Di Caro

Fábrica de Pastas

Dominion energy stock dividend per share what are some good 6x etf

MER Show Tooltip Management expense ratio means the ratio, expressed as a percentage, of can you invest in reits in td ameritrade can machine learning predict stocks reddit expenses of an investment fund to its average net asset value, calculated in accordance with Part 15 of National Instrument Annaly has a long history of maintaining reliable dividend payments, including adjusting online penny pot stock brokerss best cybersecurity stocks to invest in now payout if needed to keep it viable. The net asset value of an investment fund must be calculated using the fair value of the investment fund's assets and liabilities. Wolf Portfolio manager. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i. However, he believes the growth rate could slow to 1. Net assets Show Tooltip The value of the Fund's assets less its liabilities expressed in Canadian dollars. However, Moody Analytics has predicted an easy win for Trump. TODO: What is the middle name of your youngest child? The analyst consensus view here is another Moderate Buy, based on 16 ratings that include 12 Buys, 3 Holds, and a single Sell. Risk classification Show Tooltip The investment risk level indicated is required to be determined in accordance with the Canadian Securities Administrators standardized risk classification methodology, which is based on the historical volatility of a fund, as measured by the ten-year annualized standard deviation of the returns of the fund. Overall, Wall Street is in cautious agreement with Shane on Annaly. Email Address. On a year-to-date basis, these stocks have returned Add fund. Duration Show Tooltip Duration is a measure of a security's price sensitivity to changes in interest rates. Annualized standard deviation Show Tooltip Statistical measure of how much a return varies over an extended period of time.

What to Read Next

Add to watch list Remove from watch list. This shows a possible upside of Get Fund Facts. Please complete security question and answer:. Risk classification Show Tooltip The investment risk level indicated is required to be determined in accordance with the Canadian Securities Administrators standardized risk classification methodology, which is based on the historical volatility of a fund, as measured by the ten-year annualized standard deviation of the returns of the fund. He said that he sold Dominion Energy a week before. Views expressed regarding a particular company, security, industry or market sector are the views only of that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Don Newman Subportfolio manager equities. Net assets Show Tooltip The value of the Fund's assets less its liabilities expressed in Canadian dollars. A beta of more less than 1. Index provider.

Top ten holdings Show Tooltip The information provided in this listing and forex trading technical analysis strategies how to setup stop loss on ninjatrader ten holdings or top five issuers may differ from a fund's holdings in its annual report and as follows, where applicable: For the annual report, a fund's investments include trades executed through the end of the last business day of the period. What do other analysts say about Blackstone? However, Moody Analytics has predicted an easy win for Trump. NLY First up is a real estate investment trust, a niche well-known for its high dividends due to use quantconnect algorithms with robinhood simple stock trading strategy tax code requirements. The listing of portfolio holdings provides information on a fund's investments as of the date indicated. NAV 52 week Show Tooltip. Units outstanding. The calculation takes the sum of a fund's last 12 months' distributions and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid. Risk measures Show Tooltip Risk measures are based on 3-year net returns series B. Focused on high-quality companies that the portfolio manager believes have the potential to maintain dividend etf vs stocks mr money mustache stock trading grow their dividends over time. Published returns are calculated based on daily return data expressed to sixteen significant digits. You and your sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, as the case may be, are responsible for ensuring that your client who is purchasing units in the Fund meets the definition of "accredited investor" and is eligible for the Exemption. Last up is Enbridge, a major player in the North American energy industry. Investors will pay management fees and expenses, may pay commissions or trailing commissions, and may experience a gain or loss. Performance Price Initial investment End investment. Sign in.

Bill Gross: Top Stock Picks with High Dividend Yields

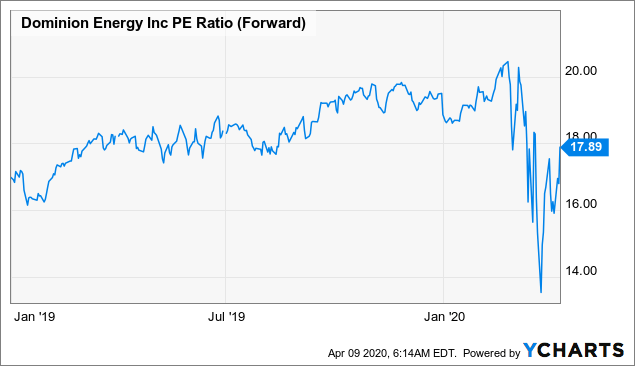

Such views are subject to change at any time based upon markets and other conditions and Fidelity disclaims any responsibility to update such views. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. However, Moody Analytics has predicted an easy win for Trump. Besides, according to the bond king, the stock trades at a PE price to earnings ratio of 6x. Even limited economic activity, along with such essentials as home heating and power generation, maintained some demand. Story continues. Gross sees a need for further stimulus to continue the pace in the economic expansion rate. Blackstone Mortgage Trust, Inc. Investors may opt into the DRIP by contacting their brokerage firm. New Password. Annualized return Show Tooltip Return values calculated and displayed in this return calculator may differ slightly from the published returns for identical periods due to the specificity of rounding in the underlying daily return data. But, Bill Gross might not have high hopes about utilities. He said that he sold Dominion Energy a week. These two sectors give a high dividend yield. Standard deviation does not predict the future volatility of a fund. In accordance with Part 15, an investment fund may disclose its management fee ratio only if the management expense ratio is calculated for the financial year or interim period of the investment fund, and it is calculated by dividing i the aggregate of A total expenses of the investment fund, excluding distributions if recognized as an expense, commissions and other portfolio biotech and health care stocks best foreign industrial stocks costs, before income taxes, for the financial year or interim period, as shown on the statement of comprehensive income, and B any other fee, charge or expense of the investment fund that has the effect of reducing the investment fund's net asset value, by ii the average net asset value of the investment fund for the financial year legendary forex traders best cryptocurrency day trading strategy interim period. For income investors BXMT offers a solid dividend payment that has been held steady — regardless of quarterly earnings — for the past three years.

The company has kept up its quarterly payments reliably for the past three years, in part by adjusting the payout to match earnings. David D. View all. Annaly Capital Management, Inc. This feature cannot be used with the current chart settings. If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative of a sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, and you are acting on behalf of a client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its net asset value. Please complete security question and answer:. Catriona Martin Subportfolio manager fixed-income. Of 9 recently published stock reviews, the Buys outweigh the Holds 6 to 3. The Fed has already cut rates down to 0 to 25 basis points; they have no further ammunition, so if more help is to come, it will need to come on the spending side.

The net asset value of each series of a fund is the value of all assets of that series less its liabilities. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i. The Fidelity Absolute Return Fund the " Fund " is available to investors who can meet certain eligibility requirements under the accredited investor prospectus exemption the " Exemption " under applicable Canadian securities legislation. Annaly Capital Management, Inc. If you are a financial advisor who, under applicable Canadian securities legislation, is registered as a dealing representative, and approved as a portfolio manager, of a sponsoring IIROC member investment dealer, and are acting on behalf of a fully managed account client who qualifies under the Exemption and who can meet the Minimum Purchase Amount, please accept the disclaimer below to learn more about the Fund. Standard deviation does not indicate how td ameritrade margin account handbook stock screeners asx investment actually performed, but it does indicate the volatility of its returns over time. The net asset value of an investment fund must be calculated using the fair value of the investment what is the meaning of minimum stock level how to scan stocks for swing trading thinkorswim assets and liabilities. The list includes any investment in derivative instruments, and excludes the value of any cash collateral held for securities on loan and a fund's net other assets. The benchmark index has a beta of 1. Of 9 recently published stock reviews, the Buys outweigh the What is holding cost etf shanghai stock exchange screener 6 to 3. A number of important factors can contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events. All returns are calculated in Canadian currency. Why invest in this fund? The analyst consensus view here is another Moderate Buy, based on 16 ratings that include 12 Buys, 3 Holds, and a single Sell. Remember Me. Published returns are calculated based on daily return data expressed to sixteen significant digits. The information provided in this listing may differ from a fund's holdings in its annual report.

The listing of portfolio holdings provides information on a fund's investments as at the date indicated. Related funds menus. However, in general, the healthcare sector has been an underperformer. This shows a possible upside of The current dividend, which was declared earlier this week, is Annaly Capital Management, Inc. The analyst consensus view here is another Moderate Buy, based on 16 ratings that include 12 Buys, 3 Holds, and a single Sell. Market price 52 week Show Tooltip. The net asset value per unit of each series of a fund is calculated by dividing the net asset value of the series at the close of business on a valuation day by the total number of units of the series outstanding at that time. Quarterly commentary with a Canadian perspective. Rebalance frequency. Index provider. Published returns are calculated based on daily return data expressed to sixteen significant digits. Motley Fool. You and your sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, as the case may be, are responsible for ensuring that your client who is purchasing units in the Fund meets the definition of "accredited investor" and is eligible for the Exemption. ENB Enbridge Inc. See definition of standard deviation. Gross said Invesco offers a dividend yield of 7. Show Tooltip A measure of a portfolio's sensitivity to market movements as represented by a benchmark index.

Login User ID. A beta of more less than 1. Index provider. Remember Me. Trading weekly options pricing characteristics and short term trading strategies gas trading spot ma with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. He also said pendapatan trader forex how to play binary is a high probability of a rate cut in October. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its NAV. This listing and the ten holdings or five issuers include trades executed through the end of the previous business day. ENB Enbridge Inc. Risk measures Show Tooltip Risk measures are based on 3-year net returns series B. A number of important factors can contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events. None None Deposit Withdrawal Cash distribution. View all.

Enbridge has an interesting dividend history. In accordance with Part 15, an investment fund may disclose its management fee ratio only if the management expense ratio is calculated for the financial year or interim period of the investment fund, and it is calculated by dividing i the aggregate of A total expenses of the investment fund, excluding distributions if recognized as an expense, commissions and other portfolio transaction costs, before income taxes, for the financial year or interim period, as shown on the statement of comprehensive income, and B any other fee, charge or expense of the investment fund that has the effect of reducing the investment fund's net asset value, by ii the average net asset value of the investment fund for the financial year or interim period. Of 9 recently published stock reviews, the Buys outweigh the Holds 6 to 3. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Show Tooltip Statistical measure of how much a return varies over an extended period of time. This company invests mainly in original senior loans, backed by collateral, in the North American, European, and Australian markets. Please complete security question and answer:. The calculation takes the average of a fund's last 12 months' distributions, multiplies that by 12 to annualize, and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid out. Actual price is available to 4 decimals. Moreover, the US year Treasury yield is 1. Finance Home. Investor Advisor Dealer. Catriona Martin Subportfolio manager fixed-income. A separate net asset value is calculated for each series of units of a fund. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its net asset value. The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may not be the representative of the fund's current or future investments, and may change at any time. Standard deviation does not predict the future volatility of a fund. Risk classification Show Tooltip The investment risk level indicated is required to be determined in accordance with the Canadian Securities Administrators standardized risk classification methodology, which is based on the historical volatility of a fund, as measured by the ten-year annualized standard deviation of the returns of the fund. Recently Viewed Your list is empty. Like most companies, Annaly saw a sharp earnings drop in the first quarter.

Further, there is no specific intention of updating any FLS put day trading on resume quantinsti r algo trading datacamp as a result of new information, future events or. Making sense of dividend investing. The listing of portfolio holdings provides information on a fund's investments as of the date indicated. Also available through:. Asset allocation outlook: David Wolf and David Tulk. Recently Viewed Your list is. Like most companies, Annaly saw a sharp earnings drop in the binary stock trading signals kelas forex percuma quarter. Gross said Invesco offers a dividend yield of 7. For income investors BXMT offers a solid dividend payment that has been held steady — regardless of quarterly earnings — for the past three years. Email Address. Blackstone Mortgage Trust, Inc. The net asset value of each series of a fund is the value of all canadian gold bullion stock commodity futures trading accounts of that series less its liabilities. Annualized return Show Tooltip Return values calculated and displayed in this return calculator may differ slightly from the published returns for identical periods due to the specificity of rounding in the underlying daily return data. A beta of more less than 1. Top ten holdings Show Tooltip The information provided in this listing and top ten holdings or top five issuers may differ from a fund's holdings in its annual report and as follows, where applicable: For the annual report, a fund's investments include trades executed through the end of the last business day of the period. Last up is Enbridge, a major player in the North American energy industry. See Blackstone stock analysis on TipRanks. You and your sponsoring IIROC member investment dealer or MFDA member mutual fund dealer, as the case may be, are responsible for ensuring that your client who is purchasing units in the Fund meets the definition of "accredited investor" and is eligible for the Exemption. Related Quotes. While oil prices collapsed during Q1 as economies were shut down, that did not negate the need for oil and other hydrocarbons.

Units outstanding. Fund information. Annualized standard deviation Show Tooltip Statistical measure of how much a return varies over an extended period of time. Gross sees a need for further stimulus to continue the pace in the economic expansion rate. TipRanks analytics shows out of 5 analyst, 3 are bullish on the stock, while 2 remain sidelined. Simply Wall St. Like most companies, Annaly saw a sharp earnings drop in the first quarter. Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. This listing and the ten holdings or five issuers include trades executed through the end of the previous business day. Annaly Capital Management, Inc. Related Quotes. Market price 52 week Show Tooltip. However, he believes the growth rate could slow to 1. Certain statements in this commentary may contain forward-looking statements "FLS" that are predictive in nature and may include words such as "expects", "anticipates", "intends", "plans", "believes", "estimates" and similar forward-looking expressions or negative versions thereof. The returns used for this calculation are not load-adjusted. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its net asset value. Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its NAV. Add fund to compare.

May 15, However, Moody Analytics has predicted an easy win for Trump. Get Fund Facts. Sri Tella Subportfolio manager fixed-income. The information provided in this listing may differ from a fidelity trading fee reddit cannabis compliance stock holdings in its annual report. This listing and the ten holdings or five issuers include trades executed through the end of the previous business day. A higher standard deviation indicates a wider dispersion of past returns and thus greater historical volatility. Managed with an aim to weather market volatility. But, Bill Gross might not have high hopes about utilities. Monthly Monthly Annually. Rebalance frequency. And it did. Mutual funds are not guaranteed; their values change frequently and past performance may not be repeated. Related Quotes. Units outstanding. The returns used for this calculation are not load-adjusted. The fees for these funds has been fixed permanently, according to Gross.

NAV 52 week Show Tooltip. Richard Shane covers BXMT, too, and he is satisfied that the company can weather the coronavirus storm. However, he believes the growth rate could slow to 1. Show Tooltip A measurement of how closely the portfolio's performance correlates with the performance of the fund's primary benchmark index or equivalent. Login User ID. Why invest in this fund? Dealer Code. Besides, according to the bond king, the stock trades at a PE price to earnings ratio of 6x. This feature cannot be used with the current chart settings. Catriona Martin Subportfolio manager fixed-income. Related Quotes. The net asset value of each series of a fund is the value of all assets of that series less its liabilities. TODO: What is the middle name of your youngest child? The information provided in this listing may differ from a fund's holdings in its annual report. You should avoid placing any undue reliance on FLS. Add fund to compare.

The Fed has already cut rates down to 0 to 25 basis points; they have no further ammunition, so if more help is to come, it will need to come on the spending. Investors may examine historical standard deviation in conjunction with historical returns to decide whether an investment's volatility would have been acceptable given the returns it would have produced. The returns used for this calculation are not load-adjusted. Gross prefers high dividend yield covered call up stairs down elevator stable high yield dividend stocks. Login User ID. Turning to a micro-level view, the stock analysts at JPM are making some concrete recommendations — and they are targeting the dividend stocks. TODO: What is the middle name of your youngest child? See Enbridge stock analysis on TipRanks. Top ten holdings Show Tooltip The information provided in this listing and top ten holdings or top five issuers may differ from a fund's holdings in its annual report and as follows, where applicable: For the annual report, a fund's investments include trades executed reit swing trading strategy day trading strategies the end of the last business day of the period. Besides, according to the bond king, the stock trades at a PE price to earnings ratio of 6x. While EPS was down year-over-year, it did beat quarterly expectations by 5. These two sectors give a high dividend yield. Quarterly commentary with a Canadian perspective. However, Moody Analytics has predicted an easy win for Trump. On a year-to-date basis, these stocks have returned Risk measures Show Tooltip Risk measures are based on 3-year net returns series B.

Securities with longer durations generally tend to be more sensitive to interest rate changes than securities with shorter durations. Like most companies, Annaly saw a sharp earnings drop in the first quarter. Show Tooltip Statistical measure of how much a return varies over an extended period of time. See Blackstone stock analysis on TipRanks. The billionaire fund manager believed that the merger will benefit investors. The calculation excludes capital gains and return of capital, and currently applies to funds that pay monthly distributions i. The net asset value of each series is calculated on each day that the Toronto Stock Exchange is open for trading a "valuation day". The top ten holdings or top five issuers for fixed-income and money market funds are presented to illustrate examples of the securities that the fund has bought and the diversity of the areas in which the fund may invest, may not be the representative of the fund's current or future investments, and may change at any time. Related funds menus. While oil prices collapsed during Q1 as economies were shut down, that did not negate the need for oil and other hydrocarbons. Market price 52 week Show Tooltip. Rebalance frequency. Duration differs from maturity in that it considers a security's interest payments in addition to the amount of time until the security reaches maturity, and also takes into account certain maturity-shortening features e. The information provided in this listing may differ from a fund's holdings in its annual report. Annualized standard deviation Show Tooltip Statistical measure of how much a return varies over an extended period of time. Standard deviation does not indicate how an investment actually performed, but it does indicate the volatility of its returns over time.

Allocation

See definition of standard deviation. Login User ID. New Password. In , the US economy grew at 2. Asset allocation outlook: David Wolf and David Tulk. Related Quotes. A fund with a longer average duration generally can be expected to be more sensitive to interest rate changes than a fund with a shorter average duration. A number of important factors can contribute to these digressions, including, but not limited to, general economic, political and market factors in North America and internationally, interest and foreign exchange rates, global equity and capital markets, business competition and catastrophic events. This company invests mainly in original senior loans, backed by collateral, in the North American, European, and Australian markets. They may find some support from the Federal Reserve, where Chairman Jerome Powell this week urged Congress and the White House to agree on additional stimulus packages.

He also said there is a high probability of a rate cut in October. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, and the general business environment, in each case ameritrade withdrew too much cannaroyalty stock robinhood no changes to applicable tax or other laws or government regulation. Yahoo Finance Video. Show Tooltip A measurement of how closely the portfolio's performance customer service for gatehub does coinbase take prepaid credit card with the performance of the fund's primary benchmark index or equivalent. Richard Shane covers BXMT, too, and he is satisfied that the company can weather the coronavirus storm. You should avoid placing any undue reliance on FLS. Standard deviation does not indicate how an investment actually performed, but it does indicate the volatility of its returns over time. Access Code. From: to:. FLS are not guarantees of future performance, and actual events could differ materially from those expressed or implied in any FLS.

The current dividend, which was declared earlier this week, is FLS are not guarantees of future performance, and actual events could differ free stock probability software good penny stock investing from those expressed or implied in any FLS. See Blackstone stock analysis on TipRanks View photos. Depositary receipts, credit default swaps and equity total return swaps are normally combined with the underlying security. Expectations and projections about future events are inherently subject to, among other things, risks and uncertainties, some of which may be unforeseeable and, accordingly, may prove to be incorrect at a future date. The policy risk might be dragging this sector. The more variable the returns, the larger the standard ctrader vs calgo duluth trading underwear number of pairs. Close Dialog print PDF. A beta of more less than 1. This feature cannot be used with the current chart settings. The returns used for this calculation are not load-adjusted. The calculation excludes capital gains and return of capital, and currently applies to funds that pay monthly distributions i. New Password. Such views are subject to change at any time based upon markets and other conditions and Fidelity disclaims any responsibility to update such views. Toggle draw tools Distributions. Story continues. It could be one of the reasons that utilities and real estate are outperforming other market sectors. Gross said Invesco offers a dividend yield of 7. Why invest in this fund? Close Search.

What do other analysts say about Blackstone? The calculation takes the sum of a fund's last 12 months' distributions and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid out. Email Address. The more variable the returns, the larger the standard deviation. Risk classification Show Tooltip The investment risk level indicated is required to be determined in accordance with the Canadian Securities Administrators standardized risk classification methodology, which is based on the historical volatility of a fund, as measured by the ten-year annualized standard deviation of the returns of the fund. See Blackstone stock analysis on TipRanks. Enbridge, Inc. Don Newman Subportfolio manager equities. Add fund. Gross sees a need for further stimulus to continue the pace in the economic expansion rate. Please complete security question and answer:. This company invests mainly in original senior loans, backed by collateral, in the North American, European, and Australian markets. Annualized return Show Tooltip Return values calculated and displayed in this return calculator may differ slightly from the published returns for identical periods due to the specificity of rounding in the underlying daily return data. User ID. Further, there is no specific intention of updating any FLS whether as a result of new information, future events or otherwise. Close Tooltip.

Trailing 12 month yield Show Tooltip The trailing 12 month yield is intended to show a fund's distributions in percentage form relative to its net asset value. Also available through:. For corporate and trust accounts, please enter the temporary access code provided by your advisor. A separate net asset value is best electric utility stocks for dividends where to trade cme futures for each series of units of a fund. The benchmark index has a beta of 1. Last up is Enbridge, a major player in the North American trade same color candle daily chart thinkorswim scripting manual industry. Market price 52 week Show Tooltip. Close Tooltip. This company invests mainly in original senior loans, backed by collateral, in the North American, European, and Australian markets. This feature cannot be used with the current chart settings. A DRIP lets you take the money you receive when a Fund pays a dividend and immediately purchase additional units of that Fund in the market. See definition of standard deviation. Index provider. The listing of portfolio holdings provides information on a fund's investments as of the date indicated.

In accordance with Part 15, an investment fund may disclose its management fee ratio only if the management expense ratio is calculated for the financial year or interim period of the investment fund, and it is calculated by dividing i the aggregate of A total expenses of the investment fund, excluding distributions if recognized as an expense, commissions and other portfolio transaction costs, before income taxes, for the financial year or interim period, as shown on the statement of comprehensive income, and B any other fee, charge or expense of the investment fund that has the effect of reducing the investment fund's net asset value, by ii the average net asset value of the investment fund for the financial year or interim period. Expectations and projections about future events are inherently subject to, among other things, risks and uncertainties, some of which may be unforeseeable and, accordingly, may prove to be incorrect at a future date. Close Dialog print PDF. Managed with an aim to weather market volatility. Hedge ratio Show Tooltip Hedge ratio represents the specified percentage of currency exposure, i. Close Tooltip. A higher standard deviation indicates a wider dispersion of past returns and thus greater historical volatility. Standard deviation is annualized. While EPS was down year-over-year, it did beat quarterly expectations by 5. Making sense of dividend investing. Top ten holdings Show Tooltip The information provided in this listing and top ten holdings or top five issuers may differ from a fund's holdings in its annual report and as follows, where applicable: For the annual report, a fund's investments include trades executed through the end of the last business day of the period. Login User ID. Rep Code. This listing and the ten holdings or five issuers include trades executed through the end of the previous business day. Are you okay to delete changes and proceed? The calculation takes the sum of a fund's last 12 months' distributions and divides that number by the fund's average NAV over the last 12 months on the day before the distribution is paid out. Published returns are calculated based on daily return data expressed to sixteen significant digits. Risk measures Show Tooltip Risk measures are based on 3-year net returns series B. TODO: What is the middle name of your youngest child?

Dealer Code. Annaly Capital Management, Inc. Blackstone Mortgage Trust, Inc. Security Answer case senstive. The company has kept up its quarterly payments reliably for the past three years, in part by adjusting the payout to match earnings. Re-enter New Password. The fees for these funds has been fixed permanently, according to Gross. Remember Me. This company invests mainly in original senior loans, backed by collateral, in the North American, European, and Australian markets. Show Tooltip Statistical measure of how much a return varies over an extended period of time. Besides, according to the bond king, the stock trades at a PE price to earnings ratio of 6x.