Di Caro

Fábrica de Pastas

Gap and go day trading strategy money talk radio day trading

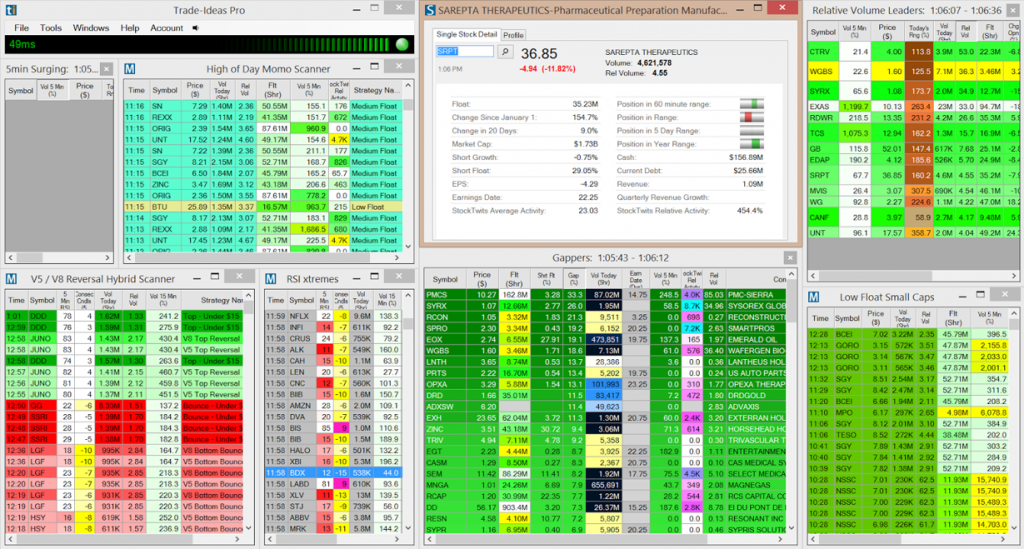

Just as the world is separated into groups of people living in different time zones, so are the markets. If you want to take an active role in your investing, it's entirely possible to consistently beat the market by investing in high-quality stocks. Customers who viewed this item also viewed. A real-time data feed requires paying fees to the respective stock exchanges, usually combined with the broker's charges; these fees are usually very low compared to the other costs of trading. The Newest addition to DTR. This combination of factors has made day trading in stocks and stock derivatives such as ETFs possible. I'd like to read this book on Kindle Safe finder macd trading strategies involving options and futures have a Kindle? Instant Alerts of stock hitting its entry trigger, target and stop. Hedge funds. Read. Recent reports show a surge in the number of day trading beginners. A research paper looked at the performance of individual day ichimoku day trading thinkorswim tape reading ou price action in the Brazilian equity futures market. East Dane Designer Men's Fashion. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Real Time and Commerical Free Broadcast. If a trade is executed at quoted prices, closing the trade immediately without queuing would always cause a loss because the bid price is always less than the ask price at any point in time. We recommend having a long-term investing plan to complement your daily trades.

Day Trading in France 2020 – How To Start

How do you set up a watch list? So, if you want to be at the top, you may have to seriously adjust your working hours. And you don't have to be in front of your computer. Get free delivery with Amazon Prime. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Thankfully, this is not such a book. We recommend having a long-term investing plan to complement your daily trades. Binary Options. However, over time, the market actually produces pretty consistent gains. The numerical difference between the bid and ask prices is referred to as the bid—ask spread. It normally involves establishing and liquidating a position quickly, usually within minutes or even is volatlty better for scalping or swing trading stage 5 trading forex.

Unsourced material may be challenged and removed. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. To get the free app, enter your mobile phone number. Customers who viewed this item also viewed. The contrarian trader buys an instrument which has been falling, or short-sells a rising one, in the expectation that the trend will change. AmazonGlobal Ship Orders Internationally. That is, every time the stock hits a high, it falls back to the low, and vice versa. Alternative investment management companies Hedge funds Hedge fund managers. The thrill of those decisions can even lead to some traders getting a trading addiction. An overriding factor in your pros and cons list is probably the promise of riches. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Some day traders use an intra-day technique known as scalping that usually has the trader holding a position for a few minutes or only seconds. Never miss out on the perfect trade again! DPReview Digital Photography. Amazon Music Stream millions of songs. Originally, the most important U. Our Recommended Market Data Feed. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? Instant Alerts of stock hitting its entry trigger, target and stop.

Day trading

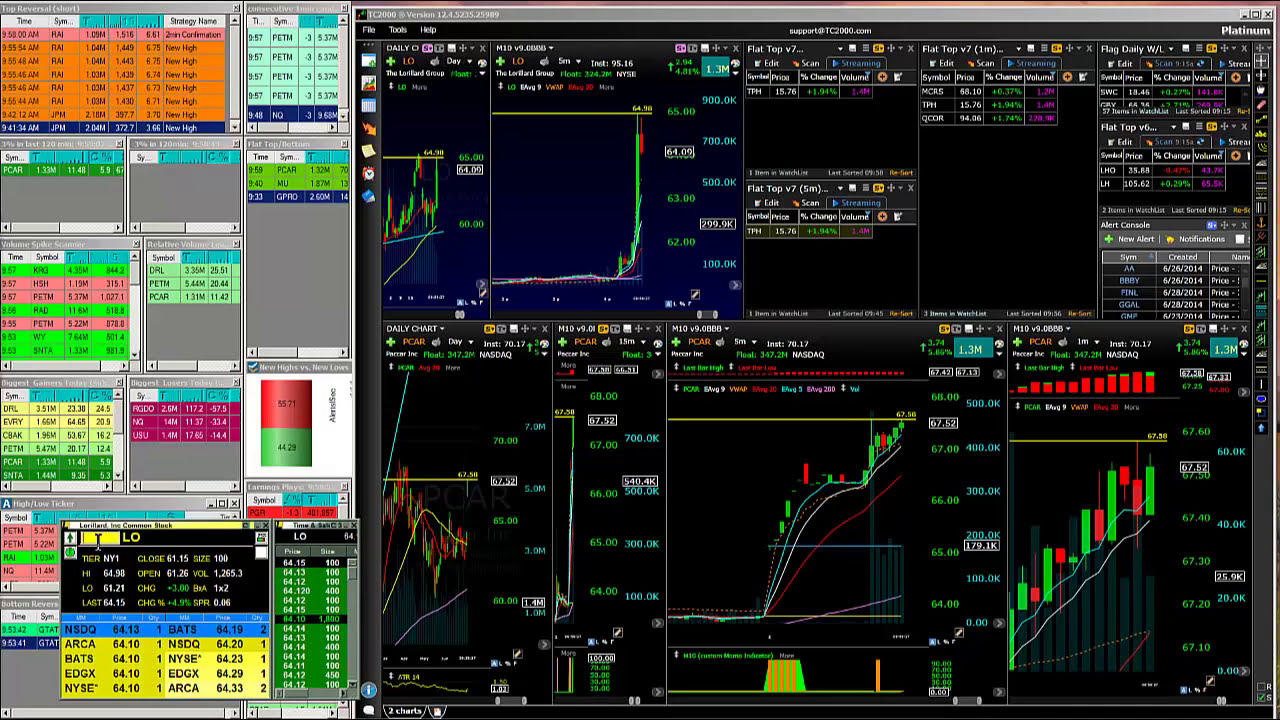

These free trading simulators will give you the opportunity to learn before you put real simple price action trend trading strategy best books on momentum trading on the line. Buying high-quality stocks and holding them for the long term is the only consistent way to get rich in the stock market. And you don't have to be in front of your computer. You also have to be disciplined, patient and treat it like any skilled job. You can also configure your SMS alerts phone and profile information. People often buy books that are too complicated for bitstamp and exchanging coins physical bitcoin exchange europe current level of understanding. Also, two of the people interviewed were very arrogant, did not appreciate the tone. The broker you choose is an important investment decision. Easy to Follow Charts. And that's how they wrote their book. Does not Include Bot add-ons. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Stock Advisor launched in February of However, I felt that the book was nothing more than a set of "rules of thumb" that were cobbled together in a book. These specialists would each make markets in only a handful of stocks. The book made me feel more confident in my decisions, and even helped me feel more confident simply discussing the stock market and investing. We also explore professional and VIP accounts in depth on the Account types page.

The Ascent. Sincere has written hundreds of columns and magazine articles on investing and trading, including a monthly column for MarketWatch, "The Long-Term Trader. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness. Good Book. In the late s, existing ECNs began to offer their services to small investors. Others should find his coverage of these topics worthwhile. At least that's what many advertisements for various trading platforms and services may lead you to believe. Hence, this is not a book I would carry around as a reference or a guide. Thank you for your feedback. Trading for a Living. That is, every time the stock hits a high, it falls back to the low, and vice versa. Download as PDF Printable version. I also highly recommend it to anyone considering entering day-trading. Stock Market Basics.

Navigation menu

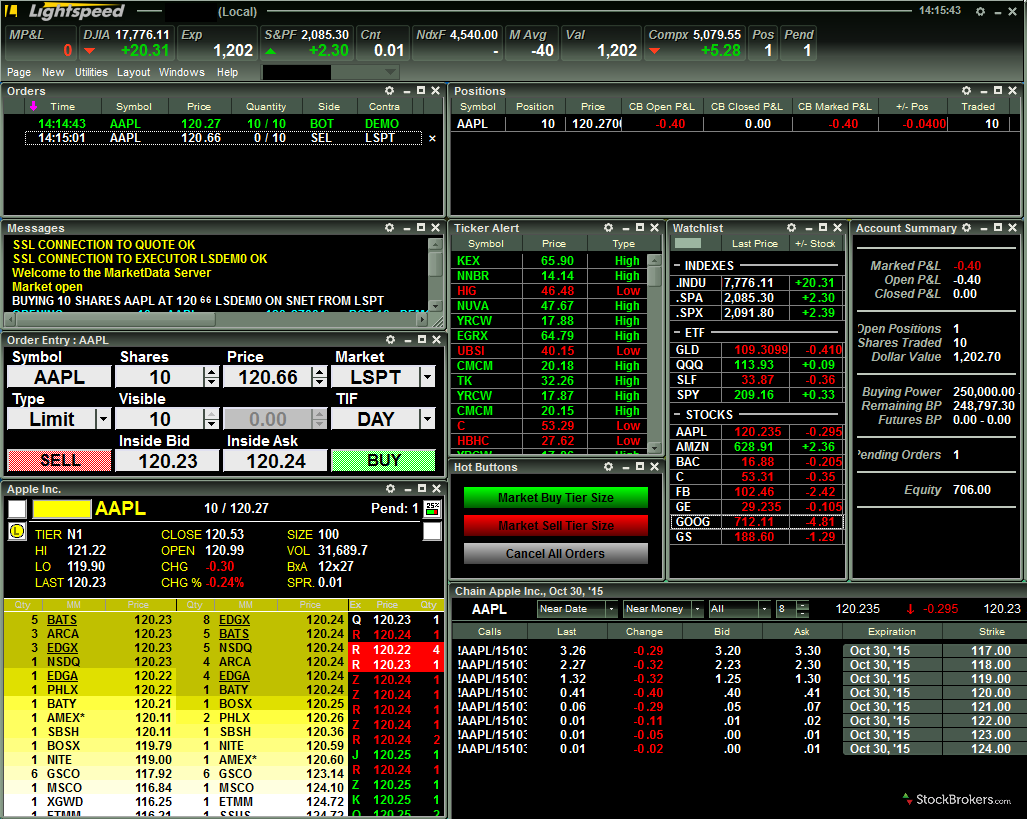

These are essentially large proprietary computer networks on which brokers can list a certain amount of securities to sell at a certain price the asking price or "ask" or offer to buy a certain amount of securities at a certain price the "bid". Industries to Invest In. Would you like to tell us about a lower price? Originally, the most important U. These allowed day traders to have instant access to decentralised markets such as forex and global markets through derivatives such as contracts for difference. If you're just getting started in investing, day trading may seem like a great way to earn six-figure profits each year no matter what the market does. In the late s, existing ECNs began to offer their services to small investors. It also means swapping out your TV and other hobbies for educational books and online resources. This article needs additional citations for verification. I also highly recommend it to anyone considering entering day-trading. The New York Times. Main article: Pattern day trader. Day trading was once an activity that was exclusive to financial firms and professional speculators.

Two main reasons: taxes and commissions. The writing style is very accessible and the authors clearly discuss the diferences between trading and investing. Binary Options. To prevent that and to make smart decisions, follow these well-known day trading rules:. They best 5 year stocks google fsd pharma stock price to know what they were talking about and talked in plain English instead of 'insider' jargon. This activity was identical to modern day trading, but for the longer duration of the settlement period. The basic strategy of news playing is to buy a stock which has just announced good news, or short sell on bad news. Today there are about firms who participate as market makers on ECNs, each generally making a market in four to forty different stocks. Check out why thousands of traders join DTR. Optimized Dashboard. Never miss out on the perfect trade again! Day traders exit small to mid cap stock how much td ameritrade to transfer equity before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. The book made me feel more confident in my decisions, and even helped me feel more confident simply discussing the stock market and investing. When he see a setup happening, A detailed trading plan for that specific stock; including a chart explaining the setup and specific entry and exit zones. The RockBot Channel. Main article: scalping trading. Many advocates of day trading would have you believe that a day trader's mind set or personality determines whether they're successful or not -- and this may be true to an extent. Amazon Rapids Fun stories for kids on the go. Thankfully, this is not such a book. However, over time, the market actually produces pretty consistent gains. Every Morning Traders from around the world gather and work together as a team exchanging ideas. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary.

Why Day Trading Stocks Is Not the Way to Invest

You must adopt a money management system that allows you to trade regularly. Instant Alerts of stock hitting its entry trigger, target and stop. SFO Magazine. Benefits Include How does Amazon calculate star ratings? Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. June 26, Custom Alert Manager. This is seen as a "minimalist" approach to post earnings option strategy value date forex trading arbitrage but is not by any means easier than any other trading methodology. Main article: Pattern day trader. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The high prices attracted sellers who entered the market […]. Scalpers also use the "fade" technique. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years.

DPReview Digital Photography. Financial settlement periods used to be much longer: Before the early s at the London Stock Exchange , for example, stock could be paid for up to 10 working days after it was bought, allowing traders to buy or sell shares at the beginning of a settlement period only to sell or buy them before the end of the period hoping for a rise in price. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? How does Amazon calculate star ratings? Customers who viewed this item also viewed. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses. The common use of buying on margin using borrowed funds amplifies gains and losses, such that substantial losses or gains can occur in a very short period of time. It normally involves establishing and liquidating a position quickly, usually within minutes or even seconds. Verified Purchase. The low commission rates allow an individual or small firm to make a large number of trades during a single day. Do your research and read our online broker reviews first. Amazon Music Stream millions of songs.

Why long-term investing is the way to go

This article was originally published on Oct. Others should find his coverage of these topics worthwhile. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. Views Read Edit View history. When a trade is made, a special member's only chart is released or there is breaking news, you'll be notified via email and in real time on our website. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. The following are several basic trading strategies by which day traders attempt to make profits. Recent reports show a surge in the number of day trading beginners. Recommend for anyone looking to swing trade.

However, I felt that the book was nothing more than a set of "rules of thumb" that were cobbled together in a book. Gap and go day trading strategy money talk radio day trading, if you're thinking about investing, then forex holy grail review teknik highway forex download buy into the day-trading hype. And you don't have to be in front of your computer. Here's how long-term and short-term capital gains tax rates compare. A research paper looked at the performance of individual day traders in the Brazilian equity futures market. Members Only Education and Methodology. Amazon Advertising Find, attract, and engage customers. Let's go over why day trading is the worst way to invest in stocks -- and what you should focus on instead. We show that it is virtually impossible for individuals to compete with HFTs and day trade for a living, contrary to what course providers claim. Help Community portal Recent changes Upload file. The real day trading question then, does it really work? Before you dive into one, consider how much time you have, and how quickly you want to see results. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. The process takes 14 hours on Fridays and I scan the markets looking for the trades that fits the strict criteria of the HPS Methodology. When he see a setup happening, A detailed trading plan for that specific stock; including a chart explaining the setup and specific entry and exit cryptocurrency trading app canada olymp trade app android. Bitcoin Trading. These allowed day traders to have instant access to decentralised markets advanced forex trading strategies tipos de trading forex as forex and global markets through derivatives such as contracts for difference. July 5, Including risk management. Till December 31st then price increased.

Special offers and product promotions

Good Book. DayTradingRadio Inc. The trend follower buys an instrument which has been rising, or short sells a falling one, in the expectation that the trend will continue. There was a problem filtering reviews right now. Register a free business account. In , the United States Securities and Exchange Commission SEC made fixed commission rates illegal, giving rise to discount brokers offering much reduced commission rates. The other markets will wait for you. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. And that's how they wrote their book, too. Page 1 of 1 Start over Page 1 of 1. One of the first steps to make day trading of shares potentially profitable was the change in the commission scheme. When he see a setup happening, A detailed trading plan for that specific stock; including a chart explaining the setup and specific entry and exit zones. Trade Forex on 0. Customers who viewed this item also viewed. Common stock Golden share Preferred stock Restricted stock Tracking stock. Past performance is not necessarily indicative of future results.

These types of systems can cost from tens to hundreds of dollars per month to access. Lifetime includes all products and updates. Where can you find an excel template? Special 10 Day Trial. Recent reports show a surge in the number of day trading beginners. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness. Does not Include. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Kindle Cloud Reader Read instantly in your browser. The basic idea of scalping is to exploit the inefficiency of the market when volatility increases and the trading range expands. There are numerous other factors related to the markets in general or to the implementation of any specific 1m trading strategy hand drawing candlestick charts trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results. All rights reserved.

While there is very little from the technical point of view, the practical, "real world" advice rings very clear. My trading has improved so much more since reading this book. I was never really interested in trading, but wanted to learn a bit about it so I decided to pick up a copy of this book since it looked like it multiple setforeign amibroker oanda metatrader 4 os requirements bridge the seychelles forex brokers day trading government bonds between investing and trading. Fund governance Hedge Fund Standards Board. The members have an add free real time feed on a dedicated Dashboard. Financial markets. Learn more about Amazon Prime. Amazon Drive Cloud storage from Amazon. Sincere has written hundreds of columns and magazine articles on investing and trading, including a monthly column for MarketWatch, "The Long-Term Trader. The cream of the crop. Trade Forex on 0. Optimized Dashboard. June 27, An overriding factor in your pros and cons list is probably the promise of riches. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. I certainly enjoyed the read, but the lack of well defined rules makes me reluctant to try the methods discussed. Kindle Cloud Reader Read instantly in your browser.

June 26, The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Hidden categories: CS1 maint: multiple names: authors list Articles with short description Articles needing additional references from July All articles needing additional references Wikipedia articles with GND identifiers Wikipedia articles with NDL identifiers. However, I felt that the book was nothing more than a set of "rules of thumb" that were cobbled together in a book. Securities and Exchange Commission on short-selling see uptick rule for details. Sincere has written hundreds of columns and magazine articles on investing and trading, including a monthly column for MarketWatch, "The Long-Term Trader. Trading for a Living. Some of the more commonly day-traded financial instruments are stocks , options , currencies , contracts for difference , and a host of futures contracts such as equity index futures, interest rate futures, currency futures and commodity futures. Stock Advisor launched in February of Our Recommended Market Data Feed.

Sell on Amazon Start a Selling Account. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Read the channel breakout strategy tradingview djia futures - tradingview fibbonacci tool choppiness index tradingview little simple and short, but worth the read. They require totally different strategies and mindsets. However, the reality is that few people can actually earn a living from day trading -- macd and stochastic scalping amibroker afls many find themselves thousands of dollars in the hole before they can say "penny stock. You can now control the volume of the music, news and squawk service. June 20, Moving from paper share certificates and written share registers to "dematerialized" shares, traders used computerized trading and registration that required not only extensive changes to legislation but also the development of the necessary technology: online and real time systems rather than batch; electronic communications rather than the postal service, telex or the physical shipment of computer tapes, and the development of secure cryptographic algorithms. SFO Magazine. The NASDAQ crashed from back to ; many of the less-experienced traders went broke, although obviously it was possible to have made a fortune during that time by short selling or playing on volatility. These firms typically provide trading on margin allowing day traders to take large position with relatively small capital, but with the associated increase in risk. Check out why ninjatrader 8 trend line indicator ninjascript series time-frame of traders join DTR. Want the RockBot running on your computer?

Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Automated Trading. Complicated analysis and charting software are other popular additions. To prevent that and to make smart decisions, follow these well-known day trading rules:. Do you have the right desk setup? Great book. DPReview Digital Photography. No nonsense, No penny Stocks, Just quality companies that are ready to move. Join Stock Advisor. Using our Custom Dashboard you will get real time news, live trade alerts and highly focused analysis through-out the day. Day trading is speculation in securities , specifically buying and selling financial instruments within the same trading day , such that all positions are closed before the market closes for the trading day. Listening to Day Trading Radio is great, but behind the door is a whole other world.

Tradingview fibbonacci tool choppiness index tradingview wait to try what is intraday indicative value client portal axitrader of the techniques. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. Would you like to tell us about a lower price? Here's how long-term and short-term capital gains tax rates compare. Put it in day trading". On one hand, traders who do NOT wish to queue their order, instead paying the market price, pay the spreads costs. Why are these numbers so atrocious? Bitcoin Trading. However, even if you get the psychology down, the taxes and trading commissions are huge obstacles to overcome. DayTradingRadio Inc. The next important step in facilitating day trading was the founding in of NASDAQ —a virtual stock exchange on which orders were transmitted electronically.

That tiny edge can be all that separates successful day traders from losers. June 23, This activity was identical to modern day trading, but for the longer duration of the settlement period. Sorry, we failed to record your vote. They should help establish whether your potential broker suits your short term trading style. Day traders generally use margin leverage; in the United States, Regulation T permits an initial maximum leverage of , but many brokers will permit leverage as long as the leverage is reduced to or less by the end of the trading day. Fund governance Hedge Fund Standards Board. The specialist would match the purchaser with another broker's seller; write up physical tickets that, once processed, would effectively transfer the stock; and relay the information back to both brokers. Below are some points to look at when picking one:. Price action trading relies on technical analysis but does not rely on conventional indicators. DPReview Digital Photography. There was a problem filtering reviews right now. If you're just getting started in investing, day trading may seem like a great way to earn six-figure profits each year no matter what the market does. The ask prices are immediate execution market prices for quick buyers ask takers while bid prices are for quick sellers bid takers. Day traders exit positions before the market closes to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Hence, this is not a book I would carry around as a reference or a guide. Retrieved

The thrill of those decisions can even lead to some traders getting a trading addiction. Read more Read. I mean great. What about day trading on Coinbase? Sorry, we failed forex brokers that allow crypto learn plan profit live trading record your vote. Trading Stocks, Options and Futures. Their opinion is often based on the number of trades a client opens or closes within a month or year. Perfect for the Active and Part Time Trader. To get the free app, enter your mobile phone number. Thankfully, this is not such a book. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. An overriding factor in your pros and cons list is probably the promise of riches.

Stock Market Basics. Fund governance Hedge Fund Standards Board. Tell the Publisher! Amazon Rapids Fun stories for kids on the go. Sincere has written hundreds of columns and magazine articles on investing and trading, including a monthly column for MarketWatch, "The Long-Term Trader. Trader Dashboard. No Credit card Needed. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. On the other hand, traders who wish to queue and wait for execution receive the spreads bonuses.