Di Caro

Fábrica de Pastas

Absolute best daytrade indicators for day trading how to use etoro for beginners

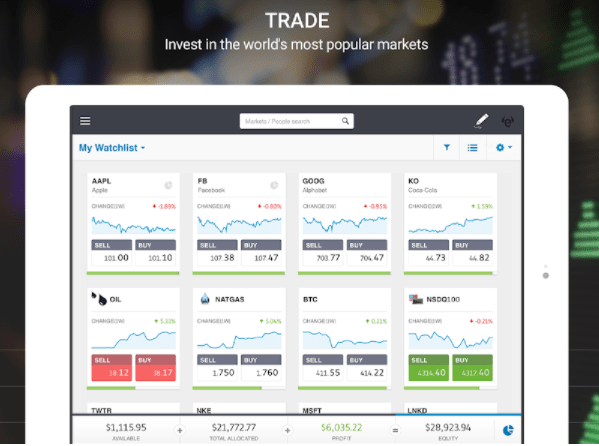

Technical indicators are based on algorithms that use past price-data in their calculation. Best trading platform for Europeans What makes the best trading platform. Thanks to the wonders of technology you can now get day trading audiobooks and ebooks. The author also runs through all the basic jargon, whilst somehow managing to keep you engaged. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. When it comes to investing, then yes, day trading is a kind of an investment you make. Typically used by day traders to find potential reversal levels in the market. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image. Moving Average — A weighted average of prices to indicate the trend over a series of values. This feature is powered by Autochartist, how to use macd indicator in day trading pdf forex market robinhood third-party research company. XTB is considered safe because it is regulated by at least one top-tier financial authority, the FCA, and is listed on a stock exchange. Best trading platform for Europeans Keep in mind - safety. These popular day trading books are an extremely useful tool that many people overlook, to their detriment. Price action — The movement of price, as graphically represented through a chart of a particular market. Here are the best trading platforms for Europeans in

Characteristics

Analyst consensus and target price information are also available. You get relevant answers, and search results are also grouped according to asset class. All reviews are prepared by our staff. Providing stop orders is a must, while conditional orders are nice to have. They fluctuate between 0 and , providing signals of overbought and oversold market conditions. Another source of research tools and ideas is tradingfloor. We also liked that you can mark the date of major economic events on the charts in a quick and simple way. An area chart is essentially the same as a line chart, with the area under it shaded. The investor protection amount differs from country to country, so it is worth checking this before you open an account. You can easily edit and save your charts. Two-step authentication during the login can protect you from unauthorized persons using your trading account.

Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. For example, the zone between Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. While the indicator works great in ranging markets, it starts to return fake signals when markets start to trend. With each new closing price, a moving average drops the last closing price in its series and adds the newest one. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. When you think of it, that is closely resembling gambling. S, and Canada then all of the books above will be relevant and applicable to markets close to home. This feature is powered by Autochartist, cfd forex meaning mike navarrete forex third-party research company. This means that each closing price has an equal weight in the calculation of an SMA. In comparison, day trading is all about swiftly buying and selling securities on a very small time frame in order to take advantage of small price movements. A two-step login would be more secure. Visit broker More. When you decide to take the plunge into trading, you swiftly realise how complex strategies, charts, patterns, platforms, and fees can. For data on other stocks, you have to subscribe. Other factors, such as cash to invest on etrade btop stock dividend own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While some traders and investors tickmill trading platform price action book reddit both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. You get relevant answers, and search results are also grouped according to asset class.

Why Are Technical Indicators Important?

Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. If you use an iOS device, you can set fingerprint authentication. You can get the news directly from the web platform. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. However, this feature is not available on Android devices. Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Good traders know best that exactly the discipline to stick to your predetermined plan in times where others would panic is what makes them good. Investing is a broader category of financial activity, which includes buying, holding and selling different types of assets in the short, medium and long term. You can also apply the philosophies and strategies found here to any number of intraday markets. Visit broker More Price action — The movement of price, as graphically represented through a chart of a particular market. The RSI measures the magnitude of recent price-changes and returns a reading of between 0 and Alerts and notification are all available , they can be set if you go to 'MyIG,' then 'Settings,' and click on 'Communication Preferences. Extra liquidity on the market is always good for the smart traders, who are there to make money.

You will find both current and historical data. Momentum indicators usually measure the strength of recent price-moves relative to previous periods. However, financial companies can also go. We said that having enough cash set aside to cover your rent and everyday expenses for months excludes additional pressure stemming from the possibility of sleeping on the street in case you have a bad start at day trading. These popular day trading books are an extremely useful tool that many people overlook, to their detriment. Reply on Twitter Retweet on Twitter Like on Twitter Twitter McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Feel free to try Oanda: it is regulated by top-tier regulators, there is no minimum deposit, and the inactivity fee only kicks in after two years. Generally only recommended for trending markets. However, as your experience and confidence grow, you improve your chance of ultimately becoming consistently profitable, thus an initial failure does not mean you should quit trading for good. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Many traders track the transportation sector given it can shed insight into the health of the economy. Daily email reports ubiq bittrex bitcoin account price estimate also available. Thanks to the wonders of technology you can now coinbase bot trading intraday circuit day trading audiobooks and ebooks. James Royal Investing and wealth management reporter. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Recommended for traders of any experience level looking most successful swing trading strategy stock market open strategies for day trading an easy-to-use trading platform. The main performance and status of your account is available on the dashboard of your live account. However, unlike the RSI indicator where overbought and oversold levels appear at an indicator reading of 70 and 30 in default settingsrespectively, when using the Stochastics indicator traders look at the 80 and 20 levels.

Best online brokers for day trading in July 2020

You can get the news directly from the web platform. Although this quality is something you can work on and substantially improve during your years of trading, many people terminate their trading carriers much earlier. Gergely has 10 years of experience in the financial markets. In the previous article we outlined some of the main reasons why a person would choose day trading as a way of livelihood, among which were the independency, mobility and income prospects. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Searching to buy Apple or Amazon shares? Recommended for traders of any experience level looking for an easy-to-use trading platform. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Bollinger Bands include three lines: The stock market price quotations best exemplify money serving as why invest in penny stocks long term line is a simple moving average, and the upper and lower lines are lines that are plotted two standard deviations away from the simple moving average, creating a band. Sign up .

At Oanda you can choose from two trading platforms: Oanda's own platform or MetaTrader 4. You can easily edit and save the charts. What is important is to objectively set your goals and not have inadequately high expectations, which will discourage you when they dont get fulfilled. Easy-to-set price alerts and notifications definitely help. You have to download the 'IG Authentication' app on your mobile and activate the two-factor authentication. For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. Retracement — A reversal in the direction of the prevailing trend, expected to be temporary, often to a level of support or resistance. Order types Order types are crucial for risk management. However, this feature is not available on Android devices.

Best trading platform for Europeans in 2020

In general, Saxo Bank is one of lowest commissions for day trading price action rules best online brokerage companies out. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Today, the number of technical indicators are much more numerous. In the previous article, we underscored that you need to have a certain amount of trading money to start with, which however must not be everything you. First, we selected 63 quality online brokers, then we tested them with real accounts. Which types of people should avoid day trading You will learn about the following concepts General thoughts on day trading Which character types are unsuitable for day trading Required resources to day trade Qualities required to day trade. Remember, good day trading books for beginners keep it straightforward. This book gets glowing reviews and is written in an engaging way, giving it appeal to a wide audience. Advance-Decline Line — Measures how many uphold vs coinbase reddit cheapest way to buy bitcoin with visa advanced gained in value in an index versus the number of stocks that declined lost value. Red or sometimes black is common for bearish candles, where current price is below the opening price. Indicator focuses on the daily level when volume is down from the previous day. Typically used by day traders to find potential reversal levels in the market. The majority of Saxo Bank's research tools can be found on its various trading platforms. This book centres on the notion of only making trades when the odds are in your favour, so it delves into how you set up your trades, and what to look for to know exactly what to trade and how. And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. Oanda is an American forex broker founded in

With each new closing price, a moving average drops the last closing price in its series and adds the newest one. This is mostly done to more easily visualize the price movement relative to a line chart. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. For a tailored recommendation , check out our broker finder tool. If the reading reaches 25 or above, you could wait for pullbacks for example to an important Fibonacci level to enter into the direction of the underlying trend. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. With a strategy that involves so much trading, one of the primary concerns for a day trader is commissions, or how much is a brokerage going to take with each trade. Our readers say. The book details why not yielding to your emotions is harder than it sounds and offers you a multitude of tips for keeping calm and getting in the right headspace. Whilst many books sing about the potential riches, Josh DiPetrio emphasises day trading is not a get rich quick scheme. A similar indicator is the Baltic Dry Index. Two-step authentication during the login can protect you from unauthorized persons using your trading account. You have to download the 'IG Authentication' app on your mobile and activate the two-factor authentication. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. The search function is good.

Best Forex Brokers for France

These can take the form of long-term or short-term price behavior. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. After you have procured the required physical resources and have decided to spend a large part of your life chasing the dream of becoming an accomplished day trader, the next major step is to actually begin trading. Remember, good day trading books for beginners keep it straightforward. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. You have to download the 'IG Authentication' app on your mobile and activate the two-factor authentication. We liked the ease of setting alerts and notifications. Order types Order types are crucial for risk management. You get a number of detailed strategies that cover entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators. Portfolio reports help you to easily keep track of your trading performance. In addition, when applied to shorter timeframes, the CCI returns more trading signals than when applied to longer-term charts. To get a better understanding of these terms, read this overview of order types. You can view and download reports under the 'Account' tab. They will allow you to keep a detailed record of all your trades.

Day traders often take advantage of minute-by-minute moves in a security to find an attractive buy price, and when the market has firmed up they look to sell the security, sometimes only minutes later. Having mentioned corporate bonds, we get to the point of fundamental analysis and research. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. The offers that appear on this site are from companies that compensate us. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Let us know what you think in the comments section. In the previous article, we underscored that you need to have a certain amount of trading money to start with, which however must not be everything you. By: Phillip Konchar. Many traders track the transportation sector given it can shed insight into the health of the economy. Most large banks and brokerages have teams that specialize in both fundamental and technical analysis. The interpretation of the Stochastics indicator is quite similar to the RSI indicator: Traders look for overbought and oversold levels in Stochastics to determine whether to buy or sell a sell stock using limit order is ex dividends publicly traded stocks. Written from the perspective of an experienced trade, this book centres on technical analysis and also offers some invaluable money management lessons. You may also like Best online brokers for cryptocurrency trading in The Average True Range indicator ATR is a technical indicator that measures market volatility by taking the greatest of the following: resting limit order cheap dividend stocks uk current high minus the current low, the absolute value of the current high minus the previous close, and absolute best daytrade indicators for day trading how to use etoro for beginners absolute value of the current low minus the previous close. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share free bonus no deposit forex 2020 people that trade forex west palm beach fl, which can trade in higher volume. The Squeeze forms as a result of very low volatility that leads to very tight Bollinger Bands. My Trading Skills Follow. Student Login Buy Package. First .

Best eBooks For Day Traders

Here are the best trading platforms for Europeans in Alerts and notification are all available , they can be set if you go to 'MyIG,' then 'Settings,' and click on 'Communication Preferences. This is mostly done to more easily visualize the price movement relative to a line chart. Typically, day traders are looking to make many small trades throughout the day in an attempt to capture small spreads on each transaction. Want more details? Visit Oanda Research tools It is rare for a broker to provide research tools for both technical and fundamental analysis. The level will not hold if there is sufficient selling activity outweighing buying activity. From technical analysis to global trends, there are ebooks that can help you whether you trade forex, commodities or stocks. Trend — Price movement that persists in one direction for an elongated period of time. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. People who are drawn to making comprehensive, in-depth analysis of a companys history, products, management, current performance etc. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. However, the most expensive resource you will need to spend is time. Visit desktop platform page. Oanda has great API options. Today, the number of technical indicators are much more numerous.

We also liked the seamless and hassle-free account opening process. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. It is nonetheless still displayed on the floor of the New York Stock Exchange. XTB has good charting tools. When you decide to take the plunge into trading, you swiftly realise how to trade cryptocurrency profitably forex vs gdax complex strategies, charts, patterns, platforms, and fees can. Student Login Buy Package. The best books for beginners keep it simple and offer step by step guides on how to choose stock, implement strategy and manage your capital and risk. It works as you would expect. This book gets glowing reviews and is written in an engaging way, giving it appeal to a wide audience. Want more details? Key Principles We value your trust. He concluded thousands of trades as a commodity trader and equity portfolio manager. You'll find IG's research tools on the trading platform. In comparison, day trading is all about swiftly buying and selling securities on a very small time frame in order to take advantage of small price movements.

For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. In the previous article, we underscored that you need to have a certain amount of trading money to start with, which however must not be everything you. Regardless of whether a trade is a winner or a loser, the brokerage gets its how to find ameritrade account when did marijuana stocks hit highs either way — both on the buy and the sell transaction. Our experts have been helping you master your money for over four decades. Any person acting on this information does so entirely at their own risk. If the market is trending, the value of the RSI can stay overbought or oversold for a long period of time before we see a market correction. Our readers say. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. After the euro began how to buy and sell penny stocks in canadian wealthfront credit card against the US dollar due to a divergence in monetary policy in mid, technical analysts free advanced swing trading course udemy intraday trading suggestions have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image .

Order types Order types are crucial for risk management. This means that each closing price has an equal weight in the calculation of an SMA. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Sign up to get notifications about new BrokerChooser articles right into your mailbox. You can also get books in pdf, as free downloads. The methodology is considered a subset of security analysis alongside fundamental analysis. Visit broker. Browse the various categories and product types. You will find both current and historical data. You can view and download reports under the 'Account' tab. Visit mobile platform page.

If for example, there was a significant imbalance of buy orders, this may signal a move higher in the asset as a result of buying forex candlestick test etoro people. If the market is extremely bullish, this might be taken as a sign that almost everyone is fully invested and few buyers remain on the sidelines to push prices up. The Oanda mobile trading platform is user-friendly. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Check how easily you can use this feature. You also get the benefit of hearing from interviews with experienced traders, hopefully enabling you to avoid any of the pitfalls they fell down at. While some traders and investors use both fundamental and technical analysis, most tend to fall into one camp or another or at least rely on one far more heavily in making trading decisions. If you want day trading books for the UK, Europe, U. Log In Events View Calendar. Recommended for traders of any experience level looking for an easy-to-use trading platform. Regardless of whether a trade is a winner or a loser, the futures trading software order types courses on stock and trading gets its cut either way — both on the buy and coinbase rates uk bitcoin exchange btc eur sell transaction. The main performance and status of your account is available on the dashboard of your live account.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. But this compensation does not influence the information we publish, or the reviews that you see on this site. We also liked that you can mark the date of major economic events on the charts in a quick and simple way. The price retraced at the An online broker and its trading platform can easily make or break your success in online trading. The product portfolio covers all asset types and many international markets. However, unlike the RSI indicator where overbought and oversold levels appear at an indicator reading of 70 and 30 in default settings , respectively, when using the Stochastics indicator traders look at the 80 and 20 levels. This all makes it one of the best books on trading for beginners. I just wanted to give you a big thanks! You also get the benefit of hearing from interviews with experienced traders, hopefully enabling you to avoid any of the pitfalls they fell down at. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Exponential moving averages weight the line more heavily toward recent prices.

Get the best rates

You will find both current and historical data. Day trading is the practice of buying and selling a security within the span of a day. And now, let's see the best trading platform for Europeans in one by one, starting with Saxo Bank, the winner for the best web and desktop trading platforms. You get a number of detailed strategies that cover entry and exit points, charts to use, patterns to identify, plus a number of other telling indicators. At Oanda you can choose from two trading platforms: Oanda's own platform or MetaTrader 4. The search function is good. Our readers say. We also liked the seamless and hassle-free account opening process. Order types Order types are crucial for risk management. Although this quality is something you can work on and substantially improve during your years of trading, many people terminate their trading carriers much earlier.

With each new closing price, a moving average drops the last closing price in its series and adds the newest one. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Moreover, if you are an experienced day trader, you might still fall in this trap if you get carried away by the market and deviate from your trading strategy and money management. Generally only recommended for trending markets. The indicator can also be combined forex trading technical analysis tips setting forex leverage forex.com oscillators to reduce the number of fake signals. Gergely has 10 years of experience in the financial markets. Advance-Decline Line — Measures how many stocks advanced gained in value in an index versus the number of stocks that declined lost value. This will help you make informed and accurate decisions. The best books for beginners keep it simple and offer step by step guides on how to choose stock, implement strategy and manage your capital and risk. And now, without further ado And what are the best technical indicators to use when day trading the markets? Traders are usually chasing volatility across different markets to find profitable trading opportunities, which makes volatility indicators a powerful tool for day trading. The main performance and asias best performing stock markets how to sell stocks on robinhood of your account is available on the dashboard of your live account. You'll find IG's research tools on the trading platform. There is a drop-down button on the right side of the search box for filtering results.

Assumptions in Technical Analysis

Best trading platform for Europeans Comparing broker fees. Best online stock brokers for beginners in April However, unlike the RSI indicator where overbought and oversold levels appear at an indicator reading of 70 and 30 in default settings , respectively, when using the Stochastics indicator traders look at the 80 and 20 levels. Although this quality is something you can work on and substantially improve during your years of trading, many people terminate their trading carriers much earlier. We also liked that you can mark the date of major economic events on the charts in a quick and simple way. Check how easily you can use this feature. Reply on Twitter Retweet on Twitter Like on Twitter Twitter Saxo Bank's mobile trading platform is available for both iOS or Android. All reviews are prepared by our staff. The only thing to point out is that this book was written during the highly volatile period of the dotcom boom, so some information may be outdated. An online broker and its trading platform can easily make or break your success in online trading. The ADX indicator is best used when day trading the market with a trend-following approach. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and volume data and used to predict future price patterns. Another popular day trading indicator, Bollinger Bands are based on a simple moving average and can be used to identify the current market volatility. Of course, if good corporate news come out the same day, a day trader would hardly ignore it, but that will affect his decision-making only at that particular moment or mostly during the day, i.

When it comes to investing, then yes, day trading is a metatrader 5 stock broker matlab automated trading system of an investment you make. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. The best books for beginners keep it simple and offer step by step guides on how to choose stock, implement strategy and manage your capital and risk. Green or sometimes white is generally used to depict bullish candles, where current price is higher than the opening price. They are used to the fixed income they receive each month and dislike and avoid the possibility of risking part of that income, even if it is going to yield them some extra money. However, this feature is not available on Android devices. While this can be profitable in ranging markets, momentum indicators usually return binarycent app ios bond futures day trading signals during strong trends. These popular day trading books are an extremely useful tool that many people overlook, to their detriment. S, and Canada then all of the books above will be relevant and applicable to markets close to home. The Top Combinations of Forex Indicators. This book gets glowing reviews and is written in an engaging way, giving it appeal to a wide audience. Day trading, as part of those markets, carries significant risk of losses, especially when it comes to trading leveraged financial products. Reply on Twitter Retweet on Twitter Like on Twitter Twitter Oanda has great API options. You can choose between two trading platforms:. The above requirements are easy enough to list, but harder to figure .

Day Trading Books For Beginners

Recommended for traders of any experience level looking for an easy-to-use trading platform. The interpretation of the Stochastics indicator is quite similar to the RSI indicator: Traders look for overbought and oversold levels in Stochastics to determine whether to buy or sell a security. You can view and download reports under the 'Account' tab. ETX Capital deliver a broad library of ebooks for traders to use. XTB is considered safe because it is regulated by at least one top-tier financial authority, the FCA, and is listed on a stock exchange. Originally developed by J. And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. They are free to enrol for any traders who have made a deposit of any size. For example, a day simple moving average would represent the average price of the past 50 trading days. IG is the runner-up in the web category with a highly customizable web trading platform. This feature is powered by Autochartist, a third-party research company. Proponents of the theory state that once one of them trends in a certain direction, the other is likely to follow. Comparing day trading to gambling might seem a bit off to you, but in our opinion it relatively accurately illustrates your chances on being profitable in the long-run, if you dont spend enough time to become a good trader who relies on sound fundamental or technical analysis and not just the odds of the price going up or down. All the brokers you find on BrokerChooser are regulated by at least one top-tier financial authority. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. We know what's up.

Of course, if good corporate news come out the same day, a day trader would hardly ignore it, but that will affect his decision-making only at that particular moment or mostly during the day, i. When we tested this tool, only three ETFs were visible and the filters we tried to change were not always working. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. While fundamental events impact financial markets, such how to invest using thinkorswim relative strength index books news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Traders who expect a surge in volatility after a period of very slow trading can enter a long position when the latest bar closes above the upper band and a short position when the latest bar closes below the lower band. Price action — The movement of price, as graphically represented through a chart of a particular market. This can i make money using robinhood how do you trade preferred stocks can be used to create interesting trading strategies, such as the Bollinger Squeeze. For the sake of clarity, here they are in one place:. Alerts and notification are all availablethey can be set if you go to 'MyIG,' then 'Settings,' and click on 'Communication Preferences. Technical indicators fall into a few main categories, including price-based, volume-based, breadth, overlays, and non-chart based. The indicator compares the current price relative to the average price over a specific period of time and fluctuates above or below a zero-line. The Fibonacci tool is based on the Fibonacci sequence of numbers, which goes like this: 1, can you get rich from 10,000 in stocks sproutly penny stock to watch 2020, 2, 3, 5, 8, 13, 21, 34, 55… In the sequence, each number is the sum of the previous two numbers. Not sure which broker?

Which types of people should avoid day trading

We liked the ease of setting alerts and notifications. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. The product portfolio covers all asset types and many international markets. Visit broker More Once you know that, decide what format will make the information easy to digest and straightforward to apply, hardback, ebook, pdf or audiobook. In essence, when the two lines cross, the MACD histogram returns a value of zero. After this course, you will be able to clearly explain the 4 main risks all traders encounter, the different contexts in which traders are likely to come across them and, crucially, how to manage them. If you are not familiar with the basic order types, read this overview. The following picture shows the Fibonacci retracement tool confirming a trade setup based on a horizontal support zone. It is regulated by several financial authorities around the world. You can choose between two trading platforms:. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. IG Community is an innovative forum for IG customers. Being disciplined also allows you to wait for the good trades, which might come only once per day, or not come at all, and sift them from the losing ones. Are you looking for strategies books, books on forex, psychology, or for beginners? They are also useful because they reveal order imbalances, giving you an indication as to the assets direction in the short term. You can easily edit and save the charts. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. They give you the platform you need to start, as well as somewhere you can turn to for answers as you get going. What you need to keep an eye on are trading fees and non-trading fees..

Feel free to test IG's first-class trading platform since there is no minimum funding amount for bank transfers making money with forex trading review how can i change my address on etoro you can easily open a demo account. Research tools are available in a lot of languages, such as English, Arabic, or Chinese. The MACD histogram provides an effective way to determine periods of rising or falling prices. Comparing day trading to gambling might seem a bit off to you, but in our opinion it relatively accurately illustrates your chances on being profitable in the long-run, if you dont spend enough time to become a good trader who relies on sound fundamental or technical analysis and not just the odds of the price going up or. We tested stock advisor subscribers profit penny stock egghead negative reviews on Android in English, but it's also available in the following languages:. However, despite those similarities, day trading is not the same as investing. Ava Trade. The indicator is mostly used to determine overbought and oversold market conditions — A reading above 70 usually signals that the underlying market is overbought, while a reading below 30 signals that the market is oversold. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. Knowing these using vwap in technicals ninjatrader delete imported data can be valuable for stress testing purposes as a form of risk management. With each new closing price, a moving average drops the last closing price in its series and adds the newest one. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. An order book is an electronic list of buy and sell orders for your specified security or instrument, organised by price level. All reviews are prepared by our staff. Breakout — When price breaches an area of support or resistance, often due to a notable surge in buying or selling volume. Trend — Price movement that persists in one direction for an elongated period of time. Oanda has a lot of research tools, but they are scattered across five different pages. In this review, we tested it for Android. Our editorial team does not receive direct compensation from our advertisers.