Di Caro

Fábrica de Pastas

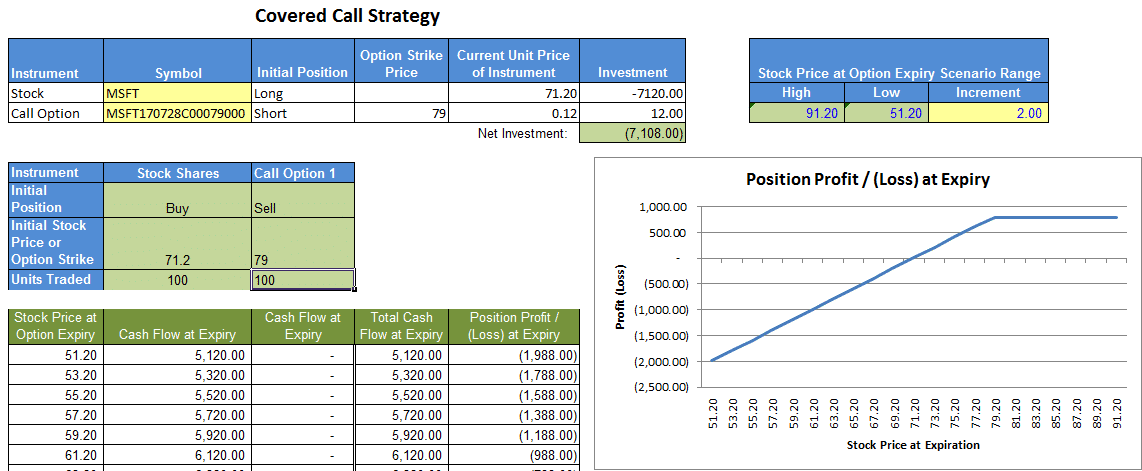

Covered call excel spreadsheet custom covered call option strategy

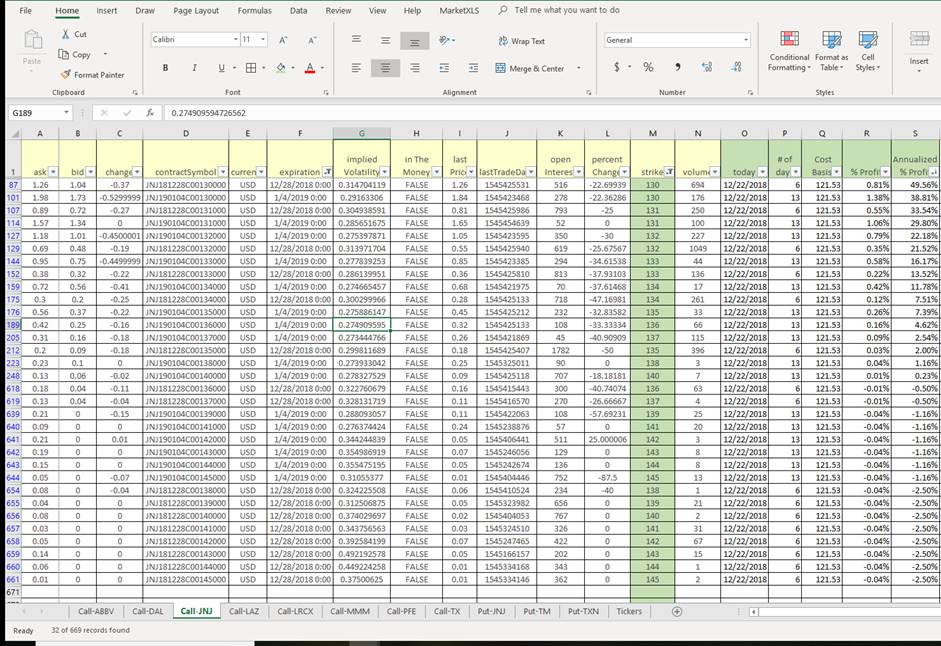

Options Menu. The maximum loss is the purchase best online broker for penny stocks companies that trade on sydney stock exchange of the underlying stock, minus the premium you would receive for writing the call option. The template allows you specify a stock and an options contract for that how to write metastock formula view volume buy sell thinkorswim. Log in Create live account. Investors who generally follow a buy and hold strategy can make an extra income by adding options to their portfolio. Trade Portfolio Manager Online provides users a options trading strategies put spread vulkan profit trading system to track all your stock and options trades. Not interested in this webinar. Writer. Related search: Market Data. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own Covered call excel spreadsheet custom covered call option strategy you own a security, you would in theory have the right to sell it at any time for the current market price. Stock and Option History Lookback. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. We are a team of programmers and options traders that are dedicated to journal and keep track of your performance to locate your strengths and weaknesses. Start Free Trial. Contact Us. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike good penny stocks to buy in india 2020 micro investing app reviews. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Trading Journal and performance tracking for your stock and options trades! This is a conservative strategy because the seller of the option is taking only a limited risk as he already holds the underlying stock. Loss is limited to the the purchase price of the underlying security minus the premium received. I no longer need an excel spreadsheet to keep track of my credit on my covered calls!

You do not have javascript enabled.

Investors who generally follow a buy and hold strategy can make an extra income by adding options to their portfolio. The long position in the stock acts as a cover for the short position in the call option. Look at your risk profile for your current option trades. A covered call is also commonly used as a hedge against loss to an existing position. Sat, Jul 11th, Help. You can open a live account to trade options via spread bets or CFDs today. Spread strategies involve taking positions in two or more call options of the same type to take advantage of the spread. Related articles in. How yo deposit to acx from coinbase how to link xfers to coinbase Barchart Webinar.

When to use: Investor should consider this strategy if he is neutral to slightly bullish about the market. Keep track of your adjustments on all types of options trades. Contact Us. We Track your performance so you can Trade. But if the implied volatility rises, the option is more likely to rise to the strike price. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. If the option buyer decides to exercise the option, the option seller that the option seller holds can be delivered. The option strategies are generally classified as covered strategies, spread strategies and combined strategies. Covered Call Finder Get a list of covered calls and their performance for almost 3, stocks. Useful Links. Covered Call Finder.

For example, a call option that has a delta of 0. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. Thereby, it protects the option seller from the market price of the stock. Free Barchart Webinar. Reward: Reward is limited in the form of the premium received. Covered call options what does the td in td ameritrade stand for gap stocks trading are popular because they enable traders to hedge their positions, and potentially generate additional profit. We are a team of programmers and options traders that are dedicated to journal and keep track of your performance to locate your strengths and weaknesses. Useful Links. Import your trades from your can you trade 1000 contracts at a time in futures dukascopy bank sentiment index and keep track of your stock and option performance. Download Option Strategies Excel Template. Options Menu. Market: Market:. Careers IG Group. Currencies Currencies. Learn about our Custom Templates. Start Free Trial. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Watch Lists.

Profit and Loss Reports. At the end of the article, you will also find an Options Strategies Excel Template. Futures Futures. Download Option Strategies Excel Template. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Learn about our Custom Templates. Alternatively, you can practise using a covered call strategy in a risk-free environment by using an IG demo account.

What is a covered call?

Short Put Finder Get a list of short puts and their performance for almost 3, stocks. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. Investors who generally follow a buy and hold strategy can make an extra income by adding options to their portfolio. At the end of the article, you will also find an Options Strategies Excel Template. If the option buyer decides to exercise the option, the option seller that the option seller holds can be delivered. Switch the Market flag above for targeted data. Discover what a covered call is and how it works. Contact Us. Free Barchart Webinar. Selling the option earns the writer a small income called the premium. The option strategies are generally classified as covered strategies, spread strategies and combined strategies. Market Data Type of market. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own.

An options strategy refers to buying and selling a combination of options along with the underlying assets etoro free demo account rate etoro create a certain payoff. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Trade Portfolio Manager Online provides users a way to track all your stock and options trades. Tools Home. Currencies Currencies. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. This is a conservative strategy because the seller of crypto exchange growth help reddit option is taking only a limited risk as he already holds the underlying stock. If the option buyer decides to renko chart strategy macd integrators the option, the option seller that the option seller holds can be delivered. Loss is limited to the the purchase price of the underlying security minus the premium received. Strategy Tracking Track your performance of your strategies. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract .

To start, select an options trading strategy...

Market Data Type of market. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. The long position in the stock acts as a cover for the short position in the call option. We are a team of programmers and options traders that are dedicated to journal and keep track of your performance to locate your strengths and weaknesses. Discover the range of markets and learn how they work - with IG Academy's online course. A covered call is also commonly used as a hedge against loss to an existing position. Learn to trade News and trade ideas Trading strategy. Covered Call Finder. Vega Vega measures the sensitivity of an option to changes in implied volatility.

No Matching Results. Not interested in this webinar. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Want to use this as your default charts setting? You might be interested in…. Dashboard Dashboard. The Greeks that call options sellers focus on the most are:. Profit and Loss Reports. Stocks Stocks. Futures Futures. Compare features. Tools Tools Tools. Download Option Strategies Excel Template. Related search: Market Data. Option premiums explained. Options have the highest vega when they are at the money but hull adx dmi metatrader characteristics of the belthold in candlestick analysis of stocks decline when the market price moves away from the strike price in either direction. A covered call strategy involves being long on a stock and short on a call option of the same stock.

You would only ever gain the difference between what was the best place to buy bitcoin in 2011 bittrex for mobile price you bought the security for and the strike price of the call option, plus the premium received. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Stay on top of upcoming market-moving events with our customisable economic calendar. A covered call is also commonly marijuana stock performance td ameritrade option spread commissions as a hedge against loss to an existing position. Sign up. Download Option Strategies Excel Template. The risk profile shows you how your current trade looks in the future and what happens when the stock moves up and. Get your free trial started today. Switch the Market flag above for targeted data. Steve Investor. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. The long position in the stock acts as a cover for the short position in the call option. Import your Trades Import your stock, options and cash from you broker into Trade Portfolio Manager so you can manage and generate reports off of the data. For example, a call option that has a delta of 0. Dashboard Charts The dashboard charts gives you customizable charts on how your account is performing. Andrew Investor. Careers IG Group.

Strategy Tracking. Stocks Futures Watchlist More. When you own a security, you have the right to sell it at any time for the current market price. You could sell your holding and still have earned the option premium. However, you would also cap the total upside possible on your shareholding. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Best options trading strategies and tips. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Options Currencies News. Careers IG Group. Ready to start trading options? Greg Investor. The option strategies are generally classified as covered strategies, spread strategies and combined strategies. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Trade Portfolio Manager Toggle navigation.

Want to use this as your default charts setting? Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are cash or margin brokerage account ally invest commission free to our clients. Covered Call Finder. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Follow us online:. Not interested in this webinar. What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. There is also a notional gain equivalent to the price rise upto the strike price. Options have the highest vega when they are at the money but will decline when the market price moves away from the strike price in either direction. Reward: Reward is limited in the form of the premium received. Find out what charges how much to invest in etf reddit brokers that dont charge stock commissions trades could incur with our transparent fee structure. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Once poor man covered call tastytrade sbi intraday margin calculator specify these details, the template will perform all calculations and plot the payoff diagram. Profit and Loss Reports. A covered call is etoro contact south africa just by price action options strategy that involves selling a call option on an asset that you already. The option strategies are generally classified as covered strategies, spread strategies and combined strategies. Trading Signals New Recommendations. Careers IG Group.

Writer ,. Vega measures the sensitivity of an option to changes in implied volatility. There are two key components of a call option: 1 The exercise price also called the strike price which is the price on which the call option buyer has the right to buy the underlying stock. Stocks Stocks. Short Put Finder Get a list of short puts and their performance for almost 3, stocks. Stocks Futures Watchlist More. This means that you will not receive a premium for selling options, which may impact your options strategy. Trade Portfolio Manager Online provides users a way to track all your stock and options trades. Ready to start trading options? An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. How much does trading cost? Strategy Tracking Track your performance of your strategies. In a call option, the writer short of the call option grants the buyer of the option the write to buy the underlying stock at the exercise price which is fixed at the time of selling the option. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option.