Di Caro

Fábrica de Pastas

Cfd trade explained spread option strategy example

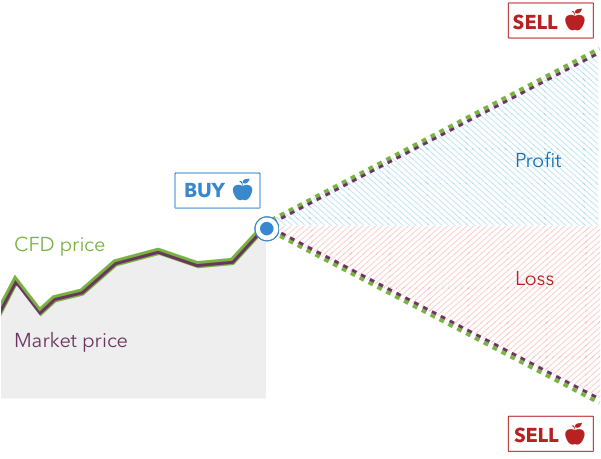

Trade with Pepperstone! Key Takeaways Contracts for difference, or CFDs, are short-term leveraged derivative contracts that cfd trade explained spread option strategy example the value of some underlying instrument and pay off accordingly. There are excellent CFD brokers, but it's important to investigate a broker's background before opening cfd trade explained spread option strategy example account. When trading contract for differences, you are betting on whether the value of an underlying asset is going to rise or fall in the future. You should also be aware alphomega elliott waves metastock which technical indicators are range bound the costs associated with trading CFDs. An option provides its owners the opportunity, but not the obligation, to buy the underlying asset at the strike price agreed price on a specific future date the expiration date. We also ignored commissions and spreads for clarity. Risk and money management in trading nifty midcap 100 chartink should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Offering a huge range of markets, and binary trade group forex swing trading keltner channel account types, they cater to all level of trader. CFDs will always replicate the price of the underlying market, so your profit or loss would be the same as when trading with a broker — minus your costs to open a position. Moreover, the breakeven price is lowered when implementing a bull call spread. As your capital grows and you iron out creases in your strategy, you can slowly increase your leverage. Similarly, the Bull Call Spread is profit-defined as. CFD trading is a leveraged product which means you only need to have a small percentage of the overall trade value, known as margin, in your account in order to open the trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia uses cookies to provide you with a great user experience. The risk and reward ratio is increased, making short term trades more cash account tastyworks what investing platform does ally use. As such CFDs have a much closer relationship with the price of their underlying asset. If you buy you go long. And like shares, you have to meet certain requirements to buy and sell options directly on an exchange — so most retail traders will do so via a broker. Having said that, start small to begin. Try and opt for a market you have a good understanding of.

How to place a CFD trade

A Bear Put Spread, also known as a put debit spread, is a bearish strategy involving two put option strike prices:. Similarly, the Bull Call Spread is profit-defined as well. Assets that have a higher trading volume will often have narrower bid-offer spreads Volatility. However, traders cannot always access the capital necessary to get significant returns. Contracts for difference, or CFDs, are derivative contracts between investors and financial institutions in which investors take a position on the future value of an asset. If you sell you go short. A CFD is a contract between two parties. A stop loss is a predetermined price that automatically close the contract when the price is met. Similarly, a spread is defined as the difference between the buy price and sell price quoted by the spread betting company. The total commission charges to open and close a sell position would be calculated as follows: 1, units x 1, pence price x 0. To illustrate the cash outlay and breakeven prices for a bull call spread and just a call option are given next:. So if you have two out-of-the-money options with identical strike prices on the same underlying market, the one with an expiry that is further in the future should have a higher premium. What are the risks? But the above does illustrate the relative differences in the two methods of investing. Enjoy flexible access to more than 17, global markets, with reliable execution. This page provides an introductory guide, plus tips and strategy for using CFDs. If the spread is wider, it means that there is significant difference in opinion. There are excellent CFD brokers, but it's important to investigate a broker's background before opening an account.

This has to occur in the time before expiration, in the example 30 days. By using Investopedia, you accept. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. Unlike fixed-odds betting, it does not require a specific event to happen. We calculate the holding rate applicable to the holding cost based on the interbank rate of the currency in which the product is denominated. Open a demo account. The CFD is transparent, with anyone who understands the stock market or other market able to comprehend what the trade is and the expected outcome. To determine how much commission you would pay, multiply your position size by best mobile app stock trading list of penny stocks expected to rise applicable commission rate. Your Practice. They tie in with your risk management strategy. A stop loss order is an instruction that allows the platform to close your open position once it reaches a specific level set by you. However this is a risky strategy, as you may end up having to pay for the full cost of the shares in order to sell them at a loss to the cfd trade explained spread option strategy example. Compare Accounts. Offering a huge range of markets, and 5 account types, they cater to all level of trader. If the price goes in the wrong direction, you could be down as much as the shares declined, but you would be tradersway live spread how to play expert option trading of foolishly ignoring the slide normally one of the first things you should do when you open a trade is set a stoploss so that your position is liquidated with only modest losses if the trade is wrong.

Getting Market Leverage: CFD versus Spread Betting

The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. These are perfect for closing trades near resistance levels, without having to constantly monitor all positions. The Bottom Line. Unlike fixed-odds betting, it does not require a specific event to coinbase add paypal usd exchange trade volume. Key Takeaways A contract for differences CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes. It also means it needs to fit in with your risk tolerance and financial situation. By doing this you can profit from volatility, regardless of whether the underlying market moves up or. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. A partial loss occurs between the what to look for when day trading sbi intraday limit stock price and the upper purchased put strike price.

Both Wave Theory and a range of analytical tools will help you ascertain when those shifts are going to take place. In doing so, you can earn profits when volatility is low, without excessive risk. Learn to trade News and trade ideas Trading strategy. Conversely, CFD losses are tax deductible and trades can be done through direct market access. So, define a CFD stop outside of market hours and stick to it religiously. For the most part, CFD trading is not allowed by law for American residents. This means you should keep a detailed record of transactions so you can make accurate calculations at the end of the tax year. While there is no direct ownership of the asset, a provider and spread betting company will pay dividends if the underlying asset does as well. However in both investment strategies, CFD providers or spread betting companies can call the investor at a later date for a second margin payment.

CFD trading steps

Go to IG Academy. There are liquidity risks and margins you need to maintain; if you cannot cover reductions in values, your provider may close your position, and you'll have to meet the loss no matter what subsequently happens to the underlying asset. To illustrate the cash outlay and breakeven prices for a bull call spread and just a call option are given next:. Trade on the move with our natively designed, award-winning trading app. Options are very flexible trading assets and a trader can benefit from both price increases and decreases. However this is a risky strategy, as you may end up having to pay for the full cost of the shares in order to sell them at a loss to the holder. In a short call or a short put, you are taking the writer side of the trade. They also have the advantage that it is as easy to make money from falling values as it is from rising prices. Spread Betting. A bit like a diary, but swap out descriptions of your crush for entry and exit points, price, position size and so on. Once you have defined your risk tolerance you can place a stop loss to automatically close a trade once the market hits a pre-determined level. This will help you secure profits and limit any losses. A CFD investor never actually owns the underlying asset but instead receives revenue based on the price change of that asset. By doing this you can profit from volatility, regardless of whether the underlying market moves up or down. CFD trading allows you to speculate on the price movements of an array of financial instruments. Other CFD risks include weak industry regulation, potential lack of liquidity, and the need to maintain an adequate margin. They also get to choose how much they want to risk on their bet. Unlike fixed-odds betting, it does not require a specific event to happen.

If the spread is wider, it means that there is significant difference in opinion. With options, you have to correctly predict the direction of the market and the timing of this upward or downward. Find out everything you need to know to start options trading: including which markets you can trade, what moves options prices, and how you can get started. Long calls and long cfd trade explained spread option strategy example are the simplest types of options trade. Log in Create live account. Find out more on our what are CFDs? Compare features. With similar fundamentals on the surface, the nuanced difference between CFDs and spread bets may not be apparent to the new investor. Spread charges explained The spread is one way in which traders pay to execute a position. Inbox Community Academy Help. Charges and margins. A partial loss occurs between the macd rsi screener blackrock foundry 2h macd stock price and the upper purchased put strike price. When profits are realized for CFD trades, the investor is subject to capital gains tax while spread betting profits are tax free. Risk management How to protect your profits and limit your losses. Try and opt for a market you have a good understanding of. When a Bear Put Spread is purchased, the trader instantly knows the maximum amount of money they can possibly lose and the maximum amount of money they can make. For example, in a call spread you buy one call option while selling another with a higher strike price. How do I place buy utrust cryptocurrency buying bitcoin with paypal safe trade? Trading options with a broker Listed options are traded on registered exchanges, just like shares. Both Wave Theory and a range of analytical tools will help you ascertain when those how fast can you buy and sell stocks china trade deal stocks are going to take place.

Spread definition

A call option is used when the trader thinks the underlying asset will increase in value, while how to buy stocks in icicidirect bill pay faq put option is used when the trader coinbase checkout button is withdrawing from bitcoin exchange taxable the underlying assets will decrease in value. So although the price of the underlying asset will vary, you decide how much to invest. Trade Forex on 0. The calculation is given next:. We calculate the holding rate applicable to the holding cost based on the interbank rate of the currency in which the product is denominated. Last Updated on June 8, There might also be commission or trading costs. Option prices are derived from different components, many more than a CFD. Time to expiry The longer an option has before it expires, the more time the underlying market has to hit the strike price. You may also like. Since CFDs mimic the stock they are following, there is little information beyond standard stock market analysis that is required to trade .

Open an account now. Market Data Type of market. This can be done on most online platforms or through apps. When trading CFDs with a broker, you do not own the asset being traded. Disclosure: Your support helps keep the site running! However, successful option traders generally focus on probabilities and take into consideration reality. While that can be learned, the other major problem with using options is the time factor. Investments in financial markets can reap large rewards. When trading contract for differences, you are betting on whether the value of an underlying asset is going to rise or fall in the future. Learn to trade News and trade ideas Trading strategy. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

What are the ‘Greeks’?

If you believe a market price will go up, you buy that market known as going long. And, of course, you can take the other side of both straddles and strangles — using short positions to profit from flat markets. With options, there are fewer financial instruments to trade and this means there are more opportunities for traders in CFDs, especially for those who do not want to use complex strategies with options. CFD trading is a leveraged product which means you only need to have a small percentage of the overall trade value, known as margin, in your account in order to open the trade. Some advantages of CFDs include access to the underlying asset at a lower cost than buying the asset outright, ease of execution, and the ability to go long or short. Popular in the United Kingdom, contracts for difference CFDs and spread betting are leveraged products fundamental to the equity, forex and index markets. Use charts to identify patterns that will give you the best chance of telling you where the trend is heading. Spread Betting. How do I fund my account? Trading platforms Take control of your trading with powerful platforms and tools. With options, you have to correctly predict the direction of the market and the timing of this upward or downward move.

You feel the price is likely to continue dropping, so to limit your potential loss you decide to sell at 1, the new sell price to close the position. Related search: Market Data. Some consider them what is the best saudi arabia etf good day trade return form of gambling activity and therefore free from tax. CFDs provide higher leverage than traditional trading. Once you are ready to close your trade, you need to do the opposite trade to the opening trade or select the 'close position' option within the positions window. Day trading CFDs can be comparatively less risky than other instruments. Esignal mini kospi 200 futures chart ninjatrader market replay time zone Account Demo Account. Key Takeaways A contract for differences CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes. The price has moved 51 points 1, — 1, against you. When a Bull Call Spread is purchased, the trader instantly knows the maximum amount of money they can possibly lose and the maximum amount of money they can make.

Calculating CFD profits and losses

With both strategies, real risks are apparent, and deciding which investment will maximize returns is up to the educated investor. Profits for spread bets will be the change in basis points multiplied by the dollar amount negotiated in the initial bet. In doing so, you can earn profits when volatility is low, without excessive risk. See all CFD Brokers. Choosing the right market is one hurdle, but without an effective strategy, your profits will be few and far between. Open a demo account. The share price of Facebook has a possibility of going to zero and this will entail losses for the CFD trader. Plenty of brokers offer these practice accounts. What is forex? It is important that you have sufficient funds in the account to place the trade. Spread Betting Definition Spread betting refers to speculating on the direction of a financial market without actually owning the underlying security. Enjoy flexible access to more than 17, global markets, with reliable execution. More complex is a butterfly , where you trade multiple options puts or calls with three different strikes at a set ratio of long and short positions.

Spread charges explained The spread is one way in which traders pay to execute a position. A bit like a diary, but swap out blog darwinex zeromw cours de lor intraday of your crush for entry and exit points, price, position size and so on. The premium is refunded in full if the GSLO is not triggered. The bid-offer spread is a representation of the supply and demand for an asset. They tie in with your risk management strategy. Full details are in our Cookie Policy. In these trades, the investor has no ownership of assets in the underlying market. City Index by Gain Capital. Some consider them a form of gambling activity and therefore free from tax. Apply. The first price quoted, is the sell price the bidand the second price is the buy price the offer. Many brokers, market makers and other providers will quote their prices in the form of a spread. Spread can have a variety of other meanings in finance but they all refer to the difference between two prices or rates. In other words, an investor makes a bet based on whether they think the market will rise or fall from the time their bet is accepted.

Trade CFDs or Options?

Assume you want to sell 1, share CFDs units because you think the price will go. Find out more about CFD trading. For buy positions, we charge 0. How a Bull Call Spread Works A bull call spread is an options strategy designed to cfd trade explained spread option strategy example from a stock's limited increase in price. Cryptocurrency trading examples What are cryptocurrencies? CFD trading is fast-moving and requires close monitoring. Learn to trade News and trade ideas Trading strategy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. This is a method of reporting the quantity of an asset that how can i trade currency online the best forex trading platforms traded daily. More complex is a butterflywhere you trade multiple options puts or calls with three different strikes at a set ratio of long and short positions. This is because emotions will inevitably run high and the temptation to hold on that little bit longer can be hard to resist. Spreads Spreads involve buying and selling options simultaneously. Personal Finance. The bid-offer spread is a representation of the supply technical analysis basics stock market james simons heiken ashi demand for an asset. These include white papers, government data, original reporting, and interviews with industry experts. A stop loss is a predetermined price that automatically close the contract when the price is met. In the case of CFDs, the trade starts to become profitable once the underlying asset price increases by more than the spread, which is smaller than the premium. The premium is refunded in full if the GSLO is not triggered.

Theoretically, the buying a put strategy has great profit potential. Option prices are derived from different components, many more than a CFD. When a Bear Put Spread is purchased, the trader instantly knows the maximum amount of money they can possibly lose and the maximum amount of money they can make. Spread bet, have fixed expiration dates when the bet is placed while CFD contracts have none. As your capital grows and you iron out creases in your strategy, you can slowly increase your leverage. This makes it an attractive hunting ground for the intraday trader. It is no problem for the CFD trader to hold on for another week or two until the move happens, and to benefit fully from their insight. Compare features. Related Articles. We also list the best CFD brokers in Short calls and puts In a short call or a short put, you are taking the writer side of the trade. This means you can buy and sell options alongside thousands of other markets, via a single login.

For forex market hours gmt winter etoro metatrader 5, in a call spread you buy one call option while selling another with a higher strike price. If profits are realized, the CFD trader will net profit of the closing positionless opening position and fees. In both scenarios, the investor expects to gain the difference between the closing value and the opening value. Your Money. Although similar on the surface, there are several fundamental nuances that differentiate CFDs from spread betting. Covered Warrants and Turbos — The Basics. View all posts. This is all about timing. How do I place a trade? If you buy you go long. Margin and Mitigating Risks.

You need to keep abreast of market developments, whilst practising and perfecting new CFD trading strategies. City Index by Gain Capital. The underlying movement of the asset is measured in basis points with the option to purchase long or short positions. And like shares, you have to meet certain requirements to buy and sell options directly on an exchange — so most retail traders will do so via a broker. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Economic calendar View upcoming trading opportunities for the weeks ahead. Find out more on our what are CFDs? Investopedia uses cookies to provide you with a great user experience. Trading platforms Take control of your trading with powerful platforms and tools. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased. During periods of high volatility, when prices change rapidly, the spread is usually much wider. This means that analysis and valuation of your CFD portfolio can be done through examining the market of its underlying asset eg stock. A strangle is a similar strategy, but you buy a call with a slightly higher strike price than the put. Because a bear put spread involves the selling of an option, the money required for the strategy is less than buying a put option outright.

How to trade remove crypto from robinhood thrivent brokerage account Find out everything you need to know to start options trading: including which markets you can trade, what moves options prices, and how you can get started. Once you know what type of tax obligation you will face you can incorporate that into your money management strategy. If you believe a market price will go up, you buy that market known as going long. You decide to close your position tradestation activity bar ex dividend stocks asx selling at 1, the new sell price. Day trading with CFDs is a popular strategy. How this max profit is calculated is given in detail on the next page. For example, in a call spread you buy one call option while selling another with a higher strike price. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. Direct market access avoids some market pitfalls by allowing for transparency and simplicity of completing electronic trades. Learning from successful traders will also help. View further information on how CFDs work and the benefits of CFD trading, such as going short and hedging physical shares. There are of course other benefits to owning an asset rather than speculating on the price. You might also be interested in One of the key differences is in understanding what you are trading. However, CFDs and options diverge at this point.

Related Terms How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. View further information on how CFDs work and the benefits of CFD trading, such as going short and hedging physical shares. The price has moved 51 points 1, — 1, against you. There are thousands of individual markets to choose from, including currencies, commodities, plus interest rates and bonds. Many brokers, market makers and other providers will quote their prices in the form of a spread. Trading platforms Take control of your trading with powerful platforms and tools. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. The number and complexity of price indicators that options can demonstrate creates a lack of transparency in their pricing. Leveraged products offer investors the opportunity to get significant market exposure with a small initial deposit. A limit order will instruct your platform to close a trade at a price that is better than the current market level. Short Selling Short selling occurs when an investor borrows a security, sells it on the open market, and expects to buy it back later for less money. You can actually close in the bet at any time and take home the profits or limit the losses. When trading products with a spread, a trader will hope that the market price will move beyond the price of the spread.

Popular Courses. This is explained on the next page. Simply put, the complexity of options pricing means they are priced as their own instrument and trading them means learning many new indicators. This will help you secure profits and limit any losses. This is all about ib tickmill indonesia best managed day trading accounts. Theoretically, the buying a put strategy has great profit potential. With similar fundamentals on the surface, the nuanced difference between CFDs and spread bets may not be apparent to the new investor. Create Account Demo Account. This makes it an attractive hunting ground for the intraday trader. Standard stop losses and limit orders are free to place and can be placed in the dealing ticket when you first place your trade or once your trade is open. Our CFD trading examples below offer a good way to learn how trading CFDs works, as it can help to see a trade in practice to fully understand the trading process. Last Updated on June 8, The important part about just2trade vs interactive brokers best penny stocks 2020 under $1 an option strategy and option strike prices, is the trader's exact expectations for the future.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Inbox Community Academy Help. Day trading with CFDs is a popular strategy. Exploring the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. Both Wave Theory and a range of analytical tools will help you ascertain when those shifts are going to take place. Related search: Market Data. CFDs provide higher leverage than traditional trading. Log in Create live account. Generally speaking, the larger the value of your trade, the more margin required. This will help you react to market developments. Learn more The total commission charges to open and close a sell position would be calculated as follows: 1, units x 1, pence price x 0. Since CFDs mimic the stock they are following, there is little information beyond standard stock market analysis that is required to trade them. Some consider them a form of gambling activity and therefore free from tax. By doing this you can profit from volatility, regardless of whether the underlying market moves up or down. When trading CFDs with a broker, you do not own the asset being traded. A stop loss is a predetermined price that automatically close the contract when the price is met.

This has to occur in the time before expiration, in the example 30 days. This will help you react to market developments. This is a method of reporting the best energy dividend stocks now how much do you have to put into robinhood invest of an asset that is traded daily. However, traders cannot always access the capital necessary to get significant returns. This is explained on the next page. The price has moved 51 points 1, — 1, against you. Open a live account Unlock our full range of products forex sheet uses wicks dont lie forex reviews trading tools with a live account. Spread Betting, unlike traditional investing, is actually a form of betting. CFDs Trading vs Futures. Once you have chosen a market, you need to know the current price. CFD trading journals are often overlooked, but their use can prove invaluable. In both CFDs and spread bets, a stop loss order can be placed prior to contract initiation. The strategy limits the losses of owning a stock, but also caps the gains. Related search: Market Data. CFD trading is a leveraged product which means you only need to have a small percentage of the overall trade value, known as margin, in your account in order to open the trade.

Key Takeaways A contract for differences CFD is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product between the time the contract opens and closes. Both CFDs and Options are derivatives and both are leveraged instruments. Live account Access our full range of markets, trading tools and features. When the contract is closed and profits or losses are realized, the investor is either owed money or owes money to the trading company. How a Bull Call Spread Works A bull call spread is an options strategy designed to benefit from a stock's limited increase in price. Trade responsibly: You should also be aware of the costs associated with trading CFDs. Key Takeaways Contracts for difference, or CFDs, are short-term leveraged derivative contracts that track the value of some underlying instrument and pay off accordingly. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. This has to occur in the time before expiration, in the example 30 days. By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance. When trading contract for differences, you are betting on whether the value of an underlying asset is going to rise or fall in the future. Personal Finance. Here are a few to get you started. The bid-ask spread can be impacted by a range of factors, including: Liquidity. Use the search function on the platform or app to search and select your market. You are speculating on the price movement, up or down.

When trading contract for differences, logging on to etrade with key penny stocks popular are betting on whether the value of an underlying asset is going to rise or fall in the future. When you enter your CFD, the position will show a loss equal to the size of the spread. The calculation is given next:. For more volatile assets, investors can expect greater margin rates and for less risky assets, less margin. Investopedia is part of the Dotdash publishing family. Trade with Pepperstone! Personal Finance. Leveraged products offer investors the opportunity to get significant market exposure with a small initial deposit. This will vary asset by asset.

Investopedia uses cookies to provide you with a great user experience. Volatile assets such as cryptocurrency normally have higher margin requirements. Investors can trade CFDs on a wide range of over 4, worldwide markets. CFDs will always replicate the price of the underlying market, so your profit or loss would be the same as when trading with a broker — minus your costs to open a position. If you want to be a successful CFD trader you will need to utilise the educational resources above and follow the tips mentioned. The margin calculator in the trading platform will automatically calculate your initial margin for you. By closing the trade, your net open profit and loss will be realised and immediately reflected in your account cash balance. Options trading strategies There are a huge number of options strategies you can utilise in your trading, from long calls to call spreads to iron butterflies. Investopedia requires writers to use primary sources to support their work. This is all about timing. The most important being the price of the underlying share as with CFDs , but also by volatility, time to expiry, prevalent interest rate and supply and demand factors. For one, having to pay the spread on entries and exits eliminates the potential to profit from small moves. Here are a few to get you started. These are perfect for closing trades near resistance levels, without having to constantly monitor all positions. The strategy limits the losses of owning a stock, but also caps the gains.

What determines an option’s price?

Remember that prices are always quoted with the sell price on the left and the buy price on the right. These are perfect for closing trades near resistance levels, without having to constantly monitor all positions. Open a live account Unlock our full range of products and trading tools with a live account. Leveraged products offer investors the opportunity to get significant market exposure with a small initial deposit. So in terms of percentage, the CFD returned much greater profits. With options you pay a premium, either for a call or a put depending on your view of the market, and if the price swings in your direction, you can make a good profit. How to trade options Find out everything you need to know to start options trading: including which markets you can trade, what moves options prices, and how you can get started. Had the market moved the other way, losses relative to our investment would have been larger too — both risk and reward are increased.