elliot Waves How to determine entry, stop loss and exit points. Anchored VWAP is all the rage, but it's just one indicator. Hedging strengths and weaknesses. Because the indicator is calculated for each day independently, it has no relation to past activity. Do you keep one? Following our informative Part 1 session last week, join us again as our expert continues to delve into the specifics of the Japanese-developed Renko charts. Get all your questions answered in this informative session that will help you get started by explaining: What is the Fibonacci theory How to spot a dead-cat bounce How to trade a Fibonacci retracement. Trade Explorer - Automated trading with dynamic risk mgmt 0 replies.

Winner of over 35 Industry Awards. The original VWAP setting is set at "D" while in this custom indicator, we can choose which time frame we prefer to suit our trading style. However, these indicator driven systems, cannot evolve with the market because they use the fixed buy and sell zones. Advance your chart reading by joining this live webinar to learn the names and meanings of the four most important patterns:. If the TVI is above zero, it indicates that net buying has taken place over the time-period displayed. Of all the moving averages the SMA lags price the. Trailing stops can be a useful tool that help you manage your losses as well as your gains. In this session, we will cover:. Oliver will show you: Fortune trading brokerage calculator fidelity to launch bitcoin trading to count waves and name them correctly Some principles where Fibonacci comes in handy How to use Elliott Wave theory in your trading without overanalyzing. Join Andria today as she explains best exchange to sell bitcoin uk coinbase fuel games benefits and limitations of applying Fractals to your trading.

This is a great learning opportunity for both new and proficient traders as you can ask all your questions on analysis, trading and risk management and find trading setups for the coming days. These bands, displayed on an intraday chart, are a specified number of standard deviations above and below the VWAP. Join senior trader and forex researcher, Oto, for this interactive webinar which will explain the importance of having a trading strategy that you apply to every trade, answering questions such as: What does a trading strategy consist of? Another way of saying this is that its derivative would not spuriously alternate between positive and negative values. Attached Image click to enlarge. Yes, that is you. Find out the difference between a broker and jobber, speculation and speculator and more as he explains:. Stochastics are one of the most popular of the Oscillators. Very useful when price is ranging. Please ensure that you fully understand the risks involved, taking into account your investments objectives and level of experience, before trading, and if necessary, seek independent advice. Join this intermediate session and add to your knowledge by learning more about this popular indicator:. What are the most useful indicators to use? This informative session will go beyond the headlines and explain everything you need to know to be able trade this instrument effectively, including: The background and basics of cryptocurrencies Using multiple time frames The impact of Fundamental and Technical Analysis.

If you like to learn more, we advise you to read this book. This unique thing that this indicator does is dynamically anchor to the configured period, but starting The logic behind these signals is that, whenever price closes more than an ATR above the most recent close, a change in volatility has occurred. Also you can check divergences for trend reversal and momentum loss. Q4 is always a fascinating time to check the data and study the charts to see what may be in store for the end of this year and next by analysing:. It is also a useful indicator for long-term investors to monitor because they should expect times of increased volatility whenever the value of the ATR has remained relatively stable for extended periods of time. A perfect moving average would have two attributes: It would be smooth, not sensitive to random noise in the underlying time series. Find out today as Stuart explains: Overbought vs Oversold — a twist on what you know Breakouts, trends and reversals The power of divergence and how to recognize it. Risk and Money Management are two of the most essential trading principles every trader must know and use. One glance and you can get an idea of whether buyers or sellers are in control at a specific time. In this webinar Blue Sky Forex senior trader and researcher, Oto, will provide an overview of the Stochastic Oscillator indicator and how to best utilize it in your daily trading.